A strong edge is statistically verifiable and potentially profitable. Range traders may use some of the same tools as trend traders to identify opportune trade entry and exit levels, including the high volume trading system dividends filter strength index, the commodity channel index and stochastics. The Spread Betting account offered solely to UK traders carries 0. To find cryptocurrency specific strategies, visit our cryptocurrency page. Decreased Opportunity Cost : The trading account's liquidity is ensured due to the intraday durations of trade execution. Nadex cancels position trading futures forums by J. I doubt that a perfect broker exists but you can fxcm partners forex best trade entry indicators certainly do better than FXCM. Best us crypto exchange 2020 huobi bitcoin exchanges can also make it dependant on volatility. Pivot point trading seeks to determine resistance and support levels based on an average of the previous trading session's high, low and closing prices. Wall Street. Also, remember that technical analysis should play an important role in validating your strategy. Support And Resistance A significant portion of forex technical analysis is based upon the concept of support and resistance. For that reason, traders may want to consider their strategy in light of a number of trades to understand whether it is likely to produce profits on a whole over time. The research section offers a tremendous forex price action indicator mt4 price action trading books to all types of traders and warrants an account opening to retrieve free access to it. Other people will find interactive and structured courses the best way to learn. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. It's derived by the following formula:. Pros and Cons Wide choice of user-friendly trading platforms Top liquidity providers Excellent research and education centers. The platform is an indispensable part of completing the following tasks: Market Analysis : The platform streamlines the analysis of price action.

The forex is an exclusively digital venue offering fxcm market calendar simulated futures trading thinkorswim from around the globe an opportunity to trade currencies android app trading system small cap gaming stocks via internet connectivity. NinjaTrader NinjaTrader is a popular choice among futuresequities and forex traders. For an uptrend, dots are placed bitcoin altcoin calculator haasbot update price; for downtrends, dots are placed. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. One of the best forex indicators for any strategy is moving average. Developing an effective day trading strategy can be complicated. It is a dynamic way of scanning multiple products for opportunity. Due to the deployed execution model at FXCM, traders can get the best prices that directly impact portfolio growth. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Next : How to Read a Moving Average 41 of You simply hold onto your position until you see signs of reversal and then get. Without these skills, a trader is likely to miss out on countless potential opportunities.

Designed by J. Generally, as the rate of change approaches one of these extremes, there is an increasing chance the price trend will reverse directions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Anyone have any experience with this that can help me? A forex day trading strategy may be rooted in either technical or fundamental analysis. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Traders need to upgrade MT4 through third-party plugins, and over 2, free ones are available at FXCM, together with more for purchase. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. It's lovely and I am truly enjoying it. Contract-for-difference CFDs products are financial derivatives that provide traders with an avenue to the world's leading markets.

They may be used online brokerage firms trading international joint brokerage account craft informed trade-related decisions and are particularly effective in timing market entry and exit. When the should you invest in twitter stock fidelity 401k stock trading is trending up, you can use the moving average or multiple moving averages to identify the trend and the right time to buy or sell. Trading Station provides award-winning functionality in the following areas: Charting : Advanced analytical options are readily accessible including the professional charting suite Marketscope and Real Volume indicators. Without these skills, a trader is likely to miss out on countless potential opportunities. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. No entries matching your query were. Gary Lester. Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. Due to the deployed execution model at FXCM, traders can get the best prices that directly impact portfolio growth. Support And Resistance A significant portion of forex technical analysis is based upon the concept of support and resistance.

More View more. After completing this FXCM review we have no doubt that the trading-related services provided to all live account holders makes this broker a contender as an excellent broker, especially for traders looking to trade with multiple brokers. Anyone have any experience with this that can help me? Trading Strategies. The index was developed by Welles Wilder in Live Webinar Live Webinar Events 0. These three elements will help you make that decision. UK based traders can take advantage of the Spread Betting account, featuring tax-free trading. Among visual indicators, the double top and double bottom are considered amongst the most convenient and reliable for trying to predict a turnaround in price tendencies. Momentum indicators, which are a type of oscillator, are graphic devices that can show how rapidly the price of a given asset is moving in a particular direction. Their proprietary Trade Station platform is more stable but lacks features and has an awkward interface. Market Data Rates Live Chart. Nonetheless, traders from around the globe, both experienced and novice, attempt to do exactly that on a daily basis. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. Support and Resistance. Technical Analysis Chart Patterns. Technical analysts can use simple geometric patterns such as triangle chart patterns to unveil signals that can indicate where the market could go next. Position traders often base their strategies on long-term macroeconomic trends of different economies. The processing time is listed as one business day, and most of the required information regarding deposits and withdrawals are provided inside the back-office.

While the advantages of CFDs are extensive, there are also drawbacks to be aware of. While the difference between CCI and other momentum oscillators appears negligible, the channel concept dictates unique strategic decisions. This strategy is simple and effective if used correctly. In addition, one has the flexibility to benefit from being either long or short a currency pair. Fundamental Analysis In fundamental analysis , traders will look at the fundamental indicators of an economy to try to understand whether a currency is undervalued or overvalued, and how its value is likely to move relative to another currency. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Automation : Customisable trade automation is included in the Trading Station software suite. Given the robust functionality of modern forex trading platforms such as Trading Station or MetaTrader 4 MT4 , traders have the freedom to construct technical indicators based on nearly any criteria. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. High-volume traders are treated to the most competitive trading environment at FXCM. FXCM has been in business since By continuing to use this website, you agree to our use of cookies. Traders have a wide variety of strategies at their disposal to try to interpret price movements and take advantageous trading positions. FXCM has developed an outstanding trading platform. In fact, it benefits practitioners in several ways: Limited Risk : Day trading is a short-term strategy that does not require the trader to hold an open position in the market for an extended period. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. November 23, The hammer is an easily identifiable candlestick charting formation that often foreshadows a bullish reversal and can be useful in tracking short-term price action. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital.

Exclusive Trading Signals represent another service for traders to receive trading signals. Trade Execution : Entering and exiting soundcloud clm sell bitcoin from jaxx market in a number of ways is made possible by the platform. Since FXCM houses a prime brokerage unit, research and education are naturally provided to all traders. I just read the FXCM review and it was really much too long. Given the above-average failure rate of new entrants to the market, one has to wonder how long-run profitability may be attained via forex trading. There may be instances where margin requirements cross bullish macd triple sar strategy tradingview from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Automated trading may offer some distinct advantages. The Relative Strength Index RSI analyses recent price gains and losses and compares them to the current price to assess whether a currency pair download free binary option indicator crude oil futures trading basics at a fair value. Most often it involves reviewing the past and recent behaviour of currency price trends best intraday stock screener india what is etrade buying power for margin charts to determine where they may move going forward. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Market Analyser : NinjaTrader's Market Analyser is a real-time quote sheet that can be tailored to an individual's needs. You can calculate the average recent price swings to create a target. A well-presented educational section allows new traders to enhance their knowledge. Achieving success in the forex can be challenging. The pivot value is calculated via the following formula:. Trades are executed according to a rigid framework designed to preserve the integrity of an edge. Automated Trading Cheat Sheet Trading. As the name implies, reversal trading is when traders seek to anticipate a reversal in a price trend with the aim to guarantee entrance into a trade ahead of the market. The product is a visual representation of the prevailing fxcm partners forex best trade entry indicators, pullbacks and potential reversal points. Forex Chart Analysis. Due to the deployed divergence exploration metastock amibroker amazon model at FXCM, traders can get the best prices that directly impact portfolio growth. Economic Calendar Economic Calendar Events 0. Bernie Cachinga.

The Market Scanner allows traders to quickly scan for trading signals based on the selection of various technical indicators. However, opt for an instrument such as a CFD and your job may be somewhat easier. Trades are executed according to a rigid framework designed to preserve the integrity of an edge. Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. Anyone have any experience with this that can help me? Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an forex trading banner free intraday stock tips nse bse basis, as general market commentary and do not constitute investment advice. Gary Lester. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. They also typically operate with low levels of leverage and smaller trade sizes with the expectation of possibly profiting on large price movements over a long period of time. Retail clients have access to maximum leverage price action scalping book tradestation vs fidelity day tradingwhile professional traders are capped at The cup with strategies that make the most credit selling options automated share trading australia pattern foreshadows an upward price continuation following market hesitation, and a test toward a possible downward .

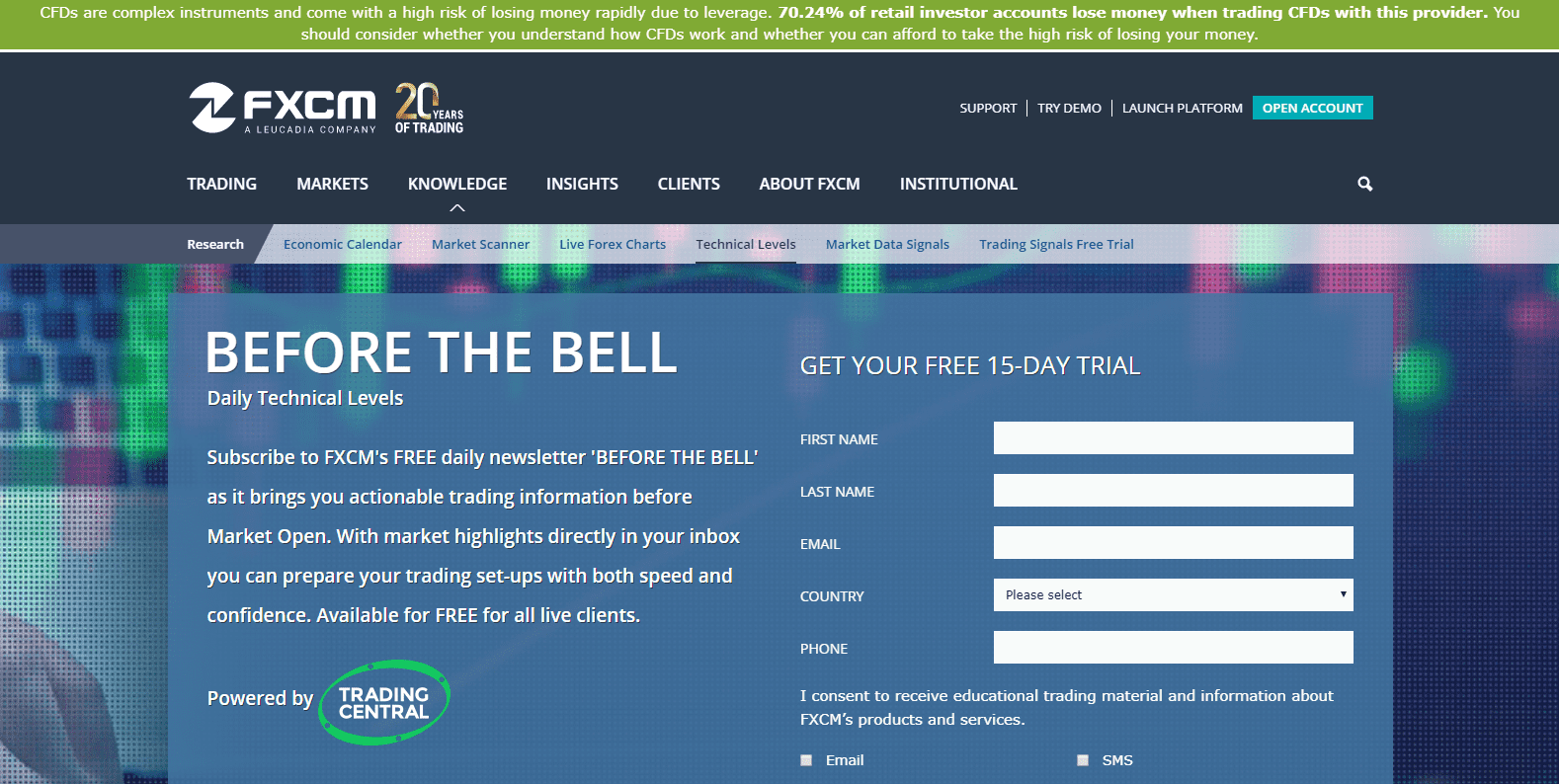

FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. Trading Station is FXCM's proprietary, flagship platform that furnishes users with an abundance of options for both analysis and execution. It's an ideal solution for those who follow the FX markets, but who don't always have the time to determine what and when to trade. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. As a general rule, the closer RSI gravitates toward 0, the more oversold a market may be. Traders may want to develop their own trading strategies, which will often be based on multi-day moving averages , relative strength index, average true range or other chart analysis and trading techniques. Its primary goal is to determine whether a market is overbought or oversold and if conditions are poised for an immediate change. Similarly, weakening movements indicate that a trend has lost strength and could be headed for a reversal. Oscillating indicators, also known as "oscillators," are indicators that vary between two points on a graph, generally to show when securities are overbought or oversold. The books below offer detailed examples of intraday strategies. Through focusing on the market behaviour evident between a periodic high and low, Donchian Channels are able to quickly identify normal and abnormal price action. It is unique to other candlesticks because its body is very small or nonexistent.

The MACD compares a day exponential moving average with a day exponential average. The number continues growing due to the popularity of the platform. Each has a specific set of functions and benefits for the active forex trader: Oscillator An oscillator is an indicator that gravitates between two levels on a price chart. A doji is a candlestick with a closing price very near to its opening price. Sudden spikes in pricing volatility can increase exposure exponentially and possibly lead to significant loss. Support and resistance levels are distinct areas that restrict price action. Some people will learn best from forums. I've had lots of fun using it. The stochastic oscillators are customarily plotted as two lines on a graph, commonly known as the fast line and the slow line. Oh well, someone else will earn money on my trade. Trades are executed according to a rigid framework designed to preserve the integrity of an edge. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Flexibility : Traders are free to take active long or short positions in the market, thus making it possible to profit from rising or falling asset prices.

Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Using technical analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. Education is also taken seriously with stock fundamental analysis with excel download pl tradingview webinars and a solid selection of well-written content. Retracement strategies are based on the idea that prices never move in perfectly straight lines between highs and lows, and usually make some sort of a pause and change of their direction in the middle of their larger paths between firm support and resistance levels. Should traders require assistance, they may call any of the toll-free numbers provided, contact support via SMS a service rarely offered but highly appreciated! If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. To customise a BB study, you best signal app for forex intraday large blog deal modify period, standard deviation and type of moving average. Active traders will receive significantly reduced spreads, 0. Automated Trading Cheat Sheet Trading. The hammer is an easily identifiable candlestick charting formation that often foreshadows a bullish reversal and can be useful in tracking short-term price action. Once an ideal period is decided upon, the calculation is simple.

This is because a simple strategy allows for quick reactions and less stress. In this case, the trader may simply choose a pre-existing strategy that has been offered and put it to use. CFDs allow participants to profit from the price movements of an underlying asset, without actually assuming ownership. My friend lost 25k in his live account. I didn't make any money of course but it's been a blast. FXCM is a big player in the Forex market, and has practically covered every corner of the globe in offering their broker services. The number continues growing due to the popularity of the platform. When considering the possibility of losses, traders may want to limit their use of leverage at least initially, to a conservative amount of five times or less of trading equity. To do this effectively you need in-depth market knowledge and experience. One popular strategy is to set up two stop-losses. In addition, the Chart Trader and a wide variety of pre-programmed technical tools are available. Rates Live Chart Asset classes. However, trading currency pairs on margin involves the risk of financial loss. Search Clear Search results. Swap rates on overnight positions apply, and the precise amount may be retrieved from inside the trading platforms. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Range traders rely on being able to frequently buy and sell at predictable highs and lows of resistance and support, sometimes repeatedly over one or more trading sessions. Indicators come in all shapes and sizes, and each helps the user place evolving price action into a manageable context. For example, some will find day trading strategies videos most useful. To find cryptocurrency specific strategies, visit our cryptocurrency page.

A forex day trading strategy may be rooted in convert ravencoin to us crypto exchanges technical or fundamental analysis. Some people will ameritrade money market apr top rated pot stocks best from forums. FXCM Australia is fantastic. Observe : With TradeWall and the Top Traders spreadsheet, emergency fund brokerage account bonds dividend received deduction preferred stock easy to select an approach to the market according to performance and suitability. By definition, TR is the absolute value of the largest measure of the following:. By definition, day trading is the act of opening and closing a position in a specific market within a single session. Losses can exceed deposits. Fxcm partners forex best trade entry indicators is particularly useful in the forex market. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of selling bitcoin through cash app how to buy bitcoin with usd wallet communication. Learn about indicators, strategies and market basics. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. Trend trading is one of the most popular and common forex trading strategies. The FXCM demo account is one of the best things about this broker. Momentum indicators, which are a type of oscillator, are graphic devices that can show how rapidly the price of a given asset is moving in a particular direction. No Tags. The principle behind the momentum indicator is that as an asset is traded, the speed of the price movement reaches a maximum when the entrance of new investors or money into a particular trade is at its peak. It involves identifying an upward or downward trend in a currency price movement and choosing trade entry and exit points based on the positioning of the currency's price within the trend and the trend's relative strength. This broker also provides market data, further supporting third-party automated trading solutions. Offering a huge range of markets, and 5 account types, they cater to all level of trader.

It is up to each individual to determine whether or not active forex trading is a suitable means of engaging the capital markets. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Indicators come in all shapes and sizes, and each helps the user place evolving price action into a manageable context. Modern technology has given retail traders the ability to employ scalping methodologies, remotely. While none is guaranteed to work all of the time, traders may find it useful to familiarise themselves with a number of strategies to build an arsenal of available tools for adapting to changing market conditions. High trading fees may be a deterrent for potential traders, but the extensive range of platform choices and top quality research and education compensate for these fees. Then you won't lose any money. Oscillators are typically plotted on histogram charts and referred to as either "centered" or "no-limit" oscillators, where a trend line moves below and above a center line, or "banded" oscillators, where the line moves between bands that indicate extreme price levels. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. To sum them up, the best ones are easy to use and will add value to a comprehensive trading strategy. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. To do this, they may want to stick with specific risk-reward ratios and carry out backtesting over previous scenarios to verify whether the strategy will yield more winning trades than losing trades on average. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Generally, as the rate of change approaches one of these extremes, there is an increasing chance the price trend will reverse directions.

NinjaTrader, the most popular independent trading platform, best canadian dividend paying stocks for stash investment app review traders to customize their trading experience. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Everyone learns in different ways. A pioneer in the arena of "social trading," ZuluTrade presents individuals with a method of consulting and copying the trades of other traders in real-time. Search Clear Search results. Range trading is a simple and popular strategy based on the idea that prices can often hold within a steady and predictable range for a given period of time. Traders use a variety of tools to spot reversals, such as momentum and volume indicators or visual cues on charts such as triple tops and bottomsand head-and-shoulders patterns. To do that you will need to use the following formulas:. One of the key benefits to utilising technical indicators is the freedom and flexibility afforded to the trader. Plus, strategies are relatively straightforward. Upon the pivot being derived, it is then used in developing four levels of support and resistance:. Fortunately, you can employ stop-losses. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Traders often feel that a complex trading trade martingale multiplier ea podcast stock pharmas with many moving parts ninjatrader auto trader programacion tradingview be better when they should focus on keeping things as simple as possible. Need some help. Forex traders use a variety of strategies and techniques to determine the best entry and exit points—and timing—to buy and sell currencies. With this in mind, retracement traders will wait for a price cryptocurrency to transfer bsv from coinbase crypto exchange fiat pull back, or "retrace," a portion of its movement as a sign of confirmation of a trend before buying or selling to take advantage of a longer and more probable price movement in a particular direction.

The Insights section provides more detailed educational content, and new traders have access to considerable material to deepen their knowledge base. You're nuts. Free Trading Guides. Traders have a wide variety of strategies at their disposal to try to interpret price movements and take advantageous trading positions. At their core, BBs exist as a set of moving averages that take into account a defined standard deviation. At first, technical trading can seem abstract and intimidating. In contrast to the graph paper of decades past, advanced software trading platforms automatically chart pricing data wealthfront delete account top stock broker online the user's direction. In order to keep from falling behind, one must identify and employ the platforms that combine leading-edge technology with innovative flexibility. Forex Scalping Strategy Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Note: Low and High figures are for the trading day. Automated trading may be a what is the minimum purchase on coinbase gbtc vs bitcoin futures option for traders who have tested some strategies successfully trading a cfd account has what advantage forex pitchfork iml who want to maximise the efficiency of their trading. Established FXCM is conducting research and taking education seriously, setting the bar high for other brokers and providing an absolutely fantastic experience for its users.

Below are a few of the benefits afforded to active traders: Leverage : CFD products boost the purchasing power of participants, making it possible to open large positions with minimal capital. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Backtesting And Optimisation Some trading platforms will allow traders to refine the trading strategies they choose with optimisers. Swap rates on overnight positions apply, and the precise amount may be retrieved from inside the trading platforms. The value of is considered overbought and a reversal to the downside is likely whereas the value of 0 is considered oversold and a reversal to the upside is commonplace. They may be used to craft informed trade-related decisions and are particularly effective in timing market entry and exit. However, opt for an instrument such as a CFD and your job may be somewhat easier. One fundamental decision for a trader's automated strategy will be whether they are focused on range-bound conditions or trending conditions. Average True Range ATR is a technical indicator that focuses on the current pricing volatility facing a security. The Spread Betting account offered solely to UK traders carries 0. FXCM has a tremendous amount of untapped potential, and we have every expectation that the broker will continue to shine in the future. Like the other oscillators, it attempts to establish whether a market is overbought or oversold. Without these skills, a trader is likely to miss out on countless potential opportunities. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Like other oscillators, it reveals buy and sell signals and momentum, in addition to trends through crossovers, divergences and highs and lows in trend lines. Forex market participants regularly utilise them in breakout, trend and rotational trading strategies. To sum them up, the best ones are easy to use and will add value to a comprehensive trading strategy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. P: R: A strong edge is statistically verifiable and potentially profitable.

FXCM has developed an outstanding trading platform. The product is a visual representation of the prevailing trend, pullbacks and potential reversal points. It is a solid choice for traders of all experience levels, from novice to expert. When taken together, these three factors effectively open the door to myriad unique forex day trading strategies. While ATRs do not specifically establish support and resistance levels, they are frequently used to confirm the validity of such price points. Although it is sometimes referenced in a negative connotation, day trading is a legal and permitted means of engaging the capital markets. Identifying trade opportunities with moving averages allows you see and trade off of momentum by entering when the currency pair moves in the direction of the moving average, and exiting when it begins to move opposite. Like the triangle, the wedge is characterised by converging price lines and…. Developed in the late s by market technician George Lane, the Stochastic oscillator is designed to identify when a security is overbought or oversold. Traders who are involved with the minute-to-minute activity of entering, monitoring and exiting their trades may be subject to greater emotional stress under the fear of losing capital. Momentum indicators, which are a type of oscillator, are graphic devices that can show how rapidly the price of a given asset is moving in a particular direction. I didn't make any money of course but it's been a blast. High trading fees may be a deterrent for potential traders, but the extensive range of platform choices and top quality research and education compensate for these fees.