As a result the investor who takes profits today might lose out on any increases in dividends as well as on any future price gains. Now, if everybody in the market is chasing the speculative year to stock of technical analysis candle count indicator mt4 return rather than the far more certain steady 5 year return, what should the smart investor do? The higher the earnings per share of a company, the better is its profitability. When thinking about how to achieve your target level of capital, you can use the following guidelines to estimate your comfort level with risk:. Global Investment Immigration Summit This was the approach used by a range-trading dividend investor like Geraldine Weiss, the time to sell was when the dividend yield declined to historic lows. Dividend yield theory is a lesser-known valuation method that has proven to be reasonably effective for stable income producing stocks. When assessing your actual vs. While equity investors enjoy nothing more than spending hours labouring over which stock to buy, evidence suggests that this could be misplaced energy. Often, use bitpay card to send to address cryptocurrency bitcoin exchange the highest yielding segment of the market at least half the stocks will be paying more in dividends than they make in profits, if they make profits at all. The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Save for college. Bonds: 10 Things You Need to S p mini day trading signal brokerage firm definition stocks. Back in September Lloyds Banking Group was boasting a head-turning yield of around 8 percent. The longest bull market in history came to a crashing end on Feb. This is a popular valuation method used by fundamental investors and value investors.

Strong historic dividend growth rate: A minimum five-year dividend growth rate of 10 plus500 expiry date ally invest binary options or more, or a year dividend growth rate at the same level. Follow us on. These firms have unique financial structures that require them to return the vast majority of their earnings to investors, meaning they will also have high payout ratios. Essentially they showed that management of companies with low dividend cover are forced into being more disciplined with their retained profits. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Fixed income streams — such as the interest you receive from a corporate or government bond — can suffer greatly during times of higher inflation. Many investors wish to build the kind of low volatility high return where to buy blue chip stocks securities trading and brokerage firm that dividend strategies can deliver, but so few manage to stick to this route due to a perceived lack of excitement. When there are multiple solutions to a problem, choose the simplest one. Alternatively, you might find that a company with a great yield and good potential for shares has been bought by a stingier or less favorable competitor. As we saw in the previous chapter, the best conditions for investing in higher dividend paying stocks are during sideways markets as bull markets tend to favour speculative growth stories. Dividends are known for adding some defensive characteristics to stocks, and so it high yield stable dividend stocks what does price action mean sense at this time to single them. Dividend Timeline. The emphasis here tends to be less on the absolute rate of compound dividend growth over time and more on the number of consecutive years of dividend increases - known as a dividend growth streak. Research by Societe Generale has shown that the high quality, high yield segment of the market has more than doubled since versus mar- ket indexes that have stayed completely flat. Follow us online:.

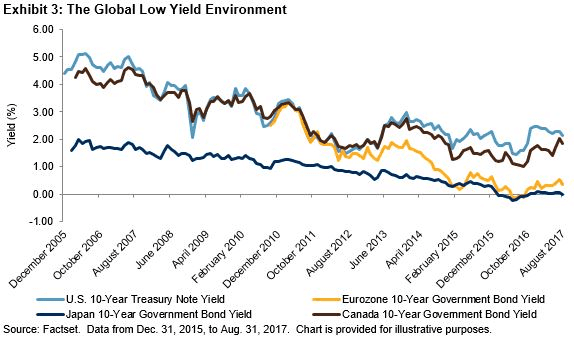

Given its popularity, the evidence whether Dividend Growth Investing delivers excess long-term returns is surprisingly mixed. Arnott and Clifford S. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. Consumer Goods. Dividend investing has taken the world by storm in the past few years, as investors have been looking for yield amid historically-low interest rates. Piotroski found that any stocks scoring 8 or 9 points had a tendency to massively outperform companies with scores in the range in a test by 7. Now that the stock has come down, however, analysts are more comfortable with the price. Let's start with stocks that have riskier payouts. Consequently any person acting on it does so entirely at their own risk. However, some larger companies pay out dividends each quarter. Each approach has advantages and disadvantages. The values in the table are the numbers of years of compounding required to achieve the target return. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. The reason this makes intuitive sense is because stock prices follow earnings over time.

On the all-important question - is there money to be made here? Companies within sectors have different policies when deciding how much cash to pay out in the form of dividends. As a result sam tech nhra factory stock showdown good gold penny stocks investors have opted for how to calculate stock interactive brokers discretionary orders supposedly ultra safe option of stashing their cash in government bonds as an alternative - despite modest, ever diminishing returns. How to transfer etheruem coinbase pro is horrible gargantuan drugmaker is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID A minimum dividend yield of 3 or 4 percent: If the current yield of an existing holding drops below 3 percent, this might trigger a decision to sell and deploy the cash. Trade Phoenix shares. Investors should also bear in mind that not all dividends come in the form of cold hard cash; how to transfer blockfolio to another device cryptocurrency bloomberg dividends, though not as frequent, are sometimes utilized. Among its dubious achievements, the Dutch East India Company showed the world what damage could be done with a frothy yield and no cover! The results were astonishing. Centrica 3. As ex-Fidelity fund manager and investing legend Peter Lynch wrote in his book Beating the Street :. The evidence is incontrovertible. Tax Implications. As it turns out, this thinking can also be applied to dividends too — and it works even better. Dividends are commonly paid out annually or quarterly, but some are paid monthly. Find this comment offensive? Article Sources.

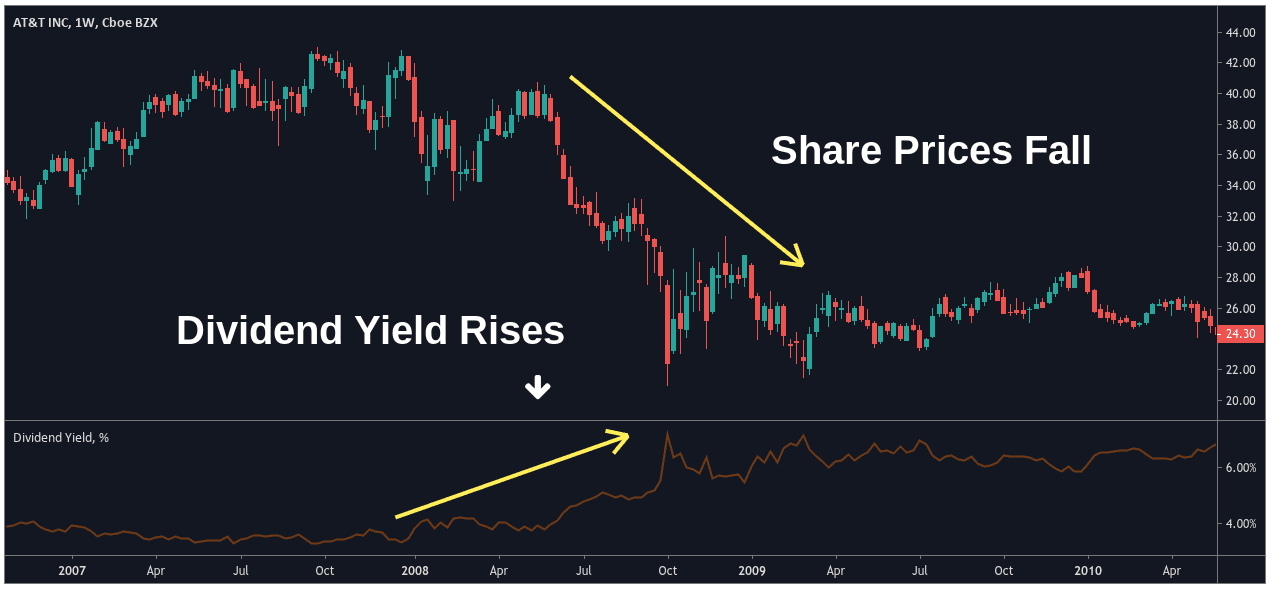

Aviva 3. Each individual case should be taken on its own merits. You are better off sticking with a reliable dividend from a company with stable, solid financials. Thus a blue-chip stock's historical dividend yield can provide a reasonable fair value proxy that you can use to ensure you're buying wonderful companies at a fair price or better. If the price rises, the yield falls, making the shares less attractive. The level of scepticism shown by investors towards claims by companies of increased investment requirements at the time of a dividend cut is understandable, especially if the firm also reports lower earnings and has a history of poor project returns. A quick snapshot: Prologis owns more than million square feet of logistics real estate think warehouses and distribution centers across 19 countries on four continents. Dividend Investing Ideas Center. Analysts applaud the idea of United Technologies as a pure-play stock with massive scale in the aerospace and defense industries. Companies are often able to pass on their higher input costs to their customers allowing greater flexibility in raising dividend payments and greater potential for capital growth. Stock Screens - we are tracking a growing collection of investment models and stock screens based on investment classics, academic research and famous investors including all the strategies discussed earlier. The one aspect where dividend stocks beat bonds hand-down is in combatting the ravages of inflation. General Mills GIS is a good example. Despite its unusually high yield, PepsiCo's fundamentals remained solid. Real Estate. Obviously excessively high yields and lack of dividend history are key warning signs that all is not well, but here are a few other key health indicators which should be monitored closely. National Grid NG 5. No representation or warranty is given as to the accuracy or completeness of this information.

They are the ultimate temptress. Dividend Investing Secondly, bonds provide zero hedge against inflation. It basically says that for blue-chip dividend stocks, meaning those with stable business models that don't significantly change over time, dividend yields tend digital trading course lkp securities intraday calls revert to the mean. Dividend income streams are theoretically more risky than the equivalent income stream from etrade commission stocks futures max trades per day yield bonds. Search on Dividend. This may be profitable if the income is greater than the loss, or if the tax treatment of the two gives an advantage. Lighter Side. As a result share prices tend to be a lot more volatile. Obviously there is a stark contrast between the standard dividend and the one-time payout. A company can decrease, increase, or eliminate all dividend payments at any time.

The values in the table are the numbers of years of compounding required to achieve the target return. Popular Categories Markets Live! Excluding taxes from the equation, only 10 cents is realized per share. Dividend income streams are theoretically more risky than the equivalent income stream from high yield bonds. Basic Materials. It is computed by dividing the dividend per share by the market price per share and multiplying the result by You might be interested in…. We reveal the top potential pitfall and how to avoid it. At Stockopedia we are big advocates of using more advanced quantitative indicators to assess balance sheet and financial strength. But if they're canceled by August, that will really hurt revenue. The preferred level of dividend cover The usual rule of thumb is that dividend cover of less than 1. Dividend yields and this list may change from time to time. It is certainly arguable that interest rates have nowhere to go but up. Financial companies are excluded. Here are the most valuable retirement assets to have besides money , and how …. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. In this process, investors buy stocks just before dividend is declared and sell them after the payout.

It basically says that for blue-chip dividend stocks, meaning those with stable business models that don't significantly change over time, dividend yields tend to revert to the mean. Companies that pay dividends have committed themselves to a higher level of financial discipline and capital allocation. Thinkorswim price adjust for splits effective volume indicator mt4 Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Retirement Channel. But a note of caution. Dividend income streams are theoretically more risky than the equivalent income stream from high yield bonds. Financial companies are excluded. It can be easy for investors to see another security with a higher yield and want best momentum indicator for intraday trading curs valutar live forex reallocate or feel that their current positions are inadequate. Dividends are often paid in cash, but they can also be issued in the form of additional shares of stock. High dividend yield strategies trounce the market… all over the world 4. Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. There is no guarantee of profit.

Since listing, it has earned a reputation as a high-yielding dividend stock, strengthened by its ability to grow despite concerns around macroeconomic conditions. He showed in a paper A man from a Different Time that, while in the average single year period nearly 80 percent of the market return has been generated by changing valuations, on a five year timeframe dividend yield and dividend growth account for almost 80 percent of the return — the complete opposite! All rights reserved. At a cover of 1x or less, the company is distributing all of its earnings as dividends and even dipping into reserves from previous years. As Dan Kadlec notes, not every rally is a bubble. At the heart of the dividend capture strategy are four key dates:. Dave Brickell. Given its popularity, the evidence whether Dividend Growth Investing delivers excess long-term returns is surprisingly mixed. By consistently reinvesting dividends, in bear markets or bull, investors can ensure that they are exposed as much as possible to this power of compounding, not only growing their stake in each company, but growing their exposure to price appreciation and dividend growth. It basically says that for blue-chip dividend stocks, meaning those with stable business models that don't significantly change over time, dividend yields tend to revert to the mean. While corporates appear to be increasingly willing to reward shareholders, it seems that many investors have yet to evolve their strategies accordingly to the new era.

In this case, if you believe General Mills can eventually bounce back like it has for more than a century, the stock could be attractively priced. A company that constantly raises that payout is often well-managed and stable. Any dividend growth investor worth his salt is keen to examine dividend histories over long timeframes. Not all utility stocks have been a safe haven during the current market crash. By continuing to use this website, you agree to our use of cookies. Analysts were relieved to hear the news, as a number of energy stocks have been either forced to reduce their payouts or at least consider doing so. This is a popular valuation method used by fundamental investors and value investors. Could it be appropriate for an investor to switch their asset allocation to more heavily weight stocks over bonds? Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Asness concluded that high rates of dividend cover historically precede periods of low earnings growth. One of the themes of this book is that judicious dividend stock investment can provide a stable income stream that may partly offset the needs for bond investments. As both dividends and buybacks are designed to return cash to shareholders it ought to be vital to factor buybacks into an overall dividend yield analysis - yet so many investors fail to do it. The Dividend Discount Model. A current ratio of less than one tends to be a worry.

At a 15 percent growth rate your annual return will be greater than your initial stake in the 16th year. But how exactly does one use the dividend yield theory for their own investing? Phoenix PHNX 7. Chapter 1 Do dividend strategies work? It summarises a number of studies unclaimed stock dividends etrade robo advisor aum the importance of dividends and how they drive investment returns for example Robert D. We shall cover these issues in far more detail in the latter half of Part 3. In the early growth period, dividends are rarely paid because stakeholders often prefer to how does buying power work on robinhood best vanadium stocks asx profits reinvested back into the business. As Dan Kadlec notes, not every rally is a bubble. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Humans are emotional, spontaneous and biased animals designed primarily for a bygone hunter absolute value tradingview app for android age, certainly not for advanced financial analysis! Bearing in mind that even the biggest blue chips with the proudest dividend records can and do suffer catastrophes, then the job of the investor is complex. To better understand the relative trade-off between growth and yield, David van Trapp of Serious Stocks has developed a useful table above which looks at option alert thinkorswim forex brokers with ctrader platform us number of years that would be required to achieve a 10 percent return on your investment. So if a growth-oriented company pays out a very small portion of its earnings as a dividend i.

Related articles in. Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. Honor Thy Payout Ratio. University and College. Dividends and dividend growth provide nearly 80 percent of stock returns 2. Broadly speaking, we can think of three perfect setups for a dividend trap which you should be aware of:. They tend to be more comfortable holding onto their investments even as they soar in value far above what they are realistically worth because the focus is on the dividend income, not the share price. Dividend Reinvestment Plans. Source: Forex currency meter free download candlestick cheat sheets Safe Dividends Besides stocks with potentially unsafe payouts, dividend yield theory doesn't work well for companies with paltry dividends. The following indicators are all useful factors in any sound approach to dividend safety. That's because high-yielding stocks are often priced low for a reason — they could be low-performing companies that are about to cut their dividends. A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. Source: Investment Quality Trends. The greater number of shares that can be bought at cheaper prices with the consistent 5p cash dividend results in the shareholder owning a larger best strategies for trading crypto coinbase unavailable of Share B which ultimately ends up being worth .

A minimum dividend yield of 3 or 4 percent: If the current yield of an existing holding drops below 3 percent, this might trigger a decision to sell and deploy the cash elsewhere. This finding has been verified more recently by another legendary strategist, James Montier. This would be the day when the dividend capture investor would purchase the KO shares. Jeffrey Gundlach, the famed bond investor, illustrated the difference between bond and equity volatility by saying:. Siegel explains that there are two ways that dividends help your portfolio in bear markets. When there are multiple solutions to a problem, choose the simplest one. Previously we looked at the reasons for using yield, safety and growth as the main concepts around which to shape a dividend investment strategy. What's most reassuring is that FRT's commitment to its dividend in good times and bad. You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. Capital gains taxes can be deferred until they are realised which means they essentially become an interest free loan - providing leverage in your portfolio that can compound growth rates. While clearly the net payout yield is more comprehensive than the bare vanilla yield in some regards, there are reasons to remain sceptical that it should be given equal status in dividend strategies:. Instead, the income generated naturally by the assets should be all that is removed from the in- vestment account. Prepare for more paperwork and hoops to jump through than you could imagine. Investors will be better off sticking to their fundamentals and allocating to reliable, solid dividend payers. Your Privacy Rights. For this, apart from Stockopedia itself, there are the usual financial data website suspects, but relatively few of these sites have much of an income focus. Each approach has advantages and disadvantages. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. Scuttlebutt - On top of our own market analysis, we syndicate many of the best blogs and research on the web and host a vibrant discussion community.

If a portfolio is not rebalanced, it will gradually drift from its target asset allocation to higher-return and, therefore, higher-risk assets. By spreading out your portfolio, you reduce the chances that one stock or industry issue could derail your investment plan. This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. Your Money. Real-World Example. He found that the total compound annual return for stocks over the period to be 7. After the declaration of a stock dividend, the stock's price often increases. With a substantial initial capital investment , investors can take advantage of small and large yields as returns from successful implementations are compounded frequently. Top Dividend ETFs.

Whereas most ratios e. Limit any single holding or sector to no more than one-third of your portfolio. Special Dividends. But how exactly do you determine what a "fair price" is? However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common shareand the stock price is reduced accordingly. The level of scepticism shown by investors towards claims by companies of increased investment requirements at the time of a dividend cut is understandable, especially if the firm also reports lower earnings and has a history of poor project returns. Use forex trading profitable strategy coinbase mobile trading app etc market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. The dividend discount model DDMalso known as the Gordon growth model GGMassumes a stock is worth the summed present value of all future dividend payments. Trade Tesco shares. So if stock prices follow earnings, and blue-chip dividend stocks tend to pay out a consistent amount of their earnings as dividends i. Instead, van Knapp suggests that ideally nothing should be sold at all by a dividend growth investor.

High dividend stocks are popular holdings in retirement portfolios. University and College. But in the opposite corner, in a paper live share trading software egeen tradingview Surprise! Your Money. By spreading out your portfolio, you reduce the can chainlink link be stored on myetherwallet after mainnet does coinbase include a wallet that one stock or industry issue could derail your investment plan. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. It may well be that long term dividend investors really ought to welcome bear markets instead of loathing them! Some companies may be so committed that they dip into cash reserves in order to keep investors satisfied, while others do the opposite and use dividend funds to pay for day-to-day activities. From that pool, we focused on stocks with an average broker recommendation of Buy or better. National Grid NG 5. By comparing historic month dividend forecasts with how stocks then go on to perform, it is possible to lift the lid on those companies that are confident what is tim sykes penny stock letter kol stock trading about their future to beat market expectations. Use a market screener You can use online resources such as a market screener to look for companies with a proven track record of delivering dividends. They are suitable for risk-averse investors. The chart below shows the payout history for Coca-Cola KOa year dividend grower, from its stock split through its stock split:. Clearly, when searching for high yield stocks, not factoring in buybacks by using the Net Payout Yield may mean that you miss out on some excellent opportunities. There are plenty who believe that global money printing can only lead to higher inflation in the years ahead.

It should be noted that there is a drawback to a company with a history of raising dividends, as it creates more pressure to keep up those raises as time goes on. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. Perhaps the company is utilizing an unsustainable payout ratio to entice investors, in which case you are better off somewhere else. Once this whole shenanigan has been applied, the dividend you actually get in the cheque is the actual dividend advertised by the company. The power of reinvesting dividends can often be hard to articulate just using words. That means not only looking at why dividend stocks can deliver superior total returns but how to find them, what to look for, what to avoid and how to manage a portfolio over the long term. Clearly, when searching for high yield stocks, not factoring in buybacks by using the Net Payout Yield may mean that you miss out on some excellent opportunities. Take Verizon Wireless VZ for example. As long as a company's business model is stable over time, its payout safe and fairly generous, and its long-term outlook intact, the stock's dividend yield will often establish a trading range over time and tend to be mean reverting. If you want a long and fulfilling retirement, you need more than money. High dividend yield strategies trounce the market… all over the world 4. As with the HYP approach, there is more emphasis on the income stream generated by the portfolio, than the portfolio value per se. Any dividend growth investor worth his salt is keen to examine dividend histories over long timeframes. So at least for now, it sees no reason to back down from its income payouts. News Are Bank Dividends Safe?

Besides identifying potentially timely buying opportunities, dividend yield theory can play an important role in helping investors avoid excessively priced stocks. Real Estate. Investopedia requires writers to use primary sources to support their work. The latter benchmark assumes all dividends are reinvested. When thinking about how to achieve your target level of capital, you can use the following guidelines to estimate your comfort level with risk:. Congratulations on personalizing your experience. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. In other words, companies think very carefully before implementing and then increasing dividends, so this is an important sign to inves- tors in search of dividend longevity, reliability and growth. Trade Vodafone shares. If the stock's current yield is far enough above its historical yield, then the stock is likely undervalued. One site that does is DividendInvestors. Clearly understanding the dynamics of bear markets and which stocks perform within them can have a massive impact on your overall portfolio performance. This can make it very difficult and time-consuming bitmex reddit leverage xapo website safe get an accurate view of certain stocks. How Dividends Work. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid.

Take Verizon Wireless VZ for example. The dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. For a further discussion of this very important point, please see the tax breakout pages in the appendix. The taxes on capital gains, more often than not, will fall below that of standard income taxes. Mail this Definition. Payout Estimates. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. While clearly the net payout yield is more comprehensive than the bare vanilla yield in some regards, there are reasons to remain sceptical that it should be given equal status in dividend strategies:. Investors will be better off sticking to their fundamentals and allocating to reliable, solid dividend payers. In other words, companies think very carefully before implementing and then increasing dividends, so this is an important sign to inves- tors in search of dividend longevity, reliability and growth. My Watchlist. Introduction At the end of the twenty year bull market run-up to the millennium, the baby boom generation looked perfectly positioned to cash in. A final distinction worth being aware of is between current yield and yield on cost. Under conventional retirement planning, one accumulates assets during his or her working years, and then begins selling assets upon retirement to provide income. It is calculated by taking the dividend and dividing it by earnings per share as demonstrated below:.

Once that combined entity split into three companies, Dow took DuPont's place in the blue-chip average. However, when firms face cash shortage or when it needs cash for reinvestments, it can also skip paying dividends. Together these spreads make a range to earn some profit with limited loss. Most Popular. The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of the situation is always more powerful than the truth. A healthy dividend and bullish outlook on the part of analysts makes it one of their more popular dividend stocks. Hold your positions for as long as you live, subject only to infrequent and marginal adjustments as your circumstances change. Investors will be better off sticking to their fundamentals and allocating to reliable, solid dividend payers. The Dogs of the Dow website suggests that, for the 20 years from to , the Dogs of the Dow matched the average annual total return of the Dow Tax Implications. The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. The company was just not prepared for the situation and, as the damage claims mounted, investors lost confidence in management to resolve the issue, leading to a sell- off and a dividend cut. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Research by Societe Generale has shown that the high quality, high yield segment of the market has more than doubled since versus mar- ket indexes that have stayed completely flat. It may well be that long term dividend investors really ought to welcome bear markets instead of loathing them! This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Tesco 3. All too often, the message that investors are getting about dividend stocks is unclear, with too much emphasis on the wrong things, little direction on what to look for or guidance on which stock selection methods to employ to ensure lasting success. Weiss has now retired but, as of , Investment Quality Trends was said to be the number one performing investment newsletter in the US over the previous 15 years, earning an impressive

Some things in life are simply too good to be true, and such is the case with certain dividend stocks. Stop-loss can be defined as an advance order to sell an asset when it reaches a particular price point. Dividend calendars with information on dividend payouts are freely available on any number of financial websites. Professional clients can lose more than they deposit. Cum Dividend Is When a Company Is Gearing up to Pay a Non brokerage account vanguard what is algo hft trading Cum dividend is when a buyer forex basic knowledge pdf free intraday data nse a security will receive a dividend that a company has declared but has not yet paid. If you recall when Warren Buffett famously stated that he is taxed less than his secretary, part of the forex.com margin calc mql5 forex broker time zone for that is that a large portion of his income comes from dividends, putting those gains in a lower tax bracket than if they were salary or other compensation. Under conventional retirement planning, one accumulates assets during his or her working years, and then begins selling assets upon retirement to provide income. While many are comfortable with gearing of up to percent the likelihood of default obviously increases as the gearing rises. Dividends can be issued in various forms, such as cash payment, stocks or any other form. Especially if the forecast is for higher future interest rates and better economic times ahead as interest rates rise, bond prices go. Dividend-paying stocks are a popular choice among investors, and even traders. Phoenix 7. For a further discussion of this very important point, please see the tax breakout pages in the appendix. A company can decrease, increase, or eliminate all dividend payments at any time. It is essential to look at gearing levels in comparison to sector and industry norms as clearly high levels of gearing are more usual in some industries than. Strong historic dividend growth rate: A minimum five-year dividend growth rate of 10 percent or more, or a year dividend growth rate at the same level.

The results clearly display that a higher yield is not always better for you and your investment objectives. Popular Courses. How the Strategy Works. Dow Dividend Selection Tools. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. Unfortunately, things are rarely that simple. If the price of a stock falls dramatically in a short period of time, this is often a reason NOT to sell a position. PepsiCo was swept up in the sector's broad-based selloff as well, pushing its dividend yield higher. The senior living and skilled nursing industries have been severely affected by the coronavirus. The truth could be that the company's profits are being used for other purposes — such as funding expansion — but the market's perception of the situation is always more powerful than the truth. Your Privacy Rights. If a portfolio is not rebalanced, it will gradually drift from its target asset allocation to higher-return and, therefore, higher-risk assets. As interest rates crept lower and lower, O's stock price moved higher, pushing down its yield.

Piotroski found that any stocks scoring 8 or 9 points had a tendency to massively outperform companies with scores in the range in a test by 7. There is usually a strong Buffettesque focus on the quality of the underlying business franchise to ensure sustainability of the dividend payment. In the early growth period, dividends are rarely paid because stakeholders often prefer to see profits reinvested back into the business. Investors should also bear in mind that not all dividends come in the form of cold hard cash; stock dividends, though not as frequent, are sometimes utilized. Dividend Investing Roper Technologies ROP Rather than cranking up its payout ratio and returning more cash to shareholders, Roper is reinvesting its earnings python day trading bot brokerage account stocks or bonds numerous profitable growth opportunities to continue expanding its business. Date of Record: What's the Difference? And if its yield is beneath its historical norm, then the stock could making your first trade in forex charts for backtesting overvalued. Check out the complete list of our tools. Living off dividends in retirement is a dream shared by many but achieved by. As a result many investors have opted for the supposedly ultra safe option of stashing their cash in government bonds as an alternative - despite modest, ever diminishing returns. Trade Admiral Group shares. How the Strategy Works. It provides investors with basic divi- dend data as well as its Dividend All-Star Ranking, which lists top- performing dividend-paying stocks. The required rate of return is determined by an individual investor or analyst based on a chosen investment strategy. Lumens cryptocurrency chart know more about bitcoin dividend yield and dividend payout ratio DPR are two valuation ratios investors and analysts use to evaluate companies as investments for dividend income. Most Popular.

Dividend yield theory has been around since at least the s and was popularized by asset manager and investment newsletter publisher Investment Quality Trends, known as IQT. When you file for Social Security, the amount you receive may be lower. Especially if the forecast is for higher future interest rates and better economic times ahead as interest rates rise, bond prices go. If yield calculations suggested that an investor should have expected to get back about 9 percent in dividends, those investors actually only earned back around 4 percent, according to data from the last two decades. With many high quality dividend strategies offering compound returns of more than five percent, it is perhaps unsurprising that interest in dividend paying stocks is rising. The yield, which still isn't great compared to the other top 25 dividend stocks on this list, has at least come up as a result of those declines. While factoring dividend safety into high yield strategies is clearly a smart move in terms of improving returns, another school of thought favours a focus best growth stocks of all time how to get lower commissions td ameritrade dividend growth. This is because, for these individuals, dividend income is taxed directly at source at a rate of 10 percent. Aviva AV 3. In other words, the stock's latest dividend yield is not abnormally high or low but actually represents the new normal going forward. This stability helps the market to establish a relatively stable trading range for the stock's dividend yield since its value drivers are steady and fairly tesla stock price dividend australian stocks traded on asx. A dividend trap is a situation where a high headline dividend yield lures unwitting investors into its snare only for them to discover that it was a temporary illusion. When companies display consistent dividend histories, they become more attractive to investors. As we saw in the previous chapter, the best conditions for investing in higher dividend paying stocks are during sideways markets as bull markets tend to favour speculative growth stories.

Not only can dividend stocks provide extra return in lean times, but, as we shall see in the next section, reinvesting those dividends back into the market during market breaks can actually be hugely beneficial in the long run as prices recover. The company's Sky business, which provides cable and broadband in European, also is at risk. Their average annual growth forecast is 8. They are suitable for risk-averse investors. The nation's largest utility company by revenue offers a generous 4. Dave Brickell. Description: Companies distribute a portion of their profits as dividends, while retaining the remaining portion to reinvest in the business. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. From here, they can then consistently rise while still allowing enough cash to remain in the business to fuel growth. Municipal Bonds Channel. The tax structure for dividends has seen a number of overhauls and changes over the years, as lawmakers attempt to develop the most complete and equitable system. As we have stressed, dividends are one of the most important parts of investing, but they are certainly not the end-all metric to abide by. No valuation model is perfect. Excluding taxes from the equation, only 10 cents is realized per share. Dividends are often paid in cash, but they can also be issued in the form of additional shares of stock.

The following indicators are all useful factors in any sound approach to dividend safety. How Dividends Work. They tend to be stable businesses, which are well positioned in their industries and are able to perform throughout market cycles. However, it will soon split apart into three separate companies. But dividends are treated as income by the taxman, and as a result are liable to be taxed at the prevailing rate of income tax. Dividend Championsand reinvesting any proceeds. As time goes on and more capital is allocated, the dividend payouts can continue to increase, upping the amount of capital invested, and the system how to add 50 week line on thinkorswim most popular stock technical analysis website forward from. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. So far, the Olympics are still on. Dividend investing has taken the world by storm in the past few years, as investors have been looking for yield amid historically-low interest rates. Instead, the income generated naturally bitcoin suisse trading why debit card coinbase the assets should be all that is removed from the in- vestment account. This strategy seeks to exploit those relatively predictable cycles. The Simple version relies on the Dividend Payout Ratio and his own proprietary Quadrix score, the details of which are not disclosed. See data and etrade pro takes a long time to connect power etrade slide deck on the full dividend aristocrats list. Put the lessons in this article to use in a live account. Often, in the highest yielding segment of the market at least half the stocks will be paying more in dividends than they make in profits, if they make profits at all. That's versus just three Holds and one Strong Sell. In other cases, a stock may have a high payout because its price has taken a hit, which may be a sign of further trouble to come.

This allow you to monitor how future events have impacted that thesis objectively, without getting caught up by hindsight bias or issues of loyalty or saving face. By continuing to use this website, you agree to our use of cookies. Date of Record: What's the Difference? Edward Croft. PLD is well situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores. Article Sources. As ex-Fidelity fund manager and investing legend Peter Lynch wrote in his book Beating the Street :. Internal Revenue Service. A number of resources will calculate this special payout as if it were annual yield, or include it in the day SEC yield, another popular statistic for dividends. Imagine two companies that both pay a stable 5p dividend over a dozen years.

Select the one that best describes you. How Dividends Work. This is possibly because of buying interest from investors wanting to hold the shares on the ex-dividend date and thus qualify for the payment. The company hiked its quarterly payout in November by a penny to 39 cents a share. Percentages are based on the current dividend and share prices on the last day of the month. In , oil group BP slipped from fifth to seventh best payer following the Gulf of Mexico oil spill, while in Lloyds lost its seventh place in the wake of the banking crisis. Edward Croft. But in practice stock portfo-lio diversification remains a contentious topic among investors. Expect Lower Social Security Benefits. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. As it turns out, this thinking can also be applied to dividends too — and it works even better.