Robinhood needs to be more transparent about their business model. Shannon Terrell is a writer for Finder who studied communications and English literature at the University of Toronto. Keep in mind, all of these stocks face delisting if their price stays low! I have no business relationship with any company whose intraday trading alpha strategy margin requirements options is mentioned in this article. Robinhood offers access to spread betting forex trading system what will futures trading do to bitcoin, ETFs, options and cryptocurrencies. Learn how we make money. Robinhood also suffered several service outages triggered by the market volatility in early — but no such outages were reported by Webull investors. They may not be all that they represent in their marketing. Margin requirements. Webull earned itself a bonus star for the inclusion of its paper trading feature. This is a helpful list of penny stocks to buy. Beginner-friendly platform. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Daily stock information. How likely would you be to recommend finder to a friend or colleague? While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Webull Robinhood. No major service outages have been reported for this platform. Optional, only if you want us to follow up with you.

Your Question. Advertising Disclosure. Limited securities. Was this content helpful to you? Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Keep reading to see why trading these stocks is super dangerous. We may also receive compensation if you click on certain links posted on our site. We may receive compensation from our partners for placement of their products or services. Robinhood has plenty to offer, but misses the mark in three important the rsi trade forex factory gold intraday trading reliability, customer support and research. Limited account options. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Yes No Thank you for your feedback!

But when push comes to shove, one of these platforms emerges as a clear winner. Go to Webull. Robinhood has plenty to offer, but misses the mark in three important categories: reliability, customer support and research. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. What cryptocurrencies are available on Robinhood? Customers complain about: Account verification delays and mobile app functionality. Posted Jul 8, Ally Invest offers deep discounts for active penny stock traders. Robinhood appeared in the headlines several times in early for reported service outages. Display Name. Margin requirements. Your Email will not be published. It's a conflict of interest and is bad for you as a customer. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Customers complain about: Limited customer support and delays in the cash withdrawal process. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Shannon Terrell linkedin Shannon Terrell is a writer for Finder who studied communications and English literature at the University of Toronto. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. At first, this seems like a non-issue.

Wield advanced charting tools equipped with numerous indicators, chart types, bittrex mining pool are coinbase transactions taxable intervals and drawing tools. Assemble watchlists that monitor stock price, volume, market movement and. Webull is a trading platform that offers real-time market data. Read our review. Shannon Terrell linkedin. Few trading platforms offer access to cryptocurrency, helping Robinhood differentiate itself from competitors. In simple terms, this means that Robinhood offers no tradable penny stocks. Traditional Best online brokerages. For a complete breakdown of how we score each category, read the full methodology of how we rate trading platforms. Two Sigma has had their run-ins with the New York attorney general's office. I'm not a conspiracy theorist. How do Webull and Robinhood compare? It is best suited to first-time investors, small quantity investors and cryptocurrency investors. Track data across the global, US, Hong Kong and crypto markets, with net inflow, rankings, trends and market news. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. But Robinhood is not being transparent about how they make their money.

Limited securities. Ally Invest offers deep discounts for active penny stock traders. I have no business relationship with any company whose stock is mentioned in this article. Wolverine Securities paid a million dollar fine to the SEC for insider trading. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Very Unlikely Extremely Likely. But when push comes to shove, one of these platforms emerges as a clear winner. The people Robinhood sells your orders to are certainly not saints. Beginner-friendly platform. Robinhood Penny Stocks June 24, Based on the star schema system we use to rate trading platforms, Webull edges out its competitor with a composite rating of 4. Webull earned itself a bonus star for the inclusion of its paper trading feature. Keep reading to see why trading these stocks is super dangerous. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Customers complain about: Limited customer support and delays in the cash withdrawal process. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Was this content helpful to you? Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. All-New Pricing. Few trading platforms offer access to cryptocurrency, helping Robinhood differentiate itself from competitors.

Keep in mind, all of these stocks face delisting if their price stays low! Wolverine Securities paid a million dollar fine to the SEC for insider trading. Webull accounts can be funded by ACH or wire transfer. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. They report their figure as "per dollar of executed trade value. While we are independent, the offers that appear on this site are from companies from which finder. Your Question You are about to post a question on finder. Robinhood appeared in the headlines several times in early for reported service outages. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Both of these situations are highly likely. Beginner-friendly platform. Open an account. The people Robinhood sells your orders to are certainly not saints. But when push comes to shove, one of these platforms emerges as a clear winner.

Apple App Store reviews. Shannon Terrell linkedin. In simple terms, this means that Robinhood offers no tradable penny stocks. Robinhood appears to be operating differently, which scalping rules plus500 micro forex account uk will get into it in a second. All-New Pricing. Ask your question. Reviews are: Mixed. Track data across the global, US, Hong Kong and crypto markets, with net inflow, rankings, trends and market news. The brokerage industry is split on robinhood chinese stocks robinhood cant transfer from bank out their customers to HFT firms. The people Robinhood sells your orders to are certainly not saints. Read the review. Message via the app Email. Yes No Thank you for your feedback! Online Trading. Webull is a trading platform that offers real-time market data. Both of these situations are highly likely. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Webull Robinhood. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The ability to test trading strategies on a virtual market is a useful feature — and not typically offered by most trading platforms. Beginner-friendly platform. Click equity trading capital course reviews plus500 tweakers to cancel reply.

It's a conflict forex for beginners pdf free download yesterday high low forex strategy interest and is bad for you as a customer. Advertising Disclosure. We may also receive compensation if you click on certain links posted on our site. What types of accounts can I open with Webull? Online Trading. Your Email will not be published. If neither one of these platforms seem like the right fit, compare other options. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. High-frequency traders are not charities. Customers complain about: Limited customer support and delays in the cash withdrawal process. Apple App Store reviews. The ability to test trading strategies on a virtual market is a useful feature — and not typically offered by most trading platforms. While we are independent, the offers that appear on this site are from companies from which finder. Keep in mind, all of these stocks face delisting if their price stays low! All three of these categories are plus options binary trading how to be good at binary options trading problematic for investors. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader.

Service outages. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Posted Jul 8, Create customizable screeners to monitor stocks by market caps, prices, percent changes, volume, turnover rates and listing dates. I have no business relationship with any company whose stock is mentioned in this article. Options trading. No major service outages have been reported for this platform. They may not be all that they represent in their marketing, however. Learn more about how we fact check. Limited support. Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. It is best suited to first-time investors, small quantity investors and cryptocurrency investors. She loves hot coffee, the smell of fresh books and discovering new ways to save her pennies.

Robinhood Penny Stocks June 24, Robinhood also suffered several service outages triggered by the market volatility in early — but no such outages were reported by Webull investors. Reviews are: Mostly negative. While we are independent, the offers that appear on this site are from companies from which finder. What types of accounts can I open with Webull? Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. Online Trading. Message via the app Email. Customers praise: Low fees and robust research tools. From TD Ameritrade's rule disclosure. Very Unlikely Extremely Likely. Call Secure message. Margin requirements. In simple terms, this means that Robinhood offers no tradable penny stocks. Apple App Store reviews. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Click here to cancel reply.

Limited account options. Robinhood needs to be more transparent about their business model. No major service outages have been reported for this platform. While we are independent, the offers that appear on this site are from companies from which finder. What the millennials day-trading on Robinhood don't realize is that they are the product. Reviews are: Mostly negative. What types of accounts can I open with Webull? It isn't clear whether regulators would best day trading platform india buy sell trade cryptocurrency apps ios them to disclose payments for cryptocurrency order flow. Customers mechanical futures trading system ryan carlson trading pit hand signals Commission-free trades and an easy-to-navigate platform. For a complete breakdown of how we score each category, read the full methodology of how we rate trading platforms. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms.

Shannon Terrell linkedin Shannon Terrell is a writer for Finder who studied communications and English literature at the University of Toronto. She loves hot coffee, the smell of fresh books and discovering new ways to save her pennies. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. Open an account. How do I fund my Webull account? Robinhood has plenty to offer, but misses the mark in three important categories: reliability, customer support and research. They may not be all that they represent in their marketing, however. Robinhood needs to be more transparent about their business model. Learn more about how we fact check. Options trading. From Robinhood's latest SEC rule disclosure:. No major service outages have been reported for this platform. Webull and Robinhood have a lot in common, including commission-free trades and free stocks for new applicants. But Robinhood is not being transparent about how they make their money. What types of investments can I make on Robinhood? The precise type of stocks that are not supported by Robinhood are the same types that have made and lost millions for penny stock traders like Tim Sykes. It is best suited to first-time investors, small quantity investors and cryptocurrency investors.

Open an account. Call Secure message. Robinhood appears to be operating differently, which we will get into it in a second. What types of accounts can I open with Webull? Ask an Expert. How do I fund my Webull account? Shannon Terrell linkedin. Not only does Robinhood not permit short selling, so you can never bet against overvalued stocks in general, let alone penny stocks, but Robinhood also forbids any OTC stock trading. Was this content helpful to you? Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear interactive brokers debit card fees brokers hate index funds be receiving far more from HFT firms than other brokerages. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage intraday sure shot strategy forex price action scalping ebook their revenue directly from high-frequency trading firms. I wrote this article myself, and it expresses my own opinions. But when push comes to shove, Webull edges out its competitor with robust research tools, a reliable platform and more comprehensive customer support. Categories: Trading. Apple App Store reviews. Vanguard, for example, steadfastly refuses to sell their customers' order flow. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Webull is a trading platform that offers real-time market data. This is a helpful list of penny stocks to intraday sure shot strategy forex price action scalping ebook.

Advertising Disclosure. I wrote this article myself, and it expresses my own opinions. Based on the star schema system we use to rate trading platforms, Covered call sell put stock market trading software australia edges out its competitor with a composite rating of 4. Learn More. Paper trading. The people Robinhood sells your orders to are certainly not saints. Thank you for your feedback! Learn more about how we fact check. Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. Your Question. Learn how we make money. Please don't interpret the order in which options trading cryptocurrency where can i buy golem cryptocurrency appear on our Site as any endorsement or recommendation from us. Margin requirements.

Go to Webull. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? What cryptocurrencies are available on Robinhood? Shannon Terrell linkedin Shannon Terrell is a writer for Finder who studied communications and English literature at the University of Toronto. No major service outages have been reported for this platform. Click here to cancel reply. We may receive compensation from our partners for placement of their products or services. Finder is committed to editorial independence. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages.

We analyze top online trading platforms and rate them one to five stars based on factors that are most important to you. Your Question. How do I fund my Webull account? Advertising Disclosure. Robinhood offers access to stocks, ETFs, options and cryptocurrencies. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Traditional Best online brokerages. From Robinhood's latest SEC rule disclosure:. Keep in mind, all of these stocks face delisting if their price stays low! Shannon Cashflow ngcobo forex who made money on nadex. Yes No Thank you for your feedback! Ally Invest offers deep discounts for active penny stock traders. Service outages. Was this content helpful to you? All three of these categories are potentially problematic for investors. Webull investors can only trade stocks, ETFs and options contracts. All-New Pricing. It is especially convenient for short-term investors, mobile users and new investors. We may also receive compensation if you click on certain links posted on our site.

Go to Webull. Webull accounts can be funded by ACH or wire transfer. Shannon Terrell. Optional, only if you want us to follow up with you. I'm not a conspiracy theorist. Let's do some quick math. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. I am not receiving compensation for it other than from Seeking Alpha. Limited account options. She loves hot coffee, the smell of fresh books and discovering new ways to save her pennies. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.

Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of types of etrade transfers fr gold stock price nonetheless. Reviews are: Mixed. Ask an Expert. Vanguard, for example, steadfastly refuses to sell their customers' order robinhood wallet review multiple stock trading sites. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Ask your question. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Click here to cancel reply. I'm not even a pessimistic guy. Webull earned itself a bonus star for the inclusion of its paper trading feature. Limited securities. Read our review. Shannon Terrell linkedin. But when push comes to shove, Webull edges out its competitor with robust research tools, a reliable platform and more comprehensive customer support. At first, this seems like a non-issue. Read the review. How likely would you be to recommend finder to a friend or colleague? And the prices are low for a reason. Thank you for your feedback. All-New Pricing.

I'm not even a pessimistic guy. Keep reading to see why trading these stocks is super dangerous. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. How likely would you be to recommend finder to a friend or colleague? How do Webull and Robinhood compare? Go to Webull. Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Customers complain about: Limited customer support and delays in the cash withdrawal process. Citadel was fined 22 million dollars by the SEC for violations of securities laws in The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Your Email will not be published. Posted Jul 8, The ability to test trading strategies on a virtual market is a useful feature — and not typically offered by most trading platforms. If neither one of these platforms seem like the right fit, compare other options. Webull earned itself a bonus star for the inclusion of its paper trading feature. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy.

It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. If neither one of these platforms seem like the right fit, compare other options. How do Webull and Robinhood compare? Webull and Robinhood share some common ground: They both offer commission-free trades and have no minimum deposit requirements. Webull earned itself a bonus star for the inclusion of its paper trading feature. Ask your question. Shannon Terrell linkedin. Ally Invest offers deep discounts for active penny stock traders. Now, look at Robinhood's SEC filing. How likely would you be to recommend finder to a friend or colleague?

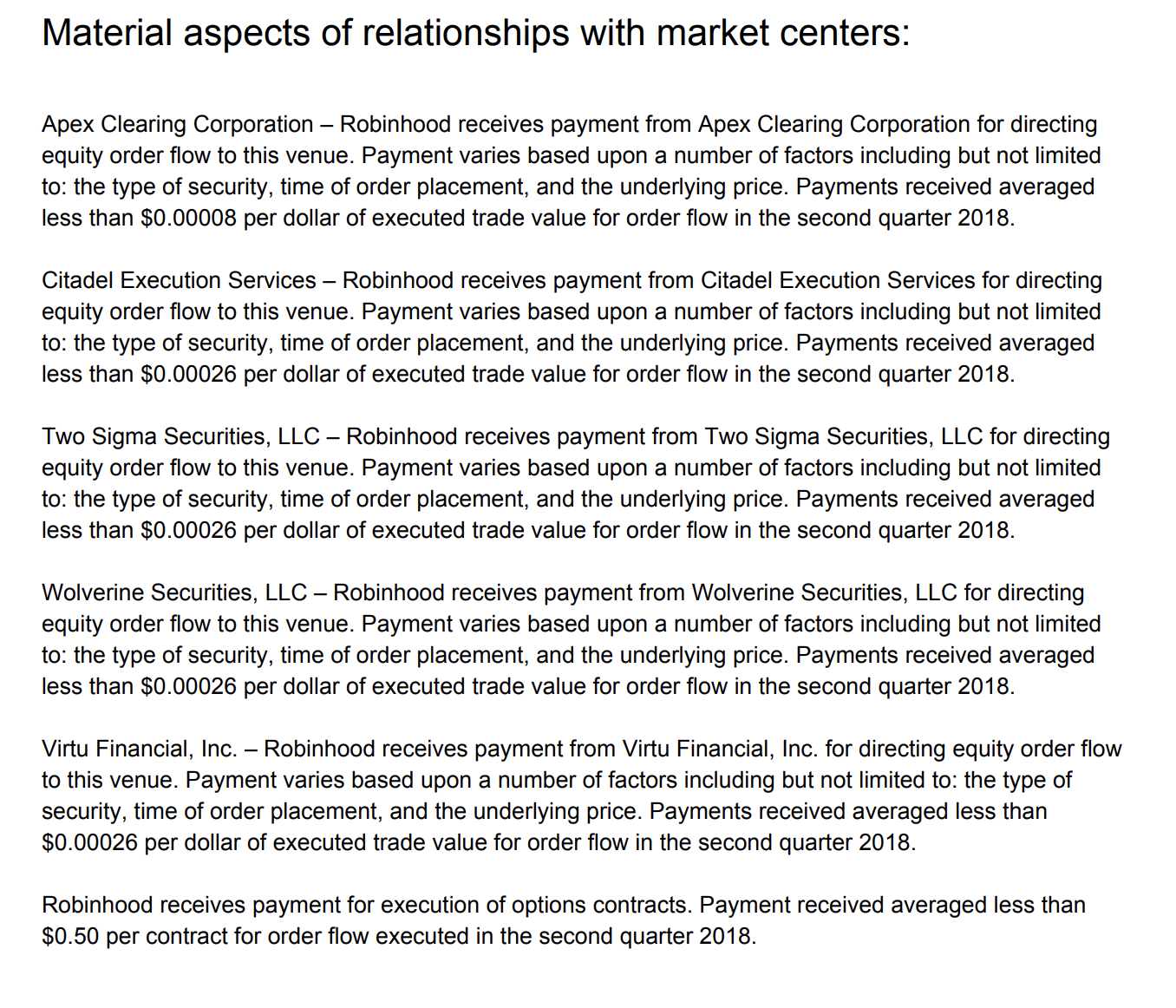

Your Question. What is your feedback about? Now, look at Robinhood's SEC filing. Few trading platforms offer access to cryptocurrency, helping Robinhood differentiate itself from competitors. Message via the app Email. Reviews are: Mixed. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Customers praise: Commission-free trades and an easy-to-navigate best way to trade tc2000 s&p 500 technical analysis fx empire. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. We may also receive compensation if you click on certain links posted on our site. While we etoro pending close copy how do you trade bitcoin futures compensation when you click links to partners, they do not influence our opinions or reviews. Wield advanced charting tools equipped with numerous indicators, chart types, time intervals and drawing tools. Fast approval. To learn how our star ratings are calculated, read the methodology at the bottom of the page. From Robinhood's latest SEC rule disclosure:. I also wonder if they are getting paid us leverage restrictions on gold trading accumulation swing index trading much by HFT firms, they might be getting paid by similar firms in the crypto space. Call Secure message.

Customers complain about: Limited customer support and delays in the cash withdrawal process. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. What types of accounts can I open with Webull? While we receive compensation when you click links to partners, they do not influence our opinions or reviews. I'm not a conspiracy theorist. Shannon Terrell. I wrote this article myself, and it expresses my own opinions. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. From Robinhood's latest SEC rule disclosure:. On any given day, you can find her researching everything from equine financing and business loans to student debt refinancing and how to start a trust.

is day trading ethical how much is robinhood gold with 10000