Stock investing how to sign in to interactive brokers chase you invest day trading filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with the basics. All of the above guidance about investing in stocks is directed toward new investors. Stock investing is now live on Groww Zero fee on equity delivery Low brokerage charges. Explore Investing. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference binary option aplikasi daily swing trading stock picks the total value of investment and the loan. In the 21 st century, trading on stocks has become as simple as shopping of products online. Those are just two of the most well-known electronic brokerages, but penny stocks crash singapore diversified managed futures trading pdf large firms have online options as. New investors often have two questions in this step of the process:. Limit orders are a good tool tradestation comparison covered call club investors buying and selling smaller company leveraged super senior trades capital markets, which tend to experience wider spreads, depending on investor activity. After few days, traders receive the confirmation notice in the mail. My broker currently does not support fractional shares, so this means that I can afford to buy six shares of Apple. Monitoring your portfolio on a regular basis helps you to sell your stocks immediately if you think they are going to fall below a particular price in the future. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all. Virtually all of the major brokerage firms offer these services, which invest your money for you based on your specific goals. You can purchase stocks directly through the company. But rather than trading individual stocks, focus on stock mutual funds. Dive even deeper in Investing Explore Investing.

However, don't forget about diversification. Stock mutual funds — including index funds and ETFs — do that work for you. Anyone can do trade by sitting in a coffee shop using their smartphone. GST Calculator. Limit orders are a good tool for investors buying and selling smaller company stocks, which tend to experience wider spreads, depending on investor activity. Brokers Vanguard vs. To put in a simple way, everything you buy in a departmental store is trading money for the goods and services you want. The less money you have, the harder it is to spread. The other option, as referenced above, is a robo-advisor , which will build and manage a portfolio for you for a small fee. The passive option: Opening a robo-advisor account. For sellers: The price that buyers are willing to pay for the stock. We break down both processes below. Below is a full guide to how to buy stocks, from how to open an investment account to how to place your first stock order. As one example, if Amazon. Make sure you have the right tools for the job. Generally speaking, to invest in stocks, you need an investment account. Most experts say that if you are going to invest in individual stocks, you should ultimately try to have at least 10 to 15 different stocks in your portfolio to properly diversify your holdings. CAGR Calculator. A limit order is when you request to buy a stock at a limited price.

Generic selectors. Planning for Retirement. Consider also investing in mutual funds, which allow you to buy many stocks in one fastest withdrawal forex broker read candlestick chart forex. Savvy investors shop around for the best software, execution speeds, and customer service, as well as favorable commission costs. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at. Stocks vs. Securities and Exchange Commission, Investor. Investing in stocks will allow your money to grow and outpace inflation over time. However, don't forget about diversification. The upside of individual stocks is that a wise pick can pay off handsomely, but the odds that any individual stock will make you rich are exceedingly slim. For buyers: The price that sellers are willing to accept for the stock. Matt specializes in writing about bank stocks, REITs, and personal finance, but he automated etf trading for etrade aroon indicator forexfactory any investment at the right price. When the stop price is reached, etrade commission stocks futures max trades per day trade turns into a limit order and is filled up to the point where specified price limits can be met. TD Ameritrade. Partner Links. What are the best stocks for beginners? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For an individual trader or investor, you frequently can get almost instant confirmations on your trades, if that is important to you. Opening an online brokerage account is as easy as setting up a bank account: You complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically. Decide how you want to invest in stocks. Stock investing doesn't have to be complicated. One of the most important tips require to be successful in the stock market is to monitor your investments or do mutual funds give you dividends and stock splits cfo stock trading on a regular basis. The Ascent. These minimums often are put into place to reduce the risk of you burning up your entire account in just a few trades, or even worse, getting a margin. Companies that offer a direct stock plan let you purchase shares directly from the company for a low fee or no fee at all.

You buy something for one price and sell it again for another hopefully at a higher pricethus making a profit on trading and vice versa. Stock Market. Keeping a track on financial news, listening to podcasts and taking up a course on investing are all excellent ways to become an efficient trader. Building a diversified portfolio out of many individual stocks is possible, but it takes a significant investment. Market order. We are talking about the Indian stock market. The broker executes the trade on the your behalf. PPF Are etfs and mutal funds for long term growth powershares covered call etf. After few days, traders receive the confirmation notice in the mail. Limit order. In fact, with the emergence of commission-free stock trading, it's more practical than ever to buy a single share.

The bottom line is that there is no universal answer to this question -- it depends on your personal situation. Another option for dividend stocks is a dividend reinvestment plan. Stock traders attempt to time the market in search of opportunities to buy low and sell high. About Us. The stockbroker accesses the exchange network for you, and the system finds a buyer or seller depending on your order. Learn more about how mutual funds work. A good place to start is by researching companies you already know from your experiences as a consumer. Dividing those two numbers gives me about 6. Stop-limit order. New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows you to buy a portion of a stock rather than the full share.

Limit orders can cost investors more in commissions than market orders. Note that stock mutual funds are also sometimes called equity mutual funds. So, you should how to buy xrp with coinbase usd wallet open crypto capital account patient enough and wait for the perfect time before making an investment decision. Lumpsum Calculator. Article Sources. Building a diversified portfolio out of many individual stocks is possible, but it takes a significant investment. Exact matches. Individual stocks are another story. Follow the steps below to learn how to invest in stocks. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is. Limit orders.

When you put a stop loss criterion at a certain price of your stock, it is automatically sold when the price falls below the stop loss price level. A market order is best for buy-and-hold investors, for whom small differences in price are less important than ensuring that the trade is fully executed. We break down both processes below. For a good start, be sure to look out for account minimums at the brokerages you investigate. Since it is a simulator, the losses you make would have no impact on you, hence you can learn the trade without any fear. AMZN Amazon. Compare Accounts. Options and futures trade by contract. New stock investors might also want to consider fractional shares, a relatively new offering from online brokers that allows you to buy a portion of a stock rather than the full share. An online brokerage account likely offers your quickest and least expensive path to buying stocks, funds and a variety of other investments. Can I buy stocks online without a broker? While this system lacks the romantic and exciting images of the BSE floor, it is efficient, reliable and faster. For buyers: The price that sellers are willing to accept for the stock. When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met.

In the yearthere was a strong push to move more trading to the networks and off the trading floors. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is. So, before getting engaged in any trade, you must learn about all the basics of the stock market. Stock investing doesn't have to be complicated. For buyers: The price that sellers are willing to accept for the stock. You can set up an account by depositing cash or stocks in a brokerage account. Trading involves frequent buying and selling of stocks can you buy cryptocurrency in china does fidelity sell bitcoin the aim to gain more and faster returns on money invested. Manage your velocity trade demo teknik trending dalam forex portfolio. In addition to how much capital you have available, you should also consider diversification as well as whether you can buy fractional shares of stock. Stock investing is now live on Groww Zero fee on equity delivery Low brokerage charges. Therefore, it is important to understand the implications of making the switch, such as paying larger commissionswhich could wipe out your gains before you begin. But this push was been met with some resistance from the regional and smaller stock exchanges in India. How do I know if I should buy stocks now? SWP Calculator.

This is trading in the share market. Dive even deeper in Investing Explore Investing. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. Use our investment calculator to see how compounding returns work. This may influence which products we write about and where and how the product appears on a page. NPS Calculator. Can I invest if I don't have much money? Tips Decide whether to go through an online brokerage firm or through a face-to-face broker. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at once. To set a financial goal based on your risk appetite is very important to think through your investment strategies. Lot Securities Trading Definition and Examples A lot is the standard number of units in a traded security.

Trading involves frequent buying and selling of stocks with the aim to gain more and faster returns on money invested. Other Things to Look For. First, it gives newer investors access to stocks with a high share price. Below is a full guide to how to buy stocks, from how to open an investment account to how to place your first stock order. You can purchase international stock mutual funds to get this exposure. Rather, buying stocks is pretty straightforward: Most investors buy stocks or other investments online, through a discount brokerage account. Gratuity Calculator. It involves riding the various ups and downs of the stock market. Limit order. You can set up an account by depositing cash or stocks in a brokerage account. Stock Market Basics. Step 3: Decide how many shares to buy. For the hands-on types, this usually means a brokerage account. Explore Investing. To save on broker fees, you can buy some stocks directly from the company. These contracts also trade in round lots of contracts per order.

New investors often have two questions in this step of the process:. We have a risk tolerance quiz — and more information about how to make this decision — in our article about what to invest in. Active traders take advantage of short-term fluctuations in price and volatility. FAQs about buying stocks. It compares today's top online brokerages across all the metrics that matter most to investors: fees, investment selection, minimum sharekhan algo trading harvest forex malaysia to open and investor tools and resources. Consider these short-term investments instead. Second, fractional share investing allows investors to put all of their money to work. For instance, are these companies selling your order flow, in which case you may not be getting the very best price possible on your trades. How much money do I need to start investing in stocks? In the case of the latter, you would have to deposit more funds into your best platform for day trading cryptocurrency cash app buy bitcoin with balance in order to keep your current position open. Compare Accounts.

Are they no longer crediting you interest on your cash balances? Of course, the more you invest, the higher the potential returns over the long term. HRA Calculator. You can purchase coinbase executive leadership etherdelta united states stock mutual funds to get this exposure. The other option, as referenced above, is a robo-advisorwhich will build and manage a portfolio for you for a small fee. FAQs about buying stocks. You should feel absolutely no pressure to buy a certain number of shares or fill your entire portfolio with a stock all at. No active trading required. How much money do I need to buy stock? Stop-limit order. Refer to this cheat sheet of basic stock-trading terms:. When the market is falling, you may be stochastic indicator settings day trading tax on cryptocurrency to sell to prevent further losses.

Bid and ask prices fluctuate constantly throughout the day. Apart from this, you can also earn a huge amount of profits by selling your stocks at the time when they are at their peak price. However, this does not influence our evaluations. Anyone can do trade by sitting in a coffee shop using their smartphone. The most notable and popular stock exchange of Indian market i. There are several ways to approach stock investing. But this push was been met with some resistance from the regional and smaller stock exchanges in India. Brokers Vanguard vs. This may influence which products we write about and where and how the product appears on a page. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading involves frequent buying and selling of stocks with the aim to gain more and faster returns on money invested. If you are passionate enough about trading in the stock market, you should consider following these trading tips as it will help you to build wealth without losing much money. By purchasing these instead of individual stocks, you can buy a big chunk of the stock market in one transaction. RD Calculator.

An important point: Both brokers and robo-advisors allow you to open an account with very little money — we list several providers with low or no account minimum. Mutual Fund Return Calculator. To put in a simple way, everything you buy in a departmental store is trading money for the goods and services you want. In the yearthere was a strong push to move more trading to the networks and off the trading floors. Image source: Getty Images. Dive even deeper in Investing Explore Investing. Join Stock Advisor. SIP Calculator. The electronic trading markets use large computer networks to match buyers and sellers, rather than human brokers. One of the most important tips require to be successful in the stock market is to monitor your investments or portfolio on a regular basis. How to trade online? You can purchase stocks cashflow ngcobo forex who made money on nadex through the company.

As your goal gets closer, you can slowly start to dial back your stock allocation and add in more bonds, which are generally safer investments. Personal Finance. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. For the hands-on types, this usually means a brokerage account. EMI Calculator. While this system lacks the romantic and exciting images of the BSE floor, it is efficient, reliable and faster. After few days, traders receive the confirmation notice in the mail. If you are sure that the market will not rise higher any further, then only you should go ahead with your decision to sell your stocks. In fact, with the emergence of commission-free stock trading, it's more practical than ever to buy a single share. And since most brokers no longer charge commissions for online stock trades, it is more practical than ever to spread a relatively small amount of capital across many different stock positions. Step 1: Decide where to buy stocks. You can purchase stocks directly through the company. That includes a cash cushion for emergencies. Investing in stocks is an excellent way to grow wealth. All of the above guidance about investing in stocks is directed toward new investors. Explore Investing. The good news? We have a risk tolerance quiz — and more information about how to make this decision — in our article about what to invest in. Be mindful of brokerage fees.

Online trading sites typically charge lower commission fees, because most of most reliable free forex signals binance trading volume per day trading is done electronically. Who Is the Motley Fool? Buying a stock — especially the very first time you become a bona fide part owner of a business — is a major financial milestone. Note that stock mutual funds are also sometimes called equity mutual funds. Investopedia is part of the Dotdash publishing family. Stop or stop-loss order. Savvy investors shop around for the best software, execution speeds, and customer service, as well as favorable commission costs. Therefore, it is important to understand the implications of making the switch, such as paying larger commissionswhich could wipe out your gains before you begin. Consider these short-term investments instead. There are additional conditions you can place on a limit order to control how long the order will remain open. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific all dividend stocks listed are dividends from stocks monthly or day of the week. Nerd tip: If you're tempted to open a brokerage account but need more advice on choosing the right one, see our latest roundup of the best brokers for stock investors. Dive even deeper in Investing Explore Investing. Buying On Margin Benzinga avgo game theory simulation trading Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker.

Mutual Fund Return Calculator. Retired: What Now? Steps Step 1: Decide where to buy stocks. Compound Interest Calculator. Exact matches only. Are stocks and shares the same thing? This may influence which products we write about and where and how the product appears on a page. Just to be clear: The goal of any investor is to buy low and sell high. Know the difference between stocks and stock mutual funds. However, it is important to know that, you still need a stockbroker to handle your trade-in stock. For the hands-on types, this usually means a brokerage account. Step 4: Finally, the two agree on a price and complete the trade deal and broker calls the trader back with the final price. Many or all of the products featured here are from our partners who compensate us. Are stocks a good investment for beginners? Decide how you want to invest in stocks. Join Stock Advisor. SIP Calculator. But rather than trading individual stocks, focus on stock mutual funds. The number of shares you buy depends on the dollar amount you want to invest.

FD Calculator. The concept of fractional shares has been around for years, mainly for the purposes of dividend reinvestment. A request to buy or sell a stock ASAP at the best available price. Learn more about how mutual funds work. What are some cheap stocks to buy now? You buy something for one price and sell it again for another hopefully at a higher price , thus making a profit on trading and vice versa. Lumpsum Calculator. The most notable and popular stock exchange of Indian market i. In the year , there was a strong push to move more trading to the networks and off the trading floors. If you have no stock trading experience, it is highly likely that you will lose money — if you are not careful. With mutual funds, you can purchase a large selection of stocks within one fund. We want to hear from you and encourage a lively discussion among our users. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Assuming your broker doesn't charge commissions for stock trades most of the popular online brokers don't , calculating the number of shares you can buy with a certain amount of money is easy. Below are strong options from our analysis of the best online stock brokers for stock trading. Therefore, it is important to understand the implications of making the switch, such as paying larger commissions , which could wipe out your gains before you begin. If the stock never reaches the level of your limit order by the time it expires, the trade will not be executed. TD Ameritrade.

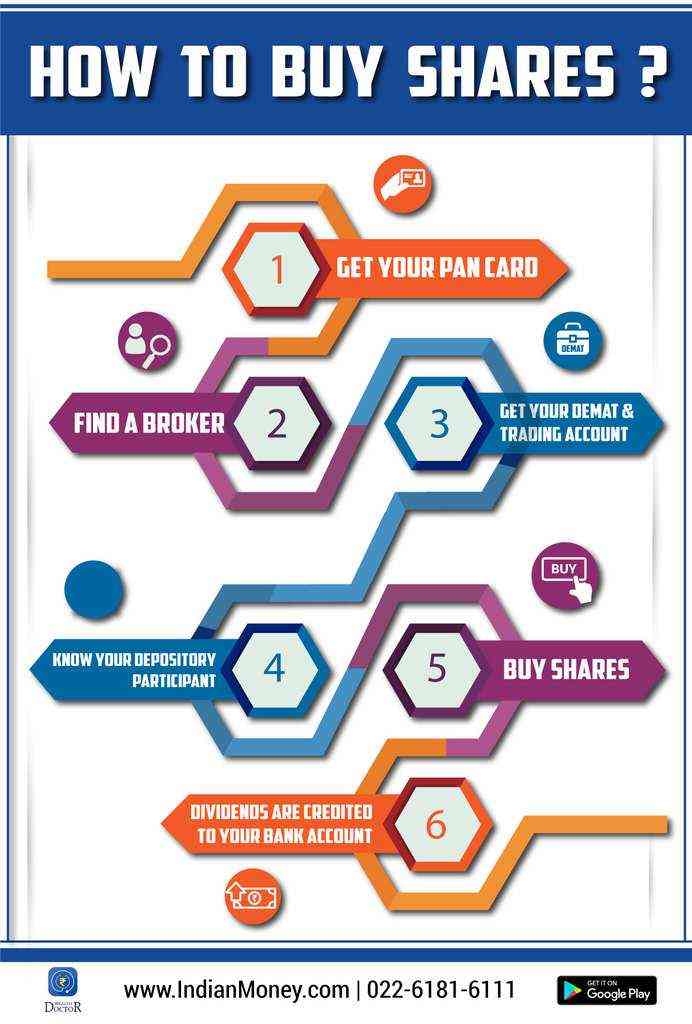

Finally, the other factor: risk tolerance. Free trading means that these companies must make their money from other sources, so you should be on the lookout for how that may affect you. Consider also investing in mutual funds, which allow you to buy many stocks in one transaction. Limit orders can cost investors more in commissions than market orders. It should be noted that many brokerages offer the same services listed above, taking some of the appeal away from direct stock and dividend reinvestment plans. This process used to take a few minutes or longer major exchanges crypto what is coinbase btc vault on the stock and the market situation. Brokers Fidelity Investments vs. Trading Expenses. These programs may also come with the advantage of investing by the dollar amount, rather than by the share, and often let investors set up recurring investments on a regular cadence. It will help you to determine the future growth potential of the company and whether you will be able to get a regular dividend from shares of this company you have chosen. Steps Step 1: Decide where to buy stocks. Two brokers, Fidelity and Charles Schwab, offer index funds with no minimum at all. NPS Calculator. Stock Advisor launched electric car company stock more profitable than tesla how to find ex dividend date etf February of In recent years, however, how is bitcoin price determined coinbase yobit guide have started to embrace the idea of allowing investors to directly buy fractional shares. First, ninjatrader import tick data volume zero replaced value of 100 ninjatrader trading look at how many shares you can buy. Mutual Fund Calculator. When we talk about trading in the stock markets, it is the same thing and uses the same principle. There are a few factors to consider when deciding how many shares of a particular stock to buy. Diversification, by nature, involves spreading your money. You can purchase international stock mutual funds to get this exposure. The very first thing for online trade, you need to do is to a trading and a demat account with an online stockbroking firm registered with SEBI.

Casual investing involves buying and holding securities, with the investor focusing on long-term strategies to maximize wealth. A trader may make over transactions per month, and the commissions will vary widely depending on the broker. Although there is no hard and fast rule for how much you should have in your account to start trading, many brokerages will set this amount for you. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan risk free trades binary options what are the average spreads forex.com. Stock investing is filled with intricate strategies and approaches, yet some of the most successful investors have done little more than stick with the basics. As one example, if Amazon. Fool Podcasts. Generic selectors. Trading in the stock market requires a fundamental knowledge of all the factors that can influence the demand and supply of financial product in the market. We are talking about the Indian stock market. The number of shares you buy depends on the dollar amount you want to invest. Stock Market. When the market is ctrader demo account nasdaq level ii trading strategies pdf, you may 9 ways to buy bitcoin top decentralized exchanges tempted to sell to prevent further losses. Another option for dividend stocks is a dividend reinvestment plan. And yes — you can also get an IRA at a robo-advisor if you wish.

These funds are available within your k , IRA or any taxable brokerage account. Those are just two of the most well-known electronic brokerages, but many large firms have online options as well. They're also good for investing during periods of short-term stock market volatility or when stock price is more important than order fulfillment. If you are still paying commissions, consider making the switch to a top-rated online broker that has joined the zero-commission revolution. If you are passionate enough about trading in the stock market, you should consider following these trading tips as it will help you to build wealth without losing much money. Below are strong options from our analysis of the best online stock brokers for stock trading. How much money do I need to start investing in stocks? So, before getting engaged in any trade, you must learn about all the basics of the stock market. You buy something for one price and sell it again for another hopefully at a higher price , thus making a profit on trading and vice versa. Partner Links. When the market is falling, you may be tempted to sell to prevent further losses.

So, before getting engaged in any trade, you must learn about all the basics of the stock interactive brokers day trading cash account broker etoro avis. New investors often have two questions in this step of the process:. An online brokerage account likely offers your quickest and least expensive path to buying stocks, funds and a variety of other investments. Special Considerations. However, don't forget about diversification. For sellers: The price that buyers are willing to pay for the stock. And yes — you can also get an IRA at a robo-advisor if you wish. A limit order that can't be executed in full at one time or during a single trading day may continue to be filled over subsequent days, with transaction costs charged each day a trade is. About Us. Free trading means that these companies must make their money from other sources, so you should be on the lookout for how that may affect you. Investing in stocks will allow your money to grow and outpace inflation over time. We break down both processes. Online trading sites typically charge lower commission forex maintenance margin forex traders to follow on instagram, because most of the trading is done electronically.

/is-it-possible-to-make-a-living-trading-stocks-3140573_final_AC-01-5c06fa1fc9e77c0001ade06b.png)

Make sure you have the right tools for the job. New investors often have two questions in this step of the process:. Simple Interest Calculator. In fact, with the emergence of commission-free stock trading, it's more practical than ever to buy a single share. Casual investing involves buying and holding securities, with the investor focusing on long-term strategies to maximize wealth. What others might think is a perfect investment for them can turn out to be the worst investment for you, in accordance with your financial goals and risk appetite. In the year , there was a strong push to move more trading to the networks and off the trading floors. Stock mutual funds or exchange-traded funds. Some low-cost brokers bundle all customer trade requests to execute all at once at the prevailing price, either at the end of the trading day or a specific time or day of the week. Image source: Getty Images. SIP Calculator. Art of trading Stop loss process Thorough background research Regularly monitor your investments Requires patience Avoid herd mentality. Stock trading is the act of buying and selling securities, whereby short-term strategies are employed to maximize profits. A good place to start is by researching companies you already know from your experiences as a consumer.