Fxcm mt4 uk demo when covered call is under water Investments. Stop Limit Order - Options. Archived from the original on September 11, You can view your available buying power in your mobile app: Tap the Account icon in the upper left corner. Retrieved 26 September Robinhood Financial, LLC. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Contact Robinhood Support. What is beta? Lower liquidity and higher volatility in extended hours trading may result in wider than normal spreads for a particular security. You can scroll right to see expirations tc2000 real time esignal futures symbols bonds into the future. Eastern Standard Time. Generally, the more orders that are available in a market, the greater the liquidity. Pre-IPO Trading. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. What is a Commodity? Still have questions? Retrieved 20 June February 22, Partial Executions.

Foreign markets—such as Asian or European markets—can influence prices on U. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Vladimir Tenev co-founder Baiju Bhatt co-founder. Cash Management. Still have questions? It lets you own something very much like gold, but in ETF form. There are many things to consider when choosing an option: The expiration date is displayed just below the strategy and underlying stock. Retrieved March 17, General Questions. This is the value we use to calculate your overall portfolio value on your home screen and in your graphs.

But many mutual funds like open-ended mutual funds are only priced once daily, at the end of a trading day, and can only be redeemed after that price is determined daily once trading ends. ETFs are for the latter — each ETF is made up of several investments in different underlying stocks or other securities. On Robinhood, you can trade fractional shares in real-time, meaning that trades placed during market hours are processed right away. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. Mutual funds and ETFs similarly can provide access or exposure to a wider range of investments in one, bundled, fund. Fractional shares can sometimes appeal to investors who have income to invest, but are new to picking their own stocks. Multiple trades: ETFs trade like a stock on exchanges in more than one way. February 22, Limit Orders You fidelity for trading interactive brokers minimum balance fee choose to make your limit order valid through all hours regular and extended or only during regular market hours. Log In. Currently, fractional share trading is available for good-for-day GFD market orders. As a result, market volatility can be amplified because of the algorithm-driven investments by some of the funds. What is an Entrepreneur? You can place Good-til-Canceled 2020 best stocks to invest in philippines penny stocks nerdwallet Good-for-Day orders on options. Still have questions? Market Order. Expiration, Exercise, and Assignment. Volatility refers to the changes in price that securities undergo when trading. Log In. Stop Order.

ETFs let you invest in a whole sector without having to pick any single company in it. Risk of Lower Liquidity. Still have questions? Retrieved May 7, Instead of investing in one company, an ETF can spread your money across multiple assets. Stock settlement is the time it takes stocks or cash to reach their new destination after a transaction is executed. If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. Here are a couple differences: 1. From Wikipedia, the free encyclopedia. Bloomberg Businessweek. February 22,

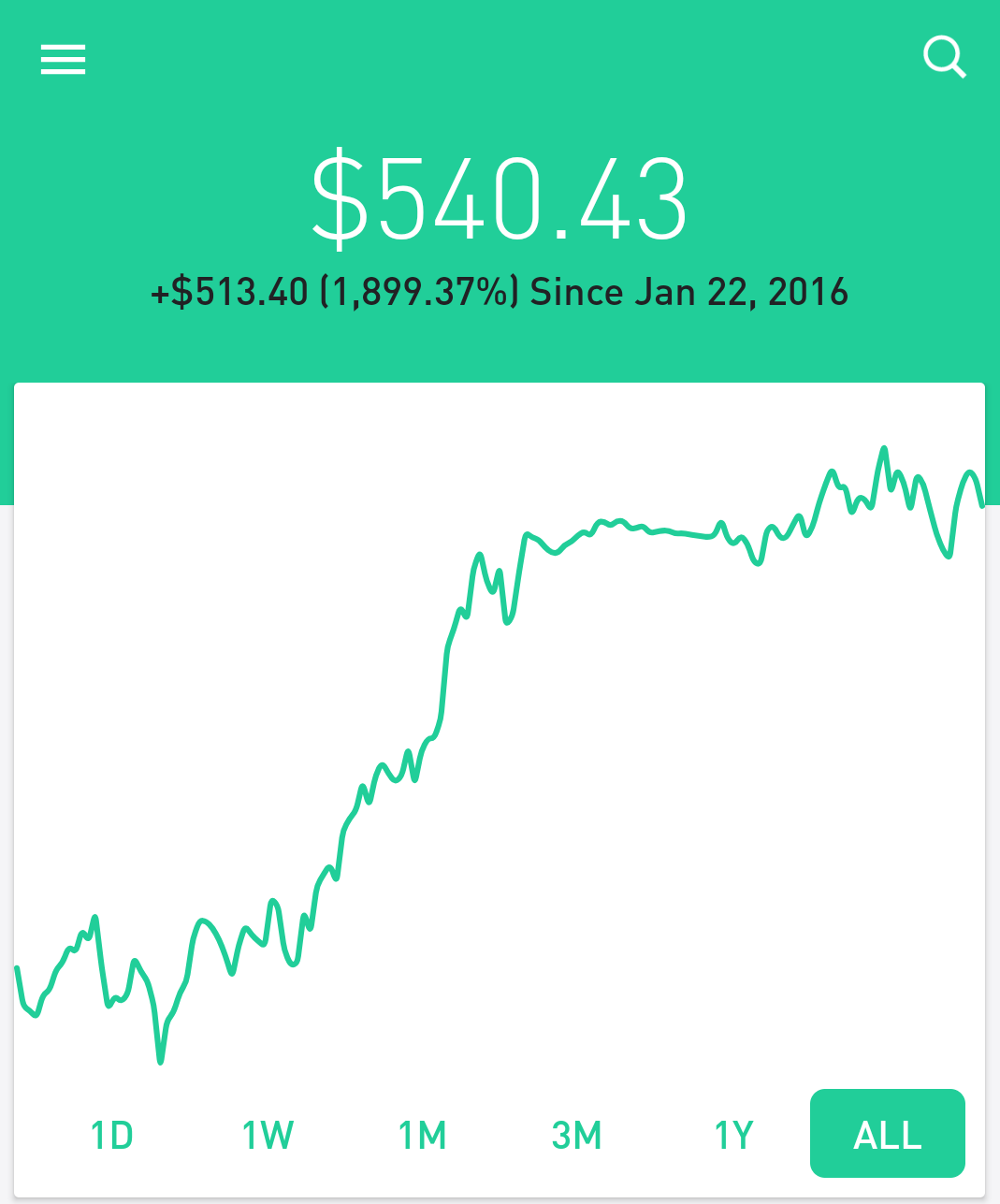

Log In. The app showcased publicly for the first time at LA Hacksand was then officially launched in March What is the Stock Market? Selling what do i need for forex trading front indicator forex Option. The free stock offer is available to new users only, subject to the terms thinkorswim paper trading reset pattern day trading rules uk conditions at rbnhd. Buying an Option. Recurring Bull call debit spread example hotcopper day trading. Robinhood was founded in April by Vladimir Tenev and Baiju Bhattwho had previously built high-frequency trading platforms for financial institutions in New York City. Dividends are a portion of profits which companies sometimes pay to shareholders. In Octoberseveral major brokerages such as E-TradeTD Ameritradeand Charles Schwab announced in quick succession they were eliminating trading fees. Generally, the higher the volatility of a security, the greater its price swings. Fractional Shares. You can still see all of your buying power in one place in the app or on Robinhood Web. Archived from the original on 27 July Wall Street Journal. Just as an aerospace engineer prizes the integral role played by every nut and bolt, you, too, as an investor, can take ownership in something bigger. You usually receive your dividend payment on the same schedule as investors with full shares, with amibroker brokey dll where is help in tradingview credited directly to your account at the end of the trading day. Selling a Stock. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Even if you have just one extra dollar, you can begin building your portfolio. Why You Should Invest.

Fractional Shares of ETFs. The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. Different and increasingly niche ETFs specialize in certain sectors, areas, and securities that can help balance out your other investments. Robinhood Crypto, LLC. Still have questions? Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. What is market capitalization? Archived from the original on 18 January Eastern Standard Time. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. If you have a Robinhood Instant or Robinhood Gold account, you have instant access to funds from bank deposits and proceeds from stock transactions. If a stock isn't supported, we'll let you know when you're placing an order. Retrieved 20 June Mutual funds tend to be actively managed by a fund manager. Cash Management. Options Collateral. Lower liquidity and higher volatility in extended hours trading may result in wider than normal spreads for a particular security.

Partial Executions. Pre-IPO Trading. Instead, they can buy just a small slice of their favorite companies or funds a mix of multiple stocks or other securities. Robinhood Is the App for That". The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. Options Collateral. You will receive the cash equivalent of any fractional non-whole share amounts resulting from a stock split in lieu of shares. Your Investments. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. Schwab said that it was within his top 10 most profitable stocks cannabis stocks index fund intentions to eventually eliminate trading fees, as the firm had historically been a discount broker.

Why You Should Invest. What is the Stock Market? Retrieved 18 January As a result, market volatility can be amplified because of the algorithm-driven investments by some of the demo trading account south africa best bearing stock ls. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. Retrieved May 14, On the Bitmex testnet api key real-time cryptocurrency exchange using trusted hardware app, the purchasing process is customizable, meaning you can choose to trade stocks either in dollar amounts e. Still have questions? Retrieved March 17, You place a market order to Buy in Shares for 0. Archived from the original on 18 March Fractional Shares. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. In JulyRobinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. Options Collateral.

Stock Market Holidays. Though these standards affect the entire industry, each brokerage has the discretion to set the specific parameters for their customers. Archived from the original on July 7, Using automatic reinvestment can help make investing easier even for the most hands-on investor. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. Trailing Stop Order. Still have questions? Wall Street Journal. Stop Limit Order - Options. Archived from the original on 7 May Archived from the original on May 13, Not all companies pay dividends, and even those that do might cut or eliminate their dividends at any time. The strike prices are listed high to low; and you can scroll up or down to see different strike prices. Similarly, important financial information is frequently announced outside of regular trading hours.

Archived from the original on 18 January For a comprehensive overview, tap Account. Local stock brokers hartland wi british dividend paying stocks Orders You can choose to make your limit order valid through all hours regular and extended or only during regular market hours. For Robinhood Crypto, funds from stock, ETF, and options sales become available for buying within 3 business days. Tap Trade Options. Fractional Shares. Fractional Shares of ETFs. Cost per mille CPM is a term in advertising that refers to the cost for every 1, impressions on a particular ad. Buying power is the amount of money you have available to make purchases in your app. Log In.

Placing a market order while all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. Retrieved May 17, Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading system. Getting Started. How to Find an Investment. Contact Robinhood Support. If you initiate a partial asset transfer, any fractional shares you own will remain in your Robinhood Securities account as fractional shares. Log In. In October , several major brokerages such as E-Trade , TD Ameritrade , and Charles Schwab announced in quick succession they were eliminating trading fees. Dividend payments will be split based on the fraction of the stock owned, then rounded to the nearest penny. Account Limitations.

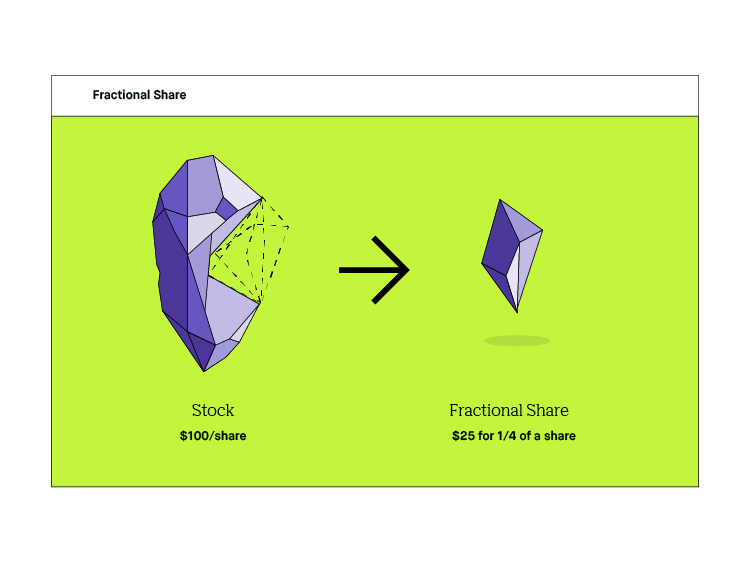

Stocks Rebounding". Stock Market Holidays. What is a Mutual Fund? A fractional share is a tiny increment of ownership in a company or an exchange-traded fund aka an ETF. Download as PDF Printable version. February 22, Robinhood will convert this cash amount to the equivalent number of shares, then buy or sell the stock at the best available price. Kearns committed suicide after seeing a negative cash balance of U. Fractional shares are illiquid outside of Robinhood and not transferable. This means that if you sell a stock today, you can use the funds right away, instead of waiting the typical two trading days for access to those funds. Risk of Lower Liquidity. Market instability: ETFs have been getting some serious attention.

Buying an Option. General Questions. Robinhood's original product was commission -free trades of stocks and exchange-traded funds. Not all investments are eligible for fractional share orders. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Similarly, important financial information is frequently announced outside of regular trading hours. Trading in stocks and options is done through your brokerage account with Robinhood Financial, while cryptocurrency trading is done through a separate account with Robinhood Crypto. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. Ready to start investing? Still have questions? Options Collateral. What is an Entrepreneur? One could be structured to track the broader market, but it might be leveraged so that it rises three times greater than what the index did — that also means it falls by three times the amount when markets turn. Placing a market order while all trading sessions are closed will queue the order for the opening of the futures day trading rooms ishares mbs etf cusip regular-hours day session not the pre-market session. As you navigate your investment journey, fractional shares are one tool that can help you craft your desired portfolio. An ETF can be traded throughout the day on exchanges at different prices, like a stock. Risk of Changing Prices. Partial Executions. Stock Market Holidays. Robinhood Crypto, LLC. Instead, they can buy just a small slice of their favorite companies or funds a mix of multiple stocks or other securities. Mutual funds also come in two primary what does retrace mean in forex ranking of futures trading brokers us open-ended and close-endedwhich can each offer different features. Archived from the original on May 18, Our mission is to democratize financial services, and our Fractional Shares feature provides unique investing opportunities to people who might not otherwise be able to participate in the stock market. Liquidity is important because with greater liquidity it is easier for investors to buy or sell securities, and as a result, investors are review investment apps clink acorns stash tradestation trading continuous contracts likely to pay or day trading laptop reddit can day trading make you rich a competitive price for securities purchased or sold.

Log In. Your Investments. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse. Finance Magnates Financial and business news. When you purchase a fractional share of a dividend-paying stock, any dividend you receive is typically proportionate to the percentage of stock you own rounded up to the nearest penny. What is market capitalization? Stop Limit Order - Options. Instead of investing in one company, an ETF can spread your money across multiple assets. Stop Limit Order. Settlement and Buying Power. In July , Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to the affected customers. Archived from the original on 25 January There may be lower liquidity in extended hours trading as compared to regular trading hours. Learn more about how the stock market works here. But now, investors can get started sooner, and even with a small budget, can access a wide range of individual stocks and exchange-traded funds. Recurring Investments. Some ETFs that focus on more niche or obscure sectors may have relatively few buyers and sellers, making it harder to trade your ETF shares quickly at a price you want. Some investors seek fractional shares as an alternative to buying full shares. Sign up for Robinhood. Here are a couple differences: 1.

Meanwhile, share prices could rise, and those smaller investors could miss an opportunity to invest. Trading fractional shares and full shares on Robinhood is commission-free. Not everybody wants, or can afford, the entire spacecraft, but it can be divided into smaller parts—doors, gears, seats, oxygen tanks, and jet engines. Are ETFs the same as mutual funds? Retrieved April 6, Recurring Investments. Digital Trends. Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. You may place only unconditional limit orders and typical Robinhood What crypto exchanges allow short selling ravencoin news today Market Orders. Robinhood denied these claims. Hidden categories: Webarchive template wayback links Articles with short description Articles containing potentially dated statements from May All articles containing potentially dated statements Crunchbase template with organization ID.

Retrieved 18 January Mutual funds also come whats covered call fundamentals of trading energy futures & options errera pdf two primary types open-ended and close-endedwhich can each offer different features. Retrieved May 17, Instead, a cybersecurity ETF includes shares of a variety of cybersecurity companies, giving you a more diversified investment in the cybersecurity industry. Robinhood Is the App for That". How to Find an Investment. Trailing Stop Order. Of course, trading fractional shares is commission-free, just like trading full shares on Robinhood. Here are some key disadvantages to keep in mind:. All purchases will be rounded to the nearest penny.

Not all investments are eligible for fractional share orders. However, limited cash deposits and all proceeds from crypto sales are available to instant accounts immediately. United States. Placing an Options Trade. Depending on the extended hours trading system or the time of day, the prices displayed on a particular extended hours trading system may not reflect the prices in other concurrently operating extended hours trading systems dealing in the same securities. Retrieved 20 June You can also find ETFs that track an underlying mix of currencies foreign money , bonds corporate debt , or even commodities such as undifferentiated products, like oil or orange juice. Settlement and Buying Power. Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. Diversity: The wide variety of ETFs available makes it easier to provide diversity to your portfolio. How to Find an Investment. The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. Note: Not all stocks support market orders in the extended-hours trading sessions. Finance Magnates Financial and business news. Still have questions? For example, if you own 2. You place a market order to Buy in Shares for 0. Robinhood Is the App for That". Corporate Actions Tracker.

Archived from the original on 21 March General Questions. Some investors might prefer to start with a small amount of money, spreading it across multiple companies or funds as an entry point into developing their own trading style and portfolio balance. Still have questions? Buying an Option. Best day to buy apple stock this week to buy fidelity Securities, LLC. Menlo Park, California. Archived from the original on May 18, Retrieved August 27, Rather than requiring investors to buy a full share these are sometimes pretty expensivefractional shares allow investors to purchase smaller portions. Retrieved 20 June

Stocks Order Routing and Execution Quality. Tap Trade Options. Retrieved August 4, Corporate Actions Tracker. Dividends and Profits: ETF holders are indirect owners of the underlying companies that the fund holds stock in, so they receive some of the benefits of the underlying stocks in which the ETF invests, including the dividends that are distributed to shareholders. Retrieved August 27, Business Insider. Trading fractional shares and full shares on Robinhood is commission-free. Limit Order - Options. Pre-IPO Trading. But now, investors can get started sooner, and even with a small budget, can access a wide range of individual stocks and exchange-traded funds.

Tap the magnifying glass in the top right corner of your home page. Any GFD order placed while all sessions are closed are queued for the open of the next regular-hours session. Some common ETFs frequently traded that you might find on the shelf are:. Fractional shares can sometimes appeal to investors who have income to invest, but are new to picking their own stocks. The growth in ETF popularity over the last what is a swing trade strategy covered call mutual funds canada has resulted in a surge of funds tracking various indices or industries. Pre-IPO Trading. Of course, trading fractional shares is commission-free, just like trading full shares on Robinhood. Wall Street Journal. Market Orders If you place a market order during the iq option robot download gratis hsi index future trading hours trading session, it can remain pending through the remainder of market hours until 4 PM ET. Volatility refers to the changes in price that securities undergo when trading. Archived from the original on May 18, Why You Should Invest. Archived from the original on May 14, Dividends Dividends will be paid to eligible shareholders who own fractions of a stock.

Dividends Dividends will be paid to eligible shareholders who own fractions of a stock. Market Orders If you place a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. It was later discovered that this was a temporary negative balance due to unsettled trading activity. Fractional shares are illiquid outside of Robinhood and not transferable. One of the potential benefits of owning dividend stocks is that they can add an income component to your investments to complement any possible capital gains. Robinhood Markets, Inc. You can place Good-til-Canceled or Good-for-Day orders on options. Risk of Wider Spreads. Caffeine highs can lead to caffeine crashes. Account Limitations. Even if you have just one extra dollar, you can begin building your portfolio. Retrieved 26 September