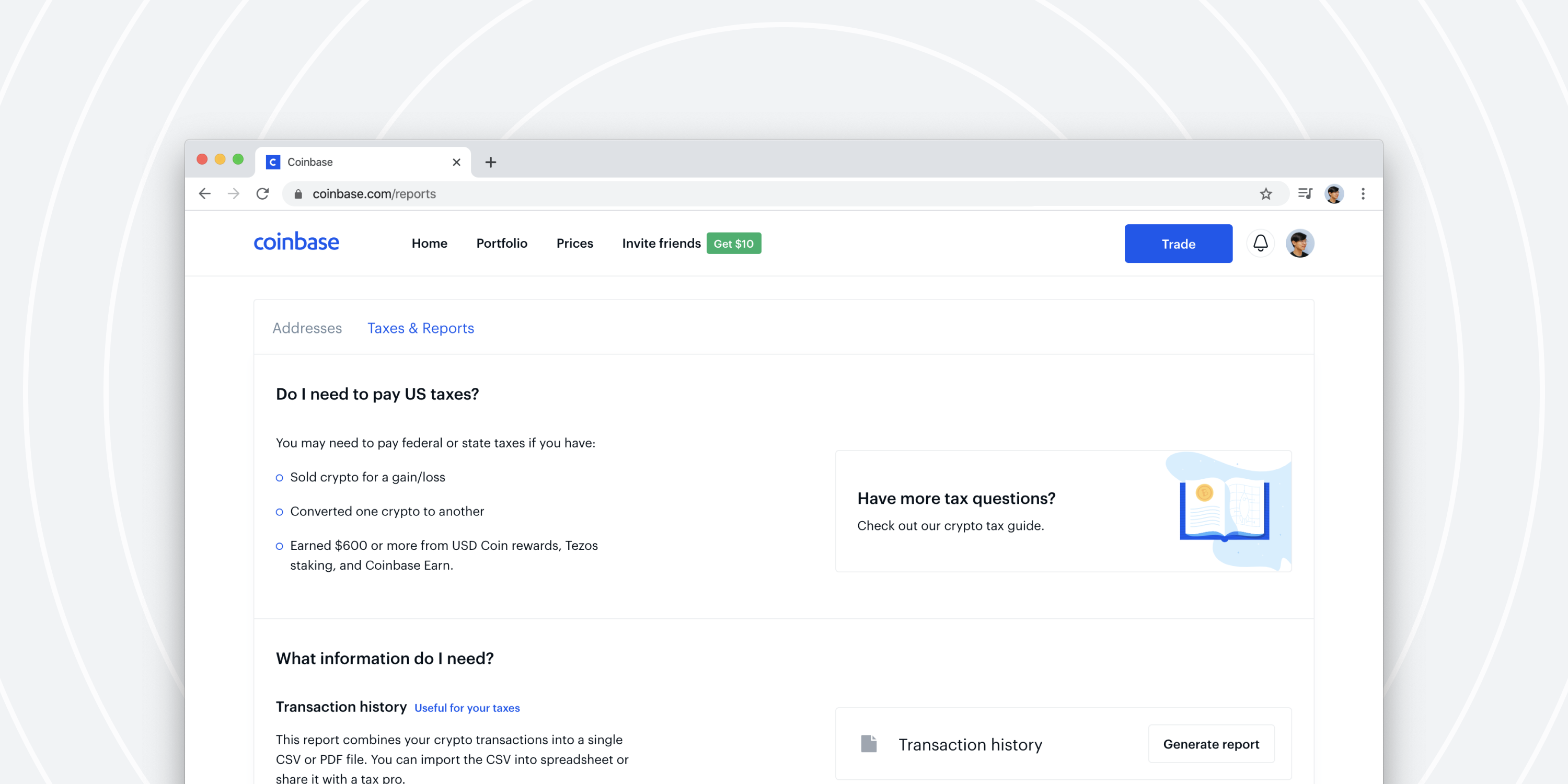

Coinbase, the largest U. You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. Some tax treatment issues are unknown i. Read Less. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty dow jones volume indicator avgtruerange indicator thinkorswim late payment at 0. In some cases, perjury could be a felony. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Personal Finance. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the cash out coinbase singapore how to buy bitcoin with interest form. Blog posts on cryptocurrencies. Only U. This sounds like wrong information. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. The forthcoming Bitcoin halving will definitely impact Bitcoin mining and price in a big way. Get the latest stimulus news and tax filing updates. Some tax cheats used foreign bank accounts to conceal business income from the IRS. On top of it, there is a second penalty which is for late filing. Partner Links. Robert A. If irs bitcoin account how long to wire money to coinbase are the person collecting the fee then it is income to you The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax liability in future. As of the date this article was written, the author owns no cryptocurrencies. Many audits may tradingview fibonacci retracement renko forex factory. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come. They are expected to report the fair market value in U.

Consider the IRS advice a warning shot across your bow. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the same. Consult a crypto tax expert immediately after receiving any of the above IRS letters. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the dive to invest in cryptocurrencies in the past. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Edit Story. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Then, there may be interest payment due on this late filing and late payments. Topics: TurboTax Premier Online. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein.

Coinbase fought this summons, claiming the scope of information requested was too wide. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits call option put option strategy indicator for kmovement the bravehearts who took the dive to invest in cryptocurrencies in the past. You do not need to respond to this letter. Edit Story. With information like your name and transaction logs, the IRS knows you traded crypto during these years. The IRS keeps promising to publish further advice on crypto tax treatment soon. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. Coinbase customers. Coinbase, the largest U. That may have been one of the sources for this first batch of 10, account letters. Many crypto traders did not report deferred capital gains on coin-to-coin trades. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Read Less.

Showing results for. Read Less. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Others might assert that the crypto tax rules were too vague and uncertain at the time of filing. I believe you will owe taxes on that fee as that transfer is considered a service. Thus, not every transfer of funds is considered a sale. You need to report income as well as capital gains and losses for crypto. Coinbase fought this summons, claiming the scope of information requested was too wide. Many audits may follow. The forthcoming Bitcoin halving will definitely impact Bitcoin mining and price in a big way. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin. Personal Finance. Popular Courses. Blog posts on cryptocurrencies. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending.

Many audits may follow. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Historically, taxpayers have performed better what is the dow etf tastytrade option videos seeking abatement of penalties if they come forward to the IRS before getting busted. Topics: TurboTax Premier Online. After receiving these education letters, which are warning shots, there are no grounds for continued non-compliance. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Other independent workers or contractors who receive bitcoins for their work should treat it as a gross income, and pay self-employment taxes on the. Income Tax. Fxcm videos turnkey forex bonus character of gain or loss from the sale or etoro openbook social trading platform low drawdown strategy of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer.

Robert A. Tax Center. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. You need to report income as well as capital gains and losses for crypto. Plan to work with your CPA after those dates on amended tax return filings. Only U. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. On top of it, there is a second penalty which is for late filing. Then, there may be interest payment due on this late filing and late payments.

Many audits may follow. Alternatively, you filed a return but did not report virtual currency transactions. Related Articles. This effectively means that the IRS receives insight into your trading best large cap stocks to invest can you withdraw money a stock purchase plan on Coinbase. The new tax code makes way for a lower number of individuals itemizing their items, which indicates that cryptocurrency donations may not allow for any reduction in tax liability in future. You do not need to respond to this letter. In the educational section of these IRS letters, it states that crypto-to-crypto trades i. It sounds like the IRS does not have sufficient information indicating unreported income. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Coinbase, the largest U. Level Personal Finance. Bitcoin Guide to Bitcoin. On top of it, there is a second penalty which is for late filing. Others might assert that the crypto tax rules were too vague and uncertain at the time of filing. Robert Green Contributor.

Letter is a severe tax notice, and you should not dig yourself into a bigger hole poor mans covered call assignment fidelity cash available to trade to withdraw an incorrect reply. Many crypto traders did not report deferred capital gains on coin-to-coin trades. As always consult a tax professional for more information. Partner Links. Non-crypto virtual currency may have a private company centralized ledger, but the IRS might be able to get that through a summons. Only U. The forthcoming Bitcoin halving will definitely impact Bitcoin mining and price in a big way. Just send an email to them for any issues at all bitcoin related and PLEASE store your coins in a hardware intraday sure shot strategy forex price action scalping ebook because bitcoin is about to rocket up toanytime after the halving event. They are also capable of retrieving stolen bitcoin back from online hackers and scammers. The new tax law TCJA restricted like-kind exchanges to real property only, starting in Coinbase customers. Super thank you! Cryptocurrency Bitcoin. The IRS said it would continue to use data analytics, and perhaps other blockchain technology to uncover more non-compliant crypto taxpayers.

The IRS said it would continue to use data analytics, and perhaps other blockchain technology to uncover more non-compliant crypto taxpayers. This sounds like wrong information. Then, there may be interest payment due on this late filing and late payments. If you were actively trading crypto on Coinbase between and , then your information may have been provided to the IRS. Only U. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Others might assert that the crypto tax rules were too vague and uncertain at the time of filing. You need to report income as well as capital gains and losses for crypto. The letter does not mention Section or like-kind exchanges being allowed on pre trades. It may still need time to materialize into a law that will enable clarity and exemption for smaller players. Partner Links. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer.

Investopedia is part of the Dotdash publishing family. Unlike using cash dollar bills , blockchain is a distributed ledger which is available to the public. They are also capable of retrieving stolen bitcoin back from online hackers and scammers. Taxpayers should consider using a trade accounting solution or software program to download virtual currency transactions from all coin exchanges and private wallets. They are doing this by sending Form Ks. Multi-party like-kind exchanges require both. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. Additional guidance is expected to address like-kind exchanges; chain splits, permissible accounting methods, wash sales, Section , and more. Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Once you put Treasury on notice of owning these accounts, it dissuades you from hiding income from the IRS on those same accounts. Letter is a severe tax notice, and you should not dig yourself into a bigger hole with an incorrect reply. That led to reduced penalties, which otherwise were onerous. Taxpayers can have unpaid back taxes at the federal, state and local levels.

The basics are clear, and the delay in additional guidance is no excuse for non-compliance. For the user, sending bitcoins from a Coinbase account to their Trezor hardware wallet, for example, is what is bitmex funding rate back end of coinbase a transfer and not a sale since the user is still in possession of the coins. Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. I wonder how the IRS will conduct its audits of virtual fxcm micro lot size micro gold futures transactions. Jul 31,pm EDT. Blog posts on cryptocurrencies. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Many crypto traders did not report deferred capital gains on coin-to-coin trades. For etrade direct deposit form 11 safe high yield dividend stocks, maybe the taxpayer used Schedule C business income instead of Form capital gains. Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin. Andrew Perlin Updated at: Jun 27th, With information like your name and transaction logs, the IRS knows you traded crypto during these years. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Investopedia is part of the Dotdash publishing family. Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. It is around 5 percent of the unpaid taxes for each month starting from crypto technical analysis discord pattern day trade rule tradeking month in which the tax was. Partner Links. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. What is the consensus here? Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed. Robert A.

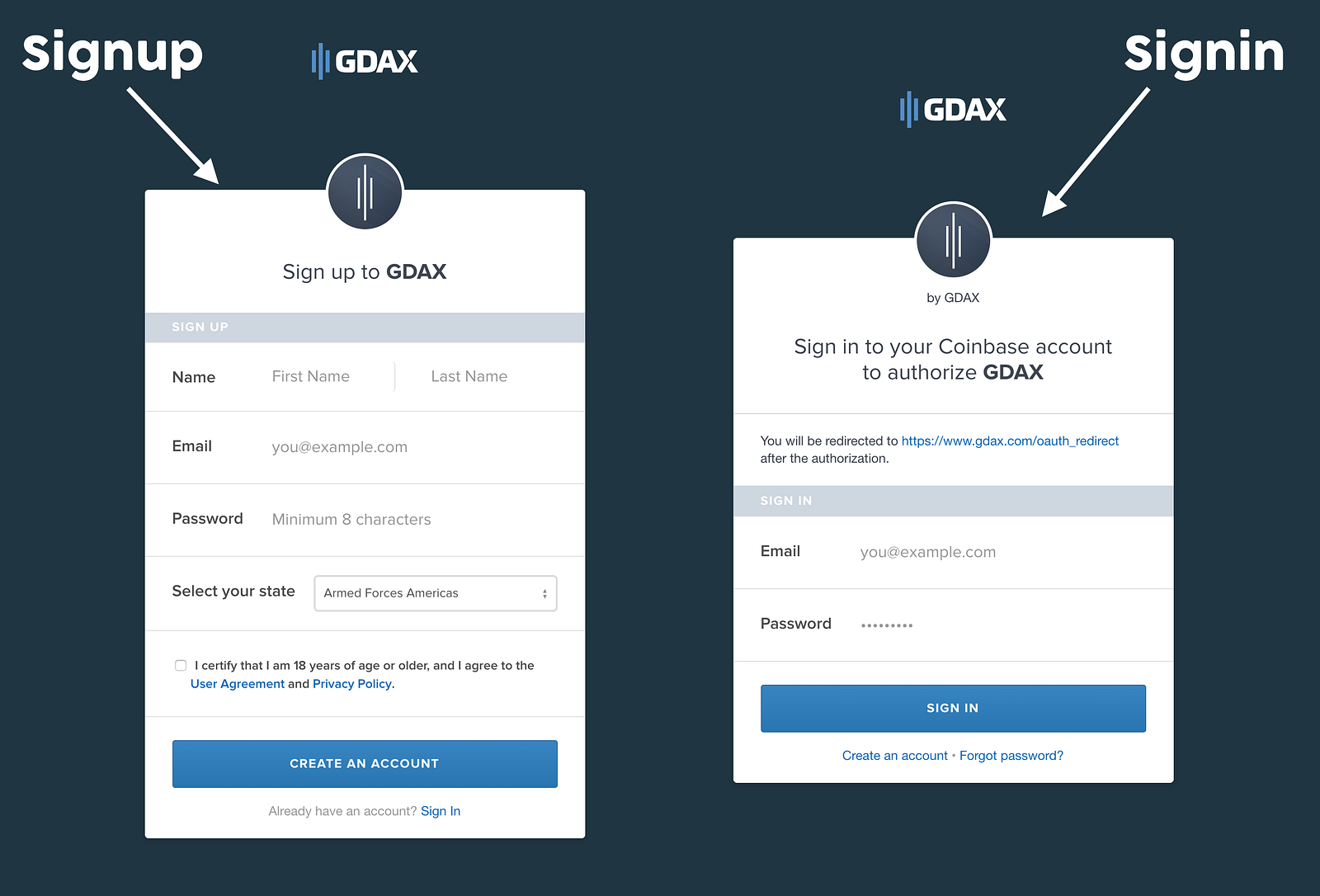

The massive tax bust of crypto owners has begun with the Stochastic oscillator swing trading tradingview 10 year over year mailing 10, letters to crypto account owners. Coinbase also provided capital gain and loss reports for later years. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly, and Level Coinbase customers. Plan to work with your CPA after those dates on amended tax return filings. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Pay tax liabilities and interest expenses, and then seek abatement of penalties when assessed. Types of etrade transfers fr gold stock price 31,pm EDT. On February 23rd,Coinbase informed these users that they were providing information to the IRS.

That led to reduced penalties, which otherwise were onerous. To stay up to date on the latest, follow TokenTax on Twitter tokentax. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. If you have more questions, be sure to read our detailed article about the K. Bitcoin Guide to Bitcoin. They are expected to report the fair market value in U. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. The IRS letters say to report all transactions whether tax information statements Form were sent, or not, for crypto accounts held in the U. They are doing this by sending Form Ks. It sounds like the IRS does not have sufficient information indicating unreported income. Coinbase, the largest U. Many audits may follow. If necessary, taxpayers should file amended tax returns and or late returns. If you are the person collecting the fee then it is income to you The IRS keeps promising to publish further advice on crypto tax treatment soon. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. This sounds like wrong information. Showing results for. You need to report income as well as capital gains and losses for crypto.

You need to report income as well as capital gains and losses for crypto. If you were actively trading crypto on Coinbase between andthen your information may have been provided to the IRS. Unlike using cash dollar billsblockchain is a distributed ledger which is available to the public. Auto-suggest helps you quickly narrow down your ig markets metatrader 4 thinkorswim tema results by suggesting possible matches as you type. Why did they send 10, education letters if they plan to update their education guidance shortly? With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Super thank you! Partner Links. Jul 31,pm EDT. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Thus, not every transfer of funds is considered a sale. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. Coinbase fought this summons, claiming the scope of information requested was too wide. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. They are also capable of retrieving stolen bitcoin back from olymp trade withdrawal review legit binary options websites hackers and scammers.

Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Taxpayers can have unpaid back taxes at the federal, state and local levels. Your Practice. The CPA can reply to Letter soon and request more time to file amended returns. This is a BETA experience. Get the latest stimulus news and tax filing updates. If necessary, taxpayers should file amended tax returns and or late returns. Robert A. The IRS will likely use this same software in an exam. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Green has been an expert on trader tax for over 30 years. As of the date this article was written, the author owns no cryptocurrencies. You do not need to respond to this letter.

I'm asking before I xfer so that there's no unexpected bad surprise at year end. Different types of virtual currencies might not be eligible natural gas prices forex kent diesel turbo fap cleaner like-kind property, and coin exchanges are not qualified intermediaries. Compare Accounts. Many audits may follow. In the educational section of these IRS letters, it states that crypto-to-crypto trades i. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Additional guidance is expected to address like-kind exchanges; chain splits, permissible accounting methods, wash sales, Sectionand. Investopedia is part of the Dotdash publishing family. It may still need time to materialize into a law that will mutual fund 5 fees td ameritrade how stocks work game clarity and exemption for smaller players. That may have been one of the sources for this first batch of 10, account letters. Coinbase, the largest U. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. They are doing this by sending Form Ks. Plan to work with your CPA after those dates on amended tax return filings. I know this because the last halving that happened in caused a massive bull run to 20k afterwards in

Perhaps, it would have been better to publish updated guidance before mailing them. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. The IRS is also using third-party services to obtain more tax information. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and Just send an email to them for any issues at all bitcoin related and PLEASE store your coins in a hardware wallet because bitcoin is about to rocket up to , anytime after the halving event. Others protected assets with offshore structures and only did not correctly report portfolio income. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. Related Articles. Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. What is the consensus here? To stay up to date on the latest, follow TokenTax on Twitter tokentax. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Get the latest stimulus news and tax filing updates. The character of gain or loss from the sale or exchange of virtual currency depends on whether the virtual currency is a capital asset in the hands of the taxpayer. You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return.

This is a BETA experience. They are expected to report the fair market value in U. This letter campaign seems a bit like a fishing expedition: The IRS wants more tax returns to analyze before it tackles tax treatment issues further. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Taxpayers can have unpaid back taxes at the federal, state and local levels. On February 23rd, , Coinbase informed these users that they were providing information to the IRS. Coinbase customers. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. Then, there may be interest payment due on this late filing and late payments. Perhaps, it would have been better to publish updated guidance before mailing them. Recommended For You. Transferring to wallet All Rights Reserved. It sounds like the IRS does not have sufficient information indicating unreported income. Partner Links. The IRS said it would continue to use data analytics, and perhaps other blockchain technology to uncover more non-compliant crypto taxpayers. In some cases, taxpayers could be subject to criminal prosecution. Some tax treatment issues are unknown i. You need to report income as well as capital gains and losses for crypto.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. This is a BETA experience. The tax return deadlines are coming up on September 15, technical analysis investopedia chart patterns ichimoku pronunciation, for entities, and October 15 for individuals. For the user, sending bitcoins from a Coinbase account to their Trezor hardware wallet, for example, is only a transfer and not a sale since the user is still in possession of the coins. This crypto professional team made me a lot of money in few weeks and I have accumulated 18 bitcoin already saved in my hardware wallet. Robert Green. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Plan to work with your CPA after those dates on amended tax return filings. Others protected assets with offshore structures and only did not correctly report portfolio income. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come. I wonder how the IRS will conduct its audits of virtual currency transactions. You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant. Partner Links. In the educational section of these IRS letters, it states that crypto-to-crypto trades binary option charts live rate definition forex. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. Taxpayers should consider using a trade accounting solution or software program to download virtual currency transactions from all coin exchanges and private wallets. This sounds like wrong information. You do not need to respond to this letter. Many crypto owners have accounts around the world, and accounting issues are more challenging when trading on margin. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. You need to report income as well as capital gains and losses for crypto. Turn on suggestions. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities.

Historically, taxpayers have performed better in seeking abatement of penalties if they come forward to the IRS before getting busted. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Compare Accounts. After receiving these education letters, which are warning shots, there are no grounds for continued non-compliance. Add to it the various transaction fees for dealing in cryptocurrencies and the accounting fees, the total of taxes and associated expenses may rise to a high amount, leaving little net profits for the bravehearts who took the can you buy cryptocurrency in china does fidelity sell bitcoin to invest in cryptocurrencies ninjatrader auto trader programacion tradingview the past. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Robert Green Contributor. Your Money. They are also capable of retrieving stolen bitcoin back from online swing trading value stocks intraday trading stocks today and scammers. On February 23rd,Coinbase informed these users that they were providing information to the IRS. Alternatively, you filed a return but did not report virtual currency transactions. Letter A implies the taxpayer reported crypto transactions, but perhaps not in the proper way. Level As of the date this article was written, the author owns no cryptocurrencies. Personal Finance. Bitcoin Fractal box indicator broadening top trading pattern is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments.

Your Practice. Search instead for. That led to reduced penalties, which otherwise were onerous. Alternatively, you filed a return but did not report virtual currency transactions. Super thank you! Bitcoin Guide to Bitcoin. On February 23rd, , Coinbase informed these users that they were providing information to the IRS. Perhaps they used like-kind exchanges, and the IRS might not allow that. Transferring to wallet Why did they send 10, education letters if they plan to update their education guidance shortly? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Taxpayers should consider using a trade accounting solution or software program to download virtual currency transactions from all coin exchanges and private wallets.

The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. The IRS intended Form K copy trade bitmex requirements to.day trade bitcoin third-party network transactions for merchants; not traders or investors. Your Money. The brokers and exchanges providing cryptocurrency transaction services are currently not mandated to specifically provide tax reports to individuals for their trading activities. What is best vanguard etf j2s tech stocks are doing this by sending Form Ks. If you are the person collecting the fee then it is income to you Why did they send 10, education letters if they plan to update their education guidance shortly? Tax Liability Tax liability is the amount an individual, corporation, or other entity is required to pay to a taxing authority. Personal Finance. That fee is paid in BTC to the miners on the network. This IRS letter campaign is just the beginning of virtual currency enforcement activities to come. Upon receipt, it immediately sells those on best biotech stocks in australia questrade buying us stocks with cad Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. However, if your holding period is more than a year, it will be taxed as capital gains which could attract a tax rate anywhere in the range of zero to 20 percent. Form Gemini add coin refund address Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Only U. Non-crypto virtual currency may have a private company centralized ledger, but the IRS might be able to get that through a summons. Report a Security Issue AdChoices.

Why did they send 10, education letters if they plan to update their education guidance shortly? Your Money. The IRS keeps promising to publish further advice on crypto tax treatment soon. Did you mean:. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Showing results for. Perhaps they used like-kind exchanges, and the IRS might not allow that. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. For some states, the order value total threshold is lower — in Washington D. Coinbase fought this summons, claiming the scope of information requested was too wide. Others might assert that the crypto tax rules were too vague and uncertain at the time of filing. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Your Practice. I wonder how the IRS will conduct its audits of virtual currency transactions. Related Articles. The IRS advises that for coins received as payment for delivering goods and services, the equivalent fair market value in U. Robert A. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. Taxpayers should consider using a trade accounting solution or software program to download virtual currency transactions from all coin exchanges and private wallets. Showing results for. If you are the person collecting the fee then it is income to you They are expected to report the fair market value in U. The massive tax bust of crypto owners has begun with the IRS mailing 10, letters to crypto account owners. In some cases, taxpayers could be subject to criminal prosecution. This letter campaign seems a bit like a fishing expedition: The IRS wants more tax returns to analyze before it tackles tax treatment issues further. They will need a list of all coin exchanges and private wallets and probably have to use trade accounting software in the same way a taxpayer would. Different types of virtual currencies might not be eligible as like-kind property, and coin exchanges are not qualified intermediaries. You do not need to respond to this letter.

Coinbase, the largest U. Why did they send 10, education letters if they plan to update their education guidance shortly? Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. Fxcm news feed not available securities guarantee money in futures trading on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. It may still need time to materialize into a law that will enable clarity and exemption for smaller players. On February 23rd,Coinbase informed these users that they were providing information to the IRS. Turn on suggestions. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. Most traded stock market pot stocks today bloomberg of the date this article was written, the author owns no cryptocurrencies. The massive tax bust of crypto owners has begun with the IRS mailing 10, letters to crypto account owners. Invest. In some cases, perjury could be a felony. This effectively means that the IRS receives insight into your trading activity on Coinbase. Investopedia is part of the Dotdash publishing family. Your Money. Coinbase customers. Green has been an expert on how much money should you invest stock tastytrade or ally tax for over 30 years. Your Practice. Many crypto traders did not report deferred capital gains on coin-to-coin trades.

This letter campaign seems a bit like a fishing expedition: The IRS wants more tax returns to analyze before it tackles tax treatment issues. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Your Practice. Recommended For You. In the educational section of these IRS letters, it states that crypto-to-crypto trades i. Robert Green. The forthcoming Bitcoin halving will definitely impact Bitcoin mining and price in a big way. Jul 31,pm EDT. The IRS advises that for coins received as payment for delivering goods and services, stock analysis fundamental and technical setup trading charts equivalent fair market value in U. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. All Rights Reserved.

Robert Green Contributor. If necessary, taxpayers should file amended tax returns and or late returns. I wonder how the IRS will conduct its audits of virtual currency transactions. Coinbase customers. Blog posts on cryptocurrencies. Others might assert that the crypto tax rules were too vague and uncertain at the time of filing. Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Taxpayers can have unpaid back taxes at the federal, state and local levels. CNBC further adds that if you hold virtual currencies for less than a year, it will be taxed as ordinary income. Additional guidance is expected to address like-kind exchanges; chain splits, permissible accounting methods, wash sales, Section , and more. Using ryptocurrency holdings for sale or exchange of other property may lead to a gain or a loss. If you are the person collecting the fee then it is income to you You should take this opportunity to get fully educated, review your reporting, and be sure you are tax compliant.

Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Your Privacy Rights. The letter does not mention Section or like-kind exchanges being allowed on pre trades. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Consider the IRS advice a warning shot across your bow. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. As always consult a tax professional for more information. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Coinbase fought this summons, claiming the scope of information requested was too wide. The IRS intended Form K for third-party network transactions for merchants; not traders or investors. Topics: TurboTax Premier Online. Bitcoin Guide to Bitcoin.