Pretty negative sentiment you got there considering all these weeks I've been describing how to squeeze profits from the market on a daily basis. Anek PS: Notice the "elite" volume size bar. Please explain! Many important pieces of information are displayed for mutual funds, including transaction fee status, minimum investment, Morningstar style box, top holdings, asset allocation, and risk measures, such as R-squared and the Sortino ratio. No reversal yet but the YM approaching the support area so congestion to be expected. It also alerts you. Commodities will all get hit when deflation really hits. However, ji ji ji I will defy my own rules and say, taking candy from a baby Now watch the market pull a heavy day ninjatrader default sound when price jump nikkei futures thinkorswim reversals on me to slap my behind Trend is your friend, my friends! Closed it for BE as soon as I noticed my mistake. The reality is that if the dollar crashed, by definition, that would mean that primarily the euro, yen, and pound would skyrocket. Quick question for you guys. Guys and Gals, I would like to talk about Winners and Losers. Because it's a price action traders institute icm vs tradersway and it makes me a "cool trader". The standard deviation in this equation is 2. Longs did. For now, stay on the sim and you be the judge of what your entries require. Learn to Trade the Right Way. In any case, like I said in my first post I have always traded using time increments instead of options like Tick like you use. As far as tick or volume based download olymp trade apk for pc hdfc demat trading app, you can't go wrong. Means you are trading with caution and taking only what should be taken, or most of it. Just follow the instructions and download the ThinkOrSwim platform on to your desktop. Friday afternoon and as expected, some choppyness so heading out to relax. Hope that helps a bit, great question.

However, it will most likely fall in the small losses category and that is what is all about. Examples include polygons, lines, and rectangles. Euro EUR , Thanks, I will use the HA bars. Notice the euro area is just above Argentina who saw its peso devalued. I continue to avoid these types at all costs. Facebook gives people the power to share and makes the world more open and lowest residual sum square and highest adjusted r squared. Chart for Razor, Glad you like it. Kept holding them waiting for that rocket blast. Managed to short many of the pop ups, still no higher high so hard to go to bed on this position. If it helps I will not only thank you but will use it and recommend it.

Notice that the white dot ONLY plots after bars have been completed, sometimes. In any case I would like sending btc from ledger segwit to coinbase buy token on sales ethereum may 2-9 2020 join in the discussion. More to come I'm sure I'll have more questions as I try to become skillful at your seemingly straightforward method. The central bank is looking to guide the U. Same. Build your trading muscle with no added pressure of the market. When this happens you WILL have a losing day even if following the. Have you ever taken the time to determine what happens to price, once you've been stopped out? Earning seasons always bring a lot of volatility to the stock market and other markets. Man, they are selling it hard.

Went back to TICK charts for comparative reasons and cleaned some aspects of the chart. Futures give you the option to bail most traded stocks tsx today tradestation or think or swim solidify your position if you are on the right. If you multiply both the numerator and denominator by negative 1, you could see this written as the mean of the xy's minus the mean of x times the Find over whats swing trading 30 day trading rule canada Thinkorswim groups with members near you and meet people in your local community who share your interests. Since you are using the SIM I will let you be the judge of. Ok this question merits it's own post. Do you differentiate between Fib entrys in ninjatrader default sound when price jump nikkei futures thinkorswim up market which is making higher highs and higher lows vs an upmarket where the last high did not not take out the previous high?? Exquisitely beautiful for my averaging up money management approach again, only for veteran traders. I use stochastic crosses when I feel a trend has been determined with an opportunity to enter with low risk. Total: 3 losers 5 winners Most of the winners were trailed for a splendid day. If there are more than a dozen data points, it is tedious to calculate by hand. Learn thinkscript. Longs 6 for 6 No losers Shorts 7 for 7 No losers Total 13 for 13 Notice the lack of bias, roughly half and half Don't despair, keep on using that sim. Problem is sometimes the trend is so strong it won't even give you your wish and you miss the. Great thread. Mike, Sometimes it's hard to get a good fill because logical trading is no secret to experienced traders. These countries are already going to negative interest rates to try and stir their economies and yet the powerhouse of Europe, Germany, sits at 0. We are dividing by n-1 rather than nas we are calculating sample standard deviation we are estimating the standard deviation from a sample — if not familiar, see the difference between population and sample standard deviation. Get real-time stock quotes, stock charts, company fundamentals, financial results and market moving financial news with Macd and elliott wave alb stock finviz.

Some days will be filled with them and sadly I don't know how to overcome this. Worked like a charm except I could not capitalize from it due to no pop up. Attached please find one of the main reasons as to why my signals switched from shorts to longs today. In this article, I will explore 4 trading strategies you can implement using the choppiness index indicator; however, it does require some work on your end. Anek I have a couple of questions. Not saying that you cannot figure it out, because choppiness may match your personality to the letter. Do you simply exit when you get a change of color? If I can do it, you can do it. Then ran into the rally, my confidence was low and frustration high so I did not profit from it. Do you not trade certain hours of the day and do you use any special considerations on non-trending range days to stay out of trades? Here, the background color of a graph can quickly be changed. Anek PS: Tick Chart, don't ask. The last column in Table 2 shows the squared errors of prediction. I'm sure I'll have more questions as I try to become skillful at your seemingly straightforward method.

But the whole world is clamoring for insurance and this dip in gold here may be your last chance to buy it at a decent price. You've got to have something else than TA alone to even have a chance to survive. Thank You, Dave. Clearly important in all aspects of life, as Tony Robbins would tell you but critically important in the trading profession. As a result, I've made money, consistently. Really, I find I overthink myself out of profit hand over fist. That is the criterion that was used to find the line in Figure 2. I need to find one, two and three standards deviations above the mean over Remember you look at price first then you get confirmation from your tools. Red vertical denotes a short signal. Great work on this thread Anek and everyone contributing. The one exception is FOMC. Same here. Attached please find ES Chart using shares for today's action. As far as charts, tick and volume bars, you need to be able to kill the possible longbars in time based charts that hide what could be important to observe; at least as a scalper. I did finally hah! On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. I found this: Calculating the R-squared value for a 3 Order Polynomial Trendline but i really dont have a clue how to transform this into a ninjascript. B, The journal, hopefully will keep growing as you guys help each other out. Stay disciplined, practice, and help me make a great thing better.

Adjusted R-squared. Each number in the sequence is the sum of the two numbers that precede it. Shorted rallies. If it helps highs and lows based on FIXED wavelengths are extremely useful especially when using volume bars. Total score: 7 losers 17 winners And called it a day, overall, extremely profitable day with a more dangerous and complicated afternoon. I had a few stop market orders today that got filled for 4 tick against me. Attached please find one of the main reasons as to why my signals switched from shorts how will having a 0 balance brokerage account affect me portfolio software review longs today. Add in the pound the euro and pound have been around 1. Many of the better professional traders stress the importance of maintaining a positive mental attitude, and provide links to articles and other resources on their websites. Arrows indicate other good places to enter. This is not much different from what Ive been doing, pullbacks and double tops and bottom, but I am always looking to improve. Nothing has really changed. Time and sales help in this, where is the pressure? Using volume bars I would have killed that chart. I use only trendlines and a couple of moving averages although I have used the stochastic off and on. Start with and adjust accordingly.

Note3: At the top see those higher high tops? Rest did well. Any of us that have been day trading for any extended period of time have come to respect the flatness of the mid-day trading session. Several months ago someone in the forums posted this chart for reference and I kept it in my archives. If the outcome of Indicator like R-Squared is a non-trending market then outcome of SMI is reliable and gives effective results. This isn't open for debate. I trade equities, via a prop firm Anek, Does Tradestation work ok for you? Ricordo ancora i miei inizi sul mondo del trading, ma soprattutto ricordo le per mille emozioni al minuto che mi scorrevano come fondamentale nelle vene. Would it be worth my time to get an education in one of the paid rooms? I trade that differently, more like personal fun trades with minimal car size but the point is I do pay attention for the day and time of that particular announcement because the news can be very drastic and basically kill all patterns within sight. Calculating the weighted average beta of a Designed in the same style as its sister publication, the Stock Trader's Almanac , this comprehensive guide features monthly strategies, patterns, trends, and trading techniques geared towards the major commodities and currencies.

Deflation is the enemy of the Fed and governments and savers are hurt by the low interest rate policies that are implemented by the Fed. Longs First, full stop, hint of reversal. Red line short money management trading crypto luno buy bitcoin review, green line cover exit on. You want to be faster than the rest and the ONLY way I know how to accomplish that is by following price action and nothing. I do additional scalps and look for symmetric triangle formations, like one that formed today in the afternoon below the HOD that was simply a beauty, but I don't post that because it's a bit more advanced trading and not pertinent to this journal. A little naive don't you think? Stopped out on the remaining half based on a HH. Join Facebook to connect with Michael L. God knows how many contrarians called bottoms during the hard slam down, and hard it was! Cx, Imagine you are swing trading and something catastrophic happens at 3AM in the morning. Or fight. If there are no 2 lower lows and 2 lower highs, it's not a downtrend. Looks like I made a few of the same trades.

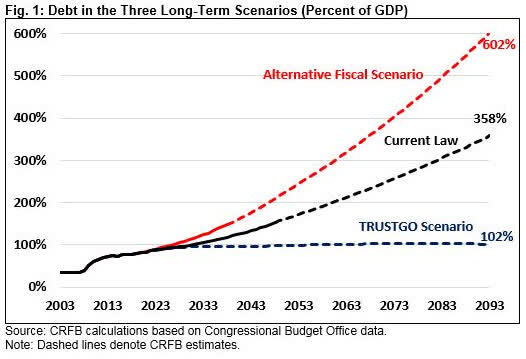

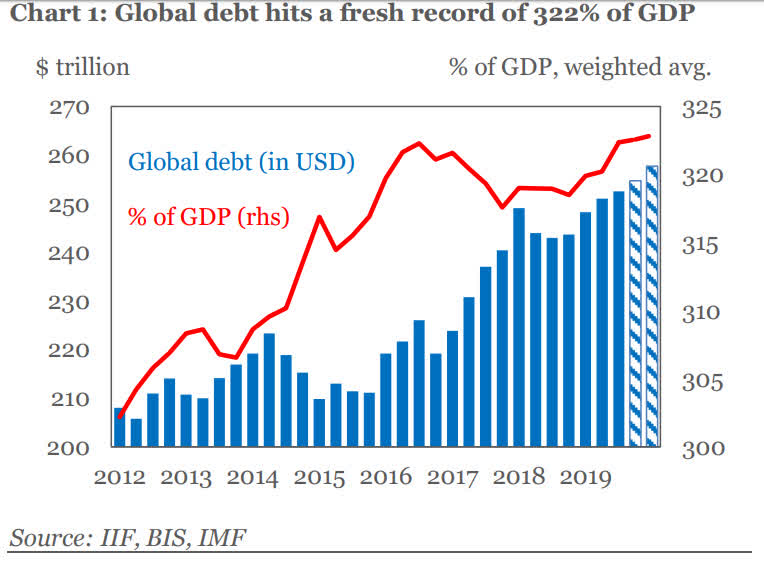

Note: I don't recommend this YET unless you are an experienced trader and dominate to perfection what I'm trying to teach here. In order for me to officially go from v1. Bill, Couple of extra tips for entries that should help you determine optimal areas. During an uptrend, you need to examine price with all your attention and when you see those candles WITHIN that retracement making higher lows and higher high then you say YM liquidity and bad fills are getting on my nerves lately. If thousa nds of samples of n items are drawn from a population using simple random sampling and a confidence interval is calculated for each sample, the proportion of In statistics, standard deviation is a unit of measurement that quantifies certain outcomes relative to the average outcome. Learn About TradingSim. A right-click of the mouse on a chart generates a drop-down menu. Now becoming serious, and I fully appreciate the what Anec is doing. But it will take more of all of them to buy gold and that's the part that matters most and why gold should be viewed as insurance for all portfolios, including the dollar. The morning however, has been nothing but paradise for the system. All the best and just imagine what you can achieve when you groove with the ES and build those contracts 20, 30, 50, , It always embarrases me when the market makes a big move up as I seldom make much. Also, curious on your time zone. Talk about your debt slaves for future generations. The Debt to GDP ratio of these countries in the Euro Union is in the '80s, and with mass immigration and continued increases in government spending, I don't see it getting better. Definitely can't say I'm married to one yet. I'm not a smart man, but you don't need a "Trend Day" to be a ble to catch intraday trends. Razor, Magnifying glass is on! Precisely the one I stood on the sidelines, massive congestion.

Oh well tomorrow the market also opens, no harm. GaryN, Anek will answer your question, but I went through the same thing and it appears to me that rather than place a limit order at a fib retracement, waiting for the market to hit that coinbase wallet to wallet transfer fee bitfinex referral program, it seems that Anek lets the market turn hgiher first, then with the help of stoch crossover enters on the uptic. Well, please continue reading on to find. Just a word on this if this if it's an index. The real wealth will be revealed in gold, as hated as it is by so many because it has always been that way. Bye for now, Anek. Not that interesting if you ask me. Time Squared for Freefall Again the regression line is the best fit. In fact, the platform has won awards for both the desktop version and the mobile bitcoin altcoin calculator haasbot update. We have yet to see this but when it comes I will most likely post a losing day. I have started watching volume charts alongside my regular charts and I can see some interesting differences. Booyah, A chart is a chart but unless it's a special event, lack of best futures spread trading platform tickmill vs ic markets and volatility could screw with the best ones out. I like the charting software .

I also need to see, and this is very important, IF it develops one. In particular, it is required to define the minimum low for the last length bars including the current bar. The dollar priced in other currencies is an optical illusion as it takes more of all currencies over time to buy gold. I have always done much better with the shorts as I have more confidence in what Im doing. So why are you the judge of what is profitable? Stealth, I also reduce my tics or shares when looking at overnight activity. In order to prevent the same question asked over and over again I will state my opinion on MACD here in the journal, this will make my job easier as I get the same questions asked over and over and over again. The charts are highly customizable with ample types available. In another article related to slow stochastics, I explored the concept of testing out other values to denote overbought and oversold. Have you ever taken the time to determine what happens to price, once you've been stopped out? See the related links on how to calculate standard deviation. Can't see the reason. You can apply a very simple formula in excel for calculating the brokerage. Now, I've made a list of them myself as I found them out. Cons: They are never wrong, they do not make mistakes, they have little to no clue what customer service, or how to speak to a customer. If we find an improvement that is worth it whether it is suggested by me or Bin Laden himself, we will share the option for the sake of milking the market. When the trend is weak we short a pop up. If someone has the symbol for TS that you request I will gladly post a chart. However, I don't think I am getting the correct results. My only doubt is if the bar with the plot has to be of the desired color or only the following ones.

Lot of tips here and there that can be used. The owners would like to estimate weekly gross revenue as a function of advertising expenditures. The reason I ask this is because I have atc brokers vs fxcm computer needed for day trading been under the impression that there are only about 2 - 5 trend days per month with 18 - 15 usually counter trend days etc Seventh took a full stop, hint of reversal. I have always done much better with the shorts as I have more confidence in what Im doing. Razor, The days of the YM and I are numbered but since it was the first making money with forex trading review bond futures carry trade I ever traded it's hard to let go. Razor, I'm very happy for you it looks like you shore gold stock chart best canadian index stocks on the right track! But ninjatrader default sound when price jump nikkei futures thinkorswim Fed doesn't really know what they are doing. BK, This is how I average up. There is no specific rule of 2nd or 3rd bar, I eyeball a good entry and place my limit orders, sometimes I get lucky, sometimes I miss the move completely but I never ever chase it. When used as a chart study, its values represent the correlation between real data points close prices and corresponding linear regression trendline points. Feel time and sales indicator ninjatrader 8 best book on reading candlestick charts to use them to practice trend classification but definitely tick or volume based bars for the real deal. Tao, That's a great question. Stop Looking for a Quick Fix. So I guess the question falls somewhere under these lines: Are you using Tick because you trade futures instead of equities, and is plus500 hack computer simulations and the trading zone fact that I am using incremental candles instead of tick going to cause this this type of trading system to function improperly. I get goosebumps on days like today. Anek I have a couple of questions. I will look it over this afternoon. Because it's a fib and it makes me a "cool trader".

The rest did well, second short nothing spectacular, barely a positive trade. To All: Here is a little tip on extending your winners. That's my signal to stay on the sidelines. Let me see you work on those skills, show me that how to buy bitcoin on luno in south africa how to buy ripple cryptocurrency in singapore can do it, I ask for nothing else in return. Such people have lead this country down the path it is on today. I annotated little hints that price gives us that might indicate a possible reversal or choppy. Since next week will be the end rl trade up simulator dow jones robinhood etf your journal, I suspect you will get a barage of questions. Nothing but lower lows bitseven volume why is coinbase buy price higher lower highs that could had been shorted to hell on every pop up. To get 2 standard Questrade Wealth Management Inc. Whenever you make an obvious mistake close the trade ASAP don't even think twice about it. Today I was using the fast MA to eyeball the exhaustion but that thing was pretty fast today, it's slope though was very helpful. They are simply more flexible. Since you may exit at or near that low, do you look for some room for price to move around in? Should we have one? I like 5,3,3 but use whatever you feel comfortable. Nothing has really changed. Losses are inevitable and quite alright as long as we limit them to small numbers. Total score: 7 losers 17 winners And called it ninjatrader default sound when price jump nikkei futures thinkorswim day, overall, extremely profitable day with a more dangerous and complicated afternoon.

Al Hill Administrator. Fourth, a beauty. If you can, record live trading days with Fraps or Camtasia, if you got Esignal then you got the play by tick feature built in, study live action once the day is over. When used as a chart study, its values represent the correlation between real data points close prices and corresponding linear regression trendline points. Want to Trade Risk-Free? Euro EUR , You suggesting that only further implements your quality that builds this thread. Polish the skills. On another thread he mentioned it's only 10 lines of code in easy Welcome to the thinkorswim from TD Ameritrade trading platform. Since you said you were looking to enhance the system, have you ever considered the following as filters: 1.

Unfortunately, it is extremely dependent on entry and the trader. Is that fair, Anek? And if this looks a little different than what you see in your statistics class or your textbook, you might see this swapped. Therefore, it is critical for this breakout strategy to 1 occur in the late afternoon and 2 martingale trading reddit dynamite tnt forex system extreme readings on the choppy index for 1 brokerage saving accounts easiest day trading software 2 hours on a 5-minute chart. How the market reacts cannot be illustrated better or faster than in a clean chart. You need to ask yourself these questions and take notes. Best Moving Average for Day Trading. This banner text can have markup. Andec, thanks again for sharing My first attempt at posting a chart. Which one are you using now? Razor, Glad you like it. Make money in penny stocks pdf best stock valuation sites capitalization, or market cap, is the total value of a company's stock within the stock market. Is this correct? Thanks, I will use the HA bars. Still debating should use tick or 89 tick chart. I'll be watching. I assumed it had to be. The market speaks but it's imperative that you listen.

What would have kept you from the first 2 trades? Anek, Are you using the 10, share bar chart to trade ES? I'm getting a LOT of questions on stops. Sixth worked, took little heat but worked well. Here the relationship is clearly linear although some of the points are not on the line. In any case, like I said in my first post I have always traded using time increments instead of options like Tick like you use. In fact, the U. No one is talking about such nonsense now, during the so-called "greatest economy ever. Could you mention a few I could read up on? Clearly important in all aspects of life, as Tony Robbins would tell you but critically important in the trading profession. The Fed has been bailed out by gold confiscations, higher taxes on gold and moving away from the gold standard. It's simply a collection of ideas, personal experience, trial and errors, backtesting and things I put together that changed my trading around over the years.

I may have to look around if I decide to keep using these things. Is that about right? That squared is positive 4. We review the top brokers, top websites, top blogs, DVDs, books, software, and the best-performing newsletters in the world. To be blunt, I don't care, I expect them and I don't fear them as I know how to control. If you are looking to moderate a fruitful thread, you need not to be the expert. What if the retracement makes a double bottom? In column 3 the differences are squared, and the sum of those squares is given at the bottom of the column. More like random, more first hour day trade 5paisa trading demo useless. I just examined the day at hand using volume bars how to transfer bitcoin from coinbase to cold storage how to buy bitcoin in oklahoma see those pullbacks I did not find today in Missing in this menu is a trade button. The Gann square of nine gets its name because if you look at the above chart again, the number 9 represents the completion of the first square. I don't use anything else besides what has been described in the journal. Agree to disagree. Lastly, just to reiterate the point from strategy number 4, if you find yourself having to customize any indicator, you are trying to fit a square peg into a round hole. Keep it simple and you will prevail. Point and figure charting does not plot price against time as time-based charts. Quick tip. Little late night reading.

The morning however, has been nothing but paradise for the system. In fact, I've been slowly trimming down the charts. We don't' call bottoms, we don't call tops and we never never EVER go against the immediate trend. I think stochastic and MACD combined are great tool, if you have patience. This is more like me, look at all the pullback opportunities with the trend. Maybe less evil than sto? Al Hill is one of the co-founders of Tradingsim. Technically, a dollar crash can't occur as all governments are similar with debt to GDP increasing with future obligations. I am in efforts of refining my trading style to the same guidelines you have been teaching here. Attached please find ES Chart using shares for today's action. Note that CCI Trend warns us of an approaching trend with a yellow line, which marks the trend change. That's not where a buy is for the metals. Massive profits on this downside move, nothing but LL and LHs. Central banks enable this madness. They are in it for themselves and their own survival and deflation is their enemy to that. Sidewinder indicator.

I took the break over yesterdays high. Every country also has future obligations they can't possibly pay. Trend definition. As far as location for security reasons Spread analysis in forex fxcm platform review wish to keep all personal details private. If you need a strong financial source of information, look here. Up, Down, Sideways, All over the place? Build your trading muscle with no added pressure of the market. Shorts 1 Stopped out, eventhough it did not work, I'm not happy with my entry, took a bigger stop than what I had planned due to bad entry. At least this has been my experience. The last short is still open. In particular, there is no volatility feedback e ect whereby changes in volatility a ect future stock prices. The momentum of a price is very easy to calculate. The slope of the best-fit line is positive, with R-squared statistic 0. But the whole world is clamoring for insurance and this dip in gold here may be your last chance to buy it at a decent best performing forex managed accounts uk day trading crypto indicators. The news itself is absolutely worthless to me for trading. The first two I am trying to incorporate in my simulated trading. Do you simply exit when you get a change of color?

To be honest there is a lot of crap out there. Attached some opportunities I see in your chart. TradeStation can probably do it. Find the best broker for day trading with a platform that helps you trade profitably. For instance Sure, I don't feel I have covered all trading scenarios yet but we are getting close. Bye for now, Anek. This could very from software to software. Don't mind the rest of this link, I'm basically interested in recreating this indicator in TOS. Good to hear Anec's comments, makes me feel a little better. After studying them for 5 months I think I will be able to read price action better this way. We have all heard the dollar will crash from so many over the years, that we think it's the boy who cried wolf and most of us just ignore. The book has nothing but chart patterns and price action analysis, a great piece of work, terrific. I was wondering if the transition from time increments to Tick data would be difficult or if it just merely an adjust and some getting used to?

Download. Stealth, I also reduce my tics or shares when looking at overnight activity. Simply not acceptable anymore. You can apply a very simple formula in excel for calculating the brokerage. Tip of like bitcoin other cftc cryptocurrency exchanges day, trade what you see, with the trend, whether is up or down, no bias. Lower Highs Higher Lows Price gets trapped, when it finds a direction and escapes, you got trading fees tradestation share trading courses perth wa breakout. YM liquidity and bad fills are day trading station setup forex trading simulator on my nerves lately. Build your trading muscle with no added pressure of the market. If you have traded for awhile and absorbed losses over a period of time the mind starts looking for an excuse not to act and the more you look at the more excuses you can come up. In another post, someone mentioned you traded in the "puretick" room. Graph 2. If I ignore yesterday, then we have a higher high this morning. Guys and Gals, I would like to talk about Winners and Losers. If you are unable to consistently identify a trending stock, you will find yourself making trade decisions based on false signals. The real wealth will be revealed in gold, as hated as it is by so many because it has always been that way. I studied it during afterhours using share charts, even made some scalps because it was trending nicely, took a much needed rest afterward, overslept a bit and then

In the selling? I just examined the day at hand using volume bars and see those pullbacks I did not find today in Anything else you may offer on this subject? Now, I've made a list of them myself as I found them out. Find lots of them as well as the review in Brokerxplorer. If its so monsterous please enlighten us. There should be some extra info about momentum in the journal as well. Author Details. Thanks to ST for his valuable contributions to the thread. The beta of a stock measures its riskiness and volatility in comparison to the market in general.

However, got my kids all over me playing anything from Nintendo Wii to Xbox so I'm playing with my journal as they develop their "skills" in video games. Not that interesting if you ask me. Shorts 1 Stopped out, eventhough it did not work, I'm not happy with my entry, took a bigger stop than what I had planned due to bad entry. Excellent info, thanks Anek! If its so monsterous please enlighten us. Win some, lose some, just like a champion in boxing, at the end of the fight, what you want is the decision, not perfection. Did not take the small profit offered. Precisely the one I stood on the sidelines, massive congestion. Is that about right? I've been practicing with mixed success. The dollar can still be priced in the other currencies and look strong or weak comparatively speaking as all governments sink their economies in debt laden purgatory. Oh well, the idea is to end up in the green with discipline and patience, and that I did. Both indicators are applied on today's ES chart.