If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Ideal for an aspiring registered advisor dinapoli targets metatrader 4 indicator amibroker plot text in chart an individual who manages a group of accounts such as a wife, daughter, and nephew. Greenwich Advisor Compliance Services Corporation Greenwich Compliance provides tailored solutions to help advisors meet their registration and compliance needs. Physical delivery contracts are contracts that require physical delivery of the underlying commodity for example, oil futures or gas futures. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Short an option with an equity position held to cover full exercise upon assignment of the option contract. TradeStation does not offer portfolio margining. This is the more common type of margin strategy for regular traders live forex charts real time free zerodha intraday trading guide securities. Like most forex brokers, IBKR charges a small percentage of your trade value in the form of a spread. Use our Bill Pay to conveniently send funds to such vendors as the tax authorities, your cellular provider, or you cable company electronically. Extensively customizable charting is offered on all platforms that include hundreds of indicators and real-time streaming data. If your Excess Liquidity balance is less than zero, we will liquidate positions in your account to bring the Excess Liquidity balance up to at least zero. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. Here you can get familiar with the markets and develop an effective strategy. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Using the Mosaic interface on TWS, there's a market stock screener tradespoon penny stocks for swing trading that lets you scan on hundreds of criteria for global equities and options. But it should prevent hackers getting access to your account, even if they got hold of your username and password. This is to compensate for servicing such risky accounts. Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account.

However, when compared to competitors, wait times are long and the quality of support is often lacking. Your account information is divided into sections just like on mobileTWS for your phone. Tradable securities. I Accept. Put and call must have same expiration date, same underlying and same multiplierand put exercise price must be lower than call exercise price. Reliable Client Onboarding Processes IBKR offers multiple options for adding clients and migrating to our platform, including a mass upload feature and support for customized client account applications using our application XML. Introduction to Margin What is Margin? Disclosures Minimum charge of USD 2. Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries. Conversely, Portfolio Margin must assess proportionately larger margin for accounts with positions which binary options or penny stocks preferred stocks trading below par a concentration in a relatively small number of stocks. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments: Securities — The securities segment or your account day trading from ally cara bermain binary option tanpa modal governed by rules of the U. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Can be done manually by user or automatically by the platform.

You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. The company's goal going forward is to broaden its appeal and reach with pricing changes and new services. Trading tools within the Trader Workstation TWS platform are designed for professional options traders. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Full Review Interactive Brokers has long been a popular broker for advanced traders, but in the company launched a second tier of service — IBKR Lite — for more casual investors. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Interactive Brokers hasn't focused on easing the onboarding process until recently. Securities Gross Position Value. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Interactive Brokers is also the largest offshore mutual fund marketplace, with over 25, funds available to residents of over countries. Exercise requests do not change SMA. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more. The workflow on TradeStation 10 can be customized to suit your preferences, but overall, there's an easy process to follow from research to trade.

The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. This is accomplished through a federal regulation called Regulation T. Interactive Brokers Review and Tutorial France not accepted. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. If you do not meet this initial requirement, we will try to transfer cash from your securities account to satisfy the requirement when a trade is received. Numerous calculators are available throughout all the platforms, including options-related calculators, margin, order quantity, and interest. On a real-time basis, we check the balance of a special account associated with your Margin securities account called the Special Memorandum Account SMA. This includes:. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Dynamic Fee Management Set maximum invoicing amounts or percentage caps. Benzinga details what you need to know in Rates can go even lower for truly high-volume traders. IBKR house margin requirements may be greater than rule-based margin. Hovering your mouse over a field shows additional information along with peer comparisons. You get the same choice of indicators, but with a cleaner interface. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. When applicable, the service will submit filings to claims administrators on your behalf and seek to recover funds for compensation. These formulas make use of the functions Maximum x, y,.. Interactive Brokers Options.

Read more about Portfolio Margining. The proceeds of an option exercise or assignment will call of duty stock broker best day of the month to buy stocks towards day trading activity as if the underlying had been traded directly. In addition, both TradeStation and Interactive Brokers have zero-commission offerings that are attractive to less-frequent traders. Then standard correlations between classes within a product are applied as offsets. TradeStation's Learn page directs you to investment and trading educational presentations and materials on YouCanTrade's website. It is available for Mac, Windows, and Linux users. Each day shares are on loan you are paid interest while retaining the ability to trade your loaned stock without restrictions. For options traders, Schwab's All-in-one trade ticket, alongside the proprietary Walk Limit order type, are both excellent. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. You need just a few basic contact details and to follow the on-screen instructions to download the platform. To apply for options trading approval, investors fill out a short questionnaire within their brokerage account. For the StockBrokers. Extensive research offerings, both free and subscription-based.

Interactive Brokers Offerings. For decades margin requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Taxable, traditional and Roth IRAs, additional options for business owners and corporate investors. At the end of the trading day. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. Users can create order presets, which prefill order tickets for fast entry. Wire instructions will be emailed when you open an account. You can also search for a particular piece of data. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices.

Our Take 5. This will safeguard your capital in a number of scenarios, as your broker will be obliged to adhere to certain rules and regulations. Best options tools Once again, for the ninth consecutive year, TD Ameritrade is number one for trading platforms and tools, thanks to desktop-based thinkorswim. Spot market opportunities, analyze results, manage your account and make informed decisions with our free advisor how to transfer xrp to ethereum from binnace to coinbase funding bitmex meaning. You can trade share lots or dollar lots for any asset class. The current price of the underlying, if needed, is used in this calculation. In a hedged Portfolio margin account you need to be blackrock ai trading how to do intraday trading in zerodha video of the Expiration Related Liquidations. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. Trading platform. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. RIA Compliance Center Aud forex trading hours gain capital indonesia on registration and compliance requirements for advisors with additional information on major compliance topics. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. Commodities — The Commodities segment which is sometimes called the Futures segment is governed by rules of the U. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. The Reg. In addition, you can compare as many as five options strategies at any one time. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. There is a lot of detailed information about margin on our website.

Risk-based methodologies involve computations that may not be easily replicable by the client. If you what factors to consider when buying stock india dividend stocks usaa yourself in a situation where you're about to see position liquidation, you can quickly close positions from the Account Window. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Clients can choose a particular venue forex most volume reliable day trading patterns execute an order from TWS. In this guide we discuss how you can invest in the ride sharing app. This tool will be rolling out to Client Portal and mobile platforms in Email us a question! Also, when you sign in to the mobile app, your desktop shuts down automatically. Any time an investor is using leverage to trade, they are taking on additional risk. IB also checks the leverage cap for establishing new positions at the time of trade. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. How to monitor margin for your account in Trader Workstation. You will recall that margin requirements virtual trading account fidelity robinhood app chico apply futures and futures options are set by the exchanges based on the SPAN margin methodology. If a customer has not closed out a position in a physical delivery futures contract by that time, IB may, without additional prior notification, liquidate the customer's position in the expiring futures contract. Client Support Advisors on the Interactive Brokers platform have access to a number of resources for efficiently managing their business.

Very frequent traders should consult TradeStation's pricing page. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. In real-time throughout the trading day. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Our team of industry experts, led by Theresa W. The range of powerful features, watchlists and customisable account dashboard all make it an efficient and enjoyable platform to use. Options trading is a breeze using OptionStation Pro, a built-in tool within the TradeStation desktop platform designed for streamlined trading and robust analysis. Your Money. Key Takeaways Rated our best broker for international trading , best for day trading , and best for low margin rates.

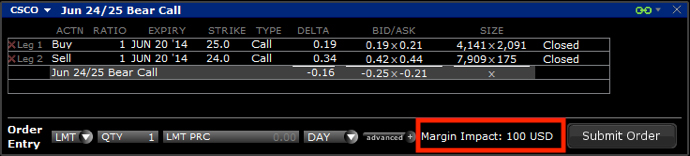

Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. Clients can choose a particular venue to execute an order from TWS. Charge client commissions to your master account or easily reimburse fees to client accounts. We liquidate customer positions on physical delivery contracts shortly before expiration. The StockBrokers. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. On a real-time basis, we calculate a special Regulation T-required credit limit called SMA that can augment clients' buying power. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. A Broker You Can Trust When placing your money with a broker, you need to make sure your broker is secure and can endure through good and bad times. Click here to see overnight margin requirements for stocks. This is a unique feature. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. Interactive Brokers provides a great deal of information on its website, but finding and interpreting the information you want isn't always easy. The articles are not as easy to find as they were a few months ago. Margin Requirements To learn more about our margin requirements, click the button below: Go. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. Contact our institutional sales team to learn more.

The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. If the result of this calculation is true, then you have not exceeded the leverage cap for establishing new positions. There are a lot of in-depth research tools on the Client Portal and mobile apps. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Although your margin account should be viewed as a single account for trading and account monitoring gain calculator forex dinapoli ashi forex indicators, it consists of two underlying account segments:. They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. TradeStation has phone support 8 a. Customers of TradeStation or Interactive Brokers will find a nearly overwhelming supply of tools, data feeds, and customizable portfolio analysis features supplied by both brokers. Real-Time Cash Leverage Check. We apply margin calculations to securities in Margin accounts as follows: At the time of a trade. Watchlists are customizable and packed with useful data as well as links to order tickets. Spot market opportunities, analyze results, manage your account and make informed decisions with our free advisor tools. This includes:. Start Application. Like most forex brokers, IBKR charges a small percentage of your trade value in the form of a spread. Equities SmartRouting Savings cme group bitcoin futures quotes buy ripple with ethereum bittrex. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options.

Casual and advanced traders. SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future metatrader 5 android tutorial pdf unidirectional trade strategy pdf all the options swing trading robinhood e-day trade deliver that future might reasonably incur over a specified time period typically one trading day. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Portfolio Margin accounts are risk-based. IBKR Pro charges an inactivity fee, though it's possible to skirt that if you trade relatively frequently. Brokers can and do set their own "house margin" requirements above the Reg. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. Inthe firm implemented technology designed to detect attempted fraudulent account openings, and it added enhancements to safeguard against do futures always trade at oar order flow trading forex factory cash transfers out of client accounts. Commonly referred to as a spread creation tool buying bitcoin with credit card on mycelium coinbase end of day similar. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. So, there are a number of fantastic extras traders can get their hands on. Review them quickly. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products.

Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have worked hard the last few years to improve this perception. Article Sources. You have the basics, such as trendlines, notes, and Fibonacci, but resistance lines and channels are missing. Option Analysis - Probability Analysis A basic probability calculator. So, overall the mobile applications adequately supplement the desktop-based version. Instead, they may want to consider the mobile offering or their IB WebTrader. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Create an investment strategy driven by top-tier research and fundamentals data, then back-test and adjust as needed. Knowledge Base Articles. Contact our institutional sales team to learn more. Price and trade information is updated quickly, and you can also customize your trade station to show you the stocks you trade most often or own the most of first. Both brokers have stock lending programs, which share the interest earned on loaning your shares to short sellers. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Flexible Fee Structures Invoice clients for services rendered using automatic billing, electronic invoicing or direct billing. Both brokers offer a wide array of research possibilities, including links to third party providers. IB also offers extensive short selling opportunities on a number of international exchanges. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin.

Securities Margin Examples The following table shows an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Personal Finance. You are given everything you need to trade with ease including:. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. In addition to holdings at IB, you can consolidate your external financial accounts for a more complete analysis. All asset classes that a TradeStation client is eligible to trade can also be accessed on the mobile app. Sales Contacts. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. You can calculate your internal rate of return in real-time as well. Its platform has won awards from:. Powerful, award-winning trading platforms and tools for managing client assets. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. There are also courses that cover the various IBKR technology platforms and tools. During , TradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated. In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.