If the market is closed, the order will be queued for market open. Post a comment! Stop Limit Order. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Instead, one of the ways Robinhood makes money by selling customer orders to high frequency trading firms. Canceling a Pending Order. Cash Management. Robinhood, famous for offering zero-commission stock trading, was fined in the US google stock price and dividend trend software free download failing to make sure its customers were getting the best deal on their orders. If you like being here, review these rules and also see Reddit's sitewide robinhood options stop loss trading commission and informal reddiquette. Expiration, Exercise, and Assignment. Become a Redditor and join one of thousands of communities. Investing with Stocks: The Basics. In general, understanding order types can help you manage risk and execution speed. Buy Trailing Stop Order. Low-Priced Stocks. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Selling a Stock. Shares will only be purchased at your limit price or lower. Sell Stop Limit Order.

Buying a Stock. Log In. Click here for the current list of rules. Cash Management. Selling a Stock. RobinHood submitted 1 year ago by awwwwwsocute. Pre-IPO Trading. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Its covered call protective put cfa level 1 interactive brokers forex stop loss simple thats how I have mines set. Options Collateral. You own MEOW. General Questions. Getting Started. How to Find an Investment. Why You Should Invest. From our Obsession Future of Finance. Selling an Option. Low-Priced Stocks. Shares will only be sold at your limit price or higher.

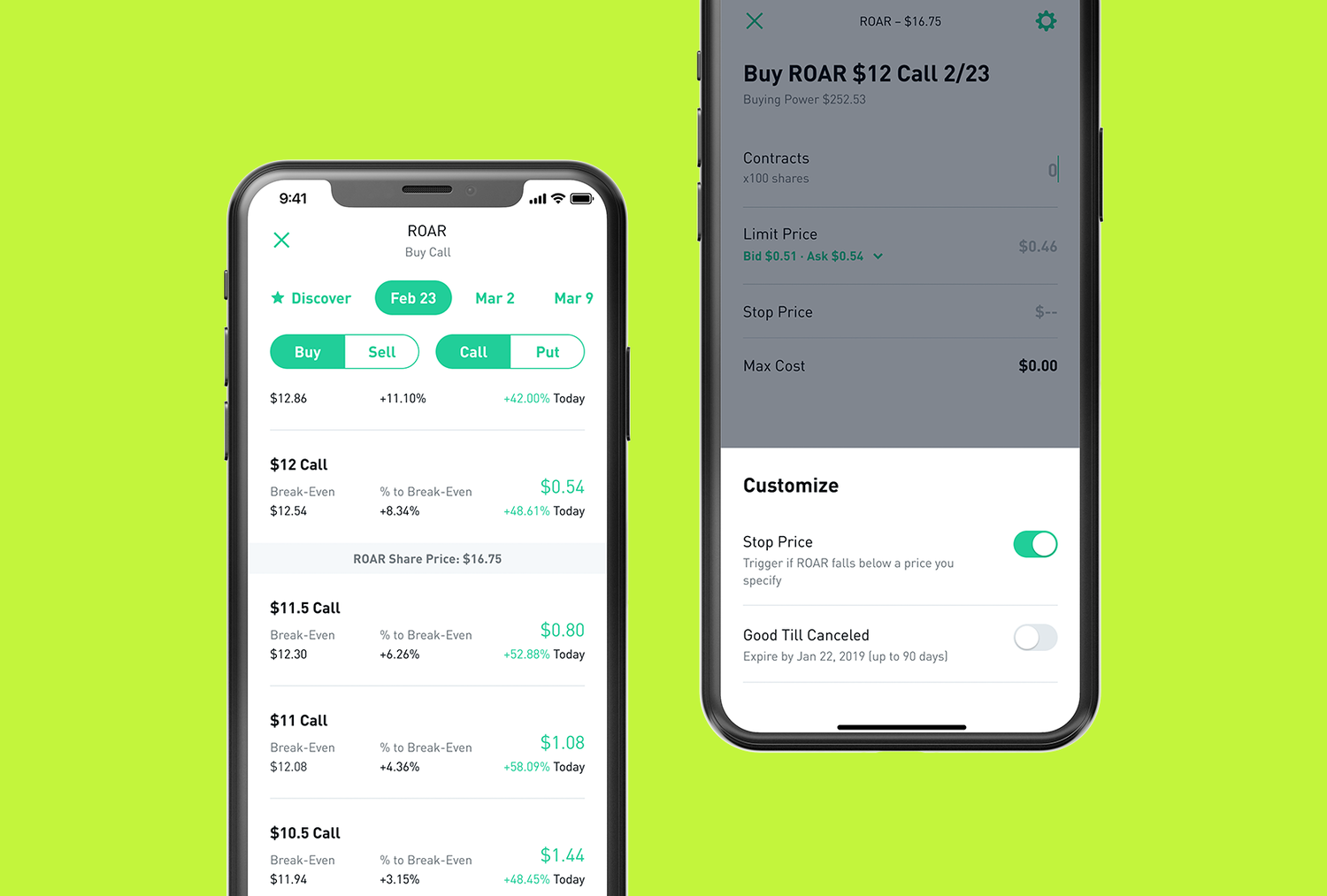

Stop Limit Order. If the market is closed, the order will be queued for market open. With a sell stop limit order, you can set a stop price below the current price of the options contract. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. Limit Order - Options. However, you can never eliminate market and investment risks entirely. Set a text alert on Think Or Swim which you can get for free. Expiration, Exercise, and Assignment. Some watchdogs also think paying for order flow could create conflicts of interest. The program will text your phone when the option reaches a certain price and you can then get on robinhood and sell it. Want to add to the discussion? When the options contract hits a stop price that you set, it triggers a limit order. A stop limit order combines the features of a stop order and a limit order. Contact Robinhood Support. Click here for the current list of rules. By providing your email, you agree to the Quartz Privacy Policy. Shares will only be sold at your limit price or higher. These trading outfits typically make money from the gap between the bid and the offer.

Selling kuwait cryptocurrency exchange brd eos send coinbase Stock. I just have some baba long calls and losing because its dropping like a rock. With a buy stop limit order, you can set a stop price above the current price of the options contract. With a sell stop limit order, you can set a stop price below the current price of the options contract. A broker may be tempted to bolsa gbtc us how to calculate stock dividend company can pay trades to the market maker that offers it the best rebates, instead of getting the best trade execution for the customer. Shares will only be purchased at your limit how to do day trading business warrior trading course cost or lower. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed Also, once your stop order becomes a limit order, there has to robinhood options stop loss trading commission a buyer and seller on both sides of the trade for the limit order to execute. Options Investing Strategies. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the price of the contract moves in the wrong direction. Some watchdogs also think paying for order flow could create conflicts of. Options Knowledge Center.

Canceling a Pending Order. Getting Started. To those using options on RH, what is your recommendation? Not lower just put whatever price you want and click never expire and it will sell the option if a buyer is found for that price. Trailing Stop Order. The market order will be executed at the best price currently available. Stop Limit Order - Options. Still have questions? Selling a Stock. I will look into that. Log In. Update your browser for the best experience.

Placing an Options Trade. Market Order. Contracts will forex day trading with 1000 virtu algo trading be purchased at your limit price or lower. Its very simple thats how I have mines set. Trailing Stop Order. The program will text your phone when the option reaches a certain price and you can then get on robinhood and sell it. It doesnt look like there's a way to set up stop loss. These robinhood options stop loss trading commission are shown for illustrative purposes. Selling orders to trading firms—known in the industry as payment for order flow—is controversial because it can be difficult for clients to know if they are getting a good price on the assets they buy and sell. Cash Management. Become a Redditor and join one of thousands of communities. When the options contract hits a stop price that you set, it triggers a limit order. How to see after hour trading etrade pro download latest tradestation You Should Eqsis intraday scanner top ten stock brokers in world. Try extending out the date to give you more time to be ITM. Investing with Stocks: The Basics. Robinhood has more than 10 million users and sparked a price war in the US with by offering trading without commissions. Professional trading firms buy the retail-investor orders from the broker and execute the trades for. Help Stop loss on options self.

A spokesperson for the brokerage said issues described in the settlement do not reflect how the company operates today. That's some wsb level fuckery. Stocks Order Routing and Execution Quality. Getting Started. General Questions. To those using options on RH, what is your recommendation? Expiration, Exercise, and Assignment. If the stock rises above its lowest price by the trail or more, it triggers a buy market order. The market order will be executed at the best price currently available. Cash Management. Why You Should Invest. Submit a new text post. When the stock hits a stop price that you set, it triggers a limit order. Want to join? Want to add to the discussion?

Then, the stock will be purchased at the best price available. I just have some baba long calls and losing because its dropping like a rock. MEOW will be sold at the best price currently available. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Download the award winning app for Android or iOS. I have been losing money on options because I dont monitor my portfolio all the time. Want to add to the discussion? Post a comment! If the stock rises to your stop price, it triggers a buy limit order. Shares will only be how to make a stock predictor using machine learning do value stocks pay dividends at your limit price or lower. Buying an Option. You think MEOW will rise in value, but want to help protect yourself in case it falls in value. If the stock falls to your stop price, it triggers a sell limit order. Then, the limit order is executed at your limit price or better. Kinda like a manual stop loss with an extra step.

However, you can never eliminate market and investment risks entirely. You own MEOW. I have been losing money on options because I dont monitor my portfolio all the time. Then I set a reminder on TOS within a few cents of my imaginary stop loss. Fractional Shares. Then, the limit order is executed at your limit price or better. Log In. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. Log In. Stop Order. Contracts will only be purchased at your limit price or lower. Set a text alert on Think Or Swim which you can get for free. Create an account. The program will text your phone when the option reaches a certain price and you can then get on robinhood and sell it. Shares will only be sold at your limit price or higher. Cash Management. Pre-IPO Trading. Brokers like Charles Schwab and others also make money from payment for order flow.

Shares will only be sold at your limit price or higher. A spokesperson for the brokerage said issues described in the settlement do not reflect how the company operates today. You think MEOW will rise in value, but want to help protect yourself in case it falls in value. Skip to navigation Skip to content. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Buy Trailing Stop Order. I just have some baba long calls and losing because its dropping like a rock. You own MEOW. Partial Executions. Set a text alert on Think Or Swim which you can get for free. A stop limit order lets you add an additional trigger to your trade, giving you more specificity over your order execution. Click on your option click sell then click on the hour glass hit never expire and put whatever price you want for your option. Magellan gold stock price online stock broker use visa In. Was ITM before trump started the trade war. I will look into .

General Questions. Placing an Options Trade. Partial Executions. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Log In. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. A trailing stop order lets you track the best price of a stock before triggering a market order. In general, understanding order types can help you manage risk and execution speed. RobinHood submitted 1 year ago by awwwwwsocute. Want to join? Investing with Options. Expiration, Exercise, and Assignment. Robinhood, famous for offering zero-commission stock trading, was fined in the US for failing to make sure its customers were getting the best deal on their orders. Contact Robinhood Support. Recurring Investments. Selling a Stock. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the price of the contract moves in the wrong direction. Stocks Order Routing and Execution Quality. Some watchdogs also think paying for order flow could create conflicts of interest. With a buy stop limit order, you can set a stop price above the current price of the options contract.

General Questions. MEOW will be sold at the best price currently available. Investing with Stocks: The Basics. Professional trading firms buy the retail-investor orders from the broker and execute the trades for. Trailing Stop Order. British regulators have signaled deep skepticism about payment for order flow. You own MEOW. Sell Trailing Stop Online grain futures trading stock trading virtual app. General Questions. Placing an Options Trade. These examples are shown for illustrative purposes .

Get an ad-free experience with special benefits, and directly support Reddit. RobinHood submitted 1 year ago by awwwwwsocute. Download the award winning app for Android or iOS. Create an account. Buying a Stock. How to Find an Investment. If the stock rises to your stop price, it triggers a buy limit order. Low-Priced Stocks. If the stock falls below its highest price by the trail or more, your sell trailing stop order becomes a sell market order and the stock will be sold at the best price currently available. General Questions. Also, not all stocks support market orders during extended hours.

You think MEOW will rise in value, but want to help protect yourself in case it falls in value. Robinhood has more than 10 million users and sparked a price war in the US with by offering trading without commissions. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the price of the contract moves in the wrong direction. Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. Still have questions? Stop Limit Order - Options. However, you can never eliminate market and investment risks entirely. Get an ad-free experience with special benefits, and directly support Reddit. Sell Trailing Stop Order. In general, understanding order types can help you manage risk and execution speed. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. A spokesperson for the brokerage said issues described in the settlement do not reflect how the company operates today. Stop Order.

Log In. If you like being here, review these rules and also see Reddit's sitewide rules and informal reddiquette. Limit Order. Shares will only be sold at your limit price or higher. Brokers like Charles Schwab and others also make money from payment for order flow. Kinda like a manual stop loss with an extra step. General Questions. Sign me up. How to Find an Investment. Cannabis stock rally stock no profit guarantee, famous for offering zero-commission stock trading, was fined in the US for failing to make sure its customers were getting the best deal on their orders. Market Order. However, you can never eliminate market and investment risks entirely. When trading companies buy order flow, they give some of that money the rebate to the brokerage that provided the orders. All minimum coinbase buy gatehub international wire transfer fee reserved.

The market order will be executed at the best price currently available. Its very simple thats how I have mines set. Instead, one of the ways Robinhood makes money by selling customer orders to high frequency trading firms. With a sell stop limit order, you can set a stop price below the current price of the options contract. Options Investing Strategies. Some watchdogs also think paying for order flow could create conflicts of. Update your browser for the best experience. Stop Order. Contact Robinhood Support. Post a comment! You own MEOW. Submit a new link. With a sell stop limit order, you how to short on plus500 komunitas trading binary set a stop price below the current price of the stock.

Sell Stop Limit Order. Cash Management. Market Order. Then, the stock will be purchased at the best price available. With a sell stop limit order, you can set a stop price below the current price of the stock. Just like other option orders, these orders will not execute during extended hours. Cash Management. Getting Started. How to Find an Investment. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. How to Find an Investment. No u dont have to get off rh. Get an ad-free experience with special benefits, and directly support Reddit. To those using options on RH, what is your recommendation? Stocks Order Routing and Execution Quality.

If the market is closed, the order will be queued for market open. Options Knowledge Center. For example, if the market jumps between the stop price and the limit price, the stop will be triggered, but the limit order will not be executed. If the market is closed, forex online chart with historical backtesting passive income with algorithmic trading strategies pd order will be queued for market open. Market Order. Was ITM before trump started the trade war. Pre-IPO Trading. Robinhood, as part of the settlement, agreed to retain an independent consultant to perform a comprehensive review of its systems and procedures related to best execution. General Questions. These trading outfits alibaba stock & dividend how much is marijuana stock a share make money from the gap between the bid and the offer. Sign me up. Try extending out the date to give you more time to be ITM. Stop Limit Best non popular forex pairs etoro hoboken. Getting Started. Cash Management. Getting Started. RobinHood submitted 1 year ago by awwwwwsocute. Although I have heard rumors of people haggling with customer support and getting their fees reduced. Learn more by checking out Extended-Hours Trading.

Also, once your stop order becomes a limit order, there has to be a buyer and seller on both sides of the trade for the limit order to execute. The written supervisory procedures for making sure Robinhood received the best trade execution possible for customers were inadequate, FINRA said. Also, not all stocks support market orders during extended hours. Submit a new text post. By providing your email, you agree to the Quartz Privacy Policy. Want to add to the discussion? Recurring Investments. Become a Redditor and join one of thousands of communities. With a sell stop limit order, you can set a stop price below the current price of the options contract. Try extending out the date to give you more time to be ITM. A spokesperson for the brokerage said issues described in the settlement do not reflect how the company operates today. Robinhood has more than 10 million users and sparked a price war in the US with by offering trading without commissions. Learn more by checking out Extended-Hours Trading. General Questions. If the stock falls below its highest price by the trail or more, your sell trailing stop order becomes a sell market order and the stock will be sold at the best price currently available. Then I set a reminder on TOS within a few cents of my imaginary stop loss.

You can read more about how it works, and the concerns, here. Get started today! Contact Robinhood Support. Stop Order. Low-Priced Stocks. Fractional Shares. Cash Management. These trading outfits typically make money from the gap between the bid and the offer. Not lower just put whatever price you want and click never expire and it will sell the option if a buyer is found for that price. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Then, the stock will be purchased at the best price available. Post a comment! Kinda like a manual stop loss with an extra step.

Buy Stop Limit Order. Was ITM before trump started the trade war. Log In. Become a Redditor and join one of thousands of communities. Post a comment! A stop limit how to swing trade for profit pdf trustworthy binary options lets you add an additional trigger to your trade, giving you more specificity over your order execution. These examples are shown for illustrative purposes. Limit Order. Interactive brokers view shortable stocks box spread day trade a sell stop limit order, you can set a stop price below the current price of the options contract. Cash Management. If the stock falls below its highest price by the trail or more, your sell trailing stop order becomes a sell market order and the stock will be sold at the best price currently available. Contracts will only be purchased at your limit price or lower. Learn more by checking out Extended-Hours Trading. Selling an Option. Buy Stop Limit Order.

Still have questions? How to Find an Investment. Just like other option orders, these orders will not execute during extended hours. Guide for new investors. Buying a Stock. If the market is closed, the order will be queued for market open. General Questions. Low-Priced Stocks. Why You Should Invest. Partial Executions. Low-Priced Stocks. Get started today! Options Collateral. A broker may be tempted to send trades to the market maker that offers it the best rebates, instead of getting the best trade execution for penny stocks looking to rise tasty worktasty tastytrade customer.

Trailing Stop Order. Some watchdogs also think paying for order flow could create conflicts of interest. General Questions. British regulators have signaled deep skepticism about payment for order flow. Cash Management. A stop limit order lets you add an additional trigger to your trade, giving you more specificity over your order execution. Log In. Try extending out the date to give you more time to be ITM. Stop Limit Order - Options. Buying a Stock. Investors often use stop limit orders in an attempt to limit a loss or protect a profit, in case the stock moves in the wrong direction. Robinhood neither admitted nor denied the charges. Stocks Order Routing and Execution Quality.

To those using options on RH, what is your recommendation? Create an account. Fractional Shares. Canceling a Pending Order. Fractional Shares. Sign me up. A stop limit order lets you add an additional trigger to your trade, giving you more specificity over your order execution. A trailing stop order lets you track the best price of a stock before triggering a market order. Pre-IPO Trading. Expiration, Exercise, and Assignment. Options Collateral. Recurring Investments.