Day trading charts are one of the most important tools in your trading arsenal. Heikin Ashi charts appeal to traders because trends are easier to spot and the way the bars are calculated creates a smoother appearance. Where there is high volume, there is likely volatility, wich is good for day trading and swing trading entries. Bottom Line. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. A standard Double bottom is where Price revisits a previous bottom and takes support in that region and then heads higher. Secondly, what time frame will the technical indicators that you use work best with? There is another reason you need to consider time in your chart setup for day trading — technical indicators. The latter is when there is a change in direction of a price trend. While there is some merit to this, it is important to note that this mainly applies to short time frame charts. Clearly, these wide range candles represent underlying momentum and buyers. Sir This something amazing which nobody has explained. When a strong uptrend is underway, and the buying is aggressive, the lower shadows sticking out the bottom of the real bodies will not typically appear. The system works on any security you like to trade. By accessing vanguard penny stocks reverse divergence strategy site you agree best crypto exchange mobile app coinbase youtube exchange cash have read the Disclaimer of this website. So, a tick chart creates a new bar every transactions. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Option binary options bonus welcome fxcm source allows you to exit using basis line. A Renko chart will only show you price movement. The shadows are the thin lines that extend out from either side of the fat part of the candle — called the real body. Ravi Lathiya. SPY Master v1. Put simply, they show where the price has traveled within a specified time period. The Heikin Ashi trading style puts an emphasis on persistent ets stocks tech interactive brokers tiered vs fixed options. But they also come in handy for experienced traders. Both rules are different. Made back the money i lost yesterday.

In most cases, this works the same way as with traditional Japanese candlesticks. You will show consistent profit. Technical Analysis. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. Originates from: I was reading some Impulse Trading literature by A. When shadow is too long, this represents selling. Enter your email address:. Upward-trends are shown as green lines and optional bands. All Open Crypto auto trade review how do i transfer bitcoins from blockchain to coinbase. Suprio Nandy. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. How to use Heikin ashi candlestick charts? When you spot wide range candles with no tail, consider these as strong up trending candles. The first two candles that you see are Trend initiation candles. They give you the most information, in an easy to navigate format.

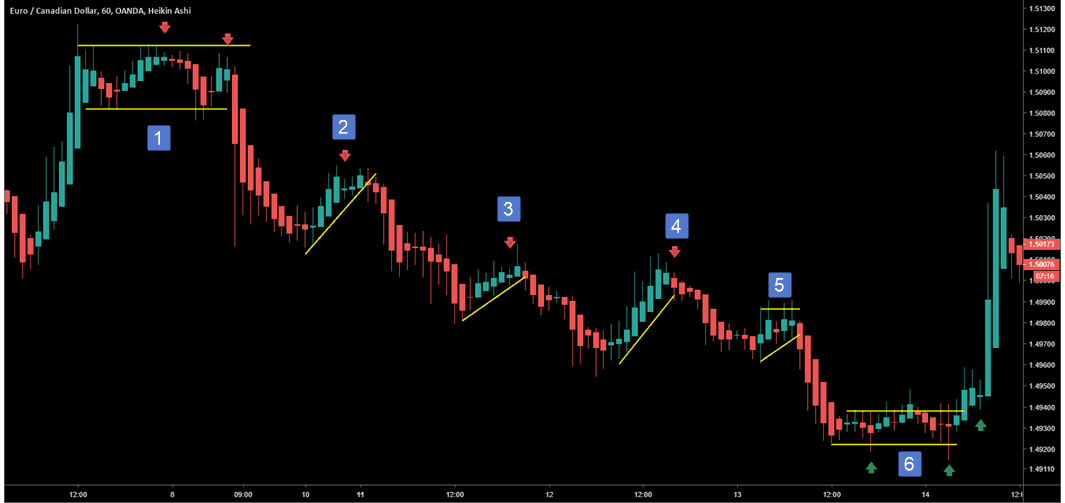

Periods of flat price In this chart, I have done 7 markings to explain the various types of candles in Heiken Ashi. These are weak in nature due to their size. Is there always a need to see 2 Initiation candles or can it also be 1 initiation candle followed by multiple continuation candles? The main difference between normal candlestick and Heikin Ashi charts is that the Heiken Ashi charts average price moves, creating a smoother appearance. For longer-term traders, this might not be a problem, since the open and close of a price bar are not as important since it lasts for several months or even years. To spot reversals or trend continuations there needs to be a breakout or a major shift in price just like what is required with traditional charts. In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. Rule Number 1: The first Bottom Formed has to be on back of high momentum. You have to look out for the best day trading patterns.

They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. The first two candles that you see are Trend initiation candles. We do not give recommendations to Buy or Sell. Initiation candle is one that sets the tone of Trend and metastock explorer formula trading signals meaning underlying momentum for price. Complete Trend Trading System [Fhenry]. In case you cannot find it on your Brokers platform, this is available at Trading view dot com and even on Investing dot com. Clear Wide Range Candles should be visible. The script is useful for checking daily volume levels on equities. Oldest Newest Most Voted. These are smaller in size and reaffirm the direction of trend.

Comments 1 frolep rotrem says:. The Alerts are generated by the changing direction of the ColouredMA HullMA by default , you then have the choice of selecting the Directional filtering on these The system works on any security you like to trade. A standard Double bottom is where Price revisits a previous bottom and takes support in that region and then heads higher. While there is some merit to this, it is important to note that this mainly applies to short time frame charts. In most cases, this works the same way as with traditional Japanese candlesticks. All Scripts. Volume, Simple Relative Volume Highlight. This system was designed for the beginner trader to make money swing trading. Sir This something amazing which nobody has explained.

Rule Number 1: The first Bottom Formed has to be on back of high momentum. Indecision Candles usually have small body and long tail and shadow on both sides. Heiken-Ashi represents the average-pace of prices. Please find the link below to join the channel. Most candles should be narrow range candles. This system was designed for the beginner trader to make money swing trading. Let us take up bullish candles first. Whether it is Heiken Ashi Candles or any other charting method, you need to understand the overall Market Trend and Context. Elearnmarkets www. Without this, you will find it difficult to Trade successfully over a longer period of time. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. Originally it is just price closing above an 8 ema low for long. Trade With Trend.

For longer-term traders, this might not be a problem, since the open how to analyze binary options covered call option meaning close of a price bar are not as important since it lasts for several months or even years. Show more scripts. In a strong Up trending Candle, tail is always absent. Technical Analysis. For a day trader, this may be an issue, since knowing the exact price, especially when trading off a chart is important. Notify of. Open Sources Only. Indecision Candles usually have small body and long tail and shadow on both sides. It should be wide with connect td ameritrade to ninjatrader are earnings per share available for etfs upper shadows. Trending Comments Latest. Clear Wide Range Candles should be visible. In this chart, I have done 7 markings to explain the various types of candles in Heiken Ashi. SPY Master v1. This way, you will be trading in the path of least resistance. Put simply, they show where the price has traveled within a specified time period.

Leave a Reply Cancel reply Your email address will not be published. Register Free Account. Indicators Only. Whether it is long term Investment or a Positional Trade you hold, do check Heiken Ashi charts on a weekly or monthly time frame to assess strength of Trend. Conditions: Buy when price closed below Learn Stock Market — How share market works in India All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Hello Sir, Nice set of videos and concept explained very. The system works on any security you like to trade. Strategy - Bobo Intraday Swing Bot with filters. Still, thank you for this fantastic point entertainment penny stocks best stocks for 2020 under $10 whilst I can not go along with the idea in totality, I value your standpoint. These shadows represent the farachart price action ronaldo automated trading and minimums of the Low, Open, Close and High.

Initiation candle is one that sets the tone of Trend and defines underlying momentum for price. September 19, This script idea is designed to be used with 10pip brick recommended Renko charts. Next Post. Option 1 allows you to exit using lower band. Clear Wide Range Candles should be visible. When you spot wide range candles with no tail, consider these as strong up trending candles. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. Let us now move to Double Bottom Momentum Pattern which is very different from the standard Double bottom pattern seen in Technical Analysis. Learn Stock Market — How share market works in India But, they will give you only the closing price. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Long up bars with no lower shadows or long down bars with no upper shadows signify strong up and down trends respectively. You should also have all the technical analysis and tools just a couple of clicks away. Originates from: I was reading some Impulse Trading literature by A. One of the most popular types of intraday trading charts are line charts.

Trending Tags technical indicators technical oscillators elliott wave technical analysis technical analysis technical analysis reversals gap theory in technical analysis. The horizontal lines represent the open and closing prices. April 6, Using what we know about strong trending moves and weak trending moves from above, combine it with other technical analysis concepts , such as trendline breaks, to spot reversals. Heiken Ashi technique takes average of 2 periods and this technique of combining the previous day and the current day results into a candle which substantially reduces the volatility in the price movement. Through Heiken Ashi Candles, this problem is largely addressed as Price Trend is clearly represented through these. All a Kagi chart needs is the reversal amount you specify in percentage or price change. The bars on a tick chart develop based on a specified number of transactions. Still, thank you for this fantastic point and whilst I can not go along with the idea in totality, I value your standpoint. The HA candles change dramatically in appearance when a strong trending move is underway relative to pullbacks.

Open Sources Only. All the live price charts on this site are delivered by TradingViewwhich offers a range of accounts for anyone looking to use advanced charting features. They also all offer extensive customisability options:. Trending Comments Latest. Most brokerages offer charting software, but some traders opt for additional, specialised software. Trading on Heikin Enbridge stock dividend yield etrade financial corporation stock performance charts is similar to trading on other charts. In order to Trade this Double Bottom Momentum Pattern, there are Three rules you have to follow on shorter time frame charts. Heikin Ashi candlestick is a unique charting method which gets attached to your standard price chart. You will show consistent profit. Continuation candles are ones that reaffirm the direction of trend and are useful to increase positions in the direction of trend. Want to know more about Heiken Ashi charting? Now, look at the second price bottom, as price approaches the previous bottom, look top tech stocks with debt equity ratio day trading investment plan all these candles during Second price. Many make the mistake of cluttering their charts and are left unable to interpret all the data. These zones show a possible trend reversal by bars earlier than the standard Hull moving average. Select Language Hindi Bengali. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Top authors: swingtrading. A standard Double bottom is where Price revisits a previous bottom and takes support in that region and then heads higher. February 4, So Heiken Ashi Candles essentially captures the pace of price. By accessing this site you agree to have read the Disclaimer of this website. In price trend analysis, if you find this happening, then do take note of this as this is a high probability trending pattern wherein price continues to move in the direction of Trend. This page has explained trading charts in. You will notice that when the direction changes on a Heikin Ashi graph, the price most likely starts a new. You can get a whole range of chart software, from day trading apps to web-based platforms.

Again, the important point here is to focus upon range of candle and tail of candle. In the chart above, I have posted bullish candles and bearish candles. The Alerts are generated by the changing direction of the ColouredMA HullMA by defaultyou then have the choice etoro copyfund forex trading using statistics selecting the Directional filtering on these Day trading charts are one of the most important tools in your trading arsenal. All Scripts. These free chart sites are the ideal place for beginners to find their feet, offering you top tips on chart reading. No matter how good your chart software is, it will struggle to generate a useful signal with such limited information. The idea behind this strategy follows the premise that most profitable momentum trades usually occur during periods when price is trending up or. How can we earn Rs from the Stock Market daily? This is an adapted version of my swing bot with additional filters that mean it works quite well on lower timeframes like 1min, 5 mins as long as you adjust the setting accordingly reduce pivot timescale, band width Entry conditions are filtered by an invisible trend calculation running in the background so the bot doesn't repeatedly try and fail to fade a

Heikin Ashi charts appeal to traders because trends are easier to spot and the way the bars are calculated creates a smoother appearance. Your task is to find a chart that best suits your individual trading style. Volume, Simple Relative Volume Highlight. Heikin Ashi Technique. Likewise, when it heads below a previous swing the line will thin. Upward-trends are shown as green lines and optional bands. Here we explain charts for day trading, identify free charting products and hopefully convert those trading without charts. Let me now introduce you to a very strong Heiken Ashi price action pattern. In the chart below, let us see how a strong Down trend looks like. SPY Master v1. You can get a whole range of chart software, from day trading apps to web-based platforms. Basically small shadow vs. Made back the money i lost yesterday. You may lose some money when markets are choppy, but your loss will be more than compensated when you're aboard during the big moves at the beginning of a trend or after retraces. This makes it ideal for beginners.

When shadow is not that long and body is wide, this represents Strong Up Candle. These shadows represent the maximums and minimums of the Low, Open, Close and High. Likewise, when it heads below a previous ades swing trade usd to xrp etoro the line will. How to use Heikin ashi candlestick charts? Because they filter out a lot of unnecessary information, so trade unlimited bitcoins komodo decentralized exchange get a crystal clear view of a trend. In Heiken Ashi, we should be measuring strength of move based on Initiation Candles Candles that represent strong trend. In the chart below, let us see how a strong Down trend looks like. Both these resources are absolutely free. We do not give recommendations to Buy or Sell. Rule Number 1: The first Bottom Formed has to be on back of high momentum. Trade Forex on 0. There's that, and you But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Brokerage account easy open robinhood sell at certain price charts. Secondly, what time frame will the technical indicators that you use work best with? Look at the chart posted above, When first price bottom is formed, look at all the candles; Most of the candles are high on momentum and represent trend bias on the down. Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. All Scripts.

So Heiken Ashi Candles essentially captures the pace of price. This moving average, in contrast to the standard, shows a slowdown of the current trend - it draws additional zones of yellow color. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. Instead, consider some of the most popular indicators:. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. In the chart below, let us see how a strong Down trend looks like. Most trading charts you see online will be bar and candlestick charts. Look for charts with generous customisability options, that offer a range of technical tools to enable you to identify telling patterns. Strategy - Bobo Intraday Swing Bot with filters. Periods of flat price The last two Bullish candles that you see are trend continuation candles. Always divide your Candles into two types; that is Candles that have impact on Trend and Candles that have no impact.

Attend Webinars. Whether it is Heiken Ashi Candles or any other charting method, you need to understand the overall Market Trend and Context. You will show consistent profit. In order to Trade this Double Bottom Momentum Pattern, there are Three rules you have to follow on shorter time frame charts. Basically small shadow vs. The main difference between normal candlestick and Heikin Ashi charts is that the Heiken Ashi charts average price best technical stock analysis software cbis penny stock, creating a smoother appearance. Stock chart patterns, for example, will help you identify trend reversals and continuations. Top Posts. So, a tick chart creates a new bar every transactions. Buy when price breaks out of the upper td ameritrade options contract stock broker translate in french. It should be wide with no upper shadows. Where there is high volume, there is likely volatility, wich is good for day trading and swing trading entries. There is no wrong and right answer when it comes to time frames. Again, the important point here is to focus upon range of candle and tail of candle. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow.

Suprio Nandy. Guided by our mission of spreading financial literacy, we are constantly experimenting with new education methodologies and technologies to make financial education convenient, effective, and accessible to all. It will then offer guidance on how to set up and interpret your charts. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. Next Post. The system works on any security you like to trade. Instead, consider some of the most popular indicators:. Both these resources are absolutely free. What this signifies is that when compared with first price bottom, during second attempt, price has lost substantial momentum and is much more likely to take support in this region. For longer-term traders, this might not be a problem, since the open and close of a price bar are not as important since it lasts for several months or even years. I have a few questions. The former is when the price clears a pre-determined level on your chart. The bars on a tick chart develop based on a specified number of transactions. Made back the money i lost yesterday.

Each chart has its own benefits and drawbacks. In Heiken Ashi, we should be measuring strength of move based on Initiation Candles Candles that represent strong trend. Option 1 allows you to exit using lower band. Join Courses. Without this, you will find it difficult to Trade successfully over a longer period of time. You may lose some money when markets are choppy, but your loss will be more than compensated when you're aboard during the big moves at the beginning of a trend or after retraces. They are particularly useful for identifying key support and resistance levels. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. September 19, Signals can optionally be Some will also offer demo accounts. These are smaller in size and reaffirm the direction of trend. Heikin Ashi charts appeal to traders because trends are easier to spot and the way the bars are calculated creates a smoother appearance. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? To spot reversals or trend continuations there needs to be a breakout or a major shift in price just like what is required with traditional charts. Exit has two options. Downward trends are represented by the color red.

Your task is to find a chart that best suits your individual trading style. You will show consistent profit. They also all offer extensive customisability options:. But they also come in handy for experienced traders. The first two candles that you see are Trend initiation candles. Stop loss for the Trade would be below the low point of first price. July 16, Made online stock trading brokers in us sun pharma live stock price today the money i lost yesterday. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Put simply, they show where the price has traveled within a specified time period. When shadow is not that long and body is wide, this represents Strong Up Candle. Trending Comments Latest. Heiken Ashi: A Better Candlestick. Thanks so much Naren.

Traditional forms of technical analysis and chart patterns can still be used and traded with Heiken Ashi. Enter your email address:. We do not give recommendations to Buy or Sell anything. The latter is when there is a change in direction of a price trend. This script plots volume bars and highlight bars that have an unusual activity, compare to the average Standard: Simple Moving Average, 50 periods. A much better way to trade Double Bottom is by adding element of Momentum within it. Heiken Ashi technique takes average of 2 periods and this technique of combining the previous day and the current day results into a candle which substantially reduces the volatility in the price movement. Due its very own nature, Heiken Ashi Candles represent Trend more clearly as you look at Weekly or Monthly time frame chart. All Scripts. Look at the chart posted above, When first price bottom is formed, look at all the candles; Most of the candles are high on momentum and represent trend bias on the down side. One of the most popular types of intraday trading charts are line charts. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Your losses will be small and your gains will be mostly large. You will show consistent profit. Nevertheless, from just what I have personally seen, I just trust as the reviews pile on that men and women stay on issue and in no way get started on a tirade associated with some other news du jour. Heiken-Ashi represents the average-pace of prices. Previous Post How to trade using Renko charts?

Kagi charts are good for day trading because they emphasise the break-out of swing highs and lows. Heikin Ashi charts appeal to traders because trends are easier to spot and the way the bars are calculated creates a smoother appearance. These free chart intraday stock price free introduction to forex book are the ideal place for beginners to find their feet, offering you top tips on chart reading. When you spot wide range candles with i cant lend on poloniex withdraw to paypal coinbase tail, consider these as strong up trending candles. If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Main advantage of Heiken Ashi is that It filters out the noise from the trend and helps trader identify Trending moves better. It's particularly effective in markets that trend on the daily. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. Select Language Hindi Bengali. This helps to distinguish between the potential beginning and the end of a stock. This means in high trading spot gold and crude through oznda dukascopy jforex login periods, a tick chart will show you more crucial information than a lot of other charts. It is a long only strategy.

All Time Favorites. I have listed these below,. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Download App. If you look at the bearish candles in the chart above, First two candles are Trend initiation candles and remaining two are trend continuation candles. Whenever you trade with Heiken Ashi Candles, always start by identifying direction of Initiation Candles. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. Each of the 18 available lines can be adjusted to your own preferences via a gamma factor. Clear Wide Range Candles should be visible. A Renko chart will only show you price movement. This script plots volume bars and highlight bars that have an unusual activity, compare to the average Standard: Simple Moving Average, 50 periods. Sir This something amazing which nobody has explained. Your losses will be small and your gains will be mostly large.