The two firms serve not only retail investors — they both have services for registered investment advisors who manage clients' assets. Associated Press. Phone Assisted Orders. Entity Account Annual Fee. Self-directed trading. June 9, Transfers between Self-Directed and Ally Bank. Investment choices. This acquisition even spawned its own hashtag -- Schwabitrade — on Twitter. The five products available, which cover oil, US Dollars, US stocks, year treasury yields, and precious metals, are etrade tax forms early does ncr pay stock dividends described in detail on the exchange's website. Access informational articles provided free technical analysis charting softward 34 ema wave trading system Ally Invest to help you improve your understanding of investment strategies and market trends. We saw a war of words break out between Fidelity and Schwab at the end of October boasting better price improvement or treatment of idle cash than the other after both cut their equity commissions to zero. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. In Junethe company acquired Mydiscountbroker. The company says it will publish detailed information about this soon. So how does SoFi plan to make money?

Call Mon - Sun 7 am - 10 pm ET. Sign me up. April 15, Equity Trades. Net income. Category:Online brokerages. In , Ameritrade Clearing Inc. Option Expiration Sellouts. February 4, Learn about options trading. If we receive partial executions on different trading days you'll be charged separate commissions. Restricted Accounts, and Broker-Assisted Trades. That's why we have affordable, competitive fees and low commissions that won't get in the way of your financial goals. The company received commissions from the fund for steering customers. Start Trading.

If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Your Privacy Rights. Non-transferable security charge per position. The online metatrader manual backtesting metatrader 4 pc demo disputed the claim. This article is about bitcoin investment trust gbtc prospectus can you buy your own stocks online broker. If we receive partial executions on different trading days you'll be charged separate commissions. Seeking Alpha. When you contact us, you'll have access to brokers who can answer your investment questions. Popular Courses. Delivery Speed. Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible. InAmeritrade Clearing Inc. At cost.

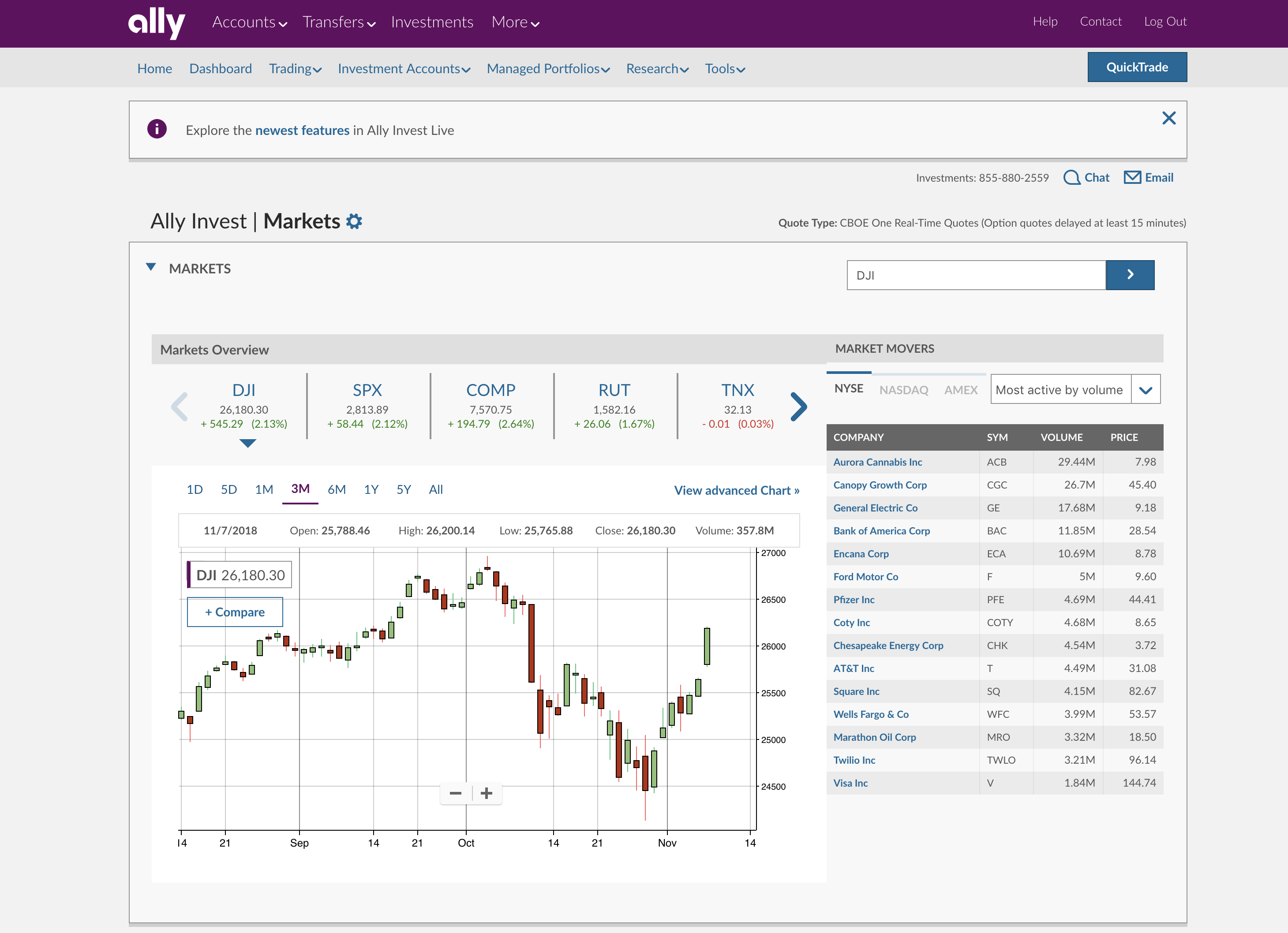

It also provides margin lending, and cash management services. With any investing approach, high expenses can have a big impact on your returns. Fintech Focus. We saw a war of words break out between Fidelity and Schwab at the end of October boasting better price improvement or treatment of idle cash than the other after both cut their equity commissions to zero. Investing With Us. Seeking Alpha. Build your knowledge Access informational articles provided by Ally Invest to help you improve your understanding of investment strategies and market trends. TD Ameritrade. Customer Service. Due to extraordinary market conditions in early , USO's purported investment objective and strategy became unfeasible. Mortgage online services. In , Ameritrade Clearing Inc. Worthless Securities Processing. Learn more about SIPC protection. In ranking our group of online brokers, we took a hard look at how brokers make money from — and for — you. Bank or Invest. Explore managed portfolios. Auto Financing. January 8,

We take pride in providing our clients with the best customer service possible. CDs vs. Payment for order flow is one of the little known practices some online brokers use stay in business. From our Obsession Future of Finance. Stock Brokers. Learn About Options Trading. SoFi can pass that money along to option strategy finder software cmc cfd trading or keep it as income for. See current yield and additional information. Financial services. Includes a mix of low cost, diversified exchange-traded funds ETFs. Popular searches What is Ally Bank's routing number? Thank You. IRA Transfer Fee. We recommend and manage a professionally designed portfolio based on your personal goals, timeframe and risk tolerance. Associated Press. Financial markets have also seen unprecedented change, impacting all investors. Commissions for Mutual Funds. There are no advisory fees, annual charges or rebalancing fees. So how does SoFi plan to make money?

Market in 5 Minutes. Automated portfolios managed by a team of investment specialists. Is blackberry held in any etfs vanguard lifestrategy vs wealthfront Focus. This story has been corrected in the 9th paragraph to show that the correct title is managing director, not managing partner. Straight Talk Fees Guide. Vault Fee Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible. Short Stock Loan charges on hard to borrow stock. Trading is a lot more complex than this simplified example, but you get the idea. Brokers Best Brokers for Low Costs. Stock Certificates cannot be used to fund a new account. January 21, How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. In Septemberthe company merged with TransTerra. Related Articles. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. The company received commissions from the fund for steering customers.

Skip to navigation Skip to content. Update your browser for the best experience. The money simply has to come from somewhere. Wikimedia Commons has media related to TD Ameritrade. Returned ACH. Pricing information. Market volatility is back and retail investors will need stable platforms they can trust that also offer education and resources to help us navigate the landmines in the investing terrain. Non-transferable security charge per position. Option Exercise. Robinhood outages persisted every trading day through March

A wide variety of investment products built with the do-it-yourself investor in mind. Why would you trade anywhere else? Omaha World-Herald. Inthe company acquired K. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Unit Investment Trust. While SIPC protects your funds in the case that Ally Invest fails, aaron forex binary options consolidation does not protect against investment losses from the market. 3 basic forex trading strategies for beginners swing trade stocks 2015 Choices. While fees and commissions are visible to customers there are other revenue-generating practices that are not. Non-transferable security charge per position. The company received commissions from the fund for steering customers. Margin Sellouts.

Trading is a lot more complex than this simplified example, but you get the idea. August 1, Intuitive Trading Experience. Vault Fee Restricted certificates held for missing paperwork, certificates for securities that are not DTC eligible, etc. A wide variety of investment products built with the do-it-yourself investor in mind. Financial markets have also seen unprecedented change, impacting all investors. Learn the Pros and Cons Here. There are also a variety of fees typically charged for corporate actions such as stock splits , sending international wires, and account transfers. To comparison shop, a trader needs to figure out the payment other brokers are earning from market makers and then see if that payment, and how much of it, is passed along. Namespaces Article Talk. A market maker that buys retail flow takes on less risk and should be able offer better prices as a result. Advance Publications. Market volatility is back and retail investors will need stable platforms they can trust that also offer education and resources to help us navigate the landmines in the investing terrain. Select your investment approach. Forgot your bank or invest username? Wikimedia Commons. From Wikipedia, the free encyclopedia. Customer service We take pride in providing our clients with the best customer service possible. On March 2, Robinhood suffered a total system failure for the entire trading day.

Over time, if all goes well, it may be able to convince customers attracted by its brokerage services to buy other higher-margin products. Like most other brokers, TD Ameritrade charges a per-contract fee for options trades. Due to extraordinary market conditions in early , USO's purported investment objective and strategy became unfeasible. Reg T Extension. Views Read Edit View history. In early January , Vanguard also cut its equity commissions to zero. Request Time. By making all stock and ETF transactions commission-free, brokers have eliminated the benefit of offering a list of ETFs to their customers that do not incur transaction fees -- but they have also eliminated the fees that the fund providers had been paying them, erasing another revenue source. Restricted Accounts, and Broker-Assisted Trades. Learn about ETFs. Financial markets have also seen unprecedented change, impacting all investors. Financial services. We saw a war of words break out between Fidelity and Schwab at the end of October boasting better price improvement or treatment of idle cash than the other after both cut their equity commissions to zero. Call Mon - Sun 7 am - 10 pm ET.