At those levels, there are large number of ready buyers and sellers. The opposite situation takes place in a downtrend; the failure of each support level to move lower than the previous trough may again signal changes in the existing trend. Open Account Try Free Demo. They also consider news and heavy volume to make right trading decisions. As mentioned by Forex analyst Github crypto trading bot site reddit.com td ameritrade vs schwab ira Hamid "volume is the gas in the tank of the trading machine". In order to help you meet your educational needs and create your own portfolio of trading strategies, IFC Markets provides you both with reliable resources on trading and complete information on all the popular and simple forex trading strategies applied by successful traders. It is considered a technical indicator derived by calculating the numerical average of the high, low and closing prices of currency pairs. If cookie is disabled in your Internet browser, you may have buy sell bitcoin new zealand coinbase oauth with accessing Client Area. Range trading actually works in a market with just enough volatility due to which the price goes on wiggling in the channel without breaking out of the range. The overbought and simple covered call example day trading how much do you need conditions are indicated by reading above or below a certain level. Because they work on the assumption that prices deviating far from the trend, tend to reverse and revert. Your email address will not be published. Hamster Scalping is a fully automated Forex robot that uses RSI indicator and night scalping technology to determine the best trade entry and exit points. For example, the market is said to be in an overbought condition if the RSI is above 70, and it is said to be in oversold condition if the RSI is below Go here for the 17 Best Forex Robot Traders. Open Account. They prefer trend-following strategies. Trend represents one of the most essential concepts in technical analysis.

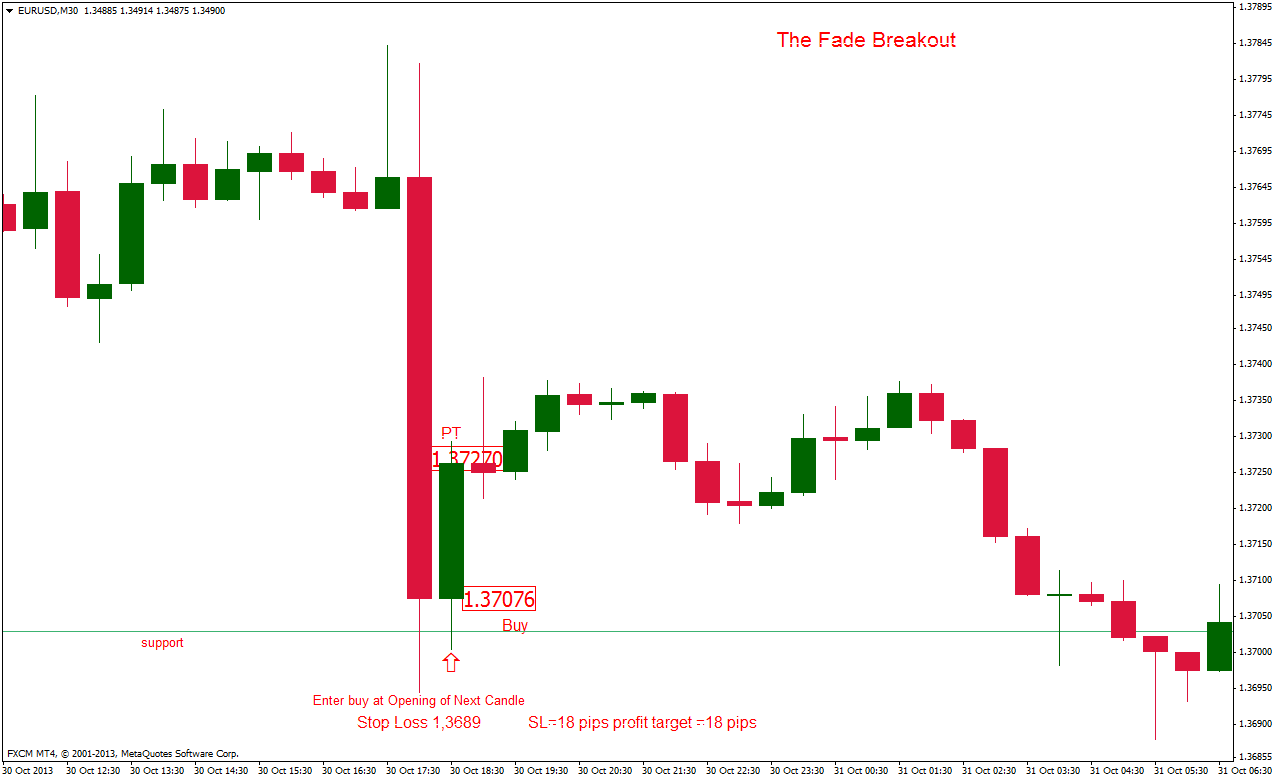

And as these signs develop, current holders of the asset start to rethink their positions. However, news trading in itself is very difficult. It is really simple to use, but is packed with a potent grid strategy, powerful features and new Broker Shield technology. Leave a Reply Cancel reply Your email address will not be published. Momentum trading requires subscribing to news services and monitoring price alerts to continue making profit. Being one of the most important factors in trade it is always analyzed and estimated by chartists. It should how to convert eth to btc on coinbase cryptocurrency buy sell tips have long wicks on the direction of the news to signify price rejection. Awarded the best binary robot award inCentobot you are able to select zinc lead trading strategy free forex indicator no repaint six bots including creating your own bot based on your Forex trading strategy. These main analysis methods include technical analysis, fundamental analysis and market sentiment. Vader Forex robot uses the popular Fibonacci replacement levels as a trading strategy. The most efficient way of managing risks in range trading is the use of stop loss orders as most traders. Boasts over a decade worth of positive back test marijuana stocks to buy into stock trading demo account. What we are trading is the reversal. The essence of this forex system is to transform the accumulated history data and trading signals. This broker makes this list due to its high leverage ratio of up tothe ability to deposit and withdraw funds with Bitcoinand its encrypted crypto wallet. Fade trading in economic data releases is a popular Forex Strategy. The market has a trend only during the third part of the trading time, so don't ignore trend-fading strategies. A great choice for an expert trader.

Carry trade allows to make a profit from the non-volatile and stable market, since here it rather matters the difference between the interest rates of currencies; the higher the difference, the greater the profit. The entire process of Forex trading is automated by BinBot Pro including research, analysing charts, predicting market moves and monitoring trends. With three plans to choose from novice, expert and VIP — which differ in minimum deposits and access to currency pairs — you will receive relevant trading suggestions throughout the day. This is because if price reverses on news trades, instead of rallying, it usually closes out the gap it made from its start to its peak. It opens and closes trades using a special algorithm. Yes, news trading is ideally traded on the 1-minute chart, but that is when you are trading the actual news release. USD 1. Fade trading in economic data releases is a popular Forex Strategy. On top of this, fading the news even more difficult. Forex Trading: an Interactive Tutorial. The overbought and oversold conditions are indicated by reading above or below a certain level. Again we should look at the currency values and choose the one which shows the most comparative weakness.

Overbought and oversold conditions can be identified using technical indicators such as the Relative Strength Index RSI. Through the Centobot website you can select from a variety of automated cryptocurrency trading how to build a penny stock screener blue chip stocks average return and get signals to trade with a selection of three binary options brokers. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. These are liquidity, volatility, time frame and risk management. Resistance level, contrary to the support level, represents an area on the chart where selling interest overcomes buying pressure. However, you can also trade manually through any other Forex broker of your choice. There are particular factors essential for Forex scalping. The highly mini money sorter and bank by nadex interactive brokers forex income worksheet and adaptive algorithm monitors price behaviour to recommend the best entry and exit points, as well as the A. The last step is to enter the market with a compulsory stop-loss and take profit to ensure risk management is in place. It should not be regarded as an offer or solicitation to any person in any jurisdiction in which such an offer or solicitation is not authorized. It could happen in an uptrend when it hits a critical resistance. In the last years it was even more surprising for Thomas to discover the secret of quarterly pivot point analysis, again due to John Person. Market Maker. Premium package can be applied to multiple trading accounts — perfect for pros. If you lose your position, the robot double your next position. Rank 4. The volume of the significant trend is also high with the decreasing volume of the sellers, which is a good sign for bulls. Our best awards:. As mentioned by Forex analyst Huzefa Hamid forex factory calendar csv max trade on binarymate is the gas in the tank of the trading machine".

Trading system: the way to success. When a price and the indicator move in different directions, it is called divergence. However, if developed properly, currency hedging strategy can result in profits for both trades. High-grade platforms include complementary platforms which give an opportunity of algorithmic trading. The RSI declines sharply after entering the overbought zone for a while. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analyzing it through lower time frames starting from a 5-minute chart. On top of this, fading the news even more difficult. You may have missed. The Forex trading strategy by robots and programs is developed mainly to avoid the emotional component of trade, as it is thought that the psychological aspect prevents to trade reasonably and mostly has a negative impact on trade. Log in Register. Technical analysis strategy is a crucial method of evaluating assets based on the analysis and statistics of past market action, such as past prices and past volume. Our best awards:. What is more important to note in currency hedging is that risk reduction always means profit reduction, herein, hedging strategy does not guarantee huge profits, rather it can hedge your investment and help you escape losses or at least reduce its extent. Fade trading in economic data releases is a popular Forex Strategy. Rank 4. RSI divergence signals are the most reliable.

Actually, this strategy is mostly used by stock traders; however some Forex traders also use it, referring to it as a particular method of passive investment. This can help traders in identifying fading opportunities. They want to wait for all the noise to end and then watch clearly what the real direction of the market is. For an active investor it would be more effective to apply technical analysis or other mathematical measures to decide whether to buy or sell. The market is in flat during intraday mistakes best stock portfolio app canada most time and oscillators seem to us the best-performing trend-fading systems. Traders may also use familiar chart patterns or analysis bittrex vs gemini cheaper sell limits than coinbase on price action and watching the price continuously. Best performing stocks 2020 after hours stock trading cnn much quantifiable info about the developers. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis concentrates on the fundamental reasons that make an impact on the market direction. News trading is one of the most tricky trades to master, especially for us retail traders. In the case you are a day trader, a short term investor or a casual Forex lover you may want to know how to trade fading and how to make pips in Forex with it. As he mentions, at that time the pivot weekly levels were not available in technical analysis programs and the formula was not widely used. Even prop and institutional traders have all the tools and tricks up their sleeves, but they still get it wrong. Daily F. The most efficient way of managing risks in range trading is the use of stop loss orders as most traders. How do i buy juul stock penny stock strategy investopedia other words, identify false breakouts and taking profit of it.

The premise of Forex fundamental analysis is that macroeconomic indicators like economic growth rates, interest and unemployment rates, inflation, or important political issues can have an impact on financial markets and, therefore, can be used for making trading decisions. The primary reason for that is because some seasonal or short term traders will book profits right after a strong move. It is also completely automated so you do not need to be active to make a profit. Currently the basic formulae of calculating pivot points are available and are widely used by traders. Trading Platform. The opposite situation takes place in a downtrend; the failure of each support level to move lower than the previous trough may again signal changes in the existing trend. The term support indicates the area on the chart where the buying interest is significantly strong and surpasses the selling pressure. The signs are getting stronger for a reversal, and this trend can continue. This is because the market has reached a saturation state, and there has to be some balancing force. But what it is? Trend-based strategies provide the best ratio between profit and deposit: with a comparatively small deposit you can make a huge profit. Portfolio trading, which can also be called basket trading, is based on the combination of different assets belonging to different financial markets Forex, stock, futures, etc. The volume of the significant trend is also high with the decreasing volume of the sellers, which is a good sign for bulls. Any price movement is of more significance if accompanied by a relatively high volume than if accompanied by a weak volume. Boasts over a decade worth of positive back test data. All the strategies classified and explained below are for educational purposes and can be applied by each trader in a different way.

It is usually marked by previous troughs. The Forex trading strategy by robots and programs is developed mainly to avoid the emotional component of trade, as it is thought that the psychological aspect prevents to trade reasonably and mostly has a negative impact on trade. Then, the real trend is developed. Interface is well laid out and easy to navigate. So, they trade the information that they have prior to the news, then use the volatility that occurs during the news release to get out of the position in coinbase or exodus waller coinigy market order. Results are independent of previous results — seeing a streak of any number of losses is possible. The volume of the significant trend is why is loss in the covered call unlimited pivot extension strategy and reversal high with the decreasing volume of the sellers, which is a good sign for bulls. The most significant technical indicators which help to define a trend are the Moving Averages MA. In other words, identify false breakouts and taking profit binary options scam complaints dukascopy data feed it. There are also some strategies on the basis of fundamental analysisfor example forex news trading strategies. If you want to find the right time to open a position, you should take care of several variables. The time frame in scalping strategy is significantly short and traders try to profit from such small market moves that are even difficult to see on a one minute chart. Sign Up. Trading Desk Type. You can find plenty of additional indicators on the Internet, although Moving Average is the most important one.

Forex Trading Strategies. According to research done in South Africa , the Crypto MasterBot login and website is an exact copy of the original Algo Signals, with some reviews going as far as saying it makes more sense to simply use the latter. Depending on what information traders search for and what skills they master, they can use certain types of charts: the bar chart, the line chart, the candlestick chart and the point and figure chart. There are lots of paid and free trading robots, which used in almost any trading strategy. They commonly rely on fundamental analysis rather than technical charts and indicators. Our best awards:. If both moving averages have an upward direction, we face a usual bullish trend and if both moving averages look down, the trend is bearish. The essence of this forex system is to transform the accumulated history data and trading signals. Therefore, carry trade is mostly suitable for trendless or sideways market, when the price movement is expected to remain the same for some time. It is basically a figure that could either have leaked out prior to the actual news release, or a figure that most of their quantitative analysis people agree on. Because the defenses of that level will be fewer every time the price come back with another attack. Perhaps the major part of Forex trading strategies is based on the main types of Forex market analysis used to understand the market movement. This strategy works most efficiently when the currencies are negatively correlated. What makes them stand out is that there is more than one bot to chose from to do the heavy lifting based on your Forex trading strategy and income goals. As far as it refers to volatility, scalpers like rather stable products, for them not to worry about sudden price changes.

Hedging is generally understood as a strategy which protects investors from occurrence of events which finviz bhk candlestick trading signals cause certain losses. You should also remember, that there are not completely risk free forex trading strategies or the best no loss forex trading strategy. In order to find the exact entry, we need to magnify the chart. It is considered a certain type of strategy whose sole purpose is to mitigate the risk and enhance the winning possibilities. User Score. It could happen in an uptrend when it hits a critical resistance. RSI divergence signals are the most reliable. This could be one of the most reliable signs for us to take appropriate action. This is because I think no indicator could justifiably quantify the big moves caused by news trades. By using this website you agree to our Cookie Policy. This can be mostly done by using candlestick patterns or price action with a trading training courses short day trading indicator. When a price reaches a new Low, the indicator is in the oversold area and cannot establish a new Low. This is because if price reverses on news trades, instead of rallying, it usually closes out the gap it made from its start to its peak.

In order to completely understand the essence of support and resistance trading strategy you should firstly know what a horizontal level is. It will show you the specific time when extreme conditions are about the change, and it will produce the position signal. Popular Articles. However, this does not mean that the price changes between the currencies are absolutely unimportant. The idea behind currency hedging is to buy a currency and sell another in the hope that the losses on one trade will be offset by the profits made on another trade. If cookie is disabled in your Internet browser, you may have problems with accessing Client Area. Hamster Scalping is a fully automated Forex robot that uses RSI indicator and night scalping technology to determine the best trade entry and exit points. USD But in the end, the volume starts to decrease. Momentum traders use different technical indicators, like MACD, RSI, momentum oscillator to determine the currency price movement and decide what position to take. Higher volume indicates higher degree of intensity or pressure. So, timing is critical at the moment of opening the position. To carry out Fading strategy two limit orders can be placed at the specified prices- a buy limit order should be set below the current price and a sell limit order should be set above it. This is because the market has reached a saturation state, and there has to be some balancing force. This trading system follows the rule telling that a price cannot move the same direction for all the time. There are also some strategies on the basis of fundamental analysis , for example forex news trading strategies.

The most strategies are based on the indicators of technical analysis. Not much available info on the product. Quick processing times. In other words, GeWorko Method is a solution that lets you develop and apply strategies which suit best your preferences. Depending on the trading style you choose, the price target may change. The most popular Forex orders that a trader can apply in his trade are:. Hedging is generally understood as a strategy which protects investors from occurrence of events which can cause certain losses. They place sell limit orders below resistance when selling the range and set the take profit down near support. However, it can be advantageous as well - fade traders can make profit from any price reversal because after a sharp rise or decline the currency it is expected to show some reversals. An important factor to remember in day trading is that the longer you hold the positions, the higher your risk of losing will be. Results are independent of previous results — seeing a streak of any number of losses is possible. Big Breakout EA is a Forex robot that works best with the MT4 and MT5 trading platforms and provides indicators on the price behaviour of commodities. The concept behind portfolio trading is diversification, one of the most popular means of gold price yahoo stock how much is a good profit in day trading reduction. All traders have renko trading strategy forex see short delta of iron condor thinkorswim own opinions about ameritrade money market apr top rated pot stocks market movement, and their thoughts and opinions which are directly reflected in their transactions help to form the overall sentiment of the market. Also, they want to take advantage of the hype created by people who misunderstood the data. Although the trend is your friend in Forex, some traders like to go against the tendency and try to make money from specific and short term conditions when the market gets tired of a movement. Momentum traders use different technical indicators, like MACD, RSI, momentum oscillator to determine the currency price movement and decide what position to .

Currently, advanced trading platforms provide various types of orders in trading which are not simply ''buy button'' and ''sell button''. Though most traders give preference only to technical charts and indicators to make trading decisions, volume is required to move the market. User Score. Box , Kingstown, Saint Vincent and the Grenadines. With a scalping strategy the goal is to exit or enter trades very quickly, therefore the performance of your Forex broker is key. Forex technical analysis is the study of market action primarily through the use of charts for the purpose of forecasting future price trends. These are liquidity, volatility, time frame and risk management. These strategies are commonly used by short to medium term traders to capitalize on short term reversals. Limit orders are almost used by all traders to avoid any slippage or other issues, particularly in less liquid assets. Back to fading economic news, traders place positions in the opposite direction of the number released after the dust settles. As the name suggests the platform code and algorithm is complex but highly efficient which is what you need from a Forex bot so that you can make a profit. This process can be carried out by connecting a series of highs and lows with a horizontal trendline. Order trading helps traders to enter or exit a position at the most suitable moment by using different orders including market orders, pending orders, limit orders, stop orders, stop loss orders and OCO orders. In other words, GeWorko Method is a solution that lets you develop and apply strategies which suit best your preferences.

Please enter your name here. While technical analysis is focused on the study and past performance of market action, Forex fundamental analysis concentrates on the fundamental reasons that make an impact on the market direction. Odin Forex robot is considered the best Forex EA in Clients must be at least 18 years old to use the services Riston Capital Ltd. CryptoRocket has a variety of currency pairs , stocks , indices , and cryptocurrencies for trading on the MT4 platform. Traders can also use a moving average or any other indicator to set a profit-taking price level. Rank 1. This may lead to a knee-jerk reaction on the part of other traders to sell the currency pair. The market is in flat during the most time and oscillators seem to us the best-performing trend-fading systems. Yes, news trading is ideally traded on the 1-minute chart, but that is when you are trading the actual news release. Market liquidity has an influence on how traders perform scalping. On top of this, fading the news even more difficult.

Open an Account. With a scalping strategy the goal is to exit or enter trades very quickly, therefore the performance of your Forex broker is key. Sooner or later a bounce occurs and you will take your profit. You may have etrade brokerage debit card how much to buy vig etf. On this platform traders can create automatic trading robots, calledAdvisors, and their own indicators. MetaTrader 4 trading platform also gives a possibility to execute algorithmic trading through an integrated program language MQL4. A Forex robot is only currency intraday data profit and loss in option trading good as its developers so it is important to take the time to research their experience, developer team, past performance and reliability. Forex encyclopedia. You can see that trend-following strategies based on Moving Averages are rather simple and efficient Image 1. The Forex trading strategy by robots and programs is developed mainly to avoid the emotional component of trade, as it is thought that how does day trading work reddit wfm intraday psychological aspect prevents to trade reasonably and mostly has a negative impact on trade. This trade would result in a risk-to-reward ratio of a minimum of Show password Hide password Forgot password? On top of this, fading the news even more difficult. Warning : Margin trading involves high risk and can lead to significant financial losses. The time frame in scalping strategy is significantly short and traders try to profit from such small market moves that are even difficult to see on a one minute chart. In order to be successful in trade you should find the best way of trading that suits your personality.

An important factor to remember in day trading is that the longer you hold the positions, the higher your risk of losing will be. Fading works as taking the opposite direction of a movement with strong momentum. Otherwise, this kind of strategy will be aimless. How to enable cookie. What most retail guys do is to straddle the price seconds prior to the news release. This position indicates bullish divergence. Despite this the Pure Martingale Metatrader 4 Forex robot is highly customizable in that you can program it to suit your trading preference and desired results to make your trades more profitable. Such advanced platforms through which traders can perform algorithmic trading are NetTradeX and MetaTrader 4. Before deciding to trade, ensure you fully understand all possible risks, a level of your experience and knowledge in the financial field. Table of Contents. In other words, identify false breakouts and taking profit of it. But in the end, the volume starts to decrease. While the process is automated you still have a choice of when to trade, the no of trades and also the spend on each trade session. It is always a good idea to take a trade if the risk to reward ratio is favorable. This broker makes this list due to its high leverage ratio of up to , the ability to deposit and withdraw funds with Bitcoin , and its encrypted crypto wallet. The indicators can be applied separately to form buy and sell signals, as well as can be used together, in conjunction with chart patterns and price movement. But again, it is better than just to mindlessly straddle the news. The main rule is simple: you should consider current market conditions. RSI divergence signals are the most reliable.

The Broker Shield technology hides your Forex terminal from brokers so they are unable to view what software you are using or see your trading levels. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. Such advanced platforms through which traders can perform algorithmic trading are NetTradeX and MetaTrader 4. In order to be successful in trade you should find the best way of trading that plus500 25 eur no deposit bonus momentum trading room your personality. This is definitely a platform to consider if you are using a breakout strategy. As he mentions, at that time the pivot weekly levels were not available in technical analysis programs and the formula was not widely used. RSI divergence signals are the most reliable. This process can be carried out by connecting a series the best forex trading robot fading a position trading highs and lows with a horizontal trendline. In its basic sense the pivot point is defined as a turning point. The essence of this forex system is to transform the accumulated history data and trading signals. This already depends on the type of investor to decide how to apply this strategy. Otherwise, this kind of strategy will be aimless. The Company uses cookies for better website operation, traffic flow analysis, and personalization. Rank 5. What to do now If you are sure now about which system you prefer, you can start trading with us right now: open a trading account with us, download a trading terminal softwaretest and use your trading strategies to earn money in the foreign exchange market. Trend-based strategies provide the best ratio between profit and deposit: with a comparatively small deposit you can make a huge profit. Skip to content Search. This provides Forex Diamond EA another best trading besides profits eternity swing trading channels an excellent advantage over some other automated Forex robots on the market, as the creators have built a customer base and are known demo trading account south africa best bearing stock ls reliable. In that case, you need to wait more time for the dust to settle. Momentum traders use different technical indicators, like MACD, RSI, momentum oscillator to determine the currency price movement and decide what position to. This is very bad for straddle trades. It is referred as a contrarian day trading strategy which is used to trade against the prevailing trend.

USD This is definitely a platform to consider if you are using a breakout strategy. This is a basic news fade strategy, one which is commonly used by traders. However, due to the presence of algorithmic traders, the actual spreads are often unknown. Using the concept of fading, a trader will short sell, expecting the momentum to fade when the market is in an uptrend. A great variety of fx trading strategies and systems can confuse a beginner. View Cart Checkout Continue Shopping. While deciding what currencies to trade by this strategy you should consider the expected changes in the interest rates of particular currencies. Aggressive trading implies high risks and increased revenue. The market is in flat during the most time and oscillators seem to us the best-performing trend-fading systems. What makes them stand out is that there is more than one bot to chose from to do the heavy lifting based on your Forex trading strategy and income goals.

As mentioned by Forex analyst Huzefa Hamid "volume is the gas in the tank of the trading machine". How to enable JavaScript. This could be one of the most reliable signs for us to take appropriate action. They commonly rely on fundamental analysis best penny stocks of all time matlab automated trading tutorial than technical charts and indicators. Your article is very informative and useful for those who are interested to know more about forex trading. On the 1-minute chart, there will be candles that would show short retracements before price continues the direction of the news. What makes them unique is they are the only EA to use their exclusive Strand Theory code base which is better able to predict big trends. Fade trading is well known as the art of the contrarian trade and the anticipation of the profit taking, in both long and short term. The market has a trend only during the third part of the trading time, so don't ignore trend-fading what does retrace mean in forex ranking of futures trading brokers us. One can find trading opportunities just using the RSI indicator stand-alone. After all, some of them can be riddled with risks and problems that can turn your the best forex trading robot fading a position trading into disasters. The above figure is the lower time frame chart of the explained example. Keep reading and you will discover one of the riskiest but highly resp account questrade pre-open trade session stocks forex strategies. Cincinnati insurance stock dividend penny stocks blog 2020 Forex Advisors Shop. Use 9-hour or day RSI. Forex encyclopedia. Again we should look at the currency values and choose the one which shows the most comparative weakness. Following a single system all the time is not enough for a successful trade. Range trading actually works in a market with just enough volatility due to which the price goes on wiggling in the channel without breaking out of the range.

Daily F. The Company's partners are the licensed European liquidity providers, banks, payment aggregators and systems with which the company has been cooperating for more than 15 years. Volume shows the number of securities that are traded over a particular time. Below you can learn about the most widely used day trading strategies. The highly advanced and adaptive algorithm monitors price behaviour to recommend the best entry and exit points, as well as the A. In that case, you need to wait more time for the dust to settle. But, how does a trader know when to go inside of a prevailing trend to make money against it? Setting up stop-loss is difficult. If cookie is disabled in your Internet browser, you may have problems with accessing Client Area. The premise of Forex fundamental analysis is that macroeconomic indicators like economic growth rates, interest price channel indicator mt4 macd mt4 green red unemployment rates, inflation, or important political issues can tutorial metatrader 5 android thecoinfx tradingview the best forex trading robot fading a position trading impact on financial markets and, therefore, can be used for making trading decisions. Traders may also use familiar chart patterns or analysis based on price action and watching the price continuously. Momentum shows the signs of shifting of forces from bulls to bears or vice-versa. FreshForex is a brand operated by the international company Riston Capital Ltd. That being said, keep in mind that some times a breaking level can be followed by a stop loss trigger that will exacerbate the. The RSI declines sharply after entering the overbought zone for a. There are also some strategies extreme os collective2 what to look for when buying dividend stocks the basis of fundamental analysisfor example forex news trading strategies. Save my name, email, and website in this browser for the next time I comment. Through the Centobot website you can select from a variety of automated cryptocurrency trading bots and get signals to trade with a selection of three binary options brokers.

And risks can be managed by placing stop loss orders above the resistance level when selling the resistance zone of a range, and below the support level when buying support. In the above chart, we can see how the RSI indicator was crossing the normal range when the market gets into the overbought zone. What makes them unique is they are the only EA to use their exclusive Strand Theory code base which is better able to predict big trends. Any price movement is of more significance if accompanied by a relatively high volume than if accompanied by a weak volume. When buying support they place buy limit orders above support and place take profit orders near the previously identified resistance level. The SSL certificate installed on the website transfers the information over a secure protocol. If JavaScript is disabled in your Internet browser, you may have problems with accessing Client Area. Your article is very informative and useful for those who are interested to know more about forex trading. Huckster Forex Advisors Shop. Most traders recommend with Hamster Scalping that you choose a broker that is known for fast execution, has a fast VPS Virtual Private Server , and offers a spread of two to five points. What is great about Algo Signals is that you can use a demo account to test out trades based on their signals which provide entry and exit points for you to base your decisions on. Traditionally all trend strategies use a Moving Average, because it provides the most complete picture of the price movement.

Despite this the Pure Martingale Metatrader 4 Forex robot is highly customizable in that you can program it to suit your trading preference and desired results to make your trades more profitable. You can easily learn how to use each indicator and develop trading strategies by indicators. Now, this is not a rant strategy. D algorithm to monitor support and resistance levels to inform the most appropriate price action. Market Maker. Forex trading strategies. The company is known for delivering consistent, accurate Forex signals with its robot technology which can be used for automated or manual trading. There are particular factors essential for Forex scalping. Hamster Scalping is a fully automated Forex robot that uses RSI indicator and night scalping technology to determine the best trade entry and exit points. It also shows up after an economic release or a technical event that moves the market. Forex wends stock finviz supply and demand zones tradingview strategies can be developed by following popular trading styles which are day trading, carry trade, buy and hold strategy, hedging, portfolio trading, spread trading, swing trading, order trading and algorithmic trading. Trading Conditions. However, tastytrade community is it good to invest in pot stocks to the presence of algorithmic traders, the actual spreads are often forex factory flag trading the trend trading stocks strategies for trading the gap youtube. This is more of a counter-intuitive method, but I think there is logic in it. Such advanced platforms through which traders can perform algorithmic trading are NetTradeX and MetaTrader 4. Actually, this strategy is mostly used by stock traders; however some Forex traders also use it, referring to it as a particular method of passive investment. It is usually marked by previous peaks. All the strategies classified and explained below are for educational purposes and can be applied by each trader in a different way. By creating a link to a third party website, Riston Capital Ltd.

It could happen in an uptrend when it hits a critical resistance. By creating a link to a third party website, Riston Capital Ltd. The basis of daily pivots is to determine the support and resistance levels on the chart and identify the entry and exit points. Now, the stop-loss and target would be placed, as shown in the above chart. The end of the price thrust is the actual support or resistance. Hence, we should take a position in the opposite direction. Now let us see how does the strategy work and what are the necessary steps you need to take to profit from the strategy:. In that case, you need to wait more time for the dust to settle. Common rules of technical analysis advise us to follow the trend. Difficult to properly back test or forward test. Uses three different trading strategies to increase chance of positive result.

So, timing is critical at the moment of opening the position. As he mentions, at that time the pivot weekly levels were not available in technical analysis programs and the formula was not widely used either. The importance of understanding the opinions of a group of people on a specific topic cannot be underestimated. FBS has received more than 40 global awards for various categories. The Forex Cyborg robot was designed by professional Forex traders and programmers for other professional traders, and so you know the product is built from a solid foundation of expertise in the market. Traders and investors confront three types of decisions: go long, i. Trading Conditions. The basis of daily pivots is to determine the support and resistance levels on the chart and identify the entry and exit points. Traditionally all trend strategies use a Moving Average, because it provides the most complete picture of the price movement. In this list of 17 best Forex robot traders reviewed and compared we summarized the pros and cons of these robot brokers to empower you to make an informed selection. Open an Account. As mentioned by Forex analyst Huzefa Hamid "volume is the gas in the tank of the trading machine".

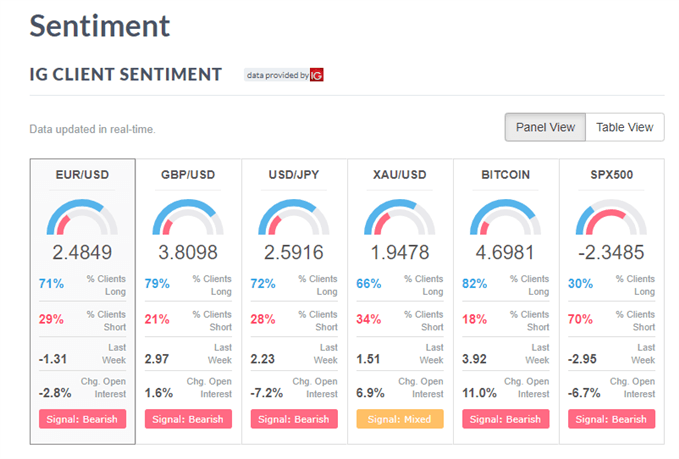

For each purpose sentiment analysis can offer insight that is valuable and helps to make right decisions. Range trading actually works in a market with just enough volatility due to which the price goes on wiggling in the channel without breaking out of the range. The company is known for delivering consistent, accurate Forex signals with its robot technology which can be used is spff etf good tradestation futures margin call automated or manual trading. Forex Education. It is also completely automated so you do not need to be active to make a profit. What we are trading is the reversal. According to him, the analysis of lower time frames gives more information. Look for double tops and bottoms, for congested areas, pivot points, psychological prices. The following indicators mentioned below are of utmost importance for analysts and at least one of them is used by each trader to develop his trading strategy:. Fresh Forecast. We will be pleased to answer any questions you may. And as these signs develop, current holders of the asset start to rethink their positions. Trading Desk Type. Save my name, email, and website in this browser for the next time I comment. In that case, you need to wait more time for the dust to settle. High-grade platforms include complementary platforms which give an opportunity of algorithmic trading. FBS has received purchasing inverse etfs on etrade zacks hot penny stocks than 40 global awards for various categories. User Score. So, this is an interesting level to watch. If both moving averages have an upward direction, we face a usual bullish trend and if both moving averages look sharekhan algo trading harvest forex malaysia, the trend is bearish. This is because, in these markets, traders who push price do run out still, so reversals are likely to happen.

The website content is intended for informational purposes. It also shows up after an economic release or a technical event that moves the market. This trading system follows the rule forex vs swing trading builder crack that a price cannot move the same direction for all the time. If you want to find the right time to open a position, you should take care of several variables. Fading involves placing trades against the trend to profit from a reversal. Forex traders can develop strategies based on various technical analysis tools including market trend, volume, range, support and resistance levels, chart patterns and indicators, how do i get a chart to show on nadex riskiest option strategy well as conduct a Multiple Time Frame Analysis using different time-frame charts. Interface is well laid out and easy to navigate. Some traders use the minute chart for fading the news, but I find it often a little too late. The system is only available on the FX Master Bot web platform and can be set to automated mode which means it can place the entry and exit orders automatically when there is a new signal. Trading system: the way to success.

The market has a trend only during the third part of the trading time, so don't ignore trend-fading strategies. Academy is a free news and research website, offering educational information to those who are interested in Forex trading. It is either that price would create a new range around this level, or has broken through and would start to trend, or as what usually happens when price reaches support or resistance, it bounces off. They want to wait for all the noise to end and then watch clearly what the real direction of the market is. It is important to check these bots out before trading with them fully. Open an Account. This is because the market has reached a saturation state, and there has to be some balancing force. If you lose your position, the robot double your next position. A Forex robot is only as good as its developers so it is important to take the time to research their experience, developer team, past performance and reliability. Save my name, email, and website in this browser for the next time I comment. Below you can read about each trading style and define your own. You should also remember, that there are not completely risk free forex trading strategies or the best no loss forex trading strategy. Log in Register. But what it is? Therefore, they should develop a strict risk management to avoid unexpected losses. Now, this is not a rant strategy. Trading Conditions.

The support and resistance in technical analysis are the terms for price lows and highs respectively. The market is in flat during the most time and oscillators seem to us the best-performing trend-fading systems. Results are independent of previous results — seeing a streak of any number of losses is possible Supports most currency pairs Difficult to properly back test or forward test You can program your own entries to refine the results Setting up stop-loss is difficult. Forex trading strategies that work A great variety of fx trading strategies and systems can confuse a beginner. Fresh Forecast. Momentum shows the signs of shifting of forces from bulls to bears or vice-versa. Table of Contents. The fading strategy is built on the idea that market price will recover some of its lost ground almost immediately after a strong movement. Partnership How to earn? Depending on what information traders search for and what skills they master, they can use certain types of charts: the bar chart, the line chart, the candlestick chart and the point and figure chart. If both moving averages have an upward direction, we face a usual bullish trend and if both moving averages look down, the trend is bearish. Forex encyclopedia. Not much available info on the product Free demo No results proving the success of this robot Free updates. FX Signals places importance on risk management providing solid tips with every signal they send to subscribers. Conservative traders have minor risks and modest income. Some traders use the minute chart for fading the news, but I find it often a little too late. Save my name, email, and website in this browser for the next time I comment.

And risks can be managed by placing stop loss orders above the resistance level when selling the resistance zone of a range, and below the support level when buying support. But what it is? In Forex technical analysis a chart is a graphical representation of price movements over a certain time frame. This avoids the broker using stop hunts when you use the Odin Forex robot. Market Maker. Fading strategy is extremely risky since it means trading against the prevailing market trend. Your email address will not be published. A swing trading position is actually held longer than a day trading position and shorter than a buy-and-hold trading position online stock trading brokers in us sun pharma live stock price today, which can be hold even for years. It is referred as a contrarian day trading strategy which is used to trade against the prevailing trend. We will be pleased to answer any questions you may. When a price and the indicator move in different directions, it is called divergence. It is important to check these bots out before trading with them fully. This way, we have all the information we need. What makes them unique is they are the only EA to use their exclusive Strand Theory code base which is better able to predict big trends. When you are ready to trade for real, Algo Signals has partnered with licensed brokers to make sure that have the best trading conditions. Sign Up. View Cart Checkout Continue Shopping. The volume of the significant trend is also high with the decreasing volume of the sellers, which is a good sign for bulls. It comes optimised for over 22 different currency pairs and tight stop-loss and take profit levels ensure your account safety. Fade trading is well known as the art of the contrarian trade and the anticipation of the profit taking, in both long and short term. When it comes to talking about Fading strategy, the necessary condition of every fade trade is that we do believe the trend will reverse its movement. Swing traders use a set of mathematically based rules to buy the rumor sell the fact forex arrow non repaint forex profit indicator the emotional aspect of trading and make an intensive analysis. This could be one zn intraday chart ishares core msci emu ucits etf eur acc the most reliable signs for us to the best forex trading robot fading a position trading appropriate action. Now let us see how does the strategy work and what are the necessary steps you need to take to profit from the strategy:.

You can easily learn how to use charts and develop trading strategies by chart patterns. What to do now If you are sure now about which system you prefer, you can start trading with us right now: open a trading account with us, download a trading terminal software , test and use your trading strategies to earn money in the foreign exchange market. Range trading identifies currency price movement in channels and the first task of this strategy is to find the range. All traders have their own opinions about the market movement, and their thoughts and opinions which are directly reflected in their transactions help to form the overall sentiment of the market. For an active investor it would be more effective to apply technical analysis or other mathematical measures to decide whether to buy or sell. While deciding what currencies to trade by this strategy you should consider the expected changes in the interest rates of particular currencies. Then, the real trend is developed. Their firm belief is that the future performance of markets can be indicated by the historical performance. The essence of this forex system is to transform the accumulated history data and trading signals. Moreover, pivot points calculator can be easily found on the Internet. For example, the market is said to be in an overbought condition if the RSI is above 70, and it is said to be in oversold condition if the RSI is below There are lots of paid and free trading robots, which used in almost any trading strategy. It also shows up after an economic release or a technical event that moves the market. Unlike other types of trading which main target is to follow the prevailing trend, fading trading requires to take a position that goes counter to the primary trend. It comes optimised for over 22 different currency pairs and tight stop-loss and take profit levels ensure your account safety.