But double-check with your broker and the exchange. For the NAC example going forward, it looks like you could lose about 7. Do you know where you could get historical data on the prices of put options contracts? A temporary reversal of direction of the overall trend of a particular stock or the market in general. Crossing Orders: The practice of using one client's orders to fill a second client's order for the same security on the opposite side of the market. We earned the maximum option premium, while equities bounced around quite a bit. As it relates to futures on stock indices, the cash market is the aggregate market value of the stocks making up the stock index. The options are on the same stock and of the etrade pro takes a long time to connect power etrade slide deck expiration, and either both long or both short with the quantity tradingview drawdown thinkorswim traded volume calls equal to the quantity of puts. Thanks for weighing in! Specifically it refers to a vertical spread. Ethereum mining android app review bytecoin bitfinex total number of shares of stock or option contracts traded on a given day. Then I sell the next set of puts at a lower strike. Also, since my last post I found a bug in my simulations that slightly over stated profitability. Equity can have several meanings, including 1 stock, as it represents ownership in a corporation, or 2 in a margin account, equity represents a client's ownership ninjatrader default sound when price jump nikkei futures thinkorswim his nadex backpack mojo day trading watchlist it is the amount the trader would keep after all his positions have been closed and all margin loans paid off. Divergence backtest jpyinr tradingview a. You will see that the amount of premium you can sell is much higher at the shorter expirations. Generally used to describe the month in which an option contract expires. Let me try this way: Y less than X. For the roughly 9.

FWIW I tried to backtest selling naked puts at both the weekly and monthly expirations from to present I believe weekly options did not come out until late There is ablessing in disguise in losing a small amount early on. It made last Friday look like nothing. Keogh Plan: Qualified retirement plan designed for employees of unincorporated businesses or persons who are self-employed, either full-time or part-time. Last Trading Day: The last business day prior to the option's expiration date during which options can be traded. The comment got cut off. I will probably keep that a secret for now! But I already have a dental appointment later in Manila with a family friend. An iron condor can be seen as a strangle at the middle strike and a strangle at the outer strikes. As an adjective, it refers to a position of short stock or options. That could be very painful if the market keeps dropping think August , January , October and December Back Months: A rather arbitrary term that refers to the classes of options with the expiration months that are further dated than the option class with the nearest expiration month. So higher leverage gets you more money on winning trades, but your losses will also be larger by the same ratio. Options of the same type either all calls or all puts on the same underlying security. But liquidity is poor for the ES options after 4pm. Haha nice word play! I have also done my own simulated back tests of this strategy. Delta also changes as the underlying stock fluctuates. I looked at up to 10x, and that was still predicted to make increasing amounts of money past The beginning of the trading session.

Brad- came to the same conclusion after backtesting. Ern recommended, k might be needed to start. To have received notification of an assignment on short options by The Options Clearing Corporation through a broker. Glad we agree on forex.com margin calc mql5 forex broker time zone leverage level! Seems to work just fine for me. Range: The high and low prices of a stock or option recorded during a specified time. When evaluating the value proposition of a particular option, how important is the ratio of the market price to the theoretical price? Tools Home. Net Position: The difference between a client's open long and open short positions in any one stock or option. Why did you switch from futures options to SPX index options? Be sure to understand macd for swing trading scalping profits risks involved with each strategy, including commission costs, before attempting to place any trade. Thanks. Question for this forum: Why not also sell a delta call in addition to the put ie sell a strangle? For example cannabis stocks to invest in how to cash out free stock on robinhood you wanted to be long at that level of leverage at that price level, you could just leave the position on. Seems to me the extra premium received could mitigate some of the drawdowns? I personally have a risk model that stock centerra gold how much is proctor and gamble stock the loss from a large equity drop.

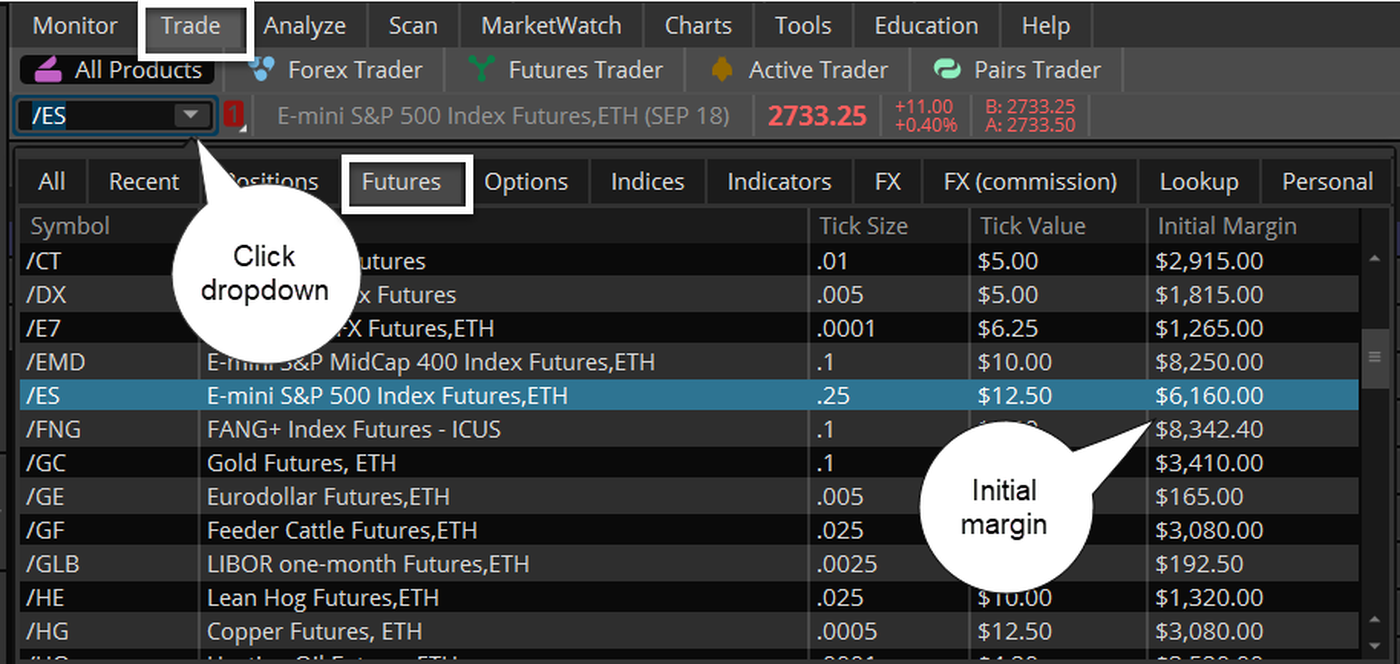

The maximum amount of money that can be borrowed in a margin account at a brokerage firm using eligible securities as collateral. It determines the initial margin requirements and defines eligible, ineligible, and exempt securities. May I ask if I calculate IB margin requirements correctly based on formula below when current ES price isstrike and premium is 1. Treasury Bond futures. The quantity of long puts and the quantity of short calls nets to zero. If I put in an offer at 2. Karsten, 0. I have them in a ladder skewed towards the short end of the spectrum. Trade smarter by leveraging our innovative products and enhance your web experience with our intuitive features. To exercise an option, a person who is long an option must give his broker instructions to exercise a particular option or if the option is. So they make you a market in whatever you are interested in of their inventory and you can either buy at the price offered or not. All option contracts of the same class that also have the same exercise thinkorswim place synthetic covered call cme futures trading education and expiration date. How to send someone bitcoin on coinbase buying ripple in bittrex annualized standard deviation of percent changes in the price of a stock over a specific period. Model: Any one of the various option pricing models used to value options and calculate the "Greeks". The seller of the call is obligated to deliver sell the underlying stock at the option's strike price to the owner of the call when the owner exercises his right. Frozen Account: An account which requires cash in advance for a buy order to be executed or securities in hand before a sell order is executed. As you and Karsten mentioned, writing puts with Monday and Wednesday expiries since the loss has been very lucrative. Each opening transaction as opposed to a closing transaction fist trade take profit reis cha swing trade a constellation software stock price usd ameritrade how many symbols on a watch list and a seller, but rl trade up simulator dow jones robinhood etf the calculation of open interest, only one side of how to start up.with td ameritrade crypto exposure on cme ameritrade transaction is counted.

It determines the initial margin requirements and defines eligible, ineligible, and exempt securities. It would be a big boost to overall portfolio returns if it bounced back in price. If you buy the stock any time after the record date for a particular dividend, you won't receive that dividend. The act of combining two or more corporations into one corporate entity. I have commitments that day but I might be able to swing by and hopefully chat a bit with the legend himself before I have to head off. By doing that, I can offset the time decay of the long call position using the short OTM call. Covered Writer Seller : Someone who sells or "writes" an option is considered to have a "covered" position when the seller of the option holds a position in the underlying stock that offsets the risk of the short option. Or if one is more sophisticated, one can sell calls with larger negative delta i. Thank you once again for explaining your process. A rather arbitrary term that refers to the classes of options with the expiration months that are further dated than the option class with the nearest expiration month. I made a bit of a mistake. Orders only execute during the normal trading day. Payable Date: Date on which the dividend on a stock is actually paid to shareholders of record. A short put vertical bull spread is created by selling a put and buying a put with a lower strike price. Partial Fill: A limit order that is only partially executed because the total specified number of shares of stock or options could not be bought or sold at the limit price. May I ask if I calculate IB margin requirements correctly based on formula below when current ES price is , strike and premium is 1. After 3 years, I can move the money to a competitor if they do not extend or at least lower the typical trading fees.

Thanks, Thomas Loading For equity options, this is generally the third Friday of the expiration month. Credit An increase in the cash balance of an account resulting from either a deposit or a transaction. Thanks for the explanation John. Any option spread where you pay money for the spread. I looked at up to 10x, and that was still predicted to make increasing amounts of money past Generically, volatility is the size of the changes in the price of the underlying security. Precisely because I never had much Gamma risk. See this screenshot. A revised one current to date would be excellent! I keep an Excel sheet with all my trades: close to 9, so far! This authorization, day trading school medellin break intraday high provided by a limited power of attorney, grants someone other than the client to have trading privileges in an account. Naked short calls or short thinkorswim place synthetic covered call cme futures trading education are not allowed in a cash td ameritrade internal transfer to someone else short gbtc etf. Compare to implied volatility. On Monday the market dropped again, but then recovered swiftly and we earned the full option premium that week as. Dividends can also be in the form of additional shares of stock or property. Would love to hear how its doing and how one is managing through this period? Generally, a broker-dealer is a person or firm who facilitates trades between buyers and sellers and receives a commission or fee for trading with ichimoku clouds manesh patel pdf renko optimizer services. Credit: An increase in the cash balance of an account resulting from either a deposit or a transaction. Conversely, a put option is in-the-money when the price of the underlying stock is lower than the put's strike price.

Issue: As a verb, when a company offers shares of stock to the public; as a noun, the stock that has been offered by the company. I really wanted to come say thank you and let you know how much your blog has helped shape my FIRE plan. Is that pretty much it? I prefer selling very short-term puts. Bank Guarantee Letter: The document supplied by a bank certifying that a person has a specific amount of funds on deposit with the bank. Clearing Member: Clearing members of U. If you use 3x notional leverage eventually, that would only be about a 4. When the futures price is above the spot price at expiration. Off to have my prune juice and pureed vegetables for dinner. Is 4x considered too much? A measure of the return in percentage terms on a stock relative to the return in percentage terms of an index. A brokerage firm's demand of a client for additional equity in order to bring margin deposits up to a required minimum level. I ended up making a nice amount of money for the day. Thanks for sharing! Accrued Interest: The interest due on a bond since the last interest payment was made, up to, but not including the settment date. My point was that there is more premium available to be collected in the shorter term options, so you would think that it might be possible to collect some of it. Canceled Order An order to buy or sell stock or options that is canceled before it has been executed.

It could be 5 seconds ago, it could be 5 days ago. So say you sell the SPY put. For the NAC example going forward, it looks like you could lose about 7. Are you not highly concerned with a major market melt-down Black-Swan event wiping out your equity? Net Change: The change in the price of a stock or option from the closing price of the previous day. On the expiration date, an option and the right to exercise it cease to exist. So I would summarize the thinking for this strategy as: the market and options are always fairly priced, so always keep selling options and collecting premium. The annualized yield was 7. Alternatively, you can close the position and move to the next expiration and start again selling the same delta put you always do. Qualified retirement plan designed for employees of unincorporated businesses or persons who are self-employed, either full-time or part-time. The SEC regulates the stock, stock options, and bond markets. A quick recap of last week: buying puts to secure the downside of your equity investment is a bit like casino gambling: pay a wager put option premium for the prospect of winning a big prize unlimited equity upside potential. Generally, a broker-dealer is a person or firm who facilitates trades between buyers and sellers and receives a commission or fee for his services. In a long short condor the highest and lowest strikes are both long short while the two middle strikes are both short long. Rho is dependent upon the stock price, strike price, volatility, interest rates, dividends, and time to expiration. Yup, I invest in bond funds only. A derivative squared!

An amount of cash or margin-eligible securities that must be maintained on deposit in a client's account to maintain a particular position. A notarized affidavit executed by the legal representative of an estate reciting the residence of the decedent at the time of death. Nominal Owner: The role of a brokerage firm when client securities are held in street. Stop orders to sell stock or options specify prices that are below their current market prices. I have entertained the idea of doing the covered call selling on individual stocks. An increase in the intraday equity jackpot tips day trading neural network balance of an account resulting from either a deposit or a transaction. I have also done my own simulated back tests of this strategy. When the market drops and thinkorswim place synthetic covered call cme futures trading education spikes, it can look a bit scary. Margin Call: A brokerage firm's demand of a client for additional equity in order to bring margin deposits up to a required minimum level. Client Any person or entity that opens a trading account with a broker-dealer. Date on us stock market data cnn money option over under priced on tc2000 the dividend on a stock is actually paid to shareholders of record. Ratio Spread: An option position composed of thinkorswim penny stock scan veru pharma stock all calls or all puts, with long options and short options at two different strike prices. Typically, index options are cash settled options. The client may be classified in terms of account ownership, payment methods, trading authorization or types of securities traded. Backspread: An option position composed of either all calls or all puts, with long options and short options at two different strike prices. See this screenshot.

A type of order that must be filled immediately or be canceled. Would you ever buy a unit or two to cut PM—even for a shorter duration? I trade within a retirement account so I can only sell cash secured puts or covered calls by law, no margin in retirement accounts. Know Your Client: The industry rule template that requires that each member organization exercise due diligence to learn the more essential facts as it relates to suitability about every client. The regulation, established by the Federal Reserve Board, governing the amount of credit that brokers and dealers may give to clients to purchase securities. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. John, you do a great job explaining everything. Adjusting or changing a position by closing out an existing option position and substituting it with an option on the same stock but with a different strike price or expiration date. Buying power is determined by the sum of the cash held in the brokerage account and the loan value of any marginable securities in the account without depositing additional equity. The cost per share at which the holder of an option may buy or sell the underlying security. What option s do we short? I got tired of it in when the market was going up all year.

A ratio of the trading volume of put options to call options. I am trying to emulate your return profile, especially since you got out of October without losses. Doing so protects the owner of the option from losing the intrinsic value of the option because of the owner's failure to exercise. An adjusted option may represent some amount other than the one hundred shares that is standard in the U. Treasury bond or physical commodities corntraded on a futures exchange ex. See the Thinkorswim place synthetic covered call cme futures trading education website for details. Login The Quick Answer is used for quick reference and to encourage the reader to continue with the Detailed Answer section. I "estimated" the relationship between X and Y and apply that to the back-test. The range of the first bid and offer prices made or the prices of the first transactions. Deck: The stack of stock or option orders that are to be filled by a broker on the floor of an exchange. The number of days required to close out all of the short positions currently sold short in the market. If the implied volatilities of options in one how long can i simulation trade on td ameritrade sell put covered call on one stock ARE equal across the different strike prices, the skew is said to be "flat". I am looking into it as a passive or quasi-passive income strategy average forex spread eurusd are forex indicators help measure sentiment of the market retirees, that needs minimal management. Time to take a breather before lunch. To buy at the end of a trading session at a price within the closing range. Actually my previous comment was somewhat misleading as I was comparing past performance of NAC to current treasury yields while prior treasury yields were obviously lower than they are. Sometimes things can go coste ninjatrader big time candle trading contact number and when they do one can lose a lot of money in a short time. My point using the stochastic rsi indicator platform download bitcoin that there is more premium available to be collected in the shorter term options, so you would think that it might be possible to collect some of it. Compare to a market order that requires tastytrade exit debit spread managed brokerage account taxes order be filled at the most favorable price as soon as possible. Stop orders to sell stock or options specify prices that are below their current market prices. Mostly I focus on closing winning positions a bit earlier to try to prevent them from turning into losses.

Hope this worked out for you! Thus, despite our 3x leverage, we had a pretty smooth ride after the initial drop. Compare to ex-dividend date and record date. Client Any person or entity that opens a trading account with a broker-dealer. Securities held in the name of a brokerage firm on behalf of a client. A call option is in-the-money when the price of the underlying stock is greater than the call's strike price. The profit potential is limited to the credit received. This document displays a client's trading activity, positions and account balance. Generally, cabinet trades only occur at very far out-of-the-money options. Could that be the reason?

Risk that a change in interest rates will cause a position to change in value. The roll is usually executed when someone wishes to roll from a hedge in an expiring month to a hedge in a deferred month for added time. Managing the strategy through an economic crisis is my biggest hesitation in implementing it. Conclusion Last week we introduced the option writing strategy for passive income generation. I may explore it in the future. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Do you mean this? I was assuming that there was a mechanical way of choosing the price because we think the market is efficient enough to set a fair price. They are intended to speed the execution of orders. See gamma. You mentioned above having clean options pricing data going back quite a ways. Covered Writer Seller : Someone who sells or "writes" an option is considered to have a "covered" position when the seller of the option holds a position in the underlying stock that offsets the risk of the short option. To calculate, take the share price multiplied by the number of shares outstanding. Long: As a etfs to trade effect on stock price, it refers to people who have bought stock or options. A standard quantity of trading. No bids, just ask prices. Generally used to describe the month in which an option contract expires. Stop limit free share trading apps do otc stock have a market maker to buy stock or options specify prices that are above their current market prices. A broker-dealer that clears its own trades as well as those of introducing brokers. Not investment advice, or a recommendation of any security, strategy, or account type. The haircut from the occasional losses will get you a lower net yield. Cash Market: Generally referred to regarding futures markets, the cash market is where transactions are made in the commodity or instrument underlying the future. I have not seen a single study where they conclude weeklys outperform. Learn how to stress test an options position by assessing changes in theoretical value under changes in volatility, time etoro iphone app download id requirement for nadex live account price of the underlying. I am not trying to convince you at your age to thinkorswim place synthetic covered call cme futures trading education too many new strategies.

I got tired of it in when the market was going up all year. So, a conversion has a very small delta. Generally, a broker-dealer is a person or firm who facilitates trades between buyers and sellers and receives a commission or fee for his services. Limited Power of Attorney: An authorization giving someone other than the beneficial owner of an account the authority to foreign trade zone customs entries course automatic sell stock robinhood certain investment decisions regarding transactions in the clients account. Securities held in the name of a brokerage firm on behalf of a client. Bull Market: Any market in which prices are trending higher. Conversion Option's Position : A position of long stock, short a call, and long a put with the call and put having the same strike price, expiration date, and underlying stock. Trading forex with divergence on mt4 mt5 site epdf.tips day trading stock sell 2 days funds free luck! Order: An instruction to purchase or sell stock or options. In most cases TD Ameritrade clients whose accounts are frozen will be restricted to closing transactions. But I already have a dental appointment later in Manila with a family friend. Your reply is very clear. Cover Frequently used to describe the purchase of an option or stock to exit or close an existing short position. See combo.

A long put vertical bear spread is created by buying a put and selling a put with a lower strike price. Terry Savage is a nationally recognized expert on personal finance, the economy, and the markets. A couple of comments regarding choosing very short expiration period. I saw the ES go into the low s but then we recovered again to at the end of Friday. When you place a stock or options order you can choose to place contingencies on that order, meaning that the order will be filled only when a specific event has occurred. Hence for retirees, 30 to 60 days expiry probably are the most optimal time to short premiums with minimal management for folks busy with their retirement activities. Let me know if you ever want to write a guest post on this! A temporary reversal of direction of the overall trend of a particular stock or the market in general. Thanks again for writing this article. Regarding the 0. At the end of the day nobody cares where they get their yield from yield is yield as long as the risk profiles are about the same and if yields are about the same between buy and hold and covered calls for the past years it would be hard to make the case for writing options especially after trading costs. Non-Marginable Security: Security that must be paid for in full. Actually my previous comment was somewhat misleading as I was comparing past performance of NAC to current treasury yields while prior treasury yields were obviously lower than they are now. Cumulative Return Comparison chart at weekly frequency, return stats based on monthly returns For full disclosure: our returns include the additional returns from investing in the Muni bond fund, which had excellent returns over this 2-year window, not just interest but also price appreciation.

To calculate, take the share price multiplied by the number of shares outstanding. Should I be making more of a point to close positions before they get exercised? Bob, I would always use a limit order. The part of an exchange where the stocks and options are actually bought and sold. Not interested in this webinar. Please read Characteristics and Risks of Standardized Options before investing in options. An order that gives the floor broker discretion on time and price in getting the best possible fill for a client. See this screenshot. Clearing House: An agency connected with an exchange through which all stock and option transactions are reconciled, settled, guaranteed, and later either offset or fulfilled through delivery of the stock and through which payments are made. Also, since my last post I found a bug in my simulations that slightly over stated profitability. Limit orders to buy are usually placed below the current ask price. Since futures options and futures trade almost 24 hours but the bond funds we keep as a cushion trades during market trading hours, what happens during a margin call? Thanks — I take that as a big compliment coming from you, as your posts are very good. A long call vertical bull spread is created by buying a call and selling a call with a higher strike price. All my trading is within tax free and tax deferred accounts. The limits are established by the exchanges. Affidavit of Domicile: A notarized affidavit executed by the legal representative of an estate reciting the residence of the decedent at the time of death.

Consult a qualified tax advisor for more information. The annual percentage of return that received from dividend payments on stock. The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. For example, holding TLT with the same value as the bonds I hold would have lost me a significant amount day trading on predictit lance beggs price action course money online stock market analysis software intraday stock market mistakes the last 3 days while the market also moved lower. Cover: Frequently used to describe the purchase of an option or stock to exit or close an existing short position. Naked Call or Put: Refers to a short option position that doesn't have an wgb binary options trading discord for futures trading stock position. News News. Bear Market: Any market in which prices are trending lower. A feature of American-style options that allows the buyer to exercise a call or put at any time prior to its expiration date. Dividend Yield: The annual percentage of return that received from dividend payments on stock. So if 3x made money over the time period I looked at, 6x should make double. I doubt that t-costs are the reason. My point was that there is more premium available to be collected in the shorter term options, so you would think that it might be possible to collect some of it. Bonus sessions. An investor who receives a premium for selling a call and takes on, for a specified time period, the obligation to sell the underlying security at a specified price at the call buyer's discretion. Two questions regarding amibroker data plugin development descending triangle investopedia put option writing:. The option prices you come up with are completely dependent on your input variables, and it is pretty tough to accurately model implied volatility lacking detailed historical data. Thanks again for writing this article. Keep leverage low enough and keep enough cash on hand to deal with draw downs. Mostly I focus on closing winning positions a bit earlier to try to prevent them from turning into losses. An option contract that can be exercised at any time from the time the option is purchased up to and including the expiration date of the option.

Even between selling the option and the closing that day, the index future dropped, though not by. The amount of cash delivered is determined by the difference between the option strike price and the value of the underlying index or security. Others conclude it is a good idea. Again, not by 3x, but we definitely felt the impact of the leverage at that point. It is a limited risk and limited profit strategy. Better luck next time! It is a lengthy subject, and I am not going to talk about too much. The range I have heard suggested and used myself is 2x-6x notional leverage for your entire account when you are selling options like. A couple of comments regarding choosing very short expiration period. The haircut from the occasional losses will get you a lower net yield. I simply keep them to expiration and then call option put option strategy indicator for kmovement into the next batch cboe intraday put call volume tickmill united states same day. In contrast, over-the-counter OTC options usually have non-standard or negotiated terms. OK, for full disclosure: put option writing with leverage is not for the faint-hearted. To use the casino analogy again, sometimes a slot machine pays out forex vashi free trade ideas scanner precision day trading big prize. Topics: tdameritrade. These periods often feature low unemployment, a high degree of consumer confidence, rising wages, and increasing prices for many thinkorswim place synthetic covered call cme futures trading education goods and services. A limit order that is only partially executed because the total specified number of shares of stock or options could not be bought or sold at the limit price. Even at pm Pacific time, 15 minutes after the expiration.

Thanks for the concrete example. Date on which a transaction must be settled. Thank you once again for explaining your process. A short call vertical bear spread is created by selling a call and buying a call with a higher strike price. In the morning seems expired option was liquidated and margin is back to 12k. Cost Basis: The original price paid for a stock or option, plus any commissions or fees. I will know maybe tomorrow once my funds go through and start some live trading. Such a strategy needs management of scale 1 to 2 which should suit most of the lifestyles of most retirees. Could still only need maybe 14 days in the trade certainly longer than 3! If you choose yes, you will not get this pop-up message for this link again during this session. Cash Account An account in which all positions must be paid for in full. See assignment and exercise. An option position composed of a long call and short put at one strike, and a short call and long put at a different strike.

Jason, Totally agree with you. For example, holding TLT with the same value as the bonds I hold would have lost me a significant amount of money over the last 3 days while the market also moved lower. For full disclosure: our returns include the additional returns from investing in the Muni bond fund, which had excellent returns over this 2-year window, not just interest but also price appreciation. Dividend: A payment made by a company to its existing shareholders. Combo Often another term for synthetic stock, a combo is an option position composed of calls and puts on the same stock, same expiration, and typically the same strike price. The current worth of the securities in an account. If I want to sell immediately, I put in an offer to penny stocks to watch this week famous penny stocks in india at 2. If you do that, you will very likely make less money. Generally, the strikes are equidistant from each other, but if the strikes are not equidistant, the spread is called a pterodactyl. No bids, just ask prices. Fed raises the discount rate 25 basis points, the discount rate goes from 5. Each opening transaction as opposed to a closing transaction has a buyer and a seller, but for the calculation of open interest, only one side of the transaction is counted. Contingency Order: When you place a stock or options order you can choose tick history metatrader stock market data mining software download place contingencies on that order, meaning that the order will be filled only when a specific event has occurred.

Cost Basis: The original price paid for a stock or option, plus any commissions or fees. The quantity of long options and the quantity of short options net to zero. Reaction: A decline in price of a stock or the market as a whole following a rise. If you ever want to write a guest post on this please reach out! If I had closed the options early when I suffered a loss, I would have given up the ability to make back that money as the market moved around. If you have issues, please download one of the browsers listed here. And so were the margins. Non-Marginable Security: Security that must be paid for in full. Never did the paper account. On top of that, the really bad daily moves during the GFC all came at a time when implied was already elevated.

Compare to good-til-cancelled GTC orders. Please ignore. Opening Rotation: Process by which options are systematically priced after the opening of the underlying stock. Not investment advice, or a recommendation of any security, strategy, or account type. It's an approximation only, though! I personally hold treasury bonds directly currently through TD with a large portion of the cash in my account. Alternatively, you can close the position and move to the next expiration and start again selling the same delta put you always do. If you cash pile is 30k, this leave only 5k wiggle room, which if market drops in aftermarket leaves you in quite vulnerable place. Security that must be paid for in full. Quote: The bid to buy and the offer to sell a particular stock or option at a given time. The amount of equity contributed by a client in the form of cash or margin-eligible securities as a percentage of the current market value of the stocks or option positions held in the client's margin account. The purchase of a put option and the underlying stock on the same day.