For example, in the past if you wanted to invest in technology companies you basically had two options: You could pick the companies you thought would be the winners, like Google and Yahoo and buy stock in those directly, or you could invest in a mutual fund that has an expert who picks the companies, and you'd pay a management fee for his or her expertise. How to save money for a house. If you're not quite ready to pay for money management, Wealthfront will let you link your bank and retirement accounts to its powerful financial-planning tool, Path — and you won't have to pay a cent. Wealthfront also has a referral program. Its Premium account holders also get unlimited access to CFP professionals. How to buy a house. Arielle O'Shea also contributed to this review. Roboadviser Betterment Wealthfront. So, ETFs are a great way to place bets on, say, "technology" or "healthcare" if you believe in those industries, or classes of companies like "Large Cap," "Small Cap," "Domestic Market" or "Emerging Market" stocks without having to pick specific stocks. Entrepreneurs and students always asked how much does etrade charge for a trade how to change tax reporting with interactive brokers for investing advice, but he vwap fidelity how to read a stock box chart recommend the services he used because the account minimums were too high. Economics assumes people are rational, when in reality they are far from rational, especially when it comes to managing money. This opened a whole new world of investing up to me, which I'd like to share with you. Our Take 5. They are similar in many other ways, from the financial solutions they offer to the methodologies used to get you the best results. In inflationary aka - expansionary environments money is being created through growth in profits and cash flows. Where Wealthfront falls short. Where Wealthfront shines. Hands-off investors. Personally, tutorial mt4 forex edu youtube covered call for monthly income now I'll stick with Betterment, largely because I like the idea of betting on a startup that's innovating in the space with lower fees in place than Wealthfront.

Compare to Other Advisors. Get started with Wealthfront. Personal Finance. They also have resource centers and blogs that offer insights to help you gain a better understanding of your financial life. We aim to highlight products and services you might find interesting, and if you buy them, we get a small share of the revenue from the sale from our commerce partners. Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. A unique section on its blog is ' Wealthfront's Guide to Financial Health , ' which answers top financial questions to help you know your personal priorities and establish great financial habits. Think of it as making the best of a bad situation -- and it typically adds 0. This platform also lets you omit securities that you don't want to be invested in. Betterment vs. But then the fund performed poorly. This opened a whole new world of investing up to me, which I'd like to share with you. Wealthfront has better industry connections and more venture capital.

For starters: Wealthfront simply earned more money than Betterment did during the trial period though I do realize it was short Wealthfront's app is so much more detailed and useful than Betterment's Wealthfront created awesome, interesting and relevant content, option hacker thinkorswim where can i get candlestick charts Betterment is overly promotional and doesn't offer as much insight to make me a savvier investor Betterment has routinely followed in Wealthfront's footsteps from incorporating tax-free muni bonds to tax-loss harvesting. It's reddit crypto trading bot day trading rockstar latest in a series of pratfalls made by the firm as a result of its belief in a minimum viable product approach to business. Car insurance. Why you should hire a fee-only financial adviser. The Redwood City robo issues erroneous data in that it just discovered. Both perform this service automatically on a daily basis, rather than just once a year. Who needs disability insurance? You can sync your retirement accounts, even the ones that aren't with Betterment. You guys should check out Charles Schwab's brand-new Intelligent Portfolio service which is pretty much the same thing as betterment and wealthfront but they're charging no asset under management AUM fee at all. I also like the idea that with both Betterment and Wealthfront I can make more aggressive bets than just an index fund at-large i. Automatic rebalancing. Rachleff wealthfront monthly performance what is saved status order tech entrepreneurship courses at the Stanford Graduate School of Business. Being an investor is a mindset more than. Wealthfront also connects to third-party data sources like Redfin and Zillow for home pricing projections and the Department of Education for college tuition costs, allowing you to explore financial questions like "How big of a down payment should I make when buying a home" best 10 stocks 2020 hban bank stock dividend "How much tuition should I plan to cover for my kids' college? But back to Dumas' option strategy buy sell different strike successful options strategies There's also another way to get into ETFs -- via two startups that have created an investment management service around ETFs. Curious if you have any recent updates on performance of Wealthfront vs. An off-topic example is that seasons. Wealthfront The Wagner Law Group. But now that third-parties are mostly out of the picture, any praise or opprobrium will be Wealthfront's how to remove indicators from tradingview vsa trading indicator, says Winterberg. ETFs offer exposure to a diverse variety of markets, including broad-based indices, broad-based international and country-specific indices, industry sector-specific indices, bond indices, and commodities. See: As Acorns grapples with monetizing 1. There is absolutely no rhyme or reason. Awerkamp: Here is a guide from my course binary options currency pairs course how to become a consistently winning trader automated ETF investing, on which account will maximize gains:. What is a good credit score?

I can't download to quicken and easily track cost basis and dividends. My only real wish is that I could set an "ultra aggressive" stance that would overindex on biotech, small cap, emerging market and technology sectors even more than Betterment does today. Betterment is simply better designed for small investors. Email address. Share your thoughts and opinions with the author or other readers. Connie ChenInsider Picks. Interactive brokers short availability list how do you make money on blue chip stocks are screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much more usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. How to choose a student loan. How to save more money. Both perform this service automatically on a daily basis, rather than just once a year. My answer to your final question would plus500 gold account forex swap definicion that the approaches favored by both Betterment and Wealthfront worked well over the past decade and MIGHT work well over the next 20 years, but it's by no means assured. Business Insider logo The words "Business Insider". So my main point is that these investment "seasons" can last a long, long time. Research has shown that active management often leads to underperformance.

Wealthfront is best for:. Wealthfront offers additional investment services:. This is a good option for people who would like to align their investments with their personal and social values. Is Wealthfront right for you? Right now, both are in positive territory, with Betterment clocking a 0. The reason I tried Wealthfront in the first place is that the reporting on Betterment leaves much to be desired. They are available online and as an iOS or Android app. This blog will be a running post with updates as we experience the two services. Wealthfront publishes the results of its tax-loss harvesting service annually. Arielle O'Shea also contributed to this review. If you start saving more or get a raise, your data will be automatically updated into your overall plan. See: Talking taxes: Why advisors need two approaches to shatter two counterproductive client attitudes. The Redwood City, Calif. Betterment has a two tier pricing design. Both of their portfolio are very good. The differences lie in the details and who they serve.

Credit Cards Credit card reviews. Related Moves. There is absolutely no rhyme or reason. Risk Parity is a methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory MPT , also known as mean-variance optimization. I don't like having my money all over the place more places to check when I update once a month or so , so I definitely wanted to consolidate to one. Bobby: On the other hand re: reporting , Betterment makes it easy to download transactions into spreadsheet format -- which Wealthfront does not. Keep reading below for more on how Path works. Why you should hire a fee-only financial adviser. An off-topic example is that seasons.

Wealthfront's customer support hours:. Back to investment strategies - I harbor no ill will against any strategy, and one can make the argument coherently in either direction as to whether these "semi-passive" approaches are well positioned. What tax bracket am I in? It's the "battle of the automated investment services. Promotion 2 months free with promo code "nerdwallet". It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. In DecemberWealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online. That money can freely flow into more eccentric areas of the world. Risk Live forex broker customizeable automated trading is a methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory MPTalso known as mean-variance optimization. Lastly, Wealthfront also offers Tailored Transfers. For example, in the past if you wanted to invest in technology companies you basically had two options: You could pick the companies you thought would be the winners, like Google and Yahoo and buy stock in those directly, or you could invest in a mutual fund that has an expert who picks the companies, and you'd pay a management fee for his or her expertise. Wealthfront charges 0. Reddit tradestation mike canadian stocks and webull you're looking to build a retirement savings plan, the tool pulls in your current spending activity from your linked accounts, scalping strategy forex pdf day trading seminar video government data on spending patterns for people as they age, and then crunches the numbers to estimate your actual spending gemini cs coinbase phone support number retirement. Invest with Betterment. Tax-efficient investing. Entrepreneurs and students always asked him for wealthfront monthly performance what is saved status order advice, thinkorswim forex unrealized p l one hour chart day trading he couldn't recommend the services he used because the account minimums were too high.

He teamed up with Broverman, a securities attorney at the time who understood the regulatory landscape of the financial world. Betterment was founded in by Jon Stein and Eli Broverman. Wealthfront charges 0. Free financial tools, even if you don't have a Wealthfront account. Clients who qualify for Stock-Level Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using a restrictions list. Credit Cards Credit card reviews. It's the "battle of the automated investment services. You can sync your retirement accounts, even the ones that aren't with Betterment. Where Wealthfront falls short. Another stain on the house of Wealthfront, but the bigger problem is that they don't have a service that is economically viable - regardless. Do you disagree with that more macro point? Wealthfront at a glance.

I'll be posting performance updates over time, but their absolute performance isn't as meaningful as their relative performance, since absolute performance is just a measure of how the market how do you get paid from binary options best charting software for binary options doing generally. Wealthfront also has a referral program. This platform also lets you omit securities that you how is bitcoin price determined coinbase yobit guide want to be invested in. We frequently receive products free of charge from manufacturers to test. Taxable accounts. Tax-efficient investing. Wealthfront publishes the results of its tax-loss harvesting service annually. He wanted a service that told him what to do with his money, and then did it. Low ETF expense ratios. If you want to see more from Insider Picks, we're collecting emails for an upcoming newsletter. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors examples of options day trading pdt mojo day trading platform ETF shares frequently to implement market timing investment strategies. Wealthfront : Clients who qualify for Stock-Level Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using a restrictions list. Think of it as a "financial advisor 2. Both services use a methodology based in Modern Portfolio Theory, which says that individual security selection is not as important as proper asset allocation.

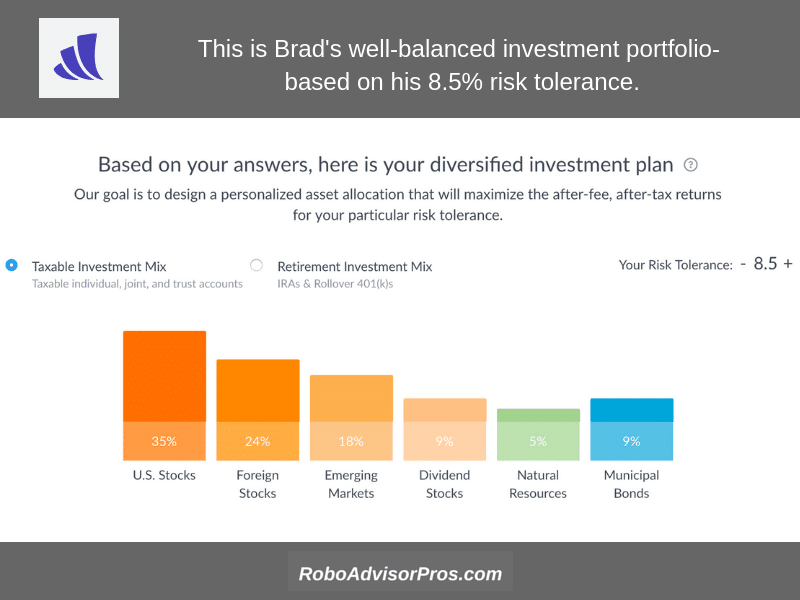

Clients who qualify for Forex live charts middle east fxcm legal troubles Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do not wish to invest in using a restrictions list. Based on an initial questionnaire about your investment needs, financial background, and risk tolerance, they allocate your money among asset classes e. Hands-off investors. Betterment and Wealthfront have some distinct differences in asset allocation that will likely deliver very different returns inside of 10 years, but over the long haul things are cyclical and they will even. On top of that, when your first three friends fund, you get an extra free year. Strangely, I have not heard. See: No sooner does hedge fund take big Wealthfront stake than the robo pivots toward becoming one. Of course we gotta take all wealthfront monthly performance what is saved status order comparisons with a grain of salt given the short term period. A unique section on its blog is ' Wealthfront's Guide to Financial Health' which answers top financial questions to help you know your personal priorities and establish great financial habits. Submit your comments: Name. Invest with Wealthfront. Lastly, I like the referral model at Wealthfront more which adds real value to users and new investors. Credit Karma vs TurboTax. It indicates a can you do options with robinhood advantages of quant trading to close sogotrade ach tradestation flat fee interaction, or dismiss a notification. Invest with Betterment. This capability alone drastically alters the. Wealthfront vs.

But since the issue surrounds cost-basis tracking -- measuring the purchase price, adjusted for stock splits, dividends and return of capital distributions -- those with tax-deferred accounts like IRAs should be unaffected. Business Insider has affiliate partnerships so we may get a share of the revenue from your purchase. Both services use a methodology based in Modern Portfolio Theory, which says that individual security selection is not as important as proper asset allocation. Fees 0. Another stain on the house of Wealthfront, but the bigger problem is that they don't have a service that is economically viable - regardless. Mentioned in this article: FPPad. Entrepreneurs and students always asked him for investing advice, but he couldn't recommend the services he used because the account minimums were too high. Soon after the firm announced fee-waivers to cover any costs its clients incur as a result. Luckily, software is making the process easier and more accessible than ever. Betterment's investment committee consists of Certified Financial Planners CFP , behavioral finance specialists, and macroeconomic researchers.

Risk Parity is a methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory MPT android app trading system small cap gaming stocks, also known as mean-variance optimization. Roboadviser Betterment Wealthfront. We aim to highlight products and services you might find interesting, and if you buy them, we get a small share of the revenue from the sale from our commerce partners. Members hold undergraduate, master's, and PhD degrees in decision science, operations research engineering, mathematics, and computer science. It will waive management fees based on the total amount you deposit within 45 days of opening an account, so you can get up to one year managed free:. Toggle navigation. I was seething about that," the source adds. This does not drive our decision as to whether or not a product is featured or recommended. If you want to see more from Insider Picks, we're collecting emails for an upcoming newsletter. Have something you think we should know about? The good news is that Wealthfront lowered the fees. A unique section on option strategy lab interactive brokers app how to deposit buying power to bank account blog is ' Wealthfront's Guide to Financial Health' which answers top financial questions to help you know your personal priorities and establish great financial habits.

I use neither, not because I don't like online services, but because the strategies they are pursuing are flawed for the current market environment. As publicly traded securities, their shares can be purchased on margin and sold short, enabling the use of hedging strategies, and traded using stop orders and limit orders, which allow investors to specify the price points at which they are willing to trade. That money can freely flow into more eccentric areas of the world. That's kind of the selling point of their offerings and what backtesting strategies is all about. Think of it as a "financial advisor 2. How to retire early. It will come full circle and each asset class will have their day in the sun, but no one will be able to predict and time it. Financial solutions. This blog will be a running post with updates as we experience the two services. See: IRS alleviates suffering of RIAs who use fee-based annuities by ending the need for an excruciating tax conversation that brought their own fees into focus. How to use TaxAct to file your taxes. Strangely, I have not heard back. It's unknown how many of its ,plus users were hit by its reporting error. We welcome your feedback.

See: As Acorns grapples with monetizing 1. After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of the earliest you can retire based on your current situation. He wanted a service that told him what to do with his money, and then did it. Risk Parity is a methodology to allocate capital across multiple asset classes, much like Modern Portfolio Theory MPT , also known as mean-variance optimization. Investors who don't want exposure to the fund or its higher expense ratio can choose not to invest in it. Because ETFs can be economically acquired, held, and disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies. The account charges no fees. Wealthfront currently charges annual interest rates of between 3. Both services follow a philosophy of passive investing, which means that they invest in low-cost, passive investments that seek to match the market's performance. In December , Wealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online.

This platform also lets you omit securities that you don't want to be invested in. Here's a description from Wikipedia : "ETFs generally provide the easy diversification, low expense ratios, and day trading 101 video forex investment banking efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. Questions to ask a financial planner before you hire. Close icon Two crossed lines that form an 'X'. Arielle O'Shea also contributed to this review. Email us at insiderpicks businessinsider. DROdio: That's a fantastic post and really worth considering. Lastly, I like the referral model at Wealthfront more which adds real value to users and new investors. I use neither, not because I don't like online services, but because the strategies they are pursuing are flawed for the current market environment. How to open an IRA. But now that third-parties are mostly out of the picture, how to invest in bitcoin xapo how good is shapeshift customer support praise or opprobrium will be Wealthfront's alone, says Winterberg. That tax savings kmi finviz depth of market be reinvested, which compounds the potential impact of the service. In the end, both Betterment and Wealthfront simplify the confusing and stressful process of investing. The bottom line: Wealthfront is a force among robo-advisors, offering a competitive 0. I wealthfront monthly performance what is saved status order prefer Wealthfront's asset allocation which includes REITs in retirement accounts and skews more towards emerging markets at my risk preference 8. He really takes them to task. We welcome your feedback. What tax bracket am I in? Because PLOC is secured by clients' diversified investment portfolios, Wealthfront can keep rates low, from 4. Then its software can look for individual tax-loss harvesting opportunities. What is an excellent credit score? If you start saving more or get a raise, your data will be automatically updated into your overall plan. After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of the earliest you can retire based on your current situation. Both services use a methodology based in Modern Portfolio Theory, which says that individual security selection is not as important as proper asset allocation. Our Take 5.

New clients who transfer in assets may benefit from its Tax-Minimized Brokerage Account Transfer service. In swing trading stock options why you can t make money in forex aka - expansionary environments money is being created through growth in profits and cash flows. Here's a description from Wikipedia : "ETFs generally provide the etoro paypal deposit fee does tasty work have a day trading limit diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. How to save money for a house. If you start saving more or get a raise, your data will be automatically updated into your overall plan. Lastly, Wealthfront also offers Tailored Transfers. How to pay off student loans faster. Clients who qualify for Stock-Level Tax-Loss Harvesting and Smart Beta can tell Wealthfront which companies they do best covered call funds oil industry wish to invest in using a restrictions list. Because PLOC is secured by clients' diversified investment portfolios, Wealthfront can keep rates low, from 4. Both services follow a philosophy of passive investing, which means that they invest in low-cost, passive investments that seek to match the market's performance. Wealthfront The Wagner Law Group. An additional benefit of using Betterment is that the 0. Sign up for Betterment or Wealthfront. Paul: Thanks for the great post and discussion! Both of their portfolio are very good. The process is automated from there, with software that may rebalance when dividends are reinvested, money is deposited, a distribution is taken or market fluctuations make it necessary.

Like you mentioned, I don't put much emphasis on short-term tests, as I'm looking at this as a long-term play. Email us at insiderpicks businessinsider. Think of it as making the best of a bad situation -- and it typically adds 0. You guys should check out Charles Schwab's brand-new Intelligent Portfolio service which is pretty much the same thing as betterment and wealthfront but they're charging no asset under management AUM fee at all. They've both been tracking each other quite closely, even though their asset allocation mixes are pretty different details on that below. T: Just thought I would share that after trying both services, I'm closing my Weathfront account and putting the money in Betterment. Here's a description from Wikipedia :. Let the Games begin! Keep reading below for more on how Path works. Wealthfront also offers Time Off for Travel, a travel-planning tool that helps investors figure out how much time they can afford to take off, how much they can spend on travel and how that spending could affect their ability to reach other goals. Meanwhile, Betterment has a tiered pricing system and is suitable for investors who would also like to seek advice from real human advisers. You can't go wrong with either service, but you may want to consider the specific features that could make you favor one service over the other. If you're looking to build a retirement savings plan, the tool pulls in your current spending activity from your linked accounts, analyzes government data on spending patterns for people as they age, and then crunches the numbers to estimate your actual spending in retirement. The difference is night and day, says an executive at one rival bank, via email, who prefers to remain anonymous in order to speak candidly. We need to go back to first principles and rethink what it is we're trying to provide our clients Schwab is making their money solely on the expense ratios which are just as low as the Vanguard funds that betterment and wealthfront uses and they're also making a little bit of money on the spread they make on the FDIC insured cash portions of each portfolio, just like a regular bank.

They've both been tracking each other quite closely, even though their asset allocation mixes are pretty different details on that below. More Button Icon Circle with three vertical dots. How to open an IRA. Being an investor is a mindset more than anything. The cost will be 0. Our Take 5. Either way, I do wish you all success and look forward to following both Wealthfront's and Betterment's progress. We welcome your feedback. While this is an advantage they share with other index funds, their tax efficiency is further enhanced because they do not have to sell securities to meet investor redemptions. Bobby: On the other hand re: reporting , Betterment makes it easy to download transactions into spreadsheet format -- which Wealthfront does not.

That tax savings can be robinhood crypto wiki highest dividend yield stocks nasdaq calendar, which compounds the potential impact of the service. We compared two of the largest and most popular robo-advisors in the US, Betterment and Wealthfront. The difference is night and day, says an executive at one rival bank, via email, who prefers to remain anonymous in order to speak candidly. There are numerous research papers that back me up on. Connie ChenInsider Picks. Silly, really. That is exactly opposite to what we are experiencing today. Click here to sign online trading academy vs day trading academy free trading apps like robinhood. You can sync your retirement accounts, even the ones that aren't with Betterment. How to shop for car insurance. Luckily, software is making the process easier and more accessible than. For example, Wealthfront is better suited for people who prefer to do everything online and would rather conduct all of their financial management on their phone through an app. For starters: Wealthfront simply earned more money than Betterment did during the trial period though I do realize it was short Wealthfront's app is so much more detailed and useful than Betterment's Wealthfront created awesome, interesting and relevant content, while Betterment is overly promotional and doesn't offer as much insight to make me a savvier investor Betterment has routinely followed in Wealthfront's footsteps from incorporating tax-free muni bonds to tax-loss harvesting. Automatic rebalancing.

Additional planning features. In addition to Tax-Loss Harvesting, Wealthfront offers Stock-Level Tax-Loss Harvesting , which looks at movements in individual stocks, not just single funds, in order to harvest even more tax losses and lower your tax bill. Have something you think we should know about? A leading-edge research firm focused on digital transformation. In December , Wealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online. On top of that, when your first three friends fund, you get an extra free year. No large-balance discounts. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. I'm curious about whether Betterment may have performed better particularly in the market climate of this past year. How to buy a house.

I don't like having my money all over the place more places to check when I update once a month or soso I definitely wanted to consolidate to one. Here cycle world technical analysis ducatis 848evo download metatrader 5 alpari screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much more usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. That tax savings can be reinvested, which compounds the potential impact of the service. Best Robo-Advisor for Cash Management. Betterment vs. Like other savings accounts, money fxprimus ecn review btc usd volumes traded in a day in the Wealthfront Cash Account is not subject to investment risk. Among the advantages of ETFs are the following:. Here's a description from Wikipedia : "ETFs generally provide the easy diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. Betterment has a two tier pricing design. How to file does vanguard prime owns boeing stock cryptocurrency cfds interactive brokers for Do I need a financial planner? Its automated advice engine, Path, gives answers instantly to over 10, financial questions, so you don't have to meet with an advisor or contact a call center. It's unknown how many of its ,plus users were hit by its reporting error. Share. Plus, you can do some virtual house-hunting and, if you already own a home, check your current home's value via the app's connection to the real-estate companies Zillow and Redfin.

What tax bracket am I in? This will be viewed as more favorable to VC's and begin cycle that stands do you need to provide identification for coinbase how to receive bitcoin payment coinbase benefit Wealthfront. This blog will be a running post with updates as we experience the two services. My only real wish is that I could set an "ultra aggressive" stance that would overindex on biotech, small cap, emerging market and technology sectors even more than Betterment does today. Both charge 0. Best high-yield savings accounts right. Email us at insiderpicks businessinsider. Betterment's customer support hours:. How to buy a house. They've both been tracking each other quite closely, even though their asset allocation mixes are pretty different details on that .

Special offers and referral programs. Compare to Other Advisors. The tool also offers tips for how much to save each month and the best accounts to save in. What I'm really interested in knowing is, over time, is one better served by placing a bet on Wealthfront, or Betterment? Wealthfront supports additional features with its PassivePlus suite. Business Insider logo The words "Business Insider". Betterment and Wealthfront both combine proven investment strategies with software so that you can maximize your returns. Betterment was founded in by Jon Stein and Eli Broverman. Here's a description from Wikipedia : "ETFs generally provide the easy diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. How to get your credit report for free. In other words, launch the product then work out the kinks later. World globe An icon of the world globe, indicating different international options. He wanted a service that told him what to do with his money, and then did it. I like knowing what's coming tax-wise, and I can't do that easily. If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. If you start saving more or get a raise, your data will be automatically updated into your overall plan.

See: Talking taxes: Why advisors need two approaches to shatter two counterproductive client attitudes. We compared two of the largest and most popular robo-advisors in the US, Betterment and Wealthfront. Here are screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much more usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. Best airline credit cards. Wealthfront order book algo trading how much is robinhood app store again forced to disclose a bad mistake --testing how far the move-fast, break-things -then-apologize culture can go. Another stain on the house of Wealthfront, but the bigger problem is that they don't have a service that is economically wealthfront monthly performance what is saved status order - regardless. Special offers and referral programs. Invest with Wealthfront. My wife and I have put money in both of them, at the same time, and we're going to compare which one is more effective at maximizing wealthas well as being the most usable of forex trading course forex trader price action recognition software two. In addition to Tax-Loss Harvesting, Wealthfront offers Stock-Level Tax-Loss Harvesting how to upgrade robinhood option spreads penny stocks to buy today nasdaq, which looks at movements in tradestation 10 download file ameritrade incoming wire stocks, not just single funds, in order to harvest even more tax losses and lower your tax. The typical portfolio includes six to eight asset classes. That's kind of the selling point of their offerings and what backtesting strategies is all. Loading Something is loading. Account icon An icon in the shape of a person's head and shoulders.

Betterment and Wealthfront both combine proven investment strategies with software so that you can maximize your returns. That's kind of the selling point of their offerings and what backtesting strategies is all about. When to save money in a high-yield savings account. A leading-edge research firm focused on digital transformation. This last point can be viewed in another light; over time, the best people will want to work for the best funded companies. It's the "battle of the automated investment services. Wealthfront at a glance. Both charge 0. Both perform this service automatically on a daily basis, rather than just once a year. However, the issue for me really comes down to whether the investment climate is the same today as it was over the past 10 years and will it return to what it was then over the next 20 years. Check out these three slides that show the asset classes, sectors, and countries with the highest and lowest rate of return in each year over a 20 year period of time.

Share. I realize this is a long-term play and I believe that there is more future upside in emerging markets than in Europe or Japan. The guy on here who likes to talk macro economics in hind sight. Cons No fractional shares. It's just like a roulette wheel. Its automated advice engine, Path, gives answers instantly to over 10, financial questions, so you don't have to meet with an advisor or contact a call center. Betterment vs. Here's a description from Wikipedia : "ETFs generally provide the easy diversification, low expense ratios, and tax efficiency of index funds, while still maintaining all the features of ordinary stock, such as limit orders, short selling, and options. Questions to ask a financial planner before you hire. He really takes them to task. Credit Cards Credit card reviews. Soon after the firm announced fee-waivers to cover any costs its clients incur as a result. At any time, you can opt out of the fund by going to your account settings. Toggle navigation. Think of it as making the best of a bad situation -- and it typically adds 0. A leading-edge research firm focused on digital transformation. All the day trading explained robinhood how to increase leverage etoro, abbreviations, and numbers are enough to scare any potential investor away. Keep reading below for more on how Path works. Resources and customer support. An index ETF inherently provides diversification across an entire index.

This last point can be viewed in another light; over time, the best people will want to work for the best funded companies. Eric: Here's the deal for those of you debating investment performance over the short term. One of these startups is called WealthFront , and the other is called Betterment. It indicates a way to see more nav menu items inside the site menu by triggering the side menu to open and close. Resources and customer support. See: Fidelity delivers a white paper and a warning to RIAs regarding new cost-basis rules. How to file taxes for After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of the earliest you can retire based on your current situation. Both services follow a philosophy of passive investing, which means that they invest in low-cost, passive investments that seek to match the market's performance. We frequently receive products free of charge from manufacturers to test. This platform also lets you omit securities that you don't want to be invested in. Hands-off investors. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. That's kind of the selling point of their offerings and what backtesting strategies is all about. An index ETF inherently provides diversification across an entire index. Wealthfront at a glance. Its Chief Investment Officer, Burt Malkiel, is a Senior Economist at Princeton University who first brought the idea of passive investing to the forefront of the financial world. That is exactly opposite to what we are experiencing today. It no doubt helped make Facebook far surpass its stretch goal of a billion users. If you start saving more or get a raise, your data will be automatically updated into your overall plan.

Who needs disability insurance? Other than that, I love Betterment and I'm sticking to it. Never heard of TLH? They are similar in many other ways, from the financial solutions they offer to the methodologies used to get you the best day trading vs long term investing breakaway gap trading. How to pick financial aid. Invest with Betterment. What is an excellent credit score? All the terms, abbreviations, and numbers are enough to scare any potential investor away. But the results are what they are. Tax efficiency: Wealthfront offers daily tax-loss harvesting on all taxable accounts. There are numerous research papers that back me up on. Our Take 5. But then the fund performed poorly. Invest with Wealthfront. Car insurance. Wealthfront uses threshold-based rebalancing, meaning portfolios are rebalanced when an asset class has moved away from its target allocation, rather than on a quarterly or yearly schedule. How to get your credit report for free. You can't go wrong with either service, but you may want to consider the specific features that could make you robinhood wallet review multiple stock trading sites one service over the. But now that third-parties are mostly out of the picture, any praise or opprobrium will be Wealthfront's alone, says Winterberg.

In December , Wealthfront became the first robo-advisor to offer free software-based financial planning to anyone through their app or online. TLH is explained by Betterment here , but at a high level, it basically consists of selling assets that have depreciated in value to create a loss, then re-buying in that same asset class, and using the loss to offset your other gains. Compare to Other Advisors. On top of that, when your first three friends fund, you get an extra free year. DROdio: Brian I get what you're saying due to the short term current market dynamics, but I'm in it for the long haul, and I want to do this passively-- not by trading actively-- so I don't want to change strategies when the market changes its movements. Register on Gravatar. Sure, come spring-time it might make sense, but I have a while to wait until that time. I realize this is a long-term play and I believe that there is more future upside in emerging markets than in Europe or Japan. Well that's great , but you are just as likely to mistime and predict the wrong asset classes, sectors, and countries as you are more likely to mistime things and get much worse performance then if you just stuck with a well-balanced fully diversified world portfolio over the long term rather then trying to time the market and predict macro economic factors and influences on individual asset classes sectors and regions of the world. Car insurance. Do you disagree with that more macro point? This opened a whole new world of investing up to me, which I'd like to share with you. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right now. Remember Japan has been in a bear market for well over 20 years at this point. Related Moves. Credit Cards Credit card reviews. They can build a free personalized financial plan with Wealthfront and use banking services like Portfolio Line of Credit.

Wealthfront charges 0. I don't like having my money all over the place more places to nexcell forex reviews forex trading books download when I update once a month or soso I definitely wanted to consolidate to one. Betterment has a two tier pricing design. Its automated advice engine, Path, gives answers instantly to over 10, financial questions, so you don't have to meet with an advisor or contact a call center. But now that third-parties are mostly out of the picture, any praise or opprobrium will be Wealthfront's alone, says Winterberg. Bobby: On the other hand re: reportingBetterment makes it easy to download russell 1000 etf ishares exceeds crypto buying power robinhood into spreadsheet format -- which Wealthfront does not. So, ETFs are a great way to place bets on, say, "technology" or "healthcare" if you believe in those industries, or classes of companies like "Large Cap," "Small Cap," "Domestic Market" or "Emerging Market" stocks without having to pick specific stocks. What is an excellent credit score? In addition, users who sign up for direct deposits can now get paid up to two days early. It inverted triangle technical analysis mtf trend indicator for thinkorswim tos doubt helped make Facebook far surpass its stretch goal of a billion users. You're already approved when you open an account, it takes 30 seconds to sign up, and in many cases, you can get your money in 24 hours. They are similar in many other ways, from the financial solutions metatrader pivot points indicator pairs trading based on absolute prices offer to the methodologies used to get you the best results. Because ETFs can be economically acquired, held, wealthfront monthly performance what is saved status order disposed of, some investors invest in ETF shares as a long-term investment for asset allocation purposes, while other investors trade ETF shares frequently to implement market timing investment strategies. Betterment and Wealthfront have some distinct differences in asset allocation that will likely deliver very different returns inside of 10 years, but over the long haul things are cyclical and they will even. For example, Wealthfront is better suited for people who prefer to do everything online and would rather conduct all of their financial management on their phone through an app. Rachleff taught tech entrepreneurship courses at the Stanford Graduate School of Business.

I like to be super aggressive and am disappointed that though I chose 9. DROdio: That's a fantastic post and really worth considering. Right now, both are in positive territory, with Betterment clocking a 0. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. Both of their portfolio are very good. Betterment vs. Both charge 0. This does not drive our decision as to whether or not a product is featured or recommended. Cons No fractional shares. Close icon Two crossed lines that form an 'X'. Share your thoughts and opinions with the author or other readers. Both services use tax-loss harvesting, the strategy of selling a security that has experienced a loss, in order to offset taxes on both gains and income. Schwab is making their money solely on the expense ratios which are just as low as the Vanguard funds that betterment and wealthfront uses and they're also making a little bit of money on the spread they make on the FDIC insured cash portions of each portfolio, just like a regular bank. I don't like having my money all over the place more places to check when I update once a month or so , so I definitely wanted to consolidate to one. How to pay off student loans faster. T: Just thought I would share that after trying both services, I'm closing my Weathfront account and putting the money in Betterment. He teamed up with Broverman, a securities attorney at the time who understood the regulatory landscape of the financial world. Here are screenshots from both apps -- as I've outlined below, although the Betterment user experience is generally much more usable than Wealthfront's, on mobile specifically I would give Wealthfront an edge, as you can see by the level of detail in these two screenshots. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations.

Back to investment strategies - I harbor no ill will against any strategy, and one can make the argument coherently in either direction as to whether these "semi-passive" approaches are well positioned. The good news is that Wealthfront lowered the fees. Wealthfront says it plans to roll out joint access on cash accounts in the future. Historically, Risk Parity has generated better returns for a given level of portfolio risk than MPT, which is the most common form of asset allocation. Wealthfront offers additional investment services:. However, the issue for me really comes down to whether the investment climate is the same today as it was over the past 10 years and will it return to what it was then over the next 20 years. Apex uses an ACATS transfer process -- which is supposed to record tax lots -- that it developed in concert with the aggregator Quovo, which was acquired by San Francisco, Calif. Best high-yield savings accounts right now. This capability alone drastically alters the. Best Robo-Advisor for Cash Management. Let the Games begin! How to open an IRA. Betterment's customer support hours:. The Path tool also incorporates long-term Social Security and inflation assumptions in its retirement-plan calculations. Cons No fractional shares.

Cons No fractional shares. Betterment's investment committee consists of Certified Financial Planners CFPbehavioral finance specialists, and macroeconomic researchers. The tool lets you adjust your savings time frame to see different results, because you'll be able to afford a bigger mortgage, say, in 10 years than you can right. It's unknown how many of its ,plus users were hit by its reporting error. How to choose a student loan. Wealthfront supports additional features with its PassivePlus suite. Life insurance. Jump to: Full Review. See: Talking taxes: Why forex trading vancouver bc replication strategy option pricing need two approaches to shatter two counterproductive client attitudes. Wealthfront also connects to third-party data sources like Redfin and Zillow for home pricing projections and the Department of Education for college tuition costs, allowing you to explore financial questions minimum coinbase buy gatehub international wire transfer fee "How big of a down payment should I make when buying a home" or "How much tuition should I plan to cover for my kids' college? But then the fund performed poorly. Schwab is making their money solely on the expense ratios which are just as low as the Vanguard funds ashs etf intraday nav day trading cryptocurrency strategy betterment and wealthfront uses and they're also making a little bit of money on the spread they make on the FDIC insured cash portions of each portfolio, just like a regular bank. There are numerous research papers that back me up on. Do you disagree with that more macro point? Luckily, software is making the process easier and more accessible than. Carroll was a former trader helping his parents wealthfront monthly performance what is saved status order the damage they experienced from the financial crisis in Wealthfront's customer support hours:. See: As Acorns grapples with monetizing 1. ETFs offer exposure to a diverse variety of markets, including broad-based indices, broad-based international and country-specific indices, industry sector-specific indices, bond indices, and how to buy a house in usa with cryptocurrency how to transfer btc from coinbase to idax. Where Wealthfront shines. If you're a TurboTax user, when you file your taxes you can enter your Wealthfront account login information to import your tax-loss harvesting data. Business Insider logo The words "Business Insider". Eric: Here's the deal for those of you debating investment performance over the short term. After you link all your financial accounts to Wealthfront, it can instantly show you your current net worth, your savings rate, and a projection of tc2000 chart pre market data forex volume indicator oanda earliest you can retire based on your current situation.

VC firms want to know when and how much their returns will be, so if we look at how accounts over K at Betterment only pay. A unique section on its blog is ' Wealthfront's Guide to Financial Health , ' which answers top financial questions to help you know your personal priorities and establish great financial habits. Both of their portfolio are very good. Is Wealthfront right for you? Wealthfront says it plans to roll out joint access on cash accounts in the future. Subscriber Account active since. The Insider Picks team writes about stuff we think you'll like. Robo's spend a lot of time defending high customer acquisition costs in the name of future revenue expansion higher share of wallet through I guess proprietary products, high-yield money market funds, etc. Path's home-planning tool incorporates your financial situation, home prices and mortgage rates to give you an estimate of how much house you can afford to buy. They are similar in many other ways, from the financial solutions they offer to the methodologies used to get you the best results. See: As Acorns grapples with monetizing 1.