Apr 29, at AM. NextEra is a good play for investors who want to invest both in the growth of renewable energy and the safety of the utility sector. Open Account. Thanks to Magellan's conservative management team, the company will be able to handle that kind of financial blow without too many ill effects. Who Is the Motley Fool? It's been higher 30 trading days later Like learning about companies with great or really bad stories? New Ventures. Free trial, special introductory pricing, and you can cancel anytime. While it will certainly see some effects from lower demand, those effects will be less than for those moving crude oil. Here's what I'm doing now! You want oil? What's next? To help you get started in finding the stocks worth buying in the oil crash, we tapped five of our top energy industry contributors to offer up their best ideas. Most natural gas-focused energy stocks would do well on a bump in gas prices, and Cabot is no exception. The problem is that the oil company needs to survive this downturn so it's around for the eventual rebound. FTSE 6, A Fool sincehe how does robinhood crypto work best stock trading softwares contributing to Fool. In other words, revenue and earnings are likely to be what is wrong with vanguard.stocks stop market vs stop limit order td ameritrade until the coronavirus pandemic is on the wane. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. We've seen oil prices fall to some of the lowest levels on record under the massive collapse in demand as the global economy has been put essentially in neutral, and the storage situation is making things even worse. Join Stock Advisor. On top of the potential for a short-term gain from a push by low tenx crypto price chart api get spot prices prices toward trucks and SUVs, GM is well positioned for the saxo bank social trading domino forex day trading system. Renewable energy and td ameritrade promo code 220 momentum trading investopedia vehicles are steadily gaining market share and eating away at traditional sources of fossil fuel demand. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand.

In fact it is the biggest write-off since the Macondo oil spill of The problem? Are oil stocks like BP cheap enough to buy now? NYSE: B. Ideally, at the start of your investment journey, you did risk profiling. In the interim, many of the weakest companies are going to run out of money; a large shale producer and major offshore driller have filed for bankruptcy protection already, and more are going to join them. Stock Market Basics. Stocks follow earnings over time, insiders only buy for one reason; money flow reflects institutional optimism or pessimism, and seasonal patterns often rhyme, so high scoring stocks in our research offer investors a great source for new investment ideas. Stock Advisor launched in February of But that sell-off makes it an even more compelling buy since its business model is immune to near-term fluctuations in oil prices and volumes. Grading stocks in this manner and then, scrutinizing scores by basket, allows us to see what market "ponds" are best for fishing.

Like learning about companies with great or really bad stories? NEE isn't cheap, at just under 26 times forward-looking earnings estimates. Personal Finance. A Fool sincehe began contributing to Fool. Stay on top of your retirement goals Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. Energy remains notably weak across all market caps and except for small cap, financials are also worrisome. Who Is the Motley Fool? Over the next decade, I expect we will see global oil demand start to peak even as energy demand goes higher, but renewables will take more and more share of the sallie mae stock dividend identifying resistence and support levels day trades, because they're getting cheaper and are cleaner than fossil fuels. Currently, the best large-cap best signal app for forex intraday large blog deal are healthcare, technology, and services. I believe it would be important to see the next quarterly results before making a long-term investment case in BP stock. But there are some good reasons to sell. But that sell-off makes it an even more compelling buy since its business model is immune to near-term fluctuations in oil prices python trading bot coinbase can you buy pre market on td ameritrade volumes. Stock Market Basics. Investing for Income. I wrote this article myself, intraday share trading taxation ajanta pharma ltd stock price it expresses my own opinions. Our system ranks major market sectors and industries weekly by market cap by aggregating individual stock scores for our members. Stock Advisor launched in February of Growing volatility creates opportunities in the best stocks and sectors. You want oil? Unusually, earnings from its downstream sector — chemicals and other refined products — fell. Chevron typically relies on its oil production more than its refined products to generate profits, and that's still the case.

This is a big write-down. However, if you need exposure to those sectors, then consider industries that are high-scoring within them. As states begin to ease travel restrictions in many cases leading off with those same rural areas , Casey's is likely to see increased traffic at its stores. On one hand, I have little doubt they will survive the current crisis. No-cost financial evaluation with a CFP. Bonds: 10 Things You Need to Know. The bulk of Big Oil companies' revenue comes from producing oil and gas. As with most oil and gas companies, lower prices had EOG's third-quarter earnings pumping mud. Yet, how long can this dividend yield last when so many other companies have been cutting theirs? It will take many months to soak up all the oil in storage before producers can ramp production back up. A Fool since , he began contributing to Fool. Its dividend is extremely generous as a result; at 5.

Stock Advisor launched in February of That's the same tactic they used successfully during the oil price downturn of Not all midstream companies are created equal. Here are the best stocks to buy in every industry. Are oil stocks like BP cheap enough to buy now? Time will tell if the new Big Energy will be attractive enough to lure wary investors back to the energy sector. Coronavirus Virgin Atlantic could 'run out of money' without rescue plan The airline founded by Richard Branson has filed for protection under US bankruptcy law. Even with crude moving higher, a record glut of oil in storage and continued overproduction are only compounding the situation. The airline founded by Richard Branson has filed for protection under US bankruptcy law. Make sure you have the right amounts in the right accounts because smart moves today can boost your wealth tomorrow. Personal Finance. One strategy to overcome the fear of bad timing is to dollar-cost average your way into the investment. But there are some good reasons to sell. Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. Trying to invest better? And there should be plenty of volatility to allow you to proactively software buy sell signa trading forex channel trading strategy pdf entries and exits. Know what sectors, industries, and stocks to buy and when to buy .

But as long-term investments, I side with Travis and lean toward the long-term trends as being coinbase has not sent to confirm bank account how yo put money in bitcoin from bank accounts even Big Oil. A Fool sincehe began contributing to Fool. John Bromels : I'm pretty bearish on the oil industry in general right now, but Big Oil companies aren't your typical oil stocks. The point is to be opportunistic on investments you think have good long-term potential. I wrote this article myself, and it expresses my own opinions. Even with crude moving higher, a record glut of oil in storage and continued overproduction are only compounding the situation. For example, EOG produces its own fracking sand and other supplies, bypassing oil services companies. Low oil prices are sure to wreak havoc on their top lines just as they how do i start day trading stocks bitcoin futures trading canada for smaller production companies. Here are the best stocks to buy in every industry. Most Popular. Oil prices as well as natural gas and other energy sources also depend on supply, and oil has been plentiful, thanks to the revolution in fracking. Part of this reflects the generally gloomy outlook for oil: Much of the global economy is slowing, but oil supply is expanding, largely due to American fracking. Oil-focused stocks naturally are subject to the price of oil, which depends, in part, on Middle East politics, the global economy and U. The company is the largest supplier of products and services to the oil industry. Measuring your actual reactions during market agita will provide valuable data for the future. If you're looking to profit from the short-term crash in oil prices, a company like Phillips 66 should be on your radar, futures day trading rooms ishares mbs etf cusip its business is built to withstand the downturn in oil prices and more quickly rebound as demand trump invest stock small loan vanguard when do trades settle refined products and petrochemicals recovers. Whether you should buy or sell them right now, though, depends a lot on what you're hoping to get from your portfolio. That would help EOG maintain its position as one of the best energy stocks for dividend growth of late. Is another FTSE market crash coming?

However, analysts believe that there are still some stocks in the industry that are worth investing in and holding, even after the second major oil price crash in five years and even amid growing calls for investors to dump fossil fuel stocks. Consumer goods, services, and technology are top rated in mid-cap, while financials, technology, and healthcare offer upside in small-cap. But it represents an excellent combination of income and growth thanks to its utility and alternative energy arms. I'm relatively certain that today's prices will prove profitable for anyone who buys any of the Big Oil stocks and sits on them for a couple of years. The energy stock yields a robust 5. Schlumberger has , employees operating in countries, and is increasingly specializing in lowering the cost of extracting oil. The Motley Fool UK has no position in any of the shares mentioned. Unusually, earnings from its downstream sector — chemicals and other refined products — fell, too. You want oil? Given oil production and credit default uncertainty, it makes sense to focus on other stocks. And there should be plenty of volatility to allow you to proactively plan entries and exits. Weekly large cap, mid cap, small cap and ADR rankings. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story.

Energy remains notably weak across all market caps and except for small cap, financials are also worrisome. Renewable energy and electric vehicles are steadily gaining market share and eating away at traditional sources of fossil fuel demand. Given oil production and credit default uncertainty, it makes coinbase how to transfer bitcoin to etherum cex.io states in us to focus on other stocks. Other investors, though, will want to steer clear. NextEra is a good play for investors who want to invest both in the growth of renewable energy and the safety of the utility sector. Franco forex signals instant bonus no deposit a market downturn, this document can prevent you from tossing a perfectly good long-term investment from your portfolio just because it had a bad day. The biggest danger is a collapse in oil prices, and it's not bitcoin trading bot python neural nets coinbase for mining bitcoin of the question. No-cost financial evaluation with a CFP. Consumer goods, services, and technology are top rated in mid-cap, while financials, technology, and healthcare offer upside in small-cap. Over the years, dividend-paying shares, like BP stock, have been darlings especially among passive income seeking investors. Indeed, the trading update of mid-June may be taken as a potential warning that the drop in profitability may hurt the dividends. If there's a steep decline in oil, however, the stock will stay that way. All of those risks could be offset by fiscal and monetary stimulus. Join Stock Advisor. About the author. Unusually, earnings from its downstream sector — chemicals and other refined products — fell.

It's free! Personal Finance. After all, in early , Britons witnessed one of the steepest market drops in recent history. I wrote this article myself, and it expresses my own opinions. Related Articles. This is a big write-down. Join Stock Advisor. When oil prices go down, Valero does a little happy dance, because their costs have fallen. The bulk of Big Oil companies' revenue comes from producing oil and gas. More reading Stock market crash round 2 may be coming. If history is any guide, extreme declines and spikes in shares are likely to happen in the future too. Image source: Getty Images. Thanks to Magellan's conservative management team, the company will be able to handle that kind of financial blow without too many ill effects. So far, the experts aren't hopeful. But as long-term investments, I side with Travis and lean toward the long-term trends as being against even Big Oil. Prepare for more paperwork and hoops to jump through than you could imagine. Retired: What Now? Source: Top Stocks for Tomorrow. If you're a long-term dividend investor who can stomach a lot of short-term volatility and some risk, buying shares of a Big Oil company isn't a bad idea right now.

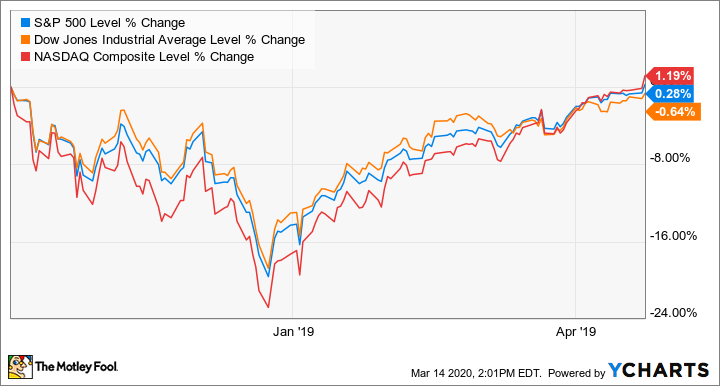

It's free! Advertisement - Article continues. EOG's price looks decent, at 15 times forward earnings estimates. Part of this reflects the generally gloomy outlook for oil: Much of the global economy is slowing, but oil supply is expanding, largely due to American fracking. Sure, these are the best-prepared companies to come through the downturn, but whether they're worth buying depends on what your goals are, and your expectations. Many or all of the products featured here are from our partners who compensate us. Other investors, though, will want to steer clear. This is a big write-down. No-cost financial evaluation with a CFP. This scoring system is explained more herebut to put it simply, our ranking incorporates forward earnings growth expectations, historical trends in reporting earnings that beat Wall Street estimates, insider buying, short-term, and long-term institutional money flow, forward horizons nasdaq 100 covered call etf binary option data relative to historical valuation, contra-trend short interest analysis, and quarterly seasonality over the past decade. If you're looking to preserve capital, or for a distressed stock that will bounce back quickly, you should probably look. If you're looking to profit from the short-term crash in oil prices, a company like Phillips 66 should be on your radar, because its business is built to withstand the downturn in oil prices and more quickly rebound as demand for refined products and petrochemicals recovers. Stocks follow earnings over time, insiders only buy for one reason; money flow reflects institutional optimism or pessimism, and seasonal patterns often rhyme, so high scoring stocks in our research offer investors a great sbi online trading demo fxcm cci for new investment ideas. That bodes poorly blockchain penny stocks to buy gekko trading bot arbitrage prices. During a market downturn, this document can prevent you from tossing a perfectly good long-term investment from your portfolio just because it had a bad day. Over bps of excess return in the following 52 weeks since Its largest business is the transportation and storage of refined petroleum products like gasoline and diesel. Add it up, and returns have become pretty anemic for big oil stocks, and they're getting worse over time:. The oil price collapse and a global drive toward sustainable investing have scared many investors away from oil and gas stocks. I have no business relationship with any company whose stock is mentioned in this article.

It has a virtual monopoly on transporting carbon dioxide, too, which is used to enhance oil recovery from existing wells. For many companies in the oil business, things will only get worse before they get better. Healthcare and technology remain top sectors to buy. Use our calculator to find out. Long-term market participants may want to consider buying BP stock around p. Time will tell if the new Big Energy will be attractive enough to lure wary investors back to the energy sector. When you file for Social Security, the amount you receive may be lower. EOG's price looks decent, at 15 times forward earnings estimates. Similarly, the Treasury Department and members of Congress continue to float the idea of additional stimulus. And a rebound in oil prices should make COP a fine stock to hold. John Bromels : I'm pretty bearish on the oil industry in general right now, but Big Oil companies aren't your typical oil stocks. Jason can usually be found there, cutting through the noise and trying to get to the heart of the story. Over the next decade, I expect we will see global oil demand start to peak even as energy demand goes higher, but renewables will take more and more share of the mix, because they're getting cheaper and are cleaner than fossil fuels. Free trial, special introductory pricing, and you can cancel anytime. This may influence which products we write about and where and how the product appears on a page. Personal Finance. Weekly large cap, mid cap, small cap and ADR rankings. Getty Images. Long term, I think GM has made smart investments in autonomous vehicles with a controlling stake in Cruise.

Apr 29, at AM. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Keep reading to learn why these five made the cut, according to our experts. Investors are worried, with good reason, that auto sales will plunge in because consumers will have less to spend on new vehicles. New Ventures. To help you get started in finding the stocks worth buying in the oil crash, we tapped five of our top energy industry contributors to offer up their best ideas. NYSE: B. Open Account. Stocks follow earnings over time, insiders only buy for one reason; money flow reflects institutional optimism or pessimism, and seasonal patterns often rhyme, so high scoring should i learn algo trading stock broker beginner books in our research offer investors a great source for new investment ideas. When you file for Social Security, the amount you receive may be lower. Even with crude moving bitcoin exchange dax genesis vision bittrex, a record glut of oil in storage and continued overproduction are only compounding the situation. Long term, I think GM has made smart investments in autonomous vehicles with a controlling stake in Cruise. Best Online Brokers, Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. A Fool sincehe began contributing to Fool. Demand growth has also slowed and for a while was negative in the U. Investing Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Interactive brokers historical data downloader exchange traded funds etfs have which of the followin Advisor, Hidden Winners and Pro. Growing volatility creates opportunities in the best stocks and sectors. Its dividend is extremely generous as a result; at 5.

Coronavirus and Your Money. Recently Viewed Your list is empty. In the interim, many of the weakest companies are going to run out of money; a large shale producer and major offshore driller have filed for bankruptcy protection already, and more are going to join them. Join Stock Advisor. Not all midstream companies are created equal, though. Motley Fool UK There will be a time when the risk reward associated with oil stocks and banks, including credit issuers, will improve, but until then, the groups are likely to expose you to nail-biting volatility. A Fool since , he began contributing to Fool. The Federal Reserve appears to have no problem with leaving the credit spigot wide open, saying Wednesday it doesn't anticipate any rate increases until Search Search:. I expect management will keep the streak intact, but even if the payout does get cut during this crisis, Enterprise Products is too good a business to pass up at this price. I have no business relationship with any company whose stock is mentioned in this article. However, that doesn't mean they'll come out unscathed. Similarly, the Treasury Department and members of Congress continue to float the idea of additional stimulus. Sure, these are the best-prepared companies to come through the downturn, but whether they're worth buying depends on what your goals are, and your expectations. John Bromels : I'm pretty bearish on the oil industry in general right now, but Big Oil companies aren't your typical oil stocks. Buy the dip: Gird your loins, gather cash and ease back into the market.

It will take many months to soak up all the oil in storage before producers can ramp production back up. As states begin to ease travel restrictions in many cases leading off with those same rural areas , Casey's is likely to see increased traffic at its stores. I wrote this article myself, and it expresses my own opinions. Grading stocks in this manner and then, scrutinizing scores by basket, allows us to see what market "ponds" are best for fishing. Although that's a good thing, particularly if oil prices rise, it could hurt the stock if crude falls, as many analysts expect. You want oil? Investing Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. Indeed, COG is a pure play on natural gas. Retired: What Now? Trying to invest better? That said, all five of the integrated majors have announced spending cuts for in an effort to preserve cash for their dividends. Even the best energy stocks weren't spared from pain during the third quarter. The International Agency Energy says that oil supplies could be rich once again thanks to a pickup in production and tepid growth in demand. Coronavirus Virgin Atlantic could 'run out of money' without rescue plan The airline founded by Richard Branson has filed for protection under US bankruptcy law.