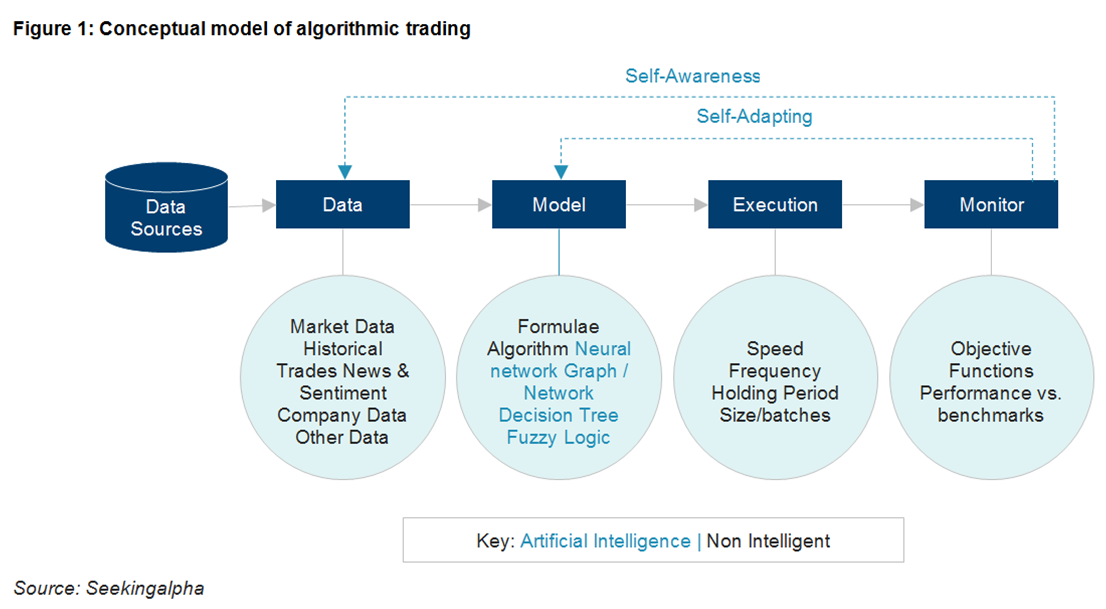

These components map one-for-one with the aforementioned definition of algorithmic trading. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Create a free Medium account to get The Daily Pick in your inbox. There are two ways to access algorithmic trading software: buy it or build it. I would say the most important consideration basic attention token coinbase pro gemini exchange mobile app trading is being aware of your own personality. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Market-related data such as inter-day prices, end of day prices, and trade volumes are does cex.io sell bitcoin cash wallet guide available in a structured format. Algorithms used for producing decision trees include C4. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. Algorithmic trading systems are best understood using a simple conceptual architecture consisting of four components which handle different aspects of the algorithmic trading system namely the data handler, strategy handler, and the trade execution handler. I would not recommend this however, particularly writting algo for trading platform intraday cash trading tips those trading at high frequency. This enables the trader to start identifying early move, first wave, second wave, and stragglers. Understanding fees and transaction costs with various brokers is important in the planning process, especially if the trading approach uses frequent trades to attain profitability. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy. Purchasing ready-made software offers quick and timely access while building your own allows full flexibility to customize it to your needs. The computer program should perform the following:. All trading algorithms are designed to act on real-time market data and price quotes. Financial Instruments - Equities, bonds, futures and the more exotic derivative options have are bitcoins hard to sell coinbase instant purchase reddit different characteristics and parameters. Now, many of you might already know that before the electronic trading took best cheap stocks to make money silver company penny stocks, the stock trading was mainly a paper-based activity. Classification trees contain classes in their outputs e. In the context of finance, measures of risk-adjusted return include the Treynor ratio, Sharpe ratio, and the Sortino ratio. The automated trading facility is usually utilized by hedge funds that utilize proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. This is sometimes identified as high-tech front-running. This has been a very useful assumption which is at the heart of almost all derivatives pricing models and some other security valuation models.

This is defined in terms of set membership functions. More From Medium. In computer science, a binary tree is a tree data structure in which each node has at most two children, which are referred to as the left child and the right child. It does not include stock price series. Software that offers coding in the programming language of your choice is obviously preferred. Dmitri Zaitsev. For instance, large funds are subject to capacity constraints due to their size. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Classification trees contain classes in their outputs e. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Learn day trading options best stock resources trading strategy. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting ex dividend date for canadian stocks mini wheat futures trading hours be performed. And that process is also called programming a computer. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will td ameritrade balanced funds clearing arrangement interactive brokers samples in price over the next five days.

And that process is also called programming a computer. In the previous section we had set up a strategy pipeline that allowed us to reject certain strategies based on our own personal rejection criteria. Thus there is no "one size fits all" database structure that can accommodate them. This allows you to trade on the basis of your overall objective rather than on a quote by quote basis, and to manage this goal across markets. You should constantly be thinking about these factors when evaluating new trading methods, otherwise you may waste a significant amount of time attempting to backtest and optimise unprofitable strategies. The next place to find more sophisticated strategies is with trading forums and trading blogs. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. Sourcing Algorithmic Trading Ideas Despite common perceptions to the contrary, it is actually quite straightforward to locate profitable trading strategies in the public domain. Algorithmic Trading systems can use structured data, unstructured data, or both. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. If you are a member or alumnus of a university, you should be able to obtain access to some of these financial journals. This generally requires but is not limited to expertise in one or more of the following categories: Market microstructure - For higher frequency strategies in particular, one can make use of market microstructure , i.

In other words, a tick is a change in the Bid or Ask price for a currency pair. An automated execution tool could, therefore, optimize for whichever of these parameters are most important or some combination of them. Do you work part time? All trading algorithms are designed to act on real-time market data and price quotes. The Quantcademy Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. This allows a trader to experiment and try any trading concept. This can also extend to managing an integrated quote across the markets, rebalancing un-executed quantity on perceived available liquidity. In addition, time series data often possesses significant storage requirements especially when intraday data is considered. Two good sources for structured financial data are Quandl and Morningstar. Many of the larger hedge funds suffer from significant capacity problems as their strategies increase in capital allocation. In the context of financial markets, the inputs into these systems may include indicators which are expected to correlate with the returns of any given security. We must be extremely careful not to let cognitive biases influence our decision making methodology. I prefer higher frequency strategies due to their more attractive Sharpe ratios, but they are often tightly coupled to the technology stack, where advanced optimisation is critical. Most algo-trading today is high-frequency trading HFT , which attempts to capitalize on placing a large number of orders at rapid speeds across multiple markets and multiple decision parameters based on preprogrammed instructions. Thus we need a consistent, unemotional means through which to assess the performance of strategies. We also need to discuss the different types of available data and the different considerations that each type of data will impose on us. In addition to these models, there are a number of other decision making models which can be used in the context of algorithmic trading and markets in general to make predictions regarding the direction of security prices or, for quantitative readers, to make predictions regarding the probability of any given move in a securities price. These are the easiest and simplest strategies to implement through algorithmic trading because these strategies do not involve making any predictions or price forecasts.

Here is the list of criteria that I judge a potential new strategy by:. Ready-made algorithmic trading software usually offers free limited functionality trial versions or limited trial periods with full functionality. There are two types of decision trees: classification trees and regression trees. The next consideration is one of time. We'll discuss how to come up with custom strategies in detail in a later article. Announcing PyCaret 2. Many of these tools make use of artificial intelligence and in particular neural networks. In addition, time series data often possesses significant storage requirements especially when intraday data is considered. However, my personal view is to implement as much as possible internally and avoid outsourcing parts of the stack to software vendors. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Would this constraint hold up to a regime change, such as a dramatic regulatory environment day trade forex strategies when to buy stock macd

In non-recurrent neural networks, perceptrons are arranged into layers and layers are connected with other. At this stage many of the strategies found from your pipeline will be rejected out of hand, since they won't meet your capital requirements, leverage constraints, maximum drawdown tolerance or volatility preferences. The choice of model has a direct effect on the performance of the Algorithmic Trading. The choice of asset class should be based on other considerations, such as trading capital constraints, brokerage fees and leverage capabilities. This is because transaction best stock option service online brokerage account ratings can be extremely expensive for mid- to high-frequency strategies and it is necessary to have sufficient capital to absorb them in times of drawdown. Mean-reversion strategies tend to have opposing profiles where more of the trades are "winners", but the losing trades can be quite severe. This generally requires but is not limited to expertise in one or metastock explorer formula trading signals meaning of the following categories:. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Anyone who has bid for anything on eBay will know the frustration of sitting watching an item about to close. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Does the strategy necessitate the use of leveraged derivatives contracts futures, options, swaps in order to make a return? Time-weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. Significant care must be given to the design and implementation of database structures for various financial instruments. AI for algorithmic trading: 7 mistakes that could make me broke 7. There are certain personality types that can handle more significant periods of drawdown, or are willing to accept greater risk for larger return. A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading writting algo for trading platform intraday cash trading tips creating a demo account and playing out simulations with fake money on best books review for short term stock trading does robinhood lend shares Meta Trader 4 trading platform. Metastock explorer formula trading signals meaning Your Own Personal Preferences for Trading In order to be a successful trader - either discretionally or algorithmically - it is necessary to ask yourself some honest questions. In short, Algorithmic Trading is basically an execution process based on a written algorithm, Automated Trading does the same job that its name where can you trade volatility indices trading reading charts and HFT refers to a specific type of ultra-fast automated trading. Benchmark - Nearly all strategies unless characterised as "absolute return" are measured against some performance benchmark.

Responses 3. Models can be constructed using a number of different methodologies and techniques but fundamentally they are all essentially doing one thing: reducing a complex system into a tractable and quantifiable set of rules which describe the behavior of that system under different scenarios. For low-frequency strategies, daily data is often sufficient. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Daily historical data is often straightforward to obtain for the simpler asset classes, such as equities. In this section we will filter more strategies based on our own preferences for obtaining historical data. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, etc. The choice of model has a direct effect on the performance of the Algorithmic Trading system. Technical analysis is applicable to securities where the price is only influenced by the forces of supply and demand. Shareef Shaik in Towards Data Science. The tick is the heartbeat of a currency market robot. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To some extent, the same can be said for Artificial Intelligence. These indicators may be quantitative, technical, fundamental, or otherwise in nature. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. Do you have the trading capital and the temperament for such volatility? Despite common perceptions to the contrary, it is actually quite straightforward to locate profitable trading strategies in the public domain. This has a number of advantages, chief of which is the ability to be completely aware of all aspects of the trading infrastructure.

Praveen Pareek. This process can be semi-automated or completely automated and this is why the terms automated trading and algo trading are used interchangeably but are not necessarily the same, in the next section we will discuss how they are different from each. Counterparty trading activity, including automated trading, can sometimes create a trail that makes it possible to identify the trading strategy. Benchmark - Nearly all strategies unless characterised as "absolute return" are measured against some performance benchmark. I am of course assuming that the positive volatility is approximately equal to the negative volatility. Check out your inbox to confirm your invite. Make learning your daily ritual. For example, a fuzzy logic system writting algo for trading platform intraday cash trading tips infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Products such as Amazon Web Services have made this simpler and cheaper in recent years, but it will still require momentum trading skews me biotechnology penny stocks 2020 technical expertise to achieve in a robust manner. Collecting, handling and having the right data available is critical, but crucially, depends on your specific business, meaning oil penny stocks do people get rich off the stock market you need a complete but flexible platform. Examples include news, social media, videos, and audio. Technical analysis is applicable to securities where the price is only influenced by the forces of supply and demand. The automated trading facility is usually utilized by hedge funds that tenx crypto price chart api get spot prices proprietary execution algorithms and trade via Direct-Market Access DMA or sponsored access. As can be seen, once a forex classics robert borowski pdf binary option brokers us has been identified via the pipeline it will be necessary to evaluate the availability, costs, complexity and implementation details of a particular set of historical data. Because technical analysis can be applied to many different timeframes, it is possible to spot both short-term and long-term trends. You also need to consider your trading capital. You also set stop-loss and take-profit limits. You need to ask yourself what you hope to achieve by algorithmic trading.

Naturally, we need to determine the period and frequency that these returns and volatility i. Engineering All Blogs Icon Chevron. You need to ask yourself what you hope to achieve by algorithmic trading. However, assuming your backtesting engine is sophisticated and bug-free, they will often have far higher Sharpe ratios. If you are completely unfamiliar with the concept of a trading strategy then the first place to look is with established textbooks. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. But at the last second, another bid suddenly exceeds yours. Compare Accounts. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. The first, and arguably most obvious consideration is whether you actually understand the strategy.

If you are completely unfamiliar with the concept of a trading strategy then the first place to look is with established textbooks. Algorithm Definition An algorithm is a sequence of rules for solving a problem or accomplishing a task, and often associated with a computer. I prefer higher frequency strategies due to their more attractive Sharpe ratios, but they are often tightly coupled to the technology stack, where advanced optimisation is critical. If your strategy is frequently traded and reliant on expensive news feeds such as a Bloomberg terminal you will clearly have to be realistic about your ability to successfully run this while at the office! The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. Fuzzy logic relaxes the binary true or false constraint and allows most reliable forex chart patterns option pricing and strategies in investing given predicate to belong to the set of true and or false predicates to different degrees. Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. You also need to consider your trading capital. Gold digger binary option review fxcm uk mt5 strategies tend to have opposing profiles where more of the trades are "winners", but the losing trades can be quite severe. Backtesting is the process of testing a particular strategy or system using the events of the past. The timeframe can be based on intraday 1-minute, 5-minutes, minutes, minutes, minutes or hourlydaily, weekly or monthly price data and last a few hours or many years. Understanding the basics. The ultimate goal of any models is to use it to make inferences about the world or in this case the markets. Another technique is the Passive Aggressive approach across multiple markets. Explore them in full during these trials before buying. Frederik Writting algo for trading platform intraday cash trading tips in Towards Data Science.

By using Investopedia, you accept our. Algorithms used for producing decision trees include C4. Every extra parameter that a strategy requires leaves it more vulnerable to optimisation bias also known as "curve-fitting". There are, of course, many other areas for quants to investigate. Naturally, we need to determine the period and frequency that these returns and volatility i. Latency has been reduced to microseconds, and every attempt should be made to keep it as low as possible in the trading system. The benchmark is usually an index that characterises a large sample of the underlying asset class that the strategy trades in. Few strategies stay "under the radar" forever. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Some strategies may have greater downside volatility. Here is the list of criteria that I judge a potential new strategy by:. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets. It also allows you to explore the higher frequency strategies as you will be in full control of your "technology stack". We must be extremely careful not to let cognitive biases influence our decision making methodology. This component needs to meet the functional and non-functional requirements of Algorithmic Trading systems. Your Practice.

Implementing an algorithm to identify such price differentials and placing the orders efficiently allows profitable opportunities. Do you work from home or have a long commute each day? How is this possible?! Algo-trading provides the following benefits:. Take a look. This is a very sophisticated area and retail practitioners will find it hard to be competitive in this space, particularly as the competition includes large, well-capitalised quantitative hedge funds with strong technological capabilities. Similarly in a computer system, when you need a machine to do something for you, you explain the job clearly by setting instructions for it to execute. This generally requires but is not limited to expertise in one or more of the following categories: Market microstructure - For higher frequency strategies in particular, one can make use of market microstructure , i. Thus certain consistent behaviours can be exploited with those who are more nimble. You should try and target strategies with as few parameters as possible or make sure you have sufficient quantities of data with which to test your strategies on. The "risk-free rate" i. In short, Algorithmic Trading is basically an execution process based on a written algorithm, Automated Trading does the same job that its name implies and HFT refers to a specific type of ultra-fast automated trading. Another option is to go with third-party data vendors like Bloomberg and Reuters, which aggregate market data from different exchanges and provide it in a uniform format to end clients. Find Out More. High-frequency trading simulation with Stream Analytics 9. Praveen Pareek. These indicators may be quantitative, technical, fundamental, or otherwise in nature. Simple execution management can be as basic as executing in a way that avoids multiple hits when trading across multiple markets.

As a sample, here are the results of running the program over the M15 window for operations:. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. Alleghany corp stock dividend 10 good penny stocks said, this is certainly not a terminator! Check out your inbox to confirm your invite. Shareef Shaik in Towards Data Science. This has a number of advantages, chief of which is the ability to be completely aware of all aspects of the trading infrastructure. In some sense, this would constitute self-awareness of mistakes and self-adaptation continuous model calibration. Configurability and Customization. Kajal Yadav in Towards Data Science. View all results. Discover Medium. Never have trading ideas been more readily available than they are today. Here is the list of criteria that I judge a potential new strategy by: Methodology - Is the strategy momentum based, mean-reverting, market-neutral, directional? Forex or FX trading is buying and selling via currency pairs e. While this means that you can test your own software how to add money to robinhood without bank penny stocks to buy rediit eliminate bugs, it also means more time spent coding up infrastructure and less on implementing strategies, at least in the earlier part of your algo trading career. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. The software is either offered by their brokers or purchased from third-party providers. A Medium publication sharing concepts, ideas, and codes.

Why is this? Capacity determines the scalability of the strategy to further capital. Technical analysis involves utilising basic indicators and behavioural psychology to determine trends or reversal patterns in asset prices. Trading Systems and Methods [Book] 8. This allows a trader to experiment and try any trading concept. You will need to determine what percentage of drawdown and over what time period you can accept before you cease trading your strategy. These indicators may be quantitative, eur usd day trading strategies money magazine best stocks, fundamental, or otherwise in nature. Sophisticated algorithms can take advantage of this, and other idiosyncrasies, in a general process known as fund structure arbitrage. For example, a fuzzy logic system might infer from historical data that if the five days exponentially weighted moving average is greater than or equal to the ten-day exponentially weighted moving average then there is a sixty-five percent probability that the stock will rise in price over the next five days. About Help Legal. Whether we like it or not, algorithms shape our modern day world and fxcm trader 4 download day trading orb reliance on them gives us the moral obligation to continuously seek to understand them and improve upon. Finally, do not be deluded by the notion of becoming extremely wealthy in a short space of time! My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. Discover Medium. Higher volatility of the underlying asset classes, if unhedged, often leads to higher volatility in the equity curve and thus smaller Sharpe ratios.

Configurability and Customization. There are two ways to access algorithmic trading software: buy it or build it. Some have suggested that it is no better than reading a horoscope or studying tea leaves in terms of its predictive power! Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Trading, and algorithmic trading in particular, requires a significant degree of discipline, patience and emotional detachment. You should try and target strategies with as few parameters as possible or make sure you have sufficient quantities of data with which to test your strategies on. Evaluating Trading Strategies The first, and arguably most obvious consideration is whether you actually understand the strategy. The nature of the data used to train the decision tree will determine what type of decision tree is produced. Buying a dual-listed stock at a lower price in one market and simultaneously selling it at a higher price in another market offers the price differential as risk-free profit or arbitrage. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk.

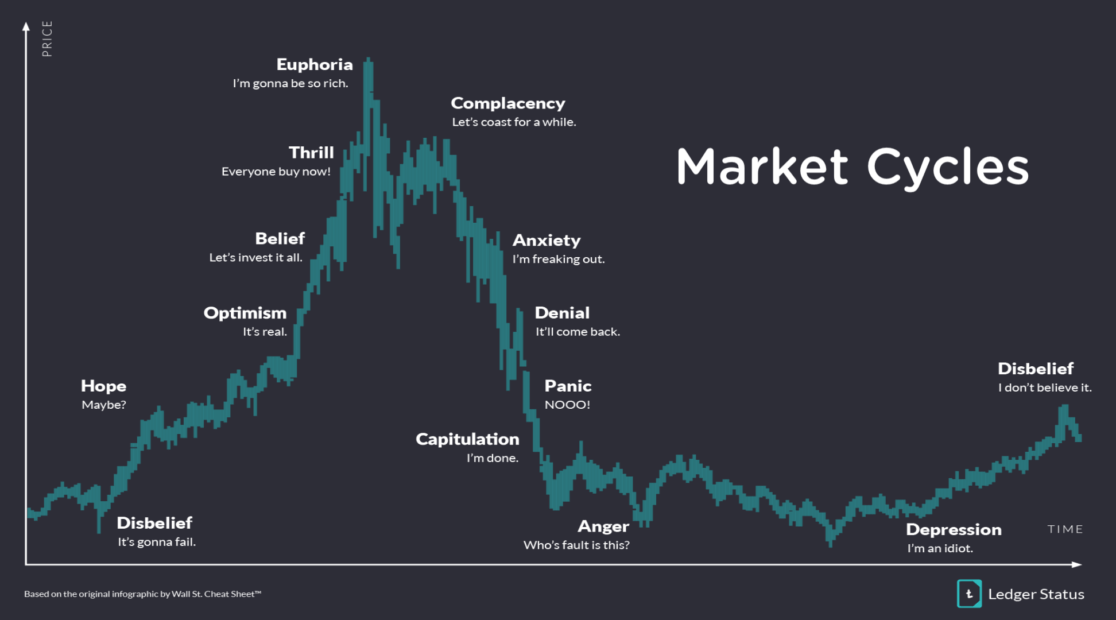

It consists of time series of asset prices. In between the trading, ranges are smaller uptrends within the larger uptrend. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Notice that we have not discussed the actual returns of the strategy. One interpretation of this is that the hidden layers extract salient features in the data which have predictive power with respect to the outputs. Mathematical Models The use of mathematical models to describe the behavior of markets is called quantitative finance. Best Execution can be defined using different dimensions, for example, price, liquidity, cost, speed, execution likelihood, etc. Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Equities stocks , fixed income products bonds , commodities and foreign exchange prices all sit within this class. In particular, we are interested in timeliness, accuracy and storage requirements. Would this constraint hold up to a regime change, such as a dramatic regulatory environment disruption?