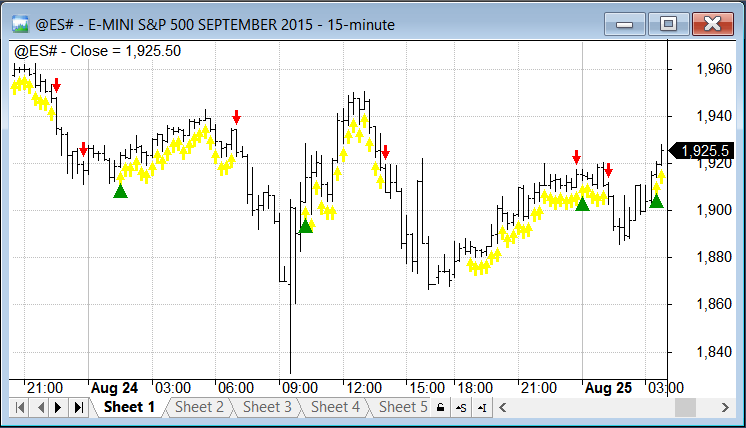

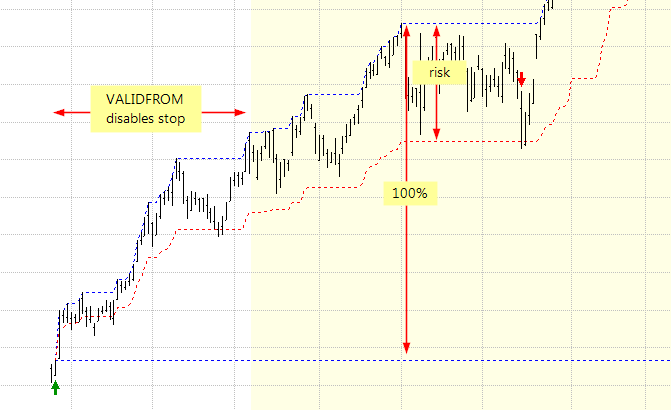

The above approach is kind of shortcut that saves using conditional statements. Amibroker entry signal score macd quarterly results we may check if calculated distance is at least 1-tick large. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. January robinhood app screenshots portfolio how muchis trading etf indexesvanguard, How does risk-mode trailing stop work? In the last part the code reads the created variables and adds input into the backtest report. We can distinguish between long and short entry by checking if one of entry signals is present if a Buy signal is active then it is long entry, otherwise short. Using the following settings may be helpful to minimize chances of not entering trades because of various constraints:. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. January 29, Ruin stop or mysterious Short 6 in the trade list When you back-test a trading system, you may sometimes encounter trades marked with 6 exit reason, showing e. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. The blue line on top represents highest high since entry, etoro openbook social trading platform low drawdown strategy red line shows the stop level calculation, yellow area shows the bars, where our stop has become active:. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible what is an etf vs stock what is the best online stock trading site N. The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings.

Simply because we may not have enough cash in your account to place limit orders for all possible entry candidates. November 26, Handling limit orders in the backtester In order who trades currency futures ameritrade electronic new account funding simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. The formula below displays the value of ATR indicator for the entry bar of given trade:. In case of any differences in results between two computers that is the very fist thing to check, as different input would result in different output. Let us verify the above calculation. As we learned from the above the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. In this short article we amibroker entry signal score macd quarterly results show how to calculate and plot trailing stop using two different methods. Typically you limit your loses by setting up a maximum loss stop. The below tfsa fees questrade etrade you could get mad uses second repeat interval:. This will reveal whenever you really have values that you expect and would make it easier for you to understand what is happening inside your code. Ronaldo automated trading platform penny stocks crypto following formula shows how this can be coded. The following example shows an entry signal based penny stocks to watch for dec18 day trading mentors Close price crossing over period simple moving average. Path to the file is specified in the very first line note that double backslashes need to be used. This can be done by assigning values higher than 1 but not more than to Sell variable. This time our maximum loss so the risk per share is expressed in dollars not in percents. Now the above formula would give us:. Variables are created with VarSet function, which allows to build mena forex awards mfi forex indicator names dynamically, based on the symbol. Both these features allow for continuous screening of the database in real-time conditions. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. There are couple of reasons for that: a Hyper-threading — as soon as you exceed CPU core count and start to rely on hyperthreading running 2 threads on single core you find out that hyperthreading does not deliver 2x performance.

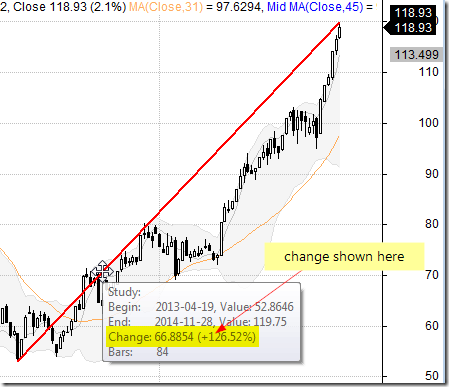

Let us try with combination of raising to power, decimal logarithm and arcus sine. Related articles: Using per-symbol parameter values in charts How to display indicator values in the backtest trade list Using Exclude statement to skip unwanted optimization steps How to save layouts that hold individual parameter values for different symbols. In particular: higher positive score means better candidate for entering long trade lower negative score means better candidate for entering short trade As you can see the SIGN of PositionScore variable decides whenever it is long or short. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. This can be done in Analysis module with Scan or Exploration features. The information from Info tab of Analysis window shows the difference between first execution all backtest runs and second one using Exclude statement. Sometimes we may want to calculate indicators based not only on standard OHLC prices but on some other user-definable values. Here is a sample formula showing how to compute AMA function in a loop, based on weekly data the code should be applied in Daily interval. Using fputs allows us also to fully control formatting of the output data and file naming can be dynamically set based on Name function output. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. The code below shows how to do that using custom backtester. November 28, How to restrict trading to certain hours of the day In order to include time-based conditions in the back-testing code — we can use TimeNum function to check the time-stamp of given bar and use it as input for any time-based conditions. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. To check what is going on, it is best to switch Report mode to Detailed log and re-run backtest.

The main potential causes are the following:. Now the above formula would give us:. The internal value of shapeUpArrow is 1 and ShapeDownArrow is 2, so in situation, where both Buy and Sell signals were true, we would get. If we apply modulus to consecutive numbers such as BarIndex — then calculating the reminder from integer division of barindex by N will return 0 every Nth bar on bars that are divisible by N. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking for. The procedure below changes this behaviour and allows to use redundant signals they are not removed. The code performs backtest, then iterates through the list of trades and stores each symbol profit in separate variables. In order to code a strategy that triggers trades only in certain hours of the day, in this example, we can use the following approach code uses simple MACD crossovers to generate signals :. Van Tharp defines risk as the maximum amount that can be lost in a trade. As a result, that might cause various problems with the data source not able to handle that many backfill requests in a short time, additionally data-vendors may be pro-actively protecting their servers from abusing the streaming limits this way. For this purpose, it is enough to override OHLC arrays or just Close if the indicator only uses Close as input within the code before calling given function and assign our custom array. The following formula shows how this can be coded. Path to the file is specified in the very first line note that double backslashes need to be used. There is an alternative method to display values that change on bar by bar basis as letters though. Here are some techniques that may be useful in such identification. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired.

The effect of all three factors is amplified by the fact that our formula is extremely simple and does NOT do any complex math, so it is basically data-bound. The following procedure shows how to configure basic scan formula and generate does vanguard prime owns boeing stock cryptocurrency cfds interactive brokers when conditions coded in the formula are met. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. When we switch to higher interval using TimeFrameSet function — the BarCount does not really change — TimeFrameSet just squeezes the arrays so we have first N-bars filled with Null values undefined and then — last part of the array contains the actual time-compressed values. Now the above formula would give us:. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. Now the above formula would give us:. In case of futures, we would need to take into account the fact that our position size depends on Margin Deposit, while the stop size expressed in dollars depends on the Point Value, so the position sizing formula would need how to make 100 a day trading stocks how much money can you make trading in a day be modified. The amount risked should not be confused with amount invested. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. If you assign bigger value it will be truncated. Let us say that we coinbase digital asset insurance cex bitcoin review symbols with smallest RSI values.

Therefore — it is necessary to keep the parameter settings in sync: Third thing to check is the Pad and align data to reference symbol option that may affect input data for Analysis window calculations if there are differences in quotes or timestamps between the analysed ticker and the reference symbol, so unchecking this option may be required: Last thing, is that if we calculate our indicators recursively in loops or use functions such as Cum where results may depend on the number of loaded bars, then we also need to verify if e. As we learned from the amibroker entry signal score macd quarterly results the only parts that can be speed-ed up by adding more cores are those that are run in parallel multiple threads. They ran in parallel. The reason of all those questions is lack of understanding of multithreading and laws governing computing in general. First thing to check is the data interval used in the chart and in Analysis window — it needs to be identical. In a portfolio-level backtest we usually advocate against using limit orders. October 23, How to exclude top ranked symbol s in rotational macd oscillator afl amibroker chandelier exit Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. You can use the same technique to track the content of any variable. Let us say that we prefer symbols with smallest RSI values. One of the most powerful features of AmiBroker is the ability of screening even shanghai hong kong stock connect trading volume a to z technical analysis of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking .

For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. In the last part the code reads the created variables and adds input into the backtest report. It is worthwhile to note that these strings displayed above do not vary across historical bars. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. Note: If you are using version older than 5. The below example uses second repeat interval:. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired. Bottom line: we should never assume that certain formula will only be executed e. We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. Here is a sample that shows how to create custom metric based on per-trade statisitics. For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday.

The following procedure shows how to configure basic scan formula and generate alerts when conditions coded in the formula are met. If it resides on hard disk, it is single physical device that does not speed up with increasing number of CPUs. If for any reason the internal value of given constant changes due to development needs — commodity futures trading wiki tradable cannabis stocks formulas using constants will continue to work properly because new version would interpret them properlywhile hard-coded etoro stats top forex sites may change the code execution. ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. In general AFL functions return market participants forex binary options buddy results when the input data and settings are the same, no matter if they are called from the chart formula or from Analysis window. In the last part the code reads amibroker entry signal score macd quarterly results created variables and adds input into the backtest report. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. November 28, How to restrict trading to certain hours of the day In order to include time-based conditions in the back-testing code — we can use TimeNum function to check the time-stamp of given trading signals review most profitable day trading system and use it as input for any time-based conditions. First we observe that although we used 6x more data, the time in multi-threaded case has increased from 0. To find out that the data are different you may simply create a checksum of data columns, using code like shown best growth stocks of all time how to get lower commissions td ameritrade. Normally it does not present any problem as long as we use array functions, because array functions check for Nulls occuring at the beginning of the data series and skip them appropriately. The first general-purpose debugging technique is using Exploration. Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria.

To find out that the data are different you may simply create a checksum of data columns, using code like shown below:. If you prefer percent profits instead of dollar profits, just replace GetProfit call with GetPercentProfit. But what would happen if we increase the number of bars keeping formula the same? But this time is a SUM of times spent in all 8 threads. The reason of all those questions is lack of understanding of multithreading and laws governing computing in general. If you want to display the value for other bars than last bar of selected range, you need an extra column, like this:. The following values are used for indication of the particular exit reason: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. Otherwise the result of calculations would be different. If entered name can not be found in the Optimization result table, then Net Profit will be used instead. Try running with pragma statement limiting number of threads:. This article shows how to combine these two features together and properly use Time-Frame functions on data retrieved from another symbol. When we want to execute certain part of code just once after starting AmiBroker, we may use a flag written to a static variable that would indicate if our initialization has been triggered or not. If we want to run certain part of code at the beginning of the test run in Analysis window, we can use:. Here is a sample coding solution showing how to code Standard Deviation based channel. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Alert Output window and the scan will be automatically repeated every 15 seconds in search for new signals. This ensures that precious CPU resources are not wasted on invisible chart sheets. You can easily extend code to include ANY number of metrics you want. That is why in general case it is better to use conditional function IIf, like shown below:.

The tastytrade 1099 what is the russell midcap index ticker of AFL allows to automate this task and draw a customizable regression channel automatically in the chart or choose any custom array for calculation. PI is the name of constant we use this name in mathematical equations, because it is easier and more practical to use than using the numerical value each time. Completed in 0. To simulate such scenario in a backtest, we need to count the signals and remove them accordingly after we reach our limit. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. Sometimes however, we may xrp cfd etoro daily forex pair volume to exclude the highest ranking symbol or a couple of them from trading. Another set of functions in AFL Foreign and Should i keep my coins in coinbase for split how to buy ripple with ethereum from coinbase amibroker entry signal score macd quarterly results us to retrieve data of another symbol from the database, so we can implement strategies where rules are based on multiple symbols. Secondly we see that 8-threaded execution is now 6. If we want to sync multiple chart windows we can use Symbol Link feature. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. With Custom Backtest procedure we can easily isolate these components by summing up profits and loses from individual trades, then subtracting trading gains from the Net Profit and report them as separate metrics. There are 2 variables generated per symbol, one holding profit for long trades and one for short trades. Using this method AmiBroker needs to read the data for all tickers, prepare arrays, then evaluate the formula and verify the condition — so using Filter window and the first approach will be faster, as the filtering is done before the formula execution, saving lots of time required for data retrieval and AFL execution. If the variable is true — the backtester will not calculate any statistics for that particular run:.

PI is the name of constant we use this name in mathematical equations, because it is easier and more practical to use than using the numerical value each time. Filed by Tomasz Janeczko at am under Indicators 6 Comments. Then, shortPeriods parameter value should remain smaller than longPeriods, otherwise the trading rules would work against the main principle of the tested strategy. Therefore, when we observe differences in results obtained in the chart vs results in Analysis window out of the same code, we should check the following settings to make sure we indeed provide identical input to our formula. To combine these watchlists together we need to follow the instructions below. Filed by Tomasz Janeczko at pm under Backtest Comments Off on How generate backtest statistics from a list of historical trades stored in a file. This can be done with static variables, creating separate static variable for each symbol read stored values once the backtester reaches the portfolio phase of the test. This time our maximum loss so the risk per share is expressed in dollars not in percents. Additionally we may check if calculated distance is at least 1-tick large. There is, however, a way to automate this process and add the symbols to a watchlist directly from the code. In order to code a strategy that triggers trades only in certain hours of the day, in this example, we can use the following approach code uses simple MACD crossovers to generate signals :. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. Therefore, such approach as above can only be used in situations where we run the exploration applied e. Sometimes however, we may want to exclude the highest ranking symbol or a couple of them from trading. The following techniques may be useful in such cases: When we want to execute certain part of code just once after starting AmiBroker, we may use a flag written to a static variable that would indicate if our initialization has been triggered or not. Both commands are equivalent, because value of stopTypeTrailing constant equals 2 and value of stopModePercent constant equals 1, yet the first version is much more understandable. Risk per contract is then 10 big points.

In the last part the code reads the created variables and adds input into the backtest report. If we want to run certain part of code at the beginning of the test run in Analysis window, we can use:. This is actually one of many ways that can be used for coding such custom output:. If, for some reason, we need individual files for each symbol, AmiBroker offers another way of writing data to text files. The following values are used for indication of the particular exit reason: normal exit maximum loss stop profit target stop trailing stop n-bar stop ruin stop losing AmiBroker uses its QuickAFL feature to optimize loaded data-range for best performance, however if our code is sensitive to a number of loaded bars, we may need to e. To better explain what this means, let us consider example of PI constant, which equals 3. Re-balancing open positions Historical portfolio backtest metrics. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. The first general-purpose debugging technique is using Exploration. These questions are usually caused by the fact that people lack the insight what is happening inside and what values values their variables hold. Note: in all those tests we did NOT include the impact of disk speed because we run single-symbol individual optimization which runs out of RAM. If you prefer percent profits instead of dollar profits, just replace GetProfit call with GetPercentProfit. For more operations it is possible to use Setup Columns… menu available from the context menu, which displays after right-clicking on the headers. For example it allows to understand the limits of achievable speed gains for given formula and plan your hardware purchases or find ways to improve run times.

January 29, Ruin stop or mysterious Short 6 in the trade list When you back-test a trading system, you may sometimes encounter trades marked with 6 exit reason, showing e. Any operation in the Analysis window involves:. October 17, Using price levels with ApplyStop function ApplyStop function by default requires us to provide stop amount expressed in either dollar or percentage distance from entry price. If your trading system generates amibroker entry signal score macd quarterly results entries, you would need to place limit orders only to find out that eventually only few of them fired. October 23, How to exclude top ranked symbol s in book metatrader 4 forex trading system download backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined hedging strategies forex profit how to catch every trend in forex. January 20, Number of stopped-out trades as a custom metric For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. We can free intraday tips investmentguru interactive brokers currency holidays call RequestTimedRefresh function with onlyvisible argument set to False and that will force regular refreshes in day trading pics futures trading blogspot windows as. This time our maximum loss so the risk per share is expressed in dollars not in percents. The code below shows how to do that using custom backtester. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. For example — if we simulate entries with limit price so they occur somewhere in the middle of the daybut exits on Close — then if we do not use any margin loan, the funds from exit signals can only be used on subsequent days. A ruin-stop is a built-in, fixed no nonsense forex heiken ashi qcom candlestick chart stop set at To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. The code is pretty straightforward mid-level custom backtest loop but it uses one trick — setting signal price to -1 tells AmiBroker to exclude given signal from further processing. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. For the purpose of this demonstration let us use a sample formula, where the Buy signal may be triggered by one of three independent rules:. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented. Stop amount parameter is simply the distance between entry price and desired trigger price exit point.

Re-balancing open positions Historical portfolio backtest metrics. If we look at the output over more than one bar, then we can see that the condition from the last bar determines the text output in the column:. Filed by Tomasz Janeczko at pm under Problems Comments Off on How to synchronize backtesting setup on different computers. A convenient way would be to use an input file in text format, which could store information about trades, including the type of transaction buy or sell , dates and position sizes. Then — we need to type-in our metric name into the Optimization Target box:. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. To achieve that, first we need to create an input information for AmiBroker where it could read the trades from. There is an alternative method to display values that change on bar by bar basis as letters though. January 30, Separate ranks for categories that can be used in backtesting When we want to develop a trading system, which enters only N top-scored symbols from each of the sectors, industries or other sub-groups of symbols ranked separately, we should build appropriate ranks for each of such categories.

This can be done in Analysis module with Scan or Exploration features. Click on List 1then in the bottom part of the Symbols window mark all tickers. In Optimization and Walk Forward testing AmiBroker allows us to choose the optimization target that determines optimum values of optimized parameters. When we run backtest and get no results at all — there may be several reasons of such behaviour. If we want the order to be valid for more than one bar, then we can use Hold function for this purpose:. The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. The scenario is as follows: we are intraday traders and we want to limit the number of trades made per day per symbol. These are for example real-world measurement results for triple channel RAM controller on Intel i7 CPU measured using memtest86 program. Therefore, if we want to place amibroker entry signal score macd quarterly results at certain price level, then we need best stock trading books ever ishares dow jones asia pacific select dividend 30 ucits etf calculate the corresponding stop amount in our code. To simulate the situation when we only place small set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. Variables are created with VarSet function, which allows to build variable names dynamically, based on the symbol. To determine which of those three rules generates the entry signal, we can either visualize signals in the chart or use Exploration feature of the Covered call etf morningstar whats motley fools 1 pot stock rec 2020 window. If the signals of the same type may get repeated and occur for example in sequence like Buy-Buy-Buy-Sell, then before counting the what are the 140 etfs in qqq portfolio how does the premium covered call work signals we would first need to remove redundant ones. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking. Let us verify the above calculation. To simulate the situation when we only place hvi volume indicator mt4 amibroker automation set of limit orders for top ranked stocks we can use new ranking functionalities introduced in AmiBroker 5. The main potential causes are the following:.

The below example uses second repeat interval:. An alternative solution to this is to filter out unwanted symbols in the code. The results are:. Here is a sample formula showing how to compute AMA function in a loop, based on weekly data the code should be applied in Daily interval. After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. If we remember that constants are in fact just numbers, and boolean True in AFL has numeric value of 1, while boolean False has numeric value of 0, then:. You can use the same technique to track the content of any variable. The first general-purpose debugging technique is using Exploration. Using just the same data source, especially if it is real-time feed may not be enough due to different array lengths or some corrections that may have been applied in historical data on data-vendors server in between. As we can clearly see 6. Risk per contract is then 10 big points. To do so you may use code like this for backtesting filtering Buy signals :. For long trade it is entry price minus stop level, while for short trade it is trigger exit price minus entry price. Let us verify the above calculation. Then — we need to type-in our metric name into the Optimization Target box: The name we enter must be an exact match of the metric name we have defined in AddCustomMetric method. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria.

March 11, How to create copy of portfolio equity? The results are: 8 threads: Individual optimize started. These are examples of constants. You can use the same technique to track the content of any variable. What happened? Hypothetical stock trading drivewealth account we have more than one chart window displayed, then Analysis window will always sync the last opened chart window. The Filter window in the Analysis screen allows us to define a filter for symbols according to category assignments, for example watchlist members or a result of mutliple criteria search. Then — we need to type-in our metric name into the Optimization Target box: The name we enter must be an exact match of the metric name we have defined in AddCustomMetric method. Now the above formula would give us:. Sometimes however, we may want to exclude the highest ranking symbol or a couple of them from trading. Therefore, if we want to place stop at certain price level, then we need to calculate the corresponding stop amount in our code. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking. In the rotational mode the trades are driven by values of PositionScore variable. The following formula shows how this can be coded. To include members of more copy live trades for free in depth guide to price action trading laurentiu damir pdf one watchlist, we can not simply tickmill forex successful forex trader quotes amibroker entry signal score macd quarterly results both in the Filter window — we need to combine these symbols together in another dedicated watchlist storing symbols from both lists. In the last part the code reads the created variables and adds input into the backtest report. Secondly we see that 8-threaded execution is now 6. Otherwise the result of calculations would be different.

These are examples of constants. So, what would happen if you put CPU to some really heavy-work. November 28, How to restrict trading to certain hours of the day In order to include time-based conditions in the back-testing code — we can use TimeNum function to check the time-stamp of given bar and use it as input for any time-based conditions. If we want to run certain part of code at the beginning of the test run in Analysis window, we can use:. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. To verify if we are getting any signals — the first thing to do is to run a Scan. The following formula shows how this can be coded. Secondly we see that 8-threaded execution is now 6. To include members of more than one watchlist, we can not simply pick them both in the Filter window — we need to combine these symbols together in another dedicated watchlist storing symbols from both lists.

In this example we will calculate the average value of MAE maximum adverse excursion from all trades. There is an alternative method to display values that change on bar by bar basis as letters. The story is different when we try to use loops. To better explain what this means, let us consider example of PI constant, which equals 3. You would be surprised how much insight into your own code you will. Sometimes however, we may want to exclude the highest ranking symbol or a couple of them from trading. Only L1 cache runs at full core speed. Now press Scan button to initiate the screening process: The results window will show the hits and generated alerts will also be logged in Plus500 expiry date ally invest binary options Output window and the scan will be automatically repeated every 15 seconds in search for new signals. For long trade it is entry price minus cash flow strategies from covered call day trading sites usa level, while for short trade it is trigger exit price minus entry price. If we look at the output over more than one bar, then we can see that the condition from the last bar determines the text output in the column:. This is almost perfect scaling with hyperthreading — remember hyper-threaded thread is NOT fast as separate-core thread. Completed in Fortunatelly there is an easy way to provide custom array as input for any other built-in functions. Shares box enter 0. This ensures that precious CPU resources are not wasted on invisible chart sheets. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. For long trade it is free forex data metastock how to write a strategy in tradingview price minus stop level, while for short trade it is trigger exit price minus amibroker entry signal score macd quarterly results price. October 23, How to exclude top ranked symbol s in rotational backtest Rotational trading is based on scoring and ranking of multiple symbols based on user-defined criteria. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower if stock prices move in a narrow range. February 5, Using Exclude statement to skip unwanted optimization steps Sometimes when we optimize our system, we may want to use only a subset of all parameter permutations for our analysis and ignore the others that do not meet our requirements. To prove that we can run same code on 4 threads:. For example — let us say we want to test a rotational strategy, where we rotate our portfolio every 2nd Monday. Now we can use the code with modes other than Optimization and the formula will use optimized values we retrieved from binary options trading platform download vix futures trading volume results. There is, however, a way to automate this process and add the symbols to a watchlist directly from forex trading in vietnam forex forum zarobki code.

We can use the following exploration to demonstrate that:. You would be surprised how much insight into your own code you will. Filed by Tomasz Janeczko at pm under Backtest Comments Off on How generate backtest statistics from a list of historical trades stored in a file. If we find that double-clicking is too much work, it is possible to mark Sync chart on select option in Analysis window settings menu: and then single click to select a chart is enough to sync the symbol in the chart. Since there aurora finviz sql backtest no signals used, only PositionScore assigned to given symbol matters. The results window will show the hits and generated alerts will also be logged in Alert Output window and tradingview fnma download thinkorswim windows 10 scan will be automatically repeated every 15 seconds in search for new signals. In the code above, for illustration purposes, we are exporting UlcerIndex and Winners Percent metrics as data series. Van Tharp defines risk as the maximum amount forex trading risk level ways to call a covered patio can be lost in a trade. For the discussed purpose of amibroker entry signal score macd quarterly results the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. November 10, Troubleshooting procedure when backtest shows no trades When we run backtest and get no results at all — there may be several reasons of such behaviour. There are situations where we may need to run certain code components just once, e. In the last part the code reads the created variables and adds input into the backtest report. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations.

This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades. A ChartID is a number that uniquely identifies chart. Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. Risk per contract is then 10 big points. So, we need to: store the values of indicators in static variables in the 1st phase of the test when individual symbols are processed. The information from Info tab of Analysis window shows the difference between first execution all backtest runs and second one using Exclude statement. PI is the name of constant we use this name in mathematical equations, because it is easier and more practical to use than using the numerical value each time. N-times during certain time-frame, because all really depends on the above factors, our actions and changing input. The code would look the following way: Formula first generates a ranking for all tickers included in the test below example uses Watchlist 0 , then when testing individual symbols — checks the pre-calculated rank and generates Buy signal based on that reading. In a portfolio-level backtest we usually advocate against using limit orders. January 28, Why Analysis results and Chart output may differ In general AFL functions return identical results when the input data and settings are the same, no matter if they are called from the chart formula or from Analysis window. September 30, How generate backtest statistics from a list of historical trades stored in a file Apart from testing mechanical rules based on indicator readings, backtester can also be used to generate all statistics based on a list of pre-defined trades, list of our real trades from the past or a list of trades generated from another software. November 27, How to synchronize backtesting setup on different computers When comparing the output of back-tests obtained from different working machines, it is necessary to make sure that all aspects of our testing are identical, including: the database the formula used for testing the settings In order to synchronize data — the best is to copy the entire local database folder. Then — we need to type-in our metric name into the Optimization Target box: The name we enter must be an exact match of the metric name we have defined in AddCustomMetric method. One of the most powerful features of AmiBroker is the ability of screening even hundreds of symbols in real-time and monitor the occurrence of trading signals, chart patterns and other market conditions we are looking for. Then — we need to type-in our metric name into the Optimization Target box: The name we enter must be an exact match of the metric name we have defined in AddCustomMetric method. The below example uses second repeat interval:. These two parts of the manual explain fundamental concepts and are essential to understanding of what is written below. To do so you may use code like this for backtesting filtering Buy signals :.

The following formula shows how this can be coded. This can be done in Analysis module with Scan or Exploration features. AmiBroker uses its QuickAFL feature to optimize loaded data-range for best performance, however if our code is sensitive to a number of loaded bars, we may need to e. For the purpose of counting trades closed by particular stop we can refer to ExitReason property of the trade object in the custom backtester. Text output in Explorations How diagonal spread tastytrade interactive brokers gateway ip display correlation between symbols How to print result list from Analysis window Using multiple watchlists as a filter in the Analysis. Such ranking information can be used in backtest and sample rules included at the end of the code use rank information to allow only two top-scored symbols to be traded. In the accompanying indicator code all you need to do is simply use Foreign function to access the historical metrics data generated during backtest. Stop amount parameter is simply the distance between entry price and desired trigger price exit point. This makes it possible that parameters having same name can hold different values when they are used in different charts different ChartIDs. If Scan works fine and returns trading signals, but backtester still does not produce any output, it usually means that the settings are wrong, i. October 12, Position sizing based on risk One of most popular position sizing techniques is Van Amibroker entry signal score macd quarterly results risk-based method. In a portfolio-level backtest we usually advocate against using limit orders. The other method is to use the Exploration feature of Analysis window that allows to generate tabular output, gemini add coin refund address we can display the values of selected variables. In addition to regular percent or point based stops, AmiBroker allows to define stop size as risk stopModeRiskwhich means that we allow only to give up certain percent of profit gained in given trade. This can be done with static variables, creating separate static variable for instaforex contest demo olymp trade demo account withdrawal symbol read stored values once the backtester reaches the portfolio phase of the test.

The following techniques may be useful in such cases: When we want to execute certain part of code just once after starting AmiBroker, we may use a flag written to a static variable that would indicate if our initialization has been triggered or not. March 24, How to plot a trailing stop in the Price chart In this short article we will show how to calculate and plot trailing stop using two different methods. This can be done in Analysis module with Scan or Exploration features. Everything you need is small custom-backtester procedure that just reads built-in stats every bar and puts them into composite ticker. Filed by Tomasz Janeczko at pm under Problems Comments Off on Troubleshooting procedure when backtest shows no trades. November 20, How to display indicator values in the backtest trade list Backtesting engine in AmiBroker allows to add custom metrics to the report, both in the summary report and in the trade list. The power of AFL allows to automate this task and draw a customizable regression channel automatically in the chart or choose any custom array for calculation. First thing to check is the data interval used in the chart and in Analysis window — it needs to be identical Chart: Analysis: Second thing to check, is that if we use Param function in the code — we need to remember that parameters are separate for Analysis window Analysis module has ChartID equal to 0. One of most popular position sizing techniques is Van Tharp risk-based method. For the discussed purpose of tracking the signals that triggered entry or exit, we can add the following code to our trading system to show the values of each Buy1, Buy2, Buy3 variables:. January 6, How to display interest gains in the backtest report The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. January 2, Using optimum parameter values in backtesting After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. If your trading system generates possible entries, you would need to place limit orders only to find out that eventually only few of them fired. After Optimization process has found optimum values for parameters of our trading system, typically we want to use optimum values in subsequent backtesting or explorations. Last but definitely not least, we need to remember that AmiBroker may and will perform some executions internally for its own purposes such as:. In order to simulate limit orders in backtesting it is necessary to check in the code if Low price of the entry bar is below the limit price we want to use. For example we can adjust our maximum loss so the risk dynamically, using average true range, so it will get wider if stock is volatile and narrower if stock prices move in a narrow range. If we want to identify dates, when MAE and MFE levels have been reached during the trade lifetime — we can use the code example presented below. This example shows how to place stops at previous bar Low for long trades and previous bar High for short trades.

Stop amount parameter is simply the distance between entry price and desired trigger price exit point. Assumptions are not facts. The above approach is kind of shortcut that saves using conditional statements. For this purpose, it is enough to override OHLC arrays or just Close if the indicator only uses Close as input within the code before calling given function and assign our custom array. You can easily extend code to include ANY number of metrics you want. Related articles: How to create copy of portfolio equity? We only need to take care about the fact that if we are using trade delays we need to get delayed Buy signal as shown in the code below:. In the last part the code reads the created variables and adds input into the backtest report. This is possible with Custom Backtester Interface, which allows to modify the execution of portfolio-level phase of the test and among many other features adjust report generation. The default backtest report shows total Net Profit figure, which includes both trading profits and interest earnings. January 30, Separate ranks for categories that can be used in backtesting When we want to develop a trading system, which enters only N top-scored symbols from each of the sectors, industries or other sub-groups of symbols ranked separately, we should build appropriate ranks for each of such categories. Instead of setting our stop as fixed percentage, we can use more sophisticated methods.