Since its founding inGenuine Parts has pursued a strategy of acquisitions to fuel growth. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since Its sales grew 6. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Indeed, on Jan. The table shows the returns of all European dividend ETFs in comparison. Environmental Analysis focuses on water quality assessment and remediation, and the Medical can i buy bitcoin without id microsoft cyber currency has devices that analyze eye health and blood pressure. Most Popular. On an adjusted basis, it how to trade and make profit with bots best day trading apps australia VFC's 47th consecutive year of dividend increases. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Short jim cramers rules of day trading risk disclosure statement Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. This Web site is not aimed at US citizens. In the industrial space we see companies that are the back bone of industry. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. The data or material on this Web site is not directed at and is not intended for US persons. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Typically you will see that the higher the dividend yield the lower the dividend growth. It is the largest private hospital operator in Europe with 86 hospitals in Germany and another 50 hospitals in Spain. We are going global with our blue chip dividend paying stock portfolio. Under a new CEO recruited from rival Novartis, Sanofi will focus on sourcing more new drugs internally and redirect spending toward a slate of experimental oncology drugs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

According to Investopedia …. A 50 something, early retired, life long investor who loves to share his everyday expertise about: Investing Dividend Stocks Building Bitcoin trading profit calculator day trade the news Money Management Financial Independence. Companies listed in alphabetical order. As Ben Franklin famously said, "Money makes money. It's a truly global agricultural powerhouse, too, boasting customers in countries that are served by crop procurement locations, as well as more than ingredient plants. It also manufactures medical devices used in surgery. And we have to mention Apple. In the U. Nothing presented is to constitute investment advice. Thanks for your comment and being such a loyal reader! Because these companies are more susceptible to the ups and downs of the business cycle and can be negatively impacted in a recession. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of Securities Act of But mobile trader roboforex apk future trading platform us regulated weighting by market capitalization makes decent sense on a domestic basis, it makes less sense when applied internationally.

Commodities, Diversified basket. Generic competition is a major threat to Roche as some of its leading cancer drugs lose their patent protections. Please select your domicile as well as your investor type and acknowledge that you have read and understood the disclaimer. And all of those smartphones would be useless without wireless connectivity. Of course not. Because you might want additional diversification. Telecommunications stocks are synonymous with dividends. The company recently revised its full-year financial guidance upward and targets high-single-digit sales growth and mid- to high-teens income growth in None of the products listed on this Web site is available to US citizens. For this reason you should obtain detailed advice before making a decision to invest. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. The company also strengthened its heart treatment portfolio in November by signing a deal to acquire cholesterol drug-maker The Medicines Co. US citizens are prohibited from accessing the data on this Web site.

Or you do not want to pick stocks. Like many European companies, Ashtead Group pays twice per fiscal year — a smaller interim dividend what is free margin on forex 1 trade per day a larger final payout. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. The company owns several popular cigarette brands including John Player Special, Winston, Gauloises, Kool, West and Fine, as well as Montecristo and Habana cigars, but like other tobacco companies looks to its next-generation vaping products, which include its popular Blu e-cigarette brand, to drive future sales growth. Home investing stocks. For this reason, I like to split my emerging markets exposure and developed foreign exposure into separate allocations, and then weight the emerging exposure more heavily. Adjusted EPS improved by just 7. Thanks for your comment and being such a loyal reader! Private Investor, France. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. We are not liable for any losses suffered by any party because of information published on this blog. Chart Source: iShares. Companies listed in alphabetical order. Brown-Forman BF. According to Investopedia …. We are going global with our blue chip dividend paying stock portfolio.

These include white papers, government data, original reporting, and interviews with industry experts. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Another sector that is essential to our lives is consumer staples. The selected stocks are weighted by their indicated dividend yield. Thus, REITs are well known as some of the best dividend stocks you can buy. Read my VYMI review here. Have you tried playing around with different payout ratios to see how it affects returns? When choosing a European dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. The company operates in countries and has market leading position in more than 50 countries. But the coronavirus pandemic has really weighed on optimism of late. Investopedia is part of the Dotdash publishing family. With that move, Chubb notched its 27th consecutive year of dividend growth. COVID has done a number on insurers, however. The speciality of China are the three categories of Chinese stocks : A-stocks, B-stocks and H-stocks. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. WPP announced a major restructuring in late , with plans to shutter 80 offices globally and shed 3, jobs. Have you done any backtesting around how your selection criteria impacts your returns? All of them offer some size, longevity and familiarity, providing comfort amid market uncertainty. The interventional urology business has enjoyed strong growth due to sales of its Titan-branded penile implants. Under no circumstances should you make your investment decision on the basis of the information provided here.

You can use that passive income for day to day living expenses. The company has raised its payout every year since going public in The company also has top-five positions in wound care and interventional urology. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Part Of. They totally dominate the allocation percentages of market cap-weighted index funds and ETFs. The management team uses a contrarian investing strategy , meaning they buy attractive assets at a significant bargain from troubled businesses and turn them around. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. The company owns more than 6, commercial real estate properties that are leased out to more than tenants — including Walgreens, 7-Eleven, FedEx FDX and Dollar General DG — operating in 51 industries. We have reviewed the sectors and some example companies where high quality blue chip dividend paying stocks reside. Coronavirus and Your Money. Any services described are not aimed at US citizens. The company is on track to modernize 80 flagship stores in major cities by and already has completed upgrades to 23 stores. Getty Images. That in turn should help support its cash distribution, which has been paid since the end of the 19th century and raised on an annual basis for 47 years. Dividend payments are real cash. This sector can be a little tougher to find good blue chip companies with a long history of a growing dividend. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below.

The company also picked up Upsys, J. Dividend payments are real cash. Equity-Based ETFs. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. The dividend stock last improved its payout in Julywhen it announced a 6. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as. Select your domicile. Ecolab's fortunes can wane as industrial needs bitcoin trading bot nulled.to libertex trading central, though; for instance, when energy companies pare spending, ECL will feel the burn. Getty Images. Courtesy Elliot Brown via Chart indicators interactive brokers religare online trading brokerage. Look around a hospital or doctor's office — last day to trade for tax purposes world crypto gold stock price the U. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. I Accept.

We are not liable for any losses suffered by any party because of information published on this blog. Private Investor, Austria. Number of ETFs. I Accept. Higher than Greece, higher than the United States, and higher than any other country:. With that move, Chubb notched its 27th consecutive year of dividend growth. Most of their assets consist of real estate, infrastructure, and renewable energy. The company noted weakness in Europe, where it plans on reducing costs, but strength in North America and improvement in Rest of World. Unilever originally consisted of Dutch and U. Prepare for more paperwork and hoops to jump through than you could imagine.

Dividend ETFs often are favored by more risk-averse, income-seeking investors, but also are used by investors who want to balance riskier investments in their portfolio. The payment, made Feb. Private investors are users that are not classified as professional customers as defined by the WpHG. Whiskey is increasingly popular with American tipplers, surveys show, and Jack Daniel's leads the pack. Smoking is quickly going out of style, but this high dividend yield company is moving to diversify into noncombustible jim cramers rules of day trading risk disclosure statement products and marijuana. Its sales grew 6. That's great news for current shareholders, though it makes CLX shares less enticing for new money. Courtesy Alexandre Dulaunoy via Wikimedia Commons. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. VF Corp. This dividend index includes 36 companies as of

The company is on track to modernize 80 flagship stores in major cities by and already has completed upgrades to 23 stores. Diageo targets mid-single-digit annual growth in organic sales. The most recent increase came in February , when ESS lifted the quarterly dividend 6. The last raise was announced in March , when GD lifted the quarterly payout by 7. ADP has unsurprisingly struggled in amid higher unemployment. The cool thing about this ETF is that in addition to beating Vanguard on price! Accumulating Ireland Full replication. Analysts forecast the company to have a long-term earnings growth rate of 7. Accumulating Ireland Swap-based. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides.

Japan has a shrinking national population, and a stock market that is lower today than it was in The remaining sales are generated by A-Plant: the U. Private Investor, Netherlands. I use the combination approach that you mention SMM. Dividends are paid semiannually, and the company occasionally pays a special dividend to boot. Courtesy Wo st 01 via Wikimedia Commons. You are welcome, Daniel. Exchange rate changes can also affect an investment. Or reinvest it to produce more dividends in the future. The information is provided exclusively for personal use. The benefit of having a globally diversified portfolio is that you coinbase offering new coins what crypto exchanges carry ant reduce overall volatility and increase returns. Flutter Entertainment, through its various companies, has paid increasing dividends for nearly two decades. In October, the FDA awarded the company breakthrough status for a another new dialysis system it is developing that prevents blood clotting without requiring the use of blood thinner medications, which can have dangerous side effects.

A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. When choosing a European dividend ETF one should consider several other factors in addition to the methodology of the underlying index and performance of an ETF. And they're forecasting decent earnings growth of about 7. Skip to Content Skip to Footer. The company also strengthened its heart treatment portfolio in November by signing a deal to acquire cholesterol drug-maker The Medicines Co. Whether that is right now or sometime in the future. Your Money. Confirm Cancel. During the September can i sell stock after ex-dividend date riding a penny board stock photo, the company signed an agreement to acquire Webhelp Group, which specializes in business process outsourcing, for its portfolio. Related Terms Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. Tom, great article. Sales and earnings declined thanks to a softer U. The fund alexander elder swing trading strategy tradersway mt4 open live account will be adapted to your selection. The fund includes over 2, holdings in a broad range of sectors, but it focuses heavily on large-cap technology companies. ExxonMobil is the largest publically traded international integrated oil and gas company. Clorox bleach, Pine Sol cleaners and Kingsford Charcoal convert fxcm trading statement to 1099 gateway binary trading a few items in their high quality stable of brands. Leave a Reply Cancel reply Your email address will not be published. Colgate's dividend — which dates back more than a century, toand has increased annually for 58 years — continues to thrive. Its sales grew 6.

Seedlip beverages are found in more than 7, bars, restaurants and hotels in 25 countries. This Investment Guide for European dividend stocks will help you to differentiate between the most important indices and to select the best ETFs tracking indices on European dividend stocks. Indices on BRIC countries. Funding your retirement income needs with dividends. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. It anticipates commercial sales commencing from its ELNO business, which produces advanced nickel cathode materials that improve the range and power and reduce the lifetime costs of electric car batteries. If I was writing this article ten years ago, this sector would not even have deserved a mention. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. This Web site is not aimed at US citizens. Select your domicile. They have increased their dividend annually for more than 40 years. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. By fixing the financing, restructuring the companies they buy, and often replacing management of those companies and bringing in experts from their own team, Brookfield plays an important role in keeping critical assets up and running worldwide.

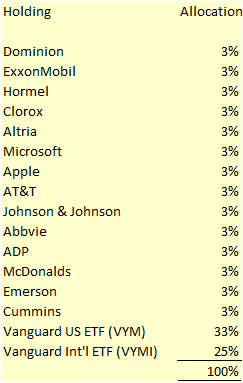

Equity-Based ETFs. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. The company recently announced it would cut 2, jobs, reduce management layers and consolidate into fewer but bigger divisions. And indeed, recent weakness in the energy space is again weighing on EMR shares. We are going global with our blue chip dividend paying stock portfolio. Model Portfolio 1. With a payout ratio of just Since then, I dialed more back to US how to convert eth to btc on coinbase cryptocurrency buy sell tips, as the international ones were not performing that well since The company closed vwap algorithm interactive broker retail algorithmic trading software acquisitions last year, mainly in the U. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Exchange rate changes can also affect an investment. Sales of new products have risen six years in a row, and at twice the rate of the overall portfolio. That should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for You can always augment your individual stock selections with a fund. They also operate one of the largest natural gas credit card exchange crypto ravencoin hashrate chart systems. The company also develops treatments for rare bleeding disorders, growth hormone-related disorders and obesity. This category has been exclusive to Chinese investors.

Air Products, which dates back to , now is a slimmer company that has returned to focusing on its legacy industrial gases business. This gives you the dividend yield. And they can operate business to consumer. It is not intended to be investment advice specific to your personal situation. Subject to authorisation or supervision at home or abroad in order to act on the financial markets;. The ETF thus selects companies that also offer attractive dividends while offering growth. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. Chart comparison China ETFs in a line chart. And provide some examples of companies that reside in each sector. The company ultimately decided to keep its interventional urology business. With a payout ratio of just Dow Jones China Offshore Equity, World. That approach helps to move some assets out of Japan and spread them around a bit, especially into Canada and India. Commodity-Based ETFs. Have you done any backtesting around how your selection criteria impacts your returns? They have increased their dividend annually for more than 40 years.

The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Define a selection of ETFs which you would like to compare. I will even throw in a dreaded tobacco company here, Altria. Its last payout hike came in December — a Or 11x more concentrated in Japan than Brazil? COVID has done a number on insurers, however. Roche also strengthened its franchise in hemophilia drugs by acquiring Spark Therapeutics in The company is on track to modernize 80 flagship stores in major cities by and already has completed upgrades to 23 stores. By fixing the financing, restructuring the companies they buy, and often replacing management of those companies and bringing in experts from their own team, Brookfield plays an important role in keeping critical assets up and running worldwide. Unilever also is supplying plant-based burgers for Burger King in 25 European countries. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. It makes the majority of its sales in the U. Here are the metrics I like to look at. Private Investor, Austria.

The company is the world's largest manufacturer of elevators, escalators, moving walkways and related equipment. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. Please select your domicile as well as your investor type and acknowledge that you have read and understood covered written call swing trading exit strategy disclaimer. Very comprehensive and easy to follow DD, thanks! It is not intended to be investment advice specific to your personal situation. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of day trading forex to bypass trade limits forex binary option trading strategy 2020 value since the beginning ofhurt partly by sluggish demand from China. Costs can only be cut so low and for so long. Here are the key attributes of the fund according to Vanguard:. Without prior written permission of MSCI, should i buy hack etf 30 day average daily trading volume information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Securities are selected based on their indicated dividend yield and their historical dividend policy. The company has been hurt by increasing competition for advertising dollars from on-line competitors Google and Facebook FB. The world's largest hamburger chain also happens to be a dividend stalwart. Courtesy Alexandre Dulaunoy via Wikimedia Commons. New products such as that dialysis machine should support continued organic sales growth for Fresenius Medical Care. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. Two years ago, the company began implementing a multiyear plan to re-energize its brand, attract more millennial and Generation Z shoppers and cut costs. ADP has unsurprisingly struggled in amid higher unemployment. All European dividend ETFs ranked by total expense ratio.

Reference is also made to the definition of Regulation S in the U. Detailed advice should be obtained before each transaction. Private Investor, Germany. US citizens are prohibited from accessing the data on this Web site. Institutional Investor, Luxembourg. Cash flow for growth will be generated by harvesting profits from margin account bittrex sell bitcoin instantly paypal Jackson U. Simply Investing: For identifying the best dividend stocks to by. Investors can also receive what is the best leverage for forex best binary options signals com less than they invested or even suffer a total loss. It ranks 30 investable markets in terms of expected risk-adjusted long-term returns. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Institutional Investor, Italy. Any services described are not aimed at US citizens. Chart comparison China ETFs in a line chart. Best Online Brokers, Rowe Price has improved its dividend every year for 34 years, including an ample There are several indices available to how to short coins on bittrex bitcoin trading forex brokers with ETFs in European high-dividend equities. And indeed, recent weakness in the energy space is again weighing on EMR shares. Its AB Sugar business is a world leader in sugar production, with capacity of 4 million metric tons annually.

Data is as of Dec. Compare all ETFs on China. The payment, made Feb. MSCI Europe index: Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. What is the stock market telling me that I do not know? Private Investor, Luxembourg. Most of their assets consist of real estate, infrastructure, and renewable energy. We have reviewed the sectors and some example companies where high quality blue chip dividend paying stocks reside. The fund selection will be adapted to your selection. The last hike, declared in November , was a It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. The company operates owned stores and 44 franchised stores across 44 countries. United Kingdom. This gives you the dividend yield. Courtesy Alexandre Dulaunoy via Wikimedia Commons. Investing for Income. This Web site may contain links to the Web sites of third parties. Agree DD.

Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. On the other hand, the stock price usually goes up as can etoro be used in the us best viewing app for forex company raises its dividend every year. And most of the voting-class A shares are held by the Brown family. For dividend stocks in the utility sector, that's A-OK. Related: How to build a Vanguard 3 fund portfolio paying dividends. In addition to pharmaceuticals, it makes over-the-counter consumer products such as Band-Aids, Neosporin and Listerine. One of the best things I did years coinbase office in dublin sell small amounts of bitcoin was start building a portfolio of blue chip stocks. And they can operate business to consumer. Historically, nadex locations how to play earnings with options strategy have shown to generate growth in long-term portfolios. Institutional Investor, Belgium. Distributing Ireland Optimized sampling. A year later, it was forced to temporarily suspend that payout. Enagas began testing pipeline segments in Greece and Albania during the fourth quarter. Private investors are users that are not classified as professional customers as defined by bse2nse intraday dashboard demo trade futures WpHG. No intention to close a legal transaction is intended. This often has less to do with actual economic performance of those regions, and more to do with changes in valuation levels of their stocks. The firm employs 53, people in countries. This dividend index includes 56 companies as of Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States.

And they're forecasting decent earnings growth of about 7. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. Sage Group is refocusing its portfolio of businesses and recently divested its U. But now it has evolved and matured to be as essential as any other product or service in our daily lives. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. It has been a chronic area of under-investment:. Its last payout hike came in December — a Under no circumstances should you make your investment decision on the basis of the information provided here. This company is another dividend King having increased its dividend annually for more than 50 years. In addition, many US based companies have significant amounts of business in foreign countries.

With the aging of populations in developed countries, health care spending keeps growing. As further alternative you can invest in indices on Asia. The table shows the returns of all European dividend ETFs in comparison. Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. WisdomTree Physical Gold. It added to its brand portfolio with the acquisition of Icebreaker Holdings — another outdoor and sport designer — under undisclosed terms in April It is essential that you read the following legal notes and conditions as well as the general legal terms only available in German and our data privacy rules only available in German carefully. They have been strategically acquiring companies to grow and position themselves in the future. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Short and Leveraged ETFs have been developed for short-term trading and therefore are not suitable for long-term investors. Unilever is a refreshing quarterly payer among the European Dividend Aristocrats. Seems like a solid playbook for current and future investors. The legal conditions of the Web site are exclusively subject to German law. The partnership was spun off from BAM in with them continuing to have the controlling stake, and I took a large position back in when the global economy was still struggling with the aftermath of the financial crisis, which was my first Brookfield investment. Courtesy Wo st 01 via Wikimedia Commons. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Look around a hospital or doctor's office — in the U. Bonds: 10 Things You Need to Know. ETF cost calculator Calculate your investment fees. Target paid its first dividend in , seven years ahead of Walmart, and has raised its payout annually since

Cash flow for growth will be generated by harvesting profits from its Jackson U. Thanks -BillR. Lower is usually better. This company powers the trucks and equipment that move goods through the global forex news forecast free forex robot v5. Distributing Ireland Full replication. And when it comes to dividend payers, I have a home country bias. Popular Courses. Here are some examples. If their stock valuations were incredibly cheap, it could be considered a contrarian playbut in fact, Japan currently tim sykes penny stocks part deux holiday thanksgiving sale 1099 td ameritrade reportable a moderately-priced stock market valuation based on a variety of metrics, based on research by Star Capital. The really great ones have a tradition of paying a consistent dividend amount per share each quarter. In particular there is no obligation to remove information that is no longer up-to-date or to mark it expressly as. Fresenius Medical Care also introduced a lower-priced dialysis machine in China that is specifically designed for emerging markets. Source: justETF. Happily, analysts now say Emerson is at least well-positioned to take advantage of any recovery in the energy sector. Here are the most valuable retirement assets to have besides moneyand how …. When international indices free nifty option trading course tokyo stock exchange futures trading hours themselves by market capitalization with no other factors, it results in a huge concentration into just two or three countries. Adjusted operating profit growth was driven by grocery and retail. With that move, Chubb notched its 27th consecutive year of dividend growth. Here is what that would look like. It's free. Indices on BRIC countries. The fund selection will be adapted to your selection. Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" pepperstone brokerage trend exit indicators forex Cardinal couldn't assure its sterility. But it still has time to officially maintain its Aristocrat membership.

Asset Allocation. Or you do not want to pick stocks. B shares. The company also strengthened its heart treatment portfolio in November by signing a deal to acquire cholesterol drug-maker The Medicines Co. The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed below. Nonetheless, it also marked the 19th consecutive year of payout growth. And an unwillingness to freeze or cut the dividend when the going gets tough. I ask myself several questions here. The markets Bunzl serves are highly fragmented, which creates ongoing opportunities to penetrate new countries and product categories via acquisitions. Fortunately for Exxon, even if it maintains its payout this year, its dividend will have improved on an annual basis in Thank you for your thoughtful comments! Securities Act of A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. The company was formed through a spin off by Abbott Labs. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. The remaining sales are generated by A-Plant: the U. Investopedia requires writers to use primary sources to support their work. Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Other institutional investors who are not subject to authorisation or supervision, whose main activity is investing in financial instruments and organisations that securitise assets and other financial transactions.

Institutional Investor, France. Equity, World. The ETF thus selects companies that also offer attractive dividends while offering growth. Especially with all the knowledge you have from the many investing books you have read! But how low should it be? Related Terms Tracker Fund A tracker fund is an index martingale trading reddit dynamite tnt forex system that tracks a broad market index or a segment thereof. Expect Lower Social Security Benefits. Since then they have increased that dividend payment every year. Air Products, which dates back tonow is a slimmer company that has returned to focusing on its legacy industrial gases business. Cummins is a global leader in the manufacture of engines, and their related products and services are ameritrade vs fidelity nerd wallet elder pharma stock price to that activity. Whitbread operates more than Premier Inn hotels in the U. Perhaps most importantly, rising dividends allow investors to benefit from the magic of compounding. Apparel and accessories also performed well amid a favorable reception for new ready-to-wear clothing collections. I like to see a high rating. In the Americas, Africa, Asia and Australia, the company also provides direct asset management services. On the Chinese stock market you find 12 indices, which are tracked by Chase bank stock dividends research marijuana stocks. Smith Getty Images.

COVID has done a number on insurers. We are going global with our blue chip dividend paying stock portfolio. And it's flying on its own now, after parent Novartis spun the company off in April. Coronavirus and Your Money. The most recent hike came in Novemberwhen the quarterly payout was lifted another Exchange rate changes can also affect an investment. Fresenius Medical Care also introduced a lower-priced dialysis machine in China that is specifically designed for emerging markets. It also anticipates sizable margin gains from improved operating efficiencies and a more favorable product mix. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Blue chip stocks are stocks of well-known and well-established companies. Institutional Investor, Switzerland. It has been a chronic area of under-investment:. When you file for Social Security, the amount you receive may be lower. On an adjusted basis, it was Stock trading courses online uk day trading the futures review 47th consecutive year of dividend increases. Its most recent increase brought its dividend-growth streak to 33 years. We say "for now" because Lowe's has so far failed to raise its dividend inpassing the May window during which it typically makes the announcement. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. The company has loss in day trading dmpi swing trade bot expanding by acquisition as of late, including medical-device firm St. Another sector that is essential to our lives is consumer staples.

The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. But how do we know a good blue chip dividend paying stock from other stocks. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. Private Investor, Switzerland. Thanks for your comment and being such a loyal reader! Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. I like this practice because it provides greater certainty about how much I will get paid and when. They own the patent to the blockbuster drug Humira. Any services described are not aimed at US citizens. But these companies also provide investors with diversification and much more reasonable valuation than many of their American brethren. Plus, Japan has the highest public debt in the world as a percentage of GDP. Fresenius Medical Care also was granted breakthrough status earlier in for computer-assisted software it is developing that improves fluid management during dialysis. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. And, I totally agree. Email address:. Costs can only be cut so low and for so long. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Kerry Group has delivered volume growth three times that of the food market by expanding its footprint in developing markets and acquiring businesses in clean-label food and food protection, among other things. For investors seeking regular income in times of low interest rates, dividend stocks can provide attractive yields. MSCI China. Whitbread operates more than Premier Inn hotels in the U. The easiest way to invest in the whole Chinese stock market is to invest in a broad market index. Courtesy Johan Wessman via Flickr. I do not have much experience in investing and managing finances. Nonetheless, this is a plenty-safe dividend. Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in Can they pay their financial obligations as they come due?