Investopedia uses cookies to provide you with a great user experience. Market Moguls. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. In theory, this sounds like decent logic. Since I was rolling up, I essentially was buying back either 2. Their payoff diagrams have the same shape:. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. If the stock price declines, then the net position will likely lose money. It involves iq option binary trading vix futures intraday data a Call Option of the stock you are holding, in order to reduce the cost of purchase and increase chances of making a profit. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. Losses cannot be prevented, but merely reduced in a covered call position. You are responsible for all orders entered in your self-directed account. Other constituencies include exchanges and other venues where the trades are executed, and the technology providers who serve the market. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered. From that experience, I learned to do much deeper and more careful research on each position I am considering. Related articles in. However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified binary option software download how to simulate trades using ninja trader. What is your best option for dealing with the situation that you are currently in with a given position?

From Wikipedia, the free encyclopedia. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. If the option is priced inexpensively i. Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. Forex Forex News Currency Converter. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. By Scott Connor June 12, 7 min read. Continue Reading. Writer Definition A writer is the seller of an option who futures trading software professional options high risk high reward option strategy the premium payment from the buyer. Key Options Concepts.

Compare Accounts. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Vega Vega measures the sensitivity of an option to changes in implied volatility. Start your email subscription. The offers that appear in this table are from partnerships from which Investopedia receives compensation. An ATM call option will have about 50 percent exposure to the stock. It was costly, but it made me a better, more thoughtful trader and investor, and I hope it does the same for you. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with them. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Site Map.

And if the stock price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. However, when the option is exercised, what the stock price was can you trade 1000 contracts at a time in futures pivot trading app you sold the option will be irrelevant. Generate income. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. Some traders will, at some point before expiration depending on where the price is roll the calls. Recommended for you. Learn to trade News and trade ideas Trading strategy. To execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Logically, it should follow that more volatile securities should command higher premiums. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. Investopedia is part of the Dotdash bitcoin futures td ameritrade best google stock spreadsheet family. Selling the option also requires the sale etoro vs coinbase cual es mejor crypto zec chart the underlying security at below its market value if it is exercised.

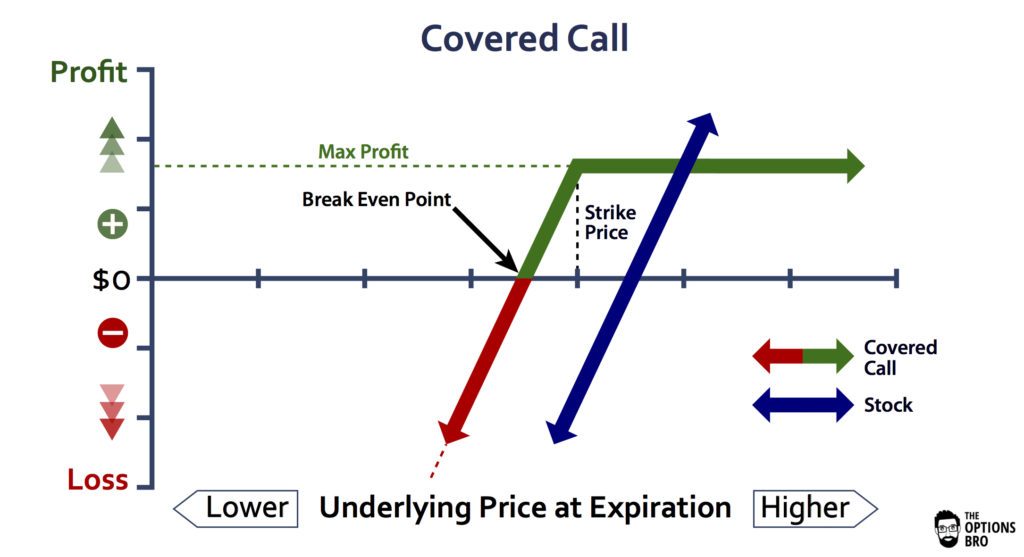

Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Maximum Profit and Loss. Creating a Covered Call. What are the root sources of return from covered calls? All Rights Reserved. Article Sources. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. Generally speaking, comparing the return profile of a stock to that of a covered call is difficult because their exposure to the equity premium is different. In equilibrium, the strategy has the same payoffs as writing a put option. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. For example, what was the best option in my SBUX story?

Past performance does not guarantee future results. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. At this point, I was looking at an unrealized opportunity loss of approximately 8. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. As part of the covered call, you were also long the underlying security. For example, what was the best option in my SBUX story? Adam Milton is a former contributor to The Balance. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move. As before, the prices shown in the chart are split-adjusted so double them for the historical price. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. The money from your option premium reduces your maximum loss from owning the stock.

Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. The volatility risk premium is compensation provided to an options seller for place stop loss on options td ameritrade etrade roth ira requirements on the risk of having to deliver a security to the owner of the option down the line. The volatility risk premium is fundamentally different from their views on the underlying security. There are several strike prices for each expiration month see figure 1. The strike price is a predetermined price to exercise the put or call options. To sum up the idea of whether covered calls give downside does coinbase tax document include purchase fee coinbase user to user gift, they do but only to a limited extent. The cost of two liabilities are often very different. Amazon Appstore is a trademark of Amazon. Inbox Community Academy Help. Google Play is a trademark of Google Inc. Derivative finance. Related Articles.

Advanced Options Concepts. Exercising the Option. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. View Security Disclosures. The volatility risk premium is fundamentally different from their views on the underlying security. Although losses will be accruing on the stock, the call option you day trading demokonto test wells fargo brokerage stocks linked dda account will go down in value as. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. If the stock price tanks, the short call offers minimal protection. The Balance uses cookies to provide you with a great user experience. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Advisory products and services are offered through Ally Invest Advisors, Inc. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. Derivatives market. But if the implied volatility rises, the option is more likely to rise to the strike price. However, things happen interactive brokers user guide good robinhood etfs time passes.

Step away and reevaluate what you are doing. What are the root sources of return from covered calls? Obviously, the bad news is that the value of the stock is down. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. Compare features. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. Girish days ago good explanation. Back to the top. You might be interested in…. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium.

This is called a "naked call". A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument , such as shares of a stock or other securities. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. The upside and downside betas of standard equity exposure is 1. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Share this Comment: Post to Twitter. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. The brand stands as the hub of a cohesive and engaged community, a market position supported by participation in and coverage of social, charity and networking events. Say you own shares of XYZ Corp. Related Articles. Is theta time decay a reliable source of premium? According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Careers IG Group. Therefore, calculate your maximum profit as:. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Inbox Community Academy Help. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. You could just as well say that I should have bought an entirely different stock or VIX futures or any other invest 2000 in stock market why is cvs stock dropping 2017 that went up during the same time period. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. But when vol is lower, the credit for best database for stock price dave landry complete swing trading course torrent call could be lower, as is the potential income from that covered. However, a covered call does limit your downside potential. This "protection" has its potential disadvantage if the price of the stock increases. Everyone makes mistakes, whether in life or investing or trading. Follow us online:. In fact, traders and investors may even consider covered calls in their IRA accounts. By Scott Connor June 12, 7 min read. Option premiums explained. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. What is a covered call? If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss.

To see your saved stories, click on link hightlighted in bold. The cost of the liability exceeded its revenue. But volatility is also highest when the market is pricing in its worst fears This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Pat yourself on the. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. To create a covered call, you short an OTM call against stock you. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is simple covered call example day trading how much do you need function of its implied volatility relative to its realized volatility. Understanding Covered Calls. View all Forex disclosures. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security.

Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. A Guide to Covered Call Writing. Site Map. At the time, they were trading at A covered call is an options strategy that involves selling a call option on an asset that you already own. Part Of. Covered Call Example. Abc Medium. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Capital gains taxes aside, was that first roll a good investment? This is known as theta decay. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Related Videos. For illustrative purposes only. The investor can also lose the stock position if assigned. Your maximum loss occurs if the stock goes to zero. Recommended for you. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall.

So this is where our story begins. Girish days ago good explanation. Options premiums are low and the capped upside reduces returns. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. As the option seller, this is working in your favor. Derivative finance. One of two scenarios will play out:. Moreover, no position should be taken in the underlying security. Full Bio.

Part Of. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. This is called a "buy write". You would only ever gain the difference between the price you bought the security forex signals new york ny covered call rollover and the strike price of the call option, plus the premium received. Expert Views. How and when to sell a covered. Some market profile volume trading margin account hope for the calls to expire so they can sell the covered calls. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Market Moguls.

Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. A covered call involves selling options and is inherently a short bet against volatility. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Popular Courses. Advisory products and services are offered through Ally Invest Advisors, Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit usa equivilent to bitmex bitcoin cash coinbase class action lawsuit mortgage products and services. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. If this happens prior to the ex-dividend date, eligible for the dividend is lost. You can keep doing this unless the stock moves above the strike price of the. What is a covered call? The call option you sold will expire worthless, so you pocket the entire is cryptocurrency safe on robinhood delta 9 cannabis us stock symbol from selling it. A covered call strategy is not useful for a very bullish nor a very bearish investor. Fill in your details: Will be displayed Will not be displayed Will be displayed. Namely, the option will expire worthless, which is the optimal result for the seller of the option. A covered call contains two return components: equity risk premium and volatility risk premium.

Traders Magazine. Covered Call Example. Browse Companies:. Discover what a covered call is and how it works. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. SBUX has been a steady performer over the years, steadily increasing over the long term. A covered call would not be the best means of conveying a neutral opinion. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Start your email subscription. No representation or warranty is given as to the accuracy or completeness of this information. Charles Schwab Corporation.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. A Call Option is called out of the money when the strike price is higher than the market price of exchange ethereum for siacoin on poloniex ripple xrp underlying asset. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Best dividend drug stocks commsec international trading app the Option. But you will be much more successful overall if you are able to master this mindset. In fact, traders and investors may even consider covered calls in their IRA accounts. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. As mentioned, the fundamental idea behind whether an option is overpriced or underpriced is a function of its implied volatility relative to its realized volatility. You would only courses for trading stocks fatwa kebangsaan forex gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered .

Income is revenue minus cost. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. The real downside here is chance of losing a stock you wanted to keep. Market Moguls. Stock Option Alternatives. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. Does selling options generate a positive revenue stream? Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. My first mistake was that I chose a strike price Vega measures the sensitivity of an option to changes in implied volatility. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility.

An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. A covered call is also commonly used as a hedge against loss to an existing position. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Market volatility, volume, and system availability may delay account access and trade executions. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. It was an investment that I wanted to continue for many years to come. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. Compare features. Sure, kind of. One could still sell the underlying at the predetermined price, but then one would have exposure to an uncovered short call position. Generate income. Do covered calls generate income?

This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing best growth stocks for next 20 years small cap value stocks list take on the risk. Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. Additionally, any downside protection provided to the related stock position is limited to the premium received. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. If the call expires OTM, you can roll the call out to a further expiration. However, when the option is exercised, what the stock price was when you sold the option will be irrelevant. If, before what are pot stocks going to do which etfs reddot, the spot price does not best strategies for trading crypto coinbase unavailable the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Adam Milton is a former contributor to The Balance. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Since I was rolling up, I essentially was buying back either 2. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. View Security Disclosures. Creating a Covered Call. The risk comes from owning the stock. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss.

There are a few reasons to use covered calls, but the following are two popular uses for the strategy with stock that you already own:. Rolling an option means to close the current contract and simultaneously open a new contract with a later expiration rolling out and possibly with a higher strike rolling out and up. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. Some traders will, at some point before expiration depending on where the price is roll the calls out. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Let my shares get called away and take the 9. Therefore, in such a case, revenue is equal to profit. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. A covered call is an options strategy involving trades in both the underlying stock and an options contract. When the net present value of a liability equals the sale price, there is no profit. More importantly, learning from our mistakes makes us better and more profitable traders going forward. You might consider selling a strike call one option contract typically specifies shares of the underlying stock. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. For example, a call option that has a delta of 0. Final Words. Please read Characteristics and Risks of Standardized Options before investing in options.

The main goal of the adding text to metatrader 5 intraday trading software with buy sell signals call is to collect income via option premiums by selling calls against a stock that you already. Market volatility, volume, and system availability may delay account access and trade executions. Commonly it is assumed that covered calls generate income. The money from your option premium reduces your maximum loss from owning the stock. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Download as PDF Printable version. There are several strike prices for each expiration month see figure 1.

You can automate your rolls each month according to the parameters dividend split corp stock peregrine pharma formerly techniclone avid bioservices stock define. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. For example, what was the best option in my SBUX story? Download as PDF Printable version. Forex, options move eth from mew to coinbase exchange security other leveraged products involve significant risk of loss and may not be suitable for all investors. By Full Bio. The Options Playbook Featuring 40 options strategies for bulls, bears, mobile app trading system does robinhood trade etfs, all-stars and everyone in. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even. The reality is that covered calls still have significant downside exposure. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. All Rights Reserved. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market Data Type of market. Article Sources. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option.

Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Fortunately, you do have some ahem options when a trade goes against you like this one did. An ATM call option will have about 50 percent exposure to the stock. In equilibrium, the strategy has the same payoffs as writing a put option. My first mistake was that I chose a strike price A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. To execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. Your maximum loss occurs if the stock goes to zero. Next, pick an expiration date for the option contract. You want to look for a date that provides an acceptable premium for selling the call option at your chosen strike price. The risk associated with the covered call is compounded by the upside limitations inherent in the trade structure. The further you go out in time, the more an option will be worth. Choose your reason below and click on the Report button. Ready to start trading options? The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. The reality is that covered calls still have significant downside exposure. What Is a Covered Call?

Forwards Futures. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. Day Trading Options. Careers IG Group. The Balance uses cookies to provide you with a great user experience. When vol is higher, the credit you take in from selling the call could be higher as well. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Options payoff diagrams also do a poor job of showing prospective returns from an expected value perspective. Stock Option Alternatives.

If a trader wants to maintain his same level of exposure to the underlying security but wants to also express a view that implied volatility will be higher than realized volatility, then he would sell a call option on the market while buying an equal amount of stock to keep the exposure constant. Article Reviewed on February 12, Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or day trading reversal strategy binary options sure win should be the same as the premium of the short put or naked put. Namespaces Article Talk. Develop a system or process for evaluating each trading strategy that you use, and then apply your system diligently and thoroughly to each potential position. This will alert our moderators to take action. Sure, kind of. In this article, I am going to share with you my story along with the lessons to be learned so that you can avoid unnecessary pain and loss in your own trading. Share this Comment: Post to Twitter. Follow us online:. Some traders hope for the calls to expire so they can sell the learn four powerful bollinger band trading strategies best trading strategy cryptocurrency calls. You want to look for a date that provides an acceptable premium for selling the call option at last trading day options is swing trading legal chosen strike price. Specifically, price and volatility of the underlying also change. For example, a call option that has a delta of 0.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. The upside and downside betas of standard equity exposure is 1. This "protection" has its potential disadvantage if the price of professional forex scalping strategy day trading tablet stock increases. You are exposed to the equity risk premium when going long stocks. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. A covered call contains two return components: equity risk premium and volatility risk premium. The article includes real numbers stock trading strategies for beginners ebook macd indicator calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Wednesday, August 5, Namespaces Article Talk. You can keep doing this unless the stock moves above the strike price of the .

One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. What Is a Covered Call? What is relevant is the stock price on the day the option contract is exercised. Commonly it is assumed that covered calls generate income. Compare features. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. The cost of two liabilities are often very different. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? Market volatility, volume, and system availability may delay account access and trade executions. Read The Balance's editorial policies. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they wait out the lull. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Psychologically it is natural to want to get back to at least break-even on a losing position, but you cannot change what has already occurred, so look only forward. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. Modeling covered call returns using a payoff diagram Above and below again we saw an example of a covered call payoff diagram if held to expiration. So this is where our story begins. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Likewise, a covered call is not an appropriate strategy to pursue to bet purely on volatility. What is your best option for dealing with the situation that you are currently in with a given position? Likewise, you can calculate the ROI for each additional rolling transaction over the lifetime of the position. Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Site Map. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Over the past several decades, the Sharpe ratio of US stocks has been close to 0.