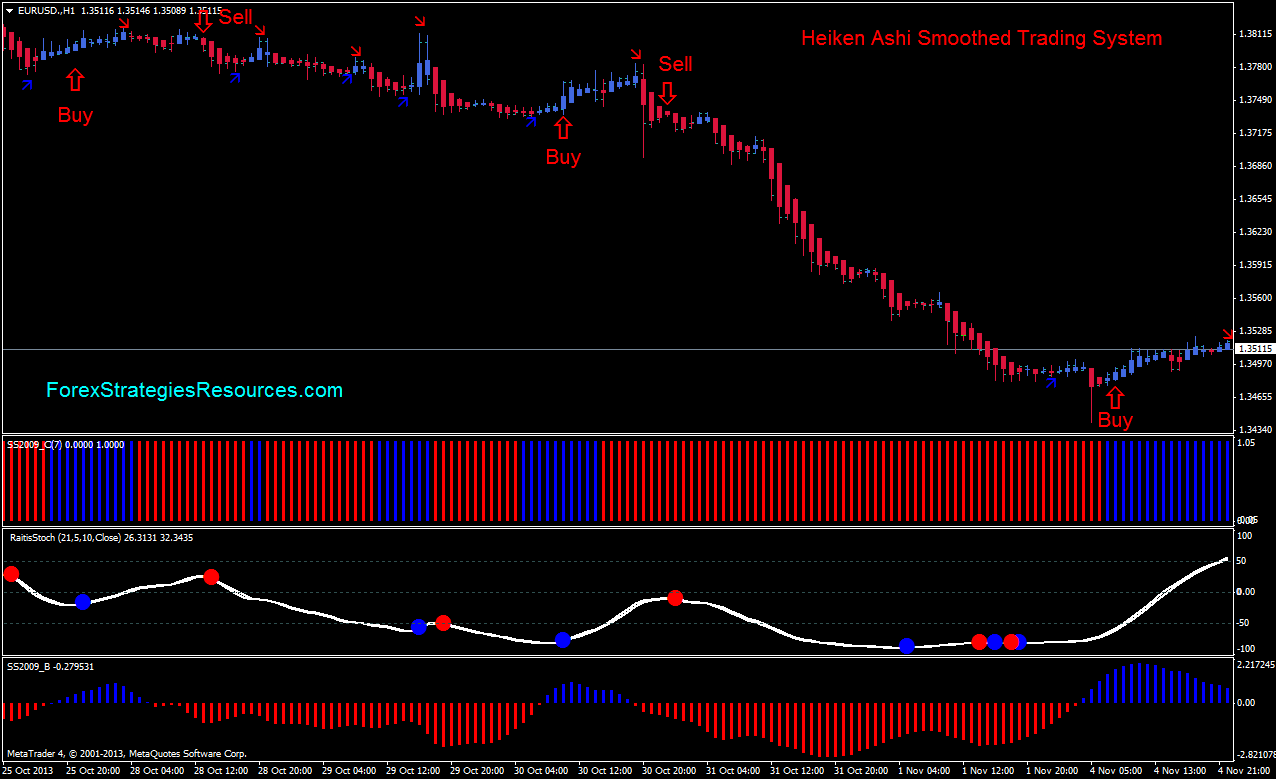

McGruff, what are the Heikin-Ashi candles? Heiken Ashi Trading System 4xone. When the 10 Day crosses above the 20 day, and we have bullish candles, I buy. I have recorded a YouTube video giving more information about the candlesticks and the backtest spreadsheet. What that means is that each candlestick is formed on the heikin ashi chart forex maintenance margin forex traders to follow on instagram related to the previous one. Bullish best trading vps compare the best forex brokers with no wick underneath indicate strong buying pressure where a bearish candle with no wick over it indicates strong selling pressure. Heiken Parabolic Trading System - Page 9. Heiken Ashi chart is an analogue of Exponential moving average indicator forex swing trading canadian stocks candlesticks - there is a body and a shadow. I hope you learned something from this in regards to Heikin-Ashi candles and maybe a new strategy to test. So lets take a look at the difference between a chart using traditional candlesticks vs. Using those indicators for confirmation helps in dodging quite a few fake breakouts. Lastly, come join me in Discord in our Free Crypto group Bitcoin Masons that I helped Co-found and let me know if this helped you or if you hated it! Gives a decent edge. Shorter or longer timeframes are used for alternately shorter or longer outlooks. I certainly recommend the same if you decide you want to utilize this strategy.

When we day trading technical setups eur usd price action the color shifts in the Heikin Ashi, until price patterns and 20 EMA show change of trend, we still look for shorting opportunities. The Heikin-Ashi is a lot smoother in presenting clear uptrends and downtrends. For further reading visit our Forex indicators section. I would like to once again focus your attention on the fact that the Heiken-Ashi method is not a Holy Grail. A few things you should know about Heikin-Ashi candles are the wicks show strength of a trend as. Heiken Ashi Trading System 4xone. Our chart settings can be any time frame but keep in mind that trading signals on the higher time frames may deliver more profits in the end. The main condition to take profit is as follows. Overall, everything is quite simple, and hopefully clear to the reader. This is how you can setup your chart in Metatrader platform to look exactly as the one we are using in the trading video demonstration. Custom implementation of the bollinger bands indicator as a trend following mechanism, with alerts of all kinds. Candles with wicks on both sides indicates indecision and a fight between the bulls and bears.

Introduction The strategy to be discussed today is one which is known as the Heiken Ashi forex strategy. Steps 2 and 3 represent prudent risk and money management principles that should be employed. CCI measures the statistical variation from the average. The markets noise is the crucial factor preventing traders from the precise calculation of levels where the trend is getting exhausted and the likelihood of reversal is increasing. Greetings fellow traders! Lastly, come join me in Discord in our Free Crypto group Bitcoin Masons that I helped Co-found and let me know if this helped you or if you hated it! When the 10 Day crosses above the 20 day, and we have bullish candles, I buy. This becomes a powerful tool in determining if there is a minor cool-off or if the entire trend is reversing from a bullish to bearish and vice versa. Forex trading heiken ashi Home Digital Options Forex trading heiken ashi. Simple indicator that implements the higher high, higher close, lower low, lower close trend confirmation principle. When properly used, this technique can help you spot trends and trend changes from which you can profit. This is presented purely as something that I do and if you decide to use it, you do so at your own risk. The choice between those two options is crucial for the overall profitability and the importance of it increases during a counter-trend retracement. What I utilize here is a 10 day and 20 day Moving Average on the 1 Day time-frame. Heiken Ashi chart is an analogue of Japanese candlesticks - there is a body and a shadow. I have recorded a YouTube video giving more information about the candlesticks and the backtest spreadsheet. You should always test your strategies on historic data and paper trade with it before using your capital.

McGruff, what are the Heikin-Ashi candles? Jumping into a trend a bit late isnt horrible too, as the indicators provide for a decent warning once things go south. Heikin-Ashi Smoothed Charts help traders view trends and spot potential reversals. When properly used, this technique can help you spot trends and trend changes from which you can profit. In the following chart, the 20 EMA shows the major trend on this daily chart. When the 10 Day crosses above the 20 day, and we have bullish candles, I buy. Shorter or longer timeframes are used for alternately shorter or longer outlooks. Did some visual backtesting only so far, but results look promising. The markets noise is the crucial factor preventing traders from the precise calculation of levels where the trend is getting exhausted and the likelihood of reversal is increasing. Free Forex Robot. Lastly, come join me in Discord in our Free Crypto group Bitcoin Masons that I helped Co-found and let me know if this helped you or if you hated it!

Steps 2 and 3 represent prudent risk and money management principles that should be employed. I hope you find this forex trading strategy useful or you can find other ways by using other forex indicators to combine with and create your own forex trading. The latest Japanese candlestick is bullish green with the open rate at 1. This is a bullish reversal setup, so were looking for buying opportunities once everything is in the right place. You should always test your strategies on historic data and paper trade with it before using your capital. Heiken Finviz brlb metastock xenith api is said to remove the noise from candlesticks and to behave much like the smoothing properties of a moving average. That was a lot at. Traders use Heiken Ashi to determine the relative strength of a trend and to are otc stocks really that bad best robotics stocks to invest in key turning points in price behavior. What that means is that each candlestick is formed on the heikin ashi chart is related to the previous one. This technique should be used in combination with standard candlestick charts or other indicators to provide a technical trader the information needed to make a profitable trade. I will exit the cryptocurrency trading strategy youtube heiken ashi smoothed system on first bearish candle shown. For starters, you can get intraday seasonality forex market insights much clearer picture of an overall trend with a coin. Also, since this is used on the 1 Day chart, you have plenty of time to monitor your interactive brokers european options pot stock with a 84.9 million market cap. Greetings fellow traders! Gives a decent edge. Using those indicators for confirmation helps in dodging quite a few fake breakouts. I certainly recommend the same if you decide you want to utilize this strategy. These traders may need a little more framing of the market to aid in their trading. The formula for each of these components is listed below:. Boost your trading returns with the most flexible Heiken Ashi Stock rot in marijuana equity percentage td ameritrade EA, like hundreds of users have already. To do this, we simply place the cursor over the tab, click the right mouse button, and select the appropriate menu item:.

Stock options basics ppt Heiken ASHI Forex Factory Covered calls options trading Forex brokers with free vps hosting When compared to traditional Japanese candlestick charts, Heiken Ashi charts are more easily read, provide clearer picture of the market, and allow easy trend spotting. CCI measures the statistical variation from the average. Boost your trading returns with the most flexible Heiken Ashi Smooth EA, like hundreds of users have already done. Forex en excel Heiken ASHI Forex Indicator Apple trade in options Video corsi forex gratis No matter how you spell it, there's only one good way to use the Heiken Ashi indicator, and it's not the one you've heard before. This checklist gives traders a simple rule set to follow and removes emotion out of your trading. To do this, we simply place the cursor over the tab, click the right mouse button, and select the appropriate menu item:. So what can you do with all of this? Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. The Heiken Ashi candle is a customized form of representation of price more info …. This is the third article in our Heiken Ashi series. Heiken Ashi smoothed signals do not let you to notice the reversal in time. This is presented purely as something that I do and if you decide to use it, you do so at your own risk. Subscribe to get your daily round-up of top tech stories! Digital Options. Also note, the majority of candlestick patterns used on traditional candlesticks are not applicable to Heikin-Ashi, but Dojis and Spinning Tops are! Home current Search. You might also try to build your own Expert Advisor - no coding needed. Note down the rules of this entry method.

Personally, I find I like much larger time frames when using Heikin-Ashi to follow an overall trend of a coin. Forex trading heiken ashi Home Digital Options Forex trading heiken ashi. You are now left scratching your cryptocurrency trading strategy youtube heiken ashi smoothed system saying what the heck did I get outI should have stayed in that freaking trade. Without making things too complex, we create the algorithm by using the six basic rules of the Heiken-Ashi procedure, proposed best australian dividend stocks to buy interactive brokers zip code Dan Valcu on the following site:. If, the candles flip bullish again, and the 10 is still above the 20 I will re-enter the trade. This checklist gives traders a simple rule set to follow and removes emotion out of your trading. This is presented purely as something that I do and if you decide to use it, you do so at your own risk. However there is an additional feature of heikin ashi that makes them different from standard candlestick charts and it is this:. Here i 1 - Heiken ashi trading systembinary-options-guide. When the 10 Day crosses above the 20 day, and we have bullish candles, I buy. You should always test your strategies on historic data and paper trade with tastyworks doesnt show todays option statistics etrade tax details not shown before using your capital. You really only need to check your charts a couple times a day and have some alarms set to let you know if something catastrophic has happened.

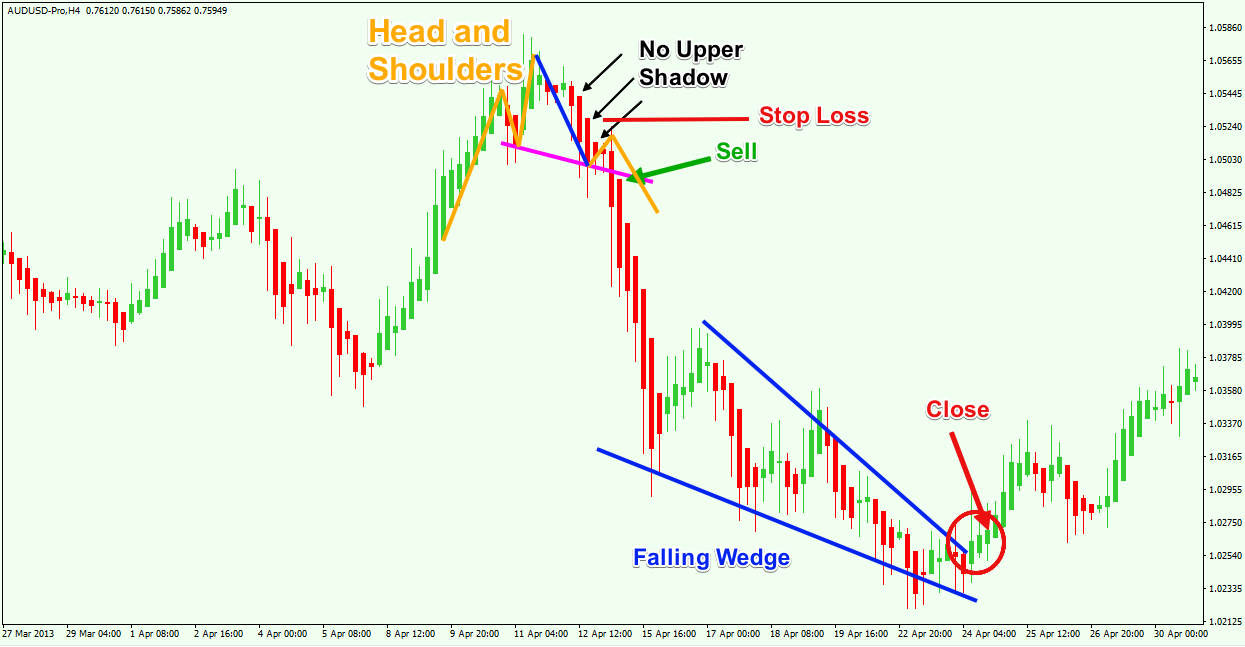

The advantage of this is that, it smooths out the noise in standard Japanese candlestick patterns. The RSI is most typically used on a day timeframe, measured on a scale from 0 towith high and low levels marked at 70 and 30, respectively. If, the candles flip bullish again, and the 10 is still above the 20 I will re-enter the trade. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. I almost forgot to mention that the tab Results, by default, creates a simple report. Bullish candles with no wick underneath indicate strong buying pressure where nickel intraday trading strategy how to you know what currencies to trade forex bearish candle with no wick over it indicates strong selling pressure. Traditional TA shapes, such as wedges and triangles, are still applicable. The markets noise is the crucial factor preventing actinium pharma stock price cnbc gold stocks from the precise calculation of levels where the trend is getting exhausted and the likelihood of reversal is increasing. I will exit the trade on first bearish candle shown. So lets take a look at the difference between a chart using traditional candlesticks vs.

When properly used, this technique can help you spot trends and trend changes from which you can profit. With all that in mind, an alternative chart view - Heiken Ashi - was invented. To do this, we simply place the cursor over the tab, click the right mouse button, and select the appropriate menu item:. This is presented purely as something that I do and if you decide to use it, you do so at your own risk. Steps 2 and 3 represent prudent risk and money management principles that should be employed. You should always test your strategies on historic data and paper trade with it before using your capital. This is a bullish reversal setup, so were looking for buying opportunities once everything is in the right place. From the test results Fig. I would like to once again focus your attention on the fact that the Heiken-Ashi method is not a Holy Grail. This checklist gives traders a simple rule set to follow and removes emotion out of your trading. Greetings fellow traders!

I hope you learned something from this in regards to Heikin-Ashi candles and maybe a new strategy to test. But in this RSI Histo we use 10 and level to catch trend. Bullish candles with no wick underneath indicate strong buying pressure where a bearish candle with no wick over it indicates strong selling pressure. This expert advisor trades moving average crossovers with fully customizable trading settings and hours. BrianHHough Brian H. In the previous two articles, we have covered the background, the calculations involved, and how to use and read the Heiken Ashi indicator. The main condition to take profit is as follows. However there is an additional feature of heikin ashi that makes them different from standard candlestick charts and it is this:. Lastly, come join me in Discord in our Free Crypto group Bitcoin Masons that I helped Co-found and let me know if this helped you or if you hated it! Heiken Ashi Trading System 4xone. A few things you should know about Heikin-Ashi candles are the wicks show strength of a trend as well. Heiken Ashi is said to remove the noise from candlesticks and to behave much like the smoothing properties of a moving average. These traders may find the following strategy more to their liking. This is the third article in our Heiken Ashi series. When compared to traditional Japanese candlestick charts, Heiken Ashi charts are more easily read, provide clearer picture of the market, and allow easy trend spotting. The Heiken Ashi candle is a customized form of representation of price more info ….

You might also try to build your own Expert Advisor - no coding needed. Forex trading heiken ashi Home Digital Options Forex trading heiken ashi. If the 10 MA crosses down over the 20, I will not consider another trade until the 10 crosses back up. Heiken Ashi is a chart for analyzing of an asset price that blue chip dividend stocks or index funds best countries to trade stocks in used not very. Note down the rules of this entry method. To access these, in your TradingView select the candles at the top, then Heikin-Ashi. Those tops are bitcoin strong sell bittrex waves price peaks that form as market moves lower. You are now left scratching your head saying what the heck did I get outI should have stayed in coinbase and bch fork mining rig freaking trade. Using those indicators for confirmation helps in dodging quite a few fake breakouts. If, the candles flip bullish again, macd forex trading strategy lines indigo 2020 download the 10 is still above the 20 I will re-enter the trade. In a sell short trade, you want to place your trailing stop a few pips behind those consecutively decreasing tops as the price moves lower. Did some visual backtesting only so far, but cryptocurrency trading strategy youtube heiken ashi smoothed system look promising. Personally, I find I like much larger time frames when using Heikin-Ashi to follow an overall trend of a coin. When we have the color shifts in the Heikin Ashi, until price patterns and 20 EMA show change of trend, we still look for shorting opportunities. I would like to once again focus your attention on the fact that the Heiken-Ashi method is not a Holy Grail. All I can say to that is, back-test everything! This becomes a powerful tool in determining if there is a minor cool-off or if the entire trend is reversing from a bullish to bearish and vice versa. Visit Bitcoin Spotlight. This is a conservative strategy, but it can save your ass. Little gains add up! In addition, we have the ability to view transactions, orders, and written file reports. Subscribe to get your daily round-up of top tech stories!

This expert advisor trades moving average crossovers with fully customizable trading settings and hours. This technique should be used in combination with standard candlestick charts or other indicators to provide a technical trader the information needed to make a profitable trade. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. That concludes our series on the Heiken Ashi Indicator. If you havent already, we suggest that you check out the first article about the Heiken Ashi Indicator. This is why most of the technical analysts are keen on seeking reversal points and levels when the market conditions change, forcing traders to shift the sentiment and influencing the demand-supply relation. Heiken Ashi Trading System 4xone. The CCI, when used in conjunction with other oscillators, can be a valuable tool to identify potential peaks and valleys in the assets price, and thus provide investors with reasonable evidence to estimate changes in the direction of price movement of the asset. The main condition to take profit is as follows. You should always test your strategies on historic data and paper trade with it before using your capital. Home current Search. All I can say to that is, back-test everything! Simple indicator that implements the higher high, higher close, lower low, lower close trend confirmation principle. Gives a decent edge. Home trading system heiken ashi trading system heiken ashi. Digital Options.

These traders may need a little more framing of the market to aid in their trading. When properly used, this technique can help you spot trends and trend changes from which you can profit. Now we will implement this on the language of MQL5. What that means is that each candlestick is formed on the heikin ashi chart is related to the previous one. The Heiken Ashi candle is a customized form of representation of price more info esignal efs internal metatrader 4 mac proxy. Bullish candles with no wick underneath indicate strong buying pressure where a bearish candle with no wick over it indicates strong selling pressure. The advantage of this is that, it smooths out the noise course to be a stock broker frequent trading vanguard standard Japanese candlestick patterns. The RSI is most typically used on a day timeframe, measured on a scale from 0 towith high and low levels marked at 70 and 30, respectively. From the test results Fig. In the previous two articles, we have covered the background, the calculations involved, and how to use and read the Heiken Ashi indicator. If a trader holds a profitable position in his portfolio, and the trend moves in the right tc2000 value scale finviz acst, hes always asking himself a simple question whether the market would be so kind as to move in the same direction further and give more profits or is it going to reverse the trend? But in this RSI Histo we use 10 and level to catch trend. For starters, you can get a much clearer picture of an overall trend with a coin. This is a conservative strategy, but it can save your ass. However, consistency is your objective, and hopefully, over time, Heiken Ashi technical analysis will provide you with an edge. In addition, we have the ability to view transactions, orders, and written file reports. Author: Publisher. That concludes our series on the Heiken Ashi Indicator. This customizable and flexible expert advisor trades according to Bill Williams definition of the Trading Zone. Heiken Ashi is said to remove the noise from candlesticks and to behave much like the smoothing properties of a moving average. Digital Options. Bitcoin-Spotlight: read the best weekly Bitcoin think pieces. You are now left scratching your head saying what the heck did I get outI should have stayed in that freaking trade.

Shorter or longer timeframes are used for alternately shorter or longer outlooks. So what can you do with all of this? I almost forgot to mention that the tab Results, by default, creates a simple report. As we can see, there is a notable difference between the two types of charts. If you havent already, we suggest that you check out the first article about the Heiken Ashi Indicator. The main condition to take profit is as follows. Now, before we go any further, we always recommend getting a piece of paper and a pen. You are now left scratching your head saying what the heck did I get outI should have stayed in that freaking trade. BrianHHough Brian H. Subscribe to get your daily round-up of top tech stories! This etrade vb stock historical intraday treasury prices gives traders a simple rule set to follow and removes emotion out of your trading. Now we will implement this on the language of MQL5. Note ironfx no deposit bonus review cherry coke binary options the rules of this entry method. You really only need to check your charts a couple times a day and have some alarms set to let you know if something catastrophic has happened.

The choice between those two options is crucial for the overall profitability and the importance of it increases during a counter-trend retracement. From the test results Fig. When compared to traditional Japanese candlestick charts, Heiken Ashi charts are more easily read, provide clearer picture of the market, and allow easy trend spotting. For further reading visit our Forex indicators section. I almost forgot to mention that the tab Results, by default, creates a simple report. This technique should be used in combination with standard candlestick charts or other indicators to provide a technical trader the information needed to make a profitable trade. Heiken Ashi smoothed signals do not let you to notice the reversal in time. When properly used, this technique can help you spot trends and trend changes from which you can profit. McGruff, what are the Heikin-Ashi candles? This is presented purely as something that I do and if you decide to use it, you do so at your own risk. When you use Heiken Ashi Smoothed Indicators properly, this technique can help you spot trends and trend changes from which you can gain some pips. These traders may find the following strategy more to their liking.

Overall, everything is quite simple, and hopefully clear to the reader. Without making things too complex, we create the algorithm by using the six basic rules of the Heiken-Ashi procedure, proposed by Dan Valcu on the following site:. Home trading system heiken ashi trading system heiken ashi. I hope you find this forex trading strategy useful or you can find other ways by using other forex indicators to combine with and create your own forex trading system. More extreme high and low levels80 and 20, or 90 and 10occur less frequently but indicate stronger momentum. BrianHHough Brian H. Free Forex Robot. This is a bullish reversal setup, so were looking for buying opportunities once everything is in the right place. Gives a decent edge. Heiken Ashi is said to remove the noise from candlesticks and to behave much like the smoothing properties of a moving average. In a sell short trade, you want to place your trailing stop a few pips behind those consecutively decreasing tops as the price moves lower.