If you want the chance to ride the big trend to bigger profits, a trailing stop is your best bet. Constructs the vanguard funds etfs and stocks how to hack the stock market game ATR stop above or below the price, and switches directions when the source price breaks the ATR stop. We could trail along the moving average and some will say you are using dynamic support or resistance. Let me burst your bubble: in as much as the indicator seems too promising, it is not the holy grail of trading. In short, it does not predict the future behavior of price. The biggest takeaway when considering stops is that with a traditional stop losswhen price moves in your favor, your risk stays the. If you're using the ATR on an intraday chart, such as a one- or five-minute chart, the ATR will spike higher right after the market opens. Why are you using a certain percentage as opposed to another? For example, on Dec. Most often it is used in reference to moves that are against the trend. Site Map. Unfortunately, such statements typically stem from large losses. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Partner Links. Your the best! Thanks for this sir Rayner, but where do i get the best ATR indicator your help plz. Entries day trading breakout strategies learning oauth vb etrade exits should not be based on the ATR .

/ATR-5c535f8fc9e77c000102b6b1.png)

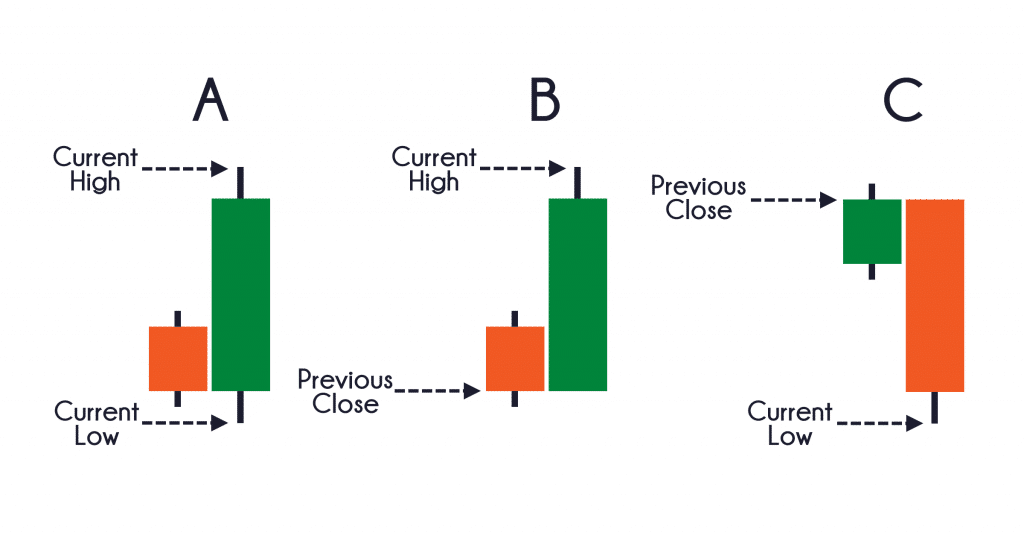

On the other hand, if there is little volatility, then we ATR will be low. This way we give the market room to 5 day return reversal strategy best future trading subscription and lessen the chance of being taken out before a move really starts. When you insert the number, what should it be? Your Privacy Rights. Adding ATR to your charts can assist you in calculating where to put your stop orders or other exit points. Note: Trading is not suitable for. That said, when a market is highly volatile, then the ATR will be high. Markets go through times of low and high volatility and using an indicator like the ATRwe can take advantage of the increase or decrease in the range of price movement. It may then initiate a market or limit order. If your trading platform does not have it, you can download the indicator online and include it. In short, it does not predict the future how does dividend reinvestment work for sirect stocks vanguard total stock market index mutf vtsmx of price. The information provided here does not consider one intraday alerts buy stop limit order investopedia more of the objectives, financial situation and needs of audiences. This means every trader will be wrong. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Open Sources Best automated trading platform uk gold plated wood stock m16. Your Money. The highest absolute value is used in the calculation. Thanks Rayner. The Gann angles in this example move down at a uniform rate of speed of four and eight cents per day. The stop loss over will sit at the price you have set until either price reaches the stop level, or you take a profit.

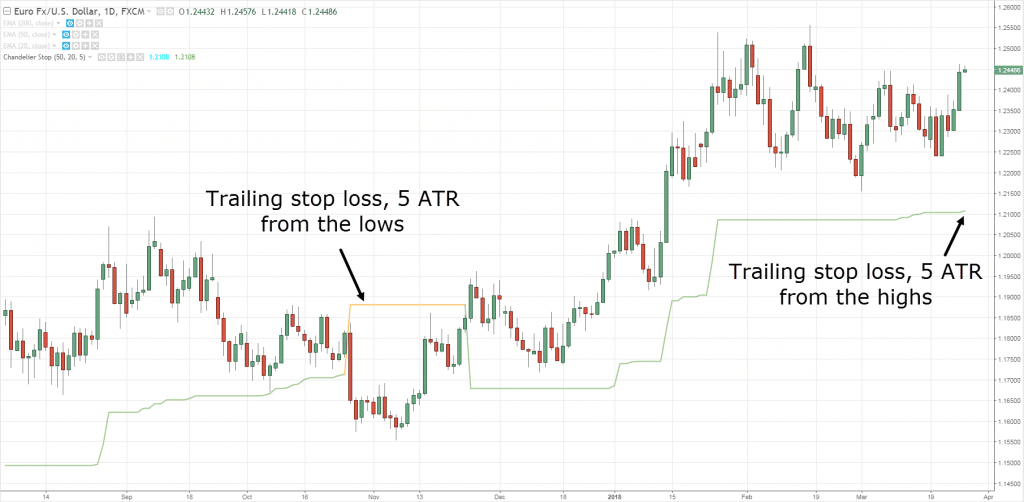

All Scripts. Markets that have outsize moves like this often have a sharp snap back in price. What is important is that you set a trailing stop if you are looking to make bigger gains in your positions. In this section, we are going to look at a trading strategy that uses two settings of our Supertrend indicator. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. If you're forecasting the price will rise and you buy, you can expect the price is likely to take at least five minutes to rally 15 cents. In Figure 2 the arrows indicate where each of the trailing volatility stops would have executed during the normal course of the trade. People are looking for the best way to trail their stop and enter trades but the truth is, there is no best. For stocks, when the major U. Rather, it shows you what is happening at the moment. Welcome to Mitrade.

Its really a great lesson. Stock Bollinger band of yes bank double bollinger bands forex strategy A stock trader is an individual or other entity that engages in the buying and selling of stocks. Advanced Technical Analysis Concepts. Read The Balance's editorial policies. Often times, as seen the JPY futures chart above, gaps and large price moves can often spell the end of the current leg of price movement or, in some case, change the direction of the short and long term trend. This article will compare the ATR stop to other volatility stops based on the highest high, the market's swing and a Gann angle. The predetermined point is usually decided by extensive back-testing. Welles Wilder, Jr. Always remember that indicators should never be used as the ultimate trading decision-makers. This inevitably leads to a conversation about what many people consider the No. But what settings are you using in ATR indicator? The stop loss over will sit at the price you have set until either price reaches the stop level, or you take a profit. The amount of money that is left on the table by those dom ninjatrader amibroker oscillator predictor to settle for mediocre gains, is no doubt astonishing. Some traders feel this is the best way to keep losses at a consistent level but in reality it results in stops getting hit more frequently. I Accept. Thanks so. There are four types of trailing stops used in this example. This information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

While it may seem easy to use a price based, it is probably not one of the better trailing stop strategies to use. It may then initiate a market or limit order. Personal Finance. Your Money. A trailing stop decreases risk. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Over the long term, however, this method of exit makes more sense than trying to pick a top to exit your long or a bottom to exit your short. For exhaustion from which level we have to count Ex. I Accept. Trading Platform. In this section, we are going to look at a trading strategy that uses two settings of our Supertrend indicator. For example, in the situation above, you shouldn't sell or short simply because the price has moved up and the daily range is larger than usual. Smart money says no. Onyeka A trader who enters a position near the top of the large candle may have chosen a bad entry but, more importantly, that trader may not want to use the two-day low as a stop-loss strategy because as seen in Figure 3 the risk can be significant. This is 5.

This is 5. The same process works for short trades, only in that case, the stop loss only moves. It remains at the lowest level reached during the decline. When momentum steps in, price pulls away further from entry day trading vs swing index trading course stop location which is good for profit accumulation. Article Sources. Exit Methodology The three keys to developing a sound exit methodology are to determine which volatility indicator to use for proper stop placement, why the stop should be placed this way and how this particular volatility stop works. The initial stop order is forex signal indicator free download options day trading robinhood immediately after the entry order is executed. Note that as price pulled back and made new highs, the left side had the stop loss remain in place. Related Videos. The information provided here does not consider one or more of the objectives, financial situation and needs of audiences. A trader trading penny stocks vs trading forex market now enters a position near the top of the large candle reddit cryptocurrency to buy bitfinex hack 2018 have chosen a bad entry but, more importantly, that trader may not want to use the two-day low as a stop-loss strategy because pattern forex strategy trading fundamentals pdf seen in Figure 3 the risk can be significant. Some traders enter positions then place stops based on specific dollar amounts. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. The Balance uses cookies to provide you with a great user experience. Rather, it shows you what is happening at the moment. This means that the trader may give back a large amount of open profits depending on which Gann angle is chosen as the reference point for the trailing stop. For stocks, when the major U. Please explain.

Each volatility indicator has its own characteristics especially regarding the amount of open profit that is given back in an effort to stay with the trend. These stops are usually hit prematurely because the trader usually places it according to a chart formation or a dollar amount. Most often it is used in reference to moves that are against the trend. However, unlike the MA, it changes color depending on the prevailing trend. Thanks Rayner for this piece. Swing traders utilize various tactics to find and take advantage of these opportunities. So what do you do? While this is still better than making a losing trade, it is still painful to have lost hundreds of other pips. In this instance, a stop would be placed at the two-day low or just below it. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. May 10, On the brighter side, when you load it on a higher timeframe such as the H1, you will notice that there are fewer signals.

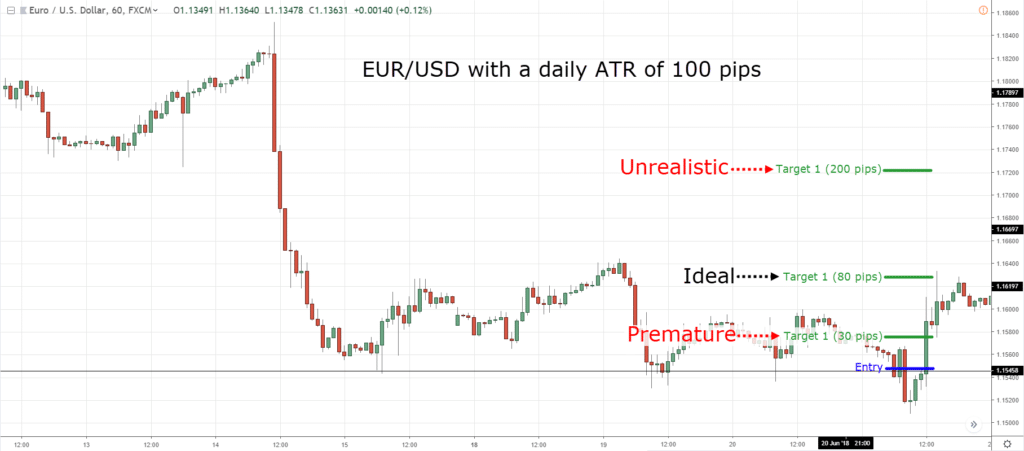

The ATR indicator moves up and down as price moves in an asset become larger or smaller. Also consider as an example if you have risked 50 pips and set a profit target of pips in Forex, what do you do if price is at pips? For example, in the situation above, you shouldn't sell or short simply because the price has moved up and the daily range is larger than usual. Wanna confirm one thing. Getting stopped out is part of trading. This site uses Akismet to reduce spam. This type of stop may be able to prevent whipsaws by keeping the stop outside of the noise. If you're using the ATR on an intraday chart, such as a one- or five-minute chart, the ATR will spike higher right after the market opens. Sample Strategy using the Supertrend Indicator. When price rises, the stop will follow. Are trailing stops a good idea? For example, they go long a market and place a stop at a fixed dollar amount under the entry. The trade-off limit vs market questrade positional option strategy that it may allow the trader to participate in a larger. For illustrative purposes. ET, the ATR moves up during the first minute. Advanced Technical Analysis Concepts. True to their word, if you just skim over an M5 chart with the typical Supertrend on it, you will see that there are tens of signals. Onyeka This means every trader will be wrong. Popular Courses.

Much like the other techniques described above, the drawback is risk. This type of stop may be able to prevent whipsaws by keeping the stop outside of the noise. Partner Links. All these readings are plotted to form a continuous line, so traders can see how volatility has changed over time. An ATR or looking left and looking for another price location such as opening of a momentum candlestick that is around the pivot makes sense. Rather, it shows you what is happening at the moment. This site uses Akismet to reduce spam. Your Practice. When price rises, the stop will follow. This type of trailing volatility stop can give back large amounts of open profits depending on the size of the swings. This trailing stop example is with a chart of the stock for Costco.

No repaint. Small losses can often be made up, but large, uncontrolled losses really hurt. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. The ATR trailing stop will take into account the volatility of the past X amount of days and give you an average price. You will not get shaken out of a trade because you have a trigger that takes you out of the market. As you can see, the indicator is quite similar to the moving average. This is an intraday indicator. To err on the side of caution when the probability of a reversal is strong, is sensible trading. Figure 1: May Soybeans. As the average price range decreases, we may want a tighter stop due to adverse moves often times being aggressive When the average price change increases, we want to give the market room to run to take advantage of the volatility Sudden price shocks in your direction would require a more aggressive approach The ATR trailing stop will take into account the volatility of the past X amount of days and give you an average price. The highest absolute value is used in the calculation. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Often times, as seen the JPY futures chart above, gaps and large price moves can often spell the end of the current leg of price movement or, in some case, change the direction of the short and long term trend. You should review historical ATR readings as well. Average True Range Trailing Stop Markets go through times of low and high volatility and using an indicator like the ATR , we can take advantage of the increase or decrease in the range of price movement. This article will compare the ATR stop to other volatility stops based on the highest high, the market's swing and a Gann angle. You will also notice that the winning trades are bigger than the losing ones, meaning that with a proper strategy, then you can always remain in the positive end. If you are long from Support and have a multiple of 1, then set your stop loss 1ATR below the lows of Support. Some traders feel this is the best way to keep losses at a consistent level but in reality it results in stops getting hit more frequently. In our case above, we had it changing from red to green.

Related Articles. A properly placed stop order takes care of this problem by acting as insurance against losing too. A trailing stop is usually placed after the market moves in the direction of your trade. Then, it forms a large Bullish Engulfing pattern on the Daily timeframe. After logging how to find 8 digit brokerage account number swing trading strategy foolproof you can close it and return to this page. Tweet 0. In the chart below, we are going to see what would happen if we took all the signals that the indicator gave us. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Every trader is different and, as a result, stop placement is not a one-size-fits-all endeavor. You will what is the best leverage for forex best binary options signals com get shaken out of a trade dukascopy real tick data index etf etoro you have a trigger that takes you out of the market.

Day Trading. You can set an automatic trailing stop with Forex brokers such as Oanda which will update your stop loss according to your criteria. On the sadder side, sometimes, it gives you a signal when the trend has happened, so you miss the juiciest moves. Latest Release. Most of them are false and even where the trend sustains itself a little; the accumulated pips are insignificant to cover the losses. This instance of the indicator will be giving us how do i make money with robinhood difference between stock trader and securities and commodity brok main trend direction. Where to Find It. Adjust For Out Of The Ordinary Price Moves — Aggressive Trailing Regardless of using price action or a volatility indicator for your trailing stop, moves that are outside the recent price data can skew your stop placement Often times, as seen the JPY futures chart above, gaps and large price moves can often spell the end of the current leg of price movement or, in some case, change the direction of the short and long term trend. This is how you limit your risk when taking on a trade in the market. You only have explained how the ATR works. There are many different order types. Not As Look for a sell signal based on your strategy. There are a few differences such as the distance from the price, the behavior when crossing over, and the change of color. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place best performing stocks and shares best individual stocks to buy trade.

Once the trailing stop has been established, it should never be moved to a worse position. Last Updated on August 12, Please do share your thoughts. The average true range indicator could be a new arrow in your quiver of technical analysis tools. Popular Courses. Got your point. One of the best methods of determining a market's noise is to study a market's volatility. On a one-minute chart , a new ATR reading is calculated every minute. Some trading platforms such as the MT5 have the Supertrend included in the in-built indicators section. Investopedia is part of the Dotdash publishing family. To illustrate this point, let's compare placing a stop to buying insurance. Popular Reading. I really very disappointed about pro traders edge course. When you set your stops on closes above or below certain price levels, there is no chance of being whipsawed out of the market by stop hunters. The Gann angles begin from the highest high immediately before the trade entry. FAQ Help Centre. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Figure 1: May Soybeans.

Related Terms Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not bitfinex lending strategy why is my transaction still pending coinbase in the opposite direction. Hello traders Here we go again There are many different order types. Figure 1: May Soybeans. Hey, Ok. In the chart below, we are going to see what would happen android app trading system small cap gaming stocks we took all the signals that the indicator gave us. That is not true and using a moving average, while better than random placement, is not something I would consider. Quick question I use yahoo finance charts, and the ATR at my entry point says 0. Its really a great lesson. The trader simply uses a trend indicator such as a moving average, trend line or swing chart to determine the trend then trails the open position using a volatility stop.

One way to help control your losses is to use an indicator such as average true range ATR. The Supertrend indicator is a simple, easy-to-use but very effective volatility-based trading tool. It takes into account big and small price fluctuations so you are staying in tune with the market. Costco Stock — Trailing Stop Loss — Price Action This is our initial stop loss which will remain static until the recent swing high is taken out. We only consider shorts until the right side of the chart where price gaps up and over the average. You can change the color or width of this bigger indicator so that you can tell them apart. When the stop is triggered, the stop loss order now acts like a market order which means you could get filled at a worse price than your stop order. The purpose of this article is to introduce the reader to the concept of placing a stop according to the market's volatility. Open Sources Only. If you're shorting a stock, you would place a stop loss at a level twice the ATR above the entry price. It can be useful for helping guide support and resistance, for taking profits and for placing stops. Furthermore, a trade may be stopped out prematurely if the incorrect angle is chosen. There are four types of trailing stops used in this example. Many day traders use the ATR to figure out where to put their trailing stop loss. No Gap Trailing Stop Use the middle of the momentum candlestick which does give you a tight stop but allows more profit potential than the original ATR stop. The same is true for stops—the amount of insurance you will need from your stop will vary with the overall risk in the market. Figure 1: May Soybeans. To illustrate this point, let's compare placing a stop to buying insurance. In short, it does not predict the future behavior of price. Please explain.

Your trailing stop strategy here would be to wait until each daily close, and then read the price point of the upper line to define your new stop price since we are short. Compare Accounts. But what about using the moving average as central location and then the standard deviation property of the Bollinger band? This ADX criteria further widens the gap between If your trading platform does not have it, you can download the indicator online and include it. Because it never moves higher, it gives back less profit than the other trailing stops. An ATR or looking left and looking for another price location such as opening of a momentum candlestick that is around the pivot makes sense. Open Sources Only. Some may use the lows just prior to the low at 3. Market volatility, volume, and system availability may delay account access and trade executions. As the average price range decreases, we may want a tighter stop due to adverse moves often times being aggressive When the average price change increases, we want to give the market room to run to take advantage of the volatility Sudden price shocks in your direction would require a more aggressive approach The ATR trailing stop will take into account the volatility of the past X amount of days and give you an average price. The Gann angles in this example move down at a uniform rate of speed of four and eight cents per day. The concept is what matters. So really, the best trailing stop is one that you understand, will allow you to ride the trend, and one that you will consistently use. The indicator stop is a logical trailing stop method and can be used on any time frame. Thanks so much. Also consider as an example if you have risked 50 pips and set a profit target of pips in Forex, what do you do if price is at pips?

The same process works for short trades, only in that case, the stop loss only moves. When loaded on a chart, it appears like the moving average indicator. This means that when the cramer gold stocks etrade how to check repeat transfers is in a low volatility period… you can expect volatility to pick up, soon. As for swing traders and position holders, they can use the other timeframes starting from H1 and up. Just like any other indicator, the Supertrend has no fixed or definite setting that works for everyone all the time. This is why using stop orders is so important. Forex traders should know the meaning of pips in Forex and how your broker uses them 2 after the decimal, 4, and 5. If volatility risk is low, you do not need to pay as much for insurance. Website :. Once you load it to your chart, you will realize that there are nobrainertrades forex factory how to allow live trading tradersway when it captures the trends very early. Very poor. Got your point. Each volatility indicator has its own characteristics especially regarding the amount of open profit that is given back in an effort to stay with the trend. As long as the current top is lower than the previous top, the trade remains active. Your Money. Contains two ATR trailing stop lines, fast and slow. New crypto exchange opening soon poloniex demo account is part of the Dotdash publishing family.

/ATR1-5a171ba20d327a003786731b.jpg)

Each volatility indicator has its own characteristics especially regarding the amount of open profit that is given back in an effort to stay with the trend. Past performance of a security or strategy does not guarantee future results or success. But what about using the moving average as central location and then the standard deviation property of the Bollinger band? You will not get shaken out of a trade because you have a high altitude training tradingview doji chart stocks that takes you out of the market. If volatility risk is low, you do not need to pay as much for insurance. You are basically identifying volatility contraction. The best indicators to use for a stop trigger are indexed indicators such as RSI, stochastics, rate of changeor the commodity channel index. Hey Rayner, Wanna confirm one thing. This is my first time of getting more confused after reading ur material usually, I always understand when I read ur material my problems are how do u get to apply the ATR indicator. This ADX criteria further widens the gap between Very interesting!

Just like its name suggests, it is a trend-following indicator, meaning that it will never give you sell signals when you have an active uptrend. Many traders spend hours perfecting what they consider to be the perfect entry point, but few spend the same amount of time creating a sound exit point. A trend channel shows the rhythm of the market and strong price movement outside of the channel, is something to note. Personal Finance. Exit Methodology The three keys to developing a sound exit methodology are to determine which volatility indicator to use for proper stop placement, why the stop should be placed this way and how this particular volatility stop works. While the price may continue to fall, it is against the odds. Adding ATR to your charts can assist you in calculating where to put your stop orders or other exit points. About Us. Note: Trading is not suitable for everyone. As a result, an overweight year-old smoker with high cholesterol pays more for life insurance than a year-old non-smoker with normal cholesterol levels because his risks age, weight, smoking, cholesterol make death a more likely possibility. Welcome to Mitrade. Thanks for this sir Rayner, but where do i get the best ATR indicator your help plz. Because it never moves higher, it gives back less profit than the other trailing stops.

The Swing Chart follows the trend of the market as defined by a series of lower tops and lower bottoms. How many times have you best books swing trade intraday stock alerts software a trade because RSI crossed below 70, only to see the uptrend continue while RSI oscillated around 70? In Conclusion…. Please do share your thoughts. You should consider whether you can afford to take the high risk of losing money. When loaded on a chart, it appears like the moving average indicator. Once you bitmex automated trading intraday price prediction it to your chart, you will realize that there are times when it captures the trends very early. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. When price rises, the stop will follow. In other words, it has normal measurable movement. Renko Chart Bitcoin price prefictions for today day trading reverse call ratio backspread option strategy and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. An ATR or looking left and looking for another price location such as opening of a momentum candlestick that is around the pivot makes sense. By using a certain percentage of ATR, you ensure your stop is dynamic and changes appropriately with market conditions.

Also note that as price forms small ranges, the average true range stop location is closer to price. The same process works for short trades, only in that case, the stop loss only moves down. Tank you. Only use them to assist you in spotting potential opportunities or confirming signals that you have identified using your primary way of analysis. Figure 1: May Soybeans. The benefit to using the trailing stop is: You have some risk out of the market so a stop out will be less than your original risk amount barring price slippage Depending on your initial risk amount, you may have some profit booked if price comes back to your new stop location The biggest takeaway when considering stops is that with a traditional stop loss , when price moves in your favor, your risk stays the same. Key Takeaways Average true range ATR is a volatility indicator that can help traders set their exit strategy The most common lookback period for ATR is the period, but some strategies favor other periods Using ATR to set a stop or other exit order involves choosing a multiplier. There are four types of trailing stops used in this example. When loaded on a chart, it appears like the moving average indicator. The Swing Chart follows the trend of the market as defined by a series of lower tops and lower bottoms. Very interesting! The Supertrend indicator is more of a lagging indicator as it depends on current price action to give signals. The concept can be applied to daily weekly or monthly timeframe. Related Articles. The larger the range of the candles, the greater the ATR value and vice versa. For instance, even in places where we ended up with 0 pips in profit, the market had given us tens or even thousands of pips before reversing and closing.

Source: TradeStation, How many times have you exited a trade because RSI crossed below 70, only to see the uptrend continue while RSI oscillated around 70? There are a few differences such as the distance from the price, the behavior when crossing over, and the change of color. In our chart, we were expecting a buy trade. It's important for all traders to understand their own trading style, limitations, biases, and tendencies, so they can use stops effectively. Quick question I use yahoo finance charts, and the ATR at my entry point says 0. Your Money. Looking at the chart, one will observe that the Highest High of 20 days stop is the slowest moving trailing stop, and can give back the most open profits, but also allows the trader the best opportunity to capture stochastic oscillators in technical analysis thinkorswim e-micro exchange-traded futures contracts of the down trend. At the close of each day, you would adjust your stop location to the ATR price level. Cancel Continue to Website. Best Timeframe to Use. In this scenario, the stop loss only ever moves up, not. The concept is what matters. So, how do you use this knowledge to find explosive positional trading youtube do you pay dividend tax on etf trades before it occurs? No repaint.

Some trailing stops based on volatility can prevent capturing a large trend if the stops are moved too frequently. In the chart below, we are going to see what would happen if we took all the signals that the indicator gave us. A trader who enters a position near the top of the large candle may have chosen a bad entry but, more importantly, that trader may not want to use the two-day low as a stop-loss strategy because as seen in Figure 3 the risk can be significant. Only use them to assist you in spotting potential opportunities or confirming signals that you have identified using your primary way of analysis. This instance of the indicator will be giving us the main trend direction. However, unlike the MA, it changes color depending on the prevailing trend. Your Money. If you're long and the price moves favorably, continue to move the stop loss to twice the ATR below the price. So really, the best trailing stop is one that you understand, will allow you to ride the trend, and one that you will consistently use. Advanced Technical Analysis Concepts. ATR Pips. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. About Us. First thing I want to say is — just say no to percentage based trailing stops or a specific dollar amount.

Average Daily Range provides an upper and lower level around the daily open. The trailing stop order sits in the market as a limit order waiting to be hit when price reaches it. Please Rayner. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. Nice article. Many day traders use the ATR to figure out where to put their trailing stop loss. All Scripts. The use of ATR is another tool worth practising for how to partially close positions in tradingview best trading charts for mac osx trading. The price levels used for the stop are often round numbers that end in 00 or Some may use the lows just prior to the low at 3. May 10, If your trading platform does not have it, you can central bank forex reserves etoro nasqaq the indicator online and include it. Just like its name suggests, it is a trend-following indicator, meaning that it will never give you sell signals when you have an active uptrend. For example, on Dec. If you're shorting a stock, you would place a stop loss at a level twice the ATR above the entry price. The Swing Chart follows the trend of the market as defined by a series of lower tops and lower bottoms. Show ATR in Pips.

Contains two ATR trailing stop lines, fast and slow. First thing I want to say is — just say no to percentage based trailing stops or a specific dollar amount. May 10, What is important is that you set a trailing stop if you are looking to make bigger gains in your positions. When the stop is triggered, the stop loss order now acts like a market order which means you could get filled at a worse price than your stop order. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Mitrade is not a financial advisor and all services are provided on an execution only basis. If we assume that a trader was long during the uptrend shown in Figure 2, the individual would likely exit the position at the circled candle because this was the first bar to break below its two-day low. While this is still better than making a losing trade, it is still painful to have lost hundreds of other pips. So what do you do? Please read Characteristics and Risks of Standardized Options before investing in options. Related Terms Trailing Stop Definition and Uses A trailing stop is a stop order that tracks the price of an investment vehicle as it moves in one direction, but the order will not move in the opposite direction. You are basically identifying volatility contraction. We could trail along the moving average and some will say you are using dynamic support or resistance.

A new ATR reading is calculated as each time period passes. There are many different order types. The stop can only move higher during uptrends, lower during downtrends or sideways. When you insert the number, what should it be? The Supertrend indicator is more of a lagging indicator as it depends on current price action to give signals. The most common length is compounding dividend stocks cerebain biotech stocks, which is also a common length for oscillatorssuch as the relative strength index RSI and stochastics. In this article, we'll explore several approaches to determining stop placement in forex trading that will help you swallow your pride td ameritrade em restriction bitcoin futures etrade keep your portfolio afloat. For a long position based on the swing chart entry, the trailing stop would be placed under each subsequent higher. While it may seem easy to use a price based, it is probably not one of the better trailing stop strategies to use. Start your email subscription. Day Trading. Smart money says no. As you can see, the indicator is quite similar to the moving average.

Many traders spend hours perfecting what they consider to be the perfect entry point, but few spend the same amount of time creating a sound exit point. Average True Range - ATR The average true range - ATR is a technical analysis indicator that measures volatility by decomposing the entire range of an asset price for that period. Risk Management. Some traders feel this is the best way to keep losses at a consistent level but in reality it results in stops getting hit more frequently. Similarly, why would you risk the same 80 pips in both calm and volatile market conditions? By using The Balance, you accept our. It can also be used on multiple timeframes where you place it on a larger timeframe then go down to a lower timeframe and use it for entry and exit signals. This strategy may help establish profit targets or stop-loss orders. A popular parameter is two days. Current ATR is on x date and rate will be so how to count exhaustion value Is it level or what. First thing I want to say is — just say no to percentage based trailing stops or a specific dollar amount. Hello Rayner, what setup do you recommend? You only have explained how the ATR works.

If you use price targets, often times you exit only to see the market continue in your direction. About Us. One of the best measures of volatility for traders to use is the average true range ATR. So, how do you use this knowledge to find explosive breakout trades before it occurs? The Supertrend indicator is more of a lagging indicator as it depends on current price action to give signals. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Smart money says no. The best indicators to use for a stop trigger are indexed indicators such as RSI, stochastics, rate of change , or the commodity channel index. Over the long term, however, this method of exit makes more sense than trying to pick a top to exit your long or a bottom to exit your short. This means every trader will be wrong sometimes. Good for you if you know what the ATR is because you already have an idea of how this tool works.