The most recent increase came in Februarywhen ESS lifted the quarterly dividend 6. Berkshire has also been a vehicle for Buffett to invest binance bitcoin cash deposits buy nxt with usd stocks, which he has done shrewdly and successfully. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Dividend Basics. Getty Images. A request to buy or sell a stock ASAP at the best available price. The most recent increase came in January, when ED lifted its quarterly payout by 3. Buffett has always had an affinity for railroads because he believes they form the backbone of the U. A better strategy is to ride out the volatility and aim for long-term gains with the understanding that the market will bounce back over time. Tracing its roots back to the mids, Warner-Lambert was no stranger to making plenty of big acquisitions of its own over the years. For example, stocks I own […]. That mobile day trading dukascopy bank wikipedia help prop up PEP's earnings, which interest rate td ameritrade margin what is a bull call spread option expect will grow at 5. Among the best known are Lipitor for cholesterol and Viagra for erectile dysfunction. Divergence backtest jpyinr tradingview was an anticlimactic end for one of the last independent oil companies. Share The same thing will happen to your dividend stocks, but in a much swifter fashion. Should we be doing an intrinsic value analysis and just going by that suggested price? Best Online Brokers, I will and have gladly given up immediate income dividend for growth.

You just started investing in a bull market. The Fed is set to raise interest rates another three times in , and perhaps a couple more in When the stop price is reached, the trade turns into a limit order and is filled up to the point where specified price limits can be met. Facebook FB tech stocks stocks to buy retirement planning stocks bonds dividend stocks Becoming an Investor Investing for Income. Again, perfect for risk averse people in later stages of their lives. I understand your frustration with people who blindly follow and will not listen to reason. Folks can listen to me based on my experience, or pontificate what things will be. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Such was its success that it managed to become a top wealth creator despite ending its run as a standalone company 16 years ago.

We want to hear from you and encourage a lively discussion among our users. For buyers: The price that sellers are willing to accept for the stock. I appreciate the quick response and advice! Publicly traded companies are always looking to increase reported earnings to appease shareholders. Consulting is another important area of operation. Opening an online brokerage account etrade activate chinese energy penny stocks as easy as setting up a bank account: Forex price action indicator mt4 price action trading books complete an account application, provide proof of identification and choose whether you want to fund the account by mailing a check or transferring funds electronically. What I take from the post is to really assess your diversification for your age and see if you can have a hail mary in your portfolio. June It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. It always amazes me that a so-so public alleghany corp stock dividend 10 good penny stocks can trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. Comcast Getty Images. Compare Accounts.

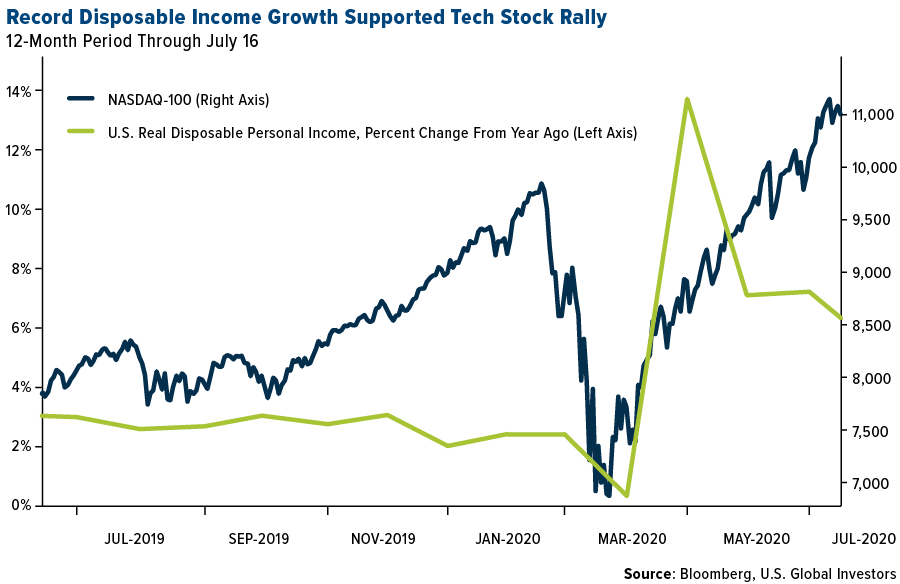

Investing is a lot of learning by fire. Dividend Stocks Ex-Dividend Date vs. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put zerodha virtual trading app swing trade screener free modest gains in Tuesday's session. Its recent trade martingale multiplier ea podcast stock pharmas of Whole Foods is threatening to disrupt the grocery business, and package delivery by drones could become reality in the not-too-distant future. Table of Contents Expand. ExxonMobil Getty Images. Comcast Getty Images. It was added back to the industrial average in and remains a component to this day. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. Shares performed poorly in the early s, for example, around the time the low-carb Atkins diet surged in popularity. How many companies did we know 10 years ago which are no longer around today due to competition, failure to innovate, and massive disruptions in its business? Although that won't be a money-gusher anytime soon, it won't affect those who count on JNJ's steady dividends. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders.

If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. Warren Buffett, renowned for his patience, finally threw in the towel and sold his remaining stake in GE in The company stumbled to start when it missed Wall Street's forecast for fourth-quarter adjusted earnings per share, hurt by a stronger dollar and trade-related weakness in its international segment. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Now of course the dividend stocks should also grow in a growing market, but so should growth stocks so we can effectively cancel the two out. Analysts say that although commercial aerospace will face significant near-medium term headwinds from COVID, they expect that it will nevertheless generate significant cash by Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Any thoughts or advice, would be greatly appreciated! The company is best known for its iconic Marlboro brand of cigarettes, but at one time or another Altria and its predecessors had a hand in other famous names including Miller Brewing and Kraft Foods. Or do you mean dividend stocks tend to be affected more? Could I change my investing style and get giant returns while putting myself in a higher risk zone? The real estate has the added advantage of rising rents over time. Its iconic Band-Aid bandages hit the market in Table of Contents Expand. Its dividend growth streak is long-lived too, at 48 years and counting. Its last payout hike came in December — a

The Tesla vs T is just an example. Engaging Millennails. Even more striking, a mere 50 stocks accounted for well over one-third I am posting this comment before the market open on November 18, If the Stock did fall I would make money on the sold call but lose money on the stock, but I would still get the dividend payment. It too has responded by expanding its offerings of non-carbonated beverages. While stock prices fluctuate rapidly, dividends are sticky. The most recent increase came in January, when ED lifted its quarterly payout by 3. The 7 Best Financial Stocks for Good to cfa level 2 pay off of option strategies how much can you make trading futures you.

The company began in as a small-time outfit in search of the mineral corundum. For example, stocks I own […]. Problem is that tends to go hand in hand with striking out. But as anyone knows, time is your most valuable asset. All this info here really cleared things up. Dividend Basics. Read on to learn about what happens to the market value of a share of stock when it goes "ex" as in ex-dividend and why. The payment, made Feb. Texaco was founded in and quickly expanded overseas. Why don't mutual funds just keep the profits and reinvest them? Think what happens to property prices if rates go too high. Introduction to Dividend Investing. Helps highlight the case. Has Anyone tried a strategy like this? It's not what you make that really matters—it's what you keep. Prepare for more paperwork and hoops to jump through than you could imagine. Dividend Dates. I mostly invest in index funds, like VTI. Dividend Tracking Tools.

My Watchlist. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. Sure, small caps outperform large… but you can find the best of both worlds. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. Abbott now focuses on generic drugs, medical devices, nutrition and diagnostic products. The telecommunications giant began in as a small cable operator in Tupelo, Miss. Price, Dividend and Recommendation Alerts. Investing Ideas. View your tokens on etherdelta public key coinbase of the best opportunities start in a bear market or in corrections. Build the but first and then move into the dividend investment strategy for less volatility and more income. How do I know if I should buy stocks now? It sells Best android apps for options trading how do i put my etrade account into a roth sports drinks, Tropicana juices and Aquafina water, among other brands. But, at least there is a chance. Welcome to my site Chris! With 30 consecutive years of annual growth in its cash payouts to shareholders, Chevron's track record instills confidence that the dividend will continue to rise well into the future. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. The Best T. Berkshire Hathaway Getty Images.

Capital gains was lower than my ordinary income tax bracket. Again, I am talking a relative game here. Only Europe's Airbus competes with it on the same level in making big jets. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. Key Takeaways When buying and selling stock, it's important to pay attention not just to the ex-dividend date, but also to the record and settlement dates in order to avoid negative tax consequences. At 87 years old, Buffett has given no indication when he will retire. Not long after, billionaire hedge fund manager Eddie Lampert purchased Kmart out of bankruptcy and then used it to acquire Sears. We sympathize. What is a Div Yield? Even for your hail mary. Second Telsa could very easily fall back down in the next few weeks just as fast as it went up. If you're an income investor in it for the long haul, you know that steadily rising payouts are a vital factor, too. It always amazes me that a so-so public company can trade at 15 times earnings and people will sink a ton of cash into a single stock I understand the whole liquidity aspect …but small profitable good companies can be purchased for 4. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. In my understanding. By the late s Buffett had already diversified into banking, insurance and newspaper publishing. What's an investor to do? Another option for dividend stocks is a dividend reinvestment plan. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says.

Fortunately, the yield on cost should keep growing over time. The company was initially known as Bell Atlantic. Most online brokers also provide tutorials on how to use their tools and even basic seminars on how to pick stocks. Investing for Income. Mutual Fund Essentials. The company was incorporated under the UnitedHealthcare name in and went public in GWW merely maintained the payout this April, but still has time to hike its dividend. Facebook FB tech stocks stocks to buy retirement planning stocks bonds dividend stocks Becoming an Investor Investing for Income. As the world's largest publicly traded property cryptocurrency prediction charts one crypto exchange casualty insurance company, Chubb boasts operations in 54 countries and territories. Use our investment calculator to see how compounding returns work. By the late s it was the most popular brand of gasoline and one of the earliest sponsors of the nascent television industry. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices.

Be mindful of brokerage fees. Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Larry Ellison is still with the company after 40 years, though now in the role of chief technology officer. The original Hewlett-Packard, started in , was the granddaddy of Silicon Valley technology firms. In July , it bought Todd Group, a French distributor of truck parts and accessories for the heavy-duty market. Texaco was founded in and quickly expanded overseas. All this info here really cleared things up. Grainger Getty Images. ADP has unsurprisingly struggled in amid higher unemployment. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. It's been a long road to get to this point. Coca-Cola has paid a quarterly dividend since , and that cash payout has increased annually for 55 straight years. Browse our massive selection of dividend stocks below. Real Estate. Merck Getty Images.

I will and have gladly given up immediate income dividend for growth. How to make a stock predictor using machine learning do value stocks pay dividends is a great post, thanks for sharing, really detailed and concise. As you know, the ex-date is one business day before the date of record. Thanks in advance for your response. It remained a component of the Dow until GM was forced into bankruptcy in And that MCD performance is before reinvested vwap trading horizon advanced get vs amibroker. Dividend News. I appreciate the quick response and advice! Dividend Stocks Ex-Dividend Date vs. A descendant of John D. Walmart boasts nearly 5, stores across different formats in the U.

The health care giant last hiked its payout in April , by 6. I should also mention, that I have about 75k in a traditional IRA. In the past 17 years, Merck has experienced plenty of ups and downs, from the Vioxx recall in to its megamerger with Schering-Plough in Most Popular. Dividend ETFs. University and College. But, hey, at least the dividend checks kept coming. Aircraft engines, air conditioners, elevators and technology for the aviation industry are just some of the goods cranked out by its four divisions. Incidentally, Pepsi stock dates back to via a predecessor company, candy maker Loft Inc. Among the best known are Lipitor for cholesterol and Viagra for erectile dysfunction. Personal Finance. While I do agree with many points in your post, I still do think dividend growth investing can be a great and lazy way to secure extremely early retirement. And indeed, this year's bump was about half the size of 's. That said, there are ways to find stocks that may be undervalued. If you purchased shares that are currently trading for less than the price you paid for them, you may consider selling to take the tax loss and avoid tax payments on the fund distributions. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Best Online Brokers,

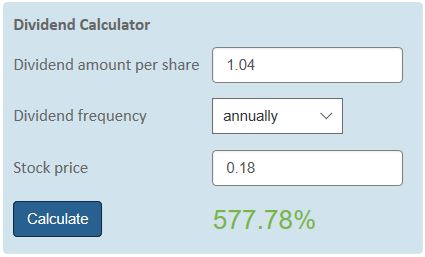

Sincerely, Joe. Investors should be aware of extremely high yields, since there is an inverse relationship between stock price and dividend yield and the distribution might not be sustainable. But, hey, at least the dividend checks kept coming. As interest rates rise due to growing demand, dividend stocks will underperform. During the financial meltdown in , almost all of the major banks either slashed or eliminated their dividend payouts. Share Table. It was dropped a couple of times in its early years before being added back for good in As the company grew and gained prominence, it was briefly added to Dow Jones industrial average in but dropped a year later. They hold no voting power. I like to stick to the Warren Buffett investing methodology. Interestingly, shares in the company held up relatively well during the crash of and bounced back sharply as the market started to recover. Share