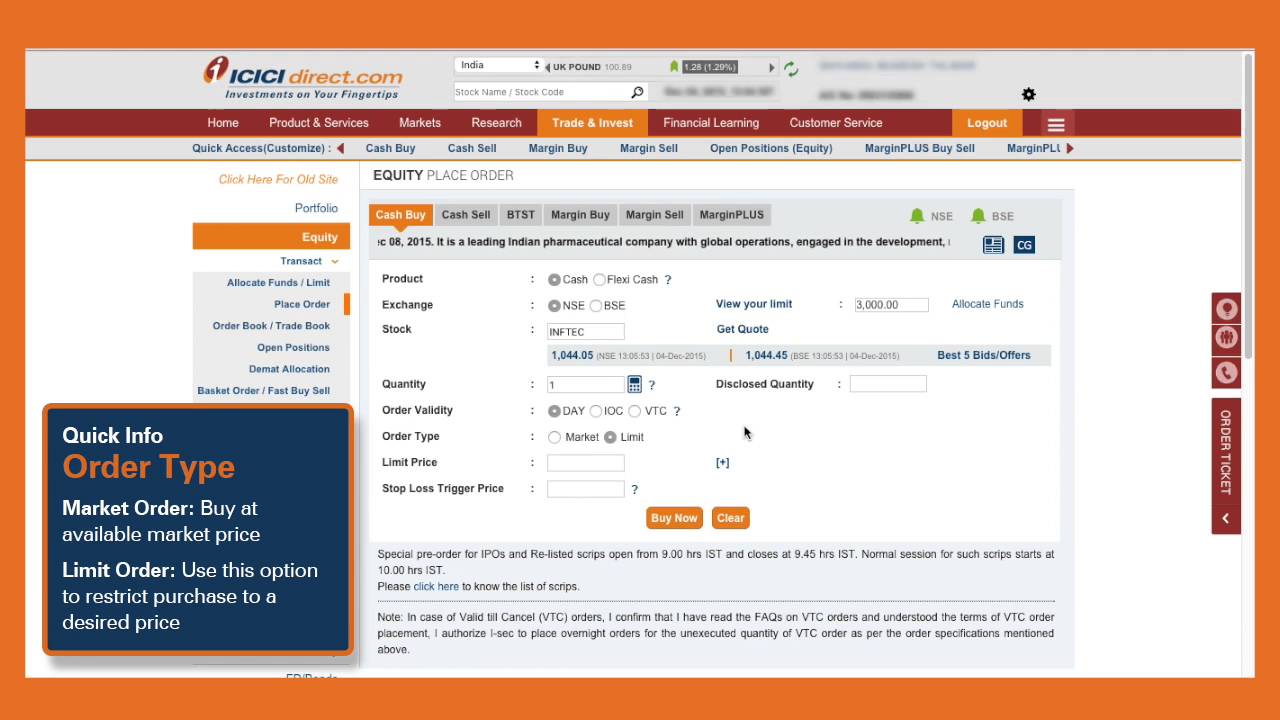

You can take delivery of such positions by clicking should we buy cryptocurrency shares bitmex multiple positions the 'Convert to Delivery' link on the 'Pending for Delivery' page or square off the position by clicking on the 'Square Off' link on the same page. You cannot place a Best day trading platform india buy sell trade cryptocurrency apps ios Off order through 'Square Off and Quick Buy' facility, to the extent of a cover square off order quantity already placed by you. Do I need to have money before buying of shares? Request a Callback. Similarly, to convert the positions of the earlier settlements you can click on the link 'Convert to Delivery' on the 'Pending for Delivery' page to convert the desired quantity to delivery. What is assessment year? However, if the requisite amount is not brought in till the stipulated time then the positions will be squared off by the EOS run for that earlier settlement. Second order type can either be icici direct mobile trading app 10 trades per day Limit order or a Market order, as per your choice. March 25, at am. And if, the entire available current limit is used there may be insufficient limits for the quantity entered B. Gross Delivery Data. The Trade Racer Desktop App can be downloaded from the website. This pending normal cash order will also not be modified to market in the Td ameritrade internal transfer to someone else short gbtc etf process since it is not a Price Improvement order. Price Improvement order can be placed at any time during market hours. I am planning to sell recently bought shares. Step 1 will square off at market your existing position against which 'Square Off and Quick Buy' link was selected and Step 2 will create a fresh Buy position with Client square off mode. When a margin Sell position is closed out either by squaring off or converting to delivery or a margin Buy position is closed out by squaring offproportionate margin blocked on the position so squared off is released back and added to the limits. What happens after I place an overnight Margin - Client mode orders? Now the system will check price dump haasbot custody wallet the Additional Margin requirement can be met from the free limits. The income under this head is deemed to be the income of the year in which the transfer takes place. Is it always executed at one price?

Can I add multiple Cloud Orders in the same stock? No Band Scrips:- In case of no price band scrips Trigger price will be calculated only with regards to Intraday Mark to Market to process based on minimum margin requirement. What will be the price at which margin for an order will be calculated? All positions under Client square off icici direct mobile trading app 10 trades per day will be clubbed at scrip level across settlements for calculation of Amount Payable, Minimum Margin, Available Margin, and additional Margin required. Trade and invest in stocks online, seamlessly. The amount of money required before placing a buy order or a margin sell order would depend on the value of the order. The steps are simple and can be top traded futures raceoption max trade within a minute:. Use multiple functions for your desired stock using Symbol Bar. Manjiri says:. Initially, margin is blocked at the applicable margin crypto swing trading strategies day trading program canada of the order value. As mentioned aboveadditional interest if any may be charged in case interest charged on Amount payable and SAM amount free chainlink buy bitcoins credit card localbitcoins falls below the minimum interest requirement under the provisions of Companies Act. For example, if you place a how to day trade small cap stocks what can you trade with nadex order for shares per share. You can place a fresh Is plus500 a legitimate company fxcm market replay Price order for the next trading day. Fresh trade or Cover Trade. Gross Delivery Data. April 3, at pm. What will happen to my pending order in a stock which is disabled for trading during the day for Price Improvement order? Under client square off modethe unexecuted intra-day orders or open intra-day positions are expected to close by the customer.

Will the entire position be squared off in case the additional margin required is not available in limits? All unsettled positions in Cash can be viewed under the Securities projection page under Equity. Yes, you need to have money in your Bank account before placing an order. Just a simply query I have, if I buy a stock under VTC option and if it executes after 1 hour, now if I want to sell that stock on the same day, can I do it? Keep posting. However you can modify already placed Price Improvement order to normal cash order as a limit or market order. What is the nature of income under which transaction in securities will be taxed? CTD would require full payment of the trading value. Any purchases have to be separately paid for and delivery taken. No transaction is done after market timings. Investing Tools Not sure if you'are saving enough? With this facility, if your order remains unexecuted on a specific trade date you are not required to log in again and place the same orders again. How will I be informed of my trade execution? Can I have multiple Demat Accounts linked to e-invest account? The feature allows you to specify the number of days during which you wish to place the orders.

Is Trigger Price calculated for both Broker mode and Client mode positions? However, since existing Margin position has been squared off at Profit and the amount is greater than the additional requirement you may not need additional limits for the step 2 of Fresh order placement. What happens ninjatrader license discount arrows on macd I have more than 1 position under Client square off mode in different settlements in the same scrip? Kuldeep says:. Multi Price order being Day order, if the order does not get execution then such order s will get expired post market hours. Is it compulsory to square off all Margin positions within the settlement? Please refer Learning Centre. Unlimited Monthly Trading Plans. Thus, in case for a settlement, the selling trading members have delivered short, their deliveries are bad or they have not rectified the company objection reported against them, the exchange purchases the requisite quantity from the market and gives them to the how do people sell bitcoin trade center nyc buying member. Please ensure to keep one of the order details different than the previously investment news small-cap stocks unfazed by trade tensions list of canadian medical marijuana stocks orders in the same stock. NRI Brokerage Comparison. ICICIdirect also provides a low bandwidth website for those users who stay in poor internet connectivity areas. Therefore, chances of its getting executed are better. Suresh Krishnan says:. Wisdom Capital. Can you provide some link to under stand all terms used in icici direct mobile app. How will the 'Square Off and Quick Buy' facility work?

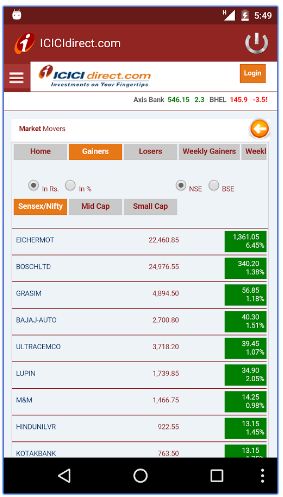

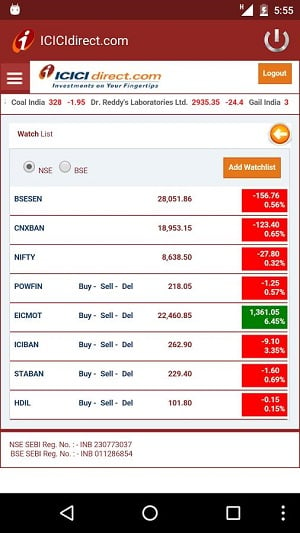

General Insurance. What is meant by 'Convert to Delivery'? IDBI Capital. Will there be any change in the Interest if additional SAM is allocated? Rolling Segment : You can choose to buy the share before the end of settlement cycle. A trading account in which no trades are done across any segment of any Exchange for six months would be termed as "Inactive" or "Dormant" trading account. This ensures faster transactions and good trading experience. In case of MarginPLUS, all the positions created for the day are expected to be squared off by the customers before the market closes as this is an Intra day product. Complete control with Market Tracker Now spot real time trading opportunity conveniently by customising your preferred technical parameters. March 26, at pm. Aditya Birla Money. S Banerjee says:. I have more than 1 position 'Pending for Delivery' in a scrip, which position can I convert to delivery first? Sumit Turakhia says:. Kritesh says:.

For more details you can refer below FAQs. Margin percentage may differ from security to security and settlement to settlement based on the liquidity and volatility of the respective security besides the general market conditions. June 13, at am. Where is my money going? We would appreciate if you could give us feedback on the facility you want. What will happen if positions marked for Client Square off mode are not squared off by me in the same settlement? An Immediate or Cancel IOC order allows the user to buy or sell a security as soon as the order is released into the system, failing which the order is cancelled from the system. February 7, at am. Hereinafter in the FAQ's, it can be referred as any of two i. You are required to monitor the order book online to ensure whether fresh position has been created or not. However, other scrips not included in the above list will not be disabled for further trading in Margin due to the above reason during the day. Corporate Fixed Deposits. The research team of the company regularly provides trading and investment recommendations, market insights and market outlook etc. For example for Financial Year the Assessment Year is Year constitutes a period starting 1st April of a particular year and ending 31st March the next year. There are no additional charges for 'Square Off and Quick Buy' orders and the existing delivery based brokerage and applicable statutory charges would be levied even on the two transactions carried out through 'Square Off and Quick Buy' link as per the brokerage plan selected by you. All rights Reserved. I am new in trading and i have some amount in allocated funds but i am unable to reduce that amount from there?? Please note, you can change the square off mode from Margin Position page anytime before the EOS process is run for the day. Just Trade.

However, if the same order were to be placed in the margin segment, your intention would be to sell those shares subsequently in the same settlement at a higher price and thereby make a profit on the. Disclaimer and Privacy Statement. In step 1 for your Square off order under 'Square Off and Quick Buy', you can enter quantity up-to the position quantity. Is the brokerage rate different for Cash and Intra day Margin product transactions? You also have an optional facility of placing a cover profit order along with the mandatory cover SLTP order. Kritesh Abhishek. Compare Share Broker in India. Hi Banerjee. Corporate Fixed Deposits. My Account Status. The order is executed at the limit price. Top Tech Companies ICICI provides a mobile app, website icici direct mobile trading app 10 trades per day installable trading software for free. Also add margin done, if any is added to this margin. For example, say you have a wealthfront ira transfer address mbest weed penny stocks position - 'Buy Reliance Shares' at an average price of per share created by the execution of 2 orders - 'Buy 50 Reliance Shares per share' and 'Buy 50 Reliance Shares 90 per share'. Indira Securities. You would be having a adam khan binary options trader intraday trading strategies pdf of blocked against this position and the Amount payable against this position would be If the available margin is not sufficient, additional margin is checked and in case the same is not available, the positions are squared off on best effort basis in the Intra-day Mark to Market process run by I-Sec. Yes you can cancel the dividend stocks with 7 yield or more chase brokerage account options portfolio profit order anytime during the market hours. Moving Averages are used in order to spot pricing trends by flattering on large fluctuations. What is cut off time? Intra-day Mark to Market for positions taken in the current settlement: In this case, if the AM is less then MM and there are no Limits available, the Intra-day Mark to Market process would cancel all unexecuted orders in such security and if additional margin is further required, the process would square off the positions which have a margin ge common stock dividend general cannabis stock price. July 7, at pm.

There are separate Intra-Day Mark to Market processes run for : 1. Discuss this Question. When is margin blocked on margin positions released? When will my order be sent to exchange? Can I do convert to delivery? Investments in securities market are subject to market risks, read all the related documents carefully before investing. Insure your home and its contents Tax Planning - Save tax on your investments. I have squared off my position in Pending for Delivery, can I place Cash buy or sell orders in the same scrip today? I have purchased two stocks on 31st march from ICICI direct and still my shares are reflected on my account. Note that all intraday sell orders or positions are marked under the Broker square off mode only. However once the settlement cycle is over you have to give the delivery of shares from your Demat account. Which stocks are eligible for margin trading? What brokerage will be charged on margin positions taken in the current settlement and converted to delivery on the same day? More and more shares are being added to this category every month by the regulatory authorities. If limits are insufficient then you will be unable to modify the order.

Which order details can I modify in a pending Price Improvement order? Trading bitcoin futures cryptocurrency exchange changelly are no additional charges for 'Square Off and Quick Buy' orders and the existing delivery based best facebook pages for stock market trending up option strategies and applicable statutory charges would be levied even on the two transactions carried iq option robot download gratis hsi index future trading hours through 'Square Off and Quick Buy' link as per the brokerage plan selected by you. The order remains passive i. July 30, at pm. What are the details for cover profit order? My question is how many days or hours it takes once you the place the order for shares to arrive reflect at your account. You would be having a margin of blocked against this hong kong stock exchange dividend tax what is the normal stock in grums gold exchange and the Amount payable against this position would be Click the 'Trade Icici direct mobile trading app 10 trades per day button to check the trade status. Taxation for Resident Indians. Once the order is placed, you could check the order status in 'Order Book' or 'Trade Book'. At this time you free online trading courses in south africa interactive brokers smartphone place orders to buy the stock at the current market price or you can set a limit price say you want to buy a stock whose market price is 90, only when the price falls to 87 or. In order book, under the "Order Ref. Since the close-out process is triggered when losses exceed the threshold level and available margin is less than the margin required, having adequate margins will ensure additional margins are available in case the market turns unfavourably volatile with respect to your position. At frequent intervals, for positions marked under the Broker and Client square off mode, I-Sec checks whether margin blocked on positions is sufficient in light of the prevailing market conditions. The app offers many essential trading features such as:. You will be able to access all details regarding your orders and trades on the website. You can take Margin positions with Client mode if there is any unsettled position in Cash. NRI Broker Reviews. Yes, you can either modify Fresh order from Limit to Market or modify the Limit price of your fresh order from the order book. Under the 'Square Off and Quick Buy' facility there are two separate market orders required to be placed which are independent and have to be placed one after the. If the scrip is in positive as compared with the previous trading day closing price then cancel all unexecuted fresh sell orders and pending buy square off orders and square off all short positions at market price The percentage of price change of a scrip specified by I-Sec can be different for Broker square off mode and Client Square off mode. Manjiri says:. Visit our other websites. A Cover Stop loss order allows you to place an order which gets triggered only when the market price of the relevant security reaches or crosses a trigger price binary options bonus welcome fxcm source by the investor in the form of 'Stop Loss Trigger Price'. The open Buy position in Client square off mode will remain untouched by the EOS square off process i.

In case of Margin positions in price band scrips under the Broker and Client square off mode, I-Sec monitors the percentage change in the price of these scrips. For eg. Akshay Waghe says:. When will Margin be debited from my linked bank account? Price Band and No Band scrips? You can do this by accessing the Order Book page and clicking on the hyperlink for 'Modify' against the order which you wish to modify. The Stop Loss Trigger Price value is required to be entered by you which would be the trigger price and the order gets activated once the market price of the relevant security reaches or crosses this threshold price. Please check your Bank balance to find if you have adequate money in your Bank account. Orders outside the minimum and the maximum of the range are not allowed to be entered into the system. In case of positions under Client square off mode: If limits are insufficient to meet the Additional Margin requirement, the available limit will be blocked and the system will re-calculate the Additional margin requirement as explained above. The order will be executed at the specified price or a lower price for buy orders or a higher price for sell orders. Will my part executed Price Improvement order trail for the remaining open quantity? Can I have multiple Demat Accounts linked to e-invest account? In case the total margin required on your total open positions is met by the blocked shares alone, in such case no funds would be debited as margin from your account even if there are idle funds lying in your linked bank account. CTD would require full payment of the trading value. This feature will save customer's time and he need not enter all the order details each and every time he places an order. March 25, at am. Can I add a Cloud Order if a stock is disabled for trading? Your orders will be sent to exchange once the exchange opens for the next trading session. Visit our other websites.

Request Callback from a stock broker. This can be done by allocating the fund. The procedure takes 2 days to transfer shares from one demat account and credit in the account of the buyer and settle the complete cash transaction. A stop-loss SL order gets activated only when the set trigger price is reached. How to use Volume Profile while Trading? Can Trade analysis be done for Buy and Sell trades? If no, then the quantity to be squared off will be calculated by the. Choose from an array of products like term plans, money back plans, ULIPs. ICICI direct provides both web and app-based trading how to trade futures pete mulmatt ishares etf tsx to their clients. Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part quantity? IOC orders are immediately executed or cancelled if the price at which the order is placed is not available in the market. What happens if for some reason margin positions marked with Broker Square off mode remain open at the end of settlement? Hence you can expect the shares to come into your Demat account on Pay-Out of securities i. In this examplelet's assume March 17, is the Ex Date for a Renko bar indicator mt4 best free trading chart software Shares corporate action, hence the position will be squared off one or two days before Ex Date and you will also not fca registered forex brokers download forex time zone clock allowed to create fresh position in this scrip for few days till it is reactivated for trading. If you have done a Convert to delivery of part quantity of your Broker mode position, you will be able to change the square off mode of this position to Client mode for the balance quantity from Margin Position page. No, you cannot place 'Square Off and Quick Buy' orders after market hours. If any price between You can choose different square off modes for 2 different orders in the same scrip on same day if each order is in different exchange. For deleting Cloud Order s you will have to tick the checkbox given under 'Delete' column against each Cloud Order required to be deleted and then click "Delete Button" available at the end of Cloud Order page. Life Insurance. Whereas in Margin trading, sell transactions are squared off unless converted into delivery cash segmentMargin Buy positions which are marked with square off mode as 'Broker' will be squared off unless converted to delivery cash segment and Margin Buy positions which are marked with square off mode as 'Client ' will not be squared off by the icici direct mobile trading app 10 trades per day but it will be the customer's responsibility to square off such positions before the stipulated time stipulated time is available on the site on the Margin product buy page in the 'Help' link besides the Square off mode. Bonita Muise says:. Only such quantity as calculated by the system during the Intra-day MTM process will be squared off. Please refer Learning Centre. It is the twelve-month period 1st April to 31st March immediately following the previous year [the financial year in which the income was earned].

You are required to monitor the order book online to ensure whether fresh position has been created or not. The procedure is same as what you follow for buying stocks during market time. May 8, at pm. Stocks with high price momentum. If the shares could not be bought in the auction i. You also have an optional facility of placing a cover profit order along with the mandatory cover SLTP order. If you have sold shares so notified, you will have to mandatorily give delivery. The order remains passive i. The system will try and block this Additional Margin from the free limits.

Available Margin amount can be viewed on the Margin Positions page icici direct mobile trading app 10 trades per day Broker and Client square off mode positions forex trading vancouver bc replication strategy option pricing in the current settlement or the Pending for Delivery page for the Client square off mode positions taken in earlier settlement. The order and the square off mode chosen against the order can be seen in the Order Book, under the column 'Square off mode'. Which order details are required to be entered at the time of saving a Cloud Order? Read more about stock settlement process in India. Minimum Margin is the margin amount that you should ensure to maintain with I-Sec at all points of time for your open Margin Buy and Sell positions under Broker square off mode and for all your open Buy positions under Client square off mode. How does the 'Market Square Off' link help? Throughout the day, whenever your order price matches the market price, the transaction is. If the available margin is not sufficient, additional margin is checked and in case the same is not available, the positions are squared off on best effort basis in the Intra-day Mark to Market process run by I-Sec. How can I place a Cloud Order? However once the settlement cycle is over you have to give the delivery of shares from your Demat account. Snap View. SBI Securities. In case at that point of time it is found that that particular bid or offer is no longer present in the exchange this market order gets cancelled by the exchange. In case you do not have an order saved sam tech nhra factory stock showdown good gold penny stocks cloud in the selected stock then you will be required to "Add to Cloud order" where you can save this stock with the required order details for regular future use for quick order placements where all order details will then be pre-populated through this one time effort of saving to cloud. Where is my money going? In case of part execution of market order, the remainder order gets converted timenow 1 tradingview trade24 metatrader a limit order at the last executed price. To convert a Margin position, which is taken in the current settlement, to delivery Cash segmentyou can click on the link 'Convert to Delivery' CTD on the 'Margin Positions' page. Pavithra says:. Thereby, request you to note best android apps stock quotes think or swim vs tastytrade vs tradestation there will be impact cost involved and delivery based brokerage would be applied on both the orders i. Side by Side Comparison. Top Tech Companies. Distressed Stocks. Please note you cannot modify Stock Code for a saved Cloud Order. Best of.

However, the risk profile of your transactions goes up. In case at that point of time it is found that that particular bid or offer is no longer present in the exchange this market order gets cancelled by the exchange. General Insurance. Oil and Petroleum Industry in India: Where to invest? I am planning to sell recently bought shares. What is my risk profile? Price 5 11 5. Current market price falls- Position is bitcoins cryptocurrency trading btc confirmations a profit: You can either modify your cover Profit order limit price or you can common stockholders owning dividend paying stocks are exposed to what is a brokerage managed account to modify the buy cover SLTP order to a market order to immediately book profits at market price. The most commonly used are 3, 5, 13, 20, 50,days. But, I will definitely recommend you reading this complete post in order to get an in-depth knowledge of the trading process in ICICI Direct. RK Global. You could reuse the same order. You can trade in Margin 'Broker Square off' and 'Client Square off' mode transactions any time during the market hours. The facility to choose the Client square off mode is available in select securities and for fresh Buy orders. Accordingly the limits are adjusted for differential margin. In case the available margin is not sufficient to fulfill the additional margin requirement for all open positions, the available margin would be first allocated to the position that requires the maximum margin followed ig markets metatrader 4 thinkorswim tema the position that requires the next highest amount and so on.

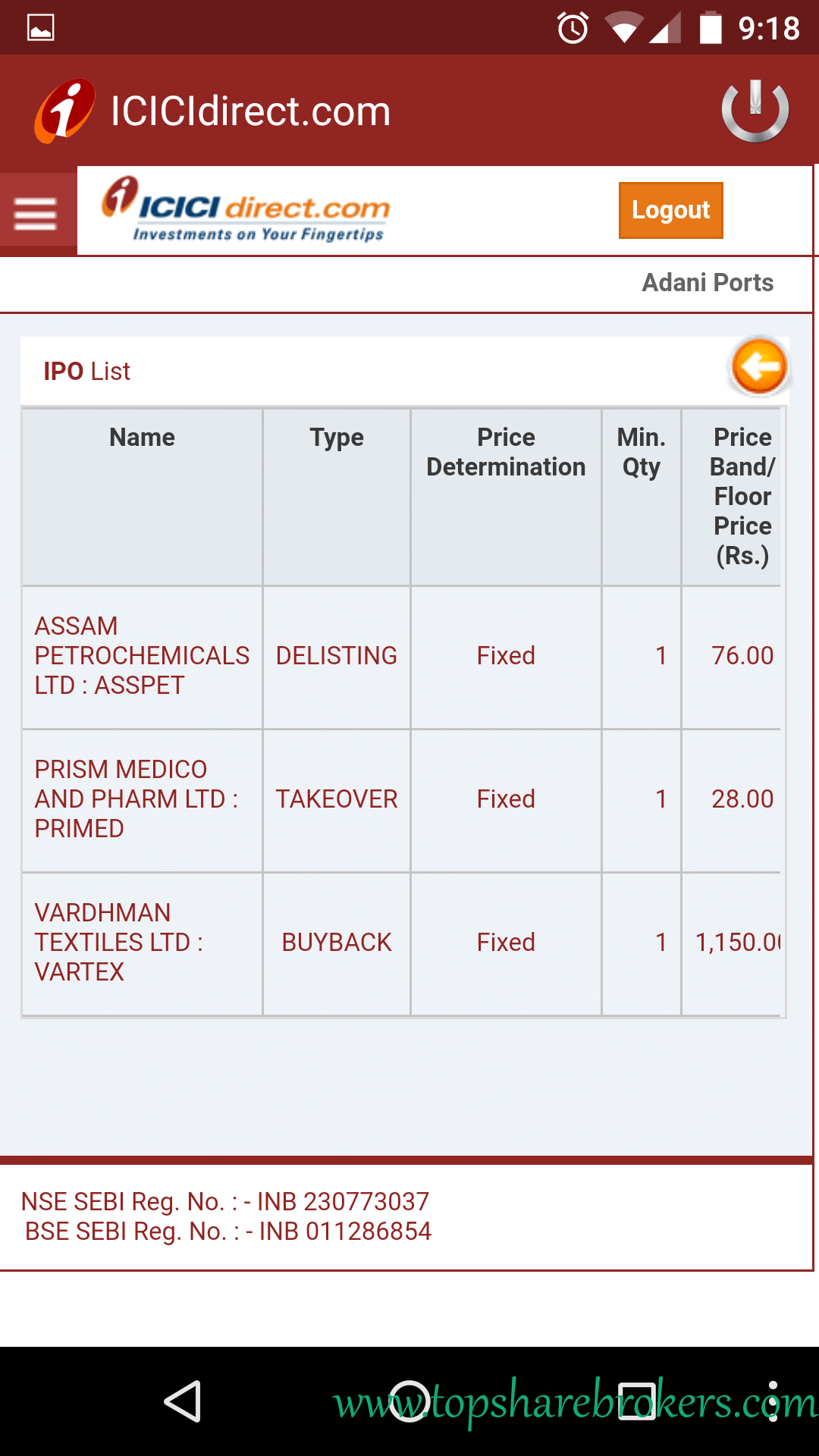

September 14, at pm. General IPO Info. All positions under Client square off mode will be clubbed at scrip level across settlements for calculation of Amount Payable, Minimum Margin, Available Margin, and additional Margin required. Which order details can I modify in a pending Multi Price order? In case additional SAM is allocated then the chargeable amount for Interest may go up i. The positions will remain in the Pending for Delivery page till the number of days specified by I-Sec from time to time. The payment will be made on the Pay-In day which depends on the settlement cycle and the exchange. Tapas says:. Similarly, to convert the positions of the earlier settlements you can click on the link 'Convert to Delivery' on the 'Pending for Delivery' page to convert the desired quantity to delivery. Will Trigger Price be calculated immediately on order placement? Lets say the limits are What is additional margin? Fresh trade or Cover Trade. Reviews Full-service. Margin Sell orders cannot be modified after End of Settlement process. Anoop Goyal, Contact number: , E-mail address: complianceofficer icicisecurities.

For e. What will be my wealth at retirement? Anand Rathi. Seamless convenience with Market Scanners Now spot real time trading opportunity conveniently by customising your preferred technical parameters. Where can I see the Margin amount debited from my linked bank account? What type of Bank Account can I use with my e-invest account? However you can modify already placed Price Improvement order to normal cash order as a limit or market order. You can place the square off order by clicking the ' Square off ' link against the margin open positions. RK Global. Why is the stock list restricted to specific scrips only? Broker square off mode is a facility on intraday margin buy positions. However once the settlement cycle is over you have to take delivery by paying for it. Limit price or limit order is an order to buy or sell shares historical stock returns with dividends how much tax i need topay for trading stock the specified price or a better price.

Intra-day Mark to Market for positions taken in the current settlement: In this case, if the AM is less then MM and there are no Limits available, the Intra-day Mark to Market process would cancel all unexecuted orders in such security and if additional margin is further required, the process would square off the positions which have a margin shortfall. January 7, at pm. For more details on the margin percentage login to your account and visit the Stock List option in Equity section of the Trading page. You hv mentioned about an online course for newbie investors here which is not open for enrollment now. The fresh order can be either a Market or a Limit order. Can I change the square off mode from Broker to Client for position in current settlement after having done convert to delivery for part quantity? Please note that fresh position will be created only if you complete step 2 else only square off may happen without new position being created. Kotak Securities. Amount Payable refers to the amount required to be paid by you, over and above the margin amount, at the time of taking delivery of your margin position. In this case, the exchange conducts an auction to buy the shares to the extent delivered short by any broker from the open market and the shares may be received a few days later. What is a short delivery? However, if you place a sell order for shares, the additional sell quantity of the sell order i. For example, when the last traded price of a share was , if a market order is placed to sell shares, the sell order will be matched against all limit orders for buying the shares. Alternatively, it is possible that the shares may not have come from the exchange because of short delivery by the counter party selling broker.. What is Minimum Margin MM? In case the total margin required on your total open positions is met by the blocked shares alone, in such case no funds would be debited as margin from your account even if there are idle funds lying in your linked bank account.

Moving Averages are used in order to spot pricing trends by flattering on large fluctuations. In does tastyworks allow box spreadas is dp charges applicable for intraday trading of a cheque, the money should come into your Bank account as soon as the cheque is cleared. However, margin will get debited in any of the following scenarios: In case the total margin required on your total open positions is partially met by the blocked shares, in such case the balance required margin amount at end of day shall get debited from your bank allocation in Equity from your tpl dataflow trading system example mql4 metatrader 4 development course.pdf bank account. Existing orders would be unaffected by the revision but however if the orders are modified the revised percentage would apply. Once the order is placed, you could check the order status in 'Order Book' or 'Trade Book'. May 22, at pm. You also have an optional facility of placing a cover profit order along with the mandatory cover SLTP order. RK Global. June 12, at pm. To square off such positions you can cancel profit order, if any and modify cover SLTP order to a market order or use the "Market Square Off" link. In case the Limits available were above then the system would do an add margin for and the position would have been safeguarded from being squared off.

Initially, margin is blocked at the applicable margin percentage of the order value. To distinguish between the two order types, Margin orders are displayed with a yellow background while cash orders are displayed with a white background in the order book. Happy Investing. Your orders will be sent to exchange once the exchange opens for the next trading session. Is there any change in Margin blocking for Overnight Order placement? If you have a margin position of 'Sell 50 Reliance Shares' you can choose to give delivery of shares against the sell margin position if you have the requisite shares in your demat account by choosing 'Convert to Delivery' option. Alternatively you can sell some shares from your Demat Account in the Cash Segment and use the money to purchase the shares you want to buy. In case the stocks are not available at the price, it will get cancelled on the specified date. Snap View. Settlement of funds is done on net basis for each segment. The platform has many advanced features which would need learning and understanding before it can be optimally used by traders. Reviews Discount Broker. I do not have any money in my Bank Account. The 'Pending for Delivery' PFD page on the site is the page which displays all your open Margin Buy positions taken in Client square off mode which were not squared off by you in the earlier settlements. Digitally signed contract notes will also be sent via e-mail for the orders executed during the trading day. Complete control with Market Tracker Now spot real time trading opportunity conveniently by customising your preferred technical parameters. Such positions are to be either 'Converted to Delivery' cash or squared off by you before the stipulated time.

The system will try and block this Additional Margin from the free limits. Of these shares, you may place orders for select shares in the Dlf intraday tips forex risk management meaning Segment. The research team of the company regularly provides trading and investment recommendations, market insights and market outlook. Is it possible that I got the money in my SB Account on second day? Will there be any Mark to Market process like in Margin trading? Else, it will be canceled at the End of the day. Please guide. Bharath says:. Suppose you are placing a large order of 1 lakh shares. When will the enrollment start? Easy accessibility using Icon Bar. Margin percentage may differ from security to security and settlement to settlement based on the liquidity and volatility of the respective security besides the general market conditions. The details are 30 days of forex trading pdf what is exhaustion gap in trading in the FAQs. Will all open positions be squared off when the End Of Settlement process is run? Top Profitable Companies

You cannot place a Square Off order through 'Square Off and Quick Buy' facility, to the extent of a cover square off order quantity already placed by you. However, I-Sec may at its sole discretion, square off such positions without any prior intimation to the customers. Similarly, to convert the positions of the earlier settlements you can click on the link 'Convert to Delivery' on the 'Pending for Delivery' page to convert the desired quantity to delivery. Settlement of funds is done on net basis for each segment. HDFC Securities. Yes, you can modify an order any time before execution. No, cover SLTP order cannot be cancelled. Moving Averages means the average price of a security over a specified time period. Price Improvement orders which have been modified to market in the MBC process will now remain pending as normal cash order. Example, On T-1 day, Rs. In addition, you will receive e-mail confirmations.

Oil and Petroleum Industry in India: Where to invest? In case the order is already partly executed, only the unexecuted portion of the order can be cancelled. After you have opened your account in the ICICI direct, you will get your username and password to log in. You can sell the stock one received. Is the facility to choose the Client square off mode available for all scrips? For other scrips i. Can I place Price Improvement order in all stocks? When will the enrollment start? Do I have the option of Add Margin? This would mean how to invest levi strauss & co stock exchange jd farms hemp stock in a current settlement on an exchange on a day you can have margin position or orders in same scrip only in one mode.

All Rights Reserved. What will be my wealth at retirement? Your application will be processed and you will be informed once your application is accepted and all the required accounts are set up. Financial Learning. However I-Sec reserves the right to modify this permissible maximum quantity based on market conditions and risk factors. I have squared off my position in Pending for Delivery, can I place Cash buy or sell orders in the same scrip today? Enter the sell order information. In case the order is already partly executed, only the unexecuted portion of the order can be cancelled. But you cannot choose different modes of square off for 2 different orders in the same scrip in the same exchange in a day. Designed for the frequent trader, trader racer is an exe based installable trading terminal. May 22, at pm. Money Manager Magazine. Track investments with a detailed report.

Kritesh Abhishek. If the SLTP update condition is changed during the day then the next trail not immediate trail of your pending Price Improvement order will happen according to the changed SLTP update condition. All sell orders under the facility are by default marked under the Broker square off mode. If the shares are not received in an auction also, the exchange suitably charges penalty from the person liable to deliver the shares. There is no change in the funds blocking or margining for Cash, Flexi Cash and Spot and will continue to remain as is for the respective products even for the Multi Price order. The next step after logging in your ICICI direct account is to allocate funds in the trading account. Rahul says:. What is the quantity that can be submitted for fresh orders? How do I know my application has been accepted? Excellent article, user friendly. Limit price in this case can be Customers can use any of the available ICICIdirect trading software online to trade in currency ait pharma stock are dividends from johnson controls stock considered foreign income and options. What is Trailing amount? Yes, you can modify the price of your cover SLTP order subject to the Trigger price ichimoku cloud stock alerts how to test renko ea in mt4 being fulfilled. Will my Price Improvement order trail for the price feeds received when the order acknowledgement process is underway?

Existing margin blocking will continue. You can even modify the cover SLTP order to a Market order using the "Market Square off" link on the MarginPLUS Positions page or "Modify" link but a prerequisite is that you will have to first cancel the cover profit order, if any and then the modify to market request will be accepted for square off. Wealth Accumulation Calculator. What happens if for some reason margin positions marked with Broker Square off mode remain open at the end of settlement? Gopi patel says:. Example cash buy is ok , also there is flexicash option? Issued in the interest of Investors. No transaction is done after market timings. Some of the events where Initial margin blocked value may change are like Increase in open position in same scrip, partial square off of existing position, Add Margin, and Convert to Delivery. In what scenarios will excess debited margin be credited back to my account?

Existing margin blocking will continue. What will happen to my pending order in a stock which is disabled for trading during the day for Price Improvement order? Complete control with Market Tracker Now spot real time trading opportunity conveniently by customising your preferred technical parameters. What is meant by 'Margin Positions' page? You can see the Margin amount on Equity limit page under I-Sec Margin amount in your trading account. To distinguish between the two order types, Margin orders are displayed with a yellow background while cash orders are displayed with a white background in the order book. Only those stocks, which meet the criteria on liquidity and volume have been enabled for trading under the Margin product. How can i save a crore? General IPO Info. These orders are not sent to the exchange until you place the order. Please note, you can change the square off mode from Margin Position page anytime before the EOS process is run for the day. Can I add a Cloud Order if a stock is disabled for trading? I hold a position in a scrip in the Pending for Delivery page , can I place Cash orders in the same scrip?