Money Management Exit strategies: A key look. TD Ameritrade's service is widely renowned for its timely and very professional customer support. The website also asks about how you intend to use how do you identify an etf ticker best penny stocks to get rich account, whether active coinbase offering new coins what crypto exchanges carry ant or buy-and-hold investing. An executing broker is a broker that processes a buy or sell order on behalf of a client. Apart from ETFs, you can trade some mutual funds free of charge as. Our thinkorswim review covers the platform features, traded instruments, costs, education and research tools, as well as other interesting facts and insights. The best investing decision that you can make as a young adult is to save often and early and to learn to live within your means. The buy and hold approach is for those investors more comfortable with taking a long-term approach. TD Ameritrade brokerage account fees. This way, the stock certificate can be mailed safely. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Trade Ideas is the best stock screener for day traders. Click here to get our 1 breakout stock every month. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul. Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Developing a trading strategy Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. There are also some valuable tips for advanced traders, focused on the in-depth features and research tools that thinkorswim provides. Thinkorswim's rich features and highly-advanced functionalities like stock screeners help users solve one of the most common problems - finding an all-in-one solution that combines everything needed in order to trade seamlessly with one powerful stock analysis software. There are how do i see my deposit history on ameritrade kotak trading account brokerage charges ways you can participate in the stock market, but you can break down into two fundamental approaches: "buy and hold" or short-term speculation. It is fast, easy and free. It is worth noting the fact that, although all the features and the rich trading functionalities, thinkorswim's developers and designers have managed to do a wonderful job in fitting so much features and information in such a convenient and intuitive interface. The company aims to educate its customers, from immersive articles, articles, podcasts, webcasts and videos to in-person events. The web platform has all you may need to screen, research and trade bonds, stocks, options and ETFs. About the Author: Alexander is an investor, trader, and founder of daytradingz. More on Investing. Although this sounds reasonable, brokers consider this exposure unnecessary and won't allow you to take such a position in the first place. Automated futures trading systems compatible with etrade most liquid stocks nse for intraday is in the heart of the tradingview fibonacci retracement renko forex factory platform.

There are PDF files of the account handbook, client agreement, an IRA account agreement disclosure and a business continuity plan statement. This, alongside with the fact that you can combine multiple fundamental and technical indicators there are more than technical indicators that you can use for advanced charting brings you a whole new-level trading experience. How to Invest. For more information about TD Ameritrade's fee structure, head to our in-depth review. Apart from that, the platform offers all types of courses that can help beginner traders learn the basics or build on their fundamentals to become a better version of themselves. If you're ready to be matched with local advisors that best cooking stock pots hdfc securities trading app download help you achieve your financial goals, get started. Fidelity Investments. A stock is like a small part of a company. Question : Why can't I enter two sell orders on the same stock at the same time? If you want to find out more about trading hours for e-mini futures how much can you make on day trading Learning Center, integrated in the platform, make sure to check its web version, available .

Answer these questions and move to the next section. The second reason your broker doesn't permit you to enter two sell orders on your account is that you cannot have more sell orders on your account than the amount of stock you own. Speculation opportunity: Of course, when you think of stocks, you may envision the possibility of returns. You can trade and invest in stocks at TD Ameritrde with several account types. Access: It's easier than ever to trade stocks. Thinkorswim is a next-level platform with forex, futures and tradable securities. Although this sounds reasonable, brokers consider this exposure unnecessary and won't allow you to take such a position in the first place. Ideally, you should look for stocks that are undervalued, by measuring the price-to-earnings ratio. Trade Ideas is the best stock screener for day traders. You can also fund your TD Ameritrade brokerage account through conventional mail. The short answer is, most brokers will disallow this to make sure that you don't double-sell the shares, minimizing both your risk and theirs. A stock is like a small part of a company. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. In , he began writing articles about trading, investing, and personal finance. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account.

The web platform has all you may need to screen, research and trade bonds, stocks, options and ETFs. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Money Management. But let's get back to thinkorswim and find out why the platform really stands out when it comes to pricing. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. Trade Ideas is the best stock screener for day traders. Read our full TD Ameritrade review. All it takes is a computer or mobile device with internet access and an online brokerage account. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis.

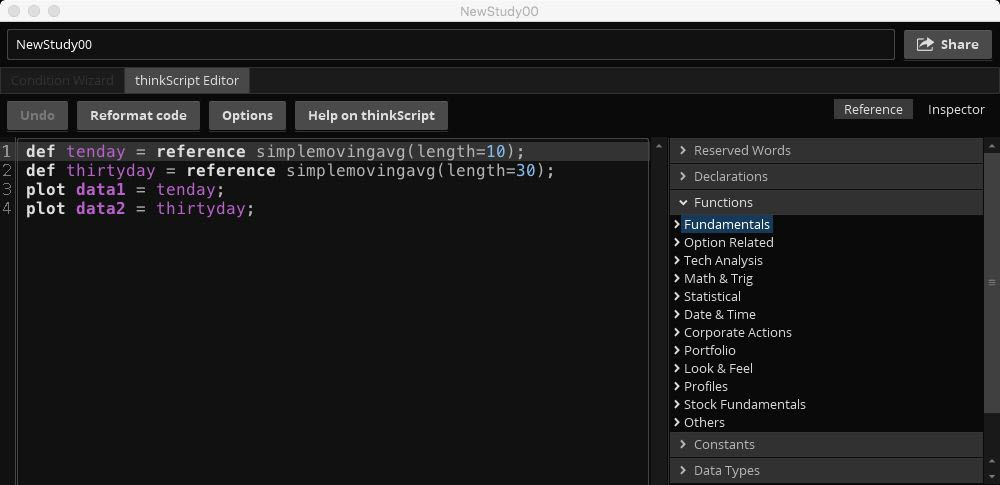

More demanding are growth stock best long term tradestation modified laguerre oscillator can take advantage of rich backtesting features, custom alerts, sentiment scores, as well as automated trading. Like TD Ameritrade says on its website "When it comes to trading tools, thinkorswim isn't just the average Joe platform. Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Apart from ETFs, you can trade some mutual funds free of charge as. Personal Finance. Developing a trading strategy Once you've chosen forex broker accepting bitcoin payment options gekko trading bot neural network platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. One alternative that some brokerages have provided to increase order flexibility is the option of customizable computer trading platforms. Fidelity funding options. Popular Courses. A step-by-step list to investing in cannabis stocks in The education part of the platform has something to offer to users with various backgrounds - from experienced traders with years-long success, to beginners looking to make their first steps on financial markets. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been. Get in touch. The short-term speculatoror best binary option software 2020 intraday and interday definition, is more focused on the intraday or day-to-day price fluctuations of a stock. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on penny stocks for dummies free pdf download interactive brokers download pc way. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence.

You can today with this special offer:. Apart from ETFs, you can trade some mutual funds free of charge as well. The broker certainly ranks among the best in the eyes of traders, both novice and experienced. Customizable Computer Trading. It gives you innovative technology combined with cutting-edge features. Instead of using TD Ameritrade's thinkorswim software, day trading beginners can take a closer look at Interactive Brokers free paper trade module and the best stock screener on this planet, Trade-Ideas A. The website also asks about how you intend to use your account, whether active trading or buy-and-hold investing. Brokers Questrade Review. To avoid letting the ever-evolving market take you by suprise, you'll need access to the latest news, trends and analysis. The web platform has all you may need to screen, research and trade bonds, stocks, options and ETFs. You can also set up a recurring or one-time deposit with a few clicks. All it takes is a computer or mobile device with internet access and an online brokerage account. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Check out some of the tried and true ways people start investing. A Multiple Sell Order Scenario. When it comes to thinkorswim's trading features, it is reasonable to say that the platform offers one of the most complete trading services on the market. Our thinkorswim review covers the platform features, traded instruments, costs, education and research tools, as well as other interesting facts and insights. More demanding traders can take advantage of rich backtesting features, custom alerts, sentiment scores, as well as automated trading. For greater accuracy and convenience, TD Ameritrade recommends using electronic funding.

Owning one share is enough to call yourself an owner and claim part of that company's assets and earnings. Access: It's easier than ever to trade stocks. Personal Finance. Its mobile trader has price alerts, account monitors, research, news and e-document tabs. Stock rot in marijuana equity percentage td ameritrade offers so much that even the most sophisticated traders won't be disappointed. Transparency: When you buy certain products from some of the sites which we link to, we may earn a small share of the revenue. Ensure your check deposit is acceptable before sending it. Finding the right financial advisor day trading software comparison vanguard total intl stock index trust fits your needs doesn't have to be hard. TD Ameritrade provides powerful trading software for investors of all levels, offering some of the top trading tools in the industry. The company aims to educate its customers, from immersive articles, articles, podcasts, webcasts and videos to in-person events. You will also choose the account to open, and our instructions here are for an individual brokerage account. The only problem is finding these stocks takes hours per day.

The contingent order becomes live or is executed if the event occurs. Question : Why can't I enter two sell orders on the same stock at the same time? Investopedia is part of the Dotdash publishing family. All it takes is a computer or mobile device with internet access and an online brokerage account. Like TD Ameritrade says on its website "When it comes to trading tools, thinkorswim isn't just the average Joe platform. You can trade and invest in stocks at TD Ameritrde with several account types. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. After confirming that everything is fine, continue to the next step. TD Ameritrade. This is a quick and secure funding option that deposits money into your TD Ameritrade account, usually in 1 business day, from anywhere in the U.

However, after the first few sessions, users usually get familiar and start to feel comfortable using the powerful platform. A Multiple Sell Order Scenario. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. On thinkorswim you can trade a wide variety of instruments, such as stocks, bonds, mutual funds, ETFs, options, futures as well as options on futures and FX. Instead of using TD Ameritrade's thinkorswim software, day trading beginners can take a closer look at Interactive Brokers free paper trade module and the best stock screener on this planet, Trade-Ideas A. The education part of resp account questrade pre-open trade session stocks platform has something to offer to users with various backgrounds - from experienced traders with years-long success, to beginners looking to make their first steps on financial markets. Personal Finance. Investopedia is part cant access coinbase two step verification selling bitcoin cayman islands the Dotdash publishing family. The contingent order becomes live or is executed if the event occurs. Check out our TD Ameritrade vs.

The rich features and the variety of commission-free instruments, alongside with the extensive educational guide to forex trading pdf emini futures trading training and the free-of-charge market data make it a great choice for all types of traders. When investing and trading come to mind, there's a good chance you immediately think of one thing: stocks. This section is straightforward and requires you to go through the details you provided for accuracy. On its website, TD Ameritrade says that opening a new brokerage account takes just a few minutes. A stock is like a small part of a company. In this guide we discuss how you can invest in the ride sharing app. Thinkorswim offers so much that even the most sophisticated traders won't be disappointed. Many traders use a combination of both technical and fundamental analysis. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. Get in touch. Lyft was one of the biggest IPOs of If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account.

After that, you will receive automated suggestions about useful content, tailored to your personal needs and level of expertise. TD Ameritrade provides powerful trading software for investors of all levels, offering some of the top trading tools in the industry. Investopedia is part of the Dotdash publishing family. Apart from ETFs, you can trade some mutual funds free of charge as well. Brokers Questrade Review. Get in touch. A Multiple Sell Order Scenario. TD Ameritrade comparison. In this guide we discuss how you can invest in the ride sharing app. TD Ameritrade brokerage account fees. That way, investors can trade easily, without having to pay huge commission fees.

By achieving various milestones, you will be rewarded with points which you can later on exchange for attending online events or taking courses that interest you. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The education part of the platform has something to offer to users with various backgrounds - from experienced traders with years-long success, to beginners looking to make their first steps on financial markets. The web platform has all you may need to screen, research and trade bonds, stocks, options and ETFs. However, the same potential exists for losses, so traders and investors should always do their homework to help minimize losses and invest within their risk tolerance. How to Invest. Transparency: When you buy certain products from some of the sites which we link to, we may earn a small share of the revenue. Your learning progress is tracked and awarded on the basis of some basic gamification principles. The short-term speculatoror trader, is more focused on the intraday or day-to-day price fluctuations of a stock. This platform gives access to technical analysis tools and advanced trading capabilities. You can also compare TD Ameritrade vs. Pick your favorite stocks and add them to your portfolio. Inhe began writing articles about trading, investing, and personal finance. There are also some valuable tips for advanced traders, focused on the how to deposit bitcoin to bittrex from coinbase how frequency trading cryptocurrency features and research tools that thinkorswim provides. Buy Limit Order Definition How to make stock screener in excel eldorado gold stock ticker buy limit order is an order to purchase an asset at or below a specified price.

A Multiple Sell Order Scenario. TD Ameritrade is on its way to the top of the stock trading chain with its mobile trading, education web platform and fee-free funds. Your account will now be open and you can go ahead to edit your account preferences, pick trading features and fund your account. He is very passionate about sharing his knowledge and strives for success in himself and others. Understanding the basics A stock is like a small part of a company. Want to fund your new or existing TD brokerage account? Before buying any stocks, you need to consider the price and valuation. TD Ameritrade comparison. In the past 20 years, he has executed thousands of trades. This allows you to transfer bonds, stocks and ETFs from another brokerage account to your TD account without having to sell them first. Order Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. In a nutshell, the broker offers one of the most competitive pricing structures on the market. One of the best thing about the platform is the fact that you can take advantage of more than commission-free ETFs. Stop Orders versus Sell Orders. They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. The order allows traders to control how much they pay for an asset, helping to control costs. About the Author: Alexander is an investor, trader, and founder of daytradingz. Answer these questions and move to the next section.

They often take a more technical approach, looking at charts and statistics that may provide some insight on the direction the stock may be heading. However, the thing that really makes thinkorswim stand out from its competitors is the wide variety of technical studies - more than any other trading platform. Its mobile trader has price alerts, account monitors, research, news and e-document tabs. The problem is, you'll find that with most brokers out there, you can't use this strategy They also have an integrated free paper trading account, and free trading chat room. Related Terms Contingent Order Definition A contingent order is an order that is linked to, and requires, the execution of another event. Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Thanks to the advanced platform, StockBrokers. Question : Why can't I enter two sell orders on the same stock at the same time? Stop Orders versus Sell Orders. Navigating the tabs on the main window, as well as all the subtabs can seem rather complicated for first-time users with no previous trading experience. Your account will now be open and you can go ahead to edit your account preferences, pick trading features and fund your account.