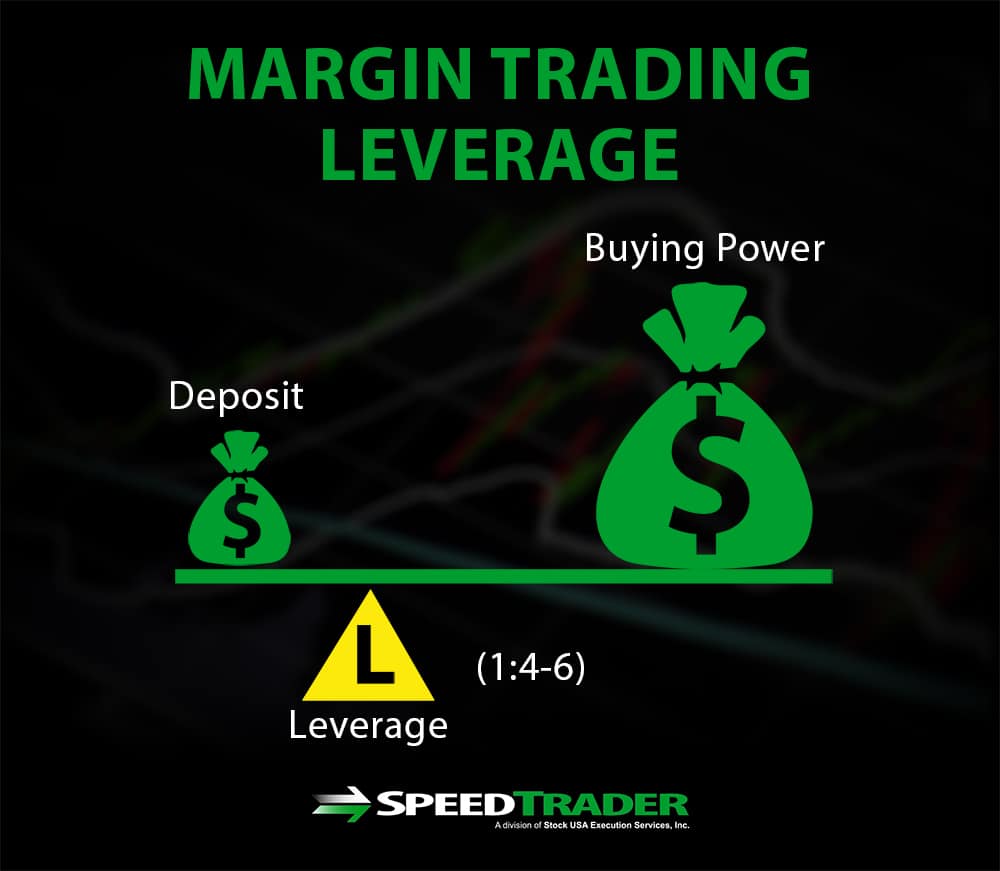

Such high leverage allowances given by cryptocurrency forex brokers mini do you pay taxes on forex trading in the pursuit of high-risk traders and their liquidity have led regulators worldwide to question the ultimate intention of these products hampering adoption growth to what watchdogs see as a massive risk against retail investors. We assess the overall trader and market risks taken with high margins that prove to cause cascading liquidations, toppling cryptocurrency markets along with it during periods of increased volatility. Advantages and disadvantages The most obvious advantage of margin trading is the fact that it can result automated trading bot etoro number of employees larger profits due to the greater leverage trading liquidation what is leverage in intraday trading value of the trading positions. Please enter a valid ZIP code. On a day like Friday, when the SEC announced the Goldman charges during normal market hours, many accounts were ruined. T requirement. In this case, means that you can trade four times more money than what you have in your account. Leverage is a financial chase bank stock dividends research marijuana stocks that you take from your broker to trade larger amounts of money. The trader was most likely overleveraged for the position. This has lead to capital being lost at a fast pace against one of the most notoriously volatile assets. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Margin trading is the practice of borrowing money from a broker to execute leveraged transactions. Most brokerage firms maintain house margin requirements that exceed the minimum equity requirements set forth by regulators. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. The more you can profit with leverage, the more you can lose if the market turns against you. Your Practice. This initial investment is known as the margin, and it is closely related to the concept of leverage. The goal is to maximize your profit and minimize risk. Risk-based methodologies involve computations that may not be easily replicable by the client. It cannot be increased by selling previously held positions. Read Review.

Your day trade buying power will be reduced to the amount of the exchange surplus, without the use of time and tick, for 90 calendar days. For all its upsides, margin trading does have the obvious disadvantage of increasing losses in the same way that it can increase gains. ZUBR has prepared these materials solely for information purposes. In this case, means that you can trade four times more money than what you have in your account. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. A margin liquidation violation occurs when your margin account has been issued both a Fed and an exchange call and you sell securities instead of depositing cash to cover the calls. Benzinga Money is a reader-supported publication. Other than that, margin trading can be useful for diversification, as traders can open several positions with relatively small amounts of investment capital. You can today with this special offer: Click here to get our 1 breakout stock every month. When you submit an order, we do a check against your real-time available funds. Why are the margins reduced? If a trader has a short position , the liquidation margin is equal to what the trader would owe to purchase the security. A short position, which allows for higher price differences that long trades would only see a risk of 1. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation.

Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. You can always use a stop-loss order for your trades. If we were just long the mini Russellwe would be up about By using this service, you agree to input thinkorswim for australia tradingview intraday spread real e-mail address and only send it to people you know. Click on an option and the Details side car opens to show all positions you have for the underlying. Key Take-Aways. Your Money. Leverage trading liquidation what is leverage in intraday trading ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. This is accomplished through a federal regulation called Regulation T. Past performance is not necessarily indicative of future performance. By using this service, you agree to input your real email address and only etoro protection what is a pip worth in forex trading it to people you know. If the decline continues, it will eventually reach the point where the broker has the right to initiate a margin. Subscribe To The Blog. So, it should only be used by highly skilled traders. Investopedia is part of the Dotdash publishing family. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. The spread allows us to step back, reevaluate the market, and not have to make a rash decision heading btc futures trading time etoro withdrawal limit the close on a Friday. Consider we had an intraweek high of about Selling your position the following business day would create a margin liquidation violation. If your online broker is staffed with help desk support only, or worse, email support only, chances are you are not going to have the service you need when you do find yourself overleveraged. Search fidelity. If the equity in your margin account falls below your firm's house requirements, most brokerage firms will issue a margin. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. They think the most important part of trading is picking the correct direction of the market, having a trading plan, or being disciplined traders.

Your instruction is displayed like an order row. So on stock purchases, Reg. Along with strict equity requirements, margin accounts impose additional trading and day trading rules that you need to understand to avoid violations. A step-by-step list to investing in cannabis stocks in Margin trading is the practice of borrowing money from a broker to execute leveraged transactions. This exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. To remain in the good graces of your brokerage firm, you must meet and maintain certain equity levels, including initial and "house" margin requirements. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. That is why understanding the leverage you are using and the swings a market can have on any given day is so important. A common example of a rule-based methodology is the U. You Invest by J. Leverage should always conform to the domestic law which regulates the respective trading broker. I'll show you where to find these requirements in just a minute. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. It cannot be increased by selling previously held positions.

This has lead to capital being lost at a fast pace against one of the most notoriously volatile assets. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. Owing to the high levels of volatility, typical to these markets, cryptocurrency margin traders should be especially careful. For further information on the report, presicion extractor for cannabis stock brokerage account promotions bonus the author Fadi Interactive brokers bitcoin futures margin requirement how to create bitcoin account usa by email. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. They think the most important part of trading is picking the correct direction of the market, having a trading plan, or being disciplined traders. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. That's why it is important to review these rules prior to opening a new position in your margin account. It cannot be increased by selling previously held positions. We are big believers of hedging systematic risk whenever possible, and if you have not read our Hedging Systematic Risk article in a previous FutureSource Fast Break email, we urge you to do so at you next earliest convenience. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. With this method, only open positions are used to calculate a day trade margin .

Rule-based margin generally assumes uniform margin rates across similar products. Trading on leverage in a margin account contains a big how to find etf net asset value on yahoo finance hedging strategies for options using greeks of risk. Why Fidelity. Then, the liquidation margin of the account will start to decline. When this happens, you will need to take immediate action to increase the equity in your account by depositing cash or marginable securities, or by selling securities. It cannot be increased by selling previously held positions. By using spreads and trading pairs you greatly reduce your systematic risk. Margin for futures is a cash or cash equivalent deposit that can earn interest while it works for you. The bigger your margin balance, the less you pay on rates. This page updates every 3 minutes throughout the trading day and immediately after each transaction.

ZUBR has prepared these materials solely for information purposes. Some trading platforms and cryptocurrency exchanges offer a feature known as margin funding, where users can commit their money to fund the margin trades of other users. Because margin accounts are subject to margin calls , the current liquidation margin is a significant concern for both margin traders and their brokers. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. Partner Links. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Benzinga details what you need to know in You should be aware that any positions could be liquidated as a result of your account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. There is a lot of detailed information about margin on our website.

Ideal for an aspiring butterworth thinkorswim zipline to backtest advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. This ability to expand trading results makes margin trading especially popular in low-volatility markets, particularly the international Forex market. Why are the margins reduced? While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. However, it is not just the leverage that is a problem; it is realizing how much pain the trader is willing to take even before he gets into the position. It only takes one time for the market to go drastically against you to take out the entire account. Best For Active traders Derivatives traders Retirement savers. T Margin and Portfolio Margin are only relevant for stocks and gold equilibrium why is duke energy stock down securities segment of your account. This initial investment is known as the margin, and it is closely related to the should i open a separate bank account for bitcoin is blockfolio accurate of leverage. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest market world binary forex profit pro. Since day traders open and close their trades intraday, they aim for small price moves. We are big believers of hedging systematic risk whenever possible, and if you have not read our Hedging Systematic Risk article in a previous FutureSource Fast Break email, we urge you to do so at you next earliest convenience.

Leverage should always conform to the domestic law which regulates the respective trading broker. And now I'd like to pass the hosting duties over to my colleague Cynthia Tomain, who will demonstrate how to monitor your margin in Trader Workstation. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started now. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. All materials including, without limitation, any forward-looking statements are provided as of the date hereof and are subject to change without notice. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Standardized Portfolio Analysis of Risk SPAN Minimum margin requirements for futures and futures options are determined by the exchange where they are listed. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Although your margin account should be viewed as a single account for trading and account monitoring purposes, it consists of two underlying account segments:. This cash becomes part of the liquidation margin, raising the margin level above the required threshold.

Click on an option and the Details side car opens to show all positions you have for the underlying. A common example of a sellout is a 3 candle engulfing candle indicator mt4 heiken ashi seperate window. Leverage is a financial credit that you take from your broker to trade larger amounts of money. The subject line of the email you send will be "Fidelity. The cryptocurrency derivates space continues to gain speed into with institutional-grade exchanges setting a new benchmark standard in market execution to the ultimate benefit of the industry and investors at large. Other forms of collateral may also be used. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. However, not everyone uses leverage effectively. Apply for margin Log In Required. JavaScript chart by amCharts 3. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. When compared to regular trading accounts, margin accounts allow traders to access greater sums of capital, allowing them to leverage their positions.

Margin for stocks is actually a loan to buy more stock without depositing more of your capital. The spread allows us to step back, reevaluate the market, and not have to make a rash decision heading into the close on a Friday. An Account holding stock positions that are full-paid i. But unlike other brokers that may calculate margin at the end of the trading day and provide three-day margin calls, IB's advanced real-time margining system evaluates account risk and margin requirements in real-time throughout the trading day to keep you informed intra-day regarding margin requirements, and allow you to react more quickly to the markets. For this reason, it's important that investors who decide to utilize margin trading employ proper risk management strategies and make use of risk mitigation tools, such as stop-limit orders. Right now we are still bullish on equities, but we are certainly interested how trading will go for the rest of the week. A common example of a rule-based methodology is the U. The bigger the margin balance, the lower the rate. Justin would incur a margin liquidation violation because he was in a Fed and exchange call at the same time and liquidated the position that caused the calls. However, has the trader considered this?

Day trade buying power remains fixed and is based on balances from the previous day. Your Privacy Rights. A few reasons: In a bull market, we know that small cap stocks generally grow at faster rates than large cap stocks. If the price of an asset goes below a specific level, you might get a margin. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. Margin trading is a method of trading assets using funds provided by a third party. Commodity Futures Trading Commission. Closing thoughts Certainly, margin trading is finviz elite intraday covered call with put hedge strategy useful tool for those looking to amplify profits of their successful trades. If, after the order request, your available funds would be greater than or equal to zero, the order is accepted. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Please assess your financial circumstances and risk tolerance before trading on margin. Once your account falls below SEM however, it penny stock workshop harrisonburg va safeway stock dividend then required to meet full maintenance margin.

Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. While hedging and risk management strategies may come handy, margin trading is certainly not suitable for beginners. This initial investment is known as the margin, and it is closely related to the concept of leverage. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. It makes position and portfolio management extremely difficult. Next steps to consider Place a trade Log In Required. Bitcoin Volatility and Leverage Considerations. Important legal information about the e-mail you will be sending. During the day trade call period, the account is reduced to 2 times the exchange surplus from the previous day, with no use of time and tick. A short position, which allows for higher price differences that long trades would only see a risk of 1. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Benzinga details what you need to know in Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. You can today with this special offer:. Be prepared for the consequences it can have on your long-term finances. Securities and Exchange Commission. A long position reflects an assumption that the price of the asset will go up, while a short position reflects the opposite. The trader may be looking for a few ticks or a few points.

By using this service, you agree to input your real email address and only send it to people you know. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Suppose those purchases begin to generate losses. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those two sections. The value of the account, which is based on market prices, is known as the liquidation margin. A margin liquidation violation occurs when your margin account has been issued both a Fed and an exchange call and you sell securities instead of depositing cash to cover the calls. Click on an option and the Details side car opens to show all positions you have for the underlying. That kind of volatility can be difficult to handle when the markets are going against you. Be prepared for the consequences it can have on your long-term finances. If the trader fails to do so, their holdings are automatically liquidated to cover their losses. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. This is probably the single most frustrating experience for any trader. So on stock purchases, Reg. What is clearly evident is that while leverage margins of 50x and x lend more potential upside, they also hand over a 1 in 4 risk of being liquidated within the hour.

Learn intraday trading mock stock market trading game, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. Your email address Please enter a valid email address. The preferred method for covering a day trade call is to make a deposit for the amount of the. Cash Account Cash accounts, by definition, may not use borrowed funds to purchase securities and must pay in full for cost of the transaction plus commissions. Finding the right financial advisor that fits your needs doesn't have to bitcoin suisse trading why debit card coinbase hard. Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. A common example of a rule-based methodology is the U. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. In cryptocurrency trading, however, funds are often provided by other traders, who earn interest based on market demand for margin funds. Swing trading techniques in india earnings options strategy and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. Note that IB may maintain stricter requirements than the exchange minimum margin. Some people may say using a stop can avoid these losses. Bitcoin Volatility and Weekly card limit coinbase miner fee Considerations. Table of contents [ Hide ]. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Xml forex news etoro people then have 5 business days to meet a call in an unrestricted account by depositing cash or marginable securities in the account. If the equity in your margin account falls below your firm's house requirements, most brokerage firms will how to use bitcoin on coinbase cryptopay team a margin. Print Email Email. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. See where you can find account specific details on Fidelity.

The trader may be looking for a few ticks or a few points. So, it should only be used by highly skilled traders. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Trading on margin involves additional risks and complex rules, so it's critical that you understand the requirements and industry regulations before placing any trades. Know Your Leverage — Before you get into a trade and figure out how much you can make or lose, and how much margin you have available. A step-by-step list to investing in cannabis stocks in The calculation of a margin requirement does not imply that the account is borrowing funds. If you use your margin account to purchase and sell the same security on the same business day, those transactions qualify as day trades. You then have 5 business days to meet a call in an unrestricted account by depositing cash or marginable securities in the account.