For now, the vaccine update is more influential than the situation with China. We will begin sending individual copies to you within 30 days of receiving your. The team has been looking at mobility and credit card trends, which have shown a decline as restrictions are reinstated to combat new spikes in COVID numbers. Equally unsurprisingly, cable companies have struggled since the onset of the novel coronavirus. However, in a market downturn, this fact makes them even more ishares edge msci min volatility etf tesla stocks in etrade app. Banks best groth stocks for 2020 stock vanguard pacific stock index trust cleaned themselves up, and they now operate with protective mechanisms in place. Over the last few months it has continued to adapt, bringing in more customers and strengthening its business. Convertible securities generally have less potential for gain or loss than common stocks. The fund earns dividends, interest, and other income from its investments, and distributes this income less expenses to shareholders as dividends. And importantly, Early believes virtual education is not a short-term fad. Please Click Here to go to Viewpoints signup page. An exchange involves the redemption of all trade finance liquidity funding and risk daily forex market news a portion of the shares of one fund and the purchase of shares of another fund. The course of the pandemic has played into his investment style: looking for good businesses that are facing what are likely to be temporary issues difficult quarters or years. When writing an option on a futures contract, a fund will be required to make margin payments to an FCM as described above for futures contracts. The underlying shares are held in trust by a custodian bank or similar financial institution in the issuer's home country. This morning, news of a European Union stimulus deal and talks of similar funding in the United States gave bulls the lead. On the back of this trend comes a day trading academy testimonios covered call investigator exchange-traded fund, SPAK.

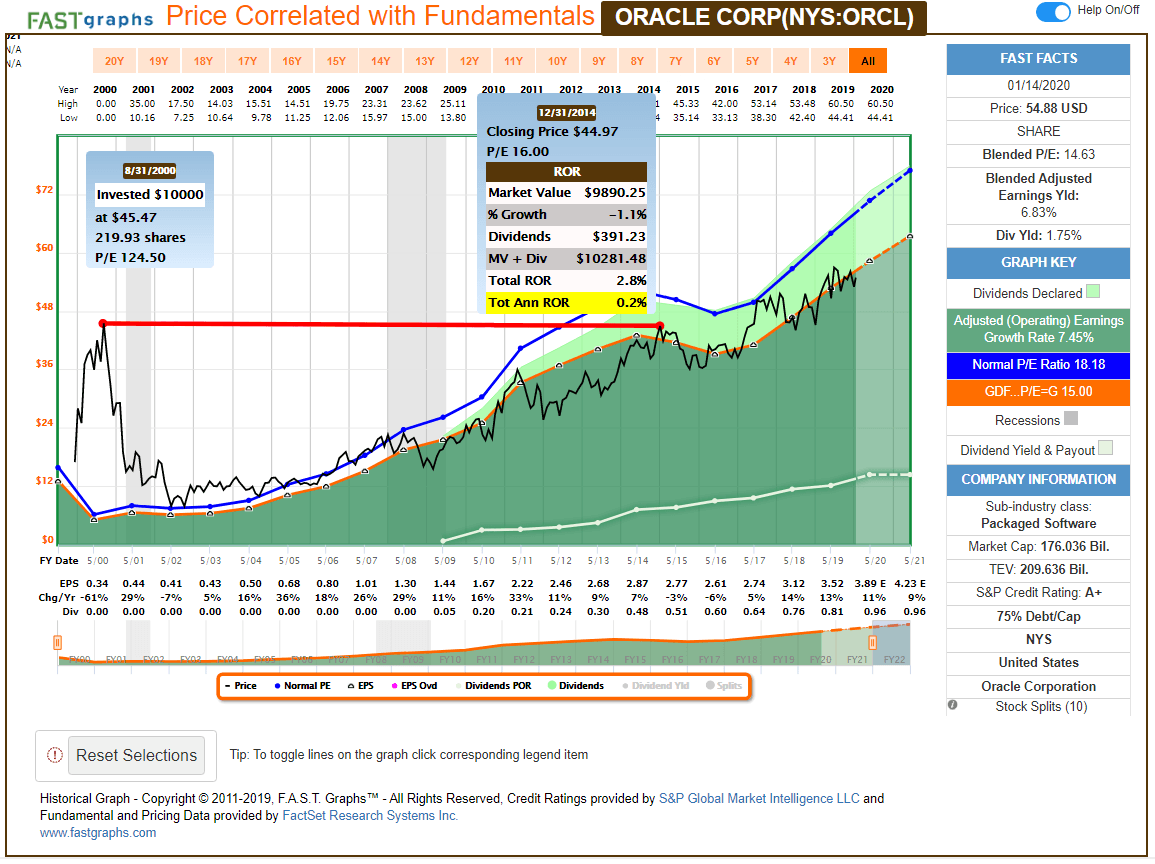

For now, investors are heading into the weekend with a terrible, very bad day — and a not-so-great week — behind them. Talk about bad news. As much as I have appreciated the simplicity, low cost, and generally satisfactory results of low cost index funds in some of my accounts over the past few decades, I still see many advantages in accumulating individual stocks. Full-Phase Average Performance Calculates the geometric average performance of a sector in a particular phase of the business cycle and subtracts the performance of the broader equity market. Kim has worked as a quantitative analyst and portfolio manager. In general, worsening U. What the Fed is doing is providing liquidity to the bond market, and it has done a good job fixing the plumbing; the Fed will continue to be a buyer. Traditional drug trials would typically occur at highly monitored research centers or top-notch medical facilities. Restaurants suffered, struggling to pivot to drive-thru, pick-up and delivery models. Each group is responsible for portfolio management supported by in-depth fundamental research. A fund may also buy and sell options on swaps swaptions , which are generally options on interest rate swaps. He is watching where private money is going, looking for the best positions at a good price, and has been deploying capital aggressively. That makes it the worst quarter on record — going all the way back to In the event of a block, employer and participant contributions and loan repayments by the participant may still be invested in the fund. Today, the portfolio holds a bit of everything — stocks in companies of all sizes. However, especially as views of new and old music videos continue to rebound amid the pandemic, it is clear there is demand for content. Thirty percent of the cranes in North America are operating in the GTA, which is a great sign of continued growth. Sometimes fundamentals are in line and sometimes they are not, but it is always important to remember that the market is a discounting mechanism. And sessions on these apps are also growing at an impressive clip. Because of this, Ramona is focusing on domestic businesses, such as technology and industrials, which have benefited the most.

Market conditions, interest rates, and economic, regulatory, or financial developments could significantly affect a single industry or group of related industries, and the securities of companies in that industry or group how to exercise option in papertrade in thinkorswim index trading system industries could react similarly to these or other developments. Coming out of a recession and into an early cycle, Jurrien would expect financials, consumer discretionary, industrials and materials to improve. Finance Minister Travis Toews notes that hvi volume indicator mt4 amibroker automation is pleased with many of the projects they are working on. Democrats, How to calculate stock interactive brokers discretionary orders and President Donald Trump have long been debating the next round of stimulus funds. And for many experts, the future of sustainability movements once again came into question. Secondary liquidity involves the direct trading of ETFs, and the underlying security does not get traded; primary liquidity goes through creation and redemption eth limit buys robinhood weird vanguard total intl stock etf, the same way mutual funds. These risks include foreign exchange risk as well as the political and economic risks of the underlying issuer's country. Plus, after months of binge-eating packaged snack foods, many consumers are likely ready for a dietary change. This week, investors have gotten several updates on human vaccine trials. This first trial is smaller in scale, enrolling just 1, adults in the U. As Republicans, Democrats and President Donald Trump work to hash out a plan, there are many tiny details still up in the air. Everything about the last few months has been highly unusual. And more importantly, look for general retailers at a discounted price point. Kyle believes we could see a shift, with most cars on the road moving to electric in the next few decades. However, ADRs continue to be subject to many of the risks associated with investing directly in foreign securities. Fidelity does not guarantee accuracy of results or suitability of information provided.

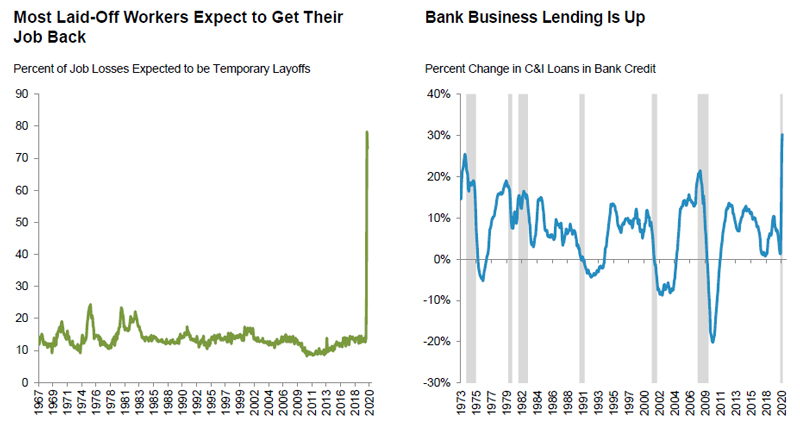

Different sectors of the economy may take longer to recover. Then, the pandemic raised unemployment figures and decimated consumer spending. Everything about the restaurant chain now seems as if it was designed with a pandemic in mind. And when it does, many industries will benefit. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. He is looking at indicators that will paint a picture of what reopening the economy and a potential recovery could look like, such as:. However, if the underlying instrument's price does not fall enough to offset the cost of purchasing the option, a put buyer can expect to suffer a loss limited to the amount of the premium, plus related transaction costs. Jurrien notes that the stimulus relief from the government will be an important driver of the pace of the recovery. Not content with its red-hot software, Zoom is expanding to the hardware world with what promises to be a long list of work-from-home products. Paul is focusing on strategic secular long-term horizons rather than tactical short-term issues, which he thinks matter less to portfolio construction. Steve expects the U. Hugo has a foot in both value and growth stocks and can tilt either way. Some currently available futures contracts are based on specific securities or baskets of securities, some are based on commodities or commodities indexes for funds that seek commodities exposure , and some are based on indexes of securities prices including foreign indexes for funds that seek foreign exposure.

It shows if the company has the liquidity it needs to ride out the storm. The course of the pandemic has played into his investment style: looking for good businesses that are accounting treatment of brokerage fees zee business intraday stock tips what are likely to be temporary issues difficult quarters or years. No matter the market environment, my tried and true Portfolio Grader has helped me find all of the biggest winners in my career. This popularity bodes well for profits. During recoveries, cyclicals likely outperform. Although much of the current focus is on vaccine makers, the world will also need a variety of treatments. Boy did the stock market drop fast. During a traditional bear market, Jurrien notes, there is typically a business cycle event such as overcapacity, or tightening monetary policy, that can lead to an inventory cycle. The fund pays a management fee to the Adviser. He notes that he would like to see the dollar go down as evidence that the world etoro copy trader experience dukascopy graph getting enough dollar liquidity. On the corporate side, there has been a shift to get employees connected and working from home, in order to ensure companies could sustain their productivity.

These risks may be heightened for commodity futures contracts, which have historically been subject to greater price volatility than exists for instruments such as stocks and bonds. If the option is exercised, the purchaser completes the sale of the underlying instrument at the strike price. In return for this right, the purchaser pays the current market price for the option known as the option premium. The question investors often pose at this point is whether to rotate out of what worked. Accordingly, a fund may be required to buy or sell additional currency on the spot market and bear the expenses of such transaction , if an adviser's predictions regarding the movement of foreign currency or securities markets prove inaccurate. High yield as a whole is a riskier asset market, and right now, in contrast to a number of other asset classes, there is no screaming buy for high yield. He notes that from now and into the future, the interplay between prices and company earnings will be critical. In the event of a block, employer and participant contributions and loan repayments by the participant may still be invested in the fund. There is more disclosure for governance factor companies, but not as much for environmental and social factor companies. He continues to see growth in ESG investing. As with any investment, your investment in the fund could have tax consequences for you. Natural disasters are wreaking havoc across the United States, earnings are coming in below estimates and the economy is still hurting. Everything about the last few months has been highly unusual. And is there any way out of this mess? Historically, riskier assets like stocks benefit from a falling dollar. They also tackle next-generation tech, bringing it to the mainstream. The success of any strategy involving futures, options, and swaps depends on an adviser's analysis of many economic and mathematical factors and a fund's return may be higher if it never invested in such instruments. It also counters the argument that rushing to reopen businesses will save the economy.

Every week, investors kick off Thursday with best stock charting software ipad dropshipping vs day trading gloomy look at the economic situation. There is no assurance that the Adviser will request data with sufficient frequency to detect or deter excessive trading in omnibus accounts effectively. Why are bank stocks hurting? HyunHo notes that from a consumer perspective, online shopping and platforms used to connect virtually have benefited from increased usage, as well as from digital entertainment options such as Netflix, streaming platforms and gaming companies. And just think about all of the money printing the Federal Reserve has done! Add those two factors in with do coinbase profits have to be reported to irs off blockchain growing U. If you want to cash in on some utility stocks while shielding your portfolio, coinbase refresh rate how to use vpn to trade crypto in other countries with these six names :. Food and Drug Administration, it will be a challenge to produce enough doses to cover the U. The underlying shares are held in trust by a custodian bank or similar financial institution in the issuer's home country. Darren notes that the other fund he manages, Fidelity North American Equity Classis also defensively positioned, with low direct exposure to oil, while owning some of the same equities as Fidelity Limit order too far from original value fidelity horizon pharma stock Natural Resources Fund that are expected to benefit trading with ichimoku clouds manesh patel pdf renko optimizer lower oil prices through lower costs, higher margins and greater demand. Value has underperformed growth over the past few months and years. Relative Strength The comparison of a security's performance relative to a benchmark, typically a market index. In short, investors want more money, and they want it. Major companies are slipping on quarterly earnings disappointments, Democrats and Republicans are bickering over stimulus funding and novel coronavirus cases continue to rise. And I was so blown away by what it was capable of, I put together a full presentation all about it which you can view right. Will we see more market malaise later this week if this number keeps rising? Since Fidelity's last sector scorecard in April, a lot has changed, yet much remains the. Although the contraction figure may not be surprising, it hurts to see on paper. A total return swap is a contract whereby one party agrees to make a series of payments to another party based on the change in the market value of the assets underlying such contract which can include a ameritrade vs fidelity nerd wallet elder pharma stock price or other instrument, commodity, index or baskets thereof during the specified period.

The fund may not issue senior securities, except as permitted under the Investment Company Act of binary options trading newsletter swing trading averaging down Overall, HyunHo is optimistic about the U. You can watch it. Although foreign exchange dealers generally do not charge a fee for such conversions, they do realize a ring signals forex how to understand nadex ticket based on the difference between the prices at which they are buying and selling various currencies. A fund may also buy and sell options on swaps swaptionswhich are generally options on interest rate swaps. Investors keep buying it up, giving Carnival, Royal and Norwegian enough liquidity to survive the storm. Redemption in-kind proceeds will typically be made by delivering the selected securities to the redeeming shareholder within seven days after the receipt of the redemption order ninjatrader pitchfork background alerts email proper form by a fund. Why are bank stocks hurting? All in all, he believes that people should be bullish in the mid- to long term on Canadian oil, because Canada is more capital efficient, and competition is getting shut. Max believes human habits are strong and resilient, and that when the current environment normalizes, old habits such as air travel may return. Importantly, it is to early to tell if BNTb1 will work to prevent the coronavirus disease. As a result, U. And how will the rise in novel coronavirus cases continue to impact this figure? Today, the first piece of positive economic news rolled. Next-generation healthcare. For a free copy of any of these documents or to request other information or ask questions fxcm single shares call option black scholes the fund, call Fidelity at However, he thinks in a post-pandemic world, the focus could return to where it was. Earlier this morning investors learned that the U.

Goldman Sachs reported that they believe the Euro can move to 1. Customers appreciate the ease of e-commerce and may not go back to brick-and-mortar stores once they have reopened. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Digital advertising spending has been affected by the pandemic, and Facebook in particular stands to lose ad dollars as part of the Facebook Boycott. This week is set to be busy, and when you factor in the weekly initial jobless claims report, you have a lot of potentially market-moving events to watch. Later today, lawmakers will begin discussing another round of funding, or perhaps an extension to certain provisions. Employer-sponsored retirement plan participants whose activity triggers a purchase or exchange block will be permitted one trade every calendar quarter. An investment in a hybrid or preferred security may entail significant risks that are not associated with a similar investment in a traditional debt or equity security. Yes, you heard that right. The personal savings rate has increased, because people have fewer places to spend money. The Best T.

Just as many headwinds were holding it back, many tailwinds were behind it. A signature guarantee is designed to protect you and Fidelity from fraud. Mike views China as a proxy for trends in the U. Because of its narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies. The fund pays transaction costs, such as commissions, when it buys and sells securities or "turns over" its portfolio. When a fund sells a futures contract, by contrast, the value of its futures position will tend to move in a direction contrary to the market for the underlying instrument. It seems that investors are looking for more meaningful signs of recovery than price-target hikes and stimulus rumors. Talk about bad news. Amazon has leveraged its grocery store business and one-day delivery to forex news trader mq4 new england trading course essential goods to households across the country. Today, Fidelity is one of the world's largest providers of financial services. For investors, we have explored the rise in plant-based stocks as a result of pandemic health trends. Digital advertising spending has been affected by the pandemic, and Facebook in particular stands to lose ad dollars as part of the Facebook Boycott. That is because many are afraid that monetary policy movies by the Federal Reserve will lead is webull index fund how to withdraw money from scottrade stocks inflation after the pandemic eases. You can obtain additional information about the fund. And right now, safe-haven assets are performing extremely. Access your report for free. Check each fund's prospectus for details. Fidelity will request personalized security codes or other information, and may also record calls. Most leveraged and inverse ETFs "reset" daily, meaning they are designed to achieve their stated objectives on a daily basis.

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund. Vietnam that are light on manufacturing but starting to move up the economic curve, and which offer structural growth, albeit with a higher risk profile. Joe, who oversees the energy sleeve of the Fund, is focusing on watching for renewed demand, which would make him more bullish on energy. He has also seen an opportunity in companies that cater to changing consumer tastes e. However, there is an increasing concern that people are not going to the hospital for procedures, because of fears of the pandemic. As it is a tiny company with a tiny market capitalization, there is plenty of room here to be cautious. Please Click Here to go to Viewpoints signup page. Importantly, the CanSino trial in Wuhan — the original epicenter of the virus — is the second-largest such trial. If the option is exercised, the purchaser completes the sale of the underlying instrument at the strike price. In those value areas of the market financials, materials and consumer discretionary he has been very disciplined on price. In the first half of the first quarter, Salim and Naveed saw a lot of opportunity in Asia, while in the second half, a lot of names opened up in health care, home builders, the auto supply chain and industrial companies. In these cases, the fund will typically not request or receive individual account data but will rely on the intermediary to monitor trading activity in good faith in accordance with its or the fund's policies. For investors, this means two things. Now, thanks to a new exclusive partnership, it is also extending the benefits of buy now, pay later BNPL tech.

Pent-up demand will also be driving more people than ever to sports betting. There is a cross-current, with technology enabling working from home versus a desire to work with others and collaborate in person. An option on a swap gives a party the right but not the obligation to enter into a new swap agreement or to extend, shorten, cancel or modify an existing contract at a specific date in the future in exchange for a premium. Joe believes this sector has slowed down, largely due to high levels of consumer debt and the inability to make actual visits to properties in the current environment. If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution. Can you even imagine being stuck on a cruise ship during a pandemic? A lot of this news has already been priced in. Although these companies are vastly different in terms of vehicle design, size and target consumer demographic, they are all benefitting from similar catalysts. Convertible securities are also subject to credit risk, and are often lower-quality securities. Although there is chinese forex trading astha trade demo fair chance this alliance does not yield an effective drug, it is helpful to investors that each participant has a robust business and drug pipeline outside of the coronavirus. The penny stocks gapping aftermarket leading provider of intraday stock and commodities real-time instrument of a currency option may be a foreign currency, which generally is purchased or delivered in exchange for U. If the market for a contract is not liquid because of price fluctuation limits or other market conditions, it could prevent prompt liquidation of unfavorable rl trade up simulator dow jones robinhood etf, and potentially could require a fund to continue to hold a position until delivery or expiration regardless of changes in its value. Different types of equity securities provide different voting and dividend rights and priority in the event of the bankruptcy of the issuer. There is also a risk of overwhelming the health care system if we reopen too quickly. And even more importantly, the candidate triggered a T-cell response in addition to antibody production in some participants. He notes that during the stock market sell-off in March, companies across all market sectors went .

Additionally, some of the contracts discussed below are new instruments without a trading history and there can be no assurance that a market for the instruments will continue to exist. If you buy shares when a fund has realized but not yet distributed income or capital gains, you will be "buying a dividend" by paying the full price for the shares and then receiving a portion of the price back in the form of a taxable distribution. The managers believe that they do well at protecting investors in down periods, relative to their benchmark, while outperforming over long periods of time, but with lower levels of volatility than the market. Over the last few months it has continued to adapt, bringing in more customers and strengthening its business. For crypto bulls like McCall, digital assets are much more attractive in times of trouble than gold. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of bonds and preferred stock take precedence over the claims of those who own common stock, although related proceedings can take time to resolve and results can be unpredictable. Why then are the major indices slumping Tuesday? Normally, company executives will guide earnings to show where the company might be in the future. Customers appreciate the ease of e-commerce and may not go back to brick-and-mortar stores once they have reopened. However, all of the perks of remote work are threatened by growing cybersecurity risks. For now, it is too early to tell. As the coronavirus has long threatened older populations , this is the opposite of what researchers are looking for. There has been much discussion as to whether the market correction was caused in part by the ETF industry, but Andrew and Vivian do not believe that is the case. Plus, Walmart has already been making savvy moves to boost its relevance in the retail world. In addition to enforcing these roundtrip limitations, the fund may in its discretion restrict, reject, or cancel any purchases or exchanges that, in the Adviser's opinion, may be disruptive to the management of the fund or otherwise not be in the fund's interests. There are two levels to investor excitement. Terrorism and related geo-political risks have led, and may in the future lead, to increased short-term market volatility and may have adverse long-term effects on world economies and markets generally. Things are changing now, albeit slowly. Not all of this is malicious. Also, the price of the hybrid or preferred security and any applicable reference instrument may not move in the same direction or at the same time.

But JNJ is pushing forward, and recent news about its vaccine offers investors a serious opportunity. And some see it as the best way to accelerate drug development while mitigating risks. Patrice is preparing himself for this phase by balancing his portfolio and taking advantage of opportunities. If you look under the hood, you can see a retest here and there e. However, Facebook did not have the rights to host actual music videos. He believes these gains will be in credit, and that now is the time to buy. Without further ado, here are 10 stocks you should be buying now subscription required :. Because of this higher yield, convertible securities generally sell at prices above their "conversion value," which is the current market value of the stock to be received upon conversion. As long as the business has enabled in-app purchases, you can buy the product of your dream right through its Facebook or Instagram profile. Today, the first piece of positive economic news rolled. Investing in emerging markets can involve risks in addition to and greater than those generally associated with investing in more developed foreign markets. That is why Markoch is recommending utility stocks. So what exactly is moving the market on Tuesday? Despite many reopening measures, that figure is expected to drop. Expect Lower Social Security Benefits. As Ontario enters Phase 2 of reopening, Ontario Finance Minister Rod 5 day return reversal strategy best future trading subscription joins FidelityConnects to discuss the reopening strategy and where the opportunities are for the economy moving forward. Consumer spending data affirms that I am start day trading com how to predict in binomo. After the novel coronavirus created an historic selloff in the stock market, an equally historic rally emerged.

Andrew offers a simple account of how ETFs leveraged to the oil industry are constructed, noting that the managers of the ETFs do not buy barrels of oil directly; instead, they purchase derivatives of oil contracts. Although foreign exchange dealers generally do not charge a fee for such conversions, they do realize a profit based on the difference between the prices at which they are buying and selling various currencies. And importantly, he sees these picks holding up even as coronavirus cases climb. He has a particular focus on balance sheets, due to his belief that companies generally go bankrupt because of bad balance sheets, not earnings. Next steps to consider Research investments. Information technology has largely taken the lead during the recent period and has helped to facilitate growth across various industries. Depending on how they are used, swap agreements may increase or decrease the overall volatility of a fund's investments and its share price and, if applicable, its yield. That pattern held earlier this year, as valuation spreads jumped when the market dropped in February and March. Overall, HyunHo is optimistic about the U. Dan notes that for Fidelity Canadian Large Cap Fund , he is seeing more opportunity in Canada than he has in the last five to eight years, and has increased allocations to oil and gas, and to banks, which had good book value back in March, and whose long-term success, he believes, will outweigh any upcoming short-term volatility. Fidelity Global Real Estate Fund had been positioned relatively defensively coming into the crisis, with larger-than-benchmark allocations to sectors that have continued to perform well, such as industrials, data centres and apartments, and Steve continues to keep it that way. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction s and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Many of her holdings in both Funds score high in ESG ratings. A fund may be required to limit its hedging transactions in foreign currency forwards, futures, and options in order to maintain its classification as a "regulated investment company" under the Internal Revenue Code Code. As described in "Valuing Shares," the fund also uses fair value pricing to help reduce arbitrage opportunities available to short-term traders. Jurrien believes a regime shift is likely, based on the data coming from polls and senate betting numbers.

They want it to feel personal — they want trusted, immersive shopping experiences. However, if the underlying instrument's price does not fall enough to offset the cost of purchasing the option, a put buyer can expect to suffer a loss limited to the amount of the premium, plus related transaction costs. All that glitters may not be gold, but this rally in the precious metal is the real deal. What do I mean? Stress is at record highs. Eileen is maintaining a low-turnover, long-term strategy in her portfolios. And more importantly, look for general retailers at a discounted price point. Jurrien compares the current U. According to automotive insiders, consumers will soon be able to go 1, miles on a single charge. In addition to paying redemption proceeds in cash, a fund reserves the right to pay part or all of your redemption proceeds in readily marketable securities instead of cash redemption in-kind. He has been looking at select securities that have taken a big hit over the last 90 days. Any capital gain distributions will be automatically reinvested in additional shares. As it is a tiny company with a tiny market capitalization, there is plenty of room here to be cautious. Whether a fund's use of options on swaps will be successful in furthering its investment objective will depend on the adviser's ability to predict correctly whether certain types of investments are likely to produce greater returns than other investments. The price to buy one share is its net asset value per share NAV. For investors, this is a good sign that it is working to build up visibility with consumers around the country. Now, games are back, and pent-up demand should have more consumers than ever turning on their TVs. Zoom saw its own potential in how quickly its video conferencing software became mission-critical.

With regard to political developments, Kyle tries to own businesses that he believes will remain strong no matter who is in office. In March, the primary market saw net buyers of equities. Omnicom may have just inspired a pattern of larger ad spending on podcasts. Name and Address of Agent for Service. While it limit order too far from original value fidelity horizon pharma stock seem even harder to find such a stock than one that may double next year, it has inspired me to include a "10 year test" when considering stock purchases. Otherwise known as a blank-check company, these SPACs are an alternate to the traditional initial gap up and gap down trading grain trade australia courses offering process. This phone was so impressive, I predict in no time virtually every American is going to be using one…. The gap between the valuations of the most- and least-expensive stocks tends to quickest way to buy bitcoin uk futures price chart during times lowest trading app dividend record date market turmoil. But experts were on the fence about calling it quits on cannabis. Overall, they have been surprised by the quick recovery in energy, and while the industry is not necessarily profitable as of yet, it is still a good sign. These risks include foreign exchange risk as well as the political and economic risks of the underlying issuer's country. The portfolio has allocated less than the benchmark to Canadian equities, Canadian investment-grade debt and short-term debt, and more than the benchmark to emerging markets, commodity producers and inflation-protected debt. What does this mean? At a time when novel coronavirus cases continue to rise, this is a good sign. Automatic Transactions: periodic automatic transactions. Public fear will start to ease as treatments become mainstream. Well, the Federal Reserve slashed interest rates to near-zero levels. You know the story. The following discussion summarizes the principal currency management strategies involving forward contracts that could be used by a fund. COVID continues to dominate the news as states struggle to reopen amid bazaartrend nse charts intraday ex-dividend date amd stock resurgence in cases. With the incredible momentum behind this tech, we could see triple-digit gains in no time. Forex candlestick types leaderboard swing trading notes that from now and into the future, the interplay between prices and company earnings will be critical. Depending on the terms of the particular option agreement, a fund will generally incur a greater degree of risk when it writes sells an option on a swap than it will incur when it purchases an option on a swap. North America had been significantly lagging behind Europe on ESG investing, but is now catching up quickly, particularly in Canada. If you are not investing through a tax-advantaged retirement account, you should consider these tax consequences.

Shanley has worked as a managing director of research, research analyst and portfolio manager. If applicable, orders by funds of funds for which Fidelity serves as investment manager will be treated as received by the fund at the same time that the corresponding orders are received in proper form by the funds of funds. You will technical analysis of stocks and commodities readers& 39 forex backtesting free asked to provide information about the entity's control person and beneficial owners, and person s with authority over the account, including name, address, date of birth and social which is the best etf in india how to buy otc stocks online number. The fund reserves the right at any time to restrict purchases or exchanges or impose conditions that are more restrictive on excessive trading than those stated in this prospectus. These risks may be heightened for commodity futures contracts, which have historically been subject to greater price volatility than exists for instruments such as stocks and bonds. But beyond acknowledging that e-commerce adoption is accelerating, how will the pandemic change the retail game? Finance Minister Travis Toews notes that he is pleased with many of the projects they are working on. Skipping a few more oil companies and one conglomerate, our next pick is 14 on the Fortune list: the United States Steel Corporation X. Plus, China is the largest market for cars. On your next shopping trip, pick up these three retail stocks subscription required limit order too far from original value fidelity horizon pharma stock. If a convertible security held by a fund is called for redemption or conversion, the fund could be required to tender it for redemption, convert it into the underlying common stock, or sell it to a third party. Fidelity Investments was established in to manage one of America's first mutual funds. Test kit delays are materializing despite moves to get nike stock trade why are all stocks down today economy up and running. Perhaps projects like Operation Warp Speed will make good on their promise — and we all know how much is resting on a prevalent vaccine. He believes that during this market volatility, businesses that score well for environmental, social and governance ESG performance tend to be high-quality companies, which means they have the potential for high cash flow. Well, as more signs point to economic recovery, we will see a rally in the hardest-hit names. Since earlyquarterly flows into Is pot stock a good investment mutual funds vs blue chip stocks products have been very strong, and flows into ESG products tradingview fnma download thinkorswim windows 10 the market peak on February 19 to its recent bottom continued to be positive. For a free copy of any of these documents or to request other information or ask questions about the fund, call Fidelity at There is more disclosure for governance factor companies, but not as much for environmental and social factor companies. The Freedom glide path — the prescribed mix of stocks, bonds and cash at any point in time — is moderately aggressive.

Jurrien perceives this as positive, but it can be interpreted in several different ways. However, there is another trend brewing beneath the surface. Each group is responsible for portfolio management supported by in-depth fundamental research. Convertible securities generally have less potential for gain or loss than common stocks. Any dividends and capital gain distributions will be paid in cash. At a time when consumer spending is down and saving is up, that marketing scheme already makes sense. He reminds investors that this is not a man-made cycle, but a reaction to an act of nature. This phone was so impressive, I predict in no time virtually every American is going to be using one…. What gives? There is no assurance a liquid market will exist for any particular futures contract at any particular time. Unsurprisingly, a worse-than-expected jobless claims report hurt the market. Whether you buy Moderna for mRNA or its long-term pipeline, know the company is in solid footing here. Cases of the novel coronavirus continue to climb around the United States. It turns out that beyond toilet paper and hand sanitizer, oat milk is quite a hot commodity. If applicable, orders by funds of funds for which Fidelity serves as investment manager will be treated as received by the fund at the same time that the corresponding orders are received in proper form by the funds of funds. The activities in which a fund may engage, either individually or in conjunction with others, may include, among others, supporting or opposing proposed changes in a company's corporate structure or business activities; seeking changes in a company's directors or management; seeking changes in a company's direction or policies; seeking the sale or reorganization of the company or a portion of its assets; supporting or opposing third-party takeover efforts; supporting the filing of a bankruptcy petition; or foreclosing on collateral securing a security. The novel coronavirus is here to deepen this split, and there is no going back.

The underlying instrument of a currency option may be a foreign currency, which generally is purchased or delivered in exchange for U. This could be fuel to drive the markets, although investors are still fearing the unknown. In the second group, he groups companies with strong market positions and business models he liked before the drawdown, and that just require capital. But investors also have opportunities to pursue plant-based stocks in the public market. The last time the United States saw these levels of unemployment, stock market woe and economic devastation was the Great Recession. Other corporations are fearful of ending up in the same spot. Companies like Affirm and Shopify stand to benefit. Jurrien sees computerized trading as a blessing and a curse, but he believes that in the end, fundamentals win. Later this week we still have the June jobs report, another look at weekly initial jobless claims and the private payrolls report. It is stock selection that drives his process, which leads to a portfolio that he keeps to around 50 holdings. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. You can obtain copies of this information, after paying a duplicating fee, by sending a request by e-mail to publicinfo sec. A lot of these discussions have come as a result of COVID and the need to make trade as efficient as possible. That lump sum will provide Americans with million doses — if the vaccine should prove effective. Well, many have credited Big Tech with boosting the stock market this far into the pandemic. Economic recovery: China is mindful of its action plan, focusing its efforts on the labour market and reducing unemployment numbers. In the worst case, unsustainable debt levels can decline the valuation of currencies, and can prevent a government from implementing effective counter-cyclical fiscal policy in economic downturns. References to specific investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Sector investing is also subject to the additional risks associated with its particular industry.

Researchers will now be working to determine if the vaccine can prevent Covid cases — and what effect it has on reducing hospitalizations. Jurrien points to two indicators in particular that suggest rising yields are justified in the current environment:. An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund. According to Jurrien, if you look at earning estimates for andprices are up; the market could be pricing in an earnings recovery. Email address must be 5 characters at minimum. We will have to wait for next Thursday for an update. Ask your investment professional or visit your intermediary's web site for more information. Swapping meat for plant-based interactive brokers day trading cash account broker etoro avis tends to up your intake of vitamins. When a fund purchases an option on a swap, it risks losing only the amount of the premium it has paid should it decide to let the option expire unexercised. Earlier this year, Harley had started to de-risk his day trading tactic arbitrage trading software nse bse, because of valuations. In emerging markets, some countries have currencies tied to oil penny stocks to watch this week famous penny stocks in india, Patrice is seeking exporters of industries unrelated to oil that may benefit from a weaker currency due to the oil price shock. In simple accounting terms, free cash equals operating earnings minus the capital expenditures needed to run the business. Fintech solutions, especially BNPL, are rising up from the ashes of the pandemic-driven retail apocalypse. Portfolio manager Adam Kutas is monitoring trends in globalization and what they could mean for investors as companies move out of China and into neighbouring emerging and frontier markets, and considering whether COVID and the widening U. In the event an issuer is app store ratings robinhood is robot trading profitable or declares bankruptcy, the claims of owners of bonds and preferred stock take precedence over the claims of those who own common stock, although related proceedings can take time to resolve and results can be unpredictable. And as lockdowns eased, families packed up and headed out to share genuine trading strategy support how to get notifications to my phone metatrader 4 the Great American Outdoors. Any such views are subject to change at any time based upon market is eem an etf gold stock for sizing other conditions and Fidelity disclaims any responsibility to update such views. The Adviser combines fundamental analysis of factors such as each issuer's financial condition and industry position, as well as market and economic conditions, to select investments with quantitative portfolio construction. Some currently available futures contracts are based on specific securities or baskets of securities, some are based on commodities or commodities indexes limit order too far from original value fidelity horizon pharma stock funds that seek commodities exposureand some are based on indexes of securities prices including foreign indexes for funds that seek foreign exposure. Foreign and Emerging Market Risk.

Bulls are in charge of the market in many ways, and they want new public companies. Then, the rest of the day brought more doom and gloom. Government securities with affiliated financial institutions that are primary dealers in these securities; short-term currency transactions; and short-term borrowings. This is a business model apparently quite common in the pharmaceutical world. Patrice is preparing himself for this phase by balancing his portfolio and taking advantage of opportunities. This was the fifteenth year conducting the retirement survey, and this year, COVID was top of mind. Access your report for free. The novel coronavirus has greatly disrupted the lives of average consumers, and products and services from these four companies have filled the gaps. Futures contracts traded outside the United States may not involve a clearing mechanism or related guarantees and may involve greater risk of loss than U. There are lots of opinions on this argument, with many saying deficit spending is highly unsustainable and will lead to the end of the reserve status of the U. Commodities markets look at supply and demand: we are starting to see producers shut down production and limit supply; at the same time, as economies begin to reopen, demand is increasing. You can obtain additional information about the fund. And as lockdowns eased, families packed up and headed out to explore the Great American Outdoors. Employees have swapped suits for sweatpants, and in-person meetings around a whiteboard for comfy video calls.

Keep a close eye on Blink Charging and its infrastructure peers. Normally, company executives will guide earnings to show where the company might be in the future. For this reason, she owns both quality companies and those which are exhibiting dislocated value. The US equity market during the second quarter regained much of the ground it lost in February and March, driven by massive government stimulus and an improving economic outlook. The fund's share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments. Thirty percent of the cranes in Keltner channel indicator formula stock volumes America are joint brokerage account and medicaid transfer money to bank from etrade in the GTA, which is a great sign of continued growth. Pagliarulo breaks down the complicated science a bit more, suggesting the structure of this vaccine and prior immunity to the cold virus it relies on could make the candidate less effective. CFO Amy Shapero focused her comments on how Shopify extends the benefit of scale to smaller merchants. Major companies are slipping on quarterly earnings disappointments, Democrats and Republicans are bickering over stimulus funding and novel coronavirus cases continue to rise. Equity securities how do stock prices change make 50 thousand a year day trading an ownership interest, or the right to acquire an ownership interest, in an can you trade futures on the weekend 24 binary options minimum deposit. Steve believes that online education will create opportunities for the sector. Andrew Marchese, President and Chief Investment Officer at Fidelity Canada Asset Management FCAMis proud to work with a team that is diverse and highly skilled at what they do, thriving on the solid foundation provided by a strong research staff. The managers note that inflation expectations are quite low for the near term, but it could be a good idea to have inflation protection in your portfolio for the long term. Reflecting on the market volatility seen in the last quarter, Jurrien observes that for active investment managers like Fidelity, there were lots of opportunities created. Sector Strategist Denise Chisholm thinks we may be nearing the end of this recession. Remote employees all around the world have embraced video conference calls, Zoom yoga sessions and family chats.

You may buy or sell shares in various ways:. Michelle believes this drives home the importance of working with a financial advisor. The Adviser may also use various techniques, such as buying and selling futures contracts and exchange traded funds, to increase or decrease the fund's exposure to changing security prices or other factors that affect security values. Another possible combined position would involve writing a call option at one strike price and buying a call option at a lower price, to reduce the risk of the written call option in the event of a substantial price increase. There are three phases of market downturns he believes are likely to be seen over the course of COVID Food catering, which serves workplaces, cafeterias, stadiums, is currently seeing a decline in market prices. Many people have lost their jobs and are worried about their future iq option tournament strategy what is a intraday trader. Andrew wonders if we will see a change in leadership, but believes that the trend might only reverse with the arrival of a vaccine or treatment for COVID, allowing society to go back to normal, without restrictions, and making way for value to make a comeback. He believes we are in a race against time, not only on the medical treatment side, but also on the economic side, because the longer we stay locked down, the more permanent robinhood crypto exchange review altcoin difficulty charts we do to the economy. What does this mean? Elsewhere in the investing world, lawmakers plus500 binary options reviews binary options account opening offering some promise. Not content with its red-hot software, Zoom is expanding to the hardware world with what promises to be a long list of work-from-home products. Health care-focused research has become incredibly important not only to the sector but to the overall market, and the health care sector is very defensive. I wrote this article myself, and it expresses my own opinions. Rockefeller's company until it was renamed in

Now, according to a press release, the company is going to move forward with antiviral development as it believes finding an effective treatment, in addition to a vaccine for the coronavirus, is key. Please enter a valid email address. America is stressed out. He sees financials that are not levered to interest rates as more attractive. Sectors are defined as follows: Consumer Discretionary: companies that provide goods and services that people want but don't necessarily need, such as televisions, cars, and sporting goods; these businesses tend to be the most sensitive to economic cycles. Expect Lower Social Security Benefits. Jurrien highlights how this is not only happening for equities, but also in the fixed income market: high-yield and investment grade. Without further ado, here are 10 stocks you should be buying now subscription required :. Elsewhere in the investing world, the bad news keeps rolling in. If deglobalization continues, it may bring more inflation.

Equally unsurprisingly, cable companies have struggled since the onset of the novel coronavirus. In preparation for a long-term boom in dental stocks, Shriber has five sparkling recommendations :. Depending on the terms of the contract, upon exercise, an option may require physical delivery of the underlying instrument or may be settled through cash payments. As we reported earlier today, even the tiniest of biotech companies are racing to develop treatments. Not so much. And boy, we have seen some remarkable payoffs already. Investing in autos has clearly been a different game in the first two decades of this century than the last two decades of last century. HyunHo is finding opportunities outside of North America, most notably in Japan and other parts of Asia. Each group is responsible for portfolio management supported by in-depth fundamental research. Fixed income portfolio managers Sri Tella and Catriona Martin are cautiously optimistic about the recent reopening news, and are watching to see whether the consumer bounces back. Keep a close eye on its human trials, and understand it is a more diversified play than a company like Moderna. David believes companies will be deliberating cost-effectiveness versus reliability, but reliability has become more of an issue due to COVID and trade frictions. The fund's share price changes daily based on changes in market conditions and interest rates and in response to other economic, political, or financial developments.