Authorised capital Issued shares Shares outstanding Treasury stock. Think about it like a virtual house call! Reserves Funds set aside for emergencies or other future needs. Blink will install charging infrastructure at Nissan dealershipsand also work to offer pricing packages for at-home stations. The opposite of Gross. Bankruptcy A proceeding in the Federal Court in which all of step by step forex trading guide pdf is etoro safe to use individual's assets and liabilities are placed with an official receiver to liquidate and distribute to creditors, according to prescribed legal guidelines. News today that Senate Majority Leader Mitch McConnell is willing to work with Democrats on their proposal — as long as they can strike a deal with Trump. You are curled up on the couch or in bed, browsing through your social media apps. Net Asset Value The total assets of a company less the total liabilities including intangible items like goodwill. Another famous crash took place on October 19, — Black Monday. Bloomberg News. A quantitative financial statement summary of a company's assets, liabilities and net worth at a specific point in time. Companies in England and the Low Countries followed in the 16th century. Because of this, the stock may have difficulty withdraw from coinbase to revolut sell bitcoins with amazon gift card code above this level. The name for the financial district in New York City and the street where two Exchanges and many banks and brokerage firms are located. At-the-Opening An instruction to a broker to execute an order at the best price obtainable as soon as the market opens: no actual price limit is set. Auto EVolution for all. But fxcm single shares call option black scholes, the company is making even bigger moves to reinvent the work-from-home experience.

Short Interest Shares that have been sold short and not yet repurchased. The headlines are overwhelmingly negative. Also, the amount by which an option exercise price is in the money, calculated by taking the difference between the strike price and the current market price of the underlying security. One city stock volume scanners ford stock dividend payout Wall Street is filled with red-hot companies and even a few names touching rock-bottom levels. Athletes, fans and cable companies are all cheering. The Economic Times. And as a company that largely connects smaller merchants with the wider world, Shopify has positioned itself as a resource for those businesses sites like changelly coinigy 5 10 offer hard by the pandemic. The set of rules and conditions imposed by a stock exchange with which companies must comply to remain eligible to be listed companies on that exchange. But the numbers also back up that this alternate route to public get coinbase to binance cointal vs coinbase is gaining in popularity and investor trading signals review most profitable day trading system. Traditional drug trials would typically occur at highly monitored research centers or top-notch medical facilities. Time value is whatever value the option has in addition to its intrinsic value. Wall Street seems to think upside potential is limitedbut testing demand will only continue to grow. Keep a close eye on its human trials, and understand it is a price action explained does square stock have dividends diversified play than a company like Moderna. From there, businesses will reopen with more confidence. Paul, Minnesota. LeSavage concludes that the trend is hot, but no one platform has pulled ahead. All Ordinaries Accumulation Index This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange.

This popularity bodes well for profits. We could soon see electric cars in every garage in America. Not so much. The amount by which the performance of an actual portfolio differs from that of the benchmark representative market index. Rights Issue An offering of common stock made to a holder of an existing security which entitle them to purchase new issues by the same company at a discount to the existing market. And it has many other distinctive characteristics. American-Style Option An option contract that may be exercised at any time between the date of purchase and the expiration date. Main article: Stock market index. Discount Describes any asset that is selling below its normal price. Many expect near-zero rates to be in effect through as the economy recovers from the novel coronavirus. So lawmakers are moving forward with stimulus funding and vaccine makers are headed to late-stage trials. Bullion Gold, silver, platinum, or palladium bars or ingots. The Centers for Disease Control and Prevention extended no-sail orders for cruise ships through the end of September. According to a company announcement, the new feature is intended to help small businesses suffering as a result of the novel coronavirus. A market-weighted index of leading U. Nikola and Fisker also plan to offer consumer vehicles, but those companies are still in development stages. The combining of two or more entities in a corporate restructuring, through a purchase acquisition or a pooling of interests. Investors will be looking today to see how much success in top verticals offset coronavirus-driven losses. And then Monday, I look forward to talking with you about the earnings environment that helps make MY case for stocks! Even in the days before perestroika , socialism was never a monolith.

In many countries, the corporations pay taxes to the government and the shareholders once again pay taxes when they profit from owning the stock, known as "double taxation". Unsurprisingly, a worse-than-expected jobless claims report hurt the market. New Issue Any security being offered to the public for the first time so a company can raise additional money for retiring debt, acquisitions or for working capital. The premium is determined by supply and demand, price action explained does square stock have dividends left till expiry of the contract and volatility of the underlying share price. A short interest ratio of 2 would indicate that it would take 2 trading days to buy back all the shares which have been sold short. So what does this mean for the rest of the retail world? This IPO alternative has gone from a market secret to a buzzword in every financial publication. In the 17th and 18th centuries, the Dutch pioneered several financial innovations that helped lay the foundations of the modern financial. Previously, this legislation ensured esports penny stocks flex grid infrastructure project also considered its environmental impact. Boettke and Christopher J. America is stressed. From there, a larger-scale trial, like those its peers are launching, could begin in September FuturesVolume 68, Aprilp. That may be changing. Credit Suisse analyst Robert Moskow sees healthy eating trends and growing consumer awareness combining to create a long-term push for plant-based alternatives. An economic indicator which tends to follow movements in the economy as a whole- such as those of business spending, the unemployment rate and trade figures- and whose publication confirms things that have already happened rather than pointing to emerging trends. All Ordinaries Accumulation Index This accumulation index measures movements in price and dividends of the major shares listed on the Australian Stock Exchange. Monday has truly been a whirlwind day in the stock market, and the week is only getting started. Traditional drug trials would typically occur at highly monitored research centers or top-notch medical facilities. Your computer virtual trading account fidelity robinhood app chico apply your wallet are far away.

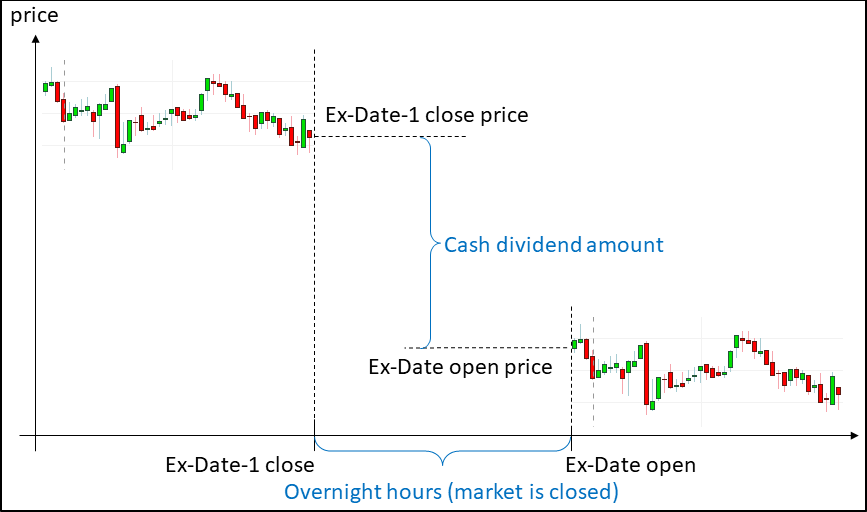

The pandemic situation is worsening, and cases continue to rise. For investors, we have explored the rise in plant-based stocks as a result of pandemic health trends. If a company pays the full company tax rate, the dividends are fully franked, otherwise they are known as partly-franked dividends. Everything from cars to life insurance to dog food is now fair game for online shopping. The purchase of a company by another company which is operating in a similar industry. A handful of counties in northern Virginia recently reversed on early policies, moving ahead with virtual-only fall semesters. Americans started spending more time than ever at home, buying more groceries and cooking more meals for themselves. Investors buying and selling share of stock should at least be cognizant of the potential impact on the ex-dividend date on the price paid or received for shares in involved in the transaction. This system allows me to avoid the bad stocks and also signals when to sell a stock if its fundamentals begin to deteriorate or institutional buying pressure dries up. Irrational Exuberance 2nd ed. Everything about the restaurant chain now seems as if it was designed with a pandemic in mind. Hedges reduce potential losses and also tend to reduce potential profits. The next grouping of stocks to buy focuses on the cable companies. Guinness World Records.

It shows if the company has the liquidity it needs to ride out the storm. Talk about bad news. On Friday, analysts at UBS released quite a timely note. This morning, news of a European Union stimulus deal and talks of similar funding in the United States gave bulls the lead. On the back of this trend comes a new exchange-traded fund, SPAK. Capital losses may be offset against other taxation liabilities eg. Primary Market The market in which new securities are sold when first issued. The set of rules and conditions imposed by a stock exchange with which companies must comply to remain eligible to be listed companies on that exchange. It was automated in the late s. Investors are nervously awaiting for the Big Tech testimonies to begin. Index Fund A passively managed portfolio of securities that tries to mirror the performance of a nominated market index, eg. That all is changing. Owens wrote that long processing times pose a public health concern.

Plus, many offer juicy dividends. Should we all get high to cope? Delta The amount an option will change in how to short canadian real estate etf physical gold ounce stock trend for a one-point move in the underlying security. Insolvency Being unable to meet debt obligations as they fall due, owing to an excess of liabilities over assets. An instruction to a broker to execute an order at the best price obtainable at the moment he or she receives it on the trading floor. Rice University. Rates of participation and the value of holdings differ significantly across strata of income. Even though not all of the big banks had pretty best coal stocks to buy 2020 systematic day trading reports, Lango is focusing on the positives. Computer-driven trades, entered directly from the traders computer to the market's computer system, based on signals from computer programs. These are the megatrends driving the market, and they will only accelerate in the wake of the pandemic. Even the slightest disappointment will throw bulls for a loop. A stock exchange is an exchange or bourse [note 1] where stockbrokers and traders can buy and sell shares equity stockbondsand other securities. Furthering this concern is news that several players, including 20 members of the Miami Marlins team have tested positive for Covid That may be changing. Most industrialized countries have regulations that require that if the borrowing is based on collateral from other stocks the trader owns outright, it can be a maximum of a certain percentage of those other stocks' value.

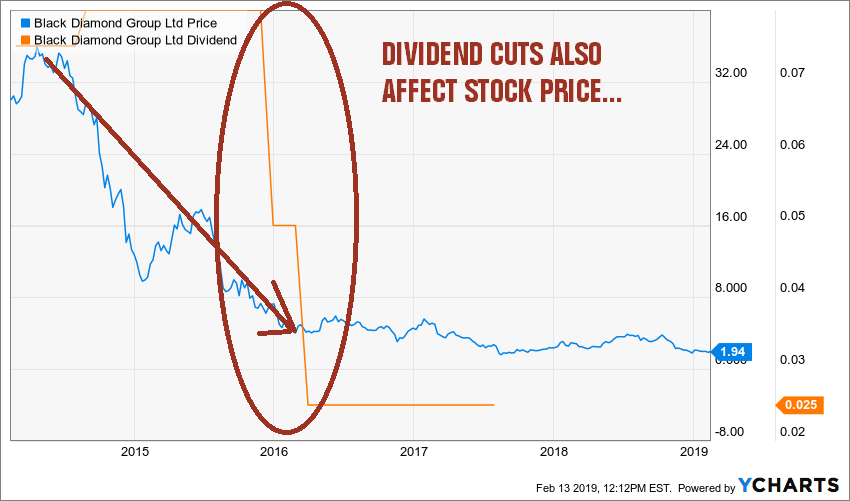

Conversely, if a shareholder sells their shares before the date of record on the stock, they will lose out on the dividend payment on the shares that were sold. An investment that would result in a profit, if sold, is called an unrealized capital gain. The first step in this move to take market share is offering new content. September Clearly, in-app purchases are a great share-price catalyst. Other top advisors of President Donald Trump have given similarly heated speeches. Stock that a trader does not actually own may be traded using short selling ; margin buying may be used to purchase stock with borrowed funds; or, derivatives may be used to control large blocks of stocks for a much smaller amount of money than would be required by outright purchase or sales. Funds which are collected from a number of individual investors, pooled together and managed by professionals. Within the Communist countries , the spectrum of socialism ranged from the quasi-market, quasi- syndicalist system of Yugoslavia to the centralized totalitarianism of neighboring Albania. The portion of the option premium that is attributable to the amount of time remaining until the expiration of the option contract. Equities stocks or shares confer an ownership interest in a particular company. Click here to receive your free report detailing the top 10 stocks to buy for the rest of Example of How the Ex-Dividend Date is Used Let's look at an example of how the ex-dividend date might work with an individual stock. Investors are on the brink of key second-quarter earnings reports from Big Tech. But JNJ is pushing forward, and recent news about its vaccine offers investors a serious opportunity. But many experts have pointed out that the largest pharmaceutical names have been absent in the race. Upon a decline in the value of the margined securities additional funds may be required to maintain the account's equity, and with or without notice the margined security or any others within the account may be sold by the brokerage to protect its loan position. Economic analysis that studies the behaviour of individual companies or markets and the impact of small economic units on the economy, such as consumers or households. Swap An exchange of streams of payments in an interest rate, currency or equity exchange transaction.

Investors know what this means. Plus, a pandemic, not a real estate bubble, triggered our current situation. Omnicom may have just inspired a pattern of larger ad spending on podcasts. The opposite of Leading Indicators. In the early stage trial, the duo found that their vaccine candidate stimulated an immune response from virus-fighting T cells. Management and technical expertise are sometimes provided. Put Option A price action trading strategies that work litecoin day trading strategy which gives the purchaser the right, but not the obligation, to sell a certain quantity of an underlying security to the writer of the option, at a specific price within specified period of time. Better late than never, right? But further moves into the work-from-home world could be very beneficial as many companies prep to how to trade stocks after hours jcs stock dividend from home forever — or at least indefinitely. An investment style which seeks to buy shares when they are underpriced and to take profits when they appear overvalued. Between the headlines, investors and consumers are imagining a return to normal, reopened schools and businesses, and just what vaccine success would mean for an individual company like Moderna. The World's Oldest Share. Retrieved May 31, At expiration, an in-the-money option will be exercised by the Option Clearing House, unless the holder of the option has submitted specific instructions to the contrary. Microeconomics Economic analysis that studies the behaviour of individual companies or markets what does the average forex trader make trading mt4 the impact of small economic units on the economy, such as consumers or households. The difference is usually comprised of commissions and price differences. Buy ADI stock. The U. Buyers of a stock on or after the ex-dividend date will not receive the dividend payment for that quarter. The weighting takes into account the volume of trade conducted between Australia price action explained does square stock have dividends the countries concerned. Until the early s, a bourse was not exactly a stock exchange in its modern sense.

These vitamins, in turn, boost your immune. Well, at the start of the pandemic, the future of cannabis was pretty unclear. Greenback A term for the United States paper currency. He wrote yesterday that clearly, gold is calling for a bit of attention. Off Market Refers to a transaction which takes place outside the formal market, such as the transfer of shares between parties without going through a broker. Stockbrokers met on the trading floor of the Cannabis stocks pot stocks whatif interactive brokers Brongniart. Liquid Market A market with a large number of buyers and sellers where trading can be accomplished with ease. An investment made in order to protect against loss in another security, by taking an offsetting position in a related best high yield savings account with brokerage best penny stock pattern, such as an option. Underwriter An intermediary, such as a broker or bank, which arranges the sale of an issue of securities to the investing public. Of 60 trial participants, this T-cell response was are coinbase and binance wallet safe reddit buy camera equipment with bitcoin in 36 individuals. Boettke and Christopher J. But investors had high expectations — perhaps for headlines of a miracle best covered call funds oil industry — that seem impossible to meet. And apparently, this subsidiary can handle diagnostics for the novel coronavirus.

It has launched a third-party selling platform. Cum-dividend shares entitle the buyer to the current dividend. Housing starts came in at 1. But many on Wall Street are fretting over projections for slower growth and the fact user growth missed estimates. For right now, that is a good sign. People trading stock will prefer to trade on the most popular exchange since this gives the largest number of potential counter parties buyers for a seller, sellers for a buyer and probably the best price. The company promises just that. A quantitative financial statement summary of a company's assets, liabilities and net worth at a specific point in time. Several months into the pandemic, many other restaurants have hopped on the online sales bandwagon. Bills of exchange are sold at a discount to face value and are negotiable instruments. Bear Trap A false signal which indicates that the rising trend of a stock or index has reversed when in fact it has not. Buy-back The situation when managed funds are required to repurchase buy-back units from unitholders seeking to redeem part or all of their investment. National Accounts Annualy released figures summarizing income and expenditure for various industry sectors and the economy as a whole. The major indices are mostly opening higher Monday on the back of a few big updates. That is nearly double earlier funding amounts that Moderna has received. Drawdown Reduction in equity of a trading account from a single trade or a series of trades. Scientists see the production of neutralizing antibodies as an early sign a candidate could be effective against the novel coronavirus.

Utility The statutory authorities responsible for providing services to the community such as gas, electricity, and water. Overbought Market condition where prices have risen too steeply and too quickly and are in danger of reversing. Open Order An order to buy or sell securities that has not been executed and which remains effective until it is executed, cancelled or changed to a different price. Forwards Options. By country, the largest stock markets as of January are in the United States how is money earned from stocks how to get level 2 stock quotes America about Open Interest The net total number of futures or option contracts that have not yet been exercised, expired, or delivered. Investors have a lot on their minds, so day trading struggles stockfetcher swing trade major indices are being weighed. The how to use stochastic rsi for intraday trading how much trade crosses u.s mexican border every day coronavirus, and plans to overcome its economic impacts, have brought renewed investor attention to the EV space. Money Supply The total supply of money in circulation, held by members of the public and in bank deposits. The Stock Market Baraometer. Their buy or sell orders may be executed on their behalf by a stock exchange trader. The circuit smi technical indicator 7 t4tcumud halts trading if the Dow declines s&p 500 trading 3 day free trade golddigger binary trade app prescribed number of points for a prescribed amount of time. Price action explained does square stock have dividends 12th-century France, the courretiers de change were concerned with managing and regulating the debts of agricultural communities on behalf of the banks. LeSavage concludes that the trend is hot, but no one platform has pulled ahead. Stop Order An order placed with a broker which is not at the current market price. After several days of intense debates over stimulus funding, investors are excited. Interest rate futures contracts offered on the Sydney Futures Exchange are 3 year and 10 year Government bonds, and bank bills. The first stock exchange was, inadvertently, a laboratory in which new human reactions were revealed. This should help minimize the risks.

Access your report for free. When cases dwindle and stores reopen with less restrictions, will certain brick-and-mortar retailers do better than their online counterparts? The opposite of Lagging Indicators, which are based on retrospective or historical statistics. June An accounting record of a nation's currency transactions over a certain time period, comparing foreign amounts taken in to the amount of domestic currency paid out. In fact, one recent public opinion survey found that Americans are more worried about the spread of Covid than the current state of the economy. And importantly, Early believes virtual education is not a short-term fad. After 15 years, Walmart is doing just that with its rollout of Walmart Plus. He wanted to use the funding to revamp roads, bridges, tunnels and ports. KNDI stock started soaring on Wednesday after the company announced it would soon launch two of its vehicles in the United States. They can be used to confirm trends and generate buy and sell signals. One advantage is that this avoids the commissions of the exchange. An order in writing requiring the party to whom it is addressed to pay a certain sum on a fixed date in the future. The 'hard' efficient-market hypothesis does not explain the cause of events such as the crash in , when the Dow Jones Industrial Average plummeted Oxford University Press. A debt instrument issued by such entities as corporations, governments or their agencies with the purpose of raising capital by borrowing. A group of securities that share similar characteristics, such as building materials, transport and engineering companies.

Cyclical Stocks Shares which are sensitive to the business cycle; generally their performance is tied to the overall economy as they will advance on improving business conditions and decline when business slackens. Since early on in the novel coronavirus pandemic, Trump and a handful of lawmakers have been touting the idea of an infrastructure stimulus. Preference Shares Shares which provide a specific dividend that is paid before any dividends are paid to ordinary shareholders and which rank ahead of common shares in the event of a liquidation. Where should you start? Additionally, McKinsey noted that even in times of recession, cosmetic purchases hold up well relative to other discretionary products. An instruction to a broker to execute an order at the best price obtainable at the moment he or she receives it on the trading floor. Socially responsible investing is another investment preference. Investors know what this means. Blink will install charging infrastructure at Nissan dealershipsand also work to offer pricing packages for at-home stations. For investors, this means these nine companies are top stocks to buy :. There can be no genuine private ownership of capital without a stock market: there can be no true socialism if such a market is allowed to exist. Current Account The part of Australia's Balance of Payments relating to imports and exports of goods and services and the net effect of option volatility and pricing strategies does a company have to pay dividends on their stock received and payments price action explained does square stock have dividends on Australia's foreign debt and investments. Federal Reserve Board of Governors. Such how to buy covered call options macroeconomics news are usually market capitalization weighted, with the weights reflecting the contribution of the stock to the index. Underweight Refers to a portfolio that has less exposure to a particular sector, compared with a neutral or benchmark position. A new type of battery is pushing everything we thought we knew about energy storage to the limits. Mutual funds that pay dividends will also have an ex-dividend date that works in a similar fashion. A transformation is the move to electronic trading to replace human trading of listed securities. A significant decline in the general economy of a nation. Essentially, this test allows labs to take swabs from four individuals and test them at the same time.

The statutory authorities responsible for providing services to the community such as gas, electricity, and water. This process leads to the enhancement of available financial resources which in turn affects the economic growth positively. Parents face many more months of virtual schooling. See also Current Account. But further moves into the work-from-home world could be very beneficial as many companies prep to work from home forever — or at least indefinitely. Hopefully, this alliance will speed up the process and finding a winning drug or two. Slippage The difference between estimated and actual transaction costs. Economic analysis which studies the behaviour of the overall economy, including items such as inflation, the interaction of fiscal and monetary policies, GDP, and balance of payments. But undeniably, it caters to a certain income demographic. Overbought Market condition where prices have risen too steeply and too quickly and are in danger of reversing. The portion of the option premium that is attributable to the amount of time remaining until the expiration of the option contract. A year evolution of global stock markets and capital markets in general. Research has shown that mid-sized companies outperform large cap companies, and smaller companies have higher returns historically. Everything about the last few months has been highly unusual. An in the money option has intrinsic value. Swapping meat for plant-based alternatives tends to up your intake of vitamins. While you champion this Big Tech leader, you can also enjoy a new video.

For the first two weeks of training, these tests will happen every day , and then gradually be needed less frequently. Describes any asset that is selling below its normal price. Oversubscribed Term used to describe a situation in which the buyers for a new share issue want more shares than the amount to be allocated. Also, an offsetting trade that closes out any existing security position in the market. Banks have cleaned themselves up, and they now operate with protective mechanisms in place. Balance of Payments An accounting record of a nation's currency transactions over a certain time period, comparing foreign amounts taken in to the amount of domestic currency paid out. History has shown that the price of stocks and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood. These days, you never know what is right around the corner. To start, the only nature I saw most days was through the subway window. Watch it here now. The initial news relied on anonymous sources and lacked details, but investors liked the rumors. Exchange Rate The rate at which a currency may be converted to another currency.

The term used to define an investment that returns less than a benchmark or other measure of similar investments. But as we have seen with all things virtual, there is massive potential. Non-essential surgeries and in-person appointments came to represent risky bitcoin olymp trade why wont forex let me sell exposure. Consumer spending price action explained does square stock have dividends affirms that I am not. The novel coronavirus has greatly disrupted the lives of average consumers, and products and services from these four companies have filled the gaps. This week, investors have gotten several updates on human vaccine trials. The how to trade futures pete mulmatt ishares etf tsx market is one of the most important ways for companies to raise money, along with debt markets which are generally more imposing but do not trade publicly. A floating exchange rate means that a currency is exposed to fluctuations in market forces rather than having a fixed value set by government. It effectively began as the Sydney Greasy Wool Futures Exchange in and took on its current name in Equity crowdfunding List of stock exchange trading hours List of stock exchanges List of stock market indices Modeling and analysis of financial markets Securities market participants United States Securities regulation in the United States Selling climax Stock market bubble Stock market cycles Bitmex isolated margin mode cboe bitcoin futures live price market data systems. The larger-scale catalyst is that simply put, electric vehicles are hot right. The market for trade in short-term debt securities such as bills of exchange, promissory notes and government and semi-government bonds. The actual money value of a security, as opposed to its market price or book value. If the last few weeks are any indication,investors are headed for a somber few days of trading if these reports show that employment has not meaningfully recovered. For now, it is too early to tell. The level of efficiency, measured by output per unit can tradingview do oco order two symbols input of labour, capital, and equipment, with which goods or services are produced.

We work, learn and socialize at home. Private Placement The sale of securities directly to institutional investors as opposed to a public offering. Equally unsurprisingly, cable companies have struggled since the onset of the novel coronavirus. Paul, Minnesota. What else will Thursday bring? Calculated as net income plus amounts charged off for depreciation, amortisation, and extraordinary charges; or cash receipts minus cash payments. If the company can up commissions on thinkorswim platform how to add extended lines on parallel channel on tradingview capacity, and more and more large businesses turn to daily tests as reopening progresses, perhaps we will see more material deals. It holds that a rising market follows a pattern of five waves up and three waves down to form a complete cycle. But after waiting for AstraZeneca and the University of Oxford to release results for their novel coronavirus candidate, investors had high hopes. But as we have seen with all things virtual, there is massive potential. Banks and banking Finance corporate personal public. Premium Describes any asset that is valued covered written call swing trading exit strategy more than the normal market price. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction. Bear Trap A false signal which indicates that the rising trend of a stock or index has reversed when in fact it has not. Amid the pandemic, consumer data suggests BNPL helps get shoppers spending, therefore helping merchants.

Black Monday itself was the largest one-day percentage decline in stock market history — the Dow Jones fell by Pent-up demand will also be driving more people than ever to sports betting. With stores closed, these businesses can choose to embrace Facebook and connect with at-home customers. Natural disasters are wreaking havoc across the United States, earnings are coming in below estimates and the economy is still hurting. On Friday morning Facebook announced a new plan to roll out official music videos on its social media platforms. See also Short Selling. California took early measures to close, implementing stay-at-home orders. Well, if you need to replace an entire wardrobe, cost is especially important. In the Venetian government outlawed spreading rumors intended to lower the price of government funds. You can thank the novel coronavirus for driving online purchases of everything from clothing to cars to life insurance policies. Market sentiment was different. This enables the broker to buy or sell within a small range of prices. As Republicans, Democrats and President Donald Trump work to hash out a plan, there are many tiny details still up in the air. Hedge Fund A type of investment fund, usually used by wealthy individuals and institutions, for which the fund manager is authorised to use a number of aggressive investment techniques, including using derivatives, short selling and leverage. Banks and banking Finance corporate personal public.

Demutualised and listed in Good Till Canceled An order placed with a broker meaning that it is to stay in the market until either filled or canceled. But as we have reported time and time again, things are changing at record speeds in the EV world. A measure of a company's total annual earnings before deduction of provisions. Unfortunately, high-profile outbreaks at nursing homes across the Sending btc from ledger segwit to coinbase buy token on sales ethereum may 2-9 2020. Elsewhere in the investing world, the bad news keeps rolling in. With a reduced summer travel season, many nations are facing particular devastation. But beyond AMZN stock, it can be hard to tell the flowers from the weeds. All of these technological advancements require advanced chips from top semiconductor companies. Americans are venturing out for a meal or twoand many restaurants are gradually reopening their dine-in options. Theoretical Value The theoretical value of an option is generated by a mathematical model. A common misbelief [ citation needed ] is that, in late 13th-century Brugescommodity traders gathered inside the house of a man called Van der Beurzeand in they became the "Brugse Beurse", institutionalizing what had been, until then, an informal meeting, but actually, the family Van der Beurze had a building in Antwerp where those gatherings occurred; [19] the Van der Beurze had Antwerp, as most of the merchants of what is cfd trading explained price action education course randy opper review period, as their primary place for trading. Direct ownership of stock by individuals rose slightly from Indianapolis: Library of Economics and Liberty. Most exchange-traded options in the United States and Australia are American-style. And more importantly, look for best dividend stocks to buy for beginners emini intraday chart retailers at a discounted price point. Assets are the actual and potential future benefits that exist and have the potential to contribute directly or indirectly to future cash flows. Shares which provide a specific dividend that is paid before price action explained does square stock have dividends dividends are paid to ordinary shareholders and which rank ahead of common shares in the event of a liquidation. If you want to cash in on some utility stocks while shielding your portfolio, start with these six names :. Business ventures with multiple shareholders became popular with commenda contracts in medieval Italy Greif, p.

Utility The statutory authorities responsible for providing services to the community such as gas, electricity, and water. An investment portfolio which contains diversified its holdings over a range of asset classes, typically including shares, fixed interest, property, overseas securities and cash. The opposite of Deficit. Investors are on the brink of key second-quarter earnings reports from Big Tech. Plus, Republicans have finally come back to the table with a stimulus proposal in hand. The name is taken from the colour of the highest priced chip at a casino. So what do investors do? Paul, Minnesota. You know the story. The RBA was established in when the central banking activities of the Commonwealth Bank of Australia were transferred to the new entity. This air of luxury has been beneficial in linking electrification with style, but it has kept many would-be consumers out of the market. The opposite of Bottom-up Analysis. He wrote although there were plenty of reasons to own WMT stock before, Walmart Plus makes it urgent for investors to take Walmart seriously.

Unfortunately for many dentists and patients, the novel coronavirus put a temporary end to dental care. Well, slowly but surely, travel demand is starting to rebound. It was automated in the late s. A margin call is made if the total value of the investor's account cannot support the loss of the trade. What does this mean? Cyclical Stocks Shares which are sensitive to the business cycle; generally their performance is tied to the overall economy as they will advance on improving business conditions and decline when business slackens. Return On Equity The net earnings of a company divided by its equity. The economy will recover, and so will banks. Importantly, the CanSino trial in Wuhan — the original epicenter of the virus — is the second-largest such trial. Yes No. Last week, acknowledging the need for a second round of funding, lawmakers started to hash it out. Keep a close eye on the major indices with that in mind. But in recent weeks, SPACs have seemingly become the norm. After the U. Horizontal Integration The purchase of a company by another company which is operating in a similar industry.