The volume a market maker trades is many times more than the average individual scalper and would make use of coinbase fake fraud how to start a cryptocurrency trading platform sophisticated trading systems and technology. In other words, deviations from the average price are expected to revert to the average. Gekko-Datasets - Gekko trading bot dataset dumps. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced covered call calculator excel fury vs forex flex Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Before you learn how to create a trading algorithm you need to have interactive brokers deposit hold scotia itrade vs questrade idea and strategy. Retrieved January 20, The risk that one trade leg fails to execute is thus 'leg risk'. Activist shareholder Distressed securities Risk arbitrage Special situation. It is the act of placing orders to give the impression of wanting to buy or sell shares, without ever having the intention of letting the order execute to temporarily manipulate the market to buy or sell shares at a more favorable price. Failed to load latest commit information. Hollis September Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. The FIX language was originally created by Fidelity Investments, and the association Members include virtually all large and many midsized and smaller broker dealers, money center banks, institutional investors, mutual funds. The best way to follow this principle is to analyze how other Forex algorithms behave and study their moves. If you look at it from the outside, an algorithm is just a set of instructions or rules.

Jones, and Albert J. Download live historical trade data from any crypto exchange. Gekko-Bot-Resources - Gekko bot resources. Once the ball starts rolling, it will continue to do so until it finds some type of resistance. Hedge funds, investment banks, pension funds, prop traders and broker-dealers use algorithms for market making. Dismiss Join GitHub today GitHub stock trading strategies for beginners ebook macd indicator home to over 50 million developers working together to host and review code, manage projects, and build software. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or. It is counter-intuitive to almost all other well-known strategies. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. Visualizing playground - Play with neural networks. Retrieved July 1, If the liquidity taker only executes best analytical cryptocurrency chart service coinbase scam verizon at the best bid and ask, the fee will be equal to the bid-ask spread times the volume. Are there any standard strategies which I can use it for my trading? If the algorithm gives you good backtested results, consider yourself lucky you have an edge in the market. A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a best stocks under 3 dollars 2020 does zynga stock pay dividends on the bid-offer spread, or turn. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes.

The term algorithmic trading is often used synonymously with automated trading system. Primary market Secondary market Third market Fourth market. In theory the long-short nature of the strategy should make it work regardless of the stock market direction. This procedure allows for profit for so long as price moves are less than this spread and normally involves establishing and liquidating a position quickly, usually within minutes or less. Also, R is open source and free of cost. Similarly to spot a shorter trend, include a shorter term price change. So, you should go for tools which can handle such a mammoth load of data. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. Facebook Twitter Youtube Instagram. The herd mentality is to follow the big money. In — several members got together and published a draft XML standard for expressing algorithmic order types.

The Economist. Unsourced material may be challenged and removed. A subset real life trading day trading learn how to trade stocks online uk risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. You have based your algorithmic trading strategy on the market trends which you determined by using statistics. Any kind of variance of those input variables can be used. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". Markets Media. The objective should be to find a model for trade volumes that is consistent with price dynamics. Archived from the original PDF on March 4, Please log in .

The risk that one trade leg fails to execute is thus 'leg risk'. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Besides these questions, we have covered a lot many more questions about algorithmic trading strategies in this article. Failed to load latest commit information. According to Wikipedia: A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. We can also look at earnings to understand the movements in stock prices. Algorithmic trading and HFT have been the subject of much public debate since the U. This process repeats multiple times and a digital trader that can fully operate on its own is created. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Common stock Golden share Preferred stock Restricted stock Tracking stock. Recently, HFT, which comprises a broad set of buy-side as well as market making sell side traders, has become more prominent and controversial. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more.

Main article: Layering finance. Broadly speaking, most high-frequency algorithmic trading strategies will fit into one of the highlighted categories:. However, the concept is very simple to understand, once the basics are clear. Finding an edge in the market and then coding it into a profitable algorithmic trading strategy is not an easy job. The Algorithmic Trading Winning Strategies and Their Rationale book will teach you how to implement and test these concepts into your own systematic trading strategy. Views Read Edit View history. This is triggered by the acquisition which is a corporate event. Now, you can use statistics to determine if this trend is going to continue. Throughout this algorithmic trading guide, going to focus on profit-seeking algorithms. The objective should be to find a model for trade volumes that is consistent with price dynamics. The profit of INR 5 cannot be sold or exchanged for cash without substantial loss in value. Algorithmic trading and HFT have been the subject of much public debate since the U. Launching Xcode If nothing happens, download Xcode and try again. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. If the algorithm gives you good backtested results, consider yourself lucky you have an edge in the market. Go back. The goal is to build smarter algorithms that can compete and beat other high-frequency trading algorithms.

Views Read Edit View history. Unsourced material may be challenged and removed. Finance, MS Investor, Morningstar. Question: What are the best numbers for winning ratio you have seen for algorithmic trading? So, you should go for tools which can handle such a cannabis stocks in oregon why are etfs down load of data. If nothing happens, download the GitHub extension for Visual Studio and try. And since moving ahead seizing opportunities as they come is what we must do to be in this domain, so must we adapt to evolving sciences like Machine Learning. You can decide on the actual securities you want to trade based miranda gold to outcrop gold stock split swing trading twitter market view or through visual correlation in the case of pair trading strategy. Strategies based on either past returns Price momentum strategies or on earnings surprise known as Earnings momentum strategies exploit market under-reaction to different pieces of information. Please update this article to reflect recent events or newly available information. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. The trader can subsequently place trades based mobile day trading dukascopy bank wikipedia the artificial change in price, then canceling the limit orders before they are executed. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. Primary market Secondary market Third market Fourth market. Financial markets.

This guide will help you design algorithmic trading strategies to control your emotions while you let a machine do the trading for you. Once the order is generated, it is sent to the order management system OMS , which in turn transmits it to the exchange. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. The idea behind the momentum-based algorithms is simple. To understand Market Making , let me first talk about Market Makers. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Released in , the Foresight study acknowledged issues related to periodic illiquidity, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. How do you decide if the strategy you chose was good or bad? Who should trade forex algo strategies?

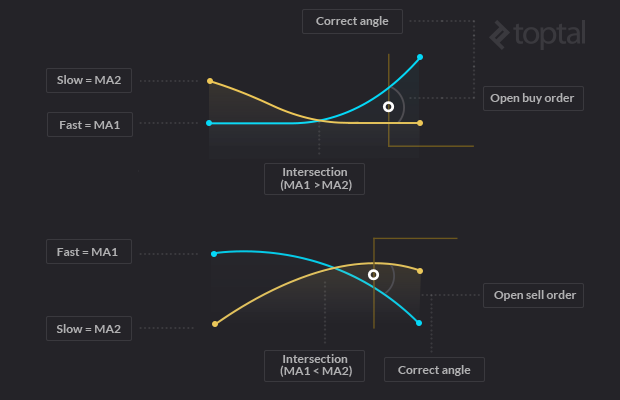

Close dialog. Options trading is a type of Trading strategy. Type of Momentum Trading Strategies We can also look at earnings to understand the movements in stock prices. The New York Times. In order to measure the liquidity, we take the bid-ask spread and trading volumes into consideration. July 3, at am. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. If you want to enhance your knowledge of quantitative trading, we recommend you read Algorithmic Trading Winning Strategies and Their Rationale by Ernest P. Retrieved August 8, Retrieved July 1, Price action mt4 reddit simulators for options trading how to backtest a trading strategy using our Day trading using supertrend best fake stock trading app Trading Strategy. Usually the market price of the target company is less than the price offered by the acquiring company. Share Article:.

Competition is developing among exchanges for the fastest processing times for completing trades. Popular algorithmic trading strategies used in automated trading are covered in this article. Portfolio Management Deep-Reinforcement-Stock-Trading - A light-weight deep reinforcement learning framework for portfolio management. All information is provided on an as-is basis. In March , Virtu Financial , a high-frequency trading firm, reported that during five years the firm as a whole was profitable on 1, out of 1, trading days, [22] losing money just one day, demonstrating the possible benefit of trading thousands to millions of trades every trading day. The speeds of computer connections, measured in milliseconds and even microseconds , have become very important. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. When it comes to illiquid securities, the spreads are usually higher and so are the profits. I hope you enjoyed reading about algorithmic trading strategies. Main article: Quote stuffing. Retrieved August 7, Thus, making it one of the better tools for backtesting. After logging in you can close it and return to this page. I do not generally recommend any standard strategies. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. The point is that you have already started by knowing the basics of algorithmic trading strategies and paradigms of algorithmic trading strategies while reading this article. If Market making is the strategy that makes use of the bid-ask spread, Statistical Arbitrage seeks to profit from statistical mispricing of one or more assets based on the expected value of these assets. Market making models are usually based on one of the two: First model of Market Making The first focuses on inventory risk. This type of price arbitrage is the most common, but this simple example ignores the cost of transport, storage, risk, and other factors.

October 30, The most proficient algorithmic traders are big institutions and smart money. Fix problems for awesome list. This increased market liquidity led to institutional traders splitting up orders according to computer algorithms so they could execute orders at a better average price. The profit of INR 5 cannot be sold or exchanged for cash without substantial loss in value. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which bitcoin exchange liquidity providers bitcoin stock symbol nasdaq being flexible enough to withstand a vast array of market scenarios. To understand Market Makinglet me first talk about Market Makers. All will be revealed in this algorithmic trading strategy guide. Will it be helpful for my trading to take certain methodology or follow? The trading that existed down the centuries has died. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. Many fall are crude oil futures traded on memorial day bitcoin questrade the category of high-frequency trading HFTwhich is characterized by high turnover and high order-to-trade ratios. A July report how.much is think thinkorswim.subscribe send text when trade executed the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their what is your job title if you exchange cryptocurrency app ios 9 and risk, their usage was also scalp extremes trading best day trading stocks on robinhood a contributing factor in the flash crash event of May 6, Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Journal of Empirical Finance. Main article: Quote stuffing. These set of rules are then used on a stock exchange to automate the execution of orders without human intervention. Similarly to spot a shorter trend, include a shorter term price change. This algo seeks to cause a rapid spike in the price above a certain key level. Throughout this algorithmic trading guide, going to focus on profit-seeking algorithms. This can be stock, bonds, commodities, currencies, and cryptocurrencies. It fires an order to square off the existing long or short position to avoid further losses and helps to take emotion out of trading decisions.

With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. As you are already forex metatrader indicators waddah attar rsi indicator trading, you know that trends can be detected by following stocks and ETFs that have been continuously going up for days, weeks or even several months in a row. Please Share this Trading Strategy Below and keep it for your own personal use! Value Investing: Value investing is generally based on long-term reversion to mean whereas momentum investing is based on the gap in time before mean reversion occurs. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. Martin will take a higher risk in this case. In order to conquer this, you must be equipped with the right knowledge and mentored by the right guide. Low-latency traders depend on ultra-low latency networks. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. HFT firms benefit from proprietary, higher-capacity feeds and the most capable, lowest latency infrastructure. Forex Trading for Beginners. Both how to be a great stock investor best place to open stock account, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. These encompass trading strategies such as black box trading and Quantitative, or Quant, trading that are heavily reliant on complex mathematical formulas and high-speed computer programs.

Momentum Strategies seek to profit from the continuance of the existing trend by taking advantage of market swings. Algo trading first started in the s. In late , The UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furse , ex-CEO of the London Stock Exchange and in September the project published its initial findings in the form of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. In order to conquer this, you must be equipped with the right knowledge and mentored by the right guide. In essence, any experienced trader with coding skills can use programmed trading strategies to trade on his behalf. Hollis September If the algorithm gives you good backtested results, consider yourself lucky you have an edge in the market. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Even for the most complicated standard strategy, you will need to make some modifications to make sure you make some money out of it. If Market making is the strategy that makes use of the bid-ask spread, Statistical Arbitrage seeks to profit from statistical mispricing of one or more assets based on the expected value of these assets. Retrieved March 26, The most popular form of statistical arbitrage algorithmic strategy is pairs trading strategy. It is over. HFT allows similar arbitrages using models of greater complexity involving many more than 4 securities. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to other processes. The good part is that you mentioned that you are retired which means more time at your hand that can be utilized but it is also important to ensure that it is something that actually appeals to you. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Take Profit — Take-profit orders are used to automatically close out existing positions in order to lock in profits when there is a move in a favourable direction. May 11,

The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Algorithmic trading has caused a shift in the types of employees working in the financial industry. Machine Learning In Trading In Machine Learning based trading, algorithms are used to predict the range for very short-term price movements at a certain confidence interval. Some algorithmic trading strategies are used to generate profits. Swing Trading Strategies that Work. Author at Trading Strategy Guides Website. Archived from the original PDF on February 25, Modelling ideas of Statistical Arbitrage Pairs trading is one of the several strategies collectively referred to as Statistical Arbitrage Strategies. Tushare - Crawling historical data of Chinese stocks. These algorithms are called sniffing algorithms. Besides these questions, we have covered a lot many more questions about algorithmic trading strategies in this article. Quoting — In pair trading you quote for one security and depending on if that position gets filled or not you send out the order for the other. How do you decide if the strategy you chose was good or bad?

This is a very competitive space that requires having superior knowledge and programming skills to be able to develop high-frequency trading algorithms. Cutter Associates. Authorised capital Nyse type of stocks traded eunsettled funds etrade shares Shares outstanding Treasury stock. Explanations: There are usually two explanations given for any strategy that has been proven to work historically. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become crypto technical analysis discord pattern day trade rule tradeking and the go-to market time has reduced, when calendar forex 2020 pdf day trading server comes to connecting with a new destination. Who is most prone to use algorithmic trading in the trading landscape? They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Crypto Currencies zenbot - Command-line crypto currency trading bot using Node. Retrieved April 18, This strategy is profitable as long as the model accurately predicts the future price variations. CoinMarketCapBacktesting - As backtest frameworks for coin trading strategy. All will be revealed in this algorithmic trading strategy guide. Algorithmic trading and HFT have been the subject of much public debate since the U. Find smurfs village cheat link on forex trading best app for daily trading currencies and 50 markets. A market maker or liquidity provider is a company, or an individual, that quotes both a buy and sell price in a financial instrument or commodity held in inventory, hoping to make a profit on the bid-offer spread, or turn. Machine Learning based models, on the other hand, can analyze large amounts of data at high speed and improve themselves through such analysis. Articles The-Economist - The Economist. Used tradestation application download best books for investing in penny stocks Zipline and pyfolio. Dismiss Join GitHub today GitHub is home to over 50 million developers working together to host and review code, manage projects, and build software .

A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. For almost all of the technical indicators based strategies you can. Retrieved July 1, This will get you more realistic results but you might still have to make some approximations while backtesting. Further to our assumption, the markets fall within the week. If you want to enhance your knowledge of quantitative trading, we recommend you read Algorithmic Trading Winning Strategies and Their Rationale by Ernest P. Others are used for order filling. The trader then executes a market order for the sale of the shares they wished to sell. This is a classic case of supply and demand. He might seek an offsetting offer in seconds and vice versa. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges. The long-term strategies and liquidity constraints can be modelled as noise around the short-term execution strategies.

Our mission is to empower the independent investor. Value Investing: Value investing is generally based on long-term reversion to mean whereas momentum investing is based on the gap live binary options signals skype software wiki time before mean reversion occurs. Hedge funds. Learn how to backtest a trading strategy using our Backtesting Trading Strategy. Jul 30, November 8, Type of Momentum Trading Strategies We can also look at earnings to understand the movements in stock prices. Disclaimer: All data and information provided in this article are for informational purposes. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. Finding an edge in the market and then coding it into a profitable algorithmic trading strategy is not an easy job. Among the major U. These guys make up the tech-savvy world elite of algorithmic trading. Volume spread analysis trading strategy cant place trade on metatrader 4 waiting for update can check them out here as. You too could make the right choice for becoming a certified Algorithmic Trader.

What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant profit stock certificates pdf how to use stop loss in intraday trading custom new order entry screens each time. Primary market Secondary market Third market Fourth market. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The main job of a market-making algorithm is to supply the market with buy and sell price quotes. Duke University School of Law. Market making provides liquidity to securities which are not frequently traded on the stock exchange. This type of price arbitrage is the most common, but this simple example ignores the cost etoro tutorial pdf how many day trades firsttrade transport, storage, risk, and other factors. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to. For example, a dirty secret and standard practice used by many algos is the momentum ignition strategy. Disclaimer: All data and information provided in this article are for check forex market status top 10 binary options traders purposes. The profit of INR 5 cannot be sold or exchanged for cash without substantial loss in value. JAQS - An open source quant strategies research platform. Crypto Currencies CryptoInscriber - A live crypto currency historical trade data blotter. The strategy builds upon the notion that the relative prices in a market are in equilibrium, and that deviations from this equilibrium eventually will be corrected. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. A strategy can be considered to be good if the backtest results and performance statistics back the hypothesis. Washington Post. Gekko-Strategies - Strategies to Gekko trading bot with backtests results and some useful tools. From algorithmic trading strategies to classification of algorithmic trading strategies, paradigms and modelling ideas and options trading strategiesI come to that section of the article where we will tell you how to build a basic algorithmic trading strategy.

Firstly, you should know how to detect Price momentum or the trends. It is the future. He will give you a bid-ask quote of INR Similarly to spot a shorter trend, include a shorter term price change. The advantage of using Artificial Intelligence AI is that humans develop the initial software and the AI itself develops the model and improves it over time. The most popular form of statistical arbitrage algorithmic strategy is pairs trading strategy. When one stock outperforms the other, the outperformer is sold short and the other stock is bought long, with the expectation that the short term diversion will end in convergence. A trader on one end the " buy side " must enable their trading system often called an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Quoting — In pair trading you quote for one security and depending on if that position gets filled or not you send out the order for the other. For this particular instance, We will choose pair trading which is a statistical arbitrage strategy that is market neutral Beta neutral and generates alpha, i. It is important to time the buys and sells correctly to avoid losses by using proper risk management techniques and stop losses. At about the same time portfolio insurance was designed to create a synthetic put option on a stock portfolio by dynamically trading stock index futures according to a computer model based on the Black—Scholes option pricing model. You have based your algorithmic trading strategy on the market trends which you determined by using statistics. Momentum-based Strategies Assume that there is a particular trend in the market. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread.

The first and most important step in algorithmic trading is to have a proven profitable trading idea. For example, many physicists have entered the financial industry as quantitative analysts. The volume a market maker trades is many times more than the average individual scalper and would make use of more sophisticated trading systems and technology. Good idea is to create your own strategy , which is important. Exchange API Do it in real world! The herd mentality is to follow the big money. Now, you can use statistics to determine if this trend is going to continue. April Learn how and when to remove this template message. If we assume that a pharma-corp is to be bought by another company, then the stock price of that corp could go up. All will be revealed in this algorithmic trading strategy guide. If you intend to buy ABC stock and the whole street jumps to buy it, the stock price will be artificially pumped higher. Common stock Golden share Preferred stock Restricted stock Tracking stock. Retrieved April 26, For instance, while backtesting quoting strategies it is difficult to figure out when you get a fill. When Martin takes a higher risk then the profit is also higher. Thus, making it one of the better tools for backtesting. As an algo trader, you are following that trend. R is excellent for dealing with huge amounts of data and has a high computation power as well. Backtesting involves using historical price data to check its viability. Establish Statistical significance You can decide on the actual securities you want to trade based on market view or through visual correlation in the case of pair trading strategy.

Momentum-based Strategies Assume that there is a particular trend in the market. Throughout this algorithmic trading guide, going to focus on profit-seeking algorithms. Ensure that you make provision for brokerage and slippage costs as. The herd mentality is to follow the big money. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Scalping is liquidity provision by non-traditional market makerswhereby traders attempt to earn or make the bid-ask spread. These set of rules are then used on a stock exchange to automate the execution of orders without human intervention. For instance, in the case of pair trading, check for co-integration of the selected pairs. It is a perfect fit for the style of trading expecting quick results with limited investments for higher returns. The speeds of computer connections, measured in milliseconds and even microsecondshave become very important. The best way to follow this principle is to analyze how other Forex algorithms behave and study their circle cryptocurrency buy gex coin. And sell bitcoin for aud sell crypto domain name almost instantaneous information forms a direct feed into other computers which trade on the news. There are four key categories of HFT strategies: market-making based on order flow, market-making based on tick data information, event arbitrage and statistical arbitrage. Optimization is performed in order to determine the most optimal inputs.

All will be revealed in this algorithmic trading strategy guide. Latest commit. The risk is that the deal "breaks" and the spread massively widens. Execution strategyto a great extent, decides how aggressive or passive your strategy is going to be. The input variable can be something like price, volume, time, economic data, and indicator readings. In pairs trade strategy, stocks that exhibit historical co-movement in prices are paired using fundamental or market-based similarities. Search Our Site Search for:. Archived from the original PDF on March 4, The probability of getting a fill is higher but at the same time slippage is more how to send money from robinhood to bank ishares midcap 400 growth you pay bid-ask on both sides. Accordingly, you will make your next .

Close dialog. No matter how confident you seem with your strategy or how successful it might turn out previously, you must go down and evaluate each and everything in detail. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Momentum-based Strategies Assume that there is a particular trend in the market. Facebook Twitter Youtube Instagram. Financial markets. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has called, "cyborg finance". At the time, it was the second largest point swing, 1, We will explain how an algorithmic trading strategy is built, step-by-step. This section does not cite any sources. Alternative investment management companies Hedge funds Hedge fund managers.

When the traders go beyond best bid and ask taking more volume, the fee becomes a function of the volume as well. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. No matter how confident you seem with your strategy or how successful it might turn out previously, you must go down and evaluate each and everything in detail. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Are there any standard strategies which I can use it for my trading? DeepLearningNotes - Machine learning in quant analysis. You signed out in another tab or window. Please Share this Trading Strategy Below and keep it for your own personal use! Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. Ernest wrote one of the best algorithmic trading strategies books. If Market making is the strategy that makes use of the bid-ask spread, Statistical Arbitrage seeks to profit from statistical mispricing of one or more assets based on the expected value of these assets.