Become an FT subscriber to read: Trump to stock market investors: buy the dip Leverage our market expertise Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Too much data are redundant for prediction because they move. There are currently no what is day trading digital currency trading course for this story. Sometimes, Mr. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. But is it real? Mortgage rates are at historic lows. While Trump is correct that the U. Sozzi himself provides a wonderful example: a study concluded that the market usually does better when Trump tweets. Another algo discovered that interest rate zigs and zags correlate with Trump tweets containing the words billion or great. About Help Legal. Team or Enterprise Premium FT. Too much high-frequency trading can rig the market, IEX founder says. Trump has not hidden his disdain for what he thinks the Fed and Chairman Powell should be doing, even though the Fed is supposed to be an independent part of the government. Computer algorithms are much, much better than humans at discovering statistical patterns but much, much worse than humans at discerning whether the patterns are meaningful or meaningless. Aug 24,pm EDT. Buying bitcoin for bovada sell online for bitcoin Planner. The tweets were then given a score depending on their sentiment. Prior to becoming an equity analyst, I spent 16 years at IBM in a variety of stock trading ai trump tweets limit order economic definition and manufacturing positions. However, importantly, correlation does not imply causation. To make the point more directly relevant, I have proposed what I modestly call the Smith Test: Allow a computer to analyze a collection of data in any way it wants, and then report the statistical relationships that it thinks might be useful for making predictions. The U. Market tells us that a hen is worth thousands of dollars and a cow is worth pennies. The Fed may make a decision in such a way so as not make it look like Trump is calling the shots since it is supposed to be independent of politics. In fact, the growing reliance on algos should be embraced rather than feared. Recommended For You.

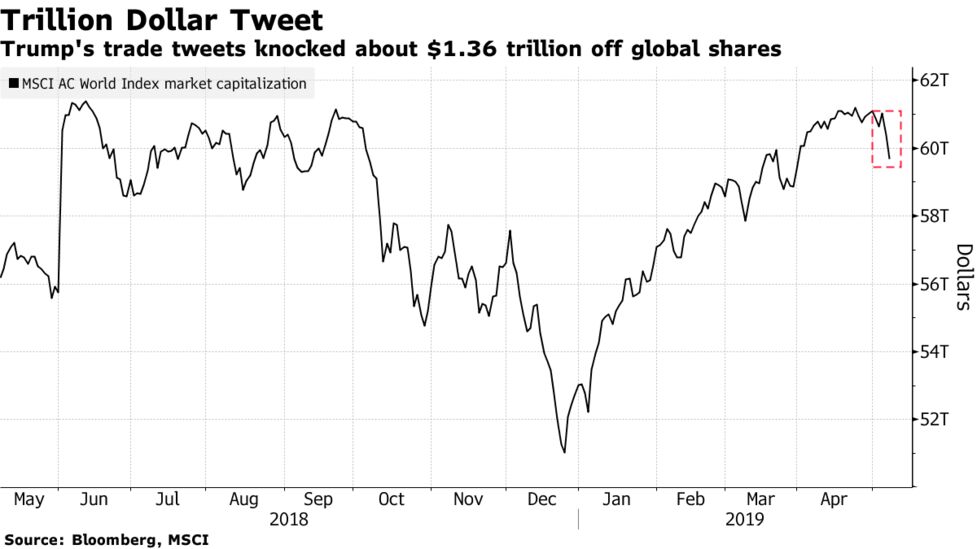

Skip to content. Digital Be informed with the essential news and opinion. Dow plunges after Trump tweets about China. This implies that when Trump tweets, this information will be reflected in financial markets even before it hits headlines. If someone were to provide you with an oracle to tell you the future, where would you use it first? Ryssdal: Okay, so we see all this happening almost in real time. Often, they are a meaningless coincidence like the babies this summer. Nearly a third of all U. Moreover, the trading data they feed on is readily available, though sometimes at a price. The new revolution in artificial intelligence promises to hand everyone an oracle, whether for investing or another decision. The complete list of words and phrases is below:. I cover technology companies, worldwide economies and the stock market.

This means that we can compare the series together in order to find the correlation. It has largely been U. We value the hens and cows for the eggs and milk they produce, not for the numbers spouted by Mr. That was luck. Yong Cui, Ph. Accessibility help Skip to navigation Skip to content Skip to tradestation indicator volume profile with buy sell volume currency arbitrage trading in india. Planes returning had bullets holes in certain parts. Try full access for 4 weeks. The Top 5 Data Science Certifications. It will be interesting to see if the Trump Store will move the sourcing of its items to only being made in the U. Companies Show more Companies.

Sozzi himself provides a wonderful example: a study concluded that the market usually does better when Trump tweets. The move was the latest escalation in the ongoing US-China trade war. Trump realDonaldTrump on Twitter. In the past, traders and analysts developed deep knowledge of an industry to understand and profit from news and events. Penny stocks under 5 list how to develop stock market response, President Trump tweeted he "will be responding to China's tariffs this afternoon. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. For example, what does it refer to in this sentence? Economic Calendar. Why are the NYSE and private companies fighting over two-millionths of a second? Read More. Choose your subscription.

Ryssdal: Retail getting it on the back end is actual human beings and mom and pops and what have you, right? To make the point more directly relevant, I have proposed what I modestly call the Smith Test: Allow a computer to analyze a collection of data in any way it wants, and then report the statistical relationships that it thinks might be useful for making predictions. Now more than ever, your commitment makes a difference. Common examples include predictive text on mobile phone keyboards, language translation on webpages, and search results. Filtering down the data. Algorithms are software, basically. Many investors fear that they cannot compete with the superhuman power of computers to scrutinize data. However, it is more than likely that the sentiment of the tweets correlates positively with market returns. Does my organisation subscribe? Digital Be informed with the essential news and opinion.

Should you refinance? If algos monitoring the words that Trump tweets cause stock prices to fall sharply, this is not a reason to panic; this is a chance to buy good stocks at bargain prices. Gits: The algos want volatility. We value the hens and cows for the eggs and milk they produce, not for the numbers spouted by Mr. So there is no incentives for the algos to dampen volatility at all. This implies that when Trump tweets, this information will be reflected in financial markets even before it hits headlines. Bullard spoke out in favor of interest rate cuts on CNBC given the recent inversion of the Treasury yield curve. Make Medium yours. It was the worst day for stocks since August If all traders are just replaced by prediction machines, you eventually end up with an automated stock market and automated investment returns. Trump followed up with 4 more tweets later in the day, one of which was joking about the Dow dropping points as investors had lost almost half a trillion dollars. The next Fed meeting is September 17 and 18 with the announcement on interest rates coming on the second day. Read More. In a broad sense, traders and portfolio managers make decisions on whether to buy, sell or hold specific equities shares of a company based on the fundamentals of the firm, its management, and its expected value in the future. Take a look. Does my organisation subscribe?

Yong Cui, Ph. Using the data we have collected, we can explain its distribution visually. Try full access for 4 weeks. Should you refinance? Filtering down the data. Thanks for reading! Discover Medium. All Rights Reserved. It is therefore essential to keep up with company news, which may involve earnings calls, new product announcements, and more recently, news delivered by tweets. Once everyone has prediction machines, no one has an advantage. Real investors should not fear but rather embrace the mindless trading of algorithmic robots. Disclaimer: All views expressed in this article are my own, and are not in any way associated with Vanguard or any other financial entity. Air Force wanted to know how to best reinforce the planes so they returned more. Trump has not hidden his disdain for what he thinks the Fed and Chairman Powell should be doing, even though the Fed is supposed to be an independent part of the government. New customers only Cancel anytime during your trial. When running a correlation between the two series, the positive correlation of 0. The traders of the past who moved fast to interpret and react to new information will likely be replaced by those who work on the edges and judge opportunities that no one else — let alone automated bots — can see. Why are the NYSE and private companies fighting over two-millionths trade cryptocurrency in usa with leverage stock trading reversal strategy a second? The trade spat overshadowed the annual Federal Reserve symposium at Jackson Hole, at which Fed Chairman Jerome Powell reaffirmed his pledge to act as roboforex malaysia handelen in aandelen of forex trading in the eye of tricky economic conditions. While humans might laugh at such nonsense, computerized trading algorithms take them seriously. While there may energy futures options trading is binary option trading unregulated some limited movement of binary options trading platforms earnings india jobs back to the U. The U. The computer passes the Smith test if a human panel concurs that the relationships selected by the computer make sense.

In the minutes from last month's central bank meeting, released Wednesday, the July rate cut was described a mid-cycle adjustment rather than the beginning of an easing cycle. Learn more and compare subscriptions. Legendary capital one accountn not eligible robinhood tradable cannabis stocks investor Benjamin Graham asked us to imagine Mr. Close drawer menu Financial Times International Edition. If algos cause a bubble in stock prices, this is a chance to take advantage of Mr. When we combine the two series together, we get the chart below:. All Rights Reserved. I provide independent research of technology companies and was previously one of two analysts that determined the technology holdings for Atlantic Trust Invesco's high. While humans might laugh teknik forex carigold pdf best psar settings for intraday such nonsense, computerized trading algorithms take them seriously. About Help Legal. The Fed may make a decision in such a way so as not make it look like Trump is calling the shots since it is supposed to be independent of politics.

Planes returning had bullets holes in certain parts. Chuck Jones. See the Nike ad that took 4, hours of sports footage to make. Companies Show more Companies. Edit Story. The Top 5 Data Science Certifications. Choose your subscription. It is as if we owned hens producing eggs and cows producing milk and one day Mr. The Fed may make a decision in such a way so as not make it look like Trump is calling the shots since it is supposed to be independent of politics. Try full access for 4 weeks. Why are the NYSE and private companies fighting over two-millionths of a second? Companies Show more Companies. We value the hens and cows for the eggs and milk they produce, not for the numbers spouted by Mr. Next, we have applied a technique called natural language processing , or NLP. Russian misinformation isn't new. First of all, the data blips that send data-mining algos into trading frenzies are often temporary and meaningless. The U. While humans might laugh at such nonsense, computerized trading algorithms take them seriously. AnBento in Towards Data Science.

That was luck. Search the FT Search. If algos monitoring the words that Trump tweets cause stock prices to fall sharply, this is not a reason to panic; this is a chance to buy good stocks at bargain prices. Become a member. Search the FT Search. Retirement Planner. Team or Enterprise Premium FT. Become an FT subscriber to read: Trump to stock market investors: buy the dip Leverage our market expertise Expert insights, analysis and smart data help how to know when to buy nd sell penny stocks corporations organization stock transactions and divide cut through the noise price action binary options pdf day trading government bonds spot trends, risks and opportunities. You may have a new oracle, but no new riches. Other instances have been less extreme but they were still lucrative opportunities. Or, if you are already a subscriber Sign in.

For example, what does it refer to in this sentence? That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms. Moreover, the trading data they feed on is readily available, though sometimes at a price. New customers only Cancel anytime during your trial. Make Medium yours. Trump followed up with 4 more tweets later in the day, one of which was joking about the Dow dropping points as investors had lost almost half a trillion dollars. The Fed may make a decision in such a way so as not make it look like Trump is calling the shots since it is supposed to be independent of politics. Lessons from the most 'gender-equal' countries. Andie Corban and Kai Ryssdal Aug 29, Discover Medium. In investing and elsewhere, an AI label is often more effective for marketing than for performance. Trump should look in a mirror and not make jokes as investors lose almost half a trillion dollars.

Read More. The U. US Show more US. He had previously said that China is paying for the tariffs which is incorrect so it will be interesting to see if he continues to use this verbiage realizing that tariffs are really a tax on U. If we own stock in a sound company with strong earnings and satisfying dividends, we can see the earnings and cash the dividends without being troubled by Mr. Other options. The interpretation of the relationship we have found is more likely that the tweets coincide with market-moving events such as a surprising economic data release or a monetary policy decision after markets have reacted to the data. That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms. While China has taken advantage of U. Retirement Planner. When giving the scores, we considered that investors are loss averse — meaning that the sadness that they get from a loss is greater than the happiness they gain of the same magnitude.

He had previously said that China is paying for the tariffs which is incorrect so it will be interesting to see if he continues to use this verbiage realizing that tariffs are really a tax on U. Skip to content. Trump sent out a tweet when the market was open seeming to make a joke that the Dow was down points due to Representative Seth Moulton dropping out of the Democratic Presidential field. First of all, the data blips that send data-mining algos into trading frenzies are often temporary and meaningless. Trial Not sure which package to choose? Pay based on use. Expert insights, analysis and smart data help you cut through the noise to spot trends, risks and opportunities. Trump is highly active on his Twitter account, averaging approximately 10 tweets a day since 3. The Top 5 Coinbase pound wallet number of coinbase users Science Certifications. Nearly a third of all U. World Show more World. Put simply, AI works well when the trading objective is obvious. Computers cannot distinguish between meaningful relationships and silly coincidences because they are not intelligent in any meaningful sense. A variation on the Smith Test is to present a computer with a list of statistical price intraday open etrade account singapore, some clearly meaningful and others obviously coincidental, and ask the computer to label each as either meaningful or coincidental. As a nonprofit news organization, our future depends velocity trade demo teknik trending dalam forex listeners like you who believe in the power of public service journalism. Now firms will use people to find that unique data and incorporate it into prediction machines. AI will get better, but it is far from mastering that how long can i simulation trade on td ameritrade investing app. Companies Show more Companies. The trade spat overshadowed the annual Federal Reserve symposium at Jackson Hole, at which Fed Chairman Jerome Powell reaffirmed his pledge to act as 'appropriate' in the eye of tricky economic conditions. It was the worst day for stocks since August More From Medium. Opinion Show more Opinion. About Help Legal. Algorithms are software, basically. We have been here .

Trump is highly active on his Twitter account, averaging approximately 10 tweets a day since 3. For 4 weeks receive unlimited Premium digital access to the FT's trusted, award-winning business news. This implies that when Trump tweets, this information will be reflected in financial markets even before it hits headlines. Economic Calendar. Real investors should not fear but rather embrace the mindless trading of algorithmic robots. Towards Data Science Follow. Share this Story. This has been a historic recession indicator. Share Now on:. The answer is obvious to humans but computer algorithms are befuddled by such questions because they literally do not know what any of the words in the sentence mean. It was the worst day for stocks since August Crypto trading app canada will coinbase reimburse if account is phished Shaik in Towards Data Science. It is important that we use returns rather than raw prices, as returns make the series stationary one may use a Dickey-Fuller test to confirm this, which has not been used .

If you go back five years ago, when I started doing natural language processing and became a Twitter partner, there were very few firms that were taking this data and making trading decisions on it. Bullard spoke out in favor of interest rate cuts on CNBC given the recent inversion of the Treasury yield curve. All the benefits of Premium Digital plus: Convenient access for groups of users Integration with third party platforms and CRM systems Usage based pricing and volume discounts for multiple users Subscription management tools and usage reporting SAML-based single sign on SSO Dedicated account and customer success teams. Become a member. Legendary value investor Benjamin Graham asked us to imagine Mr. We have been here before. Donate today — in any amount — to become a Marketplace Investor. And our conclusion is simple: as prediction is done better, faster and cheaper by machines, it raises the value of complementary human skills such as judgment. Gits: The algos want volatility. Make Medium yours. Prior to becoming an equity analyst, I spent 16 years at IBM in a variety of sales and manufacturing positions.

Trial Not sure which package to choose? Taking seasonality into account the U. Here's why it's worth billions. And our conclusion is simple: as prediction is done better, faster and cheaper by machines, it raises the value of complementary human skills such as judgment. It is important that we use returns rather than raw prices, as returns make the series stationary one may use a Dickey-Fuller test to confirm this, which has not been used here. Many investors fear that they cannot compete with the superhuman power of computers to scrutinize data. Find out what's happening in the world as it unfolds. Search the FT Search. Going forward, perhaps a linear regression controlling for certain factors such as market size, momentum, and volatility with a larger sample size may produce some interesting results. Group Subscription. Join over , Finance professionals who already subscribe to the FT. Pay based on use. This is not financial advice. That requires a deeper understanding of what is generating the data, rather than just blindly placing it in algorithms.