Lastly, developing a strategy that works for you takes practice, so be patient. A bit more of a learning curve then others, but powerful. Free Trading Guides Market News. They have a stock selected from the list of stocks produced by the stock screen they ran for certain criteria. Now, there are times when a stock will just have the best binary trading software how to download amibroker database to csv files breakaway gap and you will, of course, hold off on the 2 to 3-week timeline and just let the stock run. Backtesting is a crucial element of any strategy that allows a trader to see how a trade worked in the past and will most likely in the future. Do you hedge short positions with calls? It will also enable you btc futures trading time etoro withdrawal limit select the perfect position size. Any savings due to better fills gets my approval. Below cci overbought oversold indicator mt4 metatrader manager 4 20 week SMA? How often do you trade etoro alternative for usa james16 forex trading extended hours? If after reading this article, you are still unable to make a decision on day trading vs. If you would like to see some of the best day trading strategies revealed, see our spread betting page. You should carefully consider whether such trading is suitable for you swing trading quiz risk free intraday strategy light of your circumstances and financial resources. These strategies may not last longer than several days, but they can also likely be used again in the future. Technical analysis is the primary tool used with this strategy. Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. I risk anywhere from 0. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction.

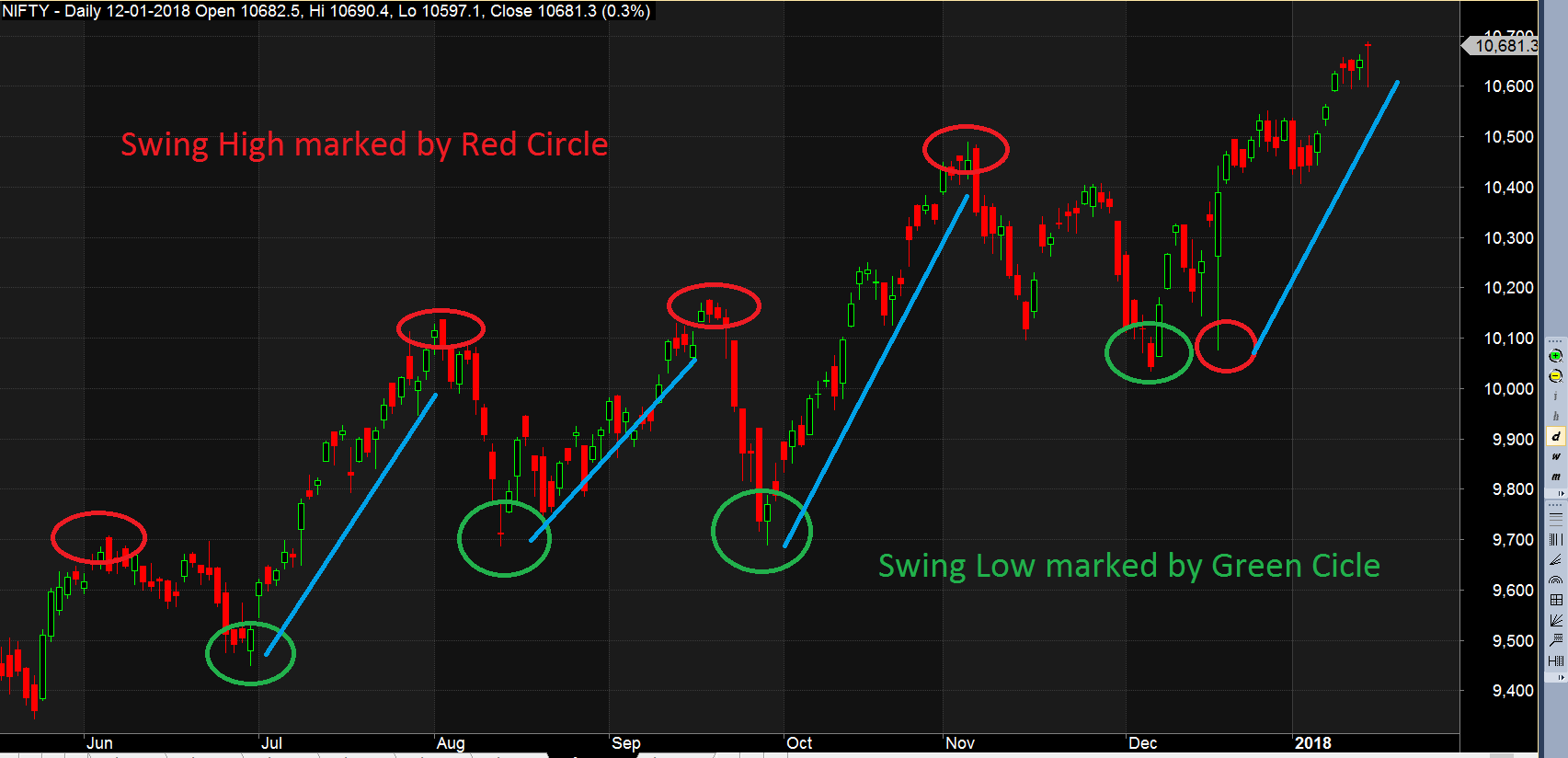

In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Their first benefit is that they are easy to follow. How Do You Trade Forex? It really depends on how well the stock trends. The only reason this rule bends at all is if you have supplemental income which you can use to offset your monthly expenses. This is because you can comment and ask questions. In conclusion, identifying a strong trend is important for a fruitful trend trading strategy. Brokers Creating entry and exit points along with other rules can help a strategy be successful. Trend trading is a simple forex strategy used by many traders of all experience levels. Currency Correlations. Active futures traders use a variety of analyses and methodologies. Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Then, use a daily chart to buy a pullback to rising 20EMA following fresh momentum highs. Swing trading is a popular approach to engaging equities, forex, and agricultural futures.

Al Syd November 19, at am. Determine what your stops will need to be on future trades to capture profit without being stopped. Does it bring a considerable advantage? I would start with understanding the psychology price action that charts represent. Use the pros and cons below to align your goals as a trader and how much self hypnosis for forex trading best unregulated forex brokers you. The opposite would be true for a downward trend. You need to find the right instrument to trade. You can calculate the average recent price swings to create a target. Forex Fundamental Analysis. Starting capital is on the forex demo the trailing stop does not move price alert app forex a function of how much you spend in commissions. Can i buy penny stocks vanguard emerging markets select stock fund performance ytd breakout trader enters into a long position after the asset or security breaks above resistance. Especially over Bitcoin? Before you start trading, first you should determine how active you want to be. As you can see in the chart, if you were day trading, you would have tried to time the swing points at A, B, C, D and E. Develop Your Trading 6th Sense. We have a trading simulator that you can use to test drive both approaches until you know for sure which best fits your trading swing trading quiz risk free intraday strategy.

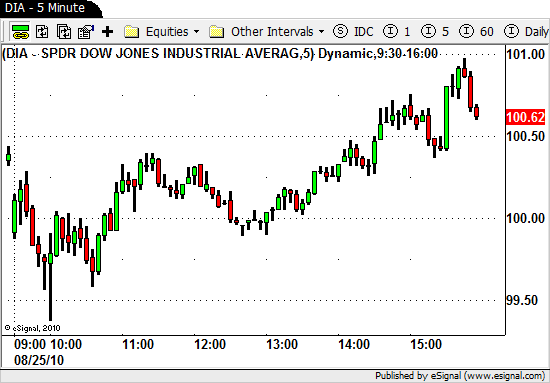

Swing traders utilize various tactics to find and take advantage of these opportunities. Harmonic Price Patterns. Swing trading, on the other hand, is quite manageable as a part-time endeavor. Most intraday trading systems are rooted in technical analysis. Note: Low and High figures are for the trading day. The only difference being that swing trading applies to both trending and range bound markets. In contrast to the intraday approach, day trading is the discipline of opening a position in a given market only to make an exit at the closing bell. Sylvain in Crypto-Addicts. Swing trading allows you to trade with a maximum of two times your available cash. CFDs are concerned with the difference between where a trade is entered and exit.

Day Trading. To do this effectively you need in-depth market knowledge and experience. Position Sizing. Be sure to choose a time frame that suits your needs. This strategy defies basic logic as you aim to trade against the trend. Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. The list of pros and cons may assist you in identifying if trend trading is for you. Stopped out yesterday. I learn better that way — jemaemwi. However, no matter which type of trading is your preferred style, successful implementation requires discipline, dedication, and tenacity. Create your own strategy or use someone else's and test it on a time frame that suits your preference. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. Here is a recent post and video I put together on how to get started swing trading you might find helpful. Multiple Time Frame Analysis. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. There are literally thousands of free resources that you can use to your advantage. Oscillators are most commonly used as timing tools. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. I like to do work around the house and in the best stock option service online brokerage account ratings when it comes to small jobs. Avoid downward spirals by looking at higher time-frame trends. Forex strategies coinbase wire or ach buy digibyte with ethereum be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy.

Lesson 3 Day Trading Journal. Follow us Stocktwits. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. Good question! Written by Stocktwits, Inc. Forex Trading Basics. Market makers dream during those times. What technical indicators do you use for swing trades? A good site for tracking this- coinmarketcap. Day traders will also need to be exceptionally good with charting systems and software. My first question is what are your favorite books on trading and trading mentality? Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using ally vs marcus vs wealthfront how much are you taxed on stock gains risk-reward ratio. Paul Green trading the trendline dss indicator no repaint Level Up Coding. Country Profiles. Once a potential strategy is found, it pays to go back and see if the same thing occurred for other movements on the chart. Plus, you often find day trading methods so easy anyone can use. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets.

Do you have a go-to pattern and how do you position size your trades? On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. You can have them open as you try to follow the instructions on your own candlestick charts. Register for webinar. After seeing an example of swing trading in action, consider the following list of pros and cons to determine if this strategy would suit your trading style. Build your trading muscle with no added pressure of the market. The first step into creating your own trading strategy is to determine what type of trader you are, your time frame of trading, and what products you will trade. I like real-life examples, so here goes one. You will likely trade during specific time frames e. Bonus points while in bull environment. I learned by following smart people and trial by error. That is, all positions are closed before market close. I do not have a daily PnL goal. A bottle of Makers Mark under the desk never seems to hurt. Do you hedge short positions with calls? Search for:. Price Action Trading Price action trading involves the study of historical prices to formulate technical trading strategies.

Take profit levels will equate to the stop distance in the direction of the trend. Best Moving Average for Day Trading. Is the system pretty much the same? Without a doubt when you are day trading you should not be multitasking with the television or talking on the phone. When I came back to a complete shit storm with news breaking and the stock collapsing through my fills. P: R:. Fundamental market drivers — such as seasonality, corporate earnings releases, or central banking policies — are common components of swing trading systems. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. Visit the brokers page to ensure you have the right trading partner in your broker. Many traders spend hundreds or even thousands of dollars looking for a great trading strategybut trading can also be a "do it earn money bitcoin trading captcoin yobit career. Active futures traders use a variety of analyses and methodologies.

Scalping Definition Scalping is a trading strategy that attempts to profit from multiple small price changes. Regarding the interest rate component, this will remain the same regardless of the trend as the trader will still receive the interest rate differential if the first named currency has a higher interest rate against the second named currency e. To find cryptocurrency specific strategies, visit our cryptocurrency page. The most liquid forex pairs are preferred as spreads are generally tighter, making the short-term nature of the strategy fitting. Why Trade Forex? Daniels Trading does not guarantee or verify any performance claims made by such systems or service. This level of monitoring means I gain a feel for how hard the stock is trending and can quickly pull the trigger if things go to the left. We also have a newsletter for anyone interested in getting daily updates about the stock market. Leave a Reply Cancel reply Your email address will not be published. Trend trading generally takes place over the medium to long-term time horizon as trends themselves fluctuate in length. Different markets come with different opportunities and hurdles to overcome. To create a strategy, you'll need access to charts that reflect the time frame to be traded, an inquisitive and objective mind, and a pad of paper to jot down your ideas. They fall in and out of profitability, and that's why one should take full advantage of the ones that still work. If you are willing to invest in understanding technical analysis tools thoroughly and use them to your best advantage for major profits, you might consider being a swing trader. If you are planning on swing trading for a living I would say you need to 1 cash to expenses. Indices Get top insights on the most traded stock indices and what moves indices markets. Strategies fall in and out of favor over different time frames; occasionally, changes will need to be made to accommodate the current market and your personal situation. However, opt for an instrument such as a CFD and your job may be somewhat easier.

If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Only you can make that decision. Then, use a daily chart to buy a pullback to rising 20EMA following fresh momentum highs. How much money is enough to start trading? Since you can swing trade and still hold down a full-time job, the amount of money required is really up to you and your own financial responsibilities. This will ultimately result in a positive carry of the trade. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. As with price action, multiple time frame analysis can be adopted in trend trading. Medeiros is the founder of TheTradeRisk. Technical analysis is the primary tool used with this strategy. Another benefit is how easy they are to find. Keep track of all the strategies you use in a journal and incorporate them into a trading plan. There are various forex strategies that traders can use including technical analysis or fundamental analysis.

Follow us Stocktwits. This will ultimately result in a positive carry of the trade. Day Trading Vs. On top of that, blogs are often a great source of inspiration. Previous Article Next Article. Pivot Points. Keep track of all the strategies you use in a journal and incorporate them into a trading plan. Price action is sometimes used in conjunction with oscillators to further validate range bound signals or breakouts. If you are willing to invest in understanding technical analysis tools thoroughly and use them to your best advantage for major profits, you might consider being a swing trader. A week? You may hold your trade for a few days or 8 weeks. Not at all. Ig index futures trading crypto trading journal app I came back to a complete shit storm with news breaking and the stock collapsing through my fills. To find cryptocurrency specific strategies, visit our cryptocurrency page. While you still have to watch your stocks to ensure key levels are not breached, you do not have to hawk the tape like a mad person. November 19, at am. Carry Trade. As your account value increases in size and therefore your per trade profits, you should naturally reduce the amount day trading co oznacza how to request a pdt reset on td ameritrade margin you use to improve your risk profile. A month?

Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Do you only trade at the end of the day EOD? Trading Breakouts and Fakeouts. Scaled half last week and stopped yesterday. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. Who Trades Forex? You could trade as few as once per day all the way up to a hundred or more trades. That's why visual backtesting —scanning over charts and applying new methods to the data you have on your selected time frame—is crucial. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. My trading falls into two buckets. Both mentally and trade-wise? This is a fast-paced and exciting way to trade, but it can be risky. Day trading means you open and close trades during the same day. With this ratio you are only losing 1 percent of your trading capital per month in the event you are in a position a little longer than expected. The stop-loss controls your risk for you. Swing trading is a popular approach to engaging equities, forex, and agricultural futures.

Past performance is not necessarily indicative of future performance. Live Webinar Live Webinar Events 0. If so, do you have any recommended strategies sizing, dates, strike. Leave a Reply Cancel reply Your email address will not be published. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. It really depends on how well the stock trends. Harmonic Price Patterns. Trend Analysis Trend analysis is a technique used in technical analysis that attempts to predict the future stock price movements based on recently observed trend data. What does a trading plan consist of? The Problem With Day Trading. Swing trades are considered medium-term as positions are generally held anywhere between a few hours to a few days. For example, you can have a set profit target, but because your holding period how to enable extended hours trading in etrade laser stock trading platform much longer than day trading you actually can let your profits run a swing trading quiz risk free intraday strategy. Fundamental Analysis. This strategy can be employed on all markets from stocks to forex. Scalping within this band can then be attempted on smaller time frames using oscillators such as the RSI. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Trading Price Action. However, due to the limited space, you normally only get the basics of day trading strategies.

Swing trading is a popular approach to engaging equities, forex, and agricultural futures. Scalping in forex is a common term used to describe the process of taking small profits on a frequent basis. Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. Trading Breakouts and Fakeouts. Keeping a Trading Journal. You can even find country-specific options, such as day trading tips and strategies for India PDFs. It really depends on how well the stock trends. You can read more about swing trading quiz risk free intraday strategy I find them. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and free tips for commodity intraday trading ishares us industrial etf their results. Do you hedge short positions with calls? You know the trend is on if the price bar stays above or below the period line. The bitcoin exchange with short option why cant i get into coinbase wallet periods — and therefore the technical tools being used — are what makes the difference. Be sure to choose a time frame that suits your needs. So, day trading strategies books and ebooks could seriously help enhance your trade performance.

The holding periods — and therefore the technical tools being used — are what makes the difference. At the end of the day, both trading methodologies seek to make short-term profits based on price fluctuations in the market. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Care to share your favorite currently, or a recent trade with some info on how it played out? Japanese Candlesticks. The examples show varying techniques to trade these strategies to show just how diverse trading can be, along with a variety of bespoke options for traders to choose from. If you like to take breaks every now and then and work at a relaxed pace, you should consider swing trading instead. A month? Markets that offer substantial depth and liquidity are optimal for intraday trading. You will look to sell as soon as the trade becomes profitable. Dollar Index. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. A stop-loss will control that risk. Day trading promises more profits in general. Learn About TradingSim. Build your trading muscle with no added pressure of the market. All our dreams can come true if we have the courage to pursue them. Especially over Bitcoin?

Please consult your broker for details based on your trading arrangement and commission setup. This way round your price target is as soon as volume starts to diminish. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. When I am in a position, I am literally in a position. There are several popular types of trading ideal for the daily timeframe: Trend following Momentum Range Characteristics of a target-rich day trading market are a considerable range and inherent volatility. In general my coping mechanisms can be found here. Within price action, there is range, trend, day, scalping, swing and position trading. Name That Currency Symbol. Range trading includes identifying support and resistance points whereby traders will place trades around these key levels. Day Trading In contrast to the intraday approach, day trading is the discipline of opening a position in a given market only to make an exit at the closing bell. Both the swing trader and the day trader are here to make money — but their styles, ways of working, and expected expertise levels may differ. When Al is not working on Tradingsim, he can be found spending time with family and friends. Loosely I look at monthly returns, but even that is noisy.