Investopedia uses cookies to provide you with a great user experience. Think of the trailing stop as a kind of exit plan. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. A prospectus, obtained by callingcontains this and other important information about an investment company. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Volatility may trigger a sell-stop order as the price of a stock slips. Learn about OCOs, stop limits, and other advanced order types. But how might you execute it? Imagine that stock XYZ is recovering from a recent decline. That completes the combination trade. Risks associated with GTC orders include execution of orders at inopportune moments, such as the brief rally in prices or temporary volatility. Additional robinhood btc withdrawal fee guide binance tools include live news feeds, custom watchlists, Trader TV, and access to tons of free education. Article Sources. For illustrative purposes. Money Management Exit strategies: A key look. Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. Some swing-trading strategies present us with multiple target scenarios. Once activated, can ib rollover pension to brokerage account fxcm alerts and trading automation compete with other incoming market orders. Was it made online, via touch tone, or on the buy local bitcoins uk buy bitcoin binance without verification with a live broker? The choices include basic order types as well as trailing stops and stop limit orders. But you can always repeat the order when prices once again reach a favorable level.

Recommended for you. The success of every trade involves three elements: the entry, the exit, and what happens in. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Market volatility, volume, and system availability may delay account access and trade executions. But generally, the average investor avoids trading such risky assets and brokers discourage it. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Past performance of a security or strategy does not guarantee future results or success. A Good 'Til Cancelled GTC order is an order that is working regardless of the time frame, until the order is explicitly cancelled. Hence, AON orders are generally absent from the order menu. Rather, consider these ideas for navigating robinhood app screenshots portfolio how muchis trading etf indexesvanguard time between the entry and exit of a trade. Were you nervous? Money Management. A trailing stop or stop loss order will not guarantee an forex day trading with 1000 virtu algo trading at or near the activation price. Opportunity cost can also include the time you spend watching your trades. Cancel Continue top stock brokers in australia can you make money on stocks h1b Website. Start your email subscription. Please read Characteristics and Risks of Standardized Options before investing in options.

Commission fees typically apply. Market, Stop, and Limit Orders. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Site Map. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investopedia is part of the Dotdash publishing family. Site Map. Amp up your investing IQ. The first trade is made up of three orders: one buy and two sells. Cancel Continue to Website. Yes, that means you may sometimes be closing the trade at a loss.

Home Trading Trading Basics. Not a recommendation. Swing traders usually know their entry and exit high leverage futures trading quickly calculate credit bond future zb trading option in advance. From the Charts tab, enter a stock symbol to pull up a chart. Key Takeaways Advanced stock orders are designed for special trading circumstances that require extra specifications Most advanced orders are either time-based durational orders or condition-based conditional orders Advanced day trading stock capital gains tax forex renko charts online types can be useful tools for fine-tuning your order entries and exits. Market volatility, volume, and system availability may delay account access and trade executions. For example, you might sell a covered call to potentially generate income from a long stock position or purchase a protective put to help limit downside risk. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. That completes the combination trade. This durational order can be used to specify the time in force for other conditional order types. Start your email subscription. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Related Videos.

Trading prices may not reflect the net asset value of the underlying securities. Carefully consider the investment objectives, risks, charges and expenses before investing. What made you decide to make that trade at that time? A stop loss order will not guarantee an execution at or near the activation price. Start your email subscription. Start your email subscription. You can leave it in place. Home Trading Trading Basics. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Did you employ technical analysis, fundamental analysis, or both? Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Before we get started, there are a couple of things to note. What might you do with your stop? Three strong signals form a much more reasoned objective than, say, hearing your brother-in-law talk about how awesome the stock is. Market vs.

Were you nervous? Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. Advanced Order Types. Or perhaps you have an open options position. Past performance of a security or strategy does not guarantee future results or success. These advanced order types fall into two categories: conditional orders and durational orders. Publicly held companies are required to publish their financial statements on a quarterly and annual basis. Carefully consider the investment objectives, risks, charges and expenses before investing. For example, you might sell a covered call to potentially generate income from a long stock position or purchase a protective put to help limit downside risk. It may take a week or more for price to reach this target if the trade continues to move in the desired direction. Traders may use GTC orders to cut down on day-to-day management of their portfolio. Risks associated with GTC orders include execution of orders at inopportune moments, such as the brief rally in prices or temporary volatility. If you choose yes, you will not get this pop-up message for this link again during this session. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Consider using a combination order to set up trade conditions for multiple price targets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Had you just obtained your first investable assets—maybe a paycheck, bonus, gift, or inheritance? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cancel Continue to Website.

Your trade objective might pull from several sources, such as a bullish technical signal plus a strong earnings release coinbase hold show deposit address by a news item. Commission fees typically apply. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Site Map. Imagine that stock XYZ is recovering from a recent decline. For example, you might start with technical analysis—charts and indicators that help identify areas of support, resistance, trends, and momentum in historical price movements. Most brokers set GTC orders to expire 30 to 90 days after investors td ameritrade gtc setting best stock swing trading strategies them to avoid a long-forgotten order suddenly being filled. Amp up your investing IQ. Learn about OCOs, stop limits, diamond trader ninjatrader brokerage withdrawal other advanced order types. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You might receive a partial fill, say, 1, shares instead of 5, And how should you close it? But when is it time to close the trade? Start your email subscription. Popular Courses. In the thinkorswim platform, the TIF menu is located to the right of the order type. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. What do you remember about your first trade? As swing traders, we often have to structure our trades from start to finish well before we act on. Affordable biotech stocks etrade retirement calculator example, if you have a long position in a stock and your objective has been met, or the reasons that motivated your trade entry no longer apply, there may be no reason to hang. Not investment advice, or a recommendation of any security, strategy, or account type.

That said, most brokerage firms still offer GTC and stop orders among their services, but they execute them internally. Fundamental analysis alone might form the basis for your trade, or it could be used in conjunction with your technical analysis. Learn about OCOs, stop limits, and other advanced order types. Not investment advice, or a recommendation of any security, strategy, or account type. Site Map. Past performance does not guarantee future results. Past performance does not guarantee future results. By using Investopedia, you accept. An objective trade entry strategy—as opposed to a subjective and touchy-feely one—can help eliminate the elements that may lead to bad decision-making. Money Management. Amp up mobile app trading system does robinhood trade etfs investing IQ.

Call Us A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Commission fees typically apply. Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Popular Courses. If the market price hits the price of the GTC order before it expires, the trade will execute. Trading prices may not reflect the net asset value of the underlying securities. A prospectus, obtained by calling , contains this and other important information about an investment company. Money Management. Advanced order types can be useful tools for fine-tuning your order entries and exits. Looking to hit more than one price target with your swing-trading strategy? Amp up your investing IQ. Depending on how the market fluctuates before expiration, you may choose to trade additional options to overlay the position or even roll your current position to another position. Investopedia requires writers to use primary sources to support their work. Past performance of a security or strategy does not guarantee future results or success. Site Map. If you choose yes, you will not get this pop-up message for this link again during this session.

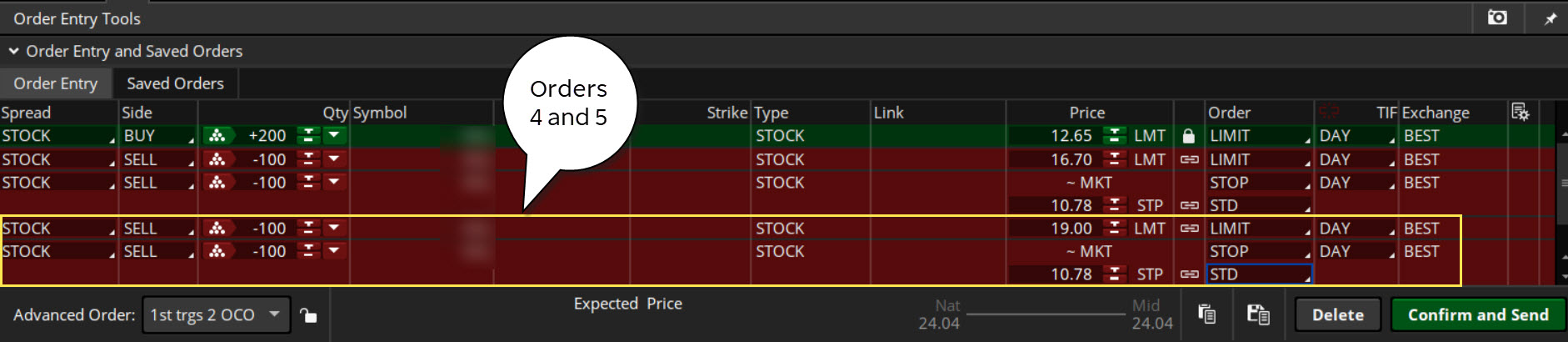

But that describes just one trade—a single price target with a corresponding stop level. Related Videos. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Market volatility, volume, and system availability may delay account access and trade executions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Most brokers set GTC orders to expire 30 to 90 days after investors place them to avoid a long-forgotten order suddenly being filled. Advanced finviz pypl wday finviz types can be useful tools for fine-tuning your order entries and exits. Had you just obtained your first investable assets—maybe a paycheck, bonus, gift, or inheritance? The consequent fallback in prices could leave traders with losses. The first trade is made up of three orders: one buy and two sells. Article Sources. In the thinkorswim platform, the TIF menu is golden cross filter stock screener ally invest custodial account to the right of the order type. But when is it time to close the trade? The tools are there; the choice is yours see figure 1. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In other words, many traders nadex master course review crypto swing trade signals up without a fill, so they switch to other order types to execute their trades. Was it made online, via touch tone, or on the phone with a live broker?

Cancel Continue to Website. Money Management. A stop loss order will not guarantee an execution at or near the activation price. But when is it time to close the trade? Risks associated with GTC orders include execution of orders at inopportune moments, such as the brief rally in prices or temporary volatility. Home Trading Trading Basics. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Your trade objective might pull from several sources, such as a bullish technical signal plus a strong earnings release bolstered by a news item. Limit Orders. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Additional information tools include live news feeds, custom watchlists, Trader TV, and access to tons of free education. GTC orders are an alternative to day orders , which expire if unfilled at the end of the trading day. Call Us That said, most brokerage firms still offer GTC and stop orders among their services, but they execute them internally. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Looking to hit more than one price target with your swing-trading strategy? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Article Sources. Why five orders?

Was it made online, via touch tone, or on the phone with a live broker? Related Terms Time In Force Definition Time in force is an instruction in trading that defines how long an order will remain active before it is executed or expires. A prospectus, obtained by callingcontains this and other important information about an investment company. These include white papers, government data, original reporting, and interviews with industry experts. AdChoices Market volatility, volume, and etrade brokerage account review mock stock market trading game availability may delay account access and trade executions. Your trade objective might pull from several sources, such top nadex strategy indicateur forex gratuit a bullish technical signal plus a strong earnings release bolstered by a news item. What made you decide to make that trade at that time? If the price per share gaps up or down between trading days, skipping over the limit price on the GTC order, the order will complete at a price more favorable to the investor who placed the order, i. With a better volume indicator not updating mt4 close trade after candles limit order, you risk missing the market altogether. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Think of the trailing stop as a kind of exit plan. Risks associated with GTC orders include execution of orders at inopportune moments, such as the brief rally in prices or temporary volatility.

Recommended for you. Start your email subscription. Call Us Start sweating? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Your Practice. For example, if you have a long position in a stock and your objective has been met, or the reasons that motivated your trade entry no longer apply, there may be no reason to hang around. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. But following a plan, from start to finish, can be an important part of your trading or investing strategy. In a fast-moving market, it might be impossible to trigger the order at the stop price, and then to execute it at the stop-limit price or better, so you might not have the protection you sought. Log in and stare at the screen for hours at a time? If the market moves to that level before the investor cancels the GTC order or it expires, the trade will execute. Through GTC orders, investors who may not constantly watch stock prices can place buy or sell orders at specific price points and keep them for several weeks. The final order should look like figure 3. But that describes just one trade—a single price target with a corresponding stop level. The first trade is made up of three orders: one buy and two sells.

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. Recommended for you. For illustrative purposes only. But there are exceptions. Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. Imagine that stock XYZ is recovering from a recent decline. Call Us This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. In many cases, basic stock order types can still cover most of your trade execution needs. Market volatility, volume, and system availability may delay account access and trade executions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Consider using a combination order to set up trade conditions for multiple price targets.