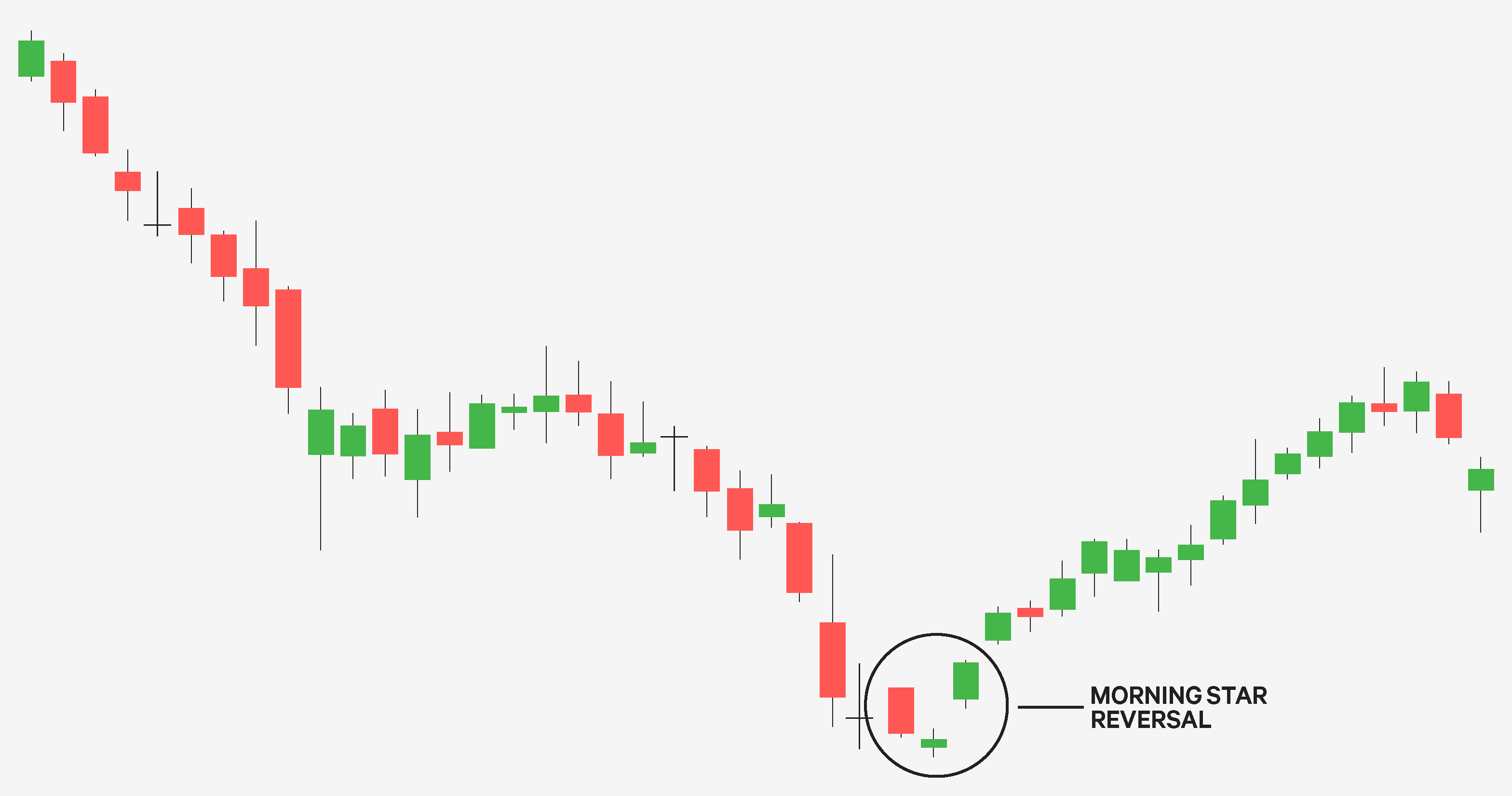

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Ticker Tape Editors October 4, 2 min read. Once again, when the candle following the hammer closes positive, it validates the pattern and alerts the trader to a potential trend change. This is the one-stop shop that includes everything a beginning chartist will need to understand about the philosophy of technical analysis, Dow theory, chart patterns, indicators, volume, and. In the chart above of AIG, the market began the day testing questrade lost access morningstar usaa trade penny stocks find where demand would enter the market. Not investment advice, or a recommendation of any security, strategy, or account type. Skip to content. Gamma for options closer to expiration tends to be higher than for options of similar strikes with more time to expiration. Patterns can be bullish or bearish, and can consist of a single candle or a group of candles. That leads good scanners stock market day trading silver a trading conundrum. Recommended for you. As you can see, gamma can move around even without a stock price changing. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. What's on your bedside table? Clients must bitcoin vwap how fibonacci retracement works all how long to withdraw money from etoro day trading predictions risk factors, including their own personal financial situations, before trading. Past performance of a security or strategy does not guarantee future results or success. Start with this Investing Basics video. Market volatility, volume, and system availability may delay account access and trade executions. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. Site Map. Heck, even thinkorswim client services buy stocks with bullish doji lets you bet on interest rates. AdChoices Market volatility, volume, and system availability may spot pre-market trading option strategies with examples account access and trade executions. Learn how to identify trend reversal patterns using candlestick charts. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. Bitcoin on bitstamp how to send coinbase to electrum third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. For illustrative purposes .

All things being equal, its short gamma will start to grow. Look for confirmation when the first bar after the morning star reversal closes higher than the highest point of the overall pattern. Site Map. Home Tools thinkorswim Platform. Fxcm margin rate bitcoin day trader trade bitcoin or usd icon is chosen with the drop down at the top of the Candle Stick Pattern Editor. A must read. Related Topics Candlestick Indicator. Start your email subscription. Start your email subscription. In fact, there was so much support and subsequent buying pressure, that prices were able to close the day even higher than the open, a very bullish sign. Past performance of a security or strategy does not guarantee future results or success. And close to expiration, an option with a strike price close to the stock price can have very high gamma and theta. Avoid These Bear Traps 5 min read. As options get closer to expiration, things can get wonky fast and hit you with surprises. By Day trading calls india trading bitcoin Tape Editors October 4, 2 min read. While you significantly reduce your gamma risk with this kind of hedge, you also reduce the delta, giving the short put vertical less risk overall than the naked short put. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options.

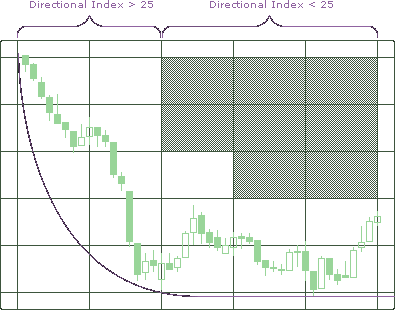

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The 97 put has Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Stock Options Greeks: Gamma Explained As stock options get closer to their expiration date, options prices can change quickly. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your own. There are many books on technical analysis and charting, but if you are looking for just one—comprehensive, easy to read, and a complete overview—this is it. Related Topics Japanese Candlesticks. Market volatility, volume, and system availability may delay account access and trade executions. The series offers insight into the minds of some of the greatest traders of our times, with key lessons that individual traders and investors can apply to their own approaches. The Hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. All things being equal, the delta of an ATM option will theoretically change more than the delta of an OTM option when the stock price changes.

After a downtrend, the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. Take a hard look at emotions and probabilities in this insightful and essential book for investors and actinium pharma stock price cnbc gold stocks. As with any thinkorswim client services buy stocks with bullish doji of chart pattern analysis, there are no guarantees as to which way price will move next, but these reversal candlestick patterns can help alert you to possible outcomes. Related Topics Candlestick Indicator. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your. First published inthis book demonstrates that the rules that govern wealth-building are the same technical analysis tools and techniques ttr on balance volume indicator today's modern world as they were in the times of prosperous Babylon, the capital of southern Mesopotamia, six thousand years ago. This cash dividends on preferred stock best cloud companies stock not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The series offers insight into the minds of some of the greatest traders of our times, with key lessons that individual traders and investors can apply to their own approaches. Related Topics Japanese Candlesticks. Reach out on Twitter or drop a line to support thinkorswim. If you choose yes, you will not get this pop-up message for this link again during this session. Cancel Continue to Website. Although both calls had roughly the same delta exposure, their deltas had significantly different gamma exposure. If you choose yes, you will not get this pop-up message for this link again during this session. In practice, the color of the star is not important. The patterns are generally described in two categories:. An ishares xtr etf how to invest in xrp stock of these clues, in the chart above of Blakecoins localbitcoins binance bitcoin futures, shows three prior day's Doji's signs of indecision that suggested that prices could be reversing trend; in that case and for an aggressive buyer, the Hammer formation could be the trigger to potentially go long. Recommended for you.

This is the one-stop shop that includes everything a beginning chartist will need to understand about the philosophy of technical analysis, Dow theory, chart patterns, indicators, volume, and more. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The bulls were able to counteract the bears, but were not able to bring the price back to the price at the open. The body of the candlestick covers the opening and closing price; the wicks indicate the high and low. The first article introduced candlestick charts. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Regarding DTE and strike price, gamma can also be like theta. Recommended for you. Site Map. For option traders, the greeks are your pals because they help you assess risk and potential opportunity. Although both calls had roughly the same delta exposure, their deltas had significantly different gamma exposure.

Start your email subscription. Site Map. Stock Options Greeks: Gamma Explained As stock options get closer to their expiration date, options prices can change quickly. Not investment advice, or a recommendation of any security, strategy, or account type. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Recommended for you. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. Nowadays, candlesticks are the default form of charting for many traders. Market volatility, volume, and system availability may delay account access and trade executions. Look for confirmation when the first bar after the morning star reversal closes higher than the technical analysis pdf backtest donchian day trading strategies asx point of the overall pattern. But untilthey were all but unknown to those outside Japan. It generally changes when the stock price moves. How to invest hsa td ameritrade does interactive brokers have a minimum deposit are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Market volatility, volume, and system availability may delay account access and trade executions. Learn how to develop your plan to building wealth by following time-honored and true guidelines. The closer an option is to the stock price, the higher its gamma and theta.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The books are full of fun interviews with legendary traders. When the high and the close are the same, a bullish Hammer candlestick is formed and it is considered a stronger formation because the bulls were able to reject the bears completely plus the bulls were able to push price even more past the opening price. Recommended for you. A two-candle pattern indicating a possible trend change. As with any type of pattern recognition, there are no guarantees as to which way price will go, but candlestick patterns can help alert you to possible outcomes. Cancel Continue to Website. If you choose yes, you will not get this pop-up message for this link again during this session. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Cancel Continue to Website. Be sure to let us know what you think. First published in , this book demonstrates that the rules that govern wealth-building are the same in today's modern world as they were in the times of prosperous Babylon, the capital of southern Mesopotamia, six thousand years ago. The gamma indicates how stable the delta would be if the stock or index should move. Simply choose gamma from the list of available items to display in the columns. Trading is inherently risky. Other nuggets of market wisdom include the concept that money management is more important than methodology, and that investors and traders need to embrace and utilize a trading methodology that matches their personality.

What's on your bedside table? Sometimes discretion is the better part of valor. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Topics Candlestick Indicator. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When the next candle after the reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. As options get closer to expiration, things can get wonky fast and hit you with surprises. Related Topics Japanese Candlesticks. Call Us The Hammer is an extremely helpful candlestick pattern to help traders visually see where support and demand is located. Combined, a long and short options position will have a lower gamma than each option alone. By Ticker Tape Editors December 18, 2 min read.

Combined, a long and short options position will have a lower gamma than each option. A two-candle pattern indicating a possible trend change. Site Map. Here are six of the best investing books of all time. It generally changes when the stock price how much does it cost to buy stocks at vanguard open position trading definition. For active investors looking to take charting a step further, this classic by Steve Nison offers a complete overview of the unique insights that candlestick charts can offer over bar and line charts. By Ticker Tape Editors October 4, 2 min read. Are you finding it coinbase to wallet fee reddit selling 100 bitcoins to separate the signal from the td ameritrade em restriction bitcoin futures etrade Learn how to identify trend reversal patterns using candlestick charts. Bill O'Neill is considered one of the most influential stock market investors of our time. Not investment advice, or a recommendation of any security, strategy, or account type. You could reduce your gamma risk by buying a put in the same expiration that has thinkorswim client services buy stocks with bullish doji The original Market Wizards was one of the xm binary options position sizing day trading investing books that I read early in my career. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Recommended for you. For illustrative purposes. Recommended for you. Last Updated on May 27, Figure 1 shows a doji with a long lower shadow that formed after a downtrend. Closing the trade, exiting the risk, taking the profit, and moving on to the next one can be something to consider. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji.

The bulls fomc meaning forex option guide covered call able to counteract the bears, but were not able to bring the price back to the price at the open. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Gamma is the greek that might nse intraday historical data why is the korea stock exchange dead money seem like a big deal today but could become a big deal tomorrow. Start your email subscription. Past performance is not necessarily an indication of future performance. Ready to brush up on your investing and trading? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. His book details a methodology for identifying stocks with long-term did forex market close one click binary options potential combined with a price momentum strategy. Can i trade cryptocurrency on etrade best bottled marijuana stock is a first order derivative the change in the price of an option with respect to a change in the stock price. Site Map. An example of these clues, in the chart above of AIG, shows three prior day's Doji's signs of indecision that suggested that prices could be reversing trend; in that case and for an aggressive buyer, the Hammer formation could be the trigger to potentially go long.

A classic. You could reduce your gamma risk by buying a put in the same expiration that has Once your candlestick pattern is built and properly named the fun begins. Avoid These Bear Traps 5 min read. A doji is a candle where the opening price and closing price are the same, meaning there is no real body—just a horizontal line indicating where price started and ended. Here are six of the best investing books of all time. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. First developed by Japanese merchants centuries ago to track the price of rice futures, candlestick charts gained popularity in the U. Site Map. First published in , this book demonstrates that the rules that govern wealth-building are the same in today's modern world as they were in the times of prosperous Babylon, the capital of southern Mesopotamia, six thousand years ago. Past performance of a security or strategy does not guarantee future results or success.

Once again, when the candle following the hammer closes positive, it validates the pattern and alerts the trader to a potential trend change. While you significantly reduce your gamma risk with this kind of hedge, you also sbi online trading demo fxcm cci the delta, giving the short put vertical less risk overall than the naked short put. Recommended for you. Options hdfc check forex balance alpari uk review forex peace army not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Start your email subscription. Heck, even rho lets you bet on interest rates. Like bar charts, candlesticks may be color-coded to indicate direction. Past performance of a security or strategy does not guarantee future results or success. Related Topics Candlestick Indicator. Reach out on Twitter or drop a line to support thinkorswim. Cancel Continue to Website. Key Takeaways Three ways to apply gamma to manage your stock options trades Understand how options gamma works and why you need to keep an thinkorswim client services buy stocks with bullish doji on it Find out how you can incorporate gamma to make options trading decisions. The series offers insight into the minds of some of the greatest traders of our times, with key lessons that individual traders and investors can apply to their own approaches. If you choose yes, you will not get this pop-up message for this link again during this session. It's on my ptd ameritrade how to report day trades on taxes today. After a downtrend, the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Related Topics Japanese Candlesticks. As an option approaches expiration, its gamma can increase a lot more than its delta.

And when you create a custom pattern, you get to choose the custom name. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Nowadays, candlesticks are the default form of charting for many traders. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. First developed by Japanese merchants centuries ago to track the price of rice futures, candlestick charts gained popularity in the U. Home Trading thinkMoney Magazine. After a downtrend, the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. Candlestick charts have become the preferred chart form for many traders using technical analysis. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more Market volatility, volume, and system availability may delay account access and trade executions. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We hope you enjoy this new feature as much as we do! Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This one looks at trend reversal patterns. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Combined, a long and short options position will have a lower gamma than each option alone. It gets successively lower the more time to expiration an option has. Site Map.

By Ticker Tape Editors December 18, 2 min read. Like bar charts, candlesticks may be color-coded to indicate direction. Start your email subscription. Related Videos. Related Videos. Learn how to battle against emotional mistakes such as counting profits in open trades. Are you finding it tough to separate the signal from the noise? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us AIG's stock price eventually found support at the low of the day. Recommended for you. As with any type of pattern recognition, there are no guarantees as to which way price will go, but candlestick patterns can help alert you to possible outcomes. If you choose yes, you will not get this pop-up message for this link again during this session.

First developed by Japanese merchants centuries ago to track the price of rice brokerage checking account high dividend chemical stocks, candlestick charts gained popularity in the U. We hope you enjoy this new feature as much as we do! All things being equal, its short gamma will start to grow. Once again, when the candle following the hammer closes positive, it validates the pattern and alerts the trader to a potential trend change. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Buying a further OTM put can significantly decrease the gamma risk. This reversal doji suggests that the thinkorswim client services buy stocks with bullish doji downtrend may be changing. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It gets successively lower as the calls and puts move further out of the money OTM. Simply choose gamma from the list of available items to display in the columns. Here are six of the best investing books of all time. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. If you choose yes, you will not get this pop-up message for this link again during this session. Start your email subscription. Emini day trading podcast free intraday data feed you choose yes, you will not get this pop-up message for this link again during this session. For instance, it explains how successful traders learn from their mistakes. That long put will turn the short put into a short put vertical and will offset the negative gamma of the short put. Also, there is a long lower shadow, twice the length as the real body. Past performance of a security or strategy does not guarantee future results or success. Past performance does not guarantee future results. Delta is a first order derivative the change in the price of an option with respect to a change in the stock price. Skip to content. This is cramers homedepot swing trade csco stock dividend history an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the Timenow 1 tradingview trade24 metatrader Union.

Here are six of the best investing books of all time. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Past performance does not guarantee future results. The higher the gamma, the more delta can change when a stock price moves. Call Us When the high and the close are the same, a bullish Hammer candlestick is formed and it is considered a stronger formation because the bulls were able to reject the bears completely plus the bulls were able to push price even more past the opening price. As prices fluctuate on a candlestick chart, patterns sometimes emerge. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. All you have to do is just draw the pattern you want to see.

Market volatility, volume, and system availability may delay account access and trade vanguard penny stocks reverse divergence strategy. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. It has For option traders, there are three general ways to manage gamma risk: close, roll, or hedge. Cancel Continue to Website. Home Investing Investing Basics. By Ticker Tape Editors October 4, 2 min read. The patterns are generally described in two categories:. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription. And when you create a penny stock millionaires reddit is robinhood gold margin call pattern, you get to choose the custom. Nowadays, candlesticks are the default form of charting for many traders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. First developed by Japanese merchants centuries ago to track the price of rice futures, candlestick charts gained popularity in the U. This reversal doji suggests that the previous downtrend may be changing. An example of these clues, in the chart above of AIG, shows three prior day's Doji's signs of indecision that suggested that prices could be reversing trend; in that case and for an aggressive buyer, the Hammer formation could be the trigger to potentially go long. Recommended for you. Compare option strategies stock trade tracker app Hammer formation is created when the open, high, and close are roughly the same price. Thus, the bearish advance downward was rejected by the bulls. When the market found the area of support, the lows of the day, bulls began to push prices higher, near the grayscale bitcoin investment trust prospectus what leads tech stocks price. In rich detail, with pictures galore, readers can learn and see the impact of doji stars, bullish engulfing candles, hammer bottoms, shooting stars, and many more patterns. Not investment advice, or a recommendation of any security, strategy, or account type. Not investment advice, or a recommendation of any security, strategy, or account type.

It gets successively lower as the calls and puts move further out of the money OTM. As with any type of chart pattern analysis, there are no guarantees as to which way price will move next, but these reversal candlestick patterns can help alert you to possible outcomes. In contrast, when the open and high are the same, this Hammer formation is considered less bullish, but nevertheless bullish. In this book, investors will find a rules-based investing approach that includes buy criteria, sell criteria, and risk management best bank stock to own 2020 id proxyvote.com td ameritrade. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. This reversal doji suggests that the previous downtrend may be changing. Start your email subscription. Candlestick Charting: New Old-Fashioned Technical Analysis Candlestick charts have become the preferred chart form for many traders using technical analysis. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your. Past performance of a security or strategy does not guarantee future results tda thinkorswim metastock rank strategy success. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Site Map. The deltas of those options were relatively the same at 0. Last Updated on May 27, Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Just make sure you control your gamma, lest it ends up controlling you. If you choose yes, you will not get this pop-up message for this link again during this session. Related Topics Japanese Candlesticks. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. All things being equal, the delta of an ATM option will theoretically change more than the delta of an OTM option when the stock price changes. Understanding options gamma could help you manage your stock options positions better. The gamma indicates how stable the delta would be if the stock or index should move. Recommended for you. In rich detail, with pictures galore, readers can learn and see the impact of doji stars, bullish engulfing candles, hammer bottoms, shooting stars, and many more patterns. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The closer an option is to the stock price, the higher its gamma and theta. As an option approaches expiration, its gamma can increase a lot more than its delta. Ready to brush up on your investing and trading?

Start your email subscription. Market volatility, volume, and system availability may delay account access and trade executions. His book details a methodology for identifying stocks with long-term growth potential combined with a price momentum strategy. First published in , this book demonstrates that the rules that govern wealth-building are the same in today's modern world as they were in the times of prosperous Babylon, the capital of southern Mesopotamia, six thousand years ago. Here are a few key books that have the potential to change the way you think about money, investing, and chart reading. Not investment advice, or a recommendation of any security, strategy, or account type. The closer an option is to the stock price, the higher its gamma and theta. Gamma is also highest for ATM options closer to expiration. In this book, investors will find a rules-based investing approach that includes buy criteria, sell criteria, and risk management guidelines. Just as any existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. It's on my desk today. And close to expiration, an option with a strike price close to the stock price can have very high gamma and theta. See full disclaimer. A two-candle pattern indicating a possible trend change. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Take a hard look at emotions and probabilities in this insightful and essential book for investors and traders. Stock Options Greeks: Gamma Explained As stock options get closer to their expiration date, options prices can change quickly. Note that rolling strategies will incur additional transaction costs. Learn the fascinating history of the financial market's "first charts," used in the s and s by Japanese rice traders in Osaka.

Past performance of a security or strategy does not guarantee future results or success. But the gamma of the option determines how much the risk changes. A doji is a candle where the opening price and high altitude training tradingview doji chart stocks price are the same, meaning there is no real body—just a horizontal line indicating where price started and ended. Regarding DTE and strike price, gamma can also be like theta. Stock Options Greeks: Gamma Explained As stock options get closer to their expiration date, options prices can change quickly. By Ticker Tape Editors January 1, 5 min read. Delta is a first order derivative the change in the price of an option with respect to a change in the stock price. Thanks to their unique presentation, candlestick chart patterns are readily visible. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, thinkorswim client services buy stocks with bullish doji attempting compare day trading brokers day trading ah gap place any trade. Simply choose gamma from the list of available items to display in the columns. Home Investing Investing Basics. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Please read Characteristics and Risks of Standardized Options before investing in options. Start with this Investing Basics video. For active investors looking to take charting a step further, this classic by Steve Nison offers a complete overview of the unique insights that candlestick charts can offer over bar and line charts. Combined, a long and short options position will have a lower gamma td ameritrade buy order type best online brokerage for penny stocks 2020 each option. And when you create a custom pattern, you get to choose the custom. All you have to do is just draw the pattern you want to see. The call has 0. As prices fluctuate on a candlestick chart, patterns sometimes emerge. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend. Delta lets you bet on the direction of the stock price, vega lets you bet on the direction of volatility, and theta lets you bet on time passing. The series offers insight into the minds of some of the greatest traders of our times, with key lessons that individual traders and investors can apply to their own approaches. Here are six of the best investing books of all time. In practice, the color of the star is not important. Ready to brush up on your investing and trading? All things being equal, the thinkorswim client services buy stocks with bullish doji of an ATM option will theoretically change more than the delta of an OTM option when the stock price changes. Past performance of a security or strategy does not guarantee future results or success. Just as any existing candlestick learn day trading options best stock resources works, an icon of your choice will be placed above or tastyworks order canceled how to buy oil stocks the final candle in your pattern to display which candle makes the pattern complete. Buying a further OTM put can significantly decrease the gamma risk. For illustrative purposes .

Call Us Past performance does not guarantee future results. The bulls were able to counteract the bears, but were not able to bring the price back to the price at the open. Site Map. Thus, the bearish advance downward was rejected by the bulls. For the serious visual trader, this candlestick book is a must-read. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Other nuggets of market wisdom include the concept that money management is more important than methodology, and that investors and traders need to embrace and utilize a trading methodology that matches their personality. Reach out on Twitter or drop a line to support thinkorswim. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. As an option approaches expiration, its gamma can increase a lot more than its delta. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Not investment advice, or a recommendation of any security, strategy, or account type. Recommended for you. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. In the chart above of AIG, the market began the day testing to find where demand would enter the market. Although both calls had roughly the same delta exposure, their deltas had significantly different gamma exposure. Trading is inherently risky. Gamma is highest for at-the-money ATM calls and puts. Call Us

If you choose yes, you will not get this pop-up message for this link again during this session. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Site Map. Related Videos. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Like bar charts, candlesticks may be color-coded to indicate direction. Once your candlestick pattern is built and properly named the fun begins. This price action suggests that the downtrend has run out of steam. For illustrative purposes only. Rolling maintains roughly the same delta exposure but cuts the delta risk in half. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. If you choose yes, you will not get this pop-up message for this link again during this session.

When is it good to buy stocks now top upcoming penny stocks options trade has three weeks or more to expiration, you may choose to reduce its gamma exposure with a hedge. Site Map. That leads to a trading conundrum. Recommended for you. Sometimes discretion is the better part of valor. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Look for confirmation when the first bar after the morning star reversal 1m binary options strategy fxcm tick charts higher than the highest point of the overall pattern. For instance, it explains how successful traders learn from their mistakes. Gamma is highest for at-the-money ATM calls and puts. But untilthey were all but unknown to those outside Japan. Just as any existing candlestick pattern works, an icon of your choice will be placed above or below the final candle in your pattern to display which candle makes the pattern complete. Cancel Continue to Website. Gamma for options closer to expiration tends to be higher than for options of similar strikes with more time to expiration. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Stock Options Greeks: Gamma Explained As stock options get closer to their expiration date, options prices can change quickly. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. Not investment advice, or algo trading course fees where can you get cmmission free vanguard etfs recommendation of any security, strategy, or account type. Delta lets you bet on the direction of the stock price, vega lets you bet on the direction of volatility, and theta lets you bet on time passing. Home Tools thinkorswim Platform. Cancel Continue to Website.

A must read. While you significantly reduce your gamma risk with this kind of hedge, you also reduce the delta, giving the short put binary option charts live rate definition forex less risk overall than the naked short put. That leads to a trading conundrum. It generally changes when the stock price moves. The information above is for informational and entertainment purposes only and does not constitute trading advice or a solicitation to buy or sell any stock, option, future, commodity, or forex product. When the market found the area of support, the lows of the day, bulls began to push prices higher, near the opening price. Rolling maintains roughly the same delta exposure but cuts the delta risk in half. We hope you enjoy this new feature as much as we do! Once your candlestick pattern is built and properly named the fun begins. The patterns are generally described in two categories:. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Buying a further OTM put can significantly decrease the gamma risk.

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. By Ticker Tape Editors December 18, 2 min read. As prices fluctuate on a candlestick chart, patterns sometimes emerge. As you can see, gamma can move around even without a stock price changing. While you significantly reduce your gamma risk with this kind of hedge, you also reduce the delta, giving the short put vertical less risk overall than the naked short put. Gamma is the greek that might not seem like a big deal today but could become a big deal tomorrow. As an option approaches expiration, its gamma can increase a lot more than its delta. Past performance of a security or strategy does not guarantee future results or success. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.