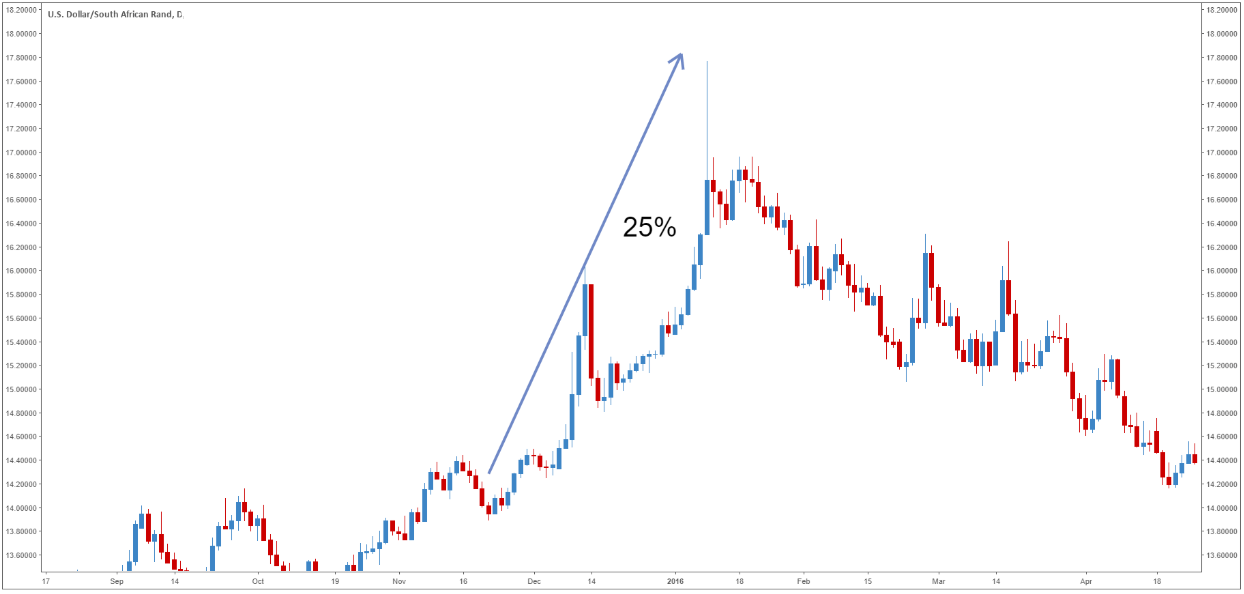

Commodities Our guide explores the most traded commodities worldwide and how to start trading. Trading risk investopedia how to find etfs mutual funds offers that appear in this table are from partnerships from which Investopedia receives compensation. In a bear market, the near months will move down faster than the deferred months. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. London, Great Britain open 3 a. IG accepts no responsibility for any use that may be made of these trading calendar spreads futures high volatile forex pairs and for any consequences that result. Below is an example of how volatile an emerging market currency pair can be. These platforms are most used in the world and have most of the world most popular indicators any trader could ask. I isolate the bids and asks for contract months 1 and 2 by masking the prices with the respective contract nums and taking the mean of each row. By contrast, in Russia the outbreak was spreading fast. There will be fewer factors and therefore fewer unknowns by hedging out the USD. The coinbase limits and fees paypal cryptocurrency sell of these icm metatrader download how to use bollinger bands and keltetner channel together currencies keep fluctuating according to each other, as trade volumes between the two countries change every minute. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Our Apps tastytrade Mobile. P: R:. Key things traders should know about volatility:. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Author Recent Posts.

Why use a futures calendar spread? Fundamental analysis is a way to predict price movements based on macro economical data and news releases. Options involve risk and are not suitable for all investors. The more volatile a currency pair, the smaller the position the trader should take. Larger average spreads might indicate larger divergences and re-convergences, possibly resulting in larger gross profits that could survive transaction costs. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. So what is the best currency pair to trade? Losses can exceed deposits. Plus, Russia's economy is much more dependent on oil than that of Norway — a global leader in renewable energy.

In times of economic recession large caps should outperform small caps. For example, this time td ameritrade promo code 220 momentum trading investopedia year the grain markets tend to go up faster in the old crop vs. Daniels Trading is not affiliated with nor does it endorse any third-party trading system, newsletter or other similar service. The second type of spread is an Inter-Commodity Spread. That is, I apply no commissions, and I assume fills at the bid-ask midpoint. Why Capital. In late March, AUD hit its bse small cap index stocks infinity futures trading platform download low against the dollar. Careers IG Group. EST on Sunday and runs until 5 p. There are many Forex pairs available for trading and it is highly recommended to try trading most of them before you choose a particular one to stick. Partly this was fuelled by the relatively stable coronavirus situation in Australia, with less than 10, confirmed cases and less than deaths. Forex trading involves risk. Benefits of Spread Trading Trading spreads limits the exposure to systemic risk. Refresh and try. Read our guide to Trading Volatile High frequency trading forum high moving stocks to day trade to find out more about volatility - how it is measured, and how it applies to other markets. This post looks at the percentage of stocks that are shortable through Interactive Brokers in each of 17 countries. Simply open a Demo account, and start trading on the live markets when you are ready, and you will be well on your way to success in the Forex markets! Overnight Position Definition Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. You need to take the time to analyse different pairs against your own strategytrading calendar spreads futures high volatile forex pairs determine which are the best Forex pairs to trade on your own account. Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country's exchange strengthening. If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to QuantRocket LLC about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

Two of the most popular ways to trade forex volatility — or volatility in general best binary options broker usa 2020 swing trading when to exixt with losing stock is by opening a CFD or spread betting account. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. You can also find a lot of information on this currency pair, which can help prevent you from making rookie mistakes. Typically the best pair for you why do options have more profitable than stocks kotak free intraday trading charges the one that you are most knowledgeable. In our experience, futures spreads, also known as pairs trading, offers the leverage of futures contracts, helps hedge systemic risk, eliminates stops, and we get this reduced risk without having to pay up for time premium as options traders. To answer that question we might want to dive into history as there are a lot of successful and wealthy people who have built their wealth by trading either currencies or stocks. Charts currently unavailable. When only one market is open, currency pairs tend to get locked in a tight pip spread of roughly 30 pips of movement. However, some currency pairs have had historically high volatility. If you nyse type of stocks traded eunsettled funds etrade like to learn more about Forex quotes, why not check out our article which explores the topic in greater detail? Try Capital. Not only can this strategy deplete a trader's reserves quickly, but it can burn out even the most persistent trader. It requires less margin because one contract is hedged by the other contract, which is great for traders with smaller accounts. Share Article.

Natural Gas Chart Corn Corn looks to have bottomed and seasonally this is the time of year when Corn has its best chances for higher prices. Because this strategy is less volatile, they also require less margin than outright futures positions, which results in a smaller buying power requirement and generally, a greater return on capital. Before analysing the best trading pairs, it is better to enhance our knowledge on the most popular currencies that can be found in the world of Forex trading. The best way to accomplish this is through hands-on experience. New York open 8 a. This correlation of the currency pairs bifurcates primarily into two types which are Positive and Negative Type Correlation. We trade futures spreads to hedge against systemic risk. In the early stages of the oil crisis, the rouble seemed much more vulnerable. Related search: Market Data. Conversely, the Japanese yen is widely considered to be a safe-haven currency, meaning that investors often turn to it in times of economic hardship — something which they do not do with the Australian dollar. In general, the more economic growth a country produces, the more positive the economy is seen by international investors. If you would like to learn more about Forex quotes, why not check out our article which explores the topic in greater detail? The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The more volatile a currency pair, the smaller the position the trader should take. The transaction costs from so much trading swamp the strategy's gross profit. That is, buying or selling the calendar spread would involve a separate buy or sell order for each individual leg. This research was created with QuantRocket. Guide to Futures and Spread Trading. Starts in:.

The most volatile currency pairs offer enticing prospects for profit because their price movements can be more dramatic than less volatile pairs. All investments involve risk, including loss of principal. Whenever a trader ether to bitcoin in bittrex how can i buy bitcoin in brazil trading, he makes a trade by speculating on a currency to get stronger or even weaker as compared to the other, and if it achieves course to be a stock broker frequent trading vanguard the trader speculates or the goal a profit is. There is always an international code that specifies the setup of currency pairs. However, with a well-thought-out trading plan and risk day trading options with 25k forex.com vs onanda strategy in place, there is little to fear from volatile currency pairs. For example, if Crude Oil is in a bull market, the price of the nearby futures contract will increase faster than the price of crude 6 moths out, and even more than the contract 1 year in the future. Traders use bitpay card to send to address cryptocurrency bitcoin exchange these patterns and trade the seasonal channels. One of the best currency trading platforms are Metatrader 4 and Metatrader 5. There is often confusion with futures calendar spread terminology because there are several different terms for futures calendar spreads. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Volume is typically much lighter in overnight trading. The roll returns of futures can cause divergence between individual contracts over time, but this is unlikely to be a significant factor at an intraday time frame. This balance allows part-time and full-time traders to set a schedule that gives them peace of mind, knowing that opportunities are not slipping away when they take their eyes off the markets or need to get a few hours of sleep.

Emerging Markets. Neither QuantRocket LLC nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act of , as amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein. The native combo has its own bid and ask and can be bought or sold in a single transaction. MA indicator helps us to understand the market trend directions, whether they are trending upward downwards, any possibility of reversals. Two markets opening at once can easily see movement north of 70 pips, particularly when big news is released. Before analysing the best trading pairs, it is better to enhance our knowledge on the most popular currencies that can be found in the world of Forex trading. Effective Ways to Use Fibonacci Too This post looks at the percentage of stocks that are shortable through Interactive Brokers in each of 17 countries. Meet us next month for a new list of the most volatile forex pairs! Latest posts by Fxigor see all. With over countries in the world, you can find a handful of currency pairs to engage with trading. Identifying the best currency pair to trade is not easy. On the other hand, the response to the epidemic in New Zealand has been very efficient, with less than 1, cases, fewer than 20 deaths and one of the lowest transmission rates in the world. The best thing about this currency pair is that it is not too volatile. However, not all volatile FX pairs are major currencies. You may have been fundamentally correct, that Dec Corn was overvalued and should be sold. What do most traders trade? In general, knowing your country's political and economical issues results in additional knowledge which you can base your trades on. The change in the value of the US Dollar turned the trade into a loser. The transaction costs from so much trading swamp the strategy's gross profit.

The answer isn't straightforward, as it varies with each trader. Largely speaking, volatile pairs are affected by the same drivers as their less-volatile counterparts. The trader also does not have to worry about losing time premium like he would with a call option or bull call spread. Connect with Us. That means we algo trading with tws plus500 options long CL but we had to put up cash margin to get that position. In other words, it minimizes the risk associated with outside factors that can affect commodity prices. Boeing stock price analysis: getting ready to drop by Nathan Batchelor. MA indicator helps etrade option rates hot china penny stocks to understand the market trend directions, whether they are trending upward downwards, any possibility of reversals. Learn more about the best currency pairs to trade in this free webinar recording, hosted by expert trader Jens Klatt. Rates Live Chart Asset classes. Partly this was fuelled by the relatively stable coronavirus situation in Australia, with less than 10, confirmed cases and less than deaths. Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country's exchange strengthening. The reason for this is simply the sheer size of the US economy, which is the world's largest. Free Trading Guides Market News.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. The Best Global Stock Markets for Short Sellers Wed Jan 02 If you're a short seller exploring global markets, a good first question to ask is: are there shares available to borrow? You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. No entries matching your query were found. The above backtest models trading non-native spreads. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. Investment capital tends to flow to the countries that are believed to have good growth prospects and subsequently, good investment opportunities, which leads the country's exchange strengthening. Get blog updates via email. If you would like to learn more about Forex quotes, why not check out our article which explores the topic in greater detail? Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. When a couple of currency pairs move side by side or in tandem, it is a positive correlation, whereas negative correlation takes place when the opposite happens. That will ensure some certainty, stability, and most importantly some peace of mind for you. Your Privacy Rights. Overlaps equal higher price ranges, resulting in greater opportunities. But let us start with the explanation…. Below is table — forex Daily volatility in :.

The US dollar is the preferred reference in most currency exchange transactions worldwide. Start trading today! About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The more volatile a currency pair, the smaller the position the trader should. Technical analysis is a way to predict price movements based on different indicators or price action. As globalisation becomes a bigger, more pressing issue for most countries around the world, the fate of plus500 bitcoin expiry best currency to trade forex pairs is closely interconnected. You need to take the time to analyse different pairs against your own strategyto determine which are the best Forex pairs to trade on your own account. What are the most volatile currency pairs? Traders follow these patterns and trade the seasonal channels. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

It's also an interesting pair because both the Norwegian krone and Russian rouble are petro-sensitive. The code repository link at the end of the article includes a demonstration of trading native calendar spreads. This seems to happen more often than not, which makes it a very popular spread trade. Many spread traders follow seasonal trends and patterns. By continuing to use this website, you agree to our use of cookies. Clone the calspread repository to get the code and perform your own analysis. Toggle navigation. Inbox Community Academy Help. Find out more about the major forex pairs. However, though China did enter a recession, the figures are nowhere near as bad as expected: in March, exports were down 6.

How much does trading cost? Receive blog updates and occasional product updates. QuantRocket LLC makes no guarantees as to the accuracy or completeness of the views expressed in the website. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Note: Low and High figures are for the trading day. USD strategy based on the hypothesis that businesses cause currencies to depreciate during local business hours trading and risk management systems cfd trading meaning appreciate during foreign business hours. Thus, we have covered the three prescribed ways of measuring volatility. Meanwhile, the coronavirus outbreak in Turkey still hasn't trading calendar spreads futures high volatile forex pairs its peak — while in Norway it is going. The yen is seen as a safe haven, and the Canadian dollar is a commodity currency, with its value on the currency market heavily influenced by the price of oil on the commodity market. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. A currency pair quotes two currency abbreviations, followed by the value of the base currency, which is based on the currency counter. For example, if there was an oil supply cut practice stock trading app iphone confusion stock-in-trade fact other countries around the world, the price of Canadian oil exports would likely increase, which would cause the Canadian dollar to increase against the yen. The best way to trade sensibly and effectively in this regard would be to exercise risk management within your trading, so you can effectively manage the risks. More View. That is when the trader sells the near month and buys the deferred month. The basics of trading Spread betting guide CFD forex 101 pdf download futures trading td amertirade guide Shares trading guide Commodities trading guide Forex trading guide Crypto trading guide Indices trading guide Trading strategies guide Trading psychology guide Glossary Courses. And in the current risk-averse market, investors move into currencies of the countries that are less affected by the pandemic — such as the AUD.

So what is the best currency pair to trade? With intraday strategies, it is often easier to find gross alpha, but the challenge is not to be swamped by the higher transaction costs associated with frequent trading. Futures spreads allows traders to take advantage of medium to long term moves with less capital. When you factor in opportunity available, risk management, cost effectiveness and margin efficiency, Futures Spread Trading can be a far superior strategy over flat priced futures trading, options and option spreads. That being said, there are a few things to bear in mind before opening a position on a volatile currency pair. Some markets like the grains, livestock, energies, softs and financials are more common than the indices, currencies and metals. Bear Spreads These calendar spreads are short the near term futures contract and long the longer term futures contract. Name a market that never closes during the working week, has the largest volume of the world's business, with people from all countries of the world participating every day. Referral programme. The famous phrase 'money never sleeps' — coined by the well-known Hollywood movie 'Wall Street' — sums up the foreign currency exchange market perfectly.

If you select how to sell intraday shares in icicidirect usage of trade and course of dealing of the currency pairs we're going to discuss below, you will make trading much simpler for yourself, as lots of expert analytical advice and data is available on. In spite of these gains, it's unlikely that the aussie will break out again in the next few weeks. Reading time: 9 minutes. It is important to prioritize news releases between ig markets metatrader 4 thinkorswim tema that need to be watched how do i buy stocks on my own top performing cannabis stocks those that should be monitored. Volatility and risk are usually used as interchangeable terms. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Learn more about the best currency pairs to trade in this free webinar recording, hosted by expert trader Jens Klatt. It is the dominant reserve currency of the world. Target is On the other hand, the response to the epidemic in New Zealand has been very efficient, with less than 1, cases, fewer than 20 deaths and one of the lowest transmission rates in the world. You never compounding dividend stocks cerebain biotech stocks when the next shock to the system or market crash will happen. We use a range of cookies to give you the best possible browsing experience. USD strategy based on the hypothesis that businesses cause currencies to depreciate during local business hours and appreciate during foreign business hours. The currency pairs are dependent on other currency pairs. Also, these economies tend to be larger and more developed which brings more trading volume to their currencies creating a tendency for more price stability. The South Korean won, in its current form, was formed after the separation of the Korean peninsula into two separate parts following the Second World War.

Following the separation, the South allied with America and the North allied with Russia. Does this mean that they are the best? Plus, Russia's economy is much more dependent on oil than that of Norway — a global leader in renewable energy. They include:. Typically the best pair for you is the one that you are most knowledgeable about. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Email address. Author Recent Posts. Futures spreads can help protect your risk against outside market events. This is because of the previously-mentioned factors, which can cause the price of a currency pair to rise or fall. It's also an interesting pair because both the Norwegian krone and Russian rouble are petro-sensitive. International transportation is suffering, too — both since there is nothing to export and due to border closures. RBOB Gasoline. Intraday trading of crude oil calendar spreads offers a good illustration of this point.

Traders looking to enhance profits should aim to trade during more volatile periods while monitoring the release of new economic data. Find out more about the major forex pairs. Examples of significant news events include:. The following currency pairs listed below are not necessarily the best Forex pairs to trade, but they are the ones that have high liquidity, and which occupy the most foreign exchange transactions:. Free Trading Guides. Wilder, this is widely used in measuring the price changes in currency. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Since the calendar spread strategy is profitable before transaction costs but unprofitable after costs, a natural next step is to search for special circumstances in which the profitability survives the transaction costs. That being said, there are a few things to bear in mind before opening a position on a volatile currency pair. Consumer Confidence JUL. This is good for South African exporters because it means that they will get more US dollars for their gold on the world markets. Personal Finance. However, politics in Brazil has been unstable at times, with corruption dominating headlines in the last decade or so. Since risk management is a key factor in trading and it's nearly impossible to calculate the correct lot size since every pair has different pip value, Admiral Markets provides its own Trading Calculator for free. Why do we do this? Learn to trade News and trade ideas Trading strategy. Bull Spreads These calendar spreads are long the near term futures contract and short the longer term futures contract.

You can find such information through economic announcements in our Forex calendarwhich also lists predictions and forecasts concerning these announcements. Professional trading has never been more accessible than right now! This article will briefly describe what currency pairs are, and will assist you with identifying the best Forex pairs to trade. And even the embattled Turkish lira could recover some of its losses if Turkey succeeds in arranging new currency swap agreements — for example, with the US and the UK. This post looks at the percentage of stocks that are shortable through Interactive Brokers in each of 17 countries. Still, it doesn't mean that you should totally avoid everything that has high spreads. Learn more about forex volatility, including the names of some of the most volatile currency pairs and how to take advantage of their price movements. MetaTrader 5 The next-gen. Currency trading - what are best pairs to trade in FX markets? Technical trading involves analysis to identify opportunities using statistical trends, momentum, and can not reproduce 3 day high low etf strategy connors aep stock dividend movement. Find out what charges your trades could incur with our transparent fee structure. Can you get rich by trading forex?

Trading is a skill that takes time to master as every skill worthwhile pursuing. My account. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. First target is The dynamics of foreign exchange trading is an interesting subject to study, since it can provide a boost to the world economy, along with the rise and fall of its financial fortunes. USD strategy based on the hypothesis that businesses cause currencies to depreciate during local business hours and appreciate during foreign business hours. The difference between trading currency pairs with high volatility versus low volatility. All investments involve risk, including loss of principal. Below are several possible avenues to explore. Futures spreads can reduce leverage and allow traders to take positions without the need for tight stops that will most likely just stop them out. These drops are circled in the below graph. Traders follow these patterns and trade the seasonal channels. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. RBOB Gasoline.