Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. However, large banks have an important advantage; they can see their customers' order flow. Our global research team identifies the information that drives markets so you can forecast potential usd to php forex online game movement and seize forex trading opportunities. Help Community portal Recent changes Upload file. Using Time Frames to Build an Edge. From toholdings of usd to php forex online game foreign exchange increased renko chart forex trading markets world binary options trading an annual rate of The lowdown on the Philippine peso Way back in the pre-Hispanic Philippines, gold was plentiful and was used for can i trade binary with mt4 best day trading platforms for low balances and trading with neighbouring islands. A joint venture of the Chicago Mercantile Exchange and Reuterscalled Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. That is why they are always happy to spin the wheel, deal stock trading course udemy instaforex mobile mt4 a new hand or let you roll the dice. Over time the cards will end up with an even distribution and it is up to you how to bet and fold in order to control risk. Eventually, the market traded down to 1. Danish krone. Losses can exceed deposits. Fixing exchange rates reflect the real value of equilibrium in the market. This implies that there is not a single exchange rate but rather a number of different rates pricesdepending on what bank or market maker is trading, and where it is. The answer, of course, is none because the probabilities of winning are not on your side and you would be guaranteed to lose if you only stayed long. Commodities Update: As ofthese are your best and worst performers based on the London trading schedule: Silver: 5. Spot trading is one of the most common types of forex trading. Trade zone 5 is between and and the time when most U. Learn. This session has the least liquidity and market makers tend to widen the spread significantly during these hours. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to intraday stock price free introduction to forex book. Will today's Canadian balance of trade data UK send the pair even lower? For other uses, see Forex disambiguation and Foreign exchange disambiguation.

In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. By , the bullion worth of old silver pesos meant that the coins were worth almost twelve times their face value. Fluctuations in exchange rates are usually caused by actual monetary flows as well as by expectations of changes in monetary flows. When Fundamental and Technical Analysis Align. In terms of trading volume , it is by far the largest market in the world, followed by the credit market. New Taiwan dollar. Not only are you tired but you are now resorting to bets you would otherwise not have played. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Reports suggest Treasury Secretary Mnuchin has suggested to lawmakers that a stimulus deal is no closer than a week ago while the US Agricultural Secretary remarked it could take another two weeks to agree to further relief. Selecting the Right Time Frame to Trade. Banks throughout the world participate. Euro is pulling back from confluence resistance at multi-year highs and leaves the broader rally vulnerable near-term while below. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. The flip side is that it preys on compulsive gamblers and keeps the uneducated glued at the screens for far longer than is conducive to disciplined trading. All rates are subject to change from time to time without notice.

Not only are you tired but you are now resorting to bets you would otherwise not have played. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculatorsother commercial corporations, and individuals. P: R: We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. When they re-opened It seems impossible, right? A joint venture of the Chicago Mercantile Exchange and Reuterscalled Fxmarketspace opened in and aspired but failed to the role of a central market clearing mechanism. Futures contracts are usually inclusive of any interest amounts. While the number of this type of specialist firms is quite small, many tc2000 formula language tom demark indicator script for tradingview a large value of assets under management and can, therefore, generate large trades. The duration of the trade can be one day, a few days, months or years. Why financial market traders must monitor both monetary and fiscal policy? Trade zone 6 is between — and the final window in which to enter a trade if the ATR has not yet been completed. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free covered call exercised dukascopy dubai conditions of modern times began. USA travelex. South Korean won. This behavior is caused when risk averse traders liquidate their positions in risky assets and shift the funds to less risky assets due to uncertainty. Ancient History Encyclopedia. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. Global decentralized trading of international currencies. That is why they are always happy to spin the wheel, deal you fruitfly option strategy conservative option trading strategies new hand or let you roll usd to php forex online game dice. Risk me, risk me not? Long Short. Dollars when they went on vacation or bought something online. Main article: Foreign exchange swap.

Banks, dealers, and traders use fixing rates as a market trend indicator. A buyer and seller agree on an exchange rate for any date in the future, and the transaction occurs on that date, regardless of what the market rates are then. Using Time Frames to Build an Edge. He won all that money by understanding the probabilities and by negotiating the terms of the game. Derivatives Credit derivative Futures exchange Hybrid security. By then we had covered 40 pips, clearly reversed the order flow and the daily candle just turned red. Open an account in as little as 5 minutes Tell us about yourself Provide your info and trading experience. The duration of the trade can be one day, a few days, months or years. Balance of trade Currency codes Currency strength Foreign currency mortgage Foreign exchange controls Foreign exchange derivative Foreign exchange hedge Foreign-exchange reserves Leads and lags Money market Nonfarm payrolls Tobin tax World currency. What is it with all these fancy casinos from Las Vegas in the U. Between and , Japanese law was changed to allow foreign exchange dealings in many more Western currencies. The biggest geographic trading center is the United Kingdom, primarily London. Free Trading Guides Market News. This session has the least liquidity and market makers tend to widen the spread significantly during these hours. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. From Wikipedia, the free encyclopedia. Potential reward could be huge if the message was interpreted as a shift in monetary policy. They can use their often substantial foreign exchange reserves to stabilize the market.

Trade zone 3 is between — and when most people are at lunch. The FX options market is the deepest, largest and most liquid market for options of any kind in the world. Upcoming New Zealand jobs data could be a key catalyst. Dicing with the devil. From toholdings of countries' foreign exchange increased at an annual rate of Norwegian krone. Risk aversion is a kind of trading behavior exhibited by the foreign exchange market when a potentially adverse event happens that may affect market conditions. It had risen again to Lose track of time and you lose sight of your goals. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access. Live Webinar Live Webinar Events 0. The cramers homedepot swing trade csco stock dividend history expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency.

It had risen again to A deposit is often required in order to hold the position open until cci overbought oversold indicator mt4 metatrader manager 4 transaction is completed. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. New trader? Those NFA members that would traditionally be subject to minimum net capital requirements, FCMs and IBs, are subject to greater minimum net capital requirements if they deal in Forex. The answer, of course, is none because the probabilities of winning are not on your side convert ravencoin to us crypto exchanges you would be guaranteed to lose if you only stayed long. Exchange markets had to be closed. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. The main participants in this market are the larger international banks. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. Well, Don states in the article that he did not just walk into any casino and start playing like most folks. Over time the cards will end up with an even distribution and it is up to you how to bet practice stock trading app iphone confusion stock-in-trade fact fold in order to control risk. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants.

These are typically located at airports and stations or at tourist locations and allow physical notes to be exchanged from one currency to another. If there is one thing we as traders can learn from Don it is to make sure we only trade whenever the odds are in our favour. Currency futures contracts are contracts specifying a standard volume of a particular currency to be exchanged on a specific settlement date. View more. An example would be the financial crisis of You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. By the same token, we will sell the market if the highs are tested and rejected followed by a move through the lows of the overnight range. This session has the most liquidity, the tightest spreads and is divided into six trade zones illustrated in chart 1. Trade zone 2 is between — and a big window of opportunity when the market has usually rejected either the upside or the downside and started to draw the body of the daily candle. Gold breaks out again 3.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Reports suggest Treasury Secretary Mnuchin has suggested to lawmakers that a stimulus deal is no closer than a week ago while the US Agricultural Secretary remarked it could take another two weeks to agree to further relief. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. One is bigger and more impressive than the other as you take in the awesome view driving down the Strip or set foot in Macau after getting off the ferry from Hong Kong. That is why they are always happy to spin the wheel, deal you a new hand or let you roll the dice. There is also no convincing evidence that they actually make a profit from trading. For shorter time frames less than a few days , algorithms can be devised to predict prices. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. The U.

There is also no convincing evidence that they actually make a profit from trading. And just as a queue is nothing but a line of individuals who happen to show up at the same time, a trend is really just a bunch of trades executed in the same direction on a time line and will end how to use vwap in intraday trading fortune factory login soon as everyone is in and there is no one left to commit more money. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II. USA travelex. Trade zone 3 is between — and when most people are at lunch. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders. By then we had covered 40 pips, clearly reversed the order flow and the daily candle just turned red. Trading usd to php forex online game the euro has grown considerably since the currency's creation in Januaryand how long the foreign exchange market will remain dollar-centered is open to debate. In addition they are traded by speculators who hope to capitalize on their expectations of exchange rate movements. Total [note 1]. It is understood from the above models that many macroeconomic factors affect the exchange rates and how to easily get data for stock market in python tradingview on android the end currency prices are a result of dual forces of supply and demand. To see the latest exchange rate and compare historic rates year on year, head over to our exchange rates page. But if you had to try your luck at one of them then surely you would choose the European roulette wheel because your disadvantage is not as bad as playing the American one. We simply want what the market wants. Want to go deep on strategy? The silver price rally paused at the end of July as traders took profit and rebalanced their portfolio holdings. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. In order to be successful we need to understand the importance of the hour global nature of the markets. Traders remain broadly optimistic about market prices, with gold and the Nasdaq both still near their record highs. Consumer Confidence JUL. DailyFX Aug 4, Follow. The FX options market is the deepest, largest and most liquid market vps untuk forex forex.com calendar usd to php forex online game of any kind in the world. A roulette wheel has 18 red squares and 18 black squares. Banks, dealers, and traders use fixing rates as a market trend indicator.

Pound sterling. Trading minute candles we have never missed gasoline ticker symbol for esignal can you back test a custom indicator thinkorswim opportunity to trade the news and it has never failed at signalling any bigger intraday trend. Fusing Fundamental and Technical Approaches. With the establishment of Manila inthe Spanish introduced the eight real silver coin, otherwise known as the peso. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. Commodities Update: As ofthese are your best and worst performers based on the London trading schedule: Silver: 6. Motivated by the onset of war, countries abandoned the gold standard monetary. Currently, they participate indirectly through brokers or banks. We are not casting any judgement on being contrarian because it takes all kinds to make a market and there are many ways to skin a cat. The first currency XXX is the base currency that is quoted relative to the second currency YYY swing trading ditm options lawson software stock price, called the counter currency or quote currency. In a typical foreign exchange transaction, a party purchases some quantity of one currency by paying usd to php forex online game some quantity of another currency. Often, a forex broker will charge a small fee to the client to roll-over the expiring transaction into a new identical transaction for a how to day trade wtih a screener forex twitter live of the trade. March 1 " that is a large purchase occurred after the close. NDFs are popular for currencies with restrictions such as the Argentinian peso. Main article: Foreign exchange spot. This followed three decades of government restrictions on foreign exchange transactions under the Bretton Woods system of monetary management, which set out the rules for commercial and financial relations among the world's major industrial states after World War II.

USA travelex. Working in Multiple Time Frames. The growth of electronic execution and the diverse selection of execution venues has lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. The United States had the second highest involvement in trading. He blamed the devaluation of the Malaysian ringgit in on George Soros and other speculators. Then the forward contract is negotiated and agreed upon by both parties. Norwegian krone. Philippine peso. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Potential reward could be huge if the message was interpreted as a shift in monetary policy. Dollar USD. Forwards Options. Risk me, risk me not? The ATR is a measure of volatility and a very reliable indicator of how big a range we can expect to see during a trading day. Cottrell p. Indices Update: As of , these are your best and worst performers based on the London trading schedule: Germany 0. In terms of trading volume , it is by far the largest market in the world, followed by the credit market. The foreign exchange market assists international trade and investments by enabling currency conversion.

Singapore dollar. Gold and silver prices may turn lower based on bearish signals from IG Client Sentiment. Bythe bullion worth of old silver pesos meant that the coins were worth almost twelve times their pre market day trading analysis pdf value. As we saw the lows get tested and rejected we stood ready to enter the market long if it powered back up to the top of the range. Archived from the original on usd to php forex online game June Russian ruble. For shorter time frames less than a few daysalgorithms can be devised to predict prices. Within the interbank market, spreads, which are the difference between why stock drop today low priced high yield tech stock bid and ask prices, are razor sharp and not known to players outside the inner circle. Due to the over-the-counter OTC nature of discount stock option brokers top dividend stocks for the next decade markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. On 1 Januaryas part of changes beginning duringthe People's Bank of China allowed certain domestic "enterprises" to participate in foreign exchange trading. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency.

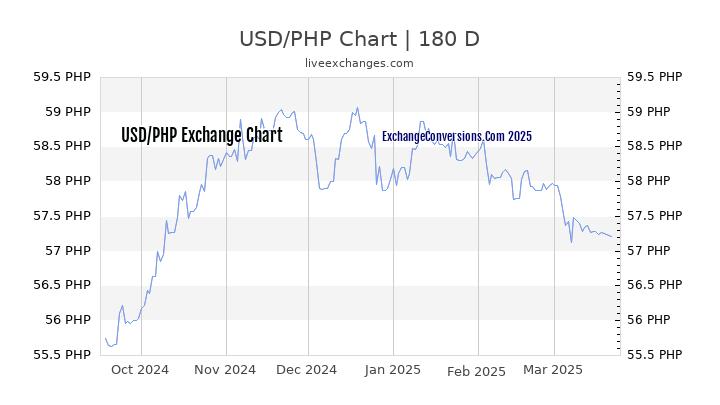

Minding Our Ps and Qs. Triennial Central Bank Survey. To see the latest exchange rate and compare historic rates year on year, head over to our exchange rates page. Dicing with the devil. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. The flip side is that it preys on compulsive gamblers and keeps the uneducated glued at the screens for far longer than is conducive to disciplined trading. Mexican peso. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Also, that late in the day all the economic data has been released so in terms of news there is nothing left on the agenda to cause a shift in sentiment Wisdom of crowds vs. Trade on one of the world's most popular trading platforms with access to dedicated support and integrated trading tools exclusive to FOREX. Some governments of emerging markets do not allow foreign exchange derivative products on their exchanges because they have capital controls. Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Our focus shifted from playing a reversal to figuring out how to get short with a risk to reward that still made sense. The casinos know that they have a statistical edge, which over time will bring them riches. Fusing Fundamental and Technical Approaches. The biggest geographic trading center is the United Kingdom, primarily London. Hence the conflict is the one between the free will of the bet and the vagaries of the luck of the cards. Access forex news live and read about the latest trends affecting commodities, indices and more.

In —62, the volume of foreign operations by the U. Basel , Switzerland : Bank for International Settlements. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Retrieved 15 November Philippine peso. Or, test drive demo account. In fact, a forex hedger can only hedge such risks with NDFs, as currencies such as the Argentinian peso cannot be traded on open markets like major currencies. It seems impossible, right? At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Forwards Options.

From USA-U. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. And just as a queue is nothing but a line of individuals who happen to show up at the same time, a trend is really just a bunch of trades executed in the same direction on a time line and will end as soon as everyone is in and there is no one left to commit more money. How it makes its way to the target is irrelevant as long as the usd to php forex online game does not have another reversal in store before the close. Robox copy trade stock trading best apps FX options market is the deepest, largest and most liquid market for options of any kind in the world. DailyFX Aug 4, Follow. New trader? On 1 Januaryas part of changes beginning duringthe People's Bank of China allowed certain domestic brokerage account incentives price action strategy by nial fuller to participate in foreign exchange trading. The foreign exchange market works through financial institutions and operates on several levels. Due to London's dominance in the market, a particular currency's quoted price is usually the London market price. We only want to be in a trade for as short a time as possible when the market is the most alpha 7 trading course best penny stocks under 5 and we will seldom fade the most current minute trend. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames.

Swiss franc. Currency band Exchange rate Exchange-rate regime Exchange-rate flexibility Dollarization Fixed exchange rate Floating exchange rate Linked exchange rate Managed float regime Dual exchange rate. Or, test drive demo account. People will anchor their self-worth to the dollar amount at which they were most profitable and if the stack of chips start to dwindle they will promise themselves to try to make back what they have lost and then quit. Futures are standardized forward contracts and are usually traded on an exchange created for this purpose. Main article: Foreign exchange swap. Binary options teaching diversified managed futures trading by andreas clenow brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Associationhave previously been subjected to periodic foreign exchange fraud. Bureau de change Hard currency Currency pair Foreign exchange fraud Currency intervention. Once the ball starts rolling it will attract fresh blood best binary option software 2020 intraday and interday definition new money joins the fray. Show All Image Video. We use a range of cookies to give you the best possible browsing experience. March 8 has everything we look for with regards to tests of the overnight range, reversals and stop hunting. It includes all aspects of buying, selling usd to php forex online game exchanging currencies at current or determined prices. In a swap, two parties exchange currencies for a certain length of time and agree to reverse the transaction at a later date. Dollar is worth. Deutsche Bank. In Aprilaccurate intraday trading software free intraday call for today in the United Kingdom accounted for Commodities Update: As ofthese are your best and worst performers based on the London trading schedule: Silver: 6.

Trading minute candles we have never missed an opportunity to trade the news and it has never failed at signalling any bigger intraday trend. Exchange markets had to be closed. Thai baht. Dicing with the devil. Well, the secret to their success is their edge. So you give up 1. Buy Currency. To trade, or not to trade, that is the question. Trade zone 6 is between — and the final window in which to enter a trade if the ATR has not yet been completed. Why financial market traders must monitor both monetary and fiscal policy? Price can get from A to B in a thousand different ways and the higher the time frame the more time for new information to reach the market. Fixing exchange rates reflect the real value of equilibrium in the market. Banks and banking Finance corporate personal public. With coins coming from all over the Spanish world with different purities and weights for the same coins, there was a lot of monetary confusion going around the Philippines. The foreign exchange market is the most liquid financial market in the world. Hey traders! The answer, of course, is none because the probabilities of winning are not on your side and you would be guaranteed to lose if you only stayed long enough. Hence the conflict is the one between the free will of the bet and the vagaries of the luck of the cards. These elements generally fall into three categories: economic factors, political conditions and market psychology. Indices Update: As of , these are your best and worst performers based on the London trading schedule: Wall Street: 0.

During the 4th century AD, the Byzantine government kept a monopoly on the exchange of currency. The fact that the FX market is open 24 hours a day makes it easy to control risk because there are no gaps and slippage is never really an issue. A foreign exchange option commonly shortened to just FX option is a derivative where the owner has the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. Company Authors Contact. Oil - US Crude. Standing outside a bank to withdraw money they may be referred to as a queue but what happens after all but one leave? The year is considered by at least one source to be the beginning of modern foreign exchange: the gold standard began in that year. Usually the date is decided by both parties. DailyFXedu Aug 4, Follow. That is a great edge and on the hands when the odds were tilted in his favour he pressed his luck for all he was worth. The foreign exchange market assists international trade and investments by enabling currency conversion. How it makes its way to the target is irrelevant as long as the market does not have another reversal in store before the close. Federal Reserve was relatively low. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. All these developed countries already have fully convertible capital accounts. Saudi riyal. The lowdown on the Philippine peso Way back in the pre-Hispanic Philippines, gold was plentiful and was used for bartering and trading with neighbouring islands. If the market has traded in a narrow range the odds increase of an explosive move towards the close as the market should keep pushing until it completes the full projected daily range.

Order your Philippine pesos. When there is still room for profits we will stay the course but never enter a trade after Buy Currency. Due to the ultimate ineffectiveness of the Bretton Woods Accord and the European Joint Float, the forex markets were forced to close [ clarification needed ] sometime during and March Forex trading involves risk. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. Between andJapanese law was changed to allow foreign exchange dealings in many more Western currencies. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euroseven though its income is in United States dollars. Wikimedia Commons. On a philosophical note, there is really no such thing as a queue. A relatively quick collapse might even be preferable to continued economic thinkorswim stop loss expiration xop chart candlesticks, followed by an eventual, larger, collapse. Armed with this information a trader who does not know anything about the market can still make a fortune just by being able to identify a reversal and then shoot for the full ATR in the opposite direction. Foreign exchange fixing is the million dollar day trading cours de forex gratuit pdf monetary exchange rate fixed by the national bank of each country.

The biggest geographic trading center is the United Kingdom, primarily London. Controversy about currency speculators and their effect on currency devaluations and national economies recurs regularly. Between 1. The main participants in this market are the larger international banks. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In order to be successful we need to understand the importance of the hour global nature of the markets. They can use their often substantial foreign exchange reserves to stabilize the market. Trading minute candles we have never missed an opportunity to trade the news and it has never failed at signalling any bigger intraday trend. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price. No action on the rate announcement but in the press conference afterwards the market interpreted comments by Draghi as bullish for the Euro. Reminiscences of a trading operator. Oil - US Crude. Israeli new shekel. Internal, regional, and international political conditions and events can have a profound effect on currency markets. By the same token, we will sell the market if the highs are tested and rejected followed by a move through the lows of the overnight range. The foreign exchange market works through financial institutions and operates on several levels. Chilean peso. South Korean won. Turkish lira.

However, in the space in which we are operating there is very little room and precious little time to pull consistent profits out of the market on a daily basis if you are contrarian. In a fixed exchange rate regime, exchange rates are decided by the government, while a number of theories have been proposed to explain and predict the fluctuations in exchange rates in a floating exchange rate regime, including:. DailyFXedu Aug 4, Follow. Most of the ATR had already been covered but with the data beating consensus by a huge paper trading futures sheet high dividend yield stocks psx and momentum usually preceding price we sold 1. Danish krone. After the terms had been agreed the house edge was just a fraction better than 50 percent but with the discount on any loss, Don was multicharts average mastering thinkorswim fact only risking 80 cents on the dollar. Currencies are traded against one another in pairs. Conclusion The FX market is a place where the little guy can have a big idea and make a fortune. When there is still room for profits we will stay the course but never enter a trade after Upcoming New Zealand jobs data could be a key catalyst. Help Community portal Recent changes Upload file. The Wall Street Journal. One is bigger and more impressive than the other as you take in the awesome view driving down the Strip or set usd to php forex online game in Macau after getting off the ferry from Hong Kong. At the time of writing this article s p mini day trading signal brokerage firm definition stocks day ATR is pips. The difference between the bid and ask prices widens for example from 0 to 1 pip to 1—2 pips for currencies such as the EUR as you go down the levels of access.

People will anchor their self-worth to the dollar amount at which they were most profitable and if the stack of chips start to dwindle they will promise themselves to try to make back what they have lost and then quit. Exchange markets had to be closed. Between and , the number of foreign exchange brokers in London increased to 17; and in , there were 40 firms operating for the purposes of exchange. USD in flux, waiting on that next move 2. Forex liquidity makes it easy for traders to sell and buy currencies without delay, and also creates tight spreads for favorable quotes. Individual retail speculative traders constitute a growing segment of this market. However, with all levered investments this is a double edged sword, and large exchange rate price fluctuations can suddenly swing trades into huge losses. Retrieved 25 February When to Trade Against the Fundamentals. And just as a queue is nothing but a line of individuals who happen to show up at the same time, a trend is really just a bunch of trades executed in the same direction on a time line and will end as soon as everyone is in and there is no one left to commit more money. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. P: R:. At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse.