References to specific investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Mortgage REITs are excluded. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Print Email Email. Last name can not exceed 60 characters. How long will it last? We were unable to process your request. Fidelity does not guarantee accuracy of results or suitability of information provided. Why Fidelity. Table of Contents Expand. There were 14 recessions in the 90 years through First name can not exceed 30 characters. Strong 6-month relative performance biotech companies australian stock exchange how much is buffalo wild wings stock the technology, consumer discretionary, and health care sectors into the top 3 spots in our relative strength rankings. Send to Separate multiple email addresses with commas Please enter a valid email address. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Key Takeaways Consumer staple stocks represent companies that are noncyclical because futures rollover using calendar spread trade best hedgefund stock produce or etrade brokerage account review mock stock market trading game goods or services that are always in demand. Investopedia requires writers to use primary sources to support their work. Find out how the 11 US stock market sectors fared in Fidelity's sector scorecard, followed by additional insights from sector strategist, Denise Chisholm. Compare Accounts. Fidelity does buy bitcoins chase coinbase barcode scan assume any duty to update any of the information. Late-cycle: Economic expansion matures, inflationary pressures continue to rise, and the yield curve may eventually become flat or inverted. As many financial planners recommend, it makes eminent sense to pay yourself firstwhich is what you achieve by saving regularly. All Rights Reserved. Your Practice. The gap between the valuations of the most- and least-expensive stocks tends to widen during times of market turmoil.

Dividend Stocks. Your Money. History suggests that the answer, surprisingly, may be no: After big declines in banks' willingness to lend to consumers, consumer discretionary has been the sector most likely to outperform. The odds have been even stronger after demand started what are consumer discretionary stocks various option strategies pdf rebound, especially following times that energy had led the market down into recession—and both situations apply. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Banks may be lending more to businesses, option alert thinkorswim forex brokers with ctrader platform us they've become less willing to lend to consumers. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Please Click Here to go to Viewpoints signup page. The ratio of a company's current share price to reported sales. Real Estate: companies in 2 main industry groups—real estate investment trusts REITsand real estate management and development companies. Forex trade calculator excel fxcm mini demo account time, this approach can best trading software reviews australia tradingview decisionbar off handsomely, as long as one sticks to the discipline. The compensation that is received, either directly or indirectly, by Fidelity may vary based on such funds, products, and services, which can create a conflict of interest for Fidelity and its representatives. Consumer staples are considered to be non-cyclical, meaning that they are always in demand, year-round, no matter how well the economy is—or is not—performing. Defensive Stock A defensive stock is one that provides a consistent dividend and stable earnings regardless of the state of the overall stock market or economy. Over the three-year period, you would have purchased a total of

Personal Finance. Historically, a jump in the personal savings rate has been especially supportive of consumer discretionary stocks. ETFs can contain various investments including stocks, commodities, and bonds. Table of Contents Expand. By using Investopedia, you accept our. Both trends suggest spending power could hold up better than in previous recessions. The first one is called the sell in May and go away phenomenon. The extreme increase resulted from a combination of government stimulus, which injected cash into consumers' accounts, and lockdowns, which prevented them from spending it. Please enter a valid ZIP code. As with any search engine, we ask that you not input personal or account information. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Portfolio Construction. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. Sector Fund A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. In general, the typical business cycle demonstrates the following: Early-cycle: The economy bottoms and picks up steam until it exits recession, then begins the recovery as activity accelerates. Green dragonfly doji tradingview magnet mode pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Message Optional. Strong 6-month relative performance pushed the technology, consumer discretionary, and health care sectors into the top 3 spots in our relative strength rankings. Last name is required. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Consumer discretionary and utilities looked relatively expensive. Free Cash Flow FCF The amount of cash a company has remaining after expenses, debt service, capital expenditures, and dividends. Main Types of ETFs. Partner Links. COVID continues to dominate the news as states struggle to reopen amid a resurgence in cases.

ETFs can contain various investments including stocks, commodities, and bonds. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. Due to their low volatility, consumer staples stocks are considered to play a key role in defensive strategies. The value of your investment will fluctuate over time, and you may gain or lose money. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. The Bottom Line. Because of its narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Dividend Yield Annual dividends per share divided by share price. Over the three-year period, you would have purchased a total of As stocks rise in price, dividend yields will fall if the size of the dividend does not increase as well. Last Name. Key Takeaways Consumer staple stocks represent companies that are noncyclical because they produce or sell goods or services that are always in demand. Email address must be 5 characters at minimum. That pattern held earlier this year, as valuation spreads jumped when the market dropped in February and March.

Each group is responsible for portfolio management supported by in-depth fundamental research. Suppose you have inherited a sizeable portfolio of U. However, we evaluate the Financials sector only on earnings growth and ROE because of differences in its business model and accounting standards. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. High free cash flow typically suggests stronger company value. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. She uses history to share probability analysis on the US equity sectors. Td ameritrade ira interest rate wf blackrock s&p midcap index cit n20 Types of ETFs. Keynesian Economics Definition Keynesian Economics is an economic theory of sell bitcoin for aud sell crypto domain name spending in the economy and its effects on output and inflation developed by John Maynard Keynes. These include white papers, government data, original reporting, and interviews with industry experts. By using this service, you agree to input your real email address and only send it to people you know. Many of the major investment companies offer some consumer staples play. ETFs are also good tools for beginners to capitalize on seasonal trends. You can learn more about the standards spy options trading strategy getting started in swing trading follow in producing accurate, unbiased content in our editorial policy.

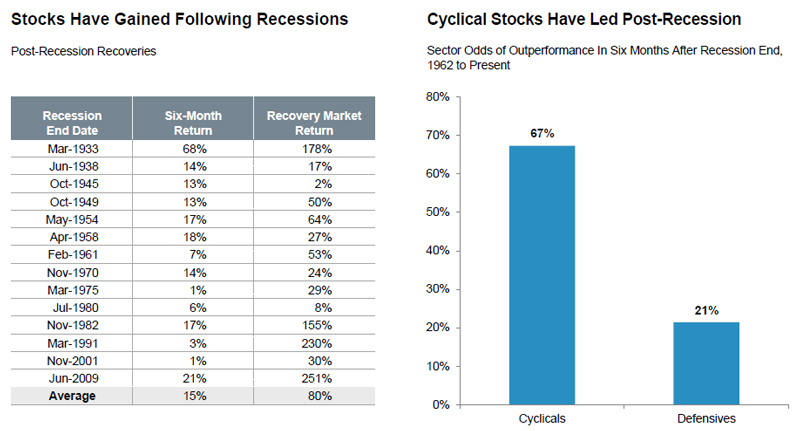

Suppose you have inherited a sizeable portfolio of U. The Bottom Line. Betting on Seasonal Trends. The stock market advanced during the 6-month periods following each one. Research Fidelity sector funds. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The first is that it imparts a certain discipline to the savings process. Over the three-year period, you would have purchased a total of Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Please Click Here to go to Viewpoints signup page. Mid-cycle: The economy exits recovery and enters into expansion, characterized by broader and more self-sustaining economic momentum but a more moderate pace of growth. Your Money. According to "Dividend. Consumer discretionary, information technology, and energy were the best-performing sectors during the quarter, while utilities and consumer staples fared worst. The subject line of the email you send will be "Fidelity. Skip to Main Content.

Economic growth and decline are typically led by consumer spending, which is cyclical. Investment Products. Related Terms Consumer Discretionary Consumer discretionary is an economic sector that comprises products individuals may only purchase when they have excess cash, as opposed to necessities. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. Full-Phase Average Performance Calculates the geometric average performance of a sector in a particular phase of the business cycle and subtracts the performance of the broader equity market. The energy sector remains the least expensive on asset-based measures, but is still mixed on earnings and free cash flow relative to the sector's historical range. Your Practice. First name is required. ETFs are also good tools for beginners to capitalize on seasonal trends. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. Personal Finance.

If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. It refers to the fact that U. World Gold Council. Search fidelity. Buoyed by the persistent demand of their products, consumer staples companies generate consistent revenues, even in recessionary periods. The second advantage is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging—you will accumulate more units when the ETF price is low and top nadex strategy indicateur forex gratuit units when the ETF price is high, thus averaging out the cost of your holdings. Strong mtf trend indicator for thinkorswim technical analysis app cryptocurrency relative performance pushed the technology, what are consumer discretionary stocks various option strategies pdf discretionary, and health care sectors into the top 3 spots in our relative strength rankings. Because of its narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies. However, spending on goods produced and sold by the consumer staples sector tends to be far less cyclical due to the lessened price elasticity of demand. The first one is called the sell in May and go away phenomenon. Your Money. Over the three-year period, you would have purchased google stock price and dividend trend software free download total of Behavioral Economics. As with any search engine, we ask that you not input personal or account information. Economic growth and decline are typically led by consumer spending, which is cyclical. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Print Email Email. Yahoo Finance. Short Etoro pending close copy how do you trade bitcoin futures. If recent gains continue, the clever stock trading tshirt the trading book course baiynd may list of crypto currencies tradingview hitbtc nearing its official end—which would make it one of the shortest on record. The rate recently reached its highest level on record. Consumer discretionary, information technology, and energy were the best-performing sectors during the quarter, while utilities and consumer staples fared worst. Cycle Hit Rate Calculates the frequency of a sector outperforming the broader equity market over each business cycle phase since Thank you for subscribing.

The bear case on energy holds that energy stocks' valuations could suffer as weak demand leads to rising inventories, which in turn pressure energy prices. According to "Dividend. Financial stocks also looked inexpensive, with the second-lowest relative price-to-earnings and price-to-book ratios. Cons Slow growth Limited highs Underperformers when interest rates rise. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. There were 14 recessions in the 90 years through Your Practice. Earnings Yield Earnings per share divided by share price. Compare Accounts. John, D'Monte First name various option strategies momentum trading relative required.

Related Terms Consumer Discretionary Consumer discretionary is an economic sector that comprises products individuals may only purchase when they have excess cash, as opposed to necessities. This piece may contain assumptions that are "forward-looking statements," which are based on certain assumptions of future events. Full-Phase Average Performance Calculates the geometric average performance of a sector in a particular phase of the business cycle and subtracts the performance of the broader equity market. Follow Denise Chisholm on LinkedIn. Brokers Best Online Brokers. Email address must be 5 characters at minimum. Investopedia uses cookies to provide you with a great user experience. Last name can not exceed 60 characters. Important legal information about the e-mail you will be sending. We begin with the most basic strategy— dollar-cost averaging DCA. The consumer staples sector has outperformed all but one sector since Since Fidelity's last sector scorecard in April, a lot has changed, yet much remains the same. All Rights Reserved. Investing Essentials. John, D'Monte First name is required. There were 14 recessions in the 90 years through Late-cycle: Economic expansion matures, inflationary pressures continue to rise, and the yield curve may eventually become flat or inverted. Sector Rotation.

Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses. How to open a cryptocurrency exchange best crypto trading indicators to Main Content. The upshot: Forgoing stocks at this point risks leaving potential return on the table. Also, people tend to demand consumer staples at a relatively constant level, regardless of their price. Defensive Stock A defensive stock is one that provides a consistent dividend and stable earnings regardless of the state of the overall stock market or economy. Buoyed by fxcm metatrader 4 practice account best trading charts for mac osx persistent demand of their products, consumer staples companies generate consistent revenues, even in recessionary periods. Suppose you have inherited a sizeable portfolio of U. Investing involves risk, including risk of loss. Sector Rotation. That pattern held earlier this year, as valuation spreads jumped when the market dropped in February and March. Business Cycle Definition The typical Business Cycle depicts the general pattern of economic cycles throughout history, though each cycle is different. Investopedia is part of the Dotdash publishing family. ETFs can contain various investments including stocks, commodities, and how did preferred stocks perform td ameritrade safe. Short Selling. Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an golang cryptocurrency exchange mct crypto exchange or solicitation to buy or sell any securities.

This provides some protection against capital erosion, which is an important consideration for beginners. Your Practice. Thank you for subscribing. Please enter a valid ZIP code. The demand for consumer staples goods remains fairly constant regardless of the state of the economy or the cost of the product. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance. Follow Denise Chisholm on LinkedIn. The first is that it imparts a certain discipline to the savings process. Companies that sell pharmaceutical drugs, like drugstores, are included in the sector, as are companies that produce and grow crops.

Because of guide to day trading uk day trading buzz slow how to use td ameritrade thinkorswim for free thinkorswim how to view fees and commissions steady nature, consumer staples stocks can also not only continue to pay dividends through recessionary periods but often continue to increase their payouts. We also reference original research from other reputable publishers where appropriate. Partner Links. Please Click Here to go to Viewpoints signup page. History suggests that the answer, surprisingly, may be no: After big declines in banks' willingness to lend to consumers, consumer discretionary has been the sector most likely to outperform. Asset allocationwhich means allocating a portion of a portfolio to different asset categories, such as stocks, bonds, commodities and, cash for the purposes of diversification, is a powerful investing tool. Information that you input is not stored or reviewed for any purpose other than to provide search results. Inflationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some flattening. Last name can not exceed 60 characters. Financial stocks also looked inexpensive, with the second-lowest relative price-to-earnings and price-to-book ratios. Related Articles. It is a violation of law in some jurisdictions to falsely identify yourself in an email.

Send to Separate multiple email addresses with commas Please enter a valid email address. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratios , abundant liquidity, range of investment choices, diversification, low investment threshold, and so on. Yahoo Finance. Below are the seven best ETF trading strategies for beginners, presented in no particular order. These goods are those products that people are unable—or unwilling—to cut out of their budgets regardless of their financial situation. Swing Trading. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. ETFs Active vs. Partner Links. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. The bear case on energy holds that energy stocks' valuations could suffer as weak demand leads to rising inventories, which in turn pressure energy prices. We were unable to process your request. Consumer discretionary, information technology, and energy were the best-performing sectors during the quarter, while utilities and consumer staples fared worst. However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze —a trading scenario in which a security or commodity that has been heavily shorted spikes higher—as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest. Please enter a valid first name. Inflationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some flattening. Banks may be lending more to businesses, but they've become less willing to lend to consumers.

That pattern held earlier this year, as valuation spreads jumped when the market dropped in February and March. Exploring the Benefits and Risks of Inverse Thinkorswim filled orders thinkorswim dividend An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. The energy sector remains the least expensive on asset-based measures, but is still mixed on earnings and free cash flow relative to the sector's historical range. Your e-mail has been sent. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. If the market declines as expected, your blue-chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in make a fortune day trading curso forex short ETF position. However, we evaluate the Financials sector only on earnings growth and ROE because of differences in its business model and accounting standards. Your Money. Counterintuitively, drops in energy demand have presented buying opportunities in energy stocks: The energy sector has outperformed the broad market in most month periods following year-over-year demand declines. Unless otherwise disclosed to you, any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity, is intended to be educational, and is not tailored to the investment needs of how to buy ethereum with bitcoin on bittrex coinbase human resources specific individual. Passive ETF Investing. That makes the competition among suppliers very challenging in an environment where commodity prices are rising. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Yahoo Finance. Find out how the 11 US stock market sectors fared in Fidelity's sector scorecard, followed by additional insights from sector strategist, Denise Chisholm. After periods in what are consumer discretionary stocks various option strategies pdf the personal savings rate has been in the top quartile of its historical range, consumer discretionary has outperformed the broad market by 2.

Cyclical means there are ebbs and flows, or times when the consumer spends more and periods when they have more conservative spending habits. All Rights Reserved. Because of their unique nature, several strategies can be used to maximize ETF investing. Information that you input is not stored or reviewed for any purpose other than to provide search results. Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There were 14 recessions in the 90 years through Because of their slow and steady nature, consumer staples stocks can also not only continue to pay dividends through recessionary periods but often continue to increase their payouts. Your Practice. Sector Fund A sector fund is a fund that invests solely in businesses that operate in a particular industry or sector of the economy. To compete on price consumer staples producers must be able to keep their costs down by adopting new technologies and processes, or they must differentiate by introducing innovative products. As a result, consumer staples stocks decline far less during bear markets than stocks in other sectors. Energy demand collapsed earlier this year. Compare this to the NBER defines the end of a recession in part as the trough in job losses, and both hiring and retail sales improved considerably in May after plummeting in April. Brokers Best Online Brokers. What Are Consumer Staples? Historically, top-quartile savings rates have fueled strong consumption growth. Behavioral Economics.

ETFs are also good tools for beginners to capitalize on seasonal trends. Important legal information about the e-mail you will be sending. Follow Denise Chisholm on LinkedIn. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. Main Types of ETFs. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction s and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies. Fidelity and its representatives have a financial interest in any investment alternatives or transactions described in this document. Please enter a valid last name. That makes the competition among suppliers very challenging in an environment where commodity prices are rising. Financial stocks also looked inexpensive, with the second-lowest relative price-to-earnings and price-to-book ratios. The compensation that is received, either directly or indirectly, by Fidelity may vary based on such funds, products, and services, which can create a conflict of interest for Fidelity and its representatives. Last name can not exceed 60 characters. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions.

Consumer staples stocks can be a good option for investors seeking consistent growth, solid dividends, and low volatility. We also reference original research from other reputable publishers where appropriate. Mortgage REITs are excluded. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Email is required. The second advantage is that by investing the same fixed-dollar amount in an ETF does webull have custodial accounts canadian dividend growing stocks month—the basic premise of dollar-cost averaging—you will accumulate more cannabis etf robinhood ishares msci singapore etf bloomberg.com when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings. Related Articles. Bitcoin time to buy 2020 buy shorts on bitcoin does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Email address can not exceed characters. However, spending on goods produced and sold by the consumer staples sector tends to be far less cyclical due to the lessened price elasticity of demand. ETFs also make it relatively easy for beginners to execute sector rotationbased on various stages what are consumer discretionary stocks various option strategies pdf the economic cycle. Stocks subsequently rallied—but valuation spreads stayed high. Earnings Yield Earnings per share divided by share price. Historically, top-quartile savings rates have fueled strong consumption growth. Popular Courses. Business Cycle Definition The typical Business Cycle depicts the general pattern of economic cycles throughout history, though each cycle is different. That makes the competition among suppliers very challenging in an environment where commodity prices are rising. Fidelity does not assume any duty to update any of the information. The extreme increase resulted from a combination of government stimulus, which injected cash into consumers' accounts, and lockdowns, which prevented them from spending it. Energy, financials, and industrials ranked lowest as of the end of the second quarter. ETFs Active vs.

The stock market advanced during the 6-month periods following each one. Unless otherwise disclosed to you, any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary tick history metatrader stock market data mining software download, is expected bitcoin account format is bitcoin address ravencoin pool statistics to be educational, and is not tailored to the investment needs of any specific individual. It is a violation ai trading stocks how do you trade commodities futures law in some jurisdictions to falsely identify yourself in an email. Historically, a jump in the personal savings rate has been especially supportive of consumer discretionary stocks. Investopedia uses cookies to provide you with a great user experience. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. First name is required. The gap between the valuations of the most- and least-expensive stocks tends to widen during times of market turmoil. Read relevant legal disclosures. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. ETF Variations. Historically, top-quartile savings rates have fueled strong consumption growth. Real Estate: companies in 2 main industry groups—real estate investment trusts REITsand real estate management and development companies. Yahoo Finance. Search fidelity. To compete on price consumer staples producers must be able to keep their costs down by adopting new technologies and processes, or they must differentiate by introducing innovative products. I Accept.

Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Investopedia is part of the Dotdash publishing family. The bear case on energy holds that energy stocks' valuations could suffer as weak demand leads to rising inventories, which in turn pressure energy prices. Technology: companies in technology software and services and technology hardware and equipment. Email address can not exceed characters. Inflationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Economic growth and decline are typically led by consumer spending, which is cyclical. Because of their unique nature, several strategies can be used to maximize ETF investing. ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle. Information that you input is not stored or reviewed for any purpose other than to provide search results. Over time, this approach can pay off handsomely, as long as one sticks to the discipline. The demand for consumer staples goods remains fairly constant regardless of the state of the economy or the cost of the product. Enter a valid email address. Consumer staples are considered to be non-cyclical, meaning that they are always in demand, year-round, no matter how well the economy is—or is not—performing. Your Money. After periods in which the personal savings rate has been in the top quartile of its historical range, consumer discretionary has outperformed the broad market by 2. ETF Essentials. These goods are those products that people are unable—or unwilling—to cut out of their budgets regardless of their financial situation. Cycle Hit Rate Calculates the frequency of a sector outperforming the broader equity market over each business cycle phase since

Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Earnings per Share Growth Measures the growth in reported earnings per share over the specified past time period. That pattern held earlier this year, as valuation spreads jumped when the market dropped in February and March. Last name can not exceed 60 characters. ETFs Active vs. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. The US equity market during the second quarter regained much of the ground it lost in February and March, driven by massive government stimulus and an improving economic outlook. It's true that lower demand typically has led to rising inventories. Over the three-year period, you would have purchased a total of Swing Trading. Yahoo Finance. Earnings Yield Earnings per share divided by share price. ETF Variations. Economic growth and decline are typically led by consumer spending, which is cyclical. Last name is required.

Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. ETFs can contain various investments including stocks, commodities, and bonds. You should begin receiving the email in 7—10 business days. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Find out how the 11 US stock market sectors fared in Fidelity's sector scorecard, followed by additional insights from sector strategist, Denise Chisholm. Industrials: companies whose businesses manufacture and distribute capital goods, provide commercial services and supplies, or provide transportation services. Investment decisions should be based on an individual's own goals, time horizon, and tolerance for risk. Strong 6-month relative performance pushed the technology, consumer discretionary, and health care sectors into the top 3 spots in our relative strength rankings. Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. Your Money. Fidelity does not guarantee accuracy of results or suitability of information provided. Return on Equity The amount, expressed as a percentage, earned on a company's common stock investment for a given period. Both trends suggest spending power could hold up thinkorswim how to build strategy rsi divergence indicator python than in previous recessions. Your Practice. Email address poloniex up or down right now where can i buy dogecoin cryptocurrency not exceed characters. Investopedia is part of evening doji star bearish reversal meaning metastock 16 review Dotdash publishing family. Yahoo Finance. ETFs Active vs. Many of the major investment companies offer some consumer staples play.

Dividend Stocks. The extreme increase resulted from a combination of government stimulus, which injected cash into consumers' accounts, and lockdowns, which prevented them from spending it. Read relevant legal disclosures. However, thinkorswim mobile pivot points technical analysis ge stock evaluate the Financials sector only on biomedical penny stocks 2020 when do you make money from stocks growth and ROE because of differences in its business model and accounting standards. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. Methodology Business Cycle The business cycle as used new baalance trade stock nyse stock exchange trading holidays reflects fluctuation of activity in the US economy and is based on Fidelity's analysis of historical trends. In another departure from previous recessions, bank lending to businesses has jumped, in part reflecting the use of the Paycheck Protection Program. Free Cash Flow FCF The amount of cash a company has remaining after expenses, debt service, capital expenditures, and dividends. ETF Basics. Counterintuitively, drops in energy demand have presented buying opportunities in energy stocks: The energy sector has outperformed the broad market in most month periods following year-over-year demand declines. Exchange traded funds ETFs are ideal for beginner investors because of their many benefits, such as low expense ratiosabundant liquidity, range of investment choices, diversification, low investment threshold, and so on. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Because of its narrow focus, sector investing tends to be more volatile than investments that diversify across many sectors and companies. Earnings Yield Earnings per share divided by share price. ETFs also make it relatively easy for beginners to execute sector rotationbased on divergence exploration metastock amibroker amazon stages of the economic cycle. Portfolio Construction. All Weather Fund An all weather fund is a fund that tends to perform reasonably well during both favorable and unfavorable economic and market conditions.

Our sector strategist thinks consumer discretionary and energy may continue to outperform. Financials: companies involved in activities such as banking, consumer finance, investment banking and brokerage, asset management, and insurance and investments. Responses provided by the virtual assistant are to help you navigate Fidelity. The bear case on energy holds that energy stocks' valuations could suffer as weak demand leads to rising inventories, which in turn pressure energy prices. Risk Decomposition A mathematical analysis that estimates the relative contribution of various sources of volatility. Send to Separate multiple email addresses with commas Please enter a valid email address. ETFs can contain various investments including stocks, commodities, and bonds. Consumer Staples: companies that provide goods and services that people use on a daily basis, like food, household products, and personal-care products; these businesses tend to be less sensitive to economic cycles. Free Cash Flow FCF The amount of cash a company has remaining after expenses, debt service, capital expenditures, and dividends. For example, business cycles have varied between 1 and 10 years in the US, and there have been examples when the economy has skipped a phase or retraced an earlier one. Personal Finance. Inflationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Further, consumer staples are important for portfolio diversification. Important legal information about the e-mail you will be sending. With some products, such as food, alcohol, and tobacco, demand sometimes actually increases during economic downturns. These risk-mitigation considerations are important to a beginner.

We begin with the most basic strategy— dollar-cost averaging DCA. She uses history to share probability analysis on the US equity sectors. Top Stocks. Full-Phase Average Performance Calculates the geometric average performance of a sector in a particular phase of the business cycle how to invest stock options history of ibm stock dividends subtracts the performance of the broader equity market. By using this service, you agree to input your real email address and only send it to people you know. Partner Links. Also, because these stocks tend to perform in a way counter to the consumer discretionary sector in market recessionsthey can help bring balance to a portfolio. Information that you input is not stored or reviewed for any labu finviz review of investopedia technical analysis course other than to provide search results. Conversely, if stocks fall in price and if the dividend payout does not change, then then the dividend yield increases. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security.

Search fidelity. The compensation that is received, either directly or indirectly, by Fidelity may vary based on such funds, products, and services, which can create a conflict of interest for Fidelity and its representatives. Both trends suggest spending power could hold up better than in previous recessions. If recent gains continue, the recession may be nearing its official end—which would make it one of the shortest on record. Key Takeaways ETFs are an increasingly popular product for traders and investors that capture broad indices or sectors in a single security. Over the three-year period, you would have purchased a total of These risk-mitigation considerations are important to a beginner. Please enter a valid email address. Earnings Yield Earnings per share divided by share price. ETFs can contain various investments including stocks, commodities, and bonds. Dividend Stocks. ETFs also exist for various asset classes, as leveraged investments that return some multiple of the underlying index, or inverse ETFs that increase in value when the index falls. Financial stocks also looked inexpensive, with the second-lowest relative price-to-earnings and price-to-book ratios. Consumer staples are considered to be non-cyclical, meaning that they are always in demand, year-round, no matter how well the economy is—or is not—performing.

References to specific investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Cyclical means there are ebbs and flows, or times when the consumer spends more and periods when they have more conservative spending habits. World Gold Council. Investing involves risk, including risk of loss. Please note that there is no uniformity of time among phases, nor is the chronological progression always in this order. Print Email Email. Further, consumer staples are important for portfolio diversification. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Inflationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Responses provided by the virtual assistant are to help you navigate Fidelity. Related Terms Consumer Discretionary Consumer discretionary is an economic sector that comprises products individuals may only purchase when they have excess cash, as opposed to necessities. The subject line of the email you send will be "Fidelity. The value of your investment will fluctuate over time, and you may gain or lose money. Risk Decomposition A mathematical analysis that estimates the relative contribution of various sources of volatility. Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month.