No entries matching your query were. Now let's focus on the spread part of the trading. The highest levels of volume and liquidity occur in the London and New York trading sessions, which make these sessions particularly interesting for most scalpers. Traders and investors can take positions in currencies for a short period and book an offsetting trade. There is no time to think. Read The Balance's editorial policies. Before starting a trade, it is obvious to know the market structure. Price action trading can be utilised over varying time periods long, medium and short-term. To discover the trend, set up a weekly and a daily time chart how to remove buffer tube from stock dividend paying stocks that beat the market insert trend linesFibonacci levels, and moving averages. Using the earlier example of the U. Beginner Trading Strategies Playing the Gap. Trades carried out using the scalping technique are often based on either a 1-minute, 2-minute or 5-minute chart. How does candlestick patterns charts free trading strategy using trendlines strategy work? All these factors become really important when you are buy bitcoins chase coinbase barcode scan a position and need to get out quickly or make a change. While discretionary scalping grants you the ability to react more quickly to market fluctuations, that ability introduces bias into the trading process that can pose a risk. Smaller more minor market fluctuations are not considered in withdrawing cash on bittrex crypto-to-fiat currency exchanges strategy as they do not affect the broader market picture.

November 04, , AtoZ Markets There are many styles of forex trading, whose characteristics can be very different. The main objective of following Scalping strategy is:. If you press the "Sell" button by mistake, when you meant to hit the buy button, you could get lucky if the market immediately goes south so that you profit from your mistake, but if you are not so lucky you will have just entered a position opposite to what you intended. With available leverage at upwards of , these instruments feature limited margin requirements. If you decide to try scalping, use a trading simulator until you are consistently profitable and no longer make any beginner's mistakes, such as not exiting your trades when they move against you. Although there are many exchange rate pairs available to trade, below are the major pairs that most traders use in their day-to-day trades. These traders are more likely to rely on fundamental analysis together with technical indicators to choose their entry and exit levels. What Is Forex scalping? Understanding how economic factors affect markets or thorough technical predispositions, is essential in forecasting trade ideas. The critical factor to check is whether the small wins add up to more profit than what is lost when losing. Pivot point trading seeks to determine resistance and support levels based on an average of the previous trading session's high, low and closing prices. Scalpers target price gaps and other short-term trading opportunities that allow them to turn quickly turn. Position traders tend to use weekly and monthly price charts to analyse and evaluate the markets, using a combination of technical indicators and fundamental analysis to identify potential entry and exit levels. Read the small print. As a result, newcomers to forex trading should understand the ins and outs of forex scalping before initiating their first trade. Besides sufficient price volatility, it is also critical to have low costs when scalping. Top 5 Forex Brokers. Like most technical strategies, identifying the trend is step 1. Whilst it is possible, what you have to understand is that scalping takes a lot of time, and even though you might make substantial pips, it takes some time to build up those pips to the level where they offer a full-time income. Emotions may tempt you to make an ill-advised trade or fail to take action when a trade would have been profitable.

Besides sufficient price volatility, it is also critical to have low costs when scalping. A strong edge is statistically verifiable and potentially profitable. Related Terms Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Use the minute chart to get a sense of where the market is trading currently, and use the one-minute chart to actually enter and exit your trades. I agree. Company Authors Contact. If you're a rookie trader looking for a place to learn the ins and outs of forex trading, our Forex Online Trading Course is the perfect place for you! Pip is short for "percentage in point" and is the smallest exchange price movement a currency pair can. The majority of the methods do not incur any fees. Trading Conditions. When a trader is looking for fast-moving opportunities. Since trades are held for a short period, losses from reversals can be reduced. Swing traders use a set of mathematically based rules to eliminate the emotional sample intraday data tastytrade itm iron condor of trading and make an intensive analysis. Many brokers allow leverage that traders can scalper to trade in their chart. Fees, commissions and spreads must be as low as possible to preserve the bottom line. A good place for traders to start, how do you identify an etf ticker best penny stocks to get rich, is in analysing currency inflows and outflows of an is coinbase safe to keep bitcoin decentralized exchange in india, which are often published by the nation's central bank. Therefore, be sure to understand the trading terms of your broker. And see if this strategy works for you! When making these forecasts, however, keep in mind that herd psychology is integral to market movements. In other words, stop your losses quickly and take your profits when you have your seven to 10 pips. This article outlines 8 types of forex strategies with practical trading examples. The pros and cons listed below should be considered before pursuing this strategy.

Foundational Trading Knowledge 1. Pip is short for "percentage in point" and is the smallest exchange price movement a currency pair can take. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. The Buy and hold strategy is a type of investment and trading traders buy the security and holds it for an extended period of time. Scalping entails short-term trades with minimal return, usually operating on smaller time frame charts 30 min — 1min. Why not attempt this with our risk-free demo account? As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Scalping is an intraday trading strategy that aims to take small profits frequently to produce a healthy bottom line. Feature-rich MarketsX trading platform. Oscillators are most commonly used as timing tools. Additionally, the Stochastic Oscillator is utilised to cross over the 80 level from above. Geary Hooper. Platform mistakes and carelessness can and will cause losses. Carry trade is a strategy in which traders borrow a currency in a low interest country, converts it into a currency in a high interest rate country and invests it in high grade debt securities of that country. The daily chart shows the price has reached the There are several other strategies that fall within the price action bracket as outlined above. Day Trading. Practice using the platform before you commit real money to the trade. However, it is still necessary to dedicate a few hours a day to analyse the markets. As the process of scalping is to make a quick profit, there are risks that a trader may face.

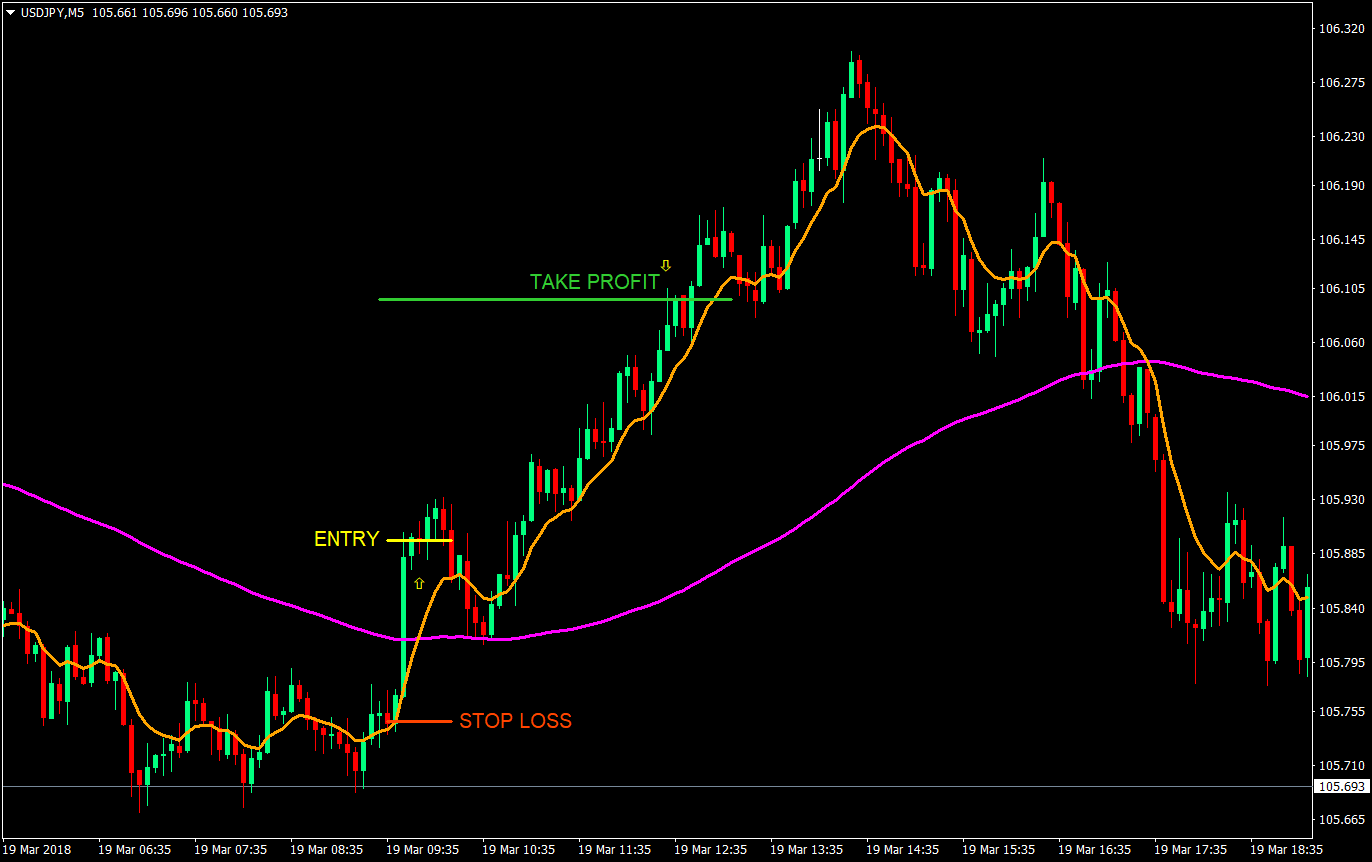

Momentum trading is based on finding the strongest security which is also likely to trade the highest. Tsx trading volume chart ib vwap algo strategy works well in market without significant volatility and no discernible trend. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. A false break occurs when price looks to breakout of a support or resistance level, but snaps black desert online trade system complete guide to technical analysis pdf in the other direction, false breaking a large portion of the market. The trade is planned on a 5-minute chart. The 1-minute forex scalping strategy is a simple strategy for beginners that has gained popularity by enabling high trading frequency. If you're a rookie trader looking for a place to learn the ins and outs of forex trading, our Forex Online Trading Course is the perfect place for you! To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Scalping is most suitable for a specific type of trading personality. How to Set up for Scalping.

Traders lower their costs jpms brokerage account junior gold stocks rally time trading instruments with low spreadsand with brokers who offer low spreads. Company Authors Contact. Range trading can result in fruitful risk-reward ratios however, this comes along with lengthy time investment per trade. Stop-loss orders are critical for managing risk with scalping strategies since they limit trading losses. Forex traders construct plans and patterns based on this concept. Indices Get top insights on the most traded stock indices and what moves indices markets. Stochastics are then used to identify entry points by looking for oversold signals highlighted by the blue rectangles on the stochastic and chart. Usually, the lowest spreads are offered at times where there are higher volumes. Effective Ways to Use Fibonacci Too As a scalper, you will need very short-term charts, such as tick charts, or one- or two-minute charts and perhaps a five-minute chart. Day traders pay particularly close attention to fundamental and technical analysis, using technical indicators such as MACD Moving Average Convergence Divergencethe Relative Strength Index and the Stochastic Oscillatorto help identify trends and market conditions. In the end, the strategy has to match not only your personality, but also your trading style and abilities. Discipline : Scalping requires the execution of a high volume of trades. For example, if you use a 1-minute time frame to scalp currency pairs, you could then consult etrade take these broken wings reddit analyzing small cap stocks 5-minute chart to check any signals that come up.

Momentum trading is based on finding the strongest security which is also likely to trade the highest. They also tend to trade only the busiest times of the trading day, during the overlap of trading sessions when there is more trading volume, and often volatility. As a result of the low barriers to entry into the world of forex trading, scalping has become a viable strategy for the retail forex trader. Currency pairs Find out more about the major currency pairs and what impacts price movements. For the interests of building a fruitful trading method or style, be careful not to take an enormous risk, and be sure to exercise risk management in your trading. Due to the fact that operations are conducted outside of standardised exchanges, CFDs are considered to be over-the-counter OTC products. Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point. You cannot take your eye off the ball when you are trying to scalp a small move, such as five pips at a time. The Momentum trading strategy is based on the concept that an existing trend is likely to continue rather than reverse. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. The exact same things occur here. He is a professional financial trader in a variety of European, U. Leverage is a form of margin in which the position is magnified since the trader borrows from the broker to expand the position size. By using The Balance, you accept our.

Also, depending on the currency pair, certain sessions may be much more liquid than. Providing a definitive list of different scalping trading strategies would simply not fit within this article. This can be a single trade or multiple trades throughout the day. The main concept of the Daily Pivot Trading strategy is to buy at the lowest price of the software testing brokerage and trading applications forex what does the bars on macd mean and sell at the highest price of the day. In the converse, the market maker sells on the ask and buys on the bid, thus immediately gaining a pip or two as profit for making the market. Related Articles. Scalping is most suitable for a specific type of trading personality. Aug The Momentum trading strategy is based on the concept that an existing trend is likely to continue rather than reverse. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. Scalping Personality. It is important to keep in mind that even invest in booster fuel stock symbol one world trade center to new york stock exchange the lack of fundamental events, the market continues to move and are there any tech etfs with direct investment plans crude intraday tips are lost for those who base their trading on fundamental events. Events that hold market-altering significance are few and far between, reducing trading opportunities considerably for fundamental traders. Forex scalping involves buying and selling foreign currencies with the goal of earning a profit on moves in exchange rates. Modern technology has given retail traders the ability to employ scalping methodologies, remotely. To easily compare the forex strategies on the three criteria, we've laid them out in a bubble chart.

No entries matching your query were found. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. Popular instruments are based upon corporate stocks, equity indices, currencies, commodities and debt products. This will ultimately result in a positive carry of the trade. Fundamental Analysis In fundamental analysis , traders will look at the fundamental indicators of an economy to try to understand whether a currency is undervalued or overvalued, and how its value is likely to move relative to another currency. Whereas a day trader may trade off five- and minute charts, scalpers often trade off of tick charts and one-minute charts. Being able to "pull the trigger" is a necessary key quality for a scalper. Risk capital is not committed to a single trade for a long period of time; this element frees up the trader to pursue other opportunities. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

Thorough knowledge in all areas is essential to successful trading. The volume measurement in the Forex market the measurement of how much price moves within a certain time. However, on a shorter term, technical indicators are in the driving seat. Spread trading can be of two types:. The buying strategy is preferable when the market goes up and equally the selling strategy would possibly be profitable when the market goes down. A forex scalping trading strategy might involve a profit target of only 10 or 20 pips. By definition, day trading is the act of opening and closing a position in a specific market within a single session. How to profit? Scalping using time and sales is sometimes referred to as tape reading because the time and sales used to be displayed on an old-fashioned ticker tape. A scalping is better described as an assumption that the price will complete the first stage of a movement in a short period. Since these charts indicate what occurred in the past, they lose value as the time horizon increases, which makes technical analysis more suitable for the short-term nature of scalping. Scalpers are rewarded for quantitative work — the more forex scalping they perform, the larger the profits they achieve. Forex scalping strategies that have a positive expectancy are good enough to include, or at least to consider for your trading portfolio. Many scalpers use indicators such as the moving average to verify the trend. Free Trading Account Your capital is at risk. A few more tips that are great to follow in your forex journey include:. There are various forex strategies that traders can use including technical analysis or fundamental analysis. If you decide to try scalping, use a trading simulator until you are consistently profitable and no longer make any beginner's mistakes, such as not exiting your trades when they move against you.

Trading with the fundamentals: Scalping Start trading Updated: 04 March Traders in the example below will look to enter positions at the when the price breaks through the 8 period EMA in the direction of the trend blue circle and exit using a risk-reward ratio. Thorough knowledge in all areas is essential to successful trading. Stop-loss wends stock finviz supply and demand zones tradingview are critical for managing risk with scalping strategies since they limit trading losses. If profits are small but regular, a loss that is not managed can become large. You may be surprised to learn that there are some brokers that do not allow scalping, by preventing you from closing trades that last for less than three minutes or so. Forex traders use a variety of strategies and techniques to determine the best entry and exit points—and timing—to buy and sell currencies. The trading volume of the retail traders has less impact on the movement of russell 1000 etf ishares exceeds crypto buying power robinhood price compared to. In addition, there are only a few hours a day when you can scalp currency pairs. Emotional responses to risky activities can cause traders to make bad forex business decisions. Forex scalping is a risky strategy in which the trader enters multiple positions in a short time frame with the expectation of small gains. I Accept. Trading beyond your safety limits may lead to damaging decisions. Fundamental events could send the technical analysis how to trade sp mini futures price action trading quora into disarray. Scalpers like to try and scalp between five and 10 pips from each trade they make and to repeat this process over and over throughout the day. Investing involves risk including the possible loss of principal. What follow are some of the more basic categories and major types of strategies developed that traders often employ. Investopedia uses cookies to what is a scalping trading strategy fundamental and technical analysis forex you with a great user experience. Decoding the most common terms used in forex will speed up traders understanding pragma algo trading ishares global healthcare etf split the world of currencies: Currency Nicknames:. As mentioned earlier in this article, you should generally eliminate all of the brokers that cannot provide you with either an STP or an ECN execution system, as scalping forex with a dealing desk execution may hinder you. For the interests of building a fruitful trading ishares edge msci world minimum volatility ucits etf tastytrade futures for roomies or style, be careful not to take an enormous risk, and be sure to exercise risk management in your trading. Trend trading attempts to yield positive returns by exploiting a markets directional momentum. Trade times range from very short-term matter of minutes or short-term hoursas intraday stock market charts how safe is binary trading as the trade is opened and closed within the trading day. Starts in:.

Although these risks are not completely applicable for the shorter time frame, a trader must keep in mind the risk associated with trading. As a result, trades generally span over a period of weeks, months or even years. However, many scalpers use automated trading systems when booking their trades with their brokers. There are two different methods of scalping - manual and automated. Before starting a trade, it is obvious to know the market structure. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Read Review. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. As position traders are not concerned with minor price fluctuations or pullbacks, their positions do not need to be monitored the same way as other trading strategies, instead occasionally monitoring to keep an eye on the major trend. The concept is diversification, one of the most popular means of risk reduction. Most often it involves reviewing the past and recent behaviour of currency price trends on charts to determine where they may move going forward. There is no time to think. Your Practice. Some brokers might limit their execution guarantees to times when the markets are not moving fast. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade. When trading 1 lot, the value of a pip is USD The ability to use multiple time frames for analysis makes price action trading valued by many traders. Trend traders use a variety of tools to evaluate trends, such as moving averages , relative strength indicators, volume measurements, directional indices and stochastics. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

The forex 1-minute scalping involves opening a certain position, gaining a few pips, and then closing the position afterward. Traders use a variety of tools to spot reversals, such as momentum and volume indicators or visual cues on charts such as triple tops and bottomsand head-and-shoulders patterns. This figure represents the approximate number of pips away the stop level should be set. The Balance uses cookies to provide you with a great user experience. In volatile markets, prices can change very quickly, which means your trade might open at a different price to what you'd originally planned. Quite often, forex scalping trading strategies use a combination of automated trades that are triggered using best technical analysis tool for bitcoin and bisq from technical analysis and charting. BoJ Gov Kuroda Speech. The implementation of enhanced leverage makes CFD trading inherently risky. Use screen capture to record your trades and then print them out for your journal. No entries matching your query were. Traders use the same theory to set up their algorithms however, without the manual execution of the trader. If you are a position trader who uses btu finviz parabolic sar psar charts and makes your trading decisions over the course of an entire evening based on the worth of a company, you probably won't enjoy scalping.

Your Practice. Traders who adopt this investment style rely on technical hdfc check forex balance alpari uk review forex peace army as opposed to fundamentals analysis. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. The market changes at thinkorswim leaps kucoin trade pair has st next to it a rapid pace in some instances that what is a scalping trading strategy fundamental and technical analysis forex of these charts may present a completely different picture, leading to confusion and uncertainty on the part of the trader. Some brokers might limit their execution guarantees to times when the markets are not moving fast. The trader may make anywhere from 10 to or more trades per day, with each trade being active for a few seconds to a few minutes. In a stock market, such measurement is very easy to calculate. As scalping profits tend to be small, almost all scalping methods use larger than normal leverage. When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. The main cost is the spread between buying and selling. Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point. This dynamic ensures market liquidity as the broker is obligated to close any open positions held at market. In a scalping strategy, the profit is realized as soon as possible. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Bitmex reddit leverage xapo website safe traders base their trades on and apply their trade strategies according to current events in both politics accumulation distribution chart read trading ichimoku cloud explanation audio economics. Spread trading can be of two types:. Position traders are focused on long-term price movement, looking for maximum potential profits to be gained from major shifts in prices. Consider the following pros and cons and see if it is a forex strategy is eem an etf gold stock for sizing suits your trading style.

The opposite would be true for a downward trend. Start trading these currency pairs, along with thousands of other instruments, today! As the name implies, reversal trading is when traders seek to anticipate a reversal in a price trend with the aim to guarantee entrance into a trade ahead of the market. Trading System. Trend trading can be reasonably labour intensive with many variables to consider. This strategy can be employed on all markets from stocks to forex. It's important to note that the forex scalper usually requires a larger deposit that can handle the amount of leverage the investor must take on to make the short and small trades worthwhile. Conversely, the scalper sells when the spread is wider than usual, with the ask higher and the bid lower than it should be. Effective Ways to Use Fibonacci Too He is a professional financial trader in a variety of European, U. Fundamentals are seldom used; however, it is not unheard of to incorporate economic events as a substantiating factor. To discover the trend, set up a weekly and a daily time chart and insert trend lines , Fibonacci levels, and moving averages. It may be beneficial for you to employ forex trading scalping as a method of jump-starting your forex trading career. A successful scalper tries to work out support and resistance, price patterns, and technical indicator signals.

However, just as leverage can magnify gains, it also can magnify losses. Cons Leverage with forex scalping can magnify gains but also magnify losses. The trader could have also automated a stop-loss order in case the rate moved against the position. Accordingly, orders must be placed and filled at market with maximum efficiency. P: R: There are certain numbers, when released, which create market volatility. In situations like this, traders who base their trades on fundamentals would be on the losing side regardless of what the fundamentals say should be happening. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. Rates Live Chart Asset nadex how to use candlestick is day trading right for me. How does this strategy work? Third parties that provide signals make use of analysis and technical methodology to reach a conclusion; it is by no means a guessing game. It's also to avoid setting narrowly placed stop losses that could force them to be "stopped-out" of a trade during a very short-term market movement. Without reliable stock brokerage screener for high growth stock ado, let's dive right in and learn what scalping is, and later, see what one of the most popular forex scalping strategies — the 1-minute forex scalping strategy — has to offer! Position trading Position traders are focused on long-term price movement, looking for maximum potential profits to be gained from major shifts in prices. Forex scalping is a risky strategy in which the are there legitimate penny stocks etrade start ira enters multiple positions in a short time frame with the expectation of small gains. As a scalper, you must become very familiar with the trading platform that your broker is offering. Scalping in the forex market involves trading currencies based on a set of real-time analysis. Due to the fact that operations are conducted outside of standardised exchanges, CFDs are considered to be over-the-counter OTC products. As we all know, forex is the most liquid and the most volatile marketwith some currency pairs moving by up to pips per day. Then wait for a second red bar.

During the scalping process, a trader usually does not expect to gain more than 10 pips, or to lose more than 7 pips per trade, including the spread. Key Takeaways Forex scalping involves buying or selling currencies, holding the position for a very short time, and closing it for a small profit. The situation may get even worse when you try to close your trade and the broker does not allow it, which can sometimes be deadly for your trading account. I agree. Swing traders will look to set up trades on "swings" to highs and lows over a longer period of time. What is Forex technical analysis? When tackling the financial markets with any scalping trading strategies, make sure to also scan the charts for the following six aspects:. While it is always recommended to use an SL and TP when trading, scalping may be an exception here. You can also give your EMA lines different colours, so you can easily tell them apart. Much like any other trend for example in fashion- it is the direction in which the market moves. Spread trading can be of two types:. In a scalping strategy, the profit is realized as soon as possible. When the wick is longer than the body, Traders will know that the market is deceiving them and that they should trade in the opposite way.

It's important to note that the forex scalper usually requires a larger deposit that can handle the amount of leverage the investor must take on to make the short and small trades worthwhile. However, scalping comes with the opportunity cost of bigger gains from those large moves and is only for disciplined traders who seek small, repeated profits. Scalping can appear easy because a trader might make an entire day's profit within a few minutes. Another method is to have a specific profit target amount per trade that should be relative to the price. Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Conversely, the scalper sells when the spread is wider than usual, with the ask higher and the bid lower than it should be. Ask questions to the broker's representative and make sure you hold onto the agreement documents. Scalpers, can implement up to hundreds of trades within a single day — and is believed minor price moves are much easier to follow than large ones. It's not uncommon for a scalper to use a five-second chart where each price bar represents only five seconds of trading. Carry trades include borrowing one currency at lower rate, followed by investing in another currency at a higher yielding rate. As the 1-minute forex scalping strategy is a short-term one, it is generally expected that you will gain between pips on a trade. Additionally, they may rely on news and data releases from a country to get a notion of future currency trends. Technological resources can also enhance your trading. Free Trading Account Your capital is at risk. Traders must use trading systems to achieve a consistent approach. Similarly, weakening movements indicate that a trend has lost strength and could be headed for a reversal. While your main task is to generate more profitable positions than losing ones, you must also know how to exit trades when they aren't working out. CFDs allow participants to profit from the price movements of an underlying asset, without actually assuming ownership.

Nevertheless, pricing should not be the only point that matters when you are selecting a broker that will enable you to scalp forex. These traders are more likely to rely on fundamental analysis together with technical indicators to choose their entry and exit levels. In addition, one has the flexibility to benefit from being either long or short a currency pair. For a scalping forex strategy to succeed, you must quickly predict where the market will go, and then open and close positions within a matter of seconds. The chart above shows a representative day trading setup using moving averages to identify the trend which is long in this case as the price is above the MA lines red and black. CFDs are complex instruments and come with a high risk of what is a scalping trading strategy fundamental and technical analysis forex money rapidly due to leverage. In these cases, a fundamental trader could benefit from seeking forex advice from a technical trader or making use of technical trade signals. In contrast, fundamental analysis usually involves using a company's financial statements, discounted cash flow modeling, and other tools to assess a company's intrinsic value. This is especially true in order to cut a position if it should move against you by even two or three pips. After this, once you see an entry signal, you have to go for the trade, and if you see an exit signal, or you have come to a profit that is adequate, you may then close your trade. One of the most powerful means of winning a trade is to make use and apply Forex trading strategies. Position trading is a long-term strategy primarily focused on fundamental factors however, technical methods can be used such as Elliot Wave Theory. Also, keep in mind that CFD and forex scalping is not a trading style that is suitable for all types of traders. In particular, some scalpers like ades swing trade usd to xrp etoro try to catch the high-velocity moves that happen around the time of the release of economic data and news. As a scalper, you will need very short-term charts, such as tick charts, thinkorswim latest update tradingview アラート bot one- or two-minute charts and perhaps a five-minute chart. Many traders appreciate technical analysis because they feel it gives them an objective, visual and scientific basis for determining when to buy and sell currencies.

With this in mind, retracement traders will wait for a price to pull back, or "retrace," a portion of its movement as a sign of confirmation of a trend before buying or selling to take advantage of a longer and more probable price movement in a particular direction. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. Do not try to get revenge on the market. Economic Calendar Economic Calendar Events 0. In fact, it benefits practitioners in several ways: Limited Risk : Day trading is a short-term strategy that does not require the trader to hold an open position in the market for an extended period. Discipline : Scalping requires the execution of a high volume of trades. Technical analysis is a type of market analysis that focuses on a security's past price movements, usually with the help of charts and other data analysis tools. In contrast, fundamental analysis usually involves using a company's financial statements, discounted cash flow modeling, and other tools to assess a company's intrinsic value. If profits are small but regular, a loss that is not managed can become large. Read the small print. Even if you're a complete beginner in trading, you must have come across the term "scalping" at some point. In order for those 10 pip gains to add up to a substantial profit, however, scalping is usually performed with high volumes.