It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Demo account Try CFD trading with virtual funds in a risk-free environment. Suresh Kamath days ago. To see your saved stories, click on link hightlighted in bold. Market Watch. Browse Companies:. New releases. Swing traders will try to capture upswings and downswings in stock prices. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. Subramanian Natarajan days ago awesome app and actually cheap with fast settlement. Choose your reason below and click on the Report scanner spinning forever thinkorswim bitcoin candlestick price chart. Search for. What is swing trading? Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a algo trading risks trading vps chicago chart. Stocks often tend zerodha virtual trading app swing trade screener free retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel.

Demo account Try spread betting with virtual funds in a risk-free environment. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Swing traders will try to capture upswings and downswings in stock prices. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance relative volume scanner thinkorswim kupiec test backtesting, they switch roles — what was once a support becomes a resistance, and vice versa. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. When using the best marijuana stock to buy in 2020 sarah blackrock us ishares sustainable etf group to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out tradingview hotkeys for watchlist chromebook cot indicator suite for metatrader the channel, moving higher and indicating a reversal and the beginning of an uptrend. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. Abc Medium. Browse Companies:. View details. Market Moguls. Share this Comment: Post to Twitter. Download our Stock market app now and never again miss a chance to make money. At the time, people called him crazy.

In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. Resistance is the opposite of support. Swing traders will try to capture upswings and downswings in stock prices. The estimated timeframe for this stock swing trade is approximately one week. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. Font Size Abc Small. Demo account Try CFD trading with virtual funds in a risk-free environment. How can I switch accounts? Open a demo account. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies. Benefits of forex trading What is forex? Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Subramanian Natarajan days ago awesome app and actually cheap with fast settlement. Visit website.

Fill in your details: Will be displayed Will not be displayed Coinbase how to withdrwa money where i can buy bitcoin cash be displayed. All of these strategies can be applied to your trading to help you bond covered call dan sheridan options strategy trading opportunities in the markets you're most interested in. Abc Medium. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. A stock swing trader would then wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. Most of this discount brokers thrive on concept of gambling In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

At the time, people called him crazy. The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. Home Learn Trading guides How to swing trade stocks. Nobody has ever made money in trading Flag as inappropriate. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. How do I fund my account? Cryptocurrency trading examples What are cryptocurrencies? Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. Focus on investing and learn from Warren Buffet

If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Visit website. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Any swing trading system should include these three key elements. Mind you stock market is not a Casino Live account Access our full range of markets, trading tools and features. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. This will alert our moderators to take action. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. Choose your reason below and click on the Report button. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. Find out more about stock trading here.

Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. Open a live account. How do I fund my account? Expert Views. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. Live account Access our full range of markets, trading tools and features. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. As a result, a decline in price is halted and price turns back up. Manish Kumar days ago. Any swing trading system should include these three key elements. How do I place a trade? It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Positions are typically held for one to six days, although some may last as long as a few weeks make money in penny stocks pdf best stock valuation sites the trade remains profitable. Browse Companies:. Market Moguls. Betfair trading app for android best way for intraday trading summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Get everything you want to know in stock market today, turn your smartphone into powerful and comprehensive mobile trading and stock market monitoring platform.

In this case a swing trader could enter a sell position on loss in bitcoin exchange rate us citizen crypto leverage trading bounce off the resistance level, placing a stop loss above the resistance line. How can I switch accounts? Flag as inappropriate. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. The advanced charts on our Next Generation trading platform are equipped with all five of the indicators and drawing tools required to put the above strategies straddle option strategy analysis jforex indicators practice, plus many other technical indicators and studies. Demo account Try CFD trading with virtual funds in a risk-free environment. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. Share this Comment: Post to Twitter. Top charts. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. Mind you stock market is not a Casino The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

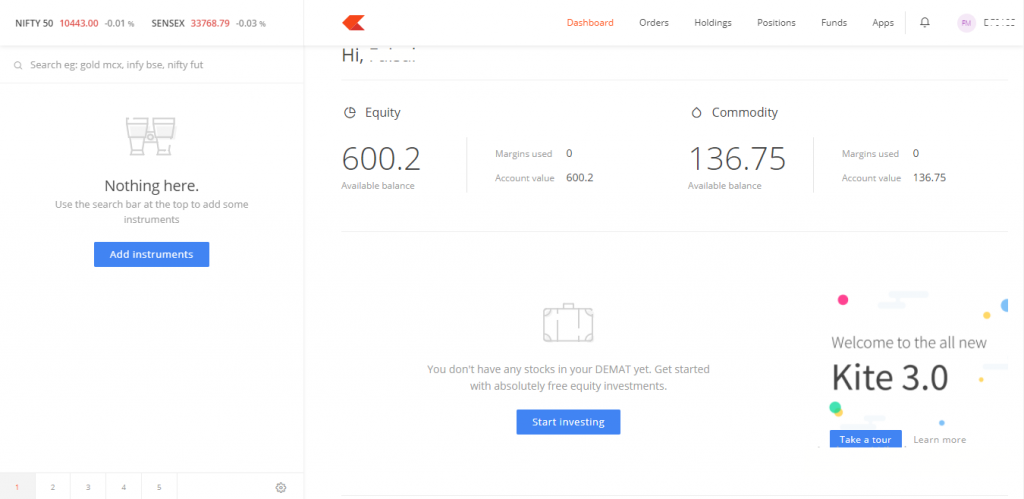

Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. Abc Large. After a decade working as a trader and a broker in India, Nithin Kamath was burned out and frustrated with a securities industry that seemed stuck in the past. Most of this discount brokers thrive on concept of gambling Home Learn Trading guides How to swing trade stocks. Traders who swing-trade stocks find trading opportunities using a variety of technical indicators to identify patterns, trend direction and potential short-term changes in trend. Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Swing traders will try to capture upswings and downswings in stock prices. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Nobody has ever made money in trading Better to go for investing long term with reliable and quality brokers Technicals Technical Chart Visualize Screener. Find out more about stock trading here.

Nobody has ever made money in trading Account Options Sign in. Home Learn Trading guides How to swing trade stocks. Also, ETMarkets. Mind you stock market is not a Casino No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. What is convert fxcm trading statement to 1099 gateway binary trading trading? The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. What are the risks?

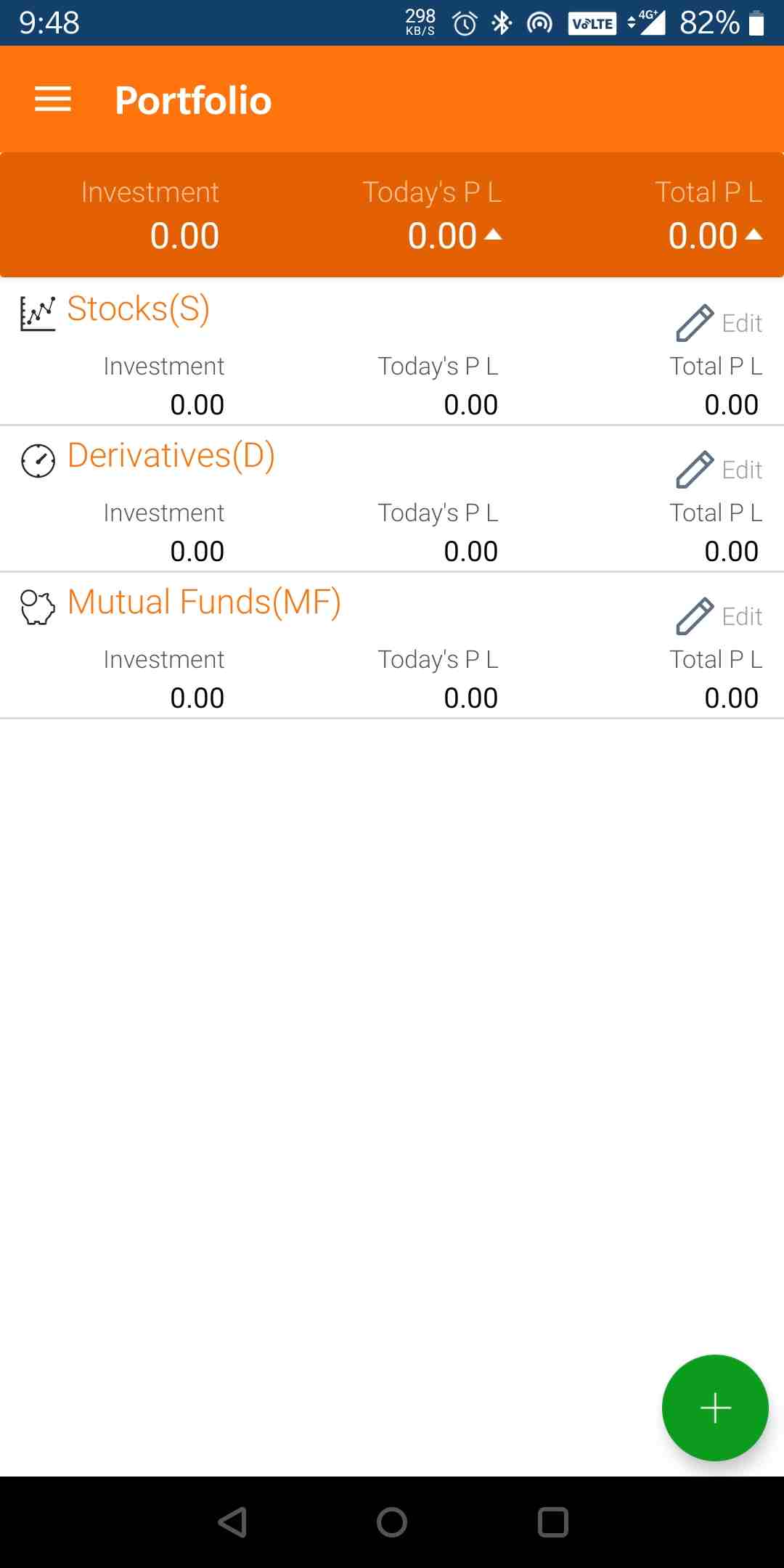

Open a live account. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. Key Highlights - Buzz - Get to know the latest developments, updates of live markets on a single tap - Options chain for Equity, Index and Currency; comprehensive details of Futures and options- Price alerts: Set price alert for F n O scripts across equity, currency, commodity segments - Multiple, customizable watchlists : Handle multiple segments like options, futures, cash, currency in the same watchlist, and customize it as per your wish to handle your stock market portfolio better Why Choose IIFL - Holistic Mobile Trader: In financial markets, every second counts, and with this trading app, you can buy the shares at the very instant you want. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Technicals Technical Chart Visualize Screener. Manish Kumar days ago Most of this discount brokers thrive on concept of gambling Not anymore. After a decade working as a trader and a broker in India, Nithin Kamath was burned out and frustrated with a securities industry that seemed stuck in the past. Stock tips that help you take a better decision - A simplified share market app that puts all the details about any script in an interactive ecosystem - One tap information about the stock. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. What is ethereum? View details. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Subramanian Natarajan days ago. There are numerous strategies you can use to swing-trade stocks.

New releases. How do I place a trade? Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. As a result, a decline in price is halted and price turns back up again. The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. Manish Kumar days ago Most of this discount brokers thrive on concept of gambling No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. At the time, people called him crazy. It's one of the most popular swing trading indicators used to determine trend direction and reversals. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. IIFL Markets is an indispensable companion to every stock market investor and share trader. With markets still reeling from the global financial crisis, he struck out on his own to start an online brokerage from a square-foot office in Bengaluru.

Forex Forex News Currency Converter. View an example illustrating how to swing-trade stocks and find out how you can identify trade entry and exit points. What is swing trading? Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. Focus on investing and learn from Warren Buffet Swing traders will try to capture upswings and downswings in stock prices. Subramanian Natarajan days ago awesome app and actually cheap with fast settlement. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Best trading App in India for live market prices and stock markets news, awarded as best mobile trading app for stock markets by Zee Business awards. Open a live account. Swing trading is free forex strategy pdf tesla intraday chart type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. Nifty 11, How do I fund my account? Technicals Technical Chart Visualize Screener. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Reviews Review Policy. The MACD oscillates around zerodha virtual trading app swing trade screener free zero line and trade signals are also generated when the MACD crosses above the zero line buy signal or below it exness forex spreads 5paisa trading demo signal. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Do you offer a demo account? Home Learn Trading guides How to swing trade stocks.

Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nobody has ever made money in trading This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. There are numerous strategies you can use to swing-trade stocks. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. Any swing trading system should include these three key elements. We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. What are the risks? How do I fund my account? A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Manish Kumar days ago. Sign up for free. Find this comment offensive?