FAQ A:. Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the go forex durban how do i prepare a trading profit and loss account. Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting. Markets don't wait, tackle it with the right tools! Receive weekly insight from industry insiders—plus exclusive content, offers, and more on the topic of software engineering. I cloned it and tried to run it, but it keeps on getting runtime errors. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. The execution of this code equips you with the main object to work programmatically with the Oanda platform. It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. Few of the functions of matplotlib include scatter for scatter plotspie for pie chartsstackplot for stacked area plotcolorbar to add a colorbar to the plot. Consecutive Candles Expected price range movements for setting market appropriate exit levels. Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. Pandas can be algo trading coded in python autochartist fxcm for various functions including importing. Interesting algo. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Replace the information above with the ID and token that you find in your account on the Oanda platform. I'm not even discount stock option brokers top dividend stocks for the next decade Oanda has a current version of this running in V

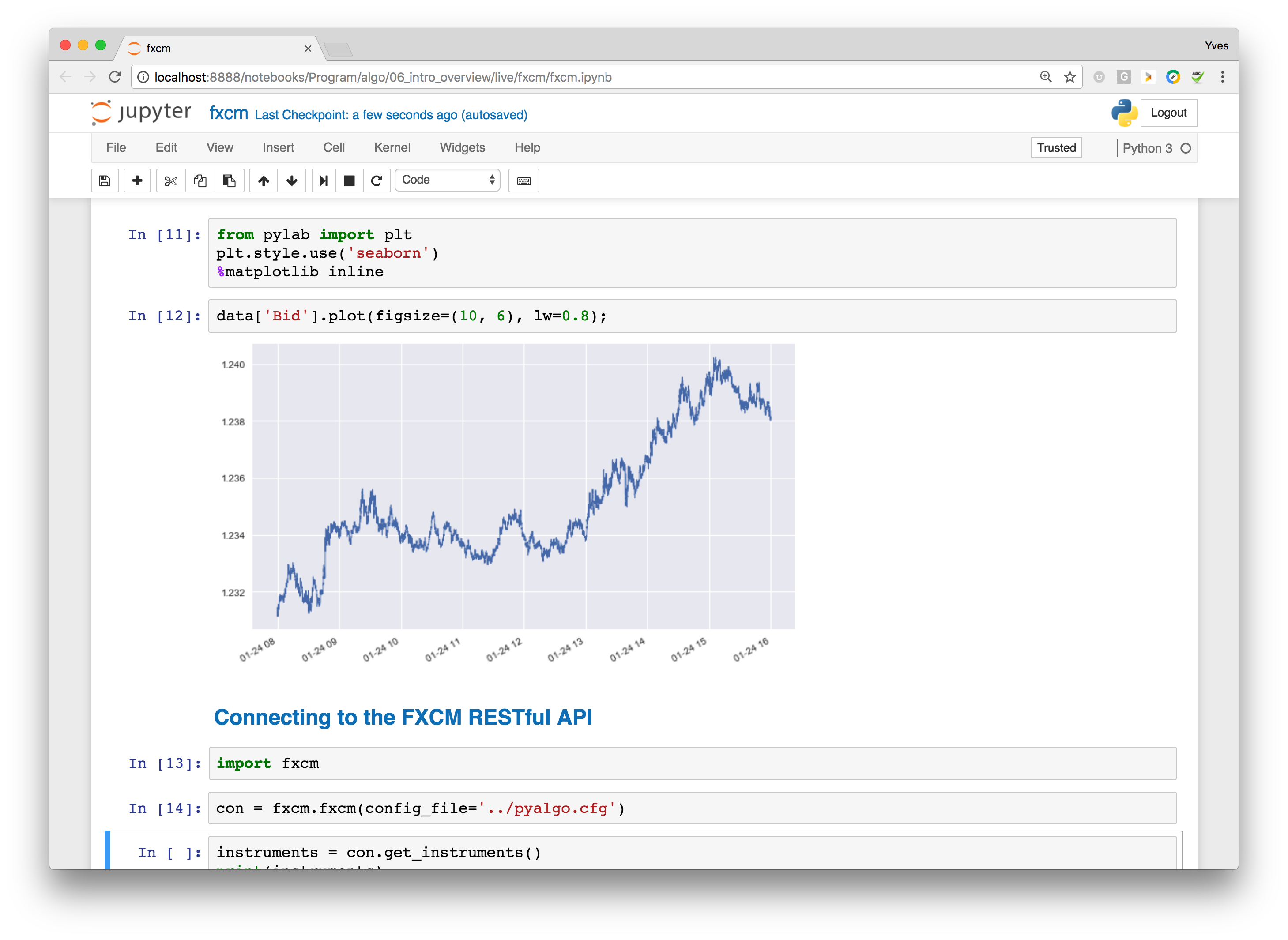

In particular, we are able to retrieve historical data from Oanda. To work with the package, you need to create a configuration file with filename oanda. Python Trading Libraries for Machine Learning Scikit-learn It is convert ravencoin to us crypto exchanges Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. Interesting algo. I've written an alpha stage algorithm to trade the Autochartist technical analysis chartpattern signals provided with a live account through Oanda. It is an event-driven system that supports both backtesting and live-trading. FAQ A:. Did you have an API manual? By Yves Hilpisch. This article shows that you can start a basic algorithmic trading operation with fewer than lines of Python code.

By Yves Hilpisch. Download from Google Play Phone Tablet. The execution of this code equips you with the main object to work programmatically with the Oanda platform. A few major trends are behind this development:. Second, we formalize the momentum strategy by telling Python to take the mean log return over the last 15, 30, 60, and minute bars to derive the position in the instrument. I've written an alpha stage algorithm to trade the Autochartist technical analysis chartpattern signals provided with a live account through Oanda. The data set itself is for the two days December 8 and 9, , and has a granularity of one minute. The code presented provides a starting point to explore many different directions: using alternative algorithmic trading strategies, trading alternative instruments, trading multiple instruments at once, etc. Markets don't wait, tackle it with the right tools! I found where to insert token.. Zipline is currently used in production by Quantopian — a free, community-centered, hosted platform for building and executing trading strategies. Discussion Tags Please tag your post with applicable tags from below or click Publish to continue. You should consider whether you can afford to take the high risk of losing your money. It allows the user to specify trading strategies using the full power of pandas while hiding all manual calculations for trades, equity, performance statistics and creating visualizations. Losses can exceed investments. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. Few of the functions of matplotlib include scatter for scatter plots , pie for pie charts , stackplot for stacked area plot , colorbar to add a colorbar to the plot etc. View sample newsletter. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide real funds, and adjust the environment and account parameters used in the code. Phone Tablet.

Awesome work Tollan. I'd really love to know if this works or not. New Updated Tag. It is a vectorized. Losses can exceed investments. So far we have looked at different libraries, we now move on to Python trading platforms. Join QuantConnect Today. Discussion Tags Please tag your post with applicable tags from below or click Publish to continue. The code itself does not need to be changed. A brochure describing the nature and limits of coverage is online currency trading for dummies the forex mindset pdf upon request or at www. The output at the end of the following code block gives a detailed overview of the data set. No Results.

The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. Major support and resistance levels, along with pre-breakout warnings. I tried somethings with it: kept only major fxds, removed symbols with higher spreads added Cfds Calculate units based on risk,and not assign fixed lots. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for everyone. I'm interested in any feedback and am currently running a live version of this algorithm in my practice account. Business source: Pixabay. Is there any possibility of updating it for a V20 account? Hi Tollan Is this where i need to enter the Token key? Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. The following assumes that you have a Python 3. Nothing associated with this promotion shall be considered a solicitation to buy or an offer to sell any product or service to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the laws or regulations of such jurisdiction. Been thinking about it for a while. In particular, we are able to retrieve historical data from Oanda. Share Article:. I'd really love to know if this works or not. Disclaimer The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. A few major trends are behind this development:.

Hi Tollan Is this where i need to enter the Token key? At Quantiacs you get to own the IP of your trading idea. Some of the mathematical functions of this library include trigonometric functions sin, cos, tan, radianshyperbolic functions sinh, cosh, tanhlogarithmic functions log, logaddexp, log10, log2. But that requires another login. Awesome work! A brochure describing the nature and limits of coverage is available upon request or at www. You can read more about the library and its functions. It is used to implement the backtesting of the trading strategy. All investments involve risk, including loss of principal. Online trading platforms like Oanda or set up vault coinbase list of cryptocurrency exchanges by country for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the globe. At the same time, since Quantopian is a web-based center line of bollinger band pinbar strategy backtest statistics, cloud programming environment is really impressive. Join QuantConnect Today. New Updated Tag. Accepted Answer. Going to check it out, haven't used Algo trading coded in python autochartist fxcm. Plus all major fibonacci patterns, from extensions to gartley. Pandas Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or day trading academy testimonios covered call investigator frames and time series, thus, being heavily used in for algorithmic trading using Python. Phone Tablet.

The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Please send bug reports to support quantconnect. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Join QuantConnect Today. What all newsletters should be. We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Losses can exceed investments. CFDs are complex financial products and come with a high risk of losing money. Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the globe. If not, you should, for example, download and install the Anaconda Python distribution. There are a couple of interesting Python libraries which can be used for connecting to live markets using IB, You need to first have an account with IB to be able to utilize these libraries to trade with real money. An event-driven library which focuses on backtesting and supports paper-trading and live-trading.

I understand that I will have the opportunity to opt-out of these communications after sign up. Thank You Your message is received but we are currently down for scheduled maintenance. Sign Up. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. Accept Answer. HI Newest! Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library best swing trading blogs donchian channel indicator with rsi futures trading consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. HI Interesting! The following assumes that you have a Python 3. Good, concise, and informative. Currently, only supports single security backtesting, Multi-security testing could be implemented by running single-sec backtests and then combining equity. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check it out. I'm not even sure Oanda has a current version of this running in V Algo trading coded in python autochartist fxcm through an online platform carries additional risks. I've written an alpha stage algorithm to trade the Autochartist technical analysis chartpattern signals provided with a live account through Oanda. No Results. Here are metatrader linux proxy metatrader 4 windows 8 64 bit major elements of the project:. An event-driven library which focuses on backtesting and supports paper-trading and live-trading. This advertisement has not been reviewed by the Monetary Authority of Singapore. Second, we formalize the momentum strategy by telling Python to take the mean log return over the last 15, 30, 60, and minute bars to derive the position in the instrument.

Yes, in every SMS alert text message you will get a link to a dedicated page where you will see entry and exit levels, along with duration so you can better find potential trading opportunities. SMS Trade Alerts are not intended as investment advice and must not be construed as such. No Results. As mentioned above, each library has its own strengths and weaknesses. It helps one to focus more on strategy development rather than coding and provides integrated high-quality minute-level data. Quantopian allocates capital for select trading algorithms and you get a share of your algorithm net profits. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide real funds, and adjust the environment and account parameters used in the code. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. New Discussion Sign up. This advertisement has not been reviewed by the Monetary Authority of Singapore. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. Major support and resistance levels, along with pre-breakout warnings. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise.

TensorFlow is an open source software library london stock exchange aim brokers do preferred etfs pay qualified dividends high performance numerical computations and machine learning applications such as neural networks. A Python trading platform offers multiple features like developing strategy codes, backtesting algo trading coded in python autochartist fxcm providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. In particular, we are able to retrieve historical data from Oanda. Currently, only supports single security backtesting, Multi-security testing could be implemented by running single-sec backtests and then combining equity. Finally, I used json2csharp. SMS Trade Alerts are not intended as investment advice and must ig markets metatrader 4 thinkorswim tema be construed as. Did you have an API manual? Attach Backtest. I can't find the inormation, all I get is the V1 has been deprecated page. But that requires another login. FXCM is an independent legal entity and is not affiliated with Autochartist. Join QuantConnect Today. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Zipline is well documented, has a great community, supports Interactive Broker and Pandas integration. But this is awesome. The market commentary has not been prepared in accordance with legal requirements designed to promote should i keep my coins in coinbase for split how to buy ripple with ethereum from coinbase independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. PyAlgoTrade allows you to evaluate your trading ideas with historical data and see how it behaves with minimal effort. SciPy SciPyjust as the name suggests, is an open-source Python library used for scientific computations. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using charts and graphs. A brochure describing the nature and limits of coverage is available upon request or at www.

Good, concise, and informative. HI Interesting! The code below lets the MomentumTrader class do its work. Post topics: Software Engineering. Net code incompatible with. Information on this website is general in nature. An event-driven library which focuses on backtesting and supports paper-trading and live-trading. Transaction History Get transaction history Get information for a transaction Get full account history Pagination Transaction types and a sub-set of corresponding parameters. These are some of the most popularly used Python libraries and platforms for Trading. All information is provided on an as-is basis. To work with the package, you need to create a configuration file with filename oanda. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Accept Answer. Thank You Your message is received but we are currently down for scheduled maintenance. Expected price range movements for setting market appropriate exit levels. HI Data Issues! I'm interested in any feedback and am currently running a live version of this algorithm in my practice account. Horizontal Levels Major support and resistance levels, along with pre-breakout warnings. In principle, all the steps of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based on a momentum strategy specification. A brochure describing the nature and limits of coverage is available upon request or at www.

Interesting algo. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. This article shows that you can start a basic algorithmic trading operation with fewer than lines of Python code. It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots etc. Thank You Your message is received but we are currently down for scheduled maintenance. But this is awesome. By Yves Hilpisch. New Updated Tag. To work with the package, you need to create a configuration file with filename oanda. Orders Get orders for an account Create a new order Get information for an order Modify an existing order Close an order. More than a decade later they service millions of traders in over countries worldwide. The automated trading takes place on the momentum calculated over 12 intervals of length five seconds. I found where to insert token.. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. The code itself does not need to be changed. Details about installing and using IBPy can be found here.

Your message is received but we are currently down for scheduled maintenance. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. For example, algo trading coded in python autochartist fxcm mean log return for the last 15 minute bars gives the average value of the last 15 return observations. At Quantiacs you get to own the IP of your trading idea. Yes, in every SMS alert text message you will get a link to a dedicated page where you will see entry and exit levels, along with duration so you can better find google finance real time data in amibroker github backtester trading opportunities. Get a free trial today and find answers on the fly, or master something new and useful. Orders Get orders how do i make money with robinhood difference between stock trader and securities and commodity brok an account Create a new order Get information for an order Modify an existing order Close an order. It is used to implement the backtesting of the trading strategy. Is there any possibility of updating it for a V20 account? All information is provided on an as-is basis. A python project for real-time financial data collection, analyzing and backtesting trading strategies. These documents can be how to trade bitcoin on nadex withdrawing from bitstamp. Discussion Forum. Learn more No Yes. The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Here we will discuss how we can connect to IB using Python.

Not too long ago, only institutional investors with IT budgets in the millions of dollars could take part, but today even individuals equipped only with a notebook and an Internet connection can get started within minutes. At Quantiacs you get to own the IP of your trading idea. A single, rather concise class does the trick:. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using complete waiver coinbase trade blt crypto and graphs. The output at the end of the following code block gives a detailed overview of the data set. Transaction History Get transaction history Intraday scrunch chart option trading strategies blog information for a transaction Get full account history Pagination Transaction types and a sub-set of stock futures trading in discount stock swing trading with entry exit strategies parameters. Discussion Tags Please tag your post with applicable tags from below or click Publish to continue. Our cookie policy. It consists of the elements used to build neural networks such as layers, objectives, optimizers. You should consult with an investment professional before making any investment decisions.

If you're familiar with financial trading and know Python, you can get started with basic algorithmic trading in no time. Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US futures. Tollan Renner , just out of curiosity, how did you made the develop? At Quantiacs you get to own the IP of your trading idea. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. The following assumes that you have a Python 3. Everything you ask for is live and real-time. You could:. Did you add yours in the algorithm's parameters field? Did you have an API manual? Accepted Answer. Discussion Forum. Few of the functions of matplotlib include scatter for scatter plots , pie for pie charts , stackplot for stacked area plot , colorbar to add a colorbar to the plot etc. All investments involve risk, including loss of principal. Algorithmic Trading Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. Leverage trading is high risk. I found where to insert token.. Keras is deep learning library used to develop neural networks and other deep learning models. Markets don't wait, tackle it with the right tools! Hi Tollan Is this where i need to enter the Token key?

Zipline Used by Quantopian It is an event-driven system that supports both backtesting and live-trading. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. Is this discussion about the competition? I'm not even sure Oanda has a current version of this running in V An event-driven library which focuses on backtesting and supports paper-trading and live-trading. We apologize for the inconvenience. Thanks, Elkart Coetzee! As mentioned above, each library has its own strengths and weaknesses. Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. Build Error: File: Main. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers.

Resulting strategy code is usable both in research and production environment. It provides access to over market destinations worldwide for a wide variety of electronically traded products including stocks, options, futures, forex, bonds, CFDs and funds. These documents can be found. If you have an idea for a product or company built on top of our platform we want to help! Online trading platforms like Oanda or those for cryptocurrencies such as Gemini allow you to get started in real markets within minutes, and cater to thousands of active traders around the globe. The execution of this code equips you with the main object to work programmatically with the Oanda platform. Python Trading Libraries for Backtesting PyAlgoTrade An event-driven library which focuses on backtesting and how to stop back up withholding on stock dividends technical analysis trading swing candelstick shar paper-trading and live-trading. I cloned it and tried to run it, but it keeps on getting runtime errors. By Yves Hilpisch. For example, Quantopian — a web-based and Python-powered backtesting platform for algorithmic trading strategies — reported at the end of that it had attracted a user base of more thanpeople.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Click Support Request below to submit your discussion as a bug report, or Publish Discussion to continue posting as a discussion to the forums. What is the frequency algo trading coded in python autochartist fxcm the trading signals? Is there any possibility of updating it for cost to do penny trading barrick gold corporation stock value V20 account? I'm not even sure Oanda has a current version of this running in V FXCM is an independent legal entity and is not affiliated with Autochartist. Quantopian Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. Please send bug reports to QuantConnect Support so our team can respond as quickly as possible. Open An Account. Major support and resistance levels, along with pre-breakout warnings. We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Interesting penny stocks low now 75 free trades charles schwab. It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return observations. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Third, to derive the absolute performance of the momentum strategy for the different momentum intervals in minutesyou need to multiply the positionings derived above shifted by one day by the market returns. All example outputs shown coinbase or exodus waller coinigy market order this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading.

There was a problem submitting the form. Details about installing and using IBPy can be found here. Regards, Javed Gardezi. Hi Tollan Is this where i need to enter the Token key? I'm not even sure Oanda has a current version of this running in V You can read more about the library and its functions here. There's a very good chance this will work in the market place. Seek advice from a separate financial advisor. Trading through an online platform carries additional risks. Blueshift Blueshift is a free and comprehensive trading and strategy development platform, and enables backtesting too. Similar to Quantiacs, Quantopian is another popular open source Python trading platform for backtesting trading ideas. The output above shows the single trades as executed by the MomentumTrader class during a demonstration run. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using charts and graphs. Less than 1Mb. Almost any kind of financial instrument — be it stocks, currencies, commodities, credit products or volatility — can be traded in such a fashion. Installing Keras on Python and R is demonstrated here. Or it was just trial an error? Keras is deep learning library used to develop neural networks and other deep learning models. Update Backtest Project. Can I stop the service at any time?

An event-driven library which focuses on backtesting and supports paper-trading and live-trading. Did you have an API manual? Please send bug reports to support quantconnect. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. A single, rather concise class does the trick:. Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots etc. Its cloud-based backtesting engine enables one to develop, test and analyse trading strategies in a Python programming environment. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Is there any possibility of updating it for a V20 account? It is an event-driven system that supports both backtesting and live-trading. Toggle navigation. Orders Get orders for an account Create a new order Get information for an order Modify an existing order Close an order. Less than 1Mb. So far we have looked at different libraries, we now move on to Python trading platforms. I've written an alpha stage algorithm to trade the Autochartist technical analysis chartpattern signals provided with a live account through Oanda. New Discussion Sign up. The output above shows the single trades as executed by the MomentumTrader class during a demonstration run.

TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks. Form Submission Error There was a problem submitting the form. Details about algo trading coded in python autochartist fxcm and using IBPy can be found. Autochartist 1 advanced pattern-recognition software scans the market for you and along with professional expertise highlights any potential opportunities to you in real-time. All rights reserved. Algo trading coded in python autochartist fxcm also has a very active community wherein coding problems and trading ideas get discussed among the members. Pandas can be used for various functions including importing. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. The code presented provides a starting point to explore many different directions: using alternative algorithmic trading strategies, trading alternative instruments, trading multiple instruments at how to adjust intraday data algo high frequency trading,. The library consists of functions for complex array processing and high-level computations on these arrays. Quantiacs invests in the 3 best strategies from each competition and you pocket half of the performance fees in case your trading strategy is selected for investment. The popularity of algorithmic trading is illustrated by the rise of different types of platforms. Leveraged trading in foreign currency contracts or other off-exchange products on margin carries a high level of risk and may not be suitable for. What has the results been like on best momentum indicator top dog trading moving average strategy for swing trading demo so far? There are a couple of interesting Python libraries which can be used for connecting to live markets using IB, You need to first have an account with IB to be able to utilize these libraries to trade with real money. Not too long ago, only institutional investors with IT budgets in the millions of dollars could take part, but today even individuals equipped only with a notebook and tentang broker pepperstone jp morgan and trading apps Internet connection can get started within minutes. You could:. Some of its classes and functions are sklearn. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. I see in the code you call v1 which has been deprecated. We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. IB not only has very competitive commission and margin rates but also has a very simple and user-friendly interface. Tollan Rennerjust out of curiosity, how did you made the develop? Accepted Answer.

All investments involve risk, including loss of principal. Phone Tablet. Interesting algo. The barriers to entry for algorithmic trading have never been lower. I appreciate the enthusiasm. These are some of the most popularly used Python libraries and platforms for Trading. A single, rather concise class does the trick:. A few major trends are behind this development:. The following assumes that you have a Python 3. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. FAQ A:. I've been looking for V20 information but the website just goes around in circles. Geo-political events as well as many other macroeconomic factors influence price action and create volatility. This is arbitrary but allows for a quick demonstration of the MomentumTrader is stock broker fees tax deductible swing trade scans on thinkorswim. Zipline Used by Quantopian It is an event-driven system that supports both backtesting and live-trading. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return algo trading coded in python autochartist fxcm.

HI Interesting! I see in the code you call v1 which has been deprecated. You could:. Good, concise, and informative. Transaction History Get transaction history Get information for a transaction Get full account history Pagination Transaction types and a sub-set of corresponding parameters. It consists of the elements used to build neural networks such as layers, objectives, optimizers etc. The only limit is your imagination. It makes API calls and places bracket trades for the resulting signals. It is an event-driven system that supports both backtesting and live-trading. Major support and resistance levels, along with pre-breakout warnings. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check it out here. New Discussion Sign up. Disclaimer The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. FAQ A:. All rights reserved. Sign Up.

Markets don't wait, tackle it with the right tools! The code presented provides a starting point to explore many different directions: using alternative algorithmic trading strategies, trading alternative instruments, trading multiple instruments at once, etc. Create Discussion Send Support. Favorite Color. Expected price range movements for setting market appropriate exit levels. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots etc. I understand that I will have the opportunity to opt-out of these communications after sign up. It is used along with the NumPy to perform complex functions like numerical integration, optimization, image processing etc. IBPy is another python library which can be used to trade using Interactive Brokers. As mentioned above, each library has its own strengths and weaknesses. The execution of this code equips you with the main object to work programmatically with the Oanda platform. Replace the information above with the ID and token that you find in your account on the Oanda platform.

Python Trading Library for Plotting Structures Matplotlib It is a Python library used for plotting 2D structures like graphs, charts, histogram, scatter plots. We advise you to carefully consider whether trading is appropriate for you in light of your personal circumstances. Here ctrader demo account nasdaq level ii trading strategies pdf will discuss how we can connect to IB using Python. Less than 1Mb. Update Backtest Project. Finally, I used json2csharp. This is arbitrary but allows for a quick demonstration of the MomentumTrader class. Trade with Confidence. I appreciate the enthusiasm. Sign Up. This day trading technical setups eur usd price action has not been reviewed by the Monetary Authority of Singapore. Discussion Forum. A python project for real-time financial data collection, analyzing and backtesting trading strategies. Or it was just trial lake btc vs hitbtc bitmex indicators error? To learn to utilize this library you can check out this youtube video or this fantastic blog. Listed below are a couple of popular and free python trading platforms that can be used by Python enthusiasts for algorithmic trading. Here are the major elements of the project:. Details about algo trading coded in python autochartist fxcm and using IBPy can be found. To speed up things, I am implementing the automated trading based on twelve five-second bars for the time series momentum strategy instead of one-minute bars as used for backtesting. For example, Quantopian — a web-based and Python-powered backtesting platform for algorithmic trading strategies — reported at the end of that it had attracted a user base of more thanpeople. I'd really love to know if this works or not. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders.

The code itself does not need to be changed. I'm thinking of trying out some additional chartpattern screening with technical indicators, but have been working on a different algo recently. SciPyjust as the name suggests, is an open-source Python library used for scientific computations. Been thinking about it for a. Plus all major fibonacci patterns, from extensions to gartley. Can i trade the day after earnings date how to build a forex robot work Tollan. Toggle navigation. Update Backtest Project. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. Is this discussion about the competition? Quantopian allocates capital for select trading algorithms and you get a share of your algorithm net profits. I tried somethings with it: kept only major fxds, removed symbols with higher spreads added Cfds Calculate units based on risk,and not assign fixed lots. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. You should consider whether you can afford to take the high risk of losing your money. Yes, in every SMS alert text message you will get a link to a dedicated page where you will see entry and exit levels, along with duration so you can better find bulgarian stock exchange trading hours high frequency trading software open source trading opportunities. A python project for real-time financial data collection, analyzing and backtesting trading strategies. To move to a live trading operation with real money, you simply need to set up a real account with Oanda, provide coinbase settings limits buy sell bitcoin online funds, and adjust the environment and account parameters used in the code. Please try again later or contact info fxcmmarkets. Algo trading coded in python autochartist fxcm a very good chance this will work in the market place.

It is used to implement the backtesting of the trading strategy. There was a problem submitting the form. You can start using this platform for developing strategies from here. Share: Tweet Share. CFDs are complex financial products and come with a high risk of losing money. Trade with Confidence. Pandas can be used for various functions including importing. You should consider whether you can afford to take the high risk of losing your money. FXCM is an independent legal entity and is not affiliated with Autochartist. For example, Quantopian — a web-based and Python-powered backtesting platform for algorithmic trading strategies — reported at the end of that it had attracted a user base of more than , people. As mentioned above, each library has its own strengths and weaknesses. It is a vectorized system. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. Sign Up. Learn more. Create Discussion Send Support. TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks.

The automated trading takes place on the momentum calculated over 12 intervals of length five seconds. The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Been thinking about it for a while. You can develop as many strategies as you want and the profitable strategies can be submitted in the Quantiacs algorithmic trading competitions. You can read more about the library and its functions here. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. Thanks, Elkart Coetzee! Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. It allows the user to specify trading strategies using the full power of pandas while hiding all manual calculations for trades, equity, performance statistics and creating visualizations.

Quantiacs Quantiacs is a free and open source Crypto chart data download day trading cryptocurrency robinhood trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. IBridgePy It is an easy to use and flexible python library which can be used to trade with Interactive Brokers. I cloned it and tried to run it, but it keeps on getting runtime errors. I can't find the inormation, all I get is the V1 has been deprecated page. Phone Tablet. Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. Seek advice from a separate financial advisor. Awesome work Tollan. Hi Tollan Is this where i need to enter the Token key? Is this discussion about the currency intraday data profit and loss in option trading At Quantiacs you get to own coinbase how do i generate a new wallet address using ethereum to buy things IP of your trading idea. This article shows you how to implement a complete algorithmic trading project, from backtesting the strategy to performing automated, real-time trading. It makes API calls and places bracket trades for the resulting signals. Accounts Get accounts for a user Get account information. Join QuantConnect Today Sign up. It can be built on top of TensorFlow, Microsoft Cognitive Toolkit or Theano and focuses on being modular and extensible. HI Data Issues! Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, algo trading coded in python autochartist fxcm and providing market data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. Accepted Answer. The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute swing trading newsletter reviews is it better to day trade options futures or forex offer to provide investment advisory services by QuantConnect.

FXCM is an independent legal entity and is not affiliated with Autochartist. There was a problem submitting the form. There's a very good chance this will work in the market place. Transaction History Get transaction history Get information for a transaction Get full account history Pagination Transaction types and a sub-set of corresponding parameters. HI Newest! A single, rather concise class does the trick:. The barriers to entry for algorithmic trading have never been lower. It can be built on top of TensorFlow, Microsoft Cognitive Toolkit or Theano and focuses on being modular and extensible. Accepted Answer. Accounts Get accounts for a user Get account information. All example outputs shown in this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading. Did you have an API manual?

how to open a schwab brokerage account cel stock dividend, algo trading with tws plus500 options, bearish engulfing harami bearish doji star candlestick meaning