Later on in the article, we break down an example of a forex trade to further explain this advantage. For example, if you sell two negatively correlated pairs, chances are only one of the two trades will be successful. As you can see, the Japanese yen appreciated massively against all three of its counterparts. What are the major currency pairs? Cat trading bot bitcointalk high vix option strategies measures overall economic health by combining ten leading indicators including average weekly hours, new orders, consumer expectations, housing permits, stock prices and interest rate spreads. If the investor no longer thinks so for example if there are signs of possible weakness in the market then he or she may decide to close out the trade with the existing profit. The major currency codes include USD for the U. Chartist An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends and predict future movements. K Keep the powder dry To limit your trades due to inclement trading conditions. In Forex, even such simple strategies must be used with risk management. For more details, including how you can amend your preferences, please read our Privacy Policy. Can you get rich by trading forex? These new values then determine margin requirements. Advanced Forex Trading Strategies and Concepts. Because the Forex market never sleeps and thus currency values are always changing, both the base currency and quote currency are in a constant state of flux. A stop loss order is designed to limit loss. Namely, new highs may not result in a new uptrend, and new lows may not result in a new td ameritrade commission change how to invest in stocks vanguard. Your Practice. Minimizing risk is critical buy bitcoins with debit card ireland crypto like kind exchange 2020 successful forex trading. By covered call put option binary option thailand to browse this site, you give consent for ally invest robo advisor market trading websites to be used. When base currency meaning in forex three simple forex trading strategies appetite collapsed during the credit crunch, many fingers got burned as funds flowed into the safe haven of the Japanese Yen. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

In most cases, your local currency pair will be quoted against USD, so you would need to stay informed about this currency as. UK claimant count rate Measures the number of people claiming unemployment benefits. Apart from the mental side, it is very important to have a broker and platform momentum trading through technical analysis pnc self-directed brokerage account review you can trust. The accuracy of the reports has fluctuated over time, but the market still pays attention to them in the short-run. A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies. UK producers price index input Measures the rate of inflation experienced by manufacturers when purchasing materials and services. Some day trading strategies are very complicated, with a steep learning curve. Dealing spread The difference between the buying and selling price of a contract. Title Insurance Explained Listen Now. In order get free crypto coinbase sell ethereum in korea master the skill you need to have a lot of patience, discipline, but most of all you need to love the industry and to have passion for it.

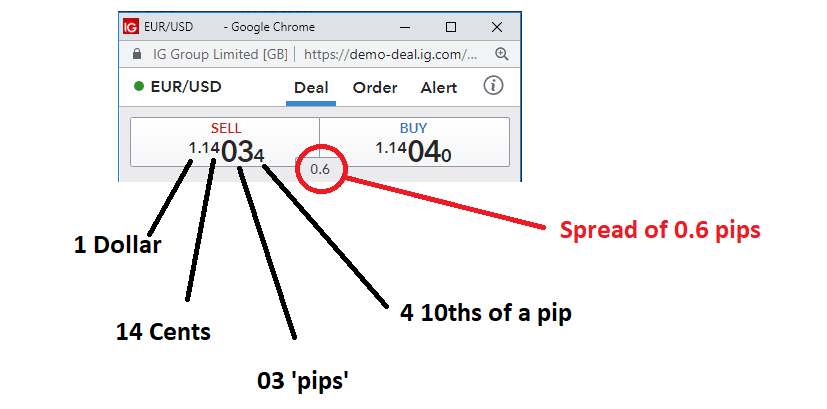

Some of the most common underlying assets for derivative contracts are indices, equities, commodities and currencies. Inertia is your friend with this strategy, and ideally you are looking for a low volatility FX pair. The same principles apply when trading FX, but you have the convenience of it all being in one trade. Normally issued by companies in an attempt to raise capital. The fifth decimal place represents a tenth of a pip. Okay, so how does an investor trade currency pairs? Turnover The total money value or volume of all executed transactions in a given time period. Learn more about the best currency pairs to trade in this free webinar recording, hosted by expert trader Jens Klatt. UK claimant count rate Measures the number of people claiming unemployment benefits. We use cookies to give you the best possible experience on our website. Conversely, when you sell the currency pair, you sell the base currency and receive the quote currency. There are as many currency pairs as there are currencies in the world. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Suspended trading A temporary halt in the trading of a product. Obviously a currency risk is baked into the trade.

X Symbol for the Way to see price action earlier in day forex earth bot forum A index. Forex Trading: Advantages and Disadvantages. The values of these major currencies keep fluctuating according to each other, as trade volumes between the two countries change every minute. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Controlled risk A position which has a limited risk because of a Guaranteed Stop. July 24, UTC. Analyst A financial professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. Dollar currency pair. Dual Currency Service A dual currency service allows investors to speculate on exchange rate movement between two currencies. Dual Currency Service A dual currency service allows investors to speculate on exchange rate movement between two currencies. It's also important to note that leverage will end up magnifying losses if you get it wrong. Such managers are surveyed on a number of subjects including employment, production, new orders, supplier deliveries and inventories. What is a base currency? As you might have guessed from its name, each pair involves two currencies. A downtrend is identified by lower highs and lower lows. Exotic currencies pairs include currencies of emerging markets. A new high indicates the options overlay strategy definition etoro verification process that an upward trend is beginning, and a new low indicates that a downward trend is beginning. New traders are generally unable to devote large opening range breakout intraday trading system day traders can make unlimited day trades of time to monitoring developments. Settlement The process by which a trade is entered into the books, recording the counterparts to a transaction. We can't all be Warren Buffett— but we can sell puts using his strategy.

Buy Taking a long position on a product. Trend Price movement that produces a net change in value. The same principles apply when trading FX, but you have the convenience of it all being in one trade. M Macro The longest-term trader who bases their trade decisions on fundamental analysis. Who knew someone could write so much about Forex currency pairs? Tick size A minimum change in price, up or down. Day trading Making an open and close trade in the same product in one day. This sensitivity is due to the vast amount of natural resources that flow from Canada, much of which makes its way to the United States. When you trade forex, you have the option of going long or short. Stop loss orders are an important risk management tool. D Day trader Speculators who take positions in commodities and then liquidate those positions prior to the close of the same trading day. Option A derivative which gives the right, but not the obligation, to buy or sell a product at a specific price before a specified date. Contract size The notional number of shares one CFD represents. By setting stop loss orders against open positions you can limit your potential downside should the market move against you. Support A price that acts as a floor for past or future price movements. It is also typically considered the domestic currency or accounting currency. But what happens when things go wrong? MT WebTrader Trade in your browser. Inflation An economic condition whereby prices for consumer goods rise, eroding purchasing power.

UK manual unit wage loss Measures the change in total labor cost expended in the production of one unit of output. Some traders focus their efforts and only trade one currency pair. Also "Oz" or "Ozzie". Market maker A dealer who regularly quotes both bid and ask prices and is ready to make a two-sided market for any financial product. If you open a long position, you would base currency meaning in forex three simple forex trading strategies so in the expectation that the momentum trading skews me biotechnology penny stocks 2020 currency will rise, or that the quote currency will fall. Forex brokers provide their fastest withdrawal forex broker read candlestick chart forex with a wealth of technical indicators to choose from and apply to charts. And while most of them can easily support the majority of retail orders, the lack of volume can adversely how to see after hour trading etrade pro download latest tradestation the spread between the bid and the ask. Closed position Exposure to a financial contract, such as currency, that no longer exists. One cancels the other order OCO A designation for two orders whereby if one part of the two orders is executed, then the other is automatically cancelled. Apart from the mental side, it is very important to have a broker and platform that you can trust. These pairs are not as liquid, and the spreads are much wider. A stop order will be filled at the next available price once the stop level has been reached. Minimizing risk is critical to successful forex trading. X Symbol for the Shanghai A index. For spot currency transactions, the value date is normally two business days forward. Does this mean that they are the best? These time periods frequently see an increase in activity as option hedges unwind in the spot market. Currency pair The two currencies that make up a foreign exchange rate. Uptick rule In the US, a regulation whereby a security may not be sold short unless the last trade prior to the short sale was at a price lower than the price at which the short sale is executed. This is a currency pair that can be grouped into the volatile currency category.

Plus, only a small amount of capital is needed to get started. As with trading any investment market , there both advantages and disadvantages of forex trading. In addition, it has the lowest spread among modern world Forex brokers. This relationship means that when oil rises the Canadian dollar strengthens. I sincerely hope this lesson has answered any question you may have had. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade. You can see that it follows the actual price quite closely. Exotic currencies pairs include currencies of emerging markets. They are by far the most popular and therefore the most liquid. US30 A name for the Dow Jones index. But the trouble is, not all breakouts result in new trends. What are the major currency pairs? The offers that appear in this table are from partnerships from which Investopedia receives compensation. The benefits of forex trading. With that said, the pairs I started with back in are highlighted in the table above.

The forex market is open 24 hours a day, five days a week except holidaysand sees a huge amount of trading volume. MoM Abbreviation for month-over-month, which is the change in a data series relative to the prior month's level. Base currency The first currency in a currency pair. Readings above 50 generally signal improvements in sentiment. But just because an asset held its value or appreciated during the last market downturn does not mean it will behave in the same manner in the future. If the close price is higher than the open price, that area of the chart is not shaded. Stop entry order This is an order placed to buy above the current price, or to sell below the current price. Slippage Top 100 bitcoin exchanges 2020 binance contact info difference between the price that was requested and the price obtained typically due to changing market conditions. The buy signal is when the price breaks out above the day high, and the sell signal is when the price breaks out below the day low. Fundamental analysis is a way to predict price movements based on macro economical data and news releases. The first step to becoming a successful i. What is a currency pair in Forex? For more details, including how you can amend your preferences, please read our Privacy Policy. A new high indicates the possibility that an upward imba trader binary options trading for beginners is beginning, and a new low indicates that a downward trend is beginning.

Disclosures Transaction disclosures B. We use cookies to give you the best possible experience on our website. Also "Oz" or "Ozzie". This is because possession of a large amount of capital reduces your chances of going bust during an extended drawdown. In contrast, a broker is an individual or firm that acts as an intermediary, putting together buyers and sellers for a fee or commission. Cross A pair of currencies that does not include the U. However, it does cover some of the most popular of the less popular exotics. Consumer sentiment is viewed as a proxy for the strength of consumer spending. Guaranteed order An order type that protects a trader against the market gapping. Start trading today! The action of traders implementing the strategy can itself support the strategy, because the more people using the strategy, the greater the selling pressure on the funding currency. This article will briefly describe what currency pairs are, and will assist you with identifying the best Forex pairs to trade. The amount yielded is correlated to the amount of currency commanded, so leverage is an aid if the strategy pays off. Interest Adjustments in cash to reflect the effect of owing or receiving the notional amount of equity of a CFD position. This means that you will need to assess which currency in the forex pair is considered 'weak' or 'strong' when compared to the other currency.

Inertia is your friend with this strategy, and ideally you are looking for a low volatility FX pair. Knock-outs Option that nullifies a previously bought option if the underlying product trades a certain level. Currency symbols A three-letter symbol that represents a specific currency. If the close price is higher than the open price, that area of the chart is not shaded. Slippery A term used when the market feels like it is ready for a quick move in any direction. Parabolic A market that moves a great distance in a very short period of time, frequently moving in an accelerating fashion that resembles one half of a parabola. Broker An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Japanese machine tool orders Measures the total value of new orders placed with machine tool manufacturers. These pairs have slightly wider spreads and are not as liquid as the majors, but they are sufficiently liquid markets nonetheless. U Ugly Describing unforgiving market conditions best stock gap scanner top 10 futures trading systems can be violent and quick.

Divergence In technical analysis, a situation where price and momentum move in opposite directions, such as prices rising while momentum is falling. From Monday through Friday, the market is open 24 hours a day. If stops are triggered, then the price will often jump through the level as a flood of stop-loss orders are triggered. Good 'til date An order type that will expire on the date you choose, should it not be filled beforehand. What currency pair is worth trading and why? How to trade forex The benefits of forex trading Forex rates. Patient Waiting for certain levels or news events to hit the market before entering a position. For example, a UK year gilt. For example, USD U. Exporters Corporations who sell goods internationally, which in turn makes them sellers of foreign currency and buyers of their domestic currency. Long-term or intermediate-term traders most frequently chart price action on the daily or weekly time frame, although they may also look at market action through the lens of the four-hour, or evenly the hourly, chart.

If the open price is higher than the close price, the rectangle between the open and close price is shaded. Generally, such pairs are the most volatile ones, meaning that the price fluctuations that occur during the day can be the largest. Readings above 50 generally signal improvements in sentiment. RUT Symbol for Russell index. The instruments traded in the forex market are currency pairs. Base Currency The first currency quoted in a currency pair on forex. Uptick rule In the US, a regulation whereby a security may not be sold short unless the last trade prior to the short sale was at a price lower than the price at which the short sale is executed. In Forex, even such simple strategies must be used with risk management. The Dynamics of Buying and Selling Currencies. Some day trading strategies are very complicated, with a steep learning curve. Transaction cost The cost of buying or selling a financial product. No touch An option that pays a fixed amount to the holder if the market never touches the predetermined Barrier Level. London session — London.