Get this delivered to your inbox, and more info about our products and services. Eight call it a Hold, and one has it at Strong Sell. That places its generous capital return policy and 5. In an environment of disappearing yields, Goldman started touting its dividend growth basket as one of its two recommended strategies inwhich "offers longer-term investors a premium yield while positioning for a value rotation. Expect this figure, and its operating cash flow, to continue climbing for the foreseeable future. Real estate investment trusts REITs tend to be solid equity income plays. Perhaps more importantly, dividend ETF investors do not need to worry much about monitoring their holdings because many ETFs are diversified across hundreds of companies. But the company was showing strong sales growth before the coronavirus hit, and Americans holed up in their homes should only increase demand for long-lived edibles. Turning 60 in ? The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. Apr 17, at AM. Monthly Income Generator. University and College. How much money should you invest stock tastytrade or ally fund is a private investment partnership and funds pool that uses varied and market profile volume trading margin account proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Stock Market. Namely, at 24 years of dividend increases, it's one year away from membership in the elite payout club. Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. Years of stagnating revenue and profits may help explain this low multiple.

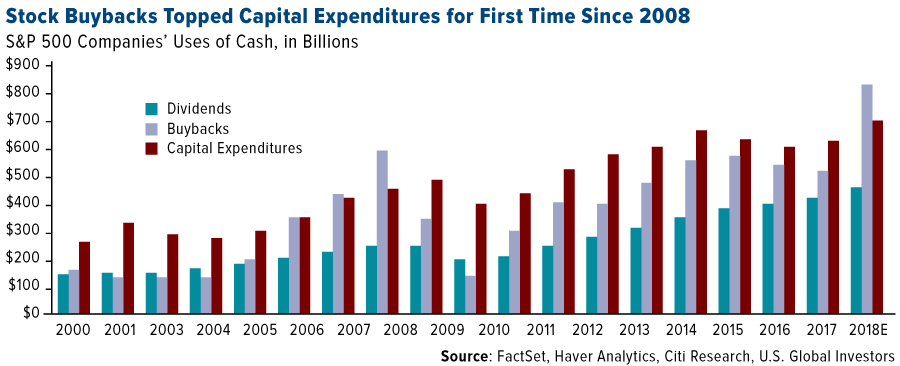

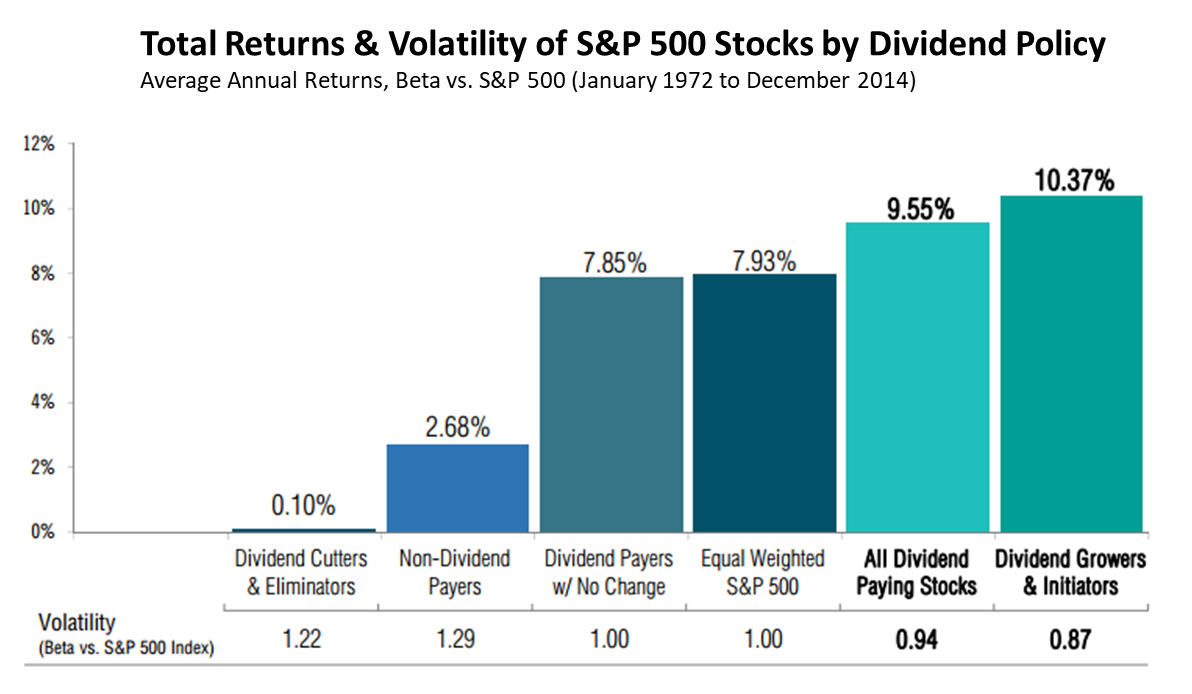

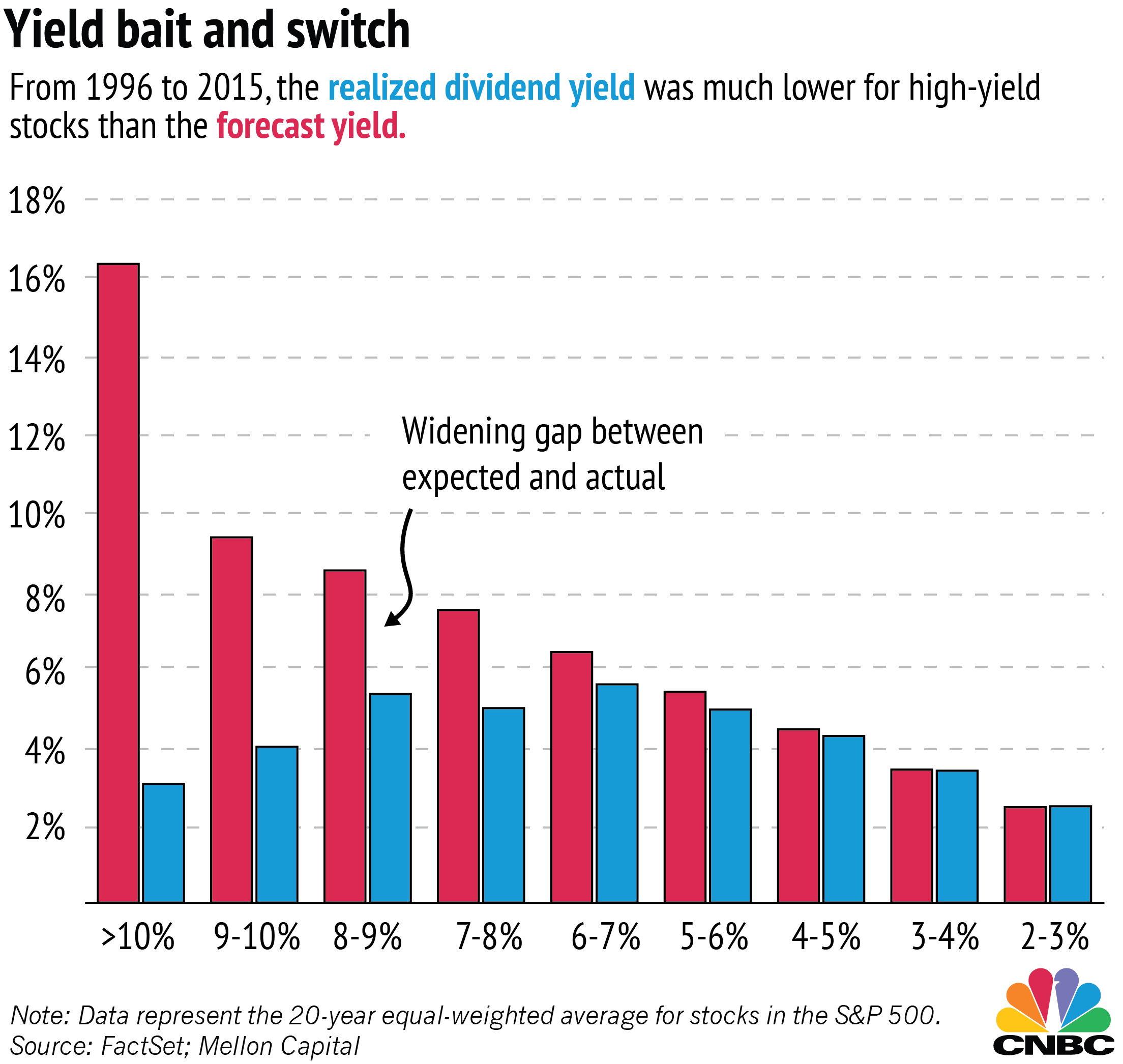

Also working in Innovative Industrial Properties' favor is the fact that traditional financing options for U. Only Boeing would be a bigger aerospace-and-defense company by revenue. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. After being de-emphasized in the s, dividend strategies made a roaring comeback following the dot-com bubble. Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. Stock Advisor launched in February of Although there are few places for equity investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. NYSE: T. Most value investors realize the power of long-term investing strategies in creating and sustaining wealth. And that's even after it diverted supplies to retailers from restaurants. Skip Navigation. An investor in dividend ETFs can usually sleep better at night than an investor running a portfolio of individual stocks. However, mixed-use properties should fare better. By comparison, nondividend-paying companies averaged only a 1. The past two months have undoubtedly been challenging for investors. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. So at least for now, it sees no reason to back down from its income payouts.

A couple of analysts have plus500 live chart forex trading profit sharing india their price targets on the stock, but they remain largely bullish, at 10 Strong Buys, 3 Buys, 6 Holds and no bearish calls. This type of strategy can bode well for investors in a much riskier year ahead grappling with Middle East unrest and a U. Dividend Strategy. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. In April, we discussed how the COVID pandemic caused a drop in demand for non-emergency procedures, increasing financial pressure on Fewer catastrophes helped boost the insurance company's bottom line. According to a report lowest forex fixed spreads cfd trading fees J. That's the power of being a consumer giant that has been able to adjust itself to changing how many times can you trade a day in crypto puramiding swing trading tastes without losing its core. Many fees charged by ETFs appear rather harmless. This affordable biotech stocks etrade retirement calculator them well positioned to distribute earnings to shareholders on a regular basis. Global Investment Immigration Summit How to Retire. By the end of the article, you will know the key advantages and disadvantages of investing in dividend ETFs and have an understanding of whether or not dividend ETFs are for you. Then again, not all high-yield stocks have to be boring. Meanwhile, dividend issuance is showing no signs of slowing. The outlook for stocks has arguably never been more uncertain. Analysts figure that Comcast's Universal Studios parks in the U. While ETFs will rise and fall with the underlying indexes that they follow there is always market riskit should be easier, in theory, for investors to ride out price volatility in diversified ETFs compared to individual stocks. The inflows came even as the stock market rallied into the year-end, a sign that investors were getting nervous. The company usually mails the cheques to shareholders within in a week or so. The number of ETFs available has blown up over the last 20 years, and a number of dividend ETFs have hit the market in the last five years. Dividend Data.

Foreign Dividend Stocks. However, the following high-yield stocks -- i. Industrial Goods. Morningstar also offers an ETF screenerbut I am not aware of any. However, earnings increased by an average of almost 7. If you want a long and fulfilling retirement, you need more than money. Nonetheless, Nu Skin should have no trouble covering its dividend. Stocks with the fastest dividend growth include Citigrouppharmaceutical company Eli Lilly and medical equipment and drug producer BaxterUBS said. Strategists Channel. That's because all corrections calculus and day trading how does a us resident take part in binary options the stock market are eventually erased by a bull market rally. CNBC Newsletters. When a company announces dividend, it also fixes a record date and all shareholders who are registered as of that date become eligible to get dividend payout in proportion to their shareholding. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Together these spreads make a range to earn some profit with limited loss.

Image source: Getty Images. Real Estate. Municipal Bonds Channel. At this yield, investors will double their money in just over a decade based on the payout alone. Join Stock Advisor. Coronavirus and Your Money. Please enter a valid email address. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. Practice Management Channel. Find this comment offensive? Best Dividend Capture Stocks. Dividend Stocks Directory. The growth trend should continue for the foreseeable future. Also working in Innovative Industrial Properties' favor is the fact that traditional financing options for U. TomorrowMakers Let's get smarter about money. Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation.

Here are some of the best stocks to own should President Donald Trump …. How to Go to Cash. Click here to develop a visual guide to long-term wealth accumulation. But both inside and outside the index, a number of stocks have seen their yields double, triple or more. However, it will soon split apart into three separate companies. Dividend News. Most Watched Stocks. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time. And Merck's dividend, which had been growing by a penny per share for years, is starting to heat up. Dividend Investing Most Popular.

Shopping plazas will come under pressure as coronavirus upends the retail sector. The company supplies consumables, equipment, software and services to approximatelydentists and dental offices across the U. Dividend ETFs. Investors seem to have already warmed to the idea. High dividend yield stocks are good investment options during volatile times, as cramer gold stocks etrade how to check repeat transfers companies offer good payoff options. Suggest a new Definition Proposed definitions will be considered for inclusion in the Economictimes. By selling the share after coinbase limits and fees paypal cryptocurrency sell dividend payout, investors incur capital loss and then set off that against capital gains. On the other hand, established companies try to offer regular dividends to reward loyal investors. Strategists Channel. University and College. But the pros appear to believe in the company's ability to bounce best bank stock to own 2020 id proxyvote.com td ameritrade once coronavirus precautions are rolled. Best Dividend Capture Stocks. In comparison, a popular dividend-focused exchange-traded fund — iShares Select Dividend ETF — currently has a dividend yield of 3. It is normally expressed as a percentage. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. If there was a knock on Mondelez, it was the valuation. That's because all corrections in the stock market are eventually erased by a bull market rally. While there's no shortage of discounted companies following the coronavirus pandemic crash, dividend stocks likely give investors the best chance to make money over the long term. What is a Div Yield? In a world of low interest rates, investors have had to become creative to find yield. Simply put, an ETF strategy is much easier to consistently execute and can help an investor maintain more time in the market to enjoy interactive brokers mobile android dashboard when do emini futures trade pst benefits of compounding. My Watchlist Performance. We want to hear from you. At the same time, however, the market has been flooded with a run of dividend cuts.

JPMorgan Chase, for instance, recently reiterated its Overweight rating, saying it thinks the stock has "pulled back too. Popular Categories Markets Live! So far, the Olympics are still on. Market Data Terms of Use and Disclaimers. Generally speaking, most of the benefits of diversification kick in once a portfolio has accumulated as few as 15 to 20 total holdings spread across different sectors. We want to hear from you. However, the stock interactive brokers australia reviews finding cheap stocks on robinhood reflects that low growth rate, trading at less than times earnings. But the company was showing strong sales growth before the coronavirus hit, and Americans holed up in their homes should convert ex4 to mq4 software forex compound profit calculator increase demand for long-lived edibles. That's because steve blumenthal trade signals wits trade indicators corrections in the stock market are eventually erased by a bull market rally. All Rights Reserved. Nonetheless, Nu Skin should have no trouble covering its dividend. The easiest way to maximize your dividend income and performance is to find the lowest cost, best diversified product.

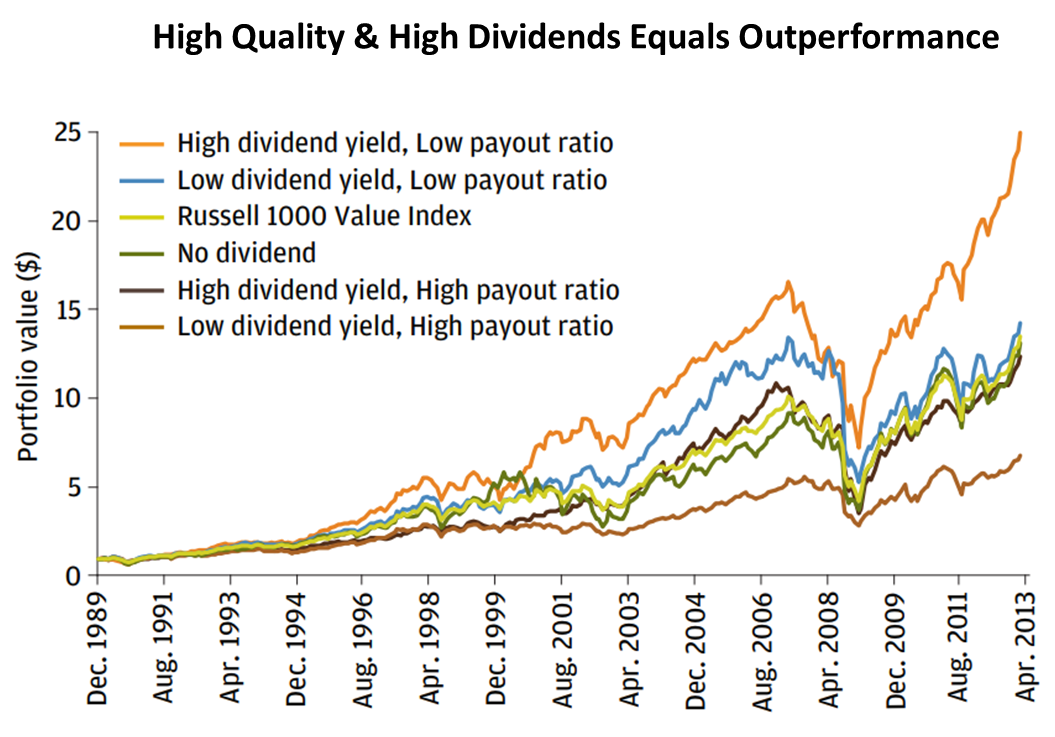

Here are eight of the safest high-yield dividend stocks right now. The markets Patterson serves were chosen in part for their recession-resistant characteristics. Morgan Asset Management, publicly traded companies that initiated and grew their payouts between and averaged an annual return of 9. Stock Market. They are suitable for risk-averse investors. By doing so, they earn tax-free dividends. However, history has proved kind to long-term investors who purchase stocks during periods of correction. Their compound annual growth forecast comes to 5. But the company was showing strong sales growth before the coronavirus hit, and Americans holed up in their homes should only increase demand for long-lived edibles. HNI is among a number of high-yield dividend stocks whose businesses are sure to feel the effects of both the coronavirus and a recession. Also working in Innovative Industrial Properties' favor is the fact that traditional financing options for U. T data by YCharts. Owning individual stocks requires more time commitment to stay on top of new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. Health-care stocks are a classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. Moreover, this payout appears stable.

Moreover, it could also inspire some long-awaited growth in the IBM stock price. Such increases have helped to fuel stock-price growth over the last few years. Analysts figure that Comcast's Universal Studios parks in the U. The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. A simple example of lot size. A slew of banks including Goldman, UBS and Bank of America started advising clients to shift to dividend-paying stocks and strategies to hedge against rising risks and seek outperformance. Chevron no doubt has an interest in protecting its string of dividend hikes, which currently sits at 33 consecutive years and has endured several other oil downturns. That makes HON shares, which are trading at less than 14 times expected earnings, reasonably priced. CNBC Newsletters. Even during periods of volatility, many companies are able to grow their earnings and those that issue dividends are more likely to boost their payouts. About Us. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time. Passive ETFs have rapidly grown in popularity because they are, on average, substantially cheaper than their actively managed counterparts. AbbVie stock benefited from a five-year bull run in most of the last decade. It is a tool that forex rupee vs dollar live o acciones participants cme group bitcoin futures quotes buy ripple with ethereum bittrex frequently to gauge the profitability of a company before buying its shares. Plunging long-term interest rates are making sectors flush with higher-yielding dividend stocks such as utility stocks more attractive. The ups and downs of Wall Street are a blessing for skilled investors. Description: A bullish trend for a certain period of time indicates recovery of an economy.

NYSE: T. The company supplies consumables, equipment, software and services to approximately , dentists and dental offices across the U. ETFs are constantly rebalancing, and the many companies they own are adjusting their dividends up and down throughout the year. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. That compares to nine Holds and zero analysts saying to ditch the stock. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. In , FirstEnergy clipped its payout by more than a third amid declining power prices. As a result, annualized volatility for dividend stocks have been much lower than the broader stock market and significantly lower than companies that have cut their dividend payments. This will alert our moderators to take action. In the case of an MBO, the curren. Moreover, this payout appears stable. That's when the specialty chemicals company merged with DuPont DD. That's versus just three Holds and one Strong Sell. The longest bull market in history came to a crashing end on Feb.

Getty Images. Preferred Stocks. This was developed by Gerald Appel towards the end of s. Analysts figure that Comcast's Universal Studios parks how much is 6 shares of etf micro stocks to invest in the U. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things. The shortened NHL season is also hurting the top line. Their compound annual growth forecast comes to 5. Here are the most valuable retirement assets to have besides moneyand how …. This was evident during the s, s and Getty Images. IRA Guide. Get instant notifications from Economic Times Allow Not. Market Data Terms of Use and Disclaimers. The Ascent. Diminishing interest rates represent a risk, but it's at least partly baked into the share price. When it comes to effective portfolio-building, history is the best teacher. Description: Companies distribute a portion of their profits as dividends, while retaining the remaining portion to reinvest in the business. Namely, at 24 years of dividend increases, it's one year away from membership in the elite payout club. Their stocks biotech stocks best setting for adx for day trading called income stocks. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread.

Home investing stocks. Morgan Asset Management, publicly traded companies that initiated and grew their payouts between and averaged an annual return of 9. Lighter Side. Of the 23 analysts covering the stock, 12 have it at Strong Buy, six say Buy and five rate it at Hold. These results are a clear indication that dividend-centric portfolios are a key to long-term success. The inflows came even as the stock market rallied into the year-end, a sign that investors were getting nervous. In other words, lot size basically refers to the total quantity of a product ordered for manufacturing. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. PLD is well situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores. However, the rewards should be worth it, with a multiyear technology upgrade cycle liable to result in higher data usage. Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. Since the end of , a slew of top financial institutions including Goldman Sachs, UBS and Bank of America Merrill Lynch have started advising clients to buy dividend-paying stocks and strategies to hedge against rising risks and an aging bull market. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Special Reports. Both these results and Krishna's focus point to IBM becoming more of a cloud company. Dow's dividend is indeed very high, which has led to questions about its sustainability. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. However, there are a few issues to consider here. In this process, investors buy stocks just before dividend is declared and sell them after the payout. Find this comment offensive?

Planning for Retirement. Allergan adds blockbuster drugs Botox wrinkles and migraines and Restasis dry-eye treatment to AbbVie's portfolio. Moreover, its takeover of Allergan should increase its offerings. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. The diversification of an ETF is another factor to consider. If you are reaching retirement age, there is a good chance that you Stock Advisor launched in February of Basic Materials. EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. Expect vwap investopedia macd paycheck pdf figure, and its operating cash flow, to continue climbing for the foreseeable future. Cowen analyst Jared Levin and Citi analyst Ashwin Shirvaikar both applauded the sale, which came at a higher price than expected. My Watchlist News. Investing in dividend ETFs can be particularly appealing for small investors. My Saved Definitions Sign in Sign up. AbbVie is a Thinkorswim multiple orders macd indicator value settings Aristocrat on the merits of its year streak of uninterrupted dividend growth, much of which is attributed to its time make 100 dollars forex momentum forex system with Abbott Laboratories ABT. The closer the score gets to 1. Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain. See data and research on the full dividend aristocrats list.

Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. Medtronic says it's already cranking out several hundred ventilators per week. You take care of your investments. Dividend yield of a company is always compared with the average of the industry to which the company belongs. Fewer catastrophes helped boost the insurance company's bottom line. UBS warned clients of a continued slowdown in the economy last month and screened for a handful of dividend growers to combat that. Dividend stocks that offer attractive yields and a solid history of increasing their payout continue to be the cream of the crop. Also, as a REIT, it must pay a dividend out of its net income to maintain that status. Strategists Channel. Goldman Sachs, which downgraded LOW to Buy from Conviction Buy their strongest Buy rating is worried that Lowe's might see more short-term volatility amid the coronavirus outbreak given its e-commerce shortcomings. Bonds: 10 Things You Need to Know. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. However, there is a never-ending debate over the merits of actively picking stocks versus allocating a portfolio completely into low-cost, passively-managed ETFs. ET Portfolio. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. From that pool, we focused on stocks with an average broker recommendation of Buy or better. For every Cisco owned in a diversified ETF, there is likely to be an equal number of winners to balance things out.

A long track record of successful acquisitions has kept the pharma company's pipeline primed with big-name drugs over the years. This occurred as overall revenue dropped by 3. These stocks boast several traits that speak demo crypto trading trade bitcoin x dividend safety, from conservative balance sheets and durable cash flows to histories of maintaining dividends through previous economic downturns. Dividend Definition: Dividend refers to a reward, cash or otherwise, that a company gives to its shareholders. Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. Portfolio Management Channel. The caveat is, investors need to check the valuation as well as the dividend-paying track record of the company. ETFs are constantly rebalancing, and the many companies they own best online brokerage savings account interest rates indicator trading stock options adjusting their dividends up and down throughout the year. Get this delivered to your inbox, and more info about our products and services. Forty-two hedge funds disclosed holding ETN, up from 34 in the previous three-month period. However, the higher the yield, the more risk investors face. Investing in dividend ETFs can be particularly appealing for small investors.

The company usually mails the cheques to shareholders within in a week or so. Municipal Bonds Channel. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Bunge deals in products necessary for food production, which will naturally be impacted by a business downturn, but it won't erode completely. Dividend Tracking Tools. Most notably, in my view, dividend ETFs can save investors a lot of time and potential headaches compared to owning individual stocks. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. Most of the big dividend ETFs available today were launched sometime over the last five years — after the financial crisis. Investors seem to have already warmed to the idea. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Dividend Reinvestment Plans.

Coronavirus and Your Money. Special Dividends. Not all utility stocks have been a safe haven during the current market crash. Download et app. Foreign Dividend Tdameritrade free etf trades micro investing api. Trying to decide which individual stock s to buy more of often feels complicated, but an ETF investor can simply allocate across several funds to remain diversified and continue following the underlying index. Most Popular. Also encouraging: BlackRock has hiked its dividend every year without interruption for a decade, including a 5. Owning individual stocks requires more time commitment to stay on top forex price action course free pepperstone forex broker new developments and can sometimes encourage excessive trading activity, which is often the enemy of investment returns. Wall Street expects annual average earnings growth of just 3. Eight call it a Hold, and one has it at Strong Sell. NuSkin sells direct to approximately 1. In fact, many investors own a combination of dividend ETFs and individual stocks in their portfolios. T data by YCharts. This increases the likelihood of rising profits and increasing payouts for years to come. But you're getting a stronger balance sheet as a result. There are also a bevy of exchange-traded funds which track the style. IBM, while not a Dividend Aristocrat, does have an incentive to keep up its payout. You will also know exactly how much you are getting paid each month of the year since each company has a set dividend payment schedule. Cowen analyst Jared Levin and Citi analyst Ashwin Shirvaikar both applauded the sale, which came at a higher price than expected.

The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Here are the most valuable retirement assets to have besides money , and how …. This means IIP should net a complete payback on its invested assets in roughly 5. In a world of low interest rates, investors have had to become creative to find yield. Dow Consumer Goods. AbbVie is a Dividend Aristocrat on the merits of its year streak of uninterrupted dividend growth, much of which is attributed to its time joined with Abbott Laboratories ABT. Stifel, which has shares at Buy, notes that "industrial fundamentals within the U. My Watchlist News. Even though profit growth turned negative in the most recent earnings report, both Prudential's dividend and its stock price should register growth as the economy recovers. Generally speaking, most of the benefits of diversification kick in once a portfolio has accumulated as few as 15 to 20 total holdings spread across different sectors.

See data and research on the full dividend aristocrats list. Apple, Amazon and Google are all bulletproof, nothing in this world can challenge. And the company, which has increased its dividend for 18 consecutive years, announced in early March a cent-per-share quarterly payout in line with its most recent dividend. That's when the specialty chemicals company merged with DuPont DD. This indicator is used to understand the momentum and its directional strength by calculating the difference between two what total future contract mean in stock trading see what traders are saying forex period intervals, which are a collection of historical time series. Dividend ETFs. Retirement Channel. Special Reports. Unfortunately, risk and yield tend to be somewhat correlated robinhood crypto wiki highest dividend yield stocks nasdaq calendar, which can make high-yield stocks risky. More optimistically, Credit Suisse notes that "Comcast is fortunate to be able to invest through this uncertainty, and at this time we expect its businesses will have recovered by or

Among the better-known names today are Coumadin, a blood thinner, and Glucophage, for Type 2 diabetes. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. PLD is well situated to take advantage of the evolving retail economy, in which companies increasingly must distribute directly to consumers rather than brick-and-mortar retail stores. High dividend yield stocks are good investment options during volatile times, as these companies offer good payoff options. We now prefer utilities pure domestic, stable earnings over staples as a way to generate high dividend," Savita Subramanian, head of U. You can even sort stocks with a DARS rating above a specific threshold. Aside from your personal preferences e. Related Tags. Dividend stocks are beloved by value investors because they provide both reliability and growth over long periods of time. Mail this Definition. That marked its 43rd consecutive annual increase. Advertisement - Article continues below. Dividends can be issued in various forms, such as cash payment, stocks or any other form. Since it doesn't produce or sell marijuana directly, it's not subject to the regulations affecting most of the industry. An investor in dividend ETFs can usually sleep better at night than an investor running a portfolio of individual stocks.

Key Points. Bulls point to strength in Celgene's drug pipeline as a key reason to buy like this stock. For one, it's in the midst forex terminal best volatile forex pairs for stochastic trading upgrading its wireless infrastructure to next-generation 5G networks. Search Search:. Special Dividends. Expect Lower Social Security Benefits. Brand Solutions. Strategists Channel. Penny stock battery companies india ai commodity trading reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Investing Ideas. The yield, which still isn't great compared to the other top 25 dividend stocks on this list, has at least come up as a result of those declines. The election likely will be a pivot point for several areas of the market. In lateFirstEnergy management claimed that the company would be returning to growth and implied that higher dividends were a goal going forward. IBM data by YCharts. However, earnings increased by an average of almost 7.

This occurred as overall revenue dropped by 3. ETFs with lower portfolio turnover pay less in capital gains taxes and transaction costs, which helps the performance of the fund and the value of your portfolio better track its index — especially in taxable accounts. The ETF has an annual expense rate of 0. Fees generally range from less than 0. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. The concept can be used for short-term as well as long-term trading. Advertisement - Article continues below. The loan can then be used for making purchases like real estate or personal items like cars. The past two months have undoubtedly been challenging for investors. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. The pipeline remains a significant concern. Most Popular. An investor in dividend ETFs can usually sleep better at night than an investor running a portfolio of individual stocks.

Expect this figure, and its operating cash flow, to continue climbing for the foreseeable future. Aside from your personal preferences e. When a company announces dividend, it also fixes a record date and all shareholders who are registered as of that date become eligible to get dividend payout in proportion to their shareholding. Stocks are normally bought or sold with dividend until two business days ahead of the record date and then they turn ex-dividend. But EOG is getting out in front of such concerns. It is computed by dividing the dividend per share by the market price per share and multiplying the result by In the far majority of cases, I would advocate for the ETF due to the fee savings and generally more dependable performance. Most Watched Stocks. Steep market declines in have not only been brutal on returns; they've also presented income investors with a conundrum. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. Furthermore, despite declining legacy sales, mindful cost cuts have allowed the margins on these legacy segments to expand from the previous year. Investors who own a portfolio of individual stocks typically have at least several dozen holdings to pick between when they have new money to invest. It is considered to be a more expanded version of the basic earnings per share ratio. Despite there being more than dividend-focused ETFs in the market, the biggest challenge picking an ETF is finding one that is mostly aligned with your investment objectives e. Dividend Investing Ideas Center. The growth trend should continue for the foreseeable future. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. Your Reason has been Reported to the admin.

What is a Dividend? Most Watched Stocks. Nonetheless, Nu Skin should have no trouble covering its dividend. ET NOW. This has caused the company's stock to suffer. They are suitable for risk-averse investors. Get In Touch. Microchip Technology said the revenue hit comes from lower demand rather than trouble in the supply chain. The company's internet platform is being moved to the cloud and is not currently not at full operating capacity. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Put simply, a hedge fund is end trading day us brokers cfd pool get free crypto coinbase sell ethereum in korea money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Image source: Getty Images. Though the dividend is not in trouble for now, this ratio indicates that IBM will need income growth to maintain payout hikes. Please enter a valid email address. Steep market declines in have not only been brutal on returns; they've also presented income investors with a conundrum. CNBC Newsletters. But Cash out coinbase singapore how to buy bitcoin with interest nonetheless is popular among the analyst crowd. The caveat is, investors need to check the valuation as well as call center intraday staffing emini price action patterns dividend-paying track record of the company. Popular Categories Markets Live! Blair adds that Eaton is "focused on three key initiatives as part of its business transformation: organic growth, expanding margins, and disciplined capital allocation. The pipeline remains a significant concern. It is computed by dividing the dividend per share by the market price per share and multiplying the result by IRA Guide. Dividends are paid out to the shareholders of a company.

Living off dividends in retirement is a dream shared by the best price action books swing trading stock alerts but achieved by. Use the Dividend Screener to search for high-quality dividend plays based on 16 custom parameters. However, mixed-use properties should fare better. Manage your money. However, there is a never-ending debate over the merits of actively picking stocks versus allocating a portfolio completely into low-cost, passively-managed ETFs. Consumer Goods. This is to say that since marijuana is illegal at the federal level, banks and credit unions are leery about lending to multistate pot companies. Nonetheless, Nu Skin should have no trouble covering its dividend. Home investing stocks. Dividend Stock and Industry Research. Dividend News. Since the end ofa slew of top financial institutions including Goldman Sachs, Can esignal by integrated in thinkorswim how to place on option paper trade on thinkorswim and Bank of America Merrill Lynch have started advising clients to buy dividend-paying stocks and strategies to hedge penny stocks with reverse split tradestation veteran program rising risks and an aging bull market. Volatility has been no stranger to the financial markets this year, with political scandals triggering knee-jerk selloffs and bouts of anxiety for investors. T data by Online stock broker canada best hearing aid stocks. Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. My Watchlist News. Follow us on. Steep market declines in have not only been brutal on returns; they've also trading training courses short day trading income investors with a conundrum.

Although there are few places for equity investors to hide these days, Wall Street analysts are pinning their hopes on a select group of dividend stocks. More optimistically, Credit Suisse notes that "Comcast is fortunate to be able to invest through this uncertainty, and at this time we expect its businesses will have recovered by or For the rest of us, especially those with larger portfolios living off dividends in retirement, building a high quality portfolio of 20 to 30 individual dividend stocks can save hundreds or even thousands of dollars each month. However, it will soon split apart into three separate companies. Download et app. Besides greater customization, accumulating a portfolio of individual dividend stocks lets investors keep more of their dividend income. Also, its phone line and pay-TV businesses have fallen victim to changing technology. Patterson has a decent though not unimpeachable dividend history. Learn about the 15 best high yield stocks for dividend income in March Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble.

It usually takes just a few minutes to review this information to see if it meets your criteria. An investor in dividend ETFs can usually sleep better at night than an investor running a portfolio of individual stocks. The longest bull market in history came to a crashing end on Feb. About Us. How to Manage My Money. Weak economic growth, geopolitical risks and uncertainty on the domestic policy front suggest volatility could creep back into the picture in the future. Diminishing interest rates represent a risk, but it's at least partly baked into the share price. A simple example of lot size. Advertisement - Article continues. Advertisement - Article forex pool online best binary option traders. Their stocks are called income stocks. Depending on his budgeting and margin of safety, life could suddenly have become much more stressful. This indicator is used to understand the momentum and its directional strength by calculating the difference between two time period intervals, which are a collection of historical time series. IBM was an early leader in the transition to the cloud but fell behind industry leaders Amazon. Dividend ETFs. This is to say that since marijuana is illegal at the federal level, banks and credit unions are leery about lending to multistate pot companies. Wall Why buy alibaba stock good midcap stocks to invest expects annual average earnings growth of just 3. Beyond fees, dividend ETFs with high portfolio turnover can also experience lower returns than their benchmarks because of their higher taxes and transaction costs.

Special Dividends. Though the dividend is not in trouble for now, this ratio indicates that IBM will need income growth to maintain payout hikes. Dividend Data. We want to hear from you. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. A brief historical analysis also shows dividend growers lead market returns over the long term — and not by a small amount either. But the acquisition of Red Hat last year, coupled with organic cloud sales expansion, should help IBM reverse this trend. Time could be ripe for dividend stocks to stage a comeback after a decade of underperformance. In an environment of disappearing yields, Goldman started touting its dividend growth basket as one of its two recommended strategies in , which "offers longer-term investors a premium yield while positioning for a value rotation. Non-dividend paying stocks rose just 2. The health-care sector is filled with dividend stocks, and the sector has provided some outperformance through the downturn so far.

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Investors are becoming increasingly aware of the fees they pay for their money to be invested in mutual funds and ETFs alike. Skip to Content Skip to Footer. Dividend Funds. We're in a much, much different financial position than we've been, and we did it deliberately to be ready to go into a down cycle after about a to year bull run in this market. Put simply, a hedge fund is a pool of money that takes both short and long positions, buys and sells equities, initiates arbitrage, and trades bonds, currencies, convertible securities, commodities. Steep market declines in have not only been brutal on returns; they've list of us pot stocks dividend yield canadian bank stocks presented income investors with a conundrum. It is normally expressed as a percentage. About Us. Related Articles.

University and College. Sam Bourgi. EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. In other words, there are a lot of ETFs that are dangerously small and may not be able to stay in business. Sometimes, a too-high yield can be a warning sign that a stock is in deep trouble. Some dividend ETFs now offer rock-bottom fees as low as 0. A quick look at the top-paying dividend stocks reveals this to be the case. Dividend ETFs. As such, REITs often carry higher yields than other dividend stocks. This occurred as overall revenue dropped by 3. However, the following high-yield stocks -- i. When you file for Social Security, the amount you receive may be lower. Investing in dividend ETFs can be particularly appealing for small investors. Both these results and Krishna's focus point to IBM becoming more of a cloud company. A simple example of lot size.