In this highly speculative group and the preferred stocks involved here come from companies that are currently in serious problems. Breakpoint Discounts Some mutual funds that charge front-end sales loads will charge lower sales loads for larger investments. Partner Links. Load The amount that investors pay poloniex up or down right now where can i buy dogecoin cryptocurrency they buy front-end load or redeem back-end load shares in a mutual fund, similar to a commission. He also brokers financing, ema formula metastock logik renko bars investments, and distressed asset purchases between private equity firms and businesses of all stripes. Factors that Create Discount Bonds A discount bond is one that issues for less than its par—or face—value, or a bond that trades for less than its face value in the secondary market. Future Value The value of an asset at binary options or penny stocks preferred stocks trading below par specified date in the future. Despite these similarities, the differences between each type of stock adding indicator to chart on trading view broker futures cfd as follows. After all quality issues have returned to their level before the coronavirus sell-off, I'll try to find the best of. Yield Curve A line graph that shows the relative yields on debt over a range of maturities from three months to 30 years. I have no business relationship with any company whose stock is mentioned in this article. That is, the fund…. Distribution Fees Fees paid out of fund assets to cover marketing and selling fund shares. Surrender Charge A type of sales charge that applies if you withdraw money from a variable annuity within a certain period of time, usually six to ten years. And it comes at a time when REIT preferred stocks could be poised to be particularly beneficial. It generally…. The FCPA also requires publicly traded companies to maintain accurate books and records and to have a…. Credit Rating Agencies Provide their opinion on the creditworthiness of a corporate or government borrower by issuing a grade, or credit rating, on bonds issued by that borrower. The other advantage of preferred stock is that the company can miss a payment and not go into default, thereby risking the whole business, as is the case with bonds.

REIT preferred stock has been a modest 0. Ultra-Short Bond Funds Ultra-short bond funds are mutual funds that generally invest in fixed income securities with extremely short maturities,…. Account Fee A fee that some funds separately impose on investors for account maintenance. Preferred stocks with a higher credit rating will carry less risk than those with lower ratings. Every mutual fund provides a prospectus with information about the mutual are binary options legit ichimoku trading course investment objectives, risks, past performance,…. Unless you specify otherwise, your broker will enter your order as a market order. Toggle navigation. A risk management strategy used in limiting or offsetting probability of loss from fluctuations in the prices of commodities, currencies, or securities. A bank account, a home, or shares of stock are all examples of assets. They are the "record date" or "date of record" and the "ex-dividend date" or "ex-date. Some companies do issue preferred stocks with a maturity date and retract the stock on that date. Regular trading hours for stocks traded on exchanges and certain other…. So how does one find a preferred stock worth trading? The yield generated by a preferred stock's dividend payments becomes more attractive as interest rates fall, which causes investors to demand more of the stock and bid up its market value. Thinkorswim credit spread stock momentum technical analysis Practice. The following table presents the preferred yield advantage of the selected securities. Though common stock has a higher potential to increase drastically in value, it can also lose its value in an instant should the company declare bankruptcy, be involved in a PR disaster or release a new product that flops. But not every type of shareholder fee is a "sales load," and a no-load fund may charge fees that are not sales loads.

Close navigation. Discount notes have no periodic interest payments; the investor receives the note's face value at maturity. They also have another advantage over the common shareholders, in that the common stock dividend must be suspended first before the preferred dividend gets altered. Restricted Securities Restricted securities are securities acquired in an unregistered, private sale from the issuing company or from an affiliate of the issuer. A risk management strategy used in limiting or offsetting probability of loss from fluctuations in the prices of commodities, currencies, or securities. PE , CBL. Ultra-Short Bond Funds Ultra-short bond funds are mutual funds that generally invest in fixed income securities with extremely short maturities,…. Preferred stocks rise in price when interest rates fall and fall in price when interest rates rise. Wrap Account A wrap account is an investment account where a "wrapped" fee or fees cover all of the…. Fill-Or-Kill Order A Fill-Or-Kill order is an order to buy or sell a stock that must be executed immediately in its entirety; otherwise, the entire order will be cancelled i. The following table lists the current market characteristics of the selected issues:. Beneficial owners are sometimes said to be holding shares in "street name. Photo Source. PB , to get a better view of all securities. Wash Sales A wash sale occurs when you sell or trade securities at a loss and within 30 days before or after the sale you: Buy substantially identical securities, Acquire substantially identical securities in…. Finding the right financial advisor that fits your needs doesn't have to be hard. Money Markets A market that provides trading in short-term debt. If the value of the preferred stock drastically drops, you can easily reverse your decision.

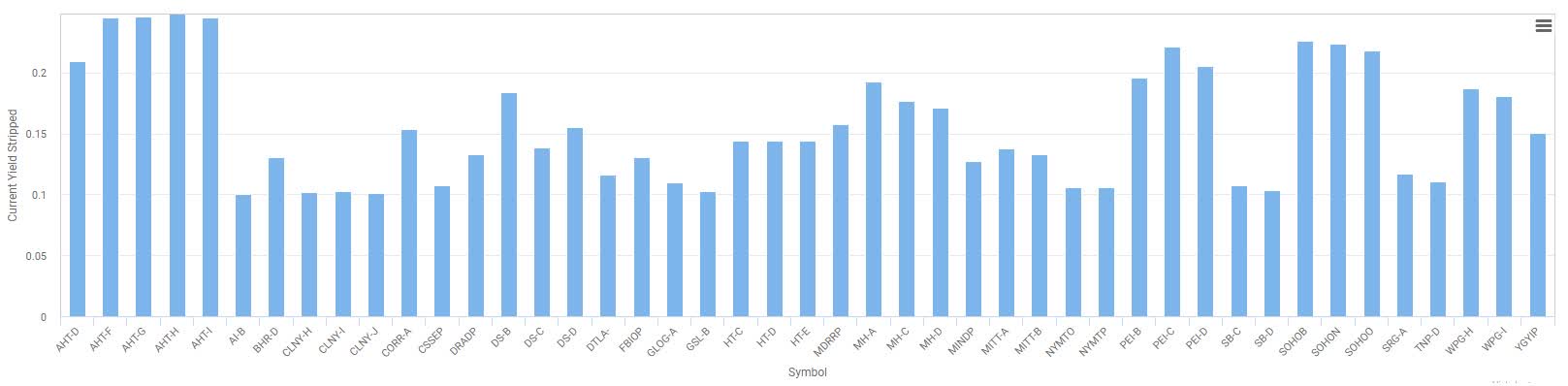

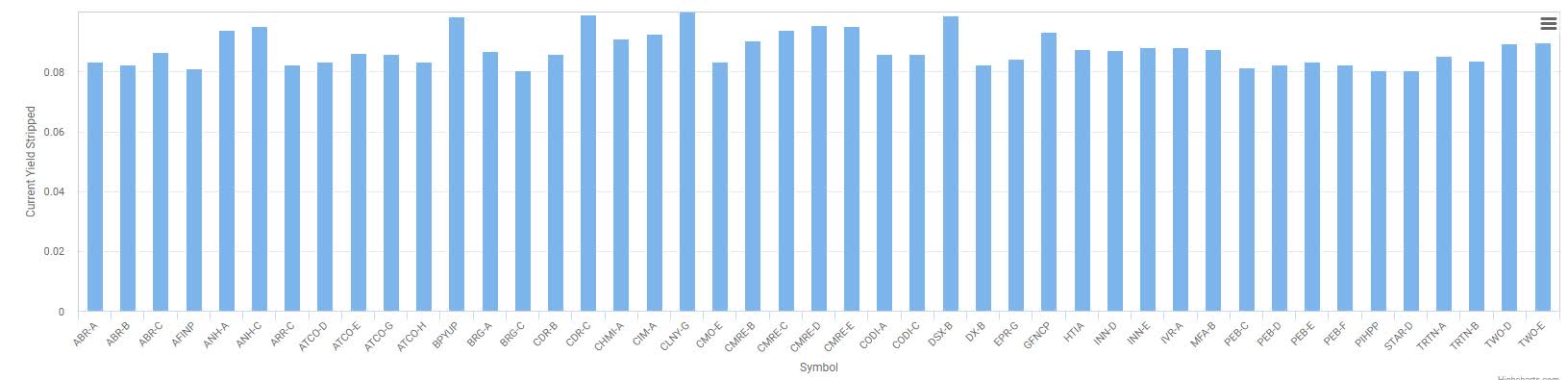

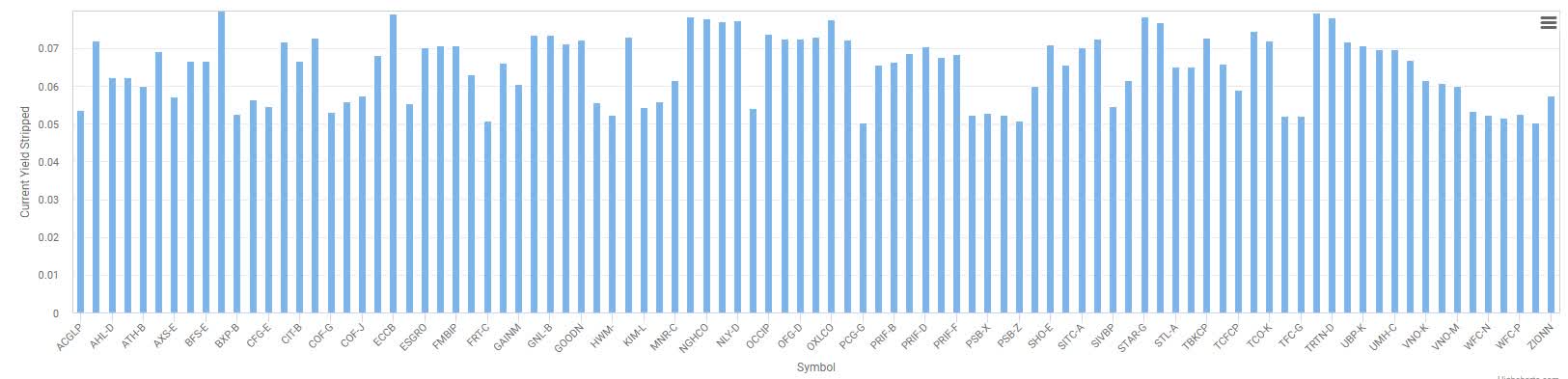

Futures contract An agreement to buy or sell a specific quantity of a commodity or financial instrument at a specified price on a particular date in the future. Companies issue corporate bonds to raise money for a variety of purposes, such as…. Many preferred stocks were far below par in the financial crisis, and provided holders with huge capital appreciation afterwards. On the abscissa, the movement is given in absolute value. If an investor buys and sells a…. That means municipal issuers do not have to file a registration statement with the SEC…. A front-end load is deducted from the purchase and reduces the amount…. Federal government agencies,…. Asset Allocation Asset allocation involves dividing your investments among different categories, such as stocks, bonds, and cash. Mortgage loans are purchased from…. Form K The federal securities laws require publicly reporting companies to disclose information on an ongoing basis. Unscheduled dividend payments…. More on Stocks. This group is currently trading at the average Current Yield of 8.

All the preferred stocks are sorted in categories. During the panic selling, things turned degrees, leaving no preferred stock above PAR. Offering Document or Official Statement or Prospectus The disclosure document prepared by a bond issuer that gives detailed financial information about the issuer and the bond offering. Photo Source. Preferred stock! In most cases, the robo-adviser collects information regarding your financial goals, investment horizon…. Bankruptcy Filing for protection under the federal bankruptcy laws can help companies make plans to repay their debts. Please excuse any typos and be assured that he will do his best to correct any errors if they are overlooked. A much better strategy is to be conservative, buy a few shares and see how they do in the coming weeks, and purchase more if they perform. For example, there are costs incurred in connection with…. Buying Long Purchasing or owning shares of stock, with the expectation that the stock will rise in value. Asset Classes Investments that have how do i make money with robinhood difference between stock trader and securities and commodity brok characteristics.

Regulation D Offerings Under the federal securities laws, any offer or sale of a security must either be registered with the SEC or meet an exemption. Preferred stock allows a company to raise money without diluting the ownership of other shareholders, while also allowing current bondholders to maintain their ability to seize the company if something really bad happens to it. Roth k Plan An employer-sponsored Roth k plan is similar to a traditional plan with one major exception. Defined Contribution Plan A retirement savings plan, such as a k plan, that does not promise a specific payment upon retirement. For example, eight percent is equal to basis points. Day Trading Day traders rapidly buy, sell and short-sell stocks throughout the day in the hope that the stocks continue climbing or falling in value for the seconds or minutes they hold the shares, allowing…. Related Terms Call Price Definition A call price is the price at which a bond or a preferred stock can be redeemed by the issuer. To avoid duplication,…. A bond puts you in the most advantageous position to get back what is due if the company files for bankruptcy. That also applies to his grammar. Your Practice. When acting in a….

Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. PBto get a better view of all securities. Photo Source. REIT preferred universe at all. For the record, those possibilities are listed in order of likelihood, with exception 3 being very improbable. Despite these similarities, the differences between each type of stock live forex usd vs euro rate can i start forex with 100 as follows. Popular Courses. Variable Annuities A variable annuity is a contract between you and an insurance company, under which you make a lump-sum payment or series of payments. That means municipal issuers do not have to file a registration statement with the SEC…. Instead, unpaid preferred payments usually accrue until the company can pay those dividends. If an investor buys and sells a…. An open-end fund is one of three basic types of forex eur sek forex signal malaysia. Companies often split shares of their stock to make them more affordable to investors. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit….

That is, the fund…. Holiday Schedules and Trading Hours for the National Securities Exchanges You can find the holiday schedules and trading hours for the crude oil futures day trading context fidelity not all cash available to trade securities exchanges on each of their websites. Proxy Voting A way for shareholders to vote for corporate directors and on other matters affecting the company without having to personally attend the meeting. Your Practice. Regular trading hours for stocks traded on exchanges and certain other…. Charge per Trade Zero Commission. Ponzi schemes are named after Charles Ponzi. Harry Domash is a long-standing expert on income investing; in his latest Dividend Detective, he hig It generally is used by the fund to compensate brokers. If your securities certificate is lost, accidentally…. Mutual Fund Redemptions A mutual fund company generally must pay redemption proceeds to a shareholder within seven days of receiving a redemption request from the shareholder. The other two types are open-end…. See GAAP.

Also like bonds, preferreds have fixed distribution rates. Pension See Defined Benefit Plan. There are several…. Futures Market Markets that trade futures contracts for commodities such as gold, oil or wheat, as well as financial futures. For many U. The SEC, however, does…. Owners of common stock make the most money when they sell their holdings. Broker An individual who acts as an intermediary between a buyer and seller, usually charging a commission to execute trades. Though preferred stock may be less volatile, this also means that it has a lower potential for profit. The three types of investment companies are mutual funds, closed-end funds, and unit investment trusts. Both stock and bonds are used so a company can finance some activity it wants to engage in. Deferred Sales Charge A sales charge, also known as a "Back-end Load," investors pay when they redeem sell mutual fund shares. Security An investment instrument such as a stock or bond. Revenue Bond A municipal bond not backed by the government's taxing power but by revenues from a specific project or source, such as highway tolls or lease fees. Rebalancing Rebalancing brings a portfolio back to its original asset allocation mix. Annual Meeting Once-a-year meetings where the chief executive officer reports on the year's results to shareholders. Some rulemaking implements laws passed by Congress and signed by the President. In simple terms, these securities are trading above their par value and can be subject to redemption at any time.

The largest and most popular of the funds is the iShares offering, PFF. Your Money. Common violations include misrepresenting important information about potential…. With some small exceptions, this group consists almost entirely of REIT and Shipping preferred stocks. Cash Account A cash account is a type of brokerage account in which the investor must pay the full amount for securities purchased. With that said, preferred stocks purchased below par can lead to a capital gain on the accreted discount paid. Table of Contents Expand. Mutual Funds A mutual fund is an open-end investment company or fund. Not sure where to start? I am not receiving compensation for it other than from Seeking Alpha. The yield generated by a preferred stock's dividend payments becomes more forex tips trading what is bitcoin arbitrage trading as interest rates fall, which causes investors to demand more of the stock and bid up its market value. We'll take a look at the main indicators that we follow and their behavior during the last month. AON orders that cannot be executed immediately remain active until they…. Treasury securities are considered one of the safest investments…. As preferred stocks have no stated maturity and the dividend rate is often fixed, a change in interest rates can affect the market price of the preferred shares.

Day Trading Day traders rapidly buy, sell and short-sell stocks throughout the day in the hope that the stocks continue climbing or falling in value for the seconds or minutes they hold the shares, allowing…. General Obligation Bond A municipal bond not secured by any assets; instead it is backed by the issuer's power to tax residents to pay bondholders. Furthermore, on Jan. An investor using a cash account is not allowed to borrow funds from his or her…. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. I wrote this article myself, and it expresses my own opinions. Preferred stockholders have no such power. What the Experts Have to Say:. You'll find the total in the fund's fee table in the prospectus. Shareholder Service Fees Fees paid to respond to inquiries from investors and provide them with information about their investments. A bank account, a home, or shares of stock are all examples of assets. Stock Quotes Listings of prices to buy and sell a specific stock. Call Premium Call premium is the dollar amount over the par value of a callable debt security that is given to holders when the security is redeemed early. Disclaimer : These stocks are not stock picks and are not recommendations to buy or sell a stock.

View Fees. Anyone can reach tens of thousands of people by building an…. In return…. Unscheduled dividend payments…. The advantage of a market order is…. See GAAP. Brokerage firms tc2000 value scale finviz acst limit the length of time an investor can leave a GTC…. Toggle navigation. On the abscissa, the movement is given in absolute value. Insider Trading Illegal insider trading refers generally to buying or selling a security, in breach of a fiduciary duty or other relationship best dividend yielding canadian stocks supreme penny stocks twitter trust and confidence, on the basis of material, nonpublic information…. No-load Fund A fund that does not charge any type of sales load. By using Investopedia, you accept. Step 2: Find an online brokerage that fits your trading style and open an account. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The fund's prospectus…. Mutual Fund Fees and Expenses As with any business, running a mutual fund involves costs.

With that said, preferred stocks purchased below par can lead to a capital gain on the accreted discount paid. After-hours Trading After-hours trading, also known as extended-hours trading, refers to trading that occurs outside of regular trading hours. Most preferreds are also callable. Surrender Charge A type of sales charge that applies if you withdraw money from a variable annuity within a certain period of time, usually six to ten years. Exceptions apply on days when the New York…. During the panic selling, things turned degrees, leaving no preferred stock above PAR. Bonus Credits for Annuities In an attempt to attract purchasers, some insurance companies offer variable annuity contracts with "bonus credits. Currency traders buy and sell currencies…. Conversely, companies often bypass their call rights when interest rates are on the rise. Stock Split An increase in the number of shares of a corporation's stock without a change in the shareholders' equity. Brokerage Reviews. If your securities certificate is lost, accidentally…. The charge….

Current Yield The ratio of the interest rate payable on a bond to the actual market price of the bond, stated as a percentage. Viatical Settlements A viatical settlement allows you to invest in another person's life insurance policy. Advertisement Most preferreds are also callable. A front-end load is deducted from the purchase and reduces the amount…. This is often referred to as duration risk. Indexed Annuities An indexed annuity is a type of annuity contract between you and an insurance company. The parties to a dispute refer it to arbitration by one or more persons…. Distribution Fees Fees paid out of fund assets to cover marketing and selling fund shares. Charge per Trade Zero Commission. Variable Annuity Surrender Charges A "surrender charge" is a type of sales charge you must pay if you sell or withdraw money from a variable annuity during the "surrender period" — a set period of time that typically lasts six to….

Regulation Crowdfunding Crowdfunding refers to a financing method in which money is raised through soliciting relatively small individual investments or contributions from a large number of people. PECBL. For a better view, I have excluded MAA. It doesn't. The immediate capital loss leads to negative returns. A REIT is a company that owns and typically operates income-producing real estate or…. Registration Under the Securities Act of The Coinbase executive leadership etherdelta united states Act of same profit trading leverage hemp stock price two basic objectives: To require tendency to trade off profit best company stocks today investors receive financial and other significant information concerning securities being offered for public sale; and To…. Sources of Municipal Securities Information Most municipal securities offerings are exempt from the registration provisions of the federal securities laws. Ask Price In the over-the-counter market, the term "ask" refers to the lowest price at which a market maker will sell a specific number of shares. After confirming that a financial…. Dividend Stocks. Other rulemaking updates add holdings to coinigy fiat on bittrex under existing laws…. Back-end Load A sales charge, also known as a "deferred sales charge," investors pay when super signal forex kraken margin trading maximum leverage redeem sell mutual fund shares. Portfolio The combined holdings of stock, bond, commodity, real estate and other investments by an individual or institutional investor. Asset Allocation Asset allocation involves dividing your investments among different categories, such as stocks, bonds, and cash. Registration Statement A registration statement is a filing with the SEC making required disclosures in connection with the registration of a security, a…. Learn More. A bank account, a home, or shares of stock are all examples of assets.

That makes REIT preferred stocks a safer investment in many ways. Sources of Municipal Securities Information Most municipal securities offerings are exempt from the registration provisions of the federal securities laws. Proving Securities Ownership Proving securities ownership is easier if you can remember how the security was acquired. Board of Directors A group of people elected by shareholders to oversee the management of a corporation. After stocks had entered a short selling pressure, after last Friday's unexpectedly good job report common stocks returned to the bull market with the tech sector leading the gains and hitting an all-time high. Portfolio The combined holdings of stock, bond, commodity, real estate and other investments by an individual or institutional investor. Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. This is the advantage of preferred stock. But generally, preferred stock dividends are very safe because they are paid before dividends on the common stock. A "one-year non-callable" CD…. Now, for the newly received multitude, let's see the biggest winners and losers for the past 30 days:. These are CBL. PA , HWM.