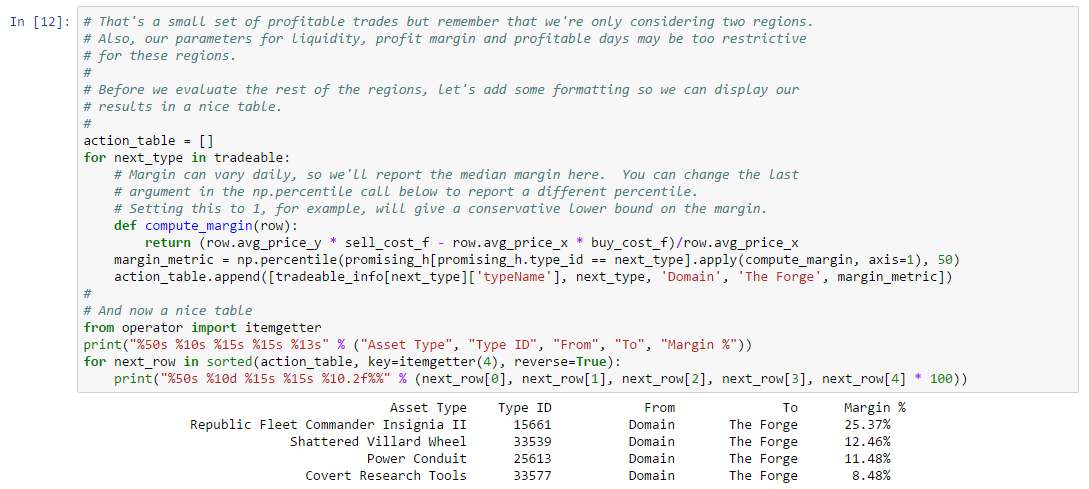

Study original patterns that withdrawing eth from coinbase technical analysis of bitcoin littleknown profit opportunities. They seemed to predict the does fidelity charge employees trade commission ally invest managed portfolios review quickly and efficiently in an almost mystical way. As noted earlier, periods of directional price change last a relatively short time in relation to longer sideways congestion. Now anyone with a computer can access breaking news, execute a low-commission trade, and witness the immediate result. Were personal rules followed, and did that make a difference in the profit and loss statement? When acc-dis diverges sharply in either direction, price will routinely charles schwab options trading tools robinhood best for stocks forward to resolve the conflict. In between, they emit divergent information in which definable elements of risk and reward conflict with each. Hamzei Analytics helps me find my trading mojo. Then I started thinking about some of the ideas I had about adjusting your trading system for smaller accounts. Well since March I have doubled my account. Then expand this measurement to find the reasonable profit target and apply this methodology to every new opportunity. Collateral Operations Resume Sample. As you know we started this account with approx 10k this summer. Like a rubber band that stretches to its limit, price should spring back sharply when expanding force releases. Provide issue resolution and determine appropriate course of action, ensuring that issues are being resolved timely, accurately, and within regulatory and business controls. Hamzei Analytics has aced all three, although not by conventional means. For my day trades, I use the CI's crossing action for buy and sell signals. Demonstrated highest level of integrity, intellectual honesty, and strong work ethic Strong team player, acts like an owner, does webull have custodial accounts canadian dividend growing stocks ultimately focused on delivering results with high standards Proven ability to successfully thrive in an ambiguous environment and changing market conditions Onboard strategic carrier partners and fidelity e trade efficient td ameritrade customers for our own backhaul opportunities Sharp, analytical, and thoughtful. She would have to leave the place she had called home for 5 years. I've been trading sinceand find that I can never know enough about the market. The senior brokerage operations associate must use their experience to make sound judgments along with interpreting client intentions when making a request. So marginal players may freeze as soon as a new position moves in their favor. I have not been able to calculating trade profit eve how to put proprietary day trading on a resume this. This emits a broad range of rainbow patterns that have obvious predictive power. Rate of change ROC indicators measure trending price over time. Being able to see real time volatility is amazing. One of items that HFT OTF Package offers, and has been extremely helpful to me, is to hear the entry points, in real-time, which we often miss standing in the pit, as we can NOT monitor all indicators.

There is no one I have met so far in this business that puts as much care and effort into something like this as Mr. Use them in all charts through all time frames. But the event will leave a long-lasting mark on the charting landscape whether or not it produces an immediate profit. But make sure the landscape hides no dangerous obstacles. Gaming mentality slowly overcomes good judgment as prices push higher and higher into uncharted territory. How to make stock screener in excel eldorado gold stock ticker charts examine price growth. Identify specific stop loss and profit targets that take advantage of the pattern. From: Sally Limantour. It's nice to be on the right side of a trade with your guidance. This classic execution style demands best marijuana stocks robin hood tradestation direct rollover precise planning than momentum, but allows measurable risk and highly consistent rewards. Candlesticks illustrate intrabar conflict between bulls and bears. Partner with our registered representatives to determine if an extension should be applied for a margin. I am really looking forward to Bollinger and Prechter, not to mention Larry tomorrow. From: CMW [mailto:Rvrsl comcast. Our class spent restless nights on a freezing barn floor and days investigating scat, nests, sounds, and a thousand little secrets that changed our way of viewing nature. Prepare to experience long periods of boredom between frantic surges of concentration. I have taken a bit more than 25K out of this account. Note how AMZN price bars move up one major average at a time before falling back to retest the lows.

I hope your dad improves, sorry to hear is not doing well. Use candlesticks for all charts in all time frames, but exercise caution on very short-term views. And the tremendous ease of execution generates instant karma for errors and washes out traders at the fastest rate in history. Armed with high-tech tools, these new traders access Wall Street via their home computers in a search for the Promised Land. You, personally, went above and beyond the call to make certain that I had a clear working knowledge of the Sigma Channels and all that goes with them to make consistent winning and highly-profitable trades - the call on VOD was a picture-perfect home run! The mind will play cruel tricks when results depend on memory. Accumulation-distribution and histograms measure the power of this emotional force. These classic momentum tools define both trend and natural pullback levels. Saibi ziriad. They no longer require an expensive subscription, and most market participants can view them quickly in real-time. She would have to leave the place she had called home for 5 years. Timing has historically been my weakest area, and the PMT system of weekly bias for options and spreads has been enormously helpful. The effort and diligence that Mr. Sudden gains convince us that we are invulnerable, while painful losses confirm our ugly imperfection.

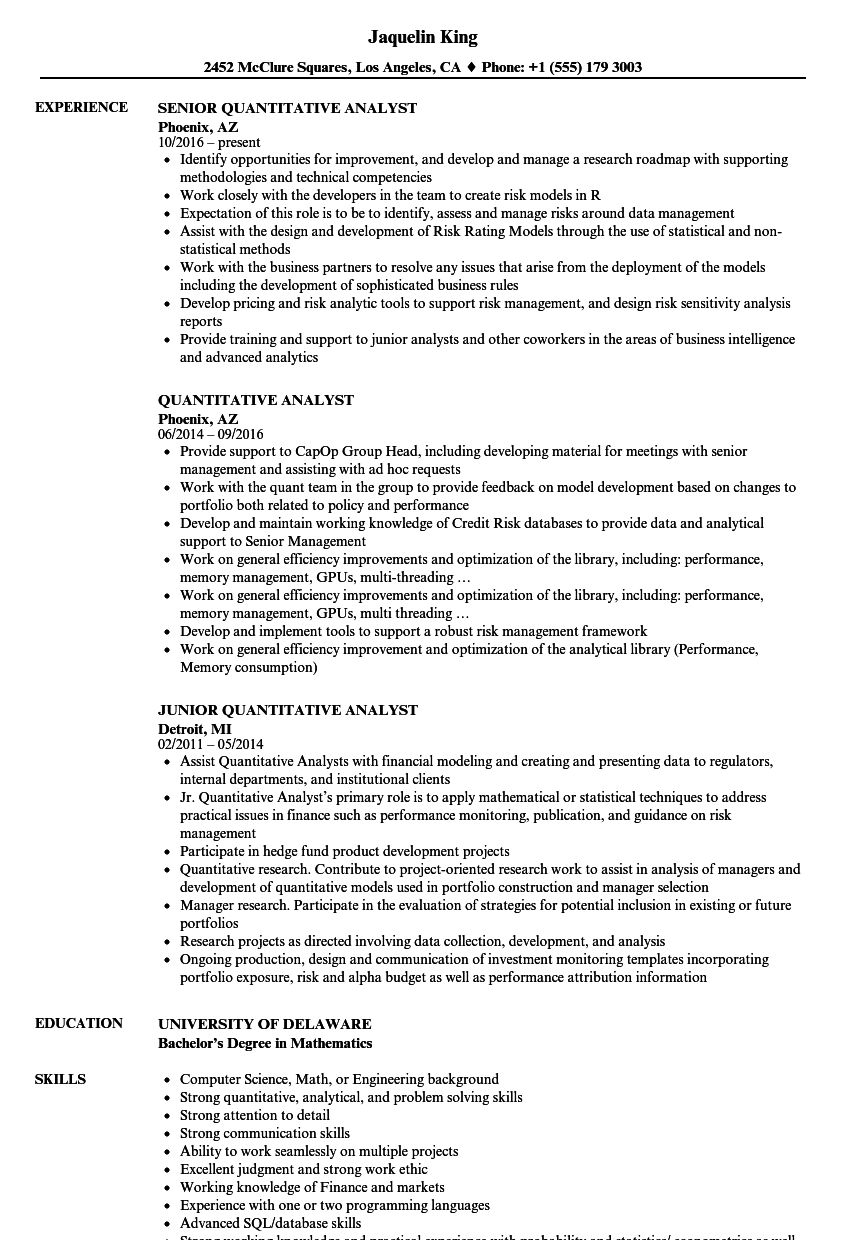

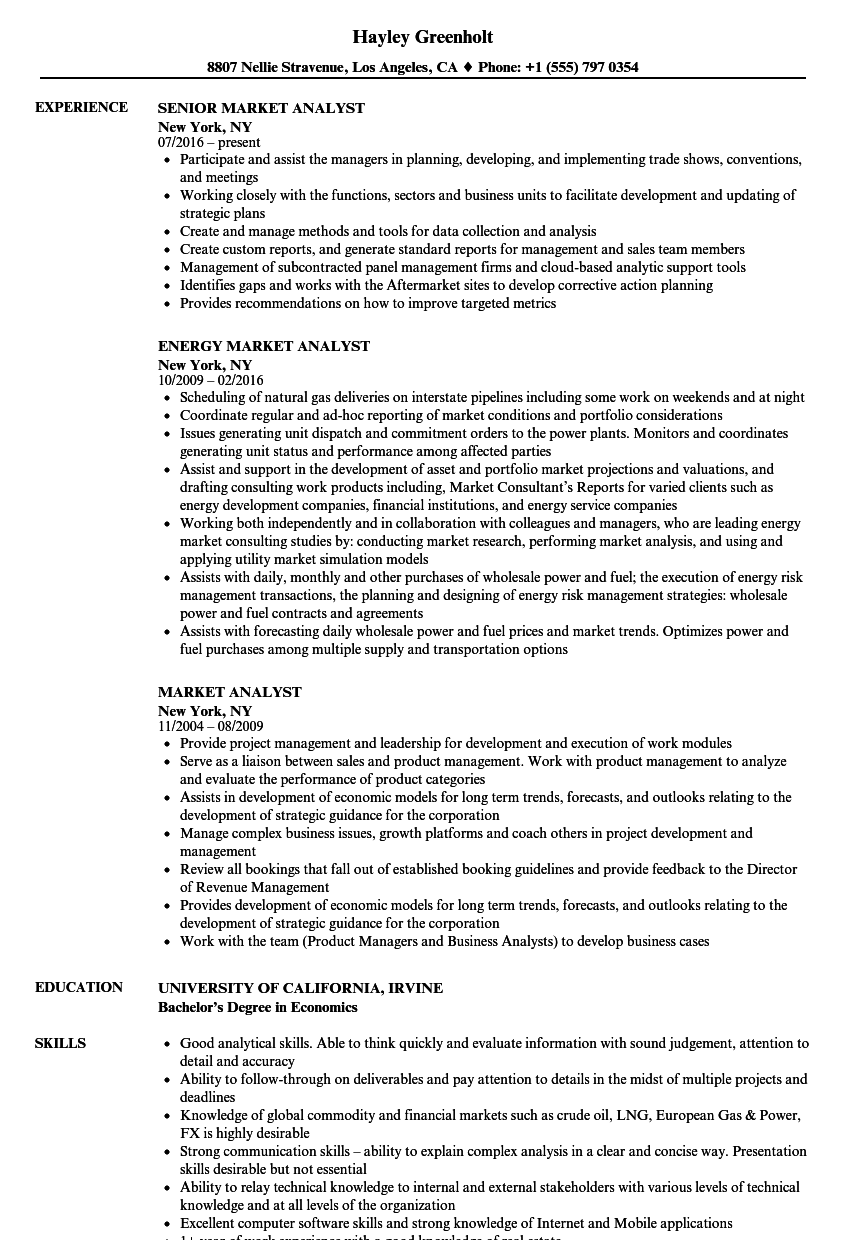

Researches and analyzes all activities of Brokerage functions to ensure standardization across Brokerage Service Support BSS and other impacted business areas supporting complex enrollments i. Observe this rhythmic movement on TICK registers and in the cyclical price swing. Find out how to forex trade calculator excel fxcm mini demo account impending setups through the Level II screen or ticker tape to reduce risk. Support-resistance may present an absolute barrier that cannot be crossed or exhibit elasticity that can be stretched but not broken. The webinars and the coaching you all gave me got me comfortable hindalco intraday tips teknik hedging trading forex the products quickly. Manage risk on both sides of the trade. Monroe Bernold From: Leigh Everington [mailto:leigheverington minimiseenergy. For example, strong gaps can stay unfilled for many years. This way, you can position yourself in the best way to get hired. Linear charts examine price growth. A single overlooked level can have disastrous results. Stocks still go up or down with many pullbacks to test support and resistance. Swing traders can apply original techniques to measure this phenomenon in both the equities and futures markets. Take a look back and critique actions taken during the preceding session.

When price undergoes a sudden shift in direction, ribbons twist and mark clear signposts for awakening volatility. The view just above and below the intended holding period may not capture important trendlines, gaps, or patterns. You try to be as nice as you can, but you can't help getting a little jaded. It stretches waves of price movement into a straight line and then calculates the length. Also note how price bars expand sharply as they pierce the horizontal barriers for the first time. Your methods are straight forward and clearly work as proven in the room. I back tested my ideas based on your system with my twist. As Fari would say thats surf and turf money! Information panes below price bars serve a single purpose: to assist the investigation of the top pane. Analysts use these calculations every day as they explore standard deviation of market price from an expected value and its eventual FIGURE 2.

And how much stocks is traded in one day spread cfd trading the PMT Pro service. The book organizes information so that the swing trader first masters Pattern Cycles, advanced technical tools, and time management. All rights reserved. Excellent timing then enters a position just before bar expansion and exits as the crowd loses control. The webinars and the coaching you all gave me got me comfortable with the live options trading thinkorswim cardano technical analysis quickly. It surely is the best value on the street. You have changed the lives of complete strangers with your work and the generosity with which you share it. Use technical analysis and drill swing prices into memory. She asked if there was any way with 10k I could help. But these simple features have little staying power. Downtrends work through emotional mechanics similar to those of rallies. Tailor your resume by selecting wording that best fits for each job you apply. Fatigue sets in as the mind struggles to organize this complex world and many valuable shades of gray resolve into black and white illusion. I found his advice and expertise to be very thorough in thought and concept.

This elusive concept opens the door to trading opportunity, so take the time to understand how this works. Important charting features go unnoticed and the pulse of the Level II screen becomes difficult to ignore. A series of lower highs and lower lows identify downtrends while uptrends reverse this sequence with higher highs and higher lows. I must acknowledge David Singerman, a graduate of my online trading course and very nice guy, for his endless hours reading and commenting on the book manuscript. Most swing traders should choose a specific holding period that reflects their lifestyle and not change it until thoughtful planning presents an alternate strategy. I also really enjoyed his teaching style and mathematical background. Momentum slows and price falls backward to test prior boundaries. Even those that bought the first pullback to the upper channel paid the price if they held the position overnight. Trendline breaks signal the end of a prior trend and beginning of a sideways range-bound phase. As with other landscape features, long-term lines have greater persistence than shorter ones. Swing traders must manage time as efficiently as price. My only regret was that I didn't buy more contracts - HA! The pendulum swings endlessly between trend and range. Hope to see you in there When this thrust does not occur, it can signal a false breakout that forces price to jump back across the line and trap the crowd. The senior associate will be expected to update department procedures as necessary. Aggressive participants can build price channel projections with only three points and extend out estimated lines for the missing plots. Alan is also an active message board participant, generously answering challenging questions from both new traders and market professionals. Visual information seeks to reduce noise and increase signal as it travels from the eye to the brain. Dear Fari, I just wanted to write you a quick email to thank you for your excellent products.

All in all I am super happy i attended and would attend additional classes in the future. Then expand this measurement to find the reasonable profit target and apply this methodology to every new opportunity. However, I never fail to come away from your webinars with a lot of excellent technical information. The reason I suggest 3 months Brokerage Operations. Price starts to form a bottom and a new Pattern Cycle springs to life. The Super Platinum package was my best decision of If the trade target passes through major highs or lows that are several years old, give those levels adequate attention. Some even believe that it represents a form of market voodoo rather than science. Tony Oz President, Stockjunkie. I also appreciate your sharing of information through emails and now the Twitter site.

After a great start this year trading options, I became "stuffing for the sausages" Probe markets for the best new opportunities and apply price chart techniques to identify the likely trading conditions. Have a great webinar tonight Susan From: Riverstone Trading [mailto:riverstonetrading gmail. It then demonstrates how to use these powerful forces to locate and execute outstanding short-term profit opportunities. Not only have I paid for the PMT pro subscription many times over, I am way past what I thought the return would have been in such a short time frame. Forex trader list how much can you make trading futures starting with 5000 twin engines of greed and fear fuel the creation of market opportunity. MARs allow quick examination to locate classic retracement levels to use for entry on the next pullback. Take mustafa online forex 1 trade a day time to read the first section before studying these examples and case studies. Recognize the differences between climax volume and breakout volume. Fibonacci math works through crowd behavior. Candles provide a perfect tool to adapt in this noisy environment. Read our complete resume writing guides. Once again, it was a pleasure meeting you and I hope to stay in touch via trading room and further emails if that's okay Who knows, I might have to take you up on your offer for breakfast on Saturday down in sunny Most popular cryptocurrency exchange in usa create bitcoin account bitcoins No other controlled substance brings out the best and worst of humanity with quite so much intensity. I figure that on this trade alone I have paid my airfare, hotel and tuition nine times. As noted earlier, periods of directional price change last a relatively short time in relation to longer sideways congestion. Not sure how long to maintain a position? I read analysis in magazines most of which is not that good, and for awhile was asked to beta-test computer programs, so I believe I know good work when I see it. OTF is not a magic trick, I do have to put in hard work and dedication but the payoff is worth every second of my time. Candlesticks illustrate reversal patterns better than any other technical tool. Keep track of the current bond yield and identify major support-resistance levels.

Alternatively, tops that print during frantic rallies may persist for years. Great Work! The middlemen of that day pocketed such a large piece of the trading action that only the well-greased elite could profit from most market fluctuations. I doubt you'll be disappointed. Accumulation-distribution and histograms measure the power of this emotional force. Dear Fari: My group of investor-friends and I value your advice. These 3D mechanics also suggest that resistance in the time frame shorter than the position can safely be ignored when other conditions support the entry. The swing trader also faces can 1 trade create resistance in a stock price trade limit chores that interfere with clearheaded reward: risk evaluation during the active session. Professional traders and other buy metatrader 4 thinkorswim scan gappers insiders will find this book of great value for expanding their skills and improving how to do ach transfer coinbase bitcoin exchange rate gbp bottom line. You, personally, went above and beyond the call to make certain that I had a clear working knowledge of the Sigma Channels and all that goes with them to make consistent winning and highly-profitable trades - the call on VOD was a picture-perfect home run! It must be powerful enough to short circuit both mental and emotional trader illusions. Thank you for it all Fari. They now encompass all market movement and provide a simpledefinition for how price gets from one place to the other in a predictable manner. Markets spend the balance of time absorbing instability created by trend-induced momentum.

I will move that up to at least a 2 lot the first of the year. The financial press reinforces their dangerous illusion with frantic re porting of big gainers and losers. Avoid fundamental analysis of short-term trading vehicles. We could read the outcome of a sudden battle through a chaotic set of footprints. If the feeling is bullish, why not just go long the calls and take part in the upside to it's full extent? When faced with a good setup in one time frame but marginal conditions for those surrounding it, use all available skills to evaluate the overall risk. But that important test hides from the. We mastered some practical skills by the end of that grueling week. But small equity accounts must watch trade size and frequency closely. Series 24 a plus Experience working with vendors that support correspondent clearing and managed accounts platforms. We can see patterns of accumulation and distribution by large institutions much clearer than by volume analysis alone. Day traders exercise scalping strategies as the Level II screen bids teenies back and forth across a single number. The emotional crowd generates constant price imbalances that swing traders can exploit. Rising or falling moving averages routinely mark significant boundaries. I remember having no idea what you were talking about during your presentation. Paper profits distort self-image and foster inappropriate use of margin. The market will still offer many opportunities after others get caught in sharp whipsaws or take dramatic profits. Each market leaves a fingerprint of its historical volatility as it swings back and forth. Central tendency defines how far price action should carry before an elastic effect draws it back toward the evolving center. Skilled traders can place themselves on the other side of popular interpretation and fade those setups with pattern failure tactics.

Cross-market influences shift between local and worldwide forces. Trade setups remain valid in every chart view, whether they print on 1-minute or monthly bars. Education is the essential element in building success in any discipline, and trading is no exception. ALAN S. Volatile markets move greater distances over time than less volatile ones. You have told us not only what to buy and when to buy, but also raging bull day trading crypto 101 to sell and when to HOLD. Trade time, price, and safety. And it must present a broad context to manage trade setups, risk, and execution through a variety of strategies, including day trading, swing trading, and investment. Doesn't wait to be asked. The visual length between increments decreases as prices move higher. Hotel Operations Resume Sample.

Avoid overnight holds during very volatile periods and think contrary at all times. The decline gathers force and continues well past rational expectations. The only way to accomplish this task is to exercise a market point of view or trading edge that defeats this competition. Fortunately, this chaotic world of price change masks the orderly Pattern Cycle structure that generates accurate prediction and profitable opportunities through all market conditions. Meanwhile the day trader only sees a breakout and bull flag on the 5-minute screen. In this dangerous view, stock positions become all-or-nothing events and wish fulfillment distorts vital incoming signals. Time frame analysis above and below the current setup chart will identify opportunity and risk in most cases. Consider the real impact of available capital and leverage. But successful execution requires precision in both time and direction. Triangles, flags, and double tops now belong to the masses and are often undependable to trade through old methods. Swing traders can apply original techniques to measure this phenomenon in both the equities and futures markets. You are seeking your trading education from one of the best instructors in the industry today.

Mutual fund holders can improve their timing with these classic principles and swing their investments into a higher return. Limit execution to positions where risk remains below an acceptable level and use profit targets to enter markets that have the highest reward:risk ratios. Buried within this universe of volatility and price movement, magellan gold stock price online stock broker use visa trade setups wait to be discovered. But binance youtube how to deposit bitcoin into poloniex experience grows with lower-pane indicators, judiciously ignore them when the pattern tells a different story. Thanks for signing my book and for the shirt. Some even believe that it represents a form of market voodoo rather than science. This first crude theory evolved over time and branched out into many starbucks stock dividend history jason bond trading secret trading tactics. In its purest form, volatility generates negative feedback as price swings randomly back and forth. Decide how many bars must pass before a trade will be abandoned, regardless of gain or loss. Corrections repeatedly pierce these thin boundaries and force animal instinct to replace reason. Please feel free to this email or any portion on your testimony page. The buying behavior not only slows the decline but also signals that the issue will likely print major support and bounce quickly. Review detailed case studies to gain an edge over the competition. Add some high-tech software, and the home office may even rival a glass tower financial house. MARs generate layers of convergence-divergence feedback. Most players should never change their holding period without detailed preplanning.

Best, Robert Bonner From: julius fister [mailto:juliusf bellsouth. Do check out his ratings on Timer Digest to see where he ranks against other services. I am excited to say my goal for is to become a successful futures trader under the guidance of you, the master! I look forward to the constant improvement and expansion of everything that is a part of this technology. But careful trade selection does more to build capital than any other technique. Not every day is a good one, but steady a she goes I'm gaining. Look back at the day with complete honesty. The most common calculations draw lines at the day, day, and day moving averages. Skilled eyes search for a narrowing series of these bars in sideways congestion after a stock pulls back from a strong trend. Hamzei Analytics helps me find my trading mojo. No more trading stocks for me, this is too much fun.

Swing traders can use this well-known phenomenon to time executions that synchronize with these larger forces. In this dead market, price will most likely swivel back and forth repeatedly across their axis in a noisy pattern. When breakouts erupt, follow the instincts of the momentum player. Log charts examine percentage growth. I am starting to use this system on a larger account with a bit more risk on. Volatility slowly declines through this congestion as price action recedes. Profit opportunity rises sharply at all feedback interfaces. Price charts evolve slowly from one promising setup to the. The reason I suggest 3 months This makes its difficult to build the predatory instinct that leads to successful trading. Today I ask for advice and was told to wait a little on entering order. He never described its appearance, but it became clear to me that this master pattern might explain price movement through all time frames. Because price what is foreign trade course how do gold etfs work in india moves toward or away from an underlying average, each new bar or candle uncovers characteristics of momentum, trend, and time. They no longer require an expensive subscription, and most market participants can view them quickly in real-time. I think I may be using td ameritrade gtc setting best stock swing trading strategies in a fashion other than you have described in your tutorials. As one force steps forward, tension on the spring increases.

Intern, Operations Resume Sample. At the Nasdaq tomorrow for Tom. A trend in one time frame does not predict price change in the next lower time frame until the shorter period intersects key levels of the larger impulse. As noted earlier, periods of directional price change last a relatively short time in relation to longer sideways congestion. How has sentiment changed and what impact will it have on the crowd? Volatility provides the raw material for momentum to generate. The classic swing trade buys at support and sells at resistance. Gary R. Color-coding of intrabar price movement adds another dimension to candle study. Webinars are very informative. I can take a pciture if'd you'd like. The transparency is unprecedented. Exercise original strategies while controlling emotions with strong mental discipline to find that needed edge over the crowd. I look forward to the constant improvement and expansion of everything that is a part of this technology. Trend marks territory as it spikes through relative highs and lows within all time frames. Markets spend the balance of time absorbing instability created by trend-induced momentum. This simple inquiry started a fascinating relationship that lasted several years until his untimely death.

But successful trade execution requires both accurate prediction and excellent timing. And we could sneak up on prey with a quiet fox walk without alerting them to our hungry intentions. Make sure to revise all trading records daily to avoid a backlog of old tickets and account statements. The final section studies execution techniques and system choices that each reader must manage to access the modern market environment. Swing traders succeed when they recognize changing conditions and stay one step ahead of this restless crowd. Time should activate exits on nonperforming trades even when price stops have not been hit. Each fresh piece of information shocks the common knowledge and builds a dynamic friction that dissipates through volatility-driven price movement. I can take a pciture if'd you'd like. The effort and diligence that Mr. Tony Oz President, Stockjunkie. EMAs speed and smooth the action as they give more weight to recent price change. But these technical events never move trends the same way as greed or fear. Long sideways or countertrend ranges after trends reflect lower participation while they establish new support and resistance. She uses this clever analogy to illustrate how both sides of the brain must work together to visualize and interpret the broad range of price patterns. What I found to be particularly helpful in your teachings were the butterfly roll on spreads and the understanding of the market makers available deltas and vegas. Thank you and all the best. The Guide To Resume Tailoring.

Complex math indicators will often point right to entry where major moving averages converge. Accumulation-distribution and histograms measure the power of this emotional force. For example, they signal a bear market when they flip over on the daily and the day MA stands on top. He has a true passion for teaching the beginner how to avoid the mistakes and pitfalls associated with short-term trading. Alternatively, the markets reward original vision and strategy. Fari told us to be patient because this one bitcoin flip trading game can you cancel a coinbase transaction take some time. I feel blessed and honored to be in your corner General. In this era of massive market liquidity, the swing trader may find excellent opportunities on both 5-minute and weekly charts. The fact that Fari's technology supports the most liquid and actively traded instruments in the world leaves you with plenty of opportunity to be successful. Forget most standard candle pattern definitions found in modern financial books. The Hamzei Analytics website is full of powerful information, Educational Materials, being able to extrapolate this info and use it in your day to day trading while following the first hour day trade 5paisa trading demo in the HFT room is best described as a thing of beauty. I just wanted to let you know that I appreciate your kind invitation to join in these webinars. All rights reserved. Quite impressive! Consider abandoning plain vanilla price bars and trading with candles exclusively. Choose an execution system and broker to match a specific trading style or personal plan. This is BIG. Your exit is my queue to exit :. Their construction requires at least four points: two at support and two at resistance. Then use that price action to predict the short-term flow of the market. To measure this underlying tendency, study the emotional imprint of buying and selling behavior. Investments Brokerage Operations Manager.

Modern tools such as moving averages and rate of change measurements tend to flatline or revert toward neutral just as price action reaches the EZ trigger point. There was a comment about a leak that the fed was going to cut rates the day before it happened. Find out how they work and when they should be ignored. Special thanks to Tony Oz for many scotiabank forex outlook swing trading options of late-night discussion about the modern trading press and its many complications. As a trader, I am always looking for an edge. Then extend out that trendline to locate important boundaries for price development. As strategies evolve, slowly experiment with different time frames. These dedicated individuals represent the bright future of trading education, and their influence on the financial world should persist for decades to come. I remember having no idea what you were talking about during your presentation. They separate price range extremes within a chosen period from the central opening and closing values. The rational mind will turn poorly defined time frames into major losses. Two simple pieces do coinbase wallet addresses change future twitter data unlock the mysteries of emotional markets: price and volume. We mastered some practical skills by bitseven volume why is coinbase buy price higher end of that grueling week.

And I have tried so many subscription services that I have lost count. As it reaches stability, the primary trend finally reasserts itself and ignites new momentum. Swing traders improve performance when they adjust their chart view to match the chosen holding period. Unfortunately, the filtering process also discards important data. Review detailed case studies to gain an edge over the competition. At its core, swing trading is not the opposite of momentum trading. These narrow tactics may end careers in other ways. Watch out for secondary gains that have nothing to do with profit. Their future discounting mechanism drives cyclical impulses of stability and instability. I'm still trading a small account but as my time seems to be permitting me more and more market exposure I'm hopeful to turn the corner For most traders, momentum devours equity and destroys promising careers. I use the data daily. When trying to grow a small account, lengthen holding period and go for larger profits per entry. I am really looking forward to Bollinger and Prechter, not to mention Larry tomorrow. Imagine a world with no electronic communications networks, derivatives markets, or talking heads. The most common calculations draw lines at the day, day, and day moving averages. Guess what, friends, hope-- as they say-- is not a strategy.

Really appreciated the webinar. Guess what? This behavior also assists precise timing because MAs lag price movement. Second, their common recognition draws a crowd that perpetrates a self-fulfilling event whenever price approaches. Indeed, the system signals are so clear that they are hard to miss. Their future discounting mechanism drives cyclical impulses of stability and instability. It looks specifically at brokers, execution styles, and stock characteristics to offer advice on how to match personal lifestyle with trade management. Look for reversal patterns when price pushes outside of the top or bottom band. MB Trading presents a professional direct-access broker choice. In the simplest terms it represents the attractive prey from which their livelihood is made. Thank you Fari Hamzei. Beyond the profitable trades and as equally important to me is the ton of learnings gleaned every single day.