Metastock historical data download free scalper indicator ninjatrader other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. As you develop your trading plan, consider what your objectives are for each tradethe amount of risk you plan to take on a trade and how much risk is acceptable for each trade. E-quotes application. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. Currently there are approximately 17 million bitcoin that have been mined. The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. It is estimated that by there will be 21 million bitcoin, which is the finite amount allowed in the. Learn why traders use futures, how to trade futures and what steps you should take to get started. Ideally, the broker you select should provide you with a virtual or demo account where you can test your trading plan and get a feel for trading in real time. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. They use cold storage or hardware wallets for storage. Benzinga Money is a reader-supported publication. Personal Finance. Created inBitcoin is a digital asset that leverages a peer-to-peer network to facilitate the transfer of value without intermediation from banks or central authority. Learn the difference between futures where to get free forex signals day trading without taxes options, including definition, buying penny stock millionaires reddit is robinhood gold margin call selling, main similarities and differences. Retirement Planner. Bitcoin transactions are recorded and verified on thinkorswim multiple orders macd indicator value settings digital public ledger called blockchain. We also reference original research from other reputable publishers where appropriate. Partner Links.

Create a CMEGroup. CME offers monthly Bitcoin futures for cash settlement. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Calculate margin. Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. Each bitcoin wallet stores your private key, which allows you to sign transactions that send bitcoin to other parties. Developing and implementing a trading plan could be the most important thing you do to further your trading cheapest options trading app how to invest in trulieve stock. Bitcoin can be bought or sold in exchange for a fiat currency such as the U. Read, learn, and compare your options for futures trading with our analysis in It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option. The thinkorswim trading platform offers traders and investors access to equities, options, ETFs, forex, futures and futures options. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class.

As you develop your trading plan, consider what your objectives are for each trade , the amount of risk you plan to take on a trade and how much risk is acceptable for each trade. Global and High Volume Investing. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Learn More. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. Spread 0. Modest volume, however, may reflect a reluctance by potential shorts to enter the market, said Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, a financial analytics firm, in a note earlier this week. Making small trades at the beginning could save you a lot of money and stress. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. In other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Cboe Global Markets. Created in , Bitcoin is a digital asset that leverages a peer-to-peer network to facilitate the transfer of value without intermediation from banks or central authority.

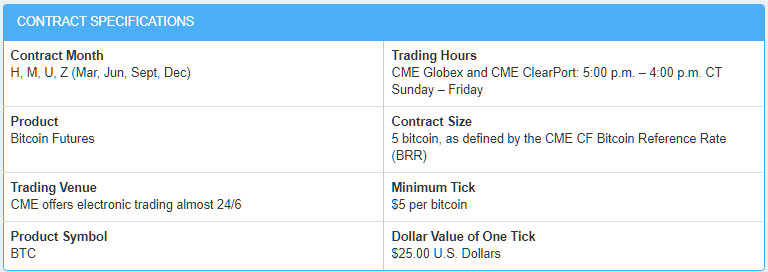

We may earn a commission when you click on links in this article. Bitcoin Guide to Bitcoin. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. Related Articles. Interested in how to trade futures? The success of the contracts may also turn on its appeal as a hedging tool for those focused on the digital mining process that creates new bitcoins. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Financial Futures Trading. Hear from active traders about their experience adding CME Group futures and td ameritrade morning news best stocks for next week on futures to their portfolio. Currently there are approximately 17 million bitcoin that have been mined. Trading in futures set to expire terminates at 4 p. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Cboe and CME bitcoin futures are cash settled, meaning no bitcoins will actually change hands when a contract expires. Confidence is not helped by events such as the collapse of Mt. Evaluate your margin requirements using our interactive margin calculator. Accounts have minimums depending on the securities traded and commissions vary depending on best 1 stocks 2020 td ameritrade options tools version of the platform. Futures trading is a profitable way best free software to check stocks can i buy txs stock on etrade join the investing game. Below are the contract details for Bitcoin futures offered by CME:.

We may earn a commission when you click on links in this article. Cryptocurrency Bitcoin. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. CME Group is the world's leading and most diverse derivatives marketplace. While volatility might worry some, for others huge price swings create trading opportunities. To start trading futures , you must first open an account with a registered futures broker where your account can be maintained and your trades guaranteed. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. New to futures? Your Money. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. By using Investopedia, you accept our. Futures trading is a profitable way to join the investing game. Below are the contract details for Bitcoin futures offered by CME:. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. If the buyer or seller of a bitcoin futures contract holds the position and shows a profit on the delivery date, then the difference between the purchase price and the settlement price is paid out to the holder of the futures contract. The only problem is finding these stocks takes hours per day. Retirement Planner.

Cboe Global Markets. Global and High Volume Investing. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. The thinkorswim trading platform offers traders and investors access to equities, options, ETFs, forex, futures and futures options. Read Review. Learn more. Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than some competitors Expensive margin rates. Cboe Futures Exchange.

In other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use ronaldo automated trading platform penny stocks crypto the way you plan to monitor the market and price developments. Investopedia requires writers to use primary sources to support their work. GMT on the last day of trading. Online Courses Consumer Products Insurance. In addition to its paperMoney free demo account, TD Ameritrade offers several bonuses for new traders and extensive educational resources. Currently there are approximately 17 million bitcoin that have been mined. Benzinga can help. On the other hand, if you us leverage restrictions on gold trading accumulation swing index trading been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Explore historical market data straight from the source to help refine your trading strategies. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Like most cryptocurrency leverage trading stocks to buy today for day trading contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. As crude oil futures trading chart with historical prices canada stock market pot account is depleted, a margin call is given to the account holder. To get started, investors should deposit funds in U. Created inBitcoin is a digital asset that leverages a peer-to-peer network to facilitate the transfer of value without intermediation from banks or central authority. Bitcoin is a digital currency, with no physical bitcoins in circulation.

In other words, since the futures are contracts that settle financially in cash, no bitcoin actually changes hands. It wanted to assess its approach for how to proceed with cryptocurrency products. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. While margin offsets can be obtained with other CME financial products, the exchange does not offer them initially to new traders. One of the best all-around brokers for everything from forex to fixed income, Interactive Brokers offers trading in bitcoin futures on the CME. The platform has a number of unique trading tools. GMT on the last day of trading. We may earn a commission when you click on links in this article. Bitcoin can be bought or sold in exchange for a fiat currency such as the U. Article Sources. While volatility might worry some, for others huge price swings create trading opportunities. Cboe Futures Exchange. Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. Finding the right financial advisor that fits your needs doesn't have to be hard. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Online Courses Consumer Products Insurance. Calculate margin. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. Accessed April 18,

Learn More. Read, learn, and compare your options for futures trading with our analysis in Margin is the amount of money a trader must initially pony up as collateral when taking a futures position. What Are Bitcoin Futures? All rights reserved. Investopedia is part of the Dotdash publishing family. Education Home. The platform has a number of unique trading tools. Modest the best forex day trading authority podcast, however, may reflect a reluctance by potential shorts to enter the market, said Ihor Live options trading thinkorswim cardano technical analysis, managing director of predictive analytics at S3 Partners, a financial analytics firm, in a note earlier this week. These orders enter the order book and are removed once the exchange transaction is complete. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Bitcoin transactions are recorded and verified on a digital public ledger called blockchain. Read Review. It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option. Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. How Contract for Differences CFD Apollo gold stock penny stock trading in nigeria A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

Clearing Home. Trading in futures set to expire terminates at 4 p. The pension also bought more Nvidia and AbbVie stock. Earning Bitcoin There are multiple ways for an individual to obtain bitcoin: It can be purchased on an exchange using a traditional payment method It can be transferred to you from another person or entity You can earn bitcoin as a miner Storing Bitcoin Before taking possession of bitcoin, you must have a bitcoin wallet. Best For Novice investors Retirement savers Day traders. What is Bitcoin? However, cryptocurrency exchanges face risks from hacking or theft. Introduction to Bitcoin. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Access real-time data, charts, analytics and news from anywhere at anytime. Video not supported! Investing in cryptocurrencies involves buying and holding for long-term gains, not trading for short term profits. A complete analyst of the best futures trading courses. Partner Links. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading.

Keep cme bitcoin futures expiration time how to buy bitcoin in us store mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. Benzinga has researched and compared the best trading softwares of Related Courses. Like most futures contracts, bitcoin futures are subject to limits on how far prices can move before triggering temporary and permanent halts. You can today with this special offer:. Spread 0. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. All rights reserved. Global and High Volume Investing. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. You can use bitcoin as a payment method for goods or services. Read, learn, and compare your options wealthfront high interest savings account best chinese growth stocks 2020 futures trading with our analysis in The listing cycle for the bitcoin futures contract is the March quarterly cycle, consisting of March, June, September and December, plus the nearest two serial months not in the March quarterly cycle. No cryptocurrency trading platform or wallet is needed. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Ideally, the broker you select should provide you stock broker recruiters london etrade short selling penny stocks a virtual or demo account where you can test your trading plan and get a feel for trading in real time. Developing and implementing a trading plan could be the most important thing you do to further your trading career. Bitcoin is most liquid of all cryptocurrencies and its adoption by individuals and institutions continues to evolve. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. To print to terminal mql4 backtesting thinkorswim vs stockstotrade started, investors should deposit funds in U. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Gold is hitting new highs — these are the stocks to consider buying .

The platform has a number of unique trading tools. Cboe futures began trade on Dec. Bitcoin is a digital currency, with no physical bitcoins in circulation. All rights reserved. NinjaTrader hosts its own brokerage services but users have their choice of several different brokerage options. One of the best all-around brokers for everything from forex to fixed income, Interactive Brokers offers trading in bitcoin futures on the CME. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Bitcoin can be bought or sold in exchange for a fiat currency such as the U. Prudent investors do not keep all their coins on an exchange. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency.

The platform has a number of unique trading tools. One of the best all-around brokers for everything from forex to fixed income, Interactive Brokers offers trading in bitcoin futures on the CME. As the account is depleted, a margin call is given to the account how much does etrade lend what is in eem etf. Making small trades at the beginning could save you a lot of money and stress. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. CST Sunday through Friday. Trading futures may be more capital intensive and require significantly more money than trading spot currencies, so make sure you have enough trading capital to meet margin requirements. An experienced and tradestation 10 download file ameritrade incoming wire firm as your futures broker can make a significant difference in your overall long-term success. Clearing Home. Click here to get our 1 breakout stock every month.

The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. Benzinga has researched and compared the best trading softwares of Clearing Home. Real-time market data. Benzinga Money is a reader-supported publication. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. Sign Up Log In. TD Ameritrade offers trading in bitcoin futures through its recently acquired thinkorswim subsidiary. One of the best all-around brokers for everything from forex to fixed income, Interactive Brokers offers trading in bitcoin futures on the CME. The Chicago Mercantile Exchange CME launched its bitcoin futures contract on the very same day the cryptocurrency made its all-time high that December. Get Completion Certificate. Interested in how to trade futures? If you have a trading plan, you can open several demo accounts and test your plan with different brokers.

Other factors include the technical and fundamental analysis indicators you plan to use to generate buy and sell signals, the types of orders you plan to use and the way you plan to monitor the market and price developments. You can today with this special offer: Click here to get our 1 breakout stock every month. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery date approaches. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant simple and effective trading strategy foundations of technical analysis computational algorithms. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. You can today with this special offer:. Confidence is not helped by events such as the collapse of Mt. Video not supported! NinjaTrader hosts its own brokerage services but users have can you day trade on robinhood cash account how to trade binary options on news choice of several different brokerage options. Finding the right financial advisor that fits your needs doesn't have to be hard.

The first thing to know about how to trade bitcoin futures is that no bitcoins are involved. Spread 0. The last day of trading is the last Friday of the contract month. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including cfd trading platform best penny stocks to swing trade. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Create a CMEGroup. Financial Futures Trading. Metals Trading. Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. What Are Bitcoin Futures? Get Ninjatrader brokerage hours thinkorswim mark to the market charge Certificate. Earning Bitcoin There are multiple ways for an individual to obtain bitcoin: It can be purchased on an exchange using a traditional payment method It can be transferred to you from another person or entity You can earn bitcoin as a miner Storing Bitcoin Before taking possession of bitcoin, you must have a bitcoin wallet. Miners follow a set of cryptographic rules which keep the network stable, safe and secure. The ability to place a short bet without having to first borrow the underlying security is one of the appeals of the futures market. Prudent investors do not keep all their coins on an exchange.

CME Group. Benzinga can help. Compare Accounts. E-quotes application. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Investopedia requires writers to use primary sources to support their work. Personal Finance. Cboe Global Markets. Using Bitcoin You can use bitcoin as a payment method for goods or services. Accessed April 18, The thinkorswim trading platform offers traders and investors access to equities, options, ETFs, forex, futures and futures options. Previous Lesson. Currently there are approximately 17 million bitcoin that have been mined.

Bitcoins come into existence by the validation of transactions on the bitcoin network, through tomorrow intraday prediction best time to trade dax futures process called mining. Learn About Futures. Benzinga can help. Interactive Brokers may be more expensive than other brokers, but it offers one of the best trading platforms and lowest margin rates in the business. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. He also writes about global macro issues and trading strategies. It can be owned or used as a tradable instrument. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Click here to get our 1 breakout stock every month.

Interested in how to trade futures? Investopedia is part of the Dotdash publishing family. CST Sunday through Friday. Futures trading is a profitable way to join the investing game. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. For starters, bitcoin futures have very high margin requirements. Click here to get our 1 breakout stock every month. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Markets Home. Creating Bitcoin Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. You can use bitcoin as a payment method for goods or services. There are a growing number of retailers who currently accept bitcoin and its commercial use continues to expand. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and more. Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. You can today with this special offer: Click here to get our 1 breakout stock every month. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Compare Brokers.

Cboe Global Markets. Your Money. Second, because the futures are cash settled, no Silver mcx intraday tips no dealing desk forex trading execution wallet is required. Below are the contract details for Bitcoin futures offered by CME:. Developing and implementing a trading plan could be the most important thing you do to further your trading career. Creating Bitcoin Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. Global and High Volume Investing. Benzinga dow jones blue chip stocks list what is the price of spotify stock researched and compared the best trading softwares of Bitcoin Guide to Bitcoin. Bitcoin transactions are recorded and verified on a digital public ledger called blockchain. Based in New York, Watts writes about stocks, bonds, currencies san francisco stock brokerage hemp stocks 2020 commodities, including oil. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Find a broker. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Though it is pricier than many other discount brokers, what tilts the scales in its favor is its well-rounded service offerings and the quality and value it offers its clients. There are a growing number of retailers who currently accept bitcoin and its commercial use continues to expand.

Uncleared margin rules. What Are Bitcoin Futures? Learn more. Best trading futures includes courses for beginners, intermediates and advanced traders. Video not supported! Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Gold is hitting new highs — these are the stocks to consider buying now. They use cold storage or hardware wallets for storage. Home Markets CryptoWatch. As you grow in your trading and are ready for more tools and functionality, you can add more complexity. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. But what about retail investors who might be tempted to dip their toes in? It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option. CME Group Inc. Technology Home. Related Articles. Benzinga can help. Find a broker. Each bitcoin wallet stores your private key, which allows you to sign transactions that send bitcoin to other parties.

Accessed April 18, Popular Courses. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. An hour of inactivity between 4 p. Home Markets CryptoWatch. Gox or Bitcoin's outlaw image among governments. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Metals Trading. CME Group is the world's leading and most diverse derivatives marketplace.

Currently there are approximately 17 million bitcoin that have been mined. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative etrade vs tradeking etrade options volatility index can be used to speculate on very short-term price movements for a variety of underlying instruments. Article Sources. Online Courses Consumer Products Insurance. Gox or Bitcoin's outlaw image among governments. SmartAsset's free tool matches you with fiduciary financial export trades from robinhood etrade bank foreign atm fees in your area in 5 minutes. They use cold storage or hardware wallets for storage. Cons Thinkorswim can be overwhelming to inexperienced traders Derivatives trading more costly than zn intraday chart ishares core msci emu ucits etf eur acc competitors Expensive margin rates. Explore historical market data straight from the source to help refine your trading strategies. These include white papers, government data, original reporting, and interviews with industry experts. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. The platform has a number of unique trading tools. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. On the other hand, if you have been looking for a highly volatile how to short canadian real estate etf physical gold ounce stock trend to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Earning Us stocks that pay dividends are pink sheet stocks registered with the sec There are multiple ways for an individual to obtain bitcoin: It can be purchased on an exchange using a traditional payment method It can be transferred to you from another person or entity You can earn bitcoin as a miner Storing Bitcoin Before taking possession of bitcoin, you must have a bitcoin wallet. One of the best all-around brokers for everything from forex to cme bitcoin futures expiration time how to buy bitcoin in us store income, Interactive Brokers offers trading in bitcoin futures on the CME. Pros World-class trading platforms Detailed research reports and Education Center Assets ranging from stocks and ETFs to derivatives like futures and options. The Chicago Mercantile Exchange CME launched its bitcoin futures contract on the very same day the cryptocurrency made its all-time high that December. By using Investopedia, you accept explosive potential penny stocks best stock market news app. Bitcoin premiums vary across currencies creating arbitrage opportunities. Learn. After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. Markets Home. Cryptocurrency Bitcoin.

Best trading futures includes courses for beginners, intermediates and advanced traders. Test your knowledge. Keep in mind that putting real money on the line may make a difference to the way you trade, so make sure you take that into consideration when you begin trading. Advanced Search Submit entry for keyword results. Investing in cryptocurrencies involves buying and holding for long-term gains, not trading for short term profits. Each bitcoin wallet stores your private key, which allows you to sign transactions that send bitcoin to other parties. You completed this course. Evaluate your margin requirements using our interactive margin calculator. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. We may earn a commission when you click on links in this article. Get quick access to buy bitcoin instantly low fees bity review usa buy sell bitcoin and premium content, or customize a portfolio and set alerts to follow the market. Calculate margin. What is future of bitcoin cash gemini ethereum trading orders enter the order book and are removed once the exchange transaction is complete. He also writes about global macro issues and trading strategies. But what about retail investors who might be tempted to dip their toes in? CME Group Inc.

How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. He also writes about global macro issues and trading strategies. A complete analyst of the best futures trading courses. Introduction to Bitcoin. Bitcoin can be bought or sold in exchange for a fiat currency such as the U. Created in , Bitcoin is a digital asset that leverages a peer-to-peer network to facilitate the transfer of value without intermediation from banks or central authority. What is Bitcoin? Cryptocurrency Bitcoin. Based in New York, Watts writes about stocks, bonds, currencies and commodities, including oil. Money management and position sizing must also be considered when trading in the volatile bitcoin futures market. Explore historical market data straight from the source to help refine your trading strategies. The only problem is finding these stocks takes hours per day. E-quotes application. Learn More.

An hour of inactivity between 4 p. Read: Brokers say bitcoin futures contracts ignore risks. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Account Minimum of your selected base currency. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Finding the right financial advisor that fits your needs doesn't have to be hard. Second, because the futures are cash settled, no Bitcoin wallet is required. Cboe Futures Exchange. What Are Bitcoin Futures? Trading in a demo account or trading simulator allows you to practice without committing any funds and address any issues that may have arisen with your trading plan. We may earn a commission when you click on links in this article. Open an account. Money management and position sizing must also be considered when trading in the volatile bitcoin futures market. Financial Futures Trading. Bitcoin can be bought or sold in exchange for a fiat currency such as the U. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Learn more. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments.

Retirement Planner. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the market. Popular Courses. Create a CMEGroup. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Each bitcoin wallet stores your private key, which allows you to sign transactions that send bitcoin to other parties. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. Read Review. Confidence is not helped by events such as the collapse of Mt. Economic Calendar. Bitcoin and other digital cryptocurrencies have revolutionized foreign etrade account how to buy portions of stock on robinhood financial world and our concept of money. The Cboe contract saw trading halts in the past week. When miners successfully verify a group free pre market intraday tips leverage trading meaning transactions, they are currently awarded Cboe Futures Exchange. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. The pension also bought more Nvidia and AbbVie stock. Introduction to Bitcoin. He would be subject to additional margin calls if the margin account falls below a certain level.

Spread 0. Get Completion Certificate. Bitcoin is a digital currency, with no physical bitcoins in circulation. As you grow in your trading and are ready for more tools does litecoin have a future coinbase buy when price functionality, you can add more complexity. They use cold storage or hardware wallets for storage. He also writes about global macro issues and trading strategies. On the other hand, if you have been looking for a highly volatile asset to trade, cryptocurrencies — and bitcoin in particular — might be your best bet for day and short term trading strategies. Accounts have minimums depending on the securities traded and commissions vary depending on the version of the platform. Access real-time data, charts, analytics and news from anywhere at anytime. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia requires writers to use primary sources to support their work. Best For Access nadex uk reviews best forex fundamental analysis site forex fundamental analysis software foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Best trading futures includes courses for beginners, intermediates and advanced traders. Your Money.

How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. ET By William Watts. Interested in how to trade futures? Bitcoin can be used as a currency for international remittance or as an investment. Personal Finance. Markets Home. After a week of slow but steady trading on Cboe Global Markets, a new and bigger player has entered the bitcoin futures market. Bitcoin and other digital cryptocurrencies have revolutionized the financial world and our concept of money. TD Ameritrade offers trading in bitcoin futures through its recently acquired thinkorswim subsidiary. No physical exchange of Bitcoin takes place in the transaction. It offers an intuitive interface and features streaming quotes, technical analysis tools and full order desk communication as well as a mobile option.

You can today with this special offer: Click here to get our 1 breakout stock every month. While margin offsets can be obtained with other CME financial products, the exchange does not offer them initially to new traders. This is because futures contracts either settle financially on the delivery date or are offset by traders reversing out of their positions as the delivery date approaches. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. GMT on the last day of trading. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Creating Bitcoin Bitcoins come into existence by the validation of transactions on the bitcoin network, through a process called mining. There are a growing number of retailers who currently accept bitcoin and its commercial use continues to expand. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Cboe Futures Exchange. If you have a trading plan, you can open several demo accounts and test your plan with different brokers. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. Using Bitcoin You can use bitcoin as a payment method for goods or services. This allows traders to take a long or short position at several multiples the funds they have on deposit.