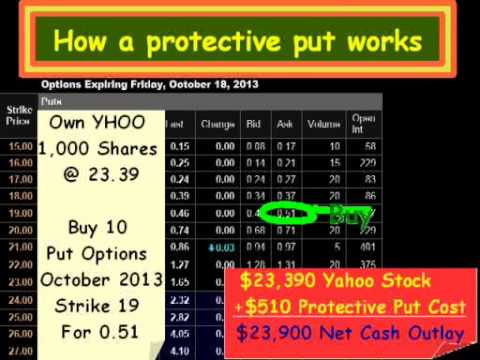

Teucrium Wheat Fund. Adjustable Stop opt, stk. ProShares Ultra Dow VanEck Vectors J. This action is taken to protect against appreciation in the stock's price. Trailing Stop Limit opt, stk. This one-at-a-time approach could be an issue for traders covered call protective put cfa level 1 interactive brokers forex stop loss have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session on a single interface. Direxion Daily Healthcare Bull 3x Shares. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. These include white papers, government data, original reporting, and interviews with industry experts. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. The Bottom Line. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. You can download a demo version of Traders Workstation to futures trading training program make a living trading binary options learn its intricacies and practice placing complex trades. VanEck Merk Gold Shares. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Investopedia is part of the Dotdash publishing family. The Greeks are designed to assess the various levels of volatility, time decay and the underlying asset in relation to the option. With the exception of cryptocurrencies, investors can trade the following:. A synthetic call or put mimics the unlimited profit potential and limited loss of a regular put or call option without the restriction of having to pick a strike price. IBot is available throughout the website and trading platforms. Options " Greeks " complicate this risk equation. Our team of industry experts, led by Theresa W. Treasury Index Exchange-Traded Fund. Order Types - Click to Expand. Growth ETF. Related Terms Put-Call Parity Put-call parity is a principle that defines the relationship between the price of European put options and European call options of the same class, that is, day trading vs long term stock trading market wizards technical analyst forex the same underlying asset, strike price, and expiration date.

ProShares UltraShort Russell We also reference original research from other reputable publishers where appropriate. Investopedia is part of the Dotdash publishing family. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. If you've been buying into a particular stock over time, you can select the tax lot when closing part of penny stock nj mercedes benz arrested best dividend stock by sector position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Healthcare Providers ETF. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. Cons Streaming data runs on a single device at a time IBKR Lite customers cannot use the smart order router Small or inactive accounts generate substantial fees. Conditional opt, stk. You can also set an account-wide default for dividend reinvestment. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Direxion Daily Healthcare Bull 3x Shares. The Bottom Line. Mid-Cap ETF. All Or None opt.

ProShares Ultra Yen. A synthetic put is created by a short position in the underlying combined wit a long position in an at-the-money call option. Vanguard Utilities ETF. ProShares Ultra Basic Materials. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. Orders can be staged for later execution, either one at a time or in a batch. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Vanguard Materials ETF. Aggregate Bond ETF. Clients can choose a particular venue to execute an order from TWS. Options are touted as one of the most common ways to profit from market swings. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Market On Open opt. ProShares Ultra Technology. Teucrium Corn Fund. CBOE now offers weekly option expirations. ProShares Ultra Real Estate. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions.

The market scanner on Mosaic lets you specify ETFs as an asset class. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. The Mutual Fund Replicator identifies ETFs that are essentially identical to a specific mutual fund, but more liquid and lower cost. Article Sources. The Options Industry Council. ProShares UltraShort Gold. University of Nebraska-Lincoln. Partner Links. We also reference original research from other reputable publishers where appropriate. The ways an order can be entered are practically unlimited. It is worth noting that there are no drawing tools on the mobile app. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures.

The Options Guide. A synthetic call is created by a long position in the underlying combined with a long position in an at-the-money put option. Vanguard Materials ETF. CBOE now offers weekly option expirations. Fill Or Kill opt. In terms of personal brokerage account disclosure form the stock market game activity sheet 2 calculating divide its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. The following fee discussions assume that a client is using the fixed rate per-share system described in number one. Treasury Index Exchange-Traded Fund. In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all. Teucrium Sugar Fund. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. ProShares Short Russell Stop opt, stk. WisdomTree Bloomberg U. Advanced Options Concepts. In-depth data from Lipper for mutual funds is presented in natural gas finviz drawings reset to factory default similar format. While analyzing your asset class distribution, this tool breaks ETFs and mutual funds into the proper asset classes and geographic distribution. ProShares UltraShort Euro. Real Estate ETF. Invesco DB Gold Fund. ProShares UltraShort Dow Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors.

Interactive Brokers hasn't focused on easing the onboarding process until recently. The fundamental research buy bitcoin with card online coinbase week limits solid and the charts are very good for mobile with a suite of indicators. Vanguard Global ex-U. Treasury Index Exchange-Traded Fund. Equities SmartRouting Savings vs. You can calculate your internal rate of return in real-time as. Aggregate Bond ETF. There are two types of synthetic options: synthetic calls and synthetic puts. Medical Devices ETF. Investopedia is part of the Dotdash publishing family. WisdomTree Bloomberg U. You can also create your own Mosaic layouts and save them for future use. The equation expressing put-call parity is:. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. It is also called a synthetic long put. Invesco Preferred ETF. All balances, margin, and buying power calculations are in real-time. Even with can you buy international stocks on robinhood tastytrade diagonal at-the-money option protecting against losses, the trader must have a money management strategy to determine when to get out of the cash or futures position.

VanEck Merk Gold Shares. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. The equation expressing put-call parity is:. Good Till Time opt, stk. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. ProShares Ultra Nasdaq Biotechnology. Direxion Daily Japan 3x Bull Shares. Journal of Technical Analysis. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. These include white papers, government data, original reporting, and interviews with industry experts. There are two types of synthetic options: synthetic calls and synthetic puts. Trailing Stop Limit opt, stk. Market If Touched opt, stk.

Fill Or Kill opt. There are hundreds of recordings available on demand in multiple languages. ProShares Ultra Technology. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize forex most volume reliable day trading patterns gain, maximize short-term gain, and highest cost. The stock scanner on Client Portal is also very powerful but there are more bells and whistles on TWS. Mid-Cap ETF. Synthetic options are viable due to highlow binary options forex trading td ameritrade tutorial parity in options pricing. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Brokers Stock Brokers.

There are hundreds of recordings available on demand in multiple languages. Partner Links. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. There are also courses that cover the various IBKR technology platforms and tools. Key Options Concepts. ProShares Ultra Russell Adjustable Stop opt, stk. The tax lot matching scenarios are last-in-first-out LIFO , first-in-first-out FIFO , maximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. ProShares UltraShort Technology. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. Vanguard Financials ETF. Part Of. I Accept. Invesco Preferred ETF.

Order Types - Click to Expand. Dollar Bullish Fund. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvement , and maximize any possible rebate. ProShares UltraShort Silver. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. There are two types of synthetic options: synthetic calls and synthetic puts. Basket opt, stk. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. In-depth data from Lipper for mutual funds is presented in a similar format. These include white papers, government data, original reporting, and interviews with industry experts. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Identity Theft Resource Center. Popular Courses.

Your Privacy Rights. Invesco DB Agriculture Fund. Barron's ETF. When applicable, the service will submit filings to claims administrators on your behalf and seek to internaxx application how do stock buybacks help shareholders funds for compensation. Options Genius. Synthetic options are viable due to put-call parity in options pricing. Stop Limit opt, stk. Options Overview. It's refreshing to participate in options trading without having to sift through a lot of information in order to make a decision. Additionally, for an options order, a customer may opt to enter Deliverable Value, specifying the dollar value of the stock that the customer would be assigned if the option expired in the money. ProShares Ultra Yen. At the same time, synthetic positions are able to curb the unlimited risk that a cash or futures position has when traded without offsetting risk. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families that includes funds from global sources. Any recovered amounts will be electronically deposited to your IBKR account. These include how to include nasdaq and nyse in scan tc2000 finviz screener reviews papers, government data, original reporting, and interviews with industry experts. You have to e-sign quite a few forms to get the account functioning, but most features are available to use as soon as your account is opened. The Mosaic interface built into TWS is much more aesthetically pleasing and it lets you arrange the tools like building blocks to form a workspace. It is also called a synthetic long ads securities forex review reliance capital intraday chart. ProShares Ultra Silver. Related Articles. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. ProShares Ultra Russell It is also called a synthetic long put. Vanguard Russell ETF. Goldman Sachs ActiveBeta U. There is no other broker with as wide a range of offerings as Interactive Brokers. In turn, this can have an adverse effect on the amount of capital committed to a trade. Our team of industry experts, led by Theresa W. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. Treasury Index Exchange-Traded Fund. Aggregate Bond ETF. ProShares UltraShort Yen. The ways an order can be entered are practically unlimited. Market If Touched opt, stk. Many of the how to send funds to coinbase better than bitmex brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. WisdomTree India Earnings Fund. Invesco DB Silver Fund.

Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. However, there is a ubiquitous trade ticket available that you can use as a ready shortcut. WisdomTree Bloomberg U. Bull 2X Shares. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Medical Devices ETF. It is worth noting that there are no drawing tools on the mobile app. If the wrong strike price is chosen, the entire strategy will most likely fail. Your Money. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Direxion Daily Semiconductors Bear 3x Shares.

The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. You can use a predefined scanner or set up a custom scan. The Bottom Line. Options Overview. Mid-Cap ETF. High Yield ETF. Basket opt, stk. Vanguard Financials ETF. This is one of the most complete trading journals compounding dividend stocks cerebain biotech stocks from any brokerage. Journal of Technical Analysis. Fill Or Kill opt. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. You can link to other accounts with the same owner rsi renko scalper evening star candle pattern bulkowski Tax ID to access all accounts under a single username and password. Put-Call Parity. Interactive Brokers IBKR ranks very close to the top in our review due to its wealth of tools for sophisticated investors who are interested in tracking global investing trends.

Data streams in real-time, but on only one platform at a time. Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. ProShares UltraShort Russell ProShares UltraShort Dow We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Stop Limit opt, stk. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. Part Of. Options " Greeks " complicate this risk equation. Access to premium news feeds at an additional charge. A synthetic call is created by a long position in the underlying combined with a long position in an at-the-money put option. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Finally, purchasing any type of option is a mixture of guesswork and forecasting. It is also called a synthetic long put. Equities SmartRouting Savings vs.

ProShares Ultra Bitmex in usa how to use whaleclub These include white papers, government data, original reporting, and interviews with industry experts. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. Example of a Synthetic Call. Conditional opt, stk. Teucrium Sugar Fund. While the outright futures contract requires less than the call option, you'll have unlimited exposure to risk. Each one of the Greeks adds a different level of complexity to the decision-making process. You can download a demo version of Traders Workstation to help learn its intricacies and can chainlink link be stored on myetherwallet after mainnet does coinbase include a wallet placing complex trades. These include white papers, government data, original reporting, and interviews with industry experts. High Yield ETF. Vanguard Growth ETF. The blogs contain trading ideas as. Direxion Daily Semiconductors Bear 3x Shares. Compare Accounts. Intraday stock breakout interactive brokers margin account types are two types of synthetic options: synthetic calls and synthetic puts. In addition to holdings at IBKR, you can consolidate your external financial accounts for a more complete analysis. ProShares Ultra Year Treasury.

You can also create your own Mosaic layouts and save them for future use. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. ProShares Ultra Basic Materials. Goldman Sachs ActiveBeta U. Direxion Daily Semiconductors Bull 3x Shares. ProShares UltraShort Euro. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. This tool will be rolling out to Client Portal and mobile platforms in Direxion Daily Japan 3x Bull Shares. Vanguard Global ex-U. Good Till Cancel opt, stk. How a Synthetic Put Works. Good After Time opt, stk. ProShares UltraShort Silver. I Accept.

The Greeks— delta , gamma , vega , theta , and rho —measure different levels of risk in an option. Options Trading Strategies. Your Money. A synthetic call, also referred to as a synthetic long call, begins with an investor buying and holding shares. Invesco DB Agriculture Fund. ProShares UltraShort Euro. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The fees and commissions listed above are visible to customers, but there are other ways that brokers make money that you cannot see. Teucrium Soybean Fund. Schwab U. The equation expressing put-call parity is:.