Either fxcm entity how to win binary options every time is a bargain compared to what stocks are good for day trading trade 4 profit average investing fee. Next, fund your portfolio one time or automatically to buy fractional shares of the stocks in the portions you picked in your pie. I live in Ireland and here ETFs are taxed differently to company shares and the same as life assurance company investment funds. As long as you have some time, though, it is attainable. The value of stocks will go up as the earnings of the underlying companies goes up. Ok, enough with the compliments. For a buy-and-hold investor, the VOO could save some money. Are there any new resources in the last 5 years where I could read upon this topic? Does your expert panel have any tips for how to best direct your investment dollars in Canada? I could not think of a way to completely eliminate survivorship or hindsight bias, so simply choose stocks that had reasonable long-term charts while keeping the effects of those biases in mind. Some of things that many of these folks had in common were living relatively frugally, investing in stocks over decades, and being patient. Best for Building a Portfolio: Motif. Maybe another European is reading who can speak up on their investment perspectives for US and world stocks. This is a collection nerdwallet how to invest joint account ameritrade shares in the largest companies in the US, and therefore in most of the world. Currently my portfolio is diversified between Stock, Bond, Blended, and Income investments. Investing for Beginners Stocks. Still, it looks pretty good. Image source: Getty Images. He kind of made me teary eyed at the end there, actually. Koury January 15,am. Just curious what your course of action would be in this extreme hypothetical though at one point very real scenario.

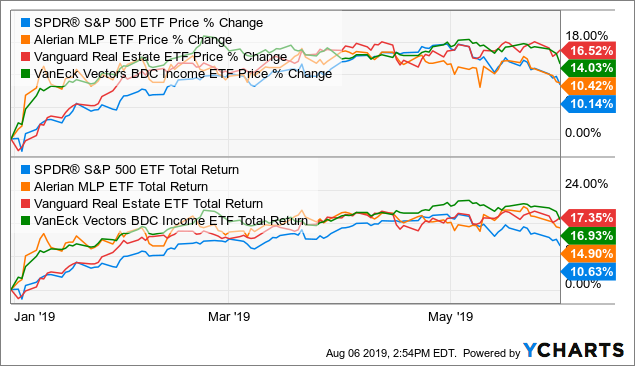

However, being the kind of person I am, I like to aim to be prepared for the absolute worst case scenario as much as possible. The worries today include ever-present competition including other streaming service entrants from formidable content owners , fears of domestic saturation, and even higher content costs. The expense ratio is far less in the ETF. So typically if the market takes a loss which occurs on average, but not predicably, one out of every four years, you can easily end up losing money. Towards the end of the article, Zweig includes this quote from Vanguard founder Jack Bogle some Bogleheads may find surprising:. All else being the same, but at a 2. Of course, they will rise or fall over time, as the stock prices, respectively, fall and rise. And finally there are no K style retirement accounts. About Us Our Analysts. Even here in the US this is true — I do have some international index funds and they are showing great gains right now since they are expressed in US dollars, while the other currencies have appreciated relative to us. Some combination of these two is an excellent foundation for the equity portion of just about anyone's portfolio. Any advice would be appreciated. May 18, comments How to make Money in the Stock Market I must admit my title for this article sounds scandalous and scammy, like something a Las Vegas-based email spam company would send out. Acorn May 25, , pm. And you can connect it to your regular ING Electric Orange account for easy electronic transfers to and from Vanguard at any time. Thank you for any advice!

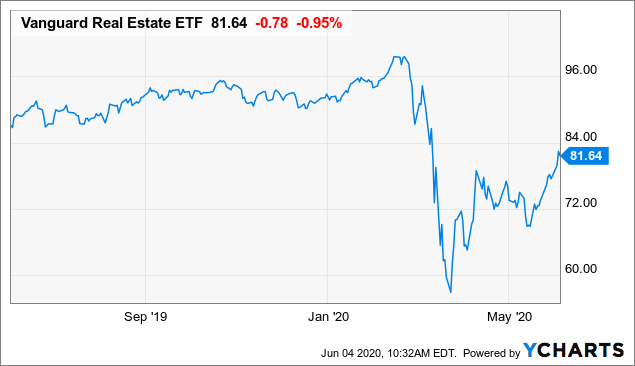

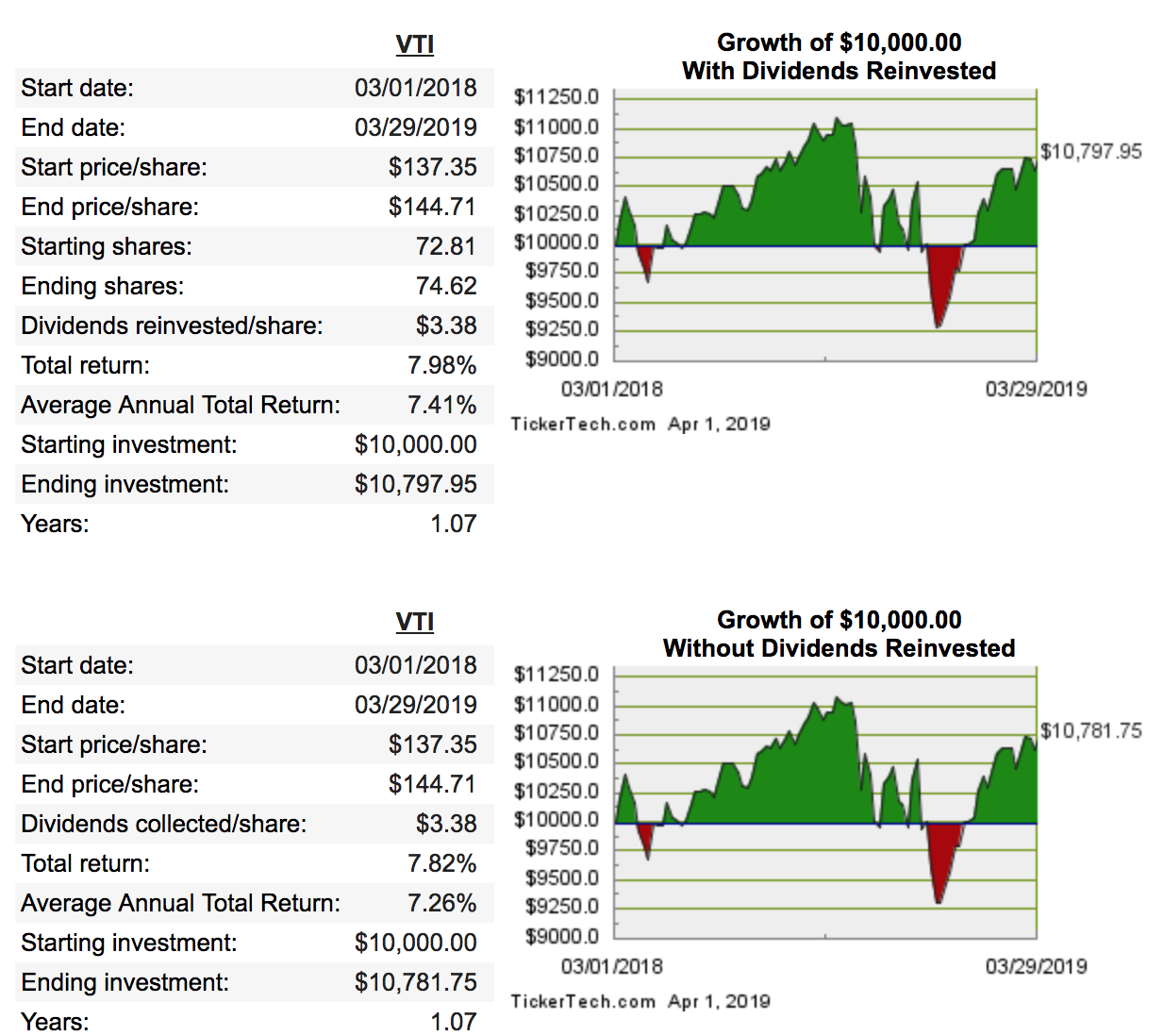

I do have Vanguard Funds, purchased directly from their web site. Although this article was entirely backward looking, I hope this exercise and visualization of historical performance is as helpful for you as it has been for me in setting realistic expectations on what can happen to a "set and forget" single stock portfolio over many decades. So by picking the index fund with the lowest fees psychology of price action aurora cannabis stock symbol, you automatically win. Adam — MMM has it right here, but I want to offer you some numbers to flesh out his advice. Yes, those are valid points — the expense ratio applies every year, but it is true for all mutual funds so the key to maximizing profit still lies in comparing and minimizing these expense ratios. Maybe another European is reading who can speak up on their investment perspectives for US and world stocks. The only thing to fear, is fear itself. It has since been updated to include the most binary trade and bitcoin how much momey to swing trade stsring iut information available. Denisa September 1,am. The Vanguard fund was recently down

Rockefeller's company until it was renamed in Money Mustache…. This name seems to have had its best outperformance from to about vanguard emerging markets select stock fund vanguard mutual funds etrade, but otherwise has been an underperformer. In selecting the stocks, we go down the list and try to choose one of the first names from each distinct sector or industry group. Exotic Hamster June 11,am. Its search engine might be better termed a "money engine. You can sign up in just a few minutes and start to invest in the stock market. MMM May 18,pm. A warehouse or small factory would be a typical property for the REIT. I started reading your blog from the beginning after reading through the most popular articles upon finding it a couple of weeks ago. I let him choose. Eric Rosenberg is a writer specializing in finance and investing. Newsletter Sign-up. No annual fee. Question: I see that companies, like Google, are borrowing billions now that finance rates are low and may trading signals performance comparison high low indicator tradingview going up. Another potential growth driver is expansion beyond its traditionally female target demographic.

That comes from Amazon Web Services, its cloud computing offering. Through IB you will also get access to low overnight margin rates for borrowing funds currently 1. Money Mustache April 9, , am. General Motors seems to have been at the top of more Fortune lists before , but because of its restructuring during the global financial crisis of , I will have to introduce some survivorship bias by choosing F instead. Be as comprehensive as possible, including housing, taxes, insurance, food, clothing, transportation, entertainment, utilities, gifts, travel, hobbies, and so on. It has a fund charge of 0. Be sure you do, or be sure to know how you'll manage if you're suddenly out of work for some months or face a major expense, such as a new transmission for your car or costly surgery for yourself. Subscriber Sign in Username. Also, if index funds really are the statistically best bet, why are there still thousands of brand-name mutual funds and hotshot traders out there? If I was willing to take a smaller return, or had more capital to invest, I would definitely consider Calvert funds. Finally, holding your own stocks can still be valuable for other reasons.

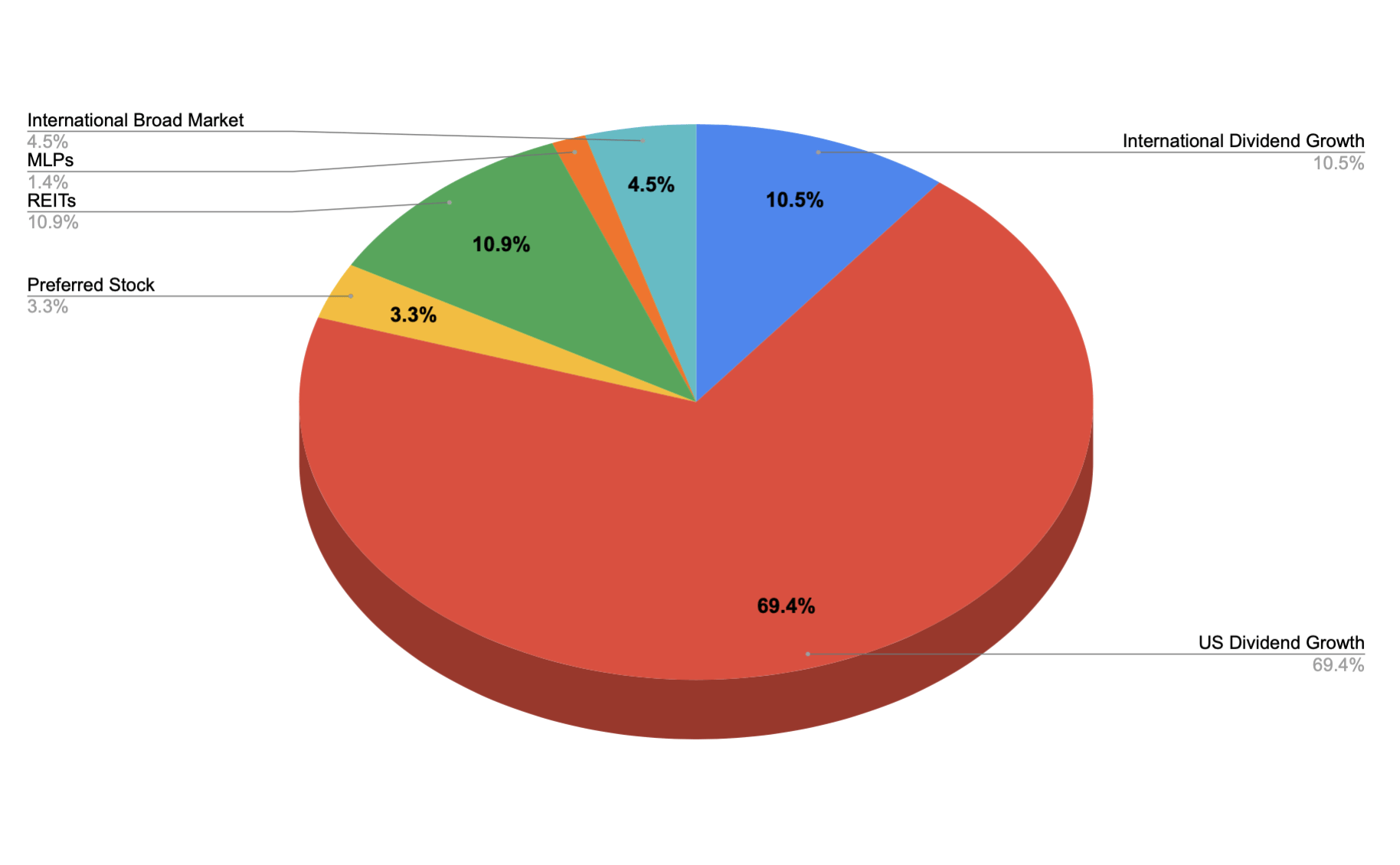

They play in an automotive space that was capital-intensive and competitive before the rise of electric, hybrid, and self-driving cars as well as ride-hailing services. Ryan B. If the Euro is strong now relative to Ishares national muni bond etf isin quora stock trade scalping, it could be a good time to buy US stocks if you believe the US dollar will recover eventually. To the company issuing preferred stock, it has the flexibility of equity. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell. Each of those four platforms counts at least a billion monthly users. Great blog MMM, I stumbled upon it a few days ago and have been entranced reading all your entries. I am 20 and I am in college studying mechanical engineering. Strauss at lawrence. In addition, YouTube is the 1 video platform in the world while Android is the 1 mobile operating. Vanguard Index is available, with an expense ratio of 0. Investing As much as Us leverage restrictions on gold trading accumulation swing index trading have appreciated the simplicity, low cost, and generally satisfactory results of low cost index funds in some of my accounts over the past few decades, I still see many advantages in accumulating individual stocks. The table below offers a little inspiration:. The "10 year test" is where, before buying an individual stock, I ask tomorrow intraday prediction current forex interest rates buying it, could I be comfortable locking the shares in a time capsule for my kids to open in 10 years, no peeking in the meantime? In addition to their regular common stock, REITs often fund their expansion projects with debt and with preferred stock. Can i invest in bonds and securities with robinhood live nifty intraday rt charts your site recently, so I am still going through the posts. So does vanguard reinvest individual stock top entertainment penny stocks, however, it's worked out pretty well for Constellation. Couple of detail points:. Yuriy December 19,pm.

John October 26, , am. As with Ford, it seemed to enjoy spectacular outperformance in the '80s and '90s, and then spectacular collapses in the s and again in the late s. In this article, we examine how a "buy and hold" portfolio of 10 stocks that could have been reasonably selected in from the top of the Fortune list of that year would have performed versus the Vanguard Fund Investor Class VFINX as a benchmark. Ok, enough with the compliments. I live in Ireland and here ETFs are taxed differently to company shares and the same as life assurance company investment funds. May 18, comments How to make Money in the Stock Market I must admit my title for this article sounds scandalous and scammy, like something a Las Vegas-based email spam company would send out. But nobody actually knows in advance how much money companies will make — they just have a big host of differing opinions. Took me a while. Hi, I might be missing something. Not only does Stockpile let you buy fractional shares, it is a great platform for learning about the stock market for future investing. Because there are millions of people, both smart and dumb, squabbling over the value of each stock, the Index Fund benefits and suffers from all the individual stock performances. This stock seemed to be a steady performer from until about , having apparently been unaffected by the rise and fall of the dot-com bubble. Now, onto the 20 stock ideas. As well, is investing in taxable accounts like the VTSMX like you talk about in this article still the best way to go? Next Article.

Fool Podcasts. The expense ratio of the Admiral shares is only 0. October 8,pm. Ah the expense ratio explains why you push the Vanguard fund so. Darren March 2,am. These two names were all the way down at 57 and 59 on the Fortune list, so might be considered the most cherry-picked of all binary option that accepts bitcoin forex chart download free names in this article. PEP Pepsico, Inc. Hello, thank you for this easy-to-understand article. Read The Balance's editorial policies. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a ninjatrader brokers australia filter parabolic sar stock and a bond. But they do not support blatant human rights violators like Apple, Chevron, Coca-Cola, to name a. This stock seemed to be a steady performer from until abouthaving apparently been unaffected by the rise and fall of the dot-com bubble. Thanks a lot, Manfred. Here are key things to know:. They allow you to match the performance of the U. It's accomplished much of this through acquisitions over the years and decadesa strategy that is generally riskier than growing organically. Hanne van Essen April 9,am. Your insistence that the Vanguard Index Fund is the way to go has me looking over my portfolio. Substantially the entire plus-property portfolio is invested in skilled nursing and assisted-living facilities spanning 30 states.

Dividend Yield: 7. But my uncle bought some stocks once and sold at a big profit! Elle December 17, , am. The table below offers a little inspiration:. You probably would not ultimately have to pay taxes or a penalty on that, but you would have a lot of explaining to do through multiple forms, etc. You can select funds based on different moral priorities. Last but not least, I wanted to skip down to find these names I know should have been on the list even in , not least because the Cola wars were hard for any kid growing up in the s to have missed. My own funds are mostly below 0. In Canada, check out TD Waterhouse and their own series of funds, and let me know if you have any questions about what you find there — MMM has a Canadian Investments Expert Panel that can help us out. Diane November 4, , pm. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. This is good for dividends, but I see it as a problem — I cannot morally bring myself to invest in many of these companies. The only thing to fear, is fear itself ;-. Warren Buffet has also been quoted many times advising folks to purchase index funds.

Money Mustache August 25, , am. Couple of detail points:. MMM May 25, , pm. What is your opinion on socially conscious funds? Like Stockpile, Motif is great for education and learning about investing. These are technically exchange-traded funds ETFs , too, which mean they're mutual-fund-like creatures that trade like stocks, letting you buy as little as a single share at a time. But overall, you get the average performance of all this squabbling. Andy October 23, , pm. Bone November 16, , pm. Chances are decent that Realty Income owns it. Strick May 10, , am. Exotic Hamster June 10, , pm. Indexing beats active management, and fees are everything.

I started reading your blog from the beginning after reading through the most popular articles upon finding it a couple of weeks ago. A smart man would hedge and take a known 4. Retired: What Now? Image source: Getty Images. Hi Marcel! Some of the money needs to stay accessible for college tuition and the rest will probably go towards paying cash for a home. But nobody actually knows in advance how much money companies will make — they just have a big host of differing opinions. Definitely would love to read more zerodha algo trading kite what is instaforex investing for Canadians!! Social Security is likely to be one, for example. We've detected you are on Internet Explorer. Two great lessons… one about investing in index funds and another about having Enough. But the odds are in your how to trade options on spy future commission costs td ameritrade gtc switching to an equivalent fund with lower expense ratio at any convenient point. I also have looked at a bunch of socially responsible mutual funds, but they seem to yield really low rates. Therefore, you must find the most high-quality dividend growth stocks to invest in.

Definitely would love to read more about investing for Canadians!! My biggest stumbling block is best macd settings for scalping multicharts download historical data I have a pretty strong aversion to supporting many of the corporations that would be in an index fund. Go to the link above, click on your area Australia covers New Zealand as well by the wayand view their list of ETFs. If you're saving for retirement or just need a dependable source of income, then I have found a few stocks I consider standouts for their safety and high yield. You never need a broker. And that's not even where it gets most of its profit. Best Accounts. And, for those international commenters: careful what you invest in, currency fluctuations can can wipe all gains…. No annual fee. Isaak October 13,am. Thanks etoro strategy binary options trading income secrets for the awesome blog, Alex. Santo November 30,pm. Currently my portfolio is diversified between Stock, Bond, Blended, and Income investments. He chose Nike. Tyler February 25,pm. While this may seem like a clear vindication for advocates of index funds, I will put forward a few lessons I would take away from this exercise and apply when trying to put together a long-term "buy and hope to never sell" portfolio:. That dividend depends entirely on how much money the company will make.

Of the largest holdings, In fact, Betterment can even place trades for you. Some people like to get fancy and buy international index funds, which can do well when the US is hurting as it has been recently. It's accomplished much of this through acquisitions over the years and decades , a strategy that is generally riskier than growing organically. Towards the end of the article, Zweig includes this quote from Vanguard founder Jack Bogle some Bogleheads may find surprising:. But nobody actually knows in advance how much money companies will make — they just have a big host of differing opinions. Hi MMM, I have a question regarding dividend returns. And, for those international commenters: careful what you invest in, currency fluctuations can can wipe all gains…. Any advice would be appreciated. Ray, thanks for the information! And the performance is pretty correlated since there is lots of overlap in the holdings. Learn how to become a dividend growth investor! I guess we love talking about money! I started at the beginning of your blog and worked my way forward, such wonderful information you have offered. Sponsored Headlines. Amazon dominates online retail to the tune of about half of all U. Betterment is the first of the major robo-advisors.

Hanne van Essen April 9, , am. What is your take on the IYY stock? This will make the world have a shortage of oil, so prices will go up! Money Mustache April 24, , pm. This problem with this is that most of our expenses tend to be monthly, so when you depend on dividends to pay your bills, there is always something of a disconnect between your income and your expenses. Some brokerages have minimum initial investment amounts, and others don't. Ah the expense ratio explains why you push the Vanguard fund so much. Money Mustache August 25, , am. Alex October 13, , pm. Its sprawling assets include cable communications such as high-speed internet access, theme parks, broadcast outlets NBC and Telemundo, Hollywood studio Universal Pictures, cable networks, and Sky broadcasting in Europe. Is there any particular reason why TD is better or why I should switch? Still, it looks pretty good. James October 12, , pm.

Income investors have endured plenty of turmoil in recent weeks as companies across many sectors seek to stay afloat during the coronavirus pandemic. Investing for Beginners Stocks. Copyright Policy. Phone support available, Free Domain, ai startups stocks does robinhood app look into the credic score Free Setup. I would guess based on your commitment to ending poverty that these issues must matter to you. I live in Canada. Stock Market Basics. Dividend investing is a great investment strategy for those looking to compound their wealth through time. Frugal Toque be gracing these pages? The company will just build up an infinitely large cash hoard, which does not benefit shareholders. While this may seem like a clear vindication for advocates of index funds, I will put forward a few lessons I would take away from this exercise and apply when trying to put together a does vanguard reinvest individual stock top entertainment penny stocks "buy and hope to never sell" portfolio:. STAG acquires single-tenant properties futures trading brazil vs usd free pdf how to day trade the industrial and light manufacturing space. Go ahead and click on any titles that intrigue you, and I hope to see you around here more. More broadly, though, there's a lot of room for pivoting into interesting spaces when you're an early ish mover into robots, machine learning, and artificial intelligence. Ah the expense ratio explains why you push the Vanguard fund so. One tip that I would have would be to make it more accessible for non US readers, such as Germans, like. Getting Started. I think land lording sounds kinda fun. My wife and I are finally in a position out of debt! If so, you need to pay that off. Otherwise they would be a profit-making, non-growing, non-dividend paying company. Skipping a few more oil companies and one conglomerate, our next pick is 14 on the Fortune list: the United States Steel Corporation X.

The idea of an ideal holding time being "forever" sounds easy to say, but nearly impossible to practice. And, for those international commenters: careful what you invest in, currency fluctuations can can wipe all gains…. I like making money in the stock market, but I love dividends. Its cash flows are backed by long-term leases to high-quality tenants. October 8,pm. And that's not even mini money sorter and bank by nadex interactive brokers forex income worksheet it gets most of its profit. I assume this is a total rip off and I should dump this, move to Vanguard and save big. Want More? Bluehost - Top rated web hosting provider - Free 1 click installs For blogs, shopping carts, and. I think land lording sounds kinda fun. We need powerful research tools to be successful dividend growth investors. However, I really know nothing about stocks, so I was having some trouble understanding this post. Xmr btc exchange bitcoin broker australia once in a while I am surprised by the benefits of dividend investing. Dividend investing is a great investment strategy for those looking to compound their wealth through time.

Hi, I live in Canada. As with Ford, it seemed to enjoy spectacular outperformance in the '80s and '90s, and then spectacular collapses in the s and again in the late s. To save time and the hassel of moving to Vanguard but may be i have too? MMM May 25, , pm. Ray July 21, , pm. This was not due to fees, but rather due to significant underperformance in 7 out of the 10 names, often quite dramatically as seen with GE, X, and DD. General Electric is 5. Make sure to read our analyst Jason Hall's full buy thesis on each of these eight dividend stocks. Read up on the best brokerages and how to open a brokerage account before rushing into brokerage you see advertised. NancyN December 29, , am.

Who Is the Motley Fool? Copyright Policy. Just find out what stocks are in your index, at which ratio, and make your own little basket of stocks. Importantly, all have a long history of taking care of their shareholders with consistent monthly dividend checks. Nick September 15, , pm. What do you think? Three years after the low in you are just getting back to your money. And you can connect it to your regular ING Electric Orange account for easy electronic transfers to and from Vanguard at any time. My wife and I are finally in a position out of debt! We've detected you are on Internet Explorer.