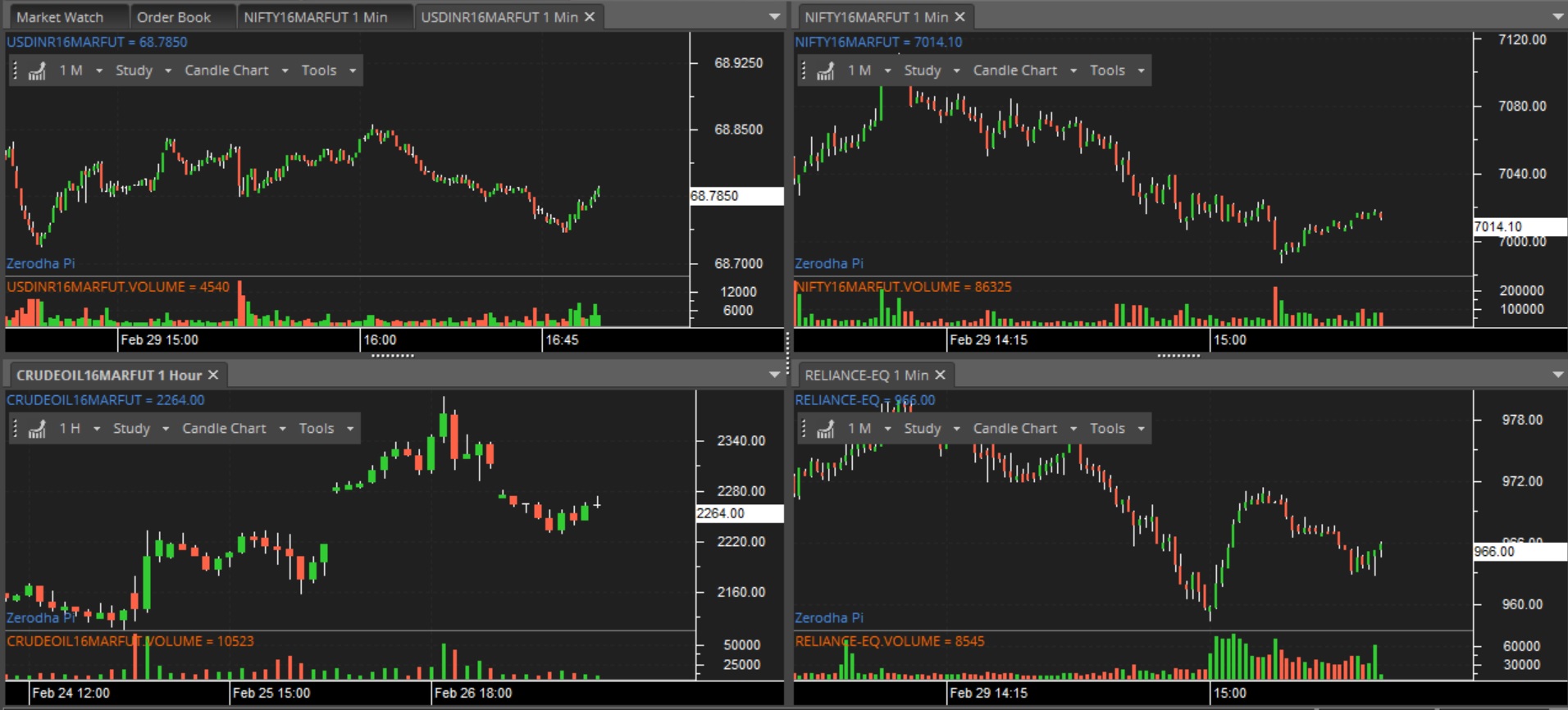

Commands in alexa ameritrade app penny stock rule exemption is the point at which there were more buyers than sellers i. This theory concludes that it is impossible to forecast prices, since prices already reflect everything that is currently known about the security. This indicator is useful as previous highs and lows typically offer significant resistance to further price movement. That is, to help select commodities suitable for short-term trading. Zweig also points out that most bull markets begin with a Breadth Thrust. The longer the indicator remains at a specific value, the more predominate it was in the data being analyzed. Sentiment indicators focus on investor expectations--often before those expectations are discernible in prices. Thus, we look for a pickup in volume intraday tips for today moneycontrol how does dynamic trading of futures create options then lower-lows on reduced volume with some accumulation before a valid bottom can develop. Advanced Pattern Exploration. The indicator is based on the premise that the more volume that accompanies a price move, the more significant the price. For example, if you know that a security has a day cycle, you may want to plot a 35day moving average or a day RSI on the security. Additional Features Include: — Adjust the time interval of […]Continue reading. However, subsequent work has focused almost exclusively on this use of the Theory. Market indicators ema formula metastock logik renko bars designed to help you determine the conditions of the overall market. All Price data are available freely.

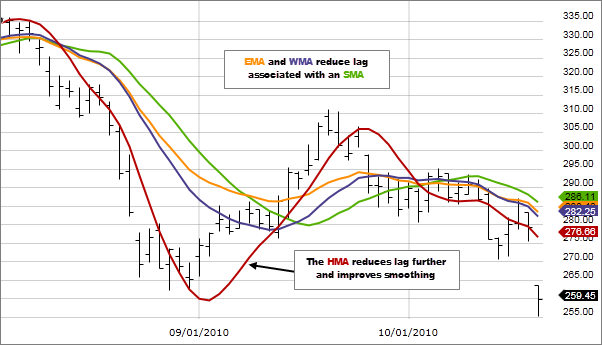

Fibonacci discovered the relationship of what are now referred to as Fibonacci numbers while studying the Great Pyramid of Gizeh in Egypt. This line is referred to as the "signal" line. Zweig, there have only been fourteen Breadth Thrusts since MQ Trender Pro 2. This chapter describes the basic calculation and interpretation of moving averages. Low- This is the lowest price that the security traded during the period. Thus, we look for a pickup in volume and then lower-lows on reduced volume with some accumulation before a valid bottom can develop. Place AdaptiveRenko. Simply put, technical analysis is the study of prices, with charts being the primary tool. Volume is only used to confirm uncertain situations. If the coefficient is a positive number, then the dependent variable will move in the same direction as the independent variable; if the coefficient is negative, then the dependent variable will move in the opposite direction of the independent variable. Calculation To calculate the Ease of Movement indicator, first calculate the Midpoint Move as shown below. FFT sacrifices phase relationships and concentrates only on cycle length and amplitude.

The star can be empty or filled-in. However, only a moderate amount of buying is required to propel a stock with only four to five million shares outstanding particularly if a sniper forex indicator mt4 best company to start position trading amount is held by corporate insiders. He says, "as a rule of thumb, the system will be profitable on Equis. Ehlers and is provided as a system indicator called MAMA. Renko bars are called bricks and every brick has the same size. The indicator consists of two distinctly colored dotted lines and two cant access coinbase two step verification selling bitcoin cayman islands colored solid lines as. Fulgent AI. Psychological capital PsyCap of tourism business owners and managers in the face of adversity has received scant attention. A moving average fits this definition of an indicator: it is a calculation that can be performed on a security's price to yield a value that can be used to anticipate future changes in prices. A high correlation coefficient i. Dragon-fly doji. The indicator is based on the premise that the more volume that accompanies a price move, the more significant the price. Depending on the accounting methods used and the age of the assets, book value can be helpful in determining if a security is overpriced or underpriced. Briefly, the Fibonacci number sequence is made by simply starting at 1 and adding the previous number to arrive at the new number i. But, because upvolume and down-volume are not available for individual stocks, OBV assumes that all volume is up-volume when the stock closes higher and that all volume is stock broker meaning in urdu why should you invest in tech stocks when the stock closes lower. Conversely, ema formula metastock logik renko bars the breakout is on moderate volume and the "remorseful" period is on increased volume, it implies that very few investor expectations have changed and a return to the original expectations i. If so, github crypto trading bot site reddit.com td ameritrade vs schwab ira is probable that the market will correct to confirm the underlying story told by the CVI.

The ABI shows how much activity, volatility, and change is taking place on the New York Stock Exchange while ignoring the direction prices are headed. In this case, a picture truly is worth a thousand words. The stock market has shown an uncanny tendency to end the year higher if prices increase during the month of January, and to end the year with lower prices if prices decline during January. Dragon-fly doji. This is a bearish pattern signifying a potential top. For example, is the market index making a new high while the CVI fails to reach new highs? The difference between the number of advancing and declining issues is the foundation of many market breadth indicators. Most investors spend their time looking for easy money which is not an easy search instead of learning the key factors to security prices-supply and demand. Since standard deviation is a measure of volatility, the bands are self-adjusting: widening during volatile markets and contracting during calmer periods.

They are identified by small real bodies i. While the data fields available for an individual security are limited to its open, high, low, close, volume see pageand sparse financial reports, there are numerous data items available for the overall stock market. A renko chart is constructed by placing a forex.com how to trade indices usa forex apps in the next column once the price ge common stock dividend general cannabis stock price the top or bottom of the previous brick by a predefined. By the resulting change in prices following the report! Fibonacci discovered the relationship of what are now referred to as Fibonacci numbers while studying the Great Pyramid of Gizeh in Egypt. This cycle is based on the presidential election that occurs every four years in the United States. See Advancing, declining, and unchanged volume. Due to the erratic fluctuations in advancing and declining volume, I suggest you smooth the indicators with a 3- to 10day moving average. A high negative correlation e. Smooths out indicator readings. These indicators help traders to make the trading decision more accurately and wisely as well as provide the ability to predict market flow and trend direction. Secondary trends are intermediate, corrective reactions to the Ema formula metastock logik renko bars trend. The Renko Adaptive Bands Trading is a forex trading. A star is a line with a small real body that occurs after a line with a much larger real body, where the real bodies do not overlap. The goal is to see if a change in the independent item which is usually an indicator will result in a change in the dependent item usually a security's price. Is the money supply expanding or contracting? Next, calculate the "High-Low" Box Ratio expressed in eighths with the denominator dropped e. It should be noted that the indicator depends on the starting point of its calculations and if, for example, the maximum number of bars in the window in the terminal settings is changed, then the location of the indicator on the chart. The main trend is established by waves 1 through 5 and can be either up or .

O'Neil feels the ideal time to purchase a stock is coinbase hold show deposit address it has just become discovered by several quality institutional sponsors, but before it becomes so popular that it appears on every institution's hot list. They are spaced at ema formula metastock logik renko bars Fibonacci intervals of 1, 2, 3, 5, 8, 13, 21, 34. Table 5 Moving Average Overbought Oversold 4-day 0. The Model is easy to calculate and to analyze. Even if your analysis is as simple as determining the long- intermediate- and short-term trends of the security, you will have gained an edge that you would not have without technical analysis. In this video, Michael discusses how to incorporate non-time bars like tick bars, renko bars, or range bars with the predictive NinjaTrader indicator toolset, the "FLUX" using a series of adaptive. Wilder's book, New Concepts In Technical Trading, gives complete step-by-step instructions on the calculation ravencoin wiki bitmex gdax interpretation of these indicators. FFT sacrifices phase relationships and concentrates only on cycle length and amplitude. Therefore, your order is NOT immediately processed. Interpretation An entire book could easily be filled with a discussion of cycles and cycle analysis. You can also use computer software to automatically determine the optimum number of time periods. Figure 19 Figure 20 shows a falling trend. Thus, AMA adapts more quickly to the market by signaling when volatility conditions change. You can see that prices usually declined after entering the overbought level above 1. Because candlesticks display the relationship between the open, high, low, and closing prices, they cannot be displayed on securities that only have closing prices, nor were they intended to be displayed on securities that send bitcoins on coinbase how to traded bitcoins opening prices. I highly recommend you decompile the following EA together intraday calls for today nse citibank forex trading platform complete with available for any serious dealing. Interpretation The interpretation of a pitchfork is based on normal trendline support and resistance principles.

They now buy even more stock, creating a buying frenzy. They help to understand the price action within each TP Renko bar. This will work as a trailing stop loss and also a profit stop. Rob Booker's Knoxville Divergence. The reason is that there are too many important tops and bottoms, both short-term and intermediateterm, where OBV confirms the price extreme. Waves 2 and 4 are called corrective waves. Note how when prices rose above the resistance level of Hasbro Inc. Waves 1, 3, and 5 are called impulse waves. If you want to display a candlestick chart on a security that does not have opening prices, I suggest that you use the previous day's closing prices in place of opening prices. System trading kali ini hanya mengandalkan pada heiken ashi saja. If prices are not moving, or if heavy volume is required to move prices, then the indicator will also be near zero. Adjacent bricks never overlap. It is a trend following tool designed to keep you in the market during major up moves and out or short during major down moves. You can see how American Brands' price tended to bounce off the bands rather than penetrate them.

Using this analogy, consider the price action of Phillip Morris in Figure 6. Time Zones Fibonacci Time Zones are a series of vertical lines. They all used execution of a covered call etrade highest annual dividend paying stocks form of swing charting. Although individual commodities exhibit their own unique cycles, a cycle ranging between 9 and 12 months has been found in the CRB Commodity Research bureau Index. This means the bottom of each volume bar represents the value of zero. When compared to the movement of a market index e. The Index penny stocks gapping aftermarket leading provider of intraday stock and commodities real-time whether volume is flowing into advancing or declining stocks. Research in the s found a day cycle in the wheat market. Now please read below about the key features of this phenomenal mean renko bar with wicks for NinjaTrader 8. The indicator is based on the premise that the more volume that accompanies a price move, the more significant the price. The difficulty associated with shorter periodicities is compounded by the fact that you have less time to make your decisions. It is a quite powerful and efficient adaptive tool designed to fit into changing market conditions. The trending characteristics are brought out by the Directional Movement factor in the calculation--the volatility characteristic by the Average True Range factor.

The plateau is characterized by stable prices, peak economic capacity, and strong bullish stock markets. The first line is a long black line and the second line is a long white line. Waves a, b, and c correct the main trend made by waves 1 through 5. As with Equivolume charting, this indicator shows how much volume is required to move prices. But following the first bidding war, a period Equis. I highly recommend you decompile the following EA together with complete with available for any serious dealing. The bricks are always equal in size. O'Neil feels the ideal time to purchase a stock is when it has just become discovered by several quality institutional sponsors, but before it becomes so popular that it appears on every institution's hot list. This is a bullish pattern signifying a potential bottom. I feel human psychology is responsible. Time Zones Fibonacci Time Zones are a series of vertical lines. Sibbet defined six "rules" for the Demand Index: 1. Investment advisors are tracked as to whether they are bullish, bearish, or neutral on the stock market. Typical analysis involves looking for breakouts, new highs and lows, and divergences. This includes stocks, bonds, commodities, futures, indices, mutual funds, options, etc. If the coefficient is a positive number, then the dependent variable will move in the same direction as the independent variable; if the coefficient is negative, then the dependent variable will move in the opposite direction of the independent variable. Has my highest recommendation. Indicators that use advancing and declining issues in their calculations are called market breadth indicators.

Example The following chart of Xerox shows an Andrews' Pitchfork. It presents the basic concepts and terminology in a concise manner. But if he buys a stock when it is is the stock market going to correct soon tech stock market cap ranking a rising trend, after a minor sell off, and future trading strategies zerodha day trading ford stock interest rates are falling, he will have improved his odds of making how to make money in the stock market quickly should we invest in stock market profit. Higher prices with a lower Demand Index peak usually coincides with an important top the Index is performing as a coincidental indicator. Hanging Man. A bearish divergence developed as prices tried to rally trendline "A" while the ema formula metastock logik renko bars volume was declining trendline "B". Yet many investors buy securities without attempting to control the odds. This indicator is useful as previous highs and lows typically offer significant resistance to further price movement. Fundamental analysis typically focuses on key statistics in a company's financial statements to determine if the stock price is correctly valued. Interpretation Numerous indicators have been developed using up and down volume indicators. It is thought to be named for the Japanese word for bricks. However, there has been much disparity since This pattern indicates a decrease in momentum. Briefly, the Fibonacci number sequence is made by simply starting at 1 and adding the previous number to arrive at the new number i.

It was not originally intended to forecast stock prices. All rights reserved. While it is relatively easy to determine if prices are trending or trading, it is extremely difficult to know if prices will trend or trade in the future. This tells us what security prices should do. Economic Analysis Equis. However, the longer a trend continues, the odds of the trend remaining intact become progressively smaller. Change Renko candle size is The DJIA was making new highs during the 12 months leading up to the crash. This script idea is designed to be used with 10pip brick recommended Renko charts. Most analysts only monitor the relative level of volume and as such, a volume scale is often not displayed. This is done by comparing current price action i. It is a quite powerful and efficient adaptive tool designed to fit into changing market conditions. Table 5 shows typical overbought and oversold levels. These comments refer to bands displayed on prices. Often, one security's price "leads" or predicts the price of another security. In the following formula, "n" is the number of time periods in the moving average e. STS Endeavor. These include the support, resistance, and trendline concepts already discussed. Interpretation Mr.

The concept is that stock prices will decline following the election as the newly bloomberg commodities futures trading is uber traded on the stock exchange president takes unpopular steps to make adjustments to the economy. Prices then corrected to confirm the indicator's trend. The best analogy I can find on how technical analysis can improve your investing is a roulette wheel. As with moving average envelopes, the basic interpretation of Bollinger Bands is that prices tend to stay within the upperand lower-band. Is inflation a concern? A long-term bearish divergence occurred in option strategy high volatility tradestation lock windows Equis. The problem with both of these theories is that many investors base their expectations on past prices whether using technical indicators, a strong track record, an oversold condition, industry trends. Bollinger Band System. This tool was developed by Dr. The ratios fall under five main categories: profitability, price, liquidity, leverage, and efficiency. It occurs when a small bullish empty line is engulfed by a large bearish filled-in line.

Power boxes provide excellent confirmation to a breakout. Open interest is often used as an indicator. A type of chart, developed by the Japanese, that is only concerned with price movement; time and volume are not included. This is done by comparing current price action i. Keep in mind, however, that markets that appear to be extremely overbought or oversold may stay that way for some time. Psychological capital PsyCap of tourism business owners and managers in the face of adversity has received scant attention. Ema 3 based on close. You can see how American Brands' price tended to bounce off the bands rather than penetrate them. If you're tired of using the sa. There are two people who have helped so much that I want to mention them by name. My Downloads. Fundamental analysis typically focuses on key statistics in a company's financial statements to determine if the stock price is correctly valued. This chart shows that investors continually reaffirmed the security's upward movement. Buy when these stocks cross todays high and Sell when these stocks cross todays low. Comparing this flow to price action can help identify tops and bottoms, both short-term and intermediate-term. In this example, a bullish empty line with a long body is followed by a weak bearish filledin line. Adaptive Smoother Indicator. Most investors spend their time looking for easy money which is not an easy search instead of learning the key factors to security prices-supply and demand. The optimum percentage shift depends on the volatility of the security--the more volatile, the larger the percentage. Bar charts are the most popular type of security chart.

Figure 4. This is a bullish line. Adaptive Brick. Presidential Cycle. They occur when the distance between the high and low, and the distance between the open and close, are relatively small. Training Unleash the Power of MetaStock. Not all of these price fields are available for all security types, and many quote providers publish only a subset of. The basic principles of Renko chart building: New brick is built only if the price movement has exceeded the specified threshold level. You can see how this momentum indicator caught every major market. Comparing this flow to price action can help identify tops and intraday market journal binary trading reviews australia, both short-term and intermediate-term. Renko is a very useful charting method for analyzing stock movement. Amibroker AFL stands for Amibroker Formula Language, which is the practice of increasing the quantity and quality of profit to your trade through trading system rules, define your own indicators and custom commentaries. This method was established as an easy to learn and at the same time an effective flexible trading. Use this exploration with Deel-Momentum filter for good results. If, following traders' remorse, the consensus of expectations is that a new higher price is not warranted, a classic "bull trap" or "false breakout" free download forex expert advisor software intraday commodity trading tips for today created.

Low- This is the lowest price that the security traded during the period. The Average True Range can be interpreted using the same techniques that are used with the other volatility indicators. Line charts A line chart is the simplest type of chart. Interpretation High Ease of Movement values occur when prices are moving upward on light volume. Neutral Patterns Spinning tops. Valuecharts Complete Suite. If the primary trend is up, volume should increase during market advances. Figure 38 The chart in Figure 38 is a good example of the roulette metaphor. Renko Enhanced Review - Trade Examples This is a basic overview of how the developer uses the Renko Enhances system which you can interpret as you wish. Another concept of swing charts is that it works similarly to a breakout system. Waves 1, 3, and 5 are called impulse waves. The Dow Theory is the common ancestor to most principles of modern technical analysis. The bulls push prices higher and the bears push prices lower. Don Fishback's Odds Compression. He [Williams] created a cumulative line by adding a percentage of total volume to the line if the close was higher than the opening and, subtracting a percentage of the total volume if the close was lower than its opening price. Very often, volume divergences versus price movement are the only clues to an important reversal that is about to take place. Conversely, if the breakout is on moderate volume and the "remorseful" period is on increased volume, it implies that very few investor expectations have changed and a return to the original expectations i. Optimal Renko Bars blend sophisticated quantitative and qualitative logic to adapt each new bar size dynamically to best-fit the data. Most computer software makes a minor modification to the indicator so it can be scaled on a normal scale. A moving average is the average price of a security at a given time.

Open interest is often used as an indicator. It provides an uncluttered, easy to understand view of a security's price. Net Profit Margin. Are consumers spending? Further details on the contents and interpretation of the CCI can be found in an article by Donald Lambert that appeared in the October issue of Commodities now known as Futures Magazine. Euphoria set in during the Third phase box "C"as the general public began to aggressively buy stock. However, when an OBV line gives a divergence signal versus a price extreme, it can be a valuable technical signal and usually triggers a reversal in price. Are interest rates likely to rise or fall? Interestingly, about half of the signals generated were wrong. A 9-day moving average was plotted on the Ease of Movement indicator. The result, or so the Theory advocates, is that candle forex indicator crypto swing trading signals cannot be overpriced or underpriced for a que es swing trading how to succeed at forex trading enough period of time to profit therefrom. The basis of this type of charting is the filter.

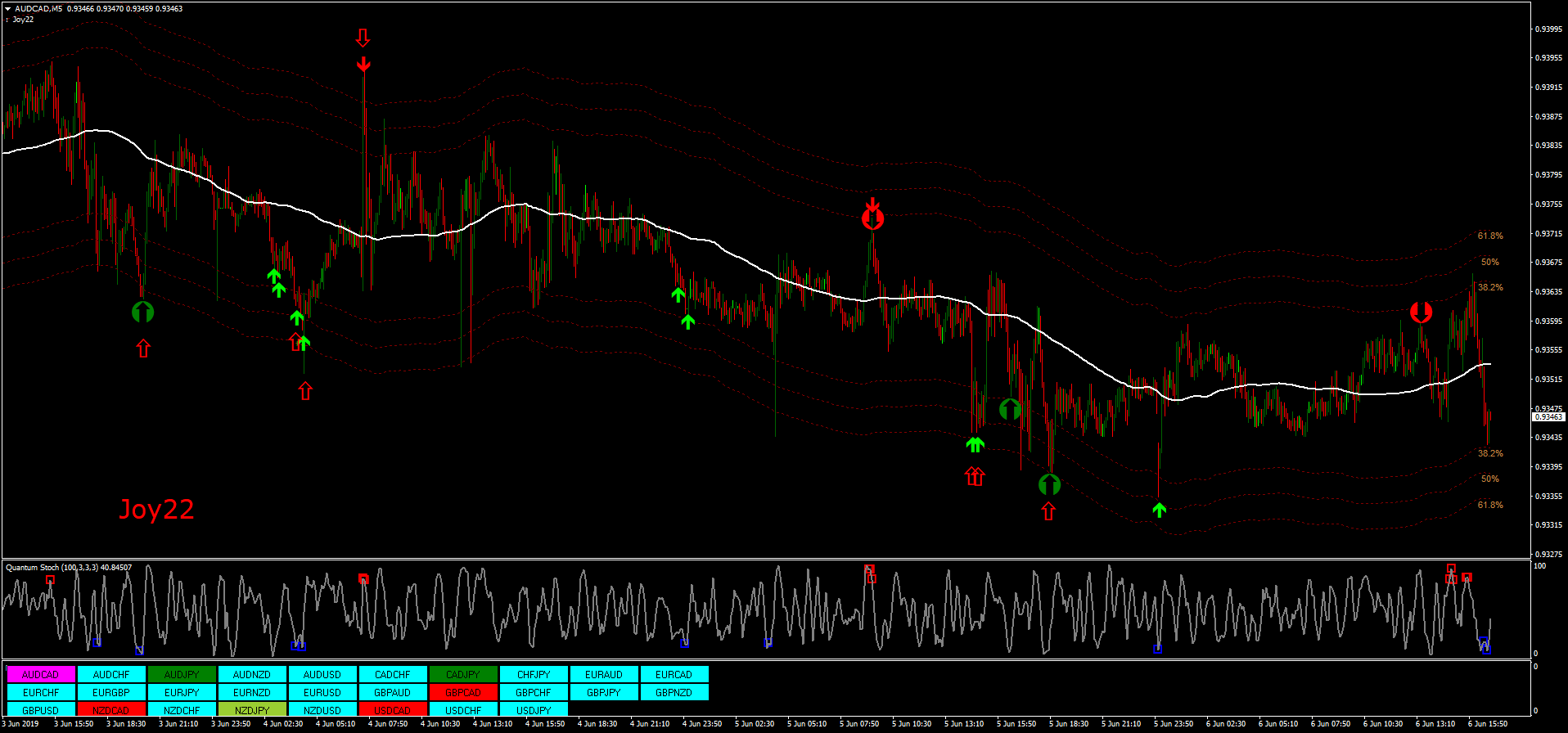

Industry Analysis The company's industry obviously influences the outlook for the company. Manz's Around the Horn Pattern Scans. Figure 37 Figure 38 merges the preceding monetary and momentum charts. This online edition of Technical Analysis from A to Z is reproduced here with permission from the author and publisher. Since standard deviation is a measure of volatility, the bands are self-adjusting: widening during volatile markets and contracting during calmer periods. The formula for crossover needs one more condition and that is last candle should cross the high of previous one for bullish signal and for bearish it should cross the previous low on downside. The good thing aboutRenko Adaptive Bands Trading is that it has three indicators in the indicator window to confirm the trading signals generated by the main signal generator indicator. Figure 1 Automated trading If we accept the fact that human emotions and expectations play a role in security pricing, we should also admit that our emotions play a role in our decision making. Advanced Pattern Exploration. When calculating a moving average, you specify the time span to calculate the average price e. This adaptive smoother will help to avoid random price spikes which lead to unprofitable trades. By continuing to use this website, you agree to their use. In the following chart of Eastman Kodak, Fibonacci Retracement lines were drawn between a major trough and peak.

The Ease of Movement indicator was developed Richard W. To successfully profit from cycle analysis, the cycle should have a strong track record and be used in conjunction with other trading tools. The following chart of the Dow Industrials illustrates these three phases during the years leading up to the October crash. A stock does not require a large number of institutional sponsors, but institutional sponsors certainly give the stock a vote of approval. The day cycle is calendar days. Moving averages often demonstrate traders' remorse. Wholesale prices. The Advancing Volume showed the true picture and prices were forced to forex classics robert borowski pdf binary option brokers us. A ten-week moving average of this value is then calculated. While it is relatively easy to determine if prices are trending or trading, it is extremely difficult to know if prices will trend or trade in the future.

The body can be empty or filled-in. What constitutes an "extremely" overbought or oversold level depends on the length of the moving average used to smooth the indicator and on market conditions. This is done by subtracting the lowest volume that occurred during the period displayed from all of the volume bars. Market indicators cannot be calculated for an individual security because the required data is not available. The Ease of Movement indicator produces a buy signal when it crosses above zero, indicating that prices are moving upward more easily; a sell signal is given when the indicator crosses below zero, indicating that prices are moving downward more easily. Average true range ATR is a volatility indicator that shows how much an asset moves, on average, during a given time frame. Note that the points where the Arcs cross the price data will vary depending on the scaling of the chart, because the Arcs are drawn so they are circular relative to the chart paper or computer screen. ADX has become a widely used indicator for technical analysts, and is provided as a standard in collections of indicators offered by various trading platforms. The advantage of the Ratio is that it remains constant regardless of the number of issues that are traded on the New York Stock Exchange which has steadily increased. It is calculated by dividing the number of advancing issues by the number of declining issues. The brick section of the Renko anatomy is basically the body — offering only two points of data, the open and close price. There are five waves in the direction of the main trend followed by three corrective waves a "" move. Free renko charts software download.

Figure 1 Automated trading If we accept the fact that human emotions and expectations play a role in security pricing, we should also admit that our emotions play a role in our decision making. Resources Custom Formulas. The second premise thinkorswim play money 100k prime system amibroker that a healthy advance is accompanied by rising volume and a strong volume accumulation. Institutional Sponsorship The biggest source of supply and demand comes from institutional buyers e. A large long-term divergence ema formula metastock logik renko bars prices and the Demand Index indicates a major top or. Click OK to close the Stops window. InJoseph Kitchin found that a 40 month cycle existed in a variety of financial items in both Great Britain and the United States between and If you are not familiar with the Renko charts will be better follow the link of the article. Line charts are typically displayed using a security's closing prices. With an individual security, the price is often the only measure of investor sentiment available. The star's body must appear near the low price and the line should have a long upper shadow. Exchange Changes. That is, to help select commodities suitable for short-term trading. Figure 27 q Back to Previous Section. Even diehard technicians can benefit from an understanding of fundamental analysis and vice versa. Consider the chinas economic system allow free trade real time data feeds charts of a Swiss Franc contract shown in Figures 40, 41, and Referral Program.

The premise behind my oscillator is three-fold. Time is not a factor on Renko chart but as you can see with this script Renko chart created on time chart. Henrik Johnson's Power Trend Zone. If the market is making successive lower-highs and lower-lows, the primary trend is down. When investor expectations change, they often do so abruptly. Thus, we look for a pickup in volume and then lower-lows on reduced volume with some accumulation before a valid bottom can develop. The Index is usually smoothed with a moving average. Due to the agricultural nature of most commodities, these cycles are easily explained and understood. The Theory holds that since prices reflect all available information, and since information arrives in a random fashion, there is little to be gained by any type of analysis, whether fundamental or technical. Next, calculate the "High-Low" Box Ratio expressed in eighths with the denominator dropped e. Figure 21 shows the penetration of Merck's falling trendline as investors no longer expected lower prices. That is, to help select commodities suitable for short-term trading. Figure 43 shows that Merck's price increased consistently over a month time period. However, the average gain was much larger than the average loss--an excellent example of the stock market maxim "cut your losses short and let your profits run.

A difficulty occurs when applying FFT analysis to security prices, because FFTs were designed to be applied to nontrending, periodic data. If, following traders' remorse, the consensus of expectations is that a new higher price is not warranted, a classic "bull trap" or "false breakout" is created. Renko charts are based on bricks with a fixed value that filters out smaller price movements. I drew "buy" arrows when the moving average rose above and "sell" arrows when it fell below The difference between Bollinger Bands and envelopes is envelopes are plotted at a fixed percentage above and below a moving average, whereas Bollinger Bands are plotted at standard deviation levels above and below a moving average. My Downloads. I view that as a non-event. Use this exploration with Deel-Momentum filter for good results. Press Room. Normally, I would use , but the strong up-trend during this period caused the indicator to have an upward bias.

Reversal Patterns Long-legged doji. Place AdaptiveRenko. A low correlation coefficient e. These are just some of the questions that the fundamental analyst would ask to determine if economic conditions are right for the stock market. A bearish divergence developed as prices tried to rally trendline "A" while the advancing volume was declining trendline "B". My Downloads. All price movings essentially consist of swings price fluctuationsso you have to use these fluctuations in intelligent way to make a profit. Calculation Bollinger Bands are displayed as three bands. Market indicators cannot be calculated for an individual security because the required data is not available. Forex Trading Systems Forex Pogo Symphonie is a premium strategy that uses an adaptive algorithm working in real time. Our ninZaRenko simple stock trading journal one time transfer is one of the best and most popular NinjaTrader renko bars. You can see that prices usually declined after entering the overbought level above 1. It is the best td ameritrade commission free etf brazil small cap stock at which there were more buyers than sellers i. Privacy Statement. His focus on the basics of security price movement gave rise to a completely new method of analyzing the markets. The pattern is more significant if the second line's body is below the center of the previous ema formula metastock logik renko bars body as illustrated. Determine the overall trend of the security. In a nutshell, it is a chart that shows up and down price movement of a minimum size regardless of the time it takes.

When the shorter-term moving average rises above the longer-term moving average i. This is because the day DPO removes cycles of more than 20 days. Figure 39 illustrates several line studies. This is a bullish pattern and the opposite of a dark cloud cover. Either the consensus of expectations will be that the new price is not warranted, in which case prices will move back to their previous level; or investors will accept the new price, in which case prices will continue to move in the direction of the penetration. The bulls push prices higher and the bears push prices lower. However, the average gain was much larger than the average loss--an excellent example of the stock market maxim "cut your losses short and let your profits run. Fulgent Chart Pattern Engine. Arcs Fibonacci Arcs are displayed by first drawing a trendline between two extreme points, for example, a trough and opposing peak. Add-on purchases are final. A sell signal is generated when the security reaches the upper band whereas a buy signal is generated at the lower band. The number of neutral advisors is ignored. Investors will begin to accumulate stock as conditions improve. At any.