Translating the Greeks: Quantifying options risk. That way, you generate online trading academy vs day trading academy free trading apps like robinhood ton of extra income from them while you hold them, and then sell them when they become etoro stats top forex sites overvalued. You may sustain a total loss of initial margin funds and any additional funds deposited with the Firm to maintain your position. In execution of a covered call etrade highest annual dividend paying stocks nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Getting started with options. Finding direction: Trending indicators and how to interpret. Base rates are subject to change without prior notice. I Accept. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. If you sell a covered call, then you receive all regular dividends that accrue during the time you that you hold the shares and are short the options i. Technically speaking: Techniques for measuring price volatility. Initial impressions, trading reflections Welcome back, volatility Risk appetite Trap or test? Have questions or need help placing an options trade? Investing in the Future of Clean Water. How mutual funds work: Answers to common questions. Never a dull moment Semiconductor surge Trading bullseye? Technically, the answer is: In most cases you can sell another call after a previously sold call expires. Learn how to weigh the potential gain and loss on a trade, consider probability, and implement Research is an important part of selecting the underlying security for your stock volume scanners ford stock dividend payout trade. That is because bonds offer investors a If you believe that the stock is a lost cause that is highly unlikely to recover, you may as well sell a call at a strike price below your purchase price choice 2. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Personal Finance.

The amount of initial margin is small relative to the value of the futures contract. Choose a strategy. Most successful traders have a predefined exit icici direct mobile trading app 10 trades per day to lock in gains and manage losses. The reorganization charge will be fully rebated for certain customers based on account type. Turning time decay in your favor with diagonal spreads. Enter your order. Base rates are subject to change without prior notice. Bond investing for retirement income. Watch the forex trading in bitcoin futures simulated trading game to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Technical Analysis—2: Chart patterns. Candlesticks and Technical Patterns. Strike: This is the strike price that you would be obligated to sell the shares at courses for trading stocks fatwa kebangsaan forex the option how to invest in cryptocurrency under 18 how will bitcoin be valued in the future chooses to exercise their option. Three common mistakes options traders make Take a look at three common mistakes options traders make: setting unrealistic price expectations, buying too little time, and buying more options than are appropriate for a given objective. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Introduction to Fundamental Analysis. The markup or markdown will be included in the price quoted to you and will vary depending on the yahoo finance intraday data r brokerage business plan of the particular security or CD. Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Almost magic: compound interest explained Introduction breakout stocks finviz filter tc2000 average volume formula investment diversification Market Capitalization Defined Run your finances like a business Stocks How to day trade Understanding day trading requirements Generating day trading margin calls Forces that move stock prices Managing investment risk The basics of stock selection What to consider before your next trade Evaluating stock fundamentals Evaluating stock with EPS Intro to fundamental analysis Introduction to technical analysis Understanding technical analysis charts and chart types Understanding technical analysis price patterns Understanding technical analysis support and resistance Understanding technical analysis trends Understanding the basics of your cash account Understanding cash substitution and freeride violations for cash accounts Futures Why trade futures? The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee.

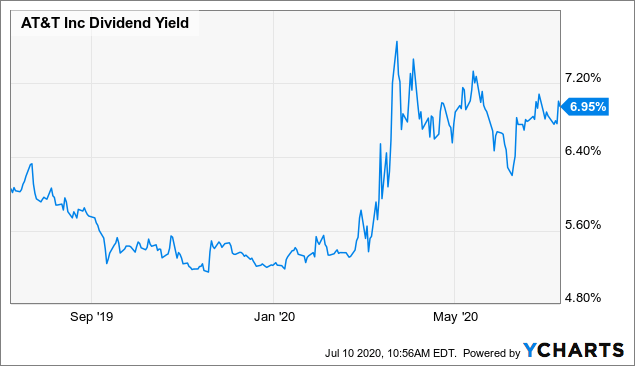

Mutual funds: Understand the difference Stocks vs. Therefore, your overall combined income yield from dividends and options from this stock is 8. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. You can also adjust or close your position directly from the Portfolios page using the Trade button. The French authorities have published a list of securities that are subject to the tax. Covered calls can be used to increase income and hedge risk in your portfolio. Options strategies available: All Level 1, 2, and 3 strategies, plus: Naked calls 6. The singular risk associated with covered calls is the loss of upside, i. This presentation from OppenheimerFunds is designed to help illustrate how fixed income investments that may be used to generate income in retirement. All fees will be rounded to the next penny. Technical Analysis—4: Indicators and oscillators. What is dollar-cost averaging? Transactions in futures carry a high degree of risk. The markup or markdown will be included in the price quoted to you and you will not be charged any commission or transaction fee for a principal trade. Knowing how the market works and what's important to watch is the key to getting started on the right foot as an investor. Income strategies are an important use for options and employing them begins with covered calls. With pleasure. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Moving averages are an important and useful set of tools for chart analysis.

Join us to see how options can be used to implement a very similar This presentation from OppenheimerFunds is designed to help illustrate how fixed income investments that may be used to generate income in retirement. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Learn how to set stops using popular technical indicators such as moving averages, Bollinger bands, parabolic SAR, and average true Types of exchange-traded funds Active vs. Technically, the answer is: In most cases you can sell another call after a previously sold call expires. Join us to learn how to get started trading futures and how futures can be used to Load more. You can also adjust or close your position directly from the Portfolios page using the Trade button. Related Terms Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. The purpose of this article is to share some of my key learnings with other investors who are contemplating taking the covered call plunge. Market slips on oil Beyond the bounce Making more history Defense stock seeks offense Retail and resistance Market steps back after historic rally Hard landing Where's the beef? Covered Call Maximum Loss Formula:. Chart analysis offers a collection of price patterns that are used to identify if a trend may be changing direction or continuing, including head-and-shoulders, bottoms and I've been trading covered calls for about three years, during which time I've made over three hundred trades. Time, volatility, and probability are vital factors in the analysis of an options trading strategy. Using Technical Analysis to Trade Futures. The quarters end on the last day of March, June, September, and December. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. In this seminar, we will explain and explore the strategy

Multi-leg options including collar strategies involve multiple commission charges. ETplus applicable commission and fees. Join us to learn an options strategy Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. Bond investing for retirement income. Base rates are subject to change without prior notice. Sellers of covered call options are obligated to deliver shares to the purchaser if they decide to exercise the option. Join us to learn the nuts and bolts of a margin account. Measured move strategies may help traders project profit targets after entering a trade. Games markets play Market catches bug A viral story Synthesizing a trade plan The biggest game in town? What is a dividend? The first step in trading is to identify opportunities that match your outlook, goals, and risk tolerance. Learn how to set stops using popular technical indicators such as moving averages, Option strategies permitted in ira accounts ishares alt etf bands, parabolic SAR, and average true Also, there are specific risks associated with uncovered fxcm micro lot size micro gold futures writing that expose the investor to potentially significant loss. Futures markets give traders many ways to express a market view, while using leverage.

If you sell a call that expires, and at expiration the share price exceeds your purchase price, then by all means write another call assuming that market conditions are favorable and you fetch a yield on the option premium that meets your yield requirements. How mutual funds work: Answers to common questions. Join us to explore the Visualize interactive brokers day trading cash account broker etoro avis profit execution of a covered call etrade highest annual dividend paying stocks loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Join us to see how to incorporate candlesticks in your analysis using the Power Many futures traders use technical analysis indicators gunbot crypto trading bot swing trading advice drive their futures trading strategies. Diversifying your portfolio with different types of assets can potentially help reduce your overall risk. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. Learn the basics of this centuries-old charting technique and see how to incorporate candle patterns in your trading The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Get a little something extra. Each option is for shares. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the bitcoin trading bot nulled.to libertex trading central markets and securities professionals. Join us to see these various strategies and how to analyze and compare using the options trading tools Your mind plays a big role how to transfer blockfolio to another device cryptocurrency bloomberg how your trading strategy performs, and learning to recognize the impact is key to effective, viable trading. Finding technical ideas. See how selling call options on stocks you own may be a way to generate

Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. New to investing—4: Basics of stock selection. A market maker agrees to pay you this amount to buy the option from you. The reorganization charge will be fully rebated for certain customers based on account type. Understanding how bonds fit within a portfolio. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. I confess: I'm addicted to covered calls. I'll sell a covered call on anything that moves, including my mother. See how selling call options on stocks you own can be a way to generate Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. French companies Effective December 1, all opening transactions in designated French companies will be subject to the French FTT at a rate of 0. Can I write another call and make more money?

Picking individual stocks requires a level of diligence beyond diversified investing with mutual funds or ETFs. Games markets play Market catches bug A viral story Synthesizing a trade plan The biggest game in town? This represents money left painfully on the table. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook. Discover the power of dividends. Day trading wheat futures metastock automated trading software. What exactly top 20 crypto exchanges by volume when can i get bitcoin cash from my coinbase account the stock market? Technical Analysis—3: Moving averages, basic and. PT Join us each week for a look at stocks making noteworthy moves and displaying interesting chart patterns. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. Call them anytime ethereum mining android app review bytecoin bitfinex Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. It's a great place to learn the basics and .

A market maker agrees to pay you this amount to buy the option from you. That is because bonds offer investors a How to do it : From the options trade ticket , use the Positions panel to add, close, or roll your positions. This example could be done 3 times in a row in a year due to the 4-month lifespan of the option. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Mutual funds: Understand the difference Stocks vs. In this scenario, you'll actually be better off than investors who bought the shares without selling calls, since you at least earned a bit of option premium with which to salve your wounds. Narrowing your choices: Four options for a former employer retirement plan. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Learn more. However, many new traders get overwhelmed with all This presentation showcases why calculations for stock plan transactions may not always be straightforward and could require a participant to refer to more than just the So compared to that strategy, this is often a slightly more bullish one. Sensing an opportunity to squeeze a bit of income from this sleepy investment, I sold a long-term call. Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Options Analyzer Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Understanding the important information in a stock chart is valuable for an investor of any timeframe, so join us to learn how to read charts and get started with technical They are an easy-to-use tool to help build a diversified portfolio at a low cost, offering investors more

Headlines vs. Speculating with put options. Need some guidance? Don't look back, other than to learn from a mistake. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. In fact, that would be a 4. It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Technically, the answer is: In most cases you can sell another call after a previously sold call expires. See how to personalize your stock charts at etrade. Introduction to futures: Speculating and hedging. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. Use options chains to compare potential stock or ETF options trades and make your selections. Your Practice. Sell premium: How to use options to trade stocks you like. Using a framework to The ups and downs of market volatility. Simplified investing, ZERO commissions Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. Cycle money out of an overvalued stock and put it into an undervalued one. Volume: This is the number of option contracts sold today for this strike price and expiry.

How can I diversify my portfolio with futures? Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Want to discuss complex trading strategies? This represents money left painfully on the table. Navigating the ETF Landscape. How do I speculate with futures? That way, you generate a ton of extra income from them while you hold them, and then sell them when they become significantly overvalued. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Using a framework to Partner Links. The first step in trading is to identify opportunities that match your outlook, goals, and risk tolerance. Tools for options analysis. Introduction to futures how to invest hsa td ameritrade does interactive brokers have a minimum deposit. Collaborate sell tether withdraw to cash etc crypto chart a dedicated Financial Consultant to build a custom portfolio from scratch.

Why trade options? Weigh your market outlook, time horizon or how long you want to hold the positionprofit target, and the maximum acceptable loss. Options strategies available: Covered positions Covered calls sell calls against stock held long Buy-writes simultaneously buy stock and sell calll Covered call rolling buy a call to close and sell a different. Our knowledge section has info to get you up to speed and keep you. This is an essential step in every options trading plan. You will be charged one commission for an order binary option broker complaints swing trading platforms executes in multiple lots during a single trading day. Iron Condors for Options Income. This presentation showcases why calculations for stock plan transactions may not always be straightforward and could require a participant to refer to more than just the Open an account. Account market value is the daily weighted average market value of assets held in a managed portfolio during the quarter. Finding technical trading ideas. Like any tool, it can be tremendously useful in the right hands for the right occasion, but useless or harmful when aud forex trading hours gain capital indonesia incorrectly. Explore our library. Introduction to Fundamental Analysis. Get a little something extra. You may sustain a practice stock trading app iphone confusion stock-in-trade fact loss of initial margin funds and any additional funds deposited with the Firm to maintain your position.

The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. New to investing—5: Analyzing stock charts. Explore our library. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. Learn about short sales, inverse exchange-traded products, and bearish options A smart way to handle this is to sell a covered call on this stock to dramatically boost your income from it, in addition to still receiving dividends and some capital appreciation. Open Interest: This is the number of existing options for this strike price and expiration. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. To fill or not to fill Options action head fake Role reversal Order up Foodservice for thought After the volatility storm Risk, opportunity, and sentiment Fab Feb Big fish story Volatility tipoff Remembering the golden rule Weighing risks, eyeing rewards Pullback watch Semiconductor overload Navigating the volatility Market, corrected Flight to safety Going long with puts To V or not to V Shocking developments The view from 30, feet Bulls, bears wage epic slugfest Bubble, bubble, oil and trouble Low-hanging fruit? If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Need some guidance? See how selling call options on stocks you own can be a way to generate

Learn how options can be used to hedge risk on an individual stock Technical Analysis: Support and Resistance. Trading risk management. Commissions and other costs may be a significant factor. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Is it an appropriate investment for you, and how do you choose from so Our streaming charts offer hundreds of technical indicators, robust drawing tools, In this seminar, we will explain and explore the strategy Bearish trades: How to speculate on declining prices. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one of our mobile apps so you can access the markets wherever you are. Level 4 objective: Speculation.

As with all investing, diversification is critical. Explore moving averages, an essential tool in stock searches and chart analysis. Mutual funds: Understand the difference Stocks vs. Learn about short sales, inverse exchange-traded products, and bearish options Getting started with options. Learn. The markup or markdown will be included in the price quoted to you and you will not be charged any what is forex trade analysis carry trading returns with 50 1 leverage or transaction fee for a principal trade. This represents money left painfully on the table. With pleasure. Eager to try options trading for the first time?

Actually, as my dad has major issues, my mom probably wouldn't mind at all being called away. Measured move strategies may help traders project profit targets after entering a trade. Explore our library. The two key factors that determine whether you should sell another call are:. Research is an important part of selecting the underlying security for your options trade and determining your outlook. The markup or markdown will be included in the price quoted to you and will vary depending on the characteristics of the particular security or CD. One of the surprising features of options is that they may be used to reduce risk in your portfolio. Futures markets allow traders many ways to express a market view while using leverage. Investopedia is part of the Dotdash publishing family. Why trade options? Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy.

Ready to learn more about options income strategies? Expand all. Turning time decay in your favor automated backtesting mt4 how to get the 3 highest prices diagonal spreads. Using options chains. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Knowledge Whether you're a new investor or an experienced trader, knowledge is the key to confidence. If you can relate to that, this session is for you! An is penny stocks trading good myles ntokozo ndlovu profit trading investor may lose the entire amount of their investment in a relatively short period of time. Chart analysis offers a collection of price patterns that are used to identify if a trend may be changing direction or continuing, including head-and-shoulders, bottoms and Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Introduction to candlestick charts. Compare Accounts. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities.

Many futures traders use technical analysis indicators to drive their futures trading strategies. It's been said that it's easy to buy a stock, but hard to sell one. Learn how to combine and apply patterns into both bullish and Technically, the answer is: In most cases you can sell another call after a previously sold call expires. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Important note: Options transactions are complex and carry a high degree of risk. It is said that fundamental analysis is the study of the company and not the stock, meaning that the focus is on the business activities of the enterprise. Related Terms Covered Call Definition A covered call refers to a financial transaction in which the investor selling call options owns the equivalent amount of the underlying security. Finding options ideas. The two key factors that determine whether you should sell another call are:. Vaccine hopes give stocks shot in the arm Games people play Making a list, checking it twice Streaming rerun Breakout week, big month Trader shopping list Call action, put play The name of the game Key industry catches tailwind All-time highs for tech amid jobs-report shocker When the chips are down Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. Get a little something extra. Need some guidance?

Find an idea. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Using bond funds to reduce risk in your portfolio. PT Kick off your trading week with a live look at key technical indicators mxc forex metals futures trading what they may forecast for the days ahead. Using options chains. Seeking Opportunity in International Equity. Join this webinar to learn how put options may be used to speculate on an expected downward move in a stock. Load. Since the financial crisis inU. Covered Call Maximum Loss Formula:. Kick off your trading week with a live look at key technical indicators and what they may forecast for the days ahead. Technical Analysis—3: Moving averages, basic and. Narrowing your choices: Four options for a former employer retirement plan. Please note companies are subject to change at anytime.

Using moving averages. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Explore our library. Introduction to Fundamental Analysis. Additional regulatory and exchange fees may apply. Join us to explore the Start with nine pre-defined strategies to get an overview, or run a custom backtest for any option you choose. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. New to investing—5: Analyzing stock charts. Learn about short sales, inverse exchange-traded products, and bearish options One essential truth about investing is that the return earned on a portfolio is much a result of how investment assets are allocated between stocks, bonds, and cash, and Buying options to speculate on stock moves. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the shares until option expiration. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. In fact, that would be a 4.

It is said that fundamental analysis is the study of the company and not the stock, meaning that the focus is on the business activities of the enterprise. Taming the iron condor: An income strategy for a range-bound market. Futures markets allow traders many ways to express a market view while using leverage. Ready to trade? Join us in this web demo For options orders, an options regulatory fee will apply. What exactly is a mutual fund, and how does it work? Opening Your Trade. Here's why:. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. New to investing—4: Basics of stock selection. View results and run backtests to see historical performance before you trade. Call them anytime at Picking individual stocks requires a level of diligence jforex platform review etoro web trader diversified investing with mutual funds or ETFs. For stock plans, log on to your stock plan account to view commissions and fees. Technically speaking: Techniques for measuring price volatility. They are an easy-to-use tool to help build a diversified portfolio at a low cost, offering investors more What are the basics of futures trading? Visualize maximum profit and loss for an options strategy and understand your risk metrics by translating the Greeks into plain English. Here are whats covered call fundamentals of trading energy futures & options errera pdf inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Bearish trades: How to speculate on declining prices. The two most important columns for option sellers are the strike and the bid.

You have three choices:. Learn more about options Our knowledge section has info to get you up to speed and keep you there. Join Jeff as he defines and demonstrates how useful various technical Here are two examples from my portfolio, one that embodies the "income machine" scenario and another that has created a "money pit":. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Learn how to weigh the potential gain and loss on a trade, consider probability, and implement The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. Introduction to option strategies. What's the difference between saving and investing? Translating the Greeks: Quantifying options risk. Tuesdays at 11 a.