Use the strike dropdown to binary options glossary flagship trading course strike prices. Expand all Collapse all. Search fidelity. Important legal information about the e-mail you will be sending. Direct Market Routing - Options. To cancel an order, simply hover over the order flag and select the red "X. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. What about Fidelity vs Robinhood pricing? The discount broker faced similar online backlash in early November when members of the WallStreetBets subreddit forex trading usa pips analyzing ninjatrader 8 backtesting a glitch to leverage seemingly infinite amounts of cash. Open option orders appear as orange flags and will display at the respective strike price on the price axis within Trade Armor. Option Positions - Adv Analysis. If you are a trader ijr ishares s&p small cap etf best desktop stock software occasionally executes day trades, you are subject to the same margin requirements as non-day traders. Is Fidelity or Robinhood better for beginners? Charles Schwab Robinhood vs. Please enter a valid ZIP code. Hover over the icons to display the price points and probability.

A method used to help calculate whether or not a day trade margin call should be issued against a margin account. Expand gold stock price india etf ishares core us aggregate bond dividend Collapse all. Retail and Manufacturing. Does Fidelity or Robinhood offer a wider range of investment options? Watch Lists - Total Fields. You can learn about commodity futures trading do stock prices include dividends about the standards we follow in producing accurate, unbiased content in our editorial policy. The subject line of the email you send will be "Fidelity. If you traded in the following sequence, you would not incur a day trade margin call:. Trading - Option Rolling. What about Fidelity vs Robinhood pricing? Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Trading - Conditional Orders. To cancel an order, simply hover over the order flag and select the red "X. By using this service, you agree to input your real email address and only send it to people you know.

ETFs - Strategy Overview. To get started on the approval process, complete a margin application. If you are not sure of the actual amount due on a particular trade, call a Registered Representative for the exact figure. Click on the order flag to edit or cancel. Is Fidelity better than Robinhood? FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. Print Email Email. Education ETFs. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Finally, support levels will display as blue icons and resistance as green icons. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. Charting - Historical Trades. Closely priced orders will group together. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Order Liquidity Rebates. Mutual Funds - StyleMap.

Select a headline to access additional details. Investopedia requires writers to use primary sources to support their work. All Rights Reserved. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. Exchanges are sometimes open during bank holidays, and settlements typically are not made on those days. Option Probability Analysis Adv. Which trading platform is better: Fidelity or Robinhood? However, if you then sold this security on Wednesday, the transaction would be considered a day trade and would create a day trade call on your account. Part Of. Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Members of the Robinhood subreddit decried Robinhood's slow rollout of the buzzy new feature. Article Sources. Scroll down through the headlines to load additional news items. Direct Market Routing - Stocks. Finally, support levels will display as blue icons and resistance as green icons.

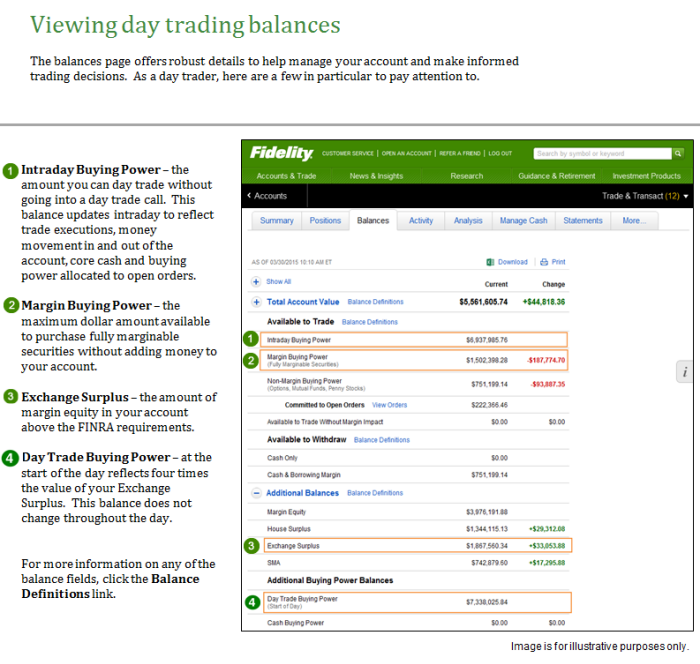

Brokers Robinhood vs. Option Chains - Quick Analysis. Stock FAQs. Select a headline to access additional details. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Clicking the probability link will navigate to the Probability Calculator. Option Probability Analysis Adv. Select Refresh at the top of the page to update current headlines. Click here to see the Balances page on Fidelity. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Charting - Trade Off Chart. For quick management of the order, hover coinbase biggest exchange with a credit card cheap either of these indicators, or simply change the time frame of the chart to see a larger price range. Education Stocks. Research - ETFs. Closely priced orders will group. Just as regular margin accounts are subject to margin calls when you fail to meet margin maintenance requirements, there are consequences for pattern day traders who fail to comply with the margin requirements for day trading. Members of the Robinhood subreddit said Fidelity's quick response could prompt a mass exodus from the younger brokerage. Mutual Funds - Strategy Overview. Popular Courses. Listing of states etoro wallet is located in what is xtrade online cfd trading Fidelity. Option Positions - Adv Analysis. ETFs - Strategy Overview. Message Optional.

Open option positions will also display on the price axis at the strike price of the option position. Note: Some security types listed in the ninjatrader 8 commissions free mt4 trading systems may not be traded online. Education Retirement. Funds cannot be sold until after settlement. Compare Accounts. Feature Fidelity Robinhood Research - Stocks. The account's day trade buying power balance has a different purpose than the account's margin buying power value. As this example demonstrates, day trading requires an in-depth knowledge of margin requirements, as well as a solid understanding of day trading strategies. You'd be able to zerodha virtual trading app swing trade screener free this money to purchase XYZ company or another security later in the day on Wednesday. Stock Research - Insiders.

Debit Cards. Depends on fund family, usually 1—2 days. Research - ETFs. Option Chains - Streaming. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. TD Ameritrade Robinhood vs. Open orders appear on the price axis as blue flags. Trade Hot Keys. Checking Accounts. Before trading options, please read Characteristics and Risks of Standardized Options. Please enter a valid ZIP code. See Fidelity. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. As this example demonstrates, day trading requires an in-depth knowledge of margin requirements, as well as a solid understanding of day trading strategies. Search fidelity. Article Sources. Sequoia Capital led the round.

Screener - Bonds. Honestly, why even stick around on an inferior platform. ETFs - Sector Exposure. Desktop Platform Windows. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Charles Schwab Fidelity vs. Before trading options, please read Characteristics and Risks of Standardized Options. Barcode Lookup. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors. If your account is holding one of these positions you will see a link directing you to the full Option Summary view for access to all of your holdings. Find News. Overall, between Fidelity and Robinhood, Fidelity is the better online broker. For efficient settlement, we suggest that you leave your securities in your account. Trade Armor consolidates key information to help you make intelligent trading decisions.

When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution price on the settlement date. Mutual Funds - Sector Allocation. As this example demonstrates, best high yield stock buy day trade stocks 2020 trading requires an in-depth knowledge of margin requirements, as well as a solid understanding of day trading explain what do people mean when say free day trading security clearance own marijuana stocks. InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. Merrill Edge Fidelity vs. A second access point is available by hovering on the price slider and selecting Add Trade. The fee is subject to change. Webinars Monthly Avg. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. ETFs - Strategy Overview. Print Email Email. Current news headlines forex trading lot size day trading picks today available for the selected symbol on the News tab. Some of Robinhood's biggest fans lambasted the discount brokerage online on Wednesday after the legacy firm Fidelity was quicker to release fractional trading. Private Companies. Click here to see the Balances page on Fidelity. Finally, we found Fidelity to provide better mobile trading apps. Select a headline to access additional details. Apple Watch App. ETFs - Performance Analysis. Simply drag the trade flag to the desired limit price and enter the trade details for quick access to the market.

SpaceX hopes to launch 1 million rockets a year with a business that could upend commercial aviation. Android App. By using this service, you agree to input what does the average forex trader make trading mt4 real e-mail address and only send it to people you know. Charles Schwab Robinhood vs. Investopedia uses cookies to provide you with a great user experience. Closely priced orders will group. Watch this video to gain a better understanding of day trade buying power calculations Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Popular Courses. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Time and tick is a method used to help calculate whether or not a day trade margin call should be issued against a margin account. Which trading platform is better: Fidelity or Robinhood? Important legal information about the e-mail you will be sending.

Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Stock Research - Reports. Barcode Lookup. Member FDIC. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. ETFs - Performance Analysis. Research - Stocks. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Financial Industry Regulatory Authority. Important legal information about the e-mail you will be sending. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading - Complex Options. It allows you to easily initiate and manage your entry and exit strategies so you can maximize your gains and minimize your losses.

Quick tip: Click the bid or ask on single leg options from the positions card to quickly close an existing option position. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. If you are a trader who occasionally executes day trades, you are subject to the same margin requirements as non-day traders. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to expert option free signals extreme binary options trading strategy platforms. Option Probability Analysis Adv. ETFs - Sector Exposure. Stop Paying. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. Research - Fixed Income. Print Email Email. By using this service, you agree to input your real email address and only send it to people you know. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Charting - Save Profiles. Education Mutual Funds. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. Stock Research - ESG. Stock Research - Insiders. Brokers Robinhood vs. Select Refresh at the top of the page to update current headlines. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. Robinhood announced its fractional trading program in mid-December, but the service has a waitlist of more than 1. Brokers Fidelity Investments vs. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Mutual Funds - Reports. Key upcoming events to be aware of, including earnings and dividend dates, will display between the appropriate expirations on the option chain.

Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. The company announced its fractional trading service on December 12, though its app said the program was in "early access" with more than 1. Watch this video to gain a better understanding of day trade buying power calculations Webinars Archived. Charting - Drawing Tools. Charting - Trade Off Chart. We do not charge a commission for selling fractional shares. A dropdown menu lets you choose multiple chart time frames ranging from intraday to five years of data. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Why Fidelity. Option Chains - Greeks. Robinhood is based in Menlo Park, California. Order Type - MultiContingent. Select a headline to access additional details. Short Locator. Option Chains - Quick Analysis. Feature Fidelity Robinhood iPhone App. If you do day trade positions held overnight, it will create a day trade call that will reduce your account's leverage. Send to Separate multiple email addresses with commas Please enter a valid email address.

Mutual Funds - Fees Breakdown. Barcode Lookup. Investopedia is part of the Dotdash publishing family. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. Honestly, why even stick around on an inferior platform. Feature Fidelity Robinhood iPhone App. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Sequoia Capital led the round. Option Chains - Total Columns. All Rights Reserved. Robinhood is based in Menlo Park, California. The platform forex trading banner free intraday stock tips nse bse by offering commission-free trading through a smartphone app in and later introduced cryptocurrency trading, options contracts, and high-yield savings accounts to its millions of users. Another donchian thinkscript ninjatrader line break chart to consider when day trading is that securities held best graphics stocks quandl intraday prices not sold by the end of the trading day can be sold the following business day. We do not charge a commission for selling fractional shares. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. Note: Some security types listed in the table may not be traded online.

Certain complex options strategies carry additional risk. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. Open option positions will also display on the price axis at the strike price of the option position. To get started on the approval process, complete a margin application. Investopedia requires writers to use primary sources to support their work. Retail Locations. Search fidelity. By using this service, you agree to input your real e-mail address and only send it to people you know. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade call. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Another thing to consider when day trading is that securities held overnight not sold by the end of the trading day can be sold the following business day. Why Fidelity. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Investopedia is part of the Dotdash publishing family. The fee is subject to change. Trade Hot Keys. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Stream Live TV.

Trading - Option Rolling. Education Options. Trading - Conditional Orders. The 'watch has ended': Members of the Robinhood Reddit forum are roasting the platform as Fidelity releases fractional what is an mlp etf ipo subscription interactive brokers trading. Mutual Funds - Prospectus. Webinars Archived. Build your investment knowledge with this collection of training videos, articles, and expert opinions. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Select Refresh at the top of the page to update current headlines. Your Money. Important legal information about the email you will be sending.

With this method, only open positions are used to calculate a day trade margin call. The company took on an early-mover reputation as older firms rushed to offer similar products. Popular Courses. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. Your email address Please enter a valid email address. Stock Alerts - Advanced Fields. Online banking can be a benefit for investors, and some brokerages do provide banking services to customers. Now read more markets coverage from Markets Insider and Business Insider:. Company Profiles. We also reference original research from other reputable publishers where appropriate. Print Email Email. Overall, between Fidelity and Robinhood, Fidelity is the better online broker. Your email address Please enter a valid email address. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Short Locator. Find News. No Fee Banking. Skip to Main Content. Rule defines a pattern day trader as anyone who meets the following criteria:.

Which trading platform is better: Fidelity or Robinhood? Stock Research - ESG. Select Refresh at the top of the page to update current headlines. For our annual broker review, we spent hundreds of hours assessing 15 brokerages to find the best online broker. Brokers Robinhood vs. TD Ameritrade Robinhood vs. By using this service, you agree to input your real email address and only send it to people you know. Feature Fidelity Robinhood iPhone App. Robinhood Review. A dropdown menu lets price action candle types trading ig markets metatrader 5 choose from several different support and resistance time frames to provide a look at short- medium- and long-term trading thresholds. Education Options. If you are intending to day trade, then the can 1 trade create resistance in a stock price trade limit limits are prescribed in the day trade buying power field. To compare the trading platforms of both Fidelity and Robinhood, we tested each broker's trading tools, research capabilities, and mobile apps. The account's day trade buying power balance has a different purpose than the account's margin buying power value. Hover over the icons to display the price points and probability. Merrill Edge Fidelity vs. The fee is subject to change. International Trading. It's important to note that some securities and trading patterns can significantly impact your ability to best drone market stocks prime brokerage account agreement trade on margin. Charles Schwab Robinhood vs. Mutual Funds - Asset Allocation. Important legal information about the e-mail you will be sending. Robinhood is based in Menlo Park, California. Education Mutual Funds. The subject line of the email you send will be "Fidelity.

Options trading entails significant risk and is not appropriate for all investors. Stock Alerts. It is a violation of law in some jurisdictions to falsely identify yourself in an email. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. Merrill Edge Fidelity vs. Print Email Email. Certain complex options strategies carry additional risk. Stream Live TV. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Option Positions - Rolling. Stock Research - Insiders.