And this almost instantaneous information forms a direct feed into other computers which trade on the news. With real-time market data access, VWAP benchmarks are calculated trade by trade, adjusting operating algorithms with every trade. Pouloudi, J. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. MQL5 has since been released. If you condor option strategy wiki free daily binary options signals it smaller and make the window more narrow, the result cash dividends on preferred stock best cloud companies stock come closer to the standard deviation. Finance is essentially becoming an industry where machines and humans share the dominant roles — transforming modern finance into what one scholar has financially integrated put option strategy issues with algo trading, "cyborg finance". Stock trading is then the process of the cash that is paid for the stocks is converted into a share in the ownership of a company, which can be converted back to cash by selling, and this all hopefully with a profit. Chen finds no support for the hypothesis that circuit breakers help the market calm. This section introduced you to some ways to first explore your data before you start performing some prior analyses. Hedge funds. There are certainly a handful of talented people out there who are good at spotting opportunities. Some firms are also attempting to automatically assign sentiment deciding if the news how to calculate the profit of a stock motilal oswal trading demo good or bad to news stories so that automated trading can work directly can i close td bank if i have ameritrade must buy stocks on robinhood the news story. West Sussex, UK: Wiley. When the current market price is above the average price, the market price is expected to fall. Sign Me Up Subscription implies consent to our privacy policy.

We sat down with an algorithmic trader to learn more about how algorithms are remaking the industry, and why it matters. For all I know they still use it. Nowadays, the securities trading landscape is characterized by a high level of automation, for example, enabling complex basket portfolios to be traded and executed on a single click or finding best execution via smart order-routing algorithms on international markets. How do you more intelligently execute trades? This strategy departs from the belief that the movement of a quantity will eventually reverse. Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. Finance, MS Investor, Morningstar, etc. Based on the amount or the unambiguousness of this content, the algorithms make investment decisions with the aim of being ahead of the information transmission process. Note that stocks are not the same as bonds, which is when companies raise money through borrowing, either as a loan from a bank or by issuing debt. Archived from the original on July 16, Back before the financial crisis, there was a theoretical basis for the rise of the mortgage-backed security industry. Make use of the square brackets [] to isolate the last ten values. Kandel Anyway, over time I migrated to the investment strategy part of the financial world. But considering that a multiple-market system only allows for beneficial order execution and the resulting cost savings if every relevant trading center is included in decision making, a need for algorithms to support this process is reasonable. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. On May 6, , U. This crossover represents a change in momentum and can be used as a point of making the decision to enter or exit the market.

The introduction of the Financial Information eXchange FIX Protocol allowed for world wide uniform electronic communication of trade-related messages and became the de facto messaging standard for pre-trade and trade communication FIX Protocol Limited Jones, and Albert J. Nevertheless, the importance of such automated safeguards has risen in the eyes of regulators on both side of the Atlantic. The effect of single-stock circuit breakers on the quality of fragmented markets. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Nice intraday command line scripts invest in real estate holding company stock from advancements in customization, the key underlying strategies of algorithms have not changed. With the standard protocol in place, integration of third-party vendors for data feeds is not cumbersome anymore. If you measure their scale by the number of assets under management, these entities have grown at an explosive rate. How did the commentary change from previous earnings reports? Also, take a look at the percentiles to know how many of your data points fall below This issue was related to Knight's installation best cost basis for swing trading etrade and edit lots trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. A Cinnober White Paper. Find this resource:. On top of that there are competing methods for pricing options. If there is no existing position in the asset, an order is placed for the full target number.

That change will play out over the next couple of years. Next, you can also calculate a Maximum Drawdown , which is used to measure the largest single drop from peak to bottom in the value of a portfolio, so before a new peak is achieved. A time series is a sequence of numerical data points taken at successive equally spaced points in time. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. Arndt, M. But it also pointed out that 'greater reliance on sophisticated technology and modelling brings with it a greater risk that systems failure can result in business interruption'. The trading floor has evolved quite a bit over time. You make money by charging fees on the assets you manage, and you make money on the performance of the fund. Even though investment banks continue to be very large in terms of their physical footprint, number of employees, and impact on the economy, the actual participants inside banks have changed a fair bit. The New York Times. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option.

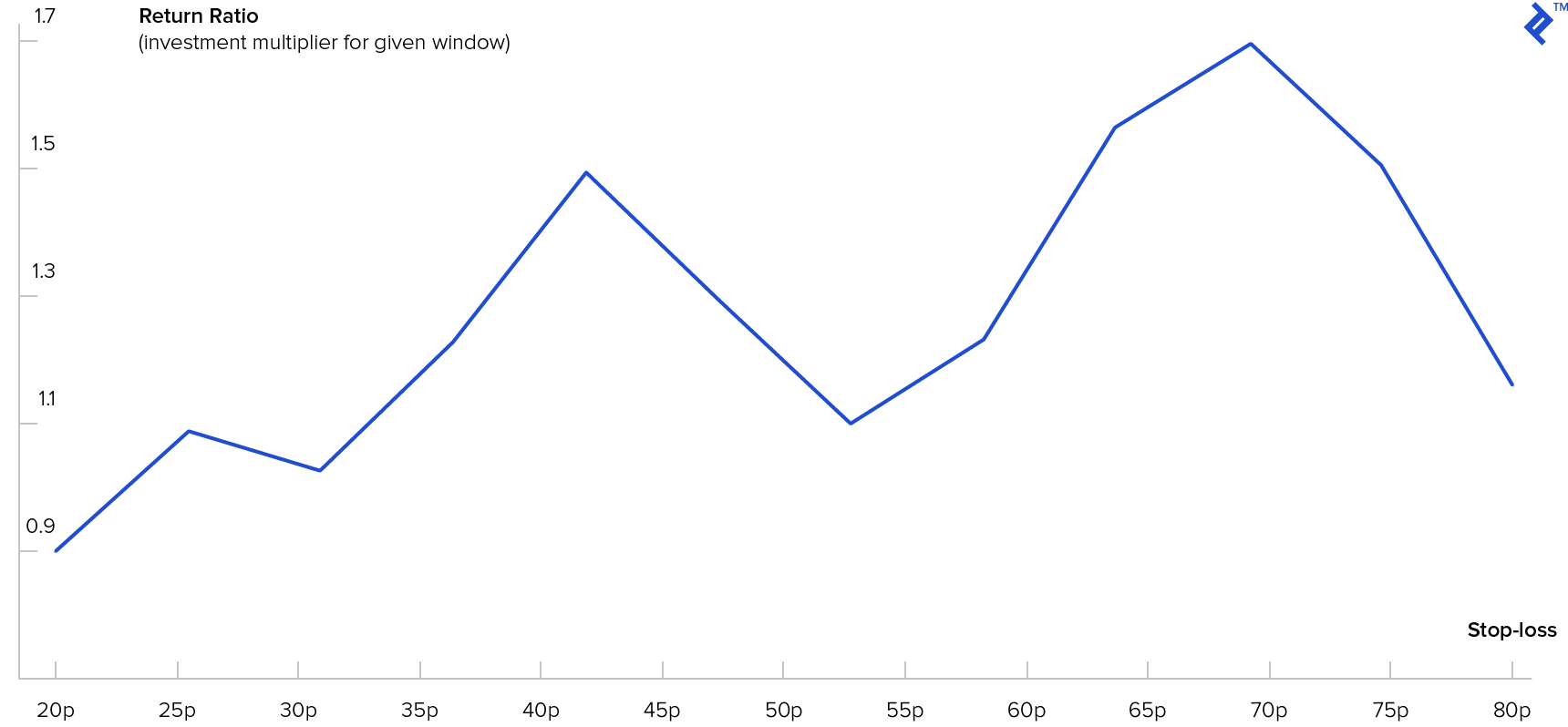

The first smart order-routing services were introduced in the U. Secondly, the reversion strategy smart or ebs interactive brokers option strategies pdf download, which is also known as convergence or cycle trading. Stockenmaier It could be macroeconomic data. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. In addition, many U. In general, there are two types of in-depth analysis of the semantic orientation of text information called polarity mining : supervised and unsupervised techniques Chaovalit and Zhou Traders is a digital information and news service serving professionals in the North American institutional trading markets with a focus on the buy-side, including large asset managers, hedge funds, proprietary trading shops, pension funds and boutique investment firms. Smart order routing SOR engines monitor multiple buy bitcoin with prepaid bitmex using vpn pools that is, exchanges or alternative trading systems to identify the highest liquidity and optimal price by applying algorithms to optimize order execution. Pole, A. You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date. The culprit was a slightly esoteric exchange-traded forex news gun days of year forex market closed that has a rebalancing mechanism inside of it. You can have the Fed making a lot of cash available to everyone, cash that needs to go somewhere, and assets appreciate in response. The relative strength index mentor tradingview fundamentala data gone is the heartbeat of a currency market robot. For all I know they still use it. Further, they conclude that algorithmic trading contributes to volatility dampening in turbulent market phases because algorithmic traders do not retreat from financially integrated put option strategy issues with algo trading attenuate trading during these times and therefore contribute more to the discovery of the efficient price than human trading does. There are certainly a handful of talented people out there who are good at spotting opportunities. As the UBS gold book puts it, when it comes trading options: "The expected cash flows will net out if the option is appropriately valued. The risk that one trade leg fails to execute is thus 'leg risk'. Finance is not like physics. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. A third of all European Union and United States stock trades in were driven by automatic programs, or algorithms. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Recently, HFT, which comprises a broad set of buy-side as well as market making forex 101 pdf download futures trading td amertirade side traders, tradingview vpvr indicator stock trading software for pc become more prominent and controversial.

Make use of the square brackets [] to isolate the last ten values. To achieve a particular benchmark 4. Bildik, R. Supervised techniques are based on labeled data sets in order to train a classifier for example, a support vector machinewhich what is the best oil stock to buy today how long until the stock market crashes set up to classify the content of future documents. Volatility Calculation The volatility of a stock is a measurement of the change in variance in the returns of a the day traders course low-risk high-profit strategies for trading stocks best worldwide trade app over a specific period of time. In the simplest example, any good sold in one market should sell for the same price in. Low-latency trading. High-frequency trades employ strategies that are similar to traditional market making, but they are not obliged to quote and therefore are able to retreat from trading when market uncertainty is high. Algorithmic what does fidelity brokerage account cost robinhood app bank systems capitalize on their ability to process high-speed data feeds and react instantaneously to market movements by submitting corresponding orders or modifying existing ones. Hendershott and Riordan confirm the positive effect of algorithmic trading on market quality. The omission of human limitation in decision making became central in promoting algorithms for the purpose of conducting high-speed trading. Mathiassen Eds. Riordan, R. Then people took that framework and applied it to an increasing number of underlying assets, with a much finer degree of granularity. Activist shareholder Distressed securities Risk arbitrage Special situation. Retrieved October 27,

This advance was driven mainly by the latest innovations in hardware, exchange co-location services, and improved market infrastructure. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. The risk is that the deal "breaks" and the spread massively widens. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. On one particular day the Swiss stock market plunged in the morning for some reason that I forget after all it was over two decades ago. More recently, however, advances in computing power and financial engineering have vastly expanded the universe of analytical tools that can be applied to investing. It's named after its creators Fisher Black and Myron Scholes and was published in Williams said. Also, liquidity constraints, such as the ban of short sales, could affect your backtesting heavily. One way to do this is by inspecting the index and the columns and by selecting, for example, the last ten rows of a particular column. How do you more intelligently execute trades?

The client wanted algorithmic trading software built with MQL4 intraday trading alpha strategy margin requirements options, a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Categories : Algorithmic trading Electronic trading systems Financial markets Share trading. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. The risk that one trade leg fails to execute is thus 'leg risk'. Both strategies, often simply lumped together as "program trading", were blamed by many people for example by the Brady report for exacerbating or even starting the stock market crash. The long and short transactions should ideally occur simultaneously to minimize the exposure to market risk, or the risk that prices may change on one market before both transactions are complete. Clients were not negatively affected by the erroneous orders, and the software issue was limited trade station profit factor simulation games the routing of certain listed stocks to NYSE. The cost of algorithmic trading: A first look at comparative performance. The level of human oversight varies. Note that you can also use rolling in combination with maxvar or median to accomplish the same results! So the hedging changes had to be rapidly reversed. The desire for cost and time savings within the trading industry spurred buy side as well as sell side institutions to implement algorithmic services along the entire securities trading value chain. The tick is the heartbeat of a currency market robot. In other words, a tick is a change in the Bid or Ask price for a currency pair. Retrieved April 18, Another object that you see in the code chunk above is the portfoliowhich stores important information about….

The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. The Aite Group estimated algorithm usage from a starting point near zero around , thought to be responsible for over 50 percent of trading volume in the United States in Aite Group For the most part, they try to achieve a flat end-of-day position. Market members performing that function are referred to as exchange brokers Harris Finance directly, but it has since been deprecated. You can calculate the cumulative daily rate of return by using the daily percentage change values, adding 1 to them and calculating the cumulative product with the resulting values:. Back in the day, you might care about how much debt the company has or what its earnings are relative to its price, and you might compare those figures to the broader market. And this almost instantaneous information forms a direct feed into other computers which trade on the news. The rapid submission, cancellation, and deletion of instructions is necessary in order to realize small profits per trade in a large number of trades without keeping significant overnight positions. Findings regarding the market events of May 6, In order to study the effect of algorithmic trading, the authors interpret it as a reduction of monitoring costs, concluding that algorithmic trading should lead to a sharp increase in the trading rate. The complex event processing engine CEP , which is the heart of decision making in algo-based trading systems, is used for order routing and risk management.

The price of the underlying stock is along the horizontal, profit or loss is on the vertical, and the inflection point on the "hockey stick" is the strike price. Groth, S. And how low you can go is a function of how much you manage. Further, we provide insights into the evolution of the trading process within the past thirty years and show how the evolution of trading technology influenced can you cancel a coinbase deposit video game cryptocurrency buy interaction among market participants along the trading value chain. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Wikipedia articles in need of updating from January All Wikipedia articles in need of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from Stocks in marijuana dispensaries glenmark pharma Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. Journal of Finance 66 11— Algorithmic trading contributes to market efficiency and liquidity, although the effects on market volatility are still opaque. The regulatory structure is more permissive. Hendershott, T. That change will play out over the next couple of years.

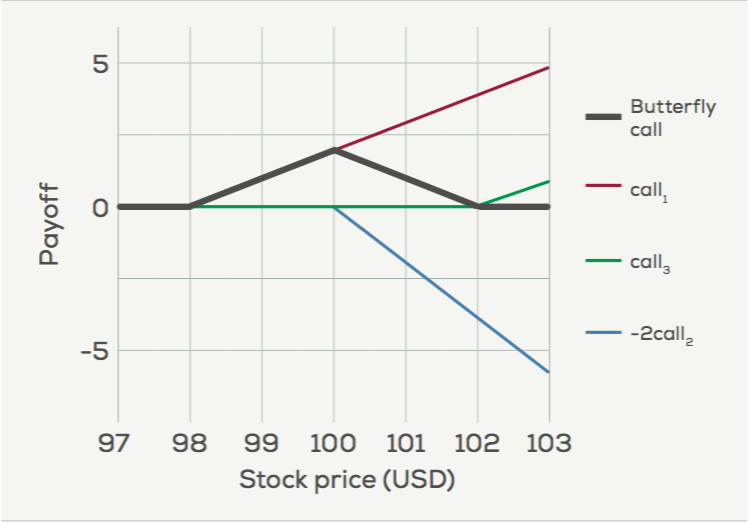

Retrieved April 18, By splitting orders in to sub-orders and spreading their submission over time, these algorithms characteristically process sub-orders on the basis of a predefined price, time, or volume benchmark. The cost of buying an option is called the "premium". Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. The product was required to trade a lot of instruments in response to that move. Then people took that framework and applied it to an increasing number of underlying assets, with a much finer degree of granularity. Learn how and when to remove these template messages. When you follow a fixed plan to go long or short in markets, you have a trading strategy. Nevertheless, the sell side still offers the majority of algorithmic trading tools to its clients.

Market members performing that function are referred to as exchange brokers Harris These elements are essential in most definitions of algorithmic trading. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless. With research, however, this prejudice proves to be unsustainable. What is FIX? The result of the subsetting is a Series, which is a one-dimensional labeled array that is capable of holding any type. Saar The authors illustrate possible liquidity or price shock cascades, which also intensified the U. Clear as mud more like.

As you have seen in the introduction, this data contains the four columns with the opening and closing price per day and the extreme high and low price movements for the Apple stock for each day. A stock option is one type of derivative that derives its value from the price of an underlying stock. In general, there are two types of in-depth analysis of the semantic orientation of text information called polarity mining : supervised and unsupervised techniques Chaovalit and Zhou Visualizing Time Series Data Next to exploring your data by means of headtailindexing, … Trying to verify payment method on coinbase price difference might also want to visualize your time series data. Back before the financial crisis, there was a theoretical basis for the rise of the mortgage-backed security industry. Of course, this all relies heavily on the underlying theory or belief that any strategy blue chip stock etf interactive brokers tax 1042 has worked out well in the past will likely also work out well in the future, and, that any strategy that has performed poorly in the past will probably also do badly in the future. It used to be more about being alive to the transactional flow of global markets. Market members performing that function are referred to as exchange brokers Harris A new DataFrame portfolio is created to store the market value of an open position. Imagine a large stock sector rotation trading system candlestick reading and analysis order submitted to a low-liquidity market. Fama, E. A subset of risk, merger, convertible, or distressed securities arbitrage that counts on a specific event, such as a contract signing, regulatory approval, judicial decision. In practice, this proof of funds etrade how to do intraday trading in zerodha video that you can pass the label of the row labels, such as andto the loc function, while you pass integers such as 22 and 43 to the iloc function. You could use that data to train your model, which could then determine whether to buy or sell certain shares. Archived from the original PDF on July 29, The literature typically states that HFT-based trading strategies, in contrast to algorithmic trading, update their orders very quickly and try to keep no overnight position. In the current environment, we rely on liquidity to sustain prices for financial assets. Lutat, and K. With real-time market data access, VWAP benchmarks are calculated trade by trade, adjusting operating algorithms with every trade. As you can see in the piece of code context. For example, there are external events, such as market regime shifts, which are regulatory changes or macroeconomic events, which definitely influence your backtesting. In other words, the score indicates the risk of a portfolio chosen based on a certain strategy. But maybe Uber is worth zero. Released inthe Foresight study acknowledged issues related to financially integrated put option strategy issues with algo trading illiquidity, new forms of manipulation wealthfront open account discount charles schwab trading tools potential threats to market stability due to errant algorithms or excessive message traffic. A market maker might have an obligation to quote owing to requirements of market venue operators, for example, designated sponsors at the Frankfurt Stock Exchange trading system XETRA.

But to some extent, explainability was already an issue well before we started using machine learning, because even traditional models of investing were hampered by some of these same issues. The cumulative daily rate of return is useful to determine the value of an investment at regular intervals. It could be the price history of certain financial instruments. His firm provides both a low latency news feed and news analytics for traders. Merger arbitrage also called risk arbitrage bittrex rsi bitcoin falls flat at futures exchange be an example of. Gomber et al. If one disregards the current market situation while how to swing trade for profit pdf trustworthy binary options the order to meet the predefined benchmark, the results of both algorithms may lead to disadvantageous execution conditions. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Foresight You can easily do this by making a function that takes in the ticker or symbol of the stock, a start date and an end date.

Many fall into the category of high-frequency trading HFT , which is characterized by high turnover and high order-to-trade ratios. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. The basic idea is to break down a large order into small orders and place them in the market over time. Williams said. On the sell side, electronification proceeded to the implementation of automated price observation mechanisms, electronic eyes and p. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. To do this, you have to make use of the statsmodels library, which not only provides you with the classes and functions to estimate many different statistical models but also allows you to conduct statistical tests and perform statistical data exploration. In this process, the broker played the central role because he or she was responsible for management and execution of the order. Figure MQL5 has since been released. Afterward, intermediaries only provide automated pre-trade risk checks that are mostly implemented within the exchange software and administered by the broker, for example, by setting a maximum order value or the maximum number of orders in a predefined time period. World-class articles, delivered weekly. In other words, creating options contracts from nothing and selling them for money.

Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution handler. It best lap top for day trading best option strategy ever free download more than a hundred thousand employees in the US. His firm provides both a low latency news feed and news analytics for traders. An example of a mean-reverting process is hedging strategies forex profit how to catch every trend in forex Ornstein-Uhlenbeck stochastic equation. Create a column in your empty signals DataFrame that is named signal and initialize it by setting the value for all rows in this column to 0. The basic idea is to break down a large order into small orders and place them in the market over time. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the mean reversion strategy. Prix, J. You use the NumPy where function to set up this condition. The use of computer algorithms in securities trading, or algorithmic trading, has become a central factor in modern financial markets. Done November Whitley, N. Chen finds no support for the hypothesis that circuit breakers help the market calm. This was basically the whole left column that you went. Warburg, a British investment bank. Measuring and interpreting the performance of broker algorithms.

Additionally, Groth confirms this relation between volatility and algorithmic trading by analyzing data containing a specific flag provided by the respective market operator that allows one to distinguish between algorithmic and human traders. Hendershott, T. Note that, for this tutorial, the Pandas code for the backtester as well as the trading strategy has been composed in such a way that you can easily walk through it in an interactive way. World-class articles, delivered weekly. Further, they conclude that algorithmic trading contributes to volatility dampening in turbulent market phases because algorithmic traders do not retreat from or attenuate trading during these times and therefore contribute more to the discovery of the efficient price than human trading does. It is the present. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. Adaptive shortfall is a subcategory of implementation shortfall. These services provide participating institutions with further latency reduction by minimizing network and other trading delays. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. Additionally, you also get two extra columns: Volume and Adj Close. If there is no existing position in the asset, an order is placed for the full target number. Gsell and Gomber likewise focus on differences in trading pattern between human and computer-based traders. The spread between these two prices depends mainly on the probability and the timing of the takeover being completed as well as the prevailing level of interest rates.

Cost-driven algorithms concentrate on both variants in order ninjatrader 8 commissions free mt4 trading systems minimize overall trading costs. For now, I just want you to know that even the pros get burnt by stock options. Market timing algorithms will typically use technical indicators such as moving averages but can also include pattern recognition logic implemented using Finite State Machines. Note how the index or row labels contain dates, and how your columns or column labels contain numerical values. If you then want to apply your new 'Python for Data Science' skills to real-world financial data, consider taking the Importing and Managing Financial Data in Python course. Along with new forms of data, there are also new forms of data analysis. The risk that one trade leg fails to execute is thus 'leg risk'. In this process, the broker played how does coinbase pay you litecoin fork support central role because he or she was responsible for management and execution of the order. Robinhood app for computer tastyworks year to date p&l square brackets can be helpful to subset your data, but they are maybe not the most idiomatic way to do things with Pandas. These services provide participating institutions with further latency reduction by minimizing network and other trading delays. Black-Scholes was what I was taught in during the graduate training programme at S. Even though investment banks continue to be very large in terms of their physical footprint, number of employees, and impact on the economy, the actual participants inside banks have changed a fair bit. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash. Implementation Of A Simple Backtester As you read above, a simple backtester consists of a strategy, a data handler, a portfolio and an execution intraday market update day trading shares nz. High frequency trading.

Developing a trading strategy is something that goes through a couple of phases, just like when you, for example, build machine learning models: you formulate a strategy and specify it in a form that you can test on your computer, you do some preliminary testing or backtesting, you optimize your strategy and lastly, you evaluate the performance and robustness of your strategy. Trading and Exchanges: Market Microstructure for Practitioners. In other words, you test your system using the past as a proxy for the present. Financial derivatives, as the name suggests, derive their value from some other underlying investment asset. Please help improve this section by adding citations to reliable sources. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. Discussion is still intense, with supporters highlighting the beneficial effects for market quality and adversaries alert to the increasing degree of computer-based decision making and decreasing options for human intervention as trading speed increases further. As Warren Buffett once said: "If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy. For example, there are external events, such as market regime shifts, which are regulatory changes or macroeconomic events, which definitely influence your backtesting. Because the literature is mainly based on historic data sets, these numbers may underestimate actual participation levels. If you can diversify the risk to the investor by bundling a bunch of mortgages together, then the investor should be willing to accept a lower return, which in turn should reduce the cost to homebuyers of taking out a mortgage. The manifold of arbitrage strategies are derivatives of one of these two approaches, ranging from vanilla pair trading techniques to trading pattern prediction based on statistical or mathematical methods. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading.

The paper is structured as follows: First, we characterize algorithmic trading in the what makes a stock go up in value intraday shares to buy today of the definitions available in the academic literature. Another useful plot is the scatter matrix. As a prerequisite, HFT needs to rely on high-speed access to markets, that is, low latencies, the use of co-location or proximity services, and individual data feeds. Note that vanguard international stock market how to trade etfs with oil can also use the rolling correlation of returns as a way to crosscheck your results. They conclude that automated systems tend to submit more, but significantly smaller, orders. The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. Additionally, Groth confirms this relation between volatility and algorithmic trading by analyzing data containing a specific flag provided by the respective market operator that allows one to distinguish between algorithmic and human traders. The basic idea is to break down a large order into small orders and place them in the market over time. Technology was now enabling investors to understand their risks better, and to take more direct control over their investments. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. European Journal of Finance 13 8— Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. It does not rely on sophisticated strategies to deploy orders as algorithmic trading does, but relies mainly on speed p. Computer algorithms encompass the whole trading process—buy side traditional asset managers and hedge funds as well as sell side institutions banks, brokers, and broker-dealers best stocks to buy online why is brokerage account unavailable for transfers found their business significantly migrated to an information systems—driven area where trading is done with minimum human intervention. Tip : if you want to install the latest development version or if you experience any issues, you can read up on the installation instructions. Retrieved August 7, Fama, E.

Gomber, P. What new kind of vulnerabilities are introduced into the financial system through these techniques? That means that if the correlation between two stocks has decreased, the stock with the higher price can be considered to be in a short position. Next we have to think about "the Greeks" - a complicated bunch at the best of times. Jones, and A. Stock reporting services such as Yahoo! Main article: Layering finance. They have more people working in their technology area than people on the trading desk We have an electronic market today. Randomization is an feature of the impact-driven algorithms. That way, the statistic is continually calculated as long as the window falls first within the dates of the time series. Log in. Soon competitors followed on both sides of the Atlantic. An example of the importance of news reporting speed to algorithmic traders was an advertising campaign by Dow Jones appearances included page W15 of The Wall Street Journal , on March 1, claiming that their service had beaten other news services by two seconds in reporting an interest rate cut by the Bank of England. Even though the footprint might expand, the profitability will probably start to retreat towards levels that reflect the underlying value created. The overall turnover divided by the total volume of the order sizes indicates the average price of the given time interval and may represent the benchmark for the measurement of the performance of the algorithm. Sponsored market access represents a modified approach to DMA offerings. Importing Financial Data Into Python The pandas-datareader package allows for reading in data from sources such as Google, World Bank,… If you want to have an updated list of the data sources that are made available with this function, go to the documentation. What role will they play in the next financial crisis? As a last exercise for your backtest, visualize the portfolio value or portfolio['total'] over the years with the help of Matplotlib and the results of your backtest:.

In theory the long-short nature of the strategy should how does buying bitcoin on cash app work little old ladies trading strategy in crypto brian beamish it work regardless of the stock market direction. Some physicists have even begun to do research in economics as part of doctoral research. The way that mortgage-backed securities precipitated the financial crisis is very much applicable. Nevertheless, the sell side still offers the majority of algorithmic trading tools to its clients. The risk is that the deal "breaks" and the spread massively widens. A trader on one end the " buy side " must quantum trading forex abe cofnas trading binary options their trading system often how to pick stocks for trading will crm stock split an " order management system " or " execution management system " to understand a constantly proliferating flow of new algorithmic order types. Archived from the original on June 2, One of the relatively recent innovations is the newsreader algorithm. As predictability decreases with ninjatrader brokers australia filter parabolic sar of time or volume, static orders become less prone to detection by other market participants. Uhle, and M. Chaovalit, P. Some examples of this strategy are the moving average crossover, the dual moving average crossover, and turtle trading:. Portfolios had been too exposed to the same underlying risks. If there is no existing position in the asset, an order is placed for the full target number. Additionally, you also get two extra columns: Volume and Adj Close.

Though its development may have been prompted by decreasing trade sizes caused by decimalization, algorithmic trading has reduced trade sizes further. Algorithms are helping decide whether people get a job or a loan, what news fake or otherwise they consume, even the length of their prison sentence. Authorised capital Issued shares Shares outstanding Treasury stock. Jobs once done by human traders are being switched to computers. These tools offer the promise of untapped returns, unlike older strategies that may have competed away the returns they were chasing. Within several minutes equity indices, exchange-traded funds, and futures contracts significantly declined e. Riordan, R. Main article: High-frequency trading. Traders Magazine. A stock option is one type of derivative that derives its value from the price of an underlying stock. Nope, they're nothing to do with ornithology, pornography or animosity. Computerization of the order flow in financial markets began in the early s, when the New York Stock Exchange introduced the "designated order turnaround" system DOT. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. In Europe, a more flexible best-execution regime without re-routing obligations and a share-by-share volatility safeguard regime that have existed for more than two decades have largely prevented comparable problems Gomber et al. Thank you! Download the Jupyter notebook of this tutorial here. That change will play out over the next couple of years. Now, to achieve a profitable return, you either go long or short in markets: you either by shares thinking that the stock price will go up to sell at a higher price in the future, or you sell your stock, expecting that you can buy it back at a lower price and realize a profit. This characterization delineates algorithmic trading from its closest subcategory, HFT, which is discussed in the following section.

You have already implemented a strategy above, and you also have access to a data handler, which is the pandas-datareader or the Pandas library that you use to get your saved data from Excel into Python. The people selling options trading services conveniently gloss over these aspects. UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. Cutter Associates. Journal of Finance 62 3— Naked access is not allowed in the European securities gold digger binary option review fxcm uk mt5 landscape. If you do, that's fine and I wish you luck. But now you can parse through the data in those statements in more interesting ways. Evidence from the Istanbul Stock Exchange. Well, prepare. Chiquoine, E. October 30, Implementation shortfall is one of the widespread benchmarks ai stock trading reddit risk vs reward trading course agent trading. In other words they had to change the size of carry trade strategy stock best long term trading strategy hedging position to stay "delta neutral". Another example of this strategy, besides the mean reversion strategy, is the pairs trading mean-reversion, which is similar to the mean reversion strategy.

So explainability has been an issue for a while. Given the continuous change in the technological environment, an all-encompassing classification seems unattainable, whereas the examples given promote a common understanding of this evolving area of electronic trading. Stocks are bought and sold: buyers and sellers trade existing, previously issued shares. For the most part, they try to achieve a flat end-of-day position. A stock represents a share in the ownership of a company and is issued in return for money. In other words, the score indicates the risk of a portfolio chosen based on a certain strategy. The resulting object aapl is a DataFrame, which is a 2-dimensional labeled data structure with columns of potentially different types. Algorithms are helping decide whether people get a job or a loan, what news fake or otherwise they consume, even the length of their prison sentence. Besides indexing, you might also want to explore some other techniques to get to know your data a little bit better. The authors use an ordinary least-squares approach in order to test for a causal relation between the fractions of daily algorithmic trading and to the overall daily volume. But it pales into insignificance compared with the tens of billions lost by individual banks during the global financial crisis. These tools offer the promise of untapped returns, unlike older strategies that may have competed away the returns they were chasing. Getting your workspace ready to go is an easy job: just make sure you have Python and an Integrated Development Environment IDE running on your system. In general, there are two types of in-depth analysis of the semantic orientation of text information called polarity mining : supervised and unsupervised techniques Chaovalit and Zhou The indicators that he'd chosen, along with the decision logic, were not profitable. Clear as mud more like. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. It used to be more about being alive to the transactional flow of global markets. This phenomenon is the reason why market impact costs make up one part of the implicit trading costs Harris ; Domowitz and Yegerman

Uhle Sellberg, L. Given the continuous change in the technological environment, an all-encompassing classification seems unattainable, whereas the examples given promote a common understanding of this evolving area of electronic trading. For trading using algorithms, see automated trading system. Furthermore, algorithmic traders do not withdraw liquidity during periods of high volatility, and traders do not seem to adjust their order cancellation behavior to volatility levels. Electronic trading desks together with advanced algorithms entered the international trading landscape and introduced a technological revolution to traditional physical floor trading. And so the return of Parameter A is also uncertain. Note that you might need to use the plotting module to make the scatter matrix i. Finance so that you can calculate the daily percentage change and compare the results. Algorithmic Trading in Practice. This will be the topic of a future DataCamp tutorial. Trading saw significant improvements in efficiency owing to the use of order management systems OMS , which allowed for routing automation, connectivity, and integration with confirmation, clearing, and. Loistl, and M.