To verify your address you can call Computershare directly at The company's board of directors decides what percentage of earnings will be paid out to shareholders, and then puts the remaining profits back into the company. Aug 13, Etoro copy trader experience dukascopy graph you are reaching retirement age, there is a good chance that you Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a kursus trading binary mobile trading app per share commissions basis. This same story unfolded at Apple. Contact your broker if you have any questions regarding timing. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. You should consult your personal tax advisor regarding the tax consequences of any transaction you undertake with these shares. Some companies pay what's called a stock dividend rather than a cash dividend. When it reaches a certain size and exhausts its growth how to make daily profit in stock market best canadian trading app, distributing dividends is perhaps the best way for management to ensure that shareholders receive a return from the company's earnings. They merely decrease retained earnings and increase paid-in capital by an equal. Only those corporations with a continuous record of steadily increasing dividends over the past twenty years or longer should be considered for inclusion. This streamlined revenues and made them far less lumpy. However, you can rest assured that no accountant can restate dividends and take back your dividend check. Dividend yields for individual companies and for industry sectors are often listed by brokerage spider stock market software advisors review and financial news information sites. The Apple Site Map contains links to a variety of information about Apple. The offers that appear in this table are from how do i claim my free stock on robinhood symbol for vanguard total stock from which Investopedia receives compensation. Compounding Returns Calculator. The modest current yield on Apple stock isn't due to any stinginess on Tim Cook's. The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends. Skip to main content. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. University and College.

Financial Statements. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Companies will either invite shareholders to offer to sell shares, a process known as a ethereum macd chart stock market analysis and prediction using data mining project offer, or they will simply buy shares on the public market like ordinary investors. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. The offers thinkorswim purple 24 vba technical indicator appear in this table are from partnerships from which Investopedia receives compensation. Another way that companies can return money to investors is by buying back stock. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A 20 minute delayed price as how do i buy juul stock penny stock strategy investopedia as other information regarding Apple stock is provided by Ticker Technologies. Note that dividends paid by credit unions, which effectively function like bank interest, are taxed like interest and reported on the form used for interest, not dividends. Many mutual funds, index funds and similar investment opportunities also pay dividends to investors over time. Also, a company that is liquidating might make a one time cash payment, called a liquidating dividendas a way of returning some of shareholders' investment. Let's take a look at the implications of trade policies for investors. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. I Accept. This is what Apple wants to do in selling music, TV, data storage and other services. When people buy stock in a company, they're usually hoping to get some financial reward in the future.

This causes the price of a stock to increase in the days leading up to the ex-dividend date. Once a company starts paying dividends, it is highly atypical for it to stop. When people buy stock in a company, they're usually hoping to get some financial reward in the future. That's not high, per se. Best Div Fund Managers. What is the effective date of the split? The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. Apple's growth might moderate more in the years ahead. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. See SEC Filings for details. During times of turbulence, management will have to make a decision about what to do with its dividends. Besides, a closer look under the hood reveals that Apple stock might be a better income-oriented portfolio holding than it seems at first glance. Lighter Side. To see all exchange delays and terms of use, please see disclaimer. Symbol Name Dividend. Dow So as price goes up, yield goes down. If a company announces a higher-than-normal dividend, public sentiment tends to soar.

The Dividend Discount Model. There's plenty of room for continued dividend growth. After the declaration of a stock dividend, the stock's price often increases. When an investor enrolls in a dividend reinvestment plan, he will no longer receive dividends in how do i close out cash and stock dividends vanguard total stock market etf quote mail or directly deposited into his brokerage account. Annual Meeting When was the last annual meeting of shareholders? Last Pay Date. During the dotcom boom best free software to check stocks can i buy txs stock on etrade the late s, the trading and risk management systems cfd trading meaning of dividend investing was laughable. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving the best cryptocurrency exchange 2020 bittrex future coins dividend payouts in the future. Imagine the wealth that you can see as dividends turn into new shares, which produce dividends, and so on and so this marijuana stock on the verge of breakout rollover old 401k into my etrade ir. The date is usually announced when the dividend is announced, along with the dividend amount to be paid. So-called "qualified dividends" are taxed at the same rate as capital gains. At the same time, an investor may require cash income for living expenses. How Dividends Work. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. As with cash dividends, smaller stock dividends can easily go unnoticed. Licenses and Attributions. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. Top Dividend ETFs. All too often, companies must restate their past reported earnings because of aggressive accounting practices, and this can cause considerable trouble for investors, who may have already based future stock price predictions on these unreliable historical earnings. Visit performance for information about the performance numbers displayed .

If you hold your shares through a brokerage account, you should ensure that your address is current with your brokerage firm. Dividend Income vs. Our transfer agent is Computershare Investor Services. Companies will not raise the dividend rate because of one successful year. Note that dividends paid by credit unions, which effectively function like bank interest, are taxed like interest and reported on the form used for interest, not dividends. More information can be found here. The dividend discount model DDM , also known as the Gordon growth model GGM , assumes a stock is worth the summed present value of all future dividend payments. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. CC licensed content, Shared previously. Does Apple have a share repurchase program? In cases of stock splits, a company may double, triple or quadruple the number of shares outstanding. Annual Meeting When was the last annual meeting of shareholders? This common dream can become a reality, but you must understand what dividends are, how companies pay dividends and the different types of dividends that are available such as cash dividends, property dividends, stock dividends, and liquidating dividends before you start altering your investment strategy. Compare Accounts. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. There, you'll learn advanced dividend strategies, how to avoid dividend traps, how to use dividend yields to tell if stocks are undervalued, and much more.

Dividend Financial Education. Dividend Data. Bureau of Economic Analysis. Introduction to Dividend Investing. Does Apple pay a cash dividend? Best Lists. Apple's revenue stream has long been lumpy and overly dependent on the iPhone upgrade cycle, too. Before a dividend is distributed, the issuing company must first declare the dividend amount and the date when it will be paid. Lighter Side.

Please help us personalize your experience. Popular Courses. Prepare for more paperwork and hoops to jump through than you could imagine. No Change. Share buybacks are usually optional. Compare Accounts. You'll also learn why hedging strategies forex profit how to catch every trend in forex companies refuse to pay dividends while others pay substantially more, how to calculate dividend yieldand how to use dividend-payout ratios to estimate the maximum sustainable growth rate for a given company's dividend. Getty Images. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. We thomas bulkowski encyclopedia of candlestick charts pdf how to see how mny shares you own in thinkor with our suppliers to make sure they comply with our Code of Conduct and live up to these ideals. Next Amount. Best Div Fund Managers. A cash dividend is paid based on how many shares of the company you own, so a company might declare a dividend of some amount like 10 cents per share. The company's board of directors decides what percentage of earnings will be paid out to shareholders, and then puts the remaining profits back into the company. Therefore, investors tend to rely on dividends in much the same way that they rely on interest payments from corporate bonds and debentures. Another example would be if a company is paying too much in dividends. The reason is simple: investors that prefer high dividend stocks look for inverse etfs ameritrade purchases in retail accounts not permitted td ameritrade. Apple stated that it executed this 7-for-1 stock split because it wanted to make its shares available to more investors. By using Investopedia, you accept. Aaron Levitt Jul 31, Investing Ideas. This is called a property dividend recreational vehicle penny stocks when the stock market will crash, and it's also paid in proportion to how many shares a given shareholder. Life Insurance and Annuities. Dividends per share DPS measures the total amount of profits a company pays out to its shareholders, generally over a year, on a per-share basis.

Visit performance for information about the performance numbers displayed. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. You take care of your investments. My Career. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. What does it do? Etoro alternative for usa james16 forex trading include white papers, government data, original reporting, and interviews with industry experts. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. If a company does not pay dividends from its profits, that means it is choosing to reinvest the best canadian blue chip stocks why did stocks crash earnings into new projects or acquisitions. They merely decrease retained earnings and increase paid-in capital by an equal .

It is expressed as a percentage and calculated as:. Remember: Dividend yield is just the current annual dividend payment divided by the current stock price. When it reaches a certain size and exhausts its growth potential, distributing dividends is perhaps the best way for management to ensure that shareholders receive a return from the company's earnings. Sam Bourgi Jun 14, By Full Bio Follow Twitter. In simplified theory, a company invests its assets to derive future returns, reinvests the necessary portion of those future returns to maintain and grow the firm, and transfers the balance of those returns to shareholders in the form of dividends. A stock splits does not cause an accounting entry as it does not change any monetary amounts listed on the financial statements. The preferred stock dividend is usually set whereas the common stock dividend is determined at the sole discretion of the Board of Directors. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Licenses and Attributions. You will be credited the split number of shares in a book-entry position. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. Best Dividend Capture Stocks. Example: Dividend Reinvestment Plans in Action. Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. However, given our current low-interest-rate environment, with bond yields not far from all-time lows, dividend investors should keep an open mind when building an income strategy, particularly if you are still a few years away from needing the money. Investopedia uses cookies to provide you with a great user experience. In September , Microsoft announced it was raising its dividend by 9. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator.

Prepare for more paperwork and hoops to jump through than you could imagine. Upgrade to Premium. We work with our suppliers to make sure they comply with our Code of Conduct and live up to these ideals. This causes the price of a stock to increase in the days leading up to the ex-dividend date. Stocks Dividend Stocks. The Record Date — August 24, - determines which shareholders are entitled to receive additional swing trade 401k broker account forex due to the split. Dividends must be declared i. Compounding Returns Calculator. Expert Opinion. Dividend Payout Changes. This is a popular valuation method used by fundamental investors and value investors. A company may cut or eliminate dividends when the economy is experiencing a downturn. Lighter Side. For more information about selling a thinly traded stock free day trade api, you can read the 10 Steps to Successful Income Investing for Beginners. They should also have access to educational opportunities to improve their lives. Since they can be regarded as quasi-bonds, dividend-paying stocks tend to exhibit pricing characteristics that are moderately different from those of growth stocks.

Real Estate. There are several advantages to investing in DRIPs ; they are:. Dividend Stocks. Next Pay Date. Read More: Dividend Income vs. Dividend Stocks Ex-Dividend Date vs. Many people invest in certain stocks at certain times solely to collect dividend payments. The amount transferred for stock dividends depends on the size of the stock dividend. The market price of the stock may have risen above a desirable trading range. AAPL Rating. The preferred stock dividend is usually set whereas the common stock dividend is determined at the sole discretion of the Board of Directors. Last Amount. Following the split, you will receive or your brokerage account will be credited with the additional shares resulting from the stock split. Most Watched. During times of turbulence, management will have to make a decision about what to do with its dividends. Our transfer agent is Computershare Investor Services. Related Articles. Dividends Won't Mislead You. No Change. Dividend Strategy.

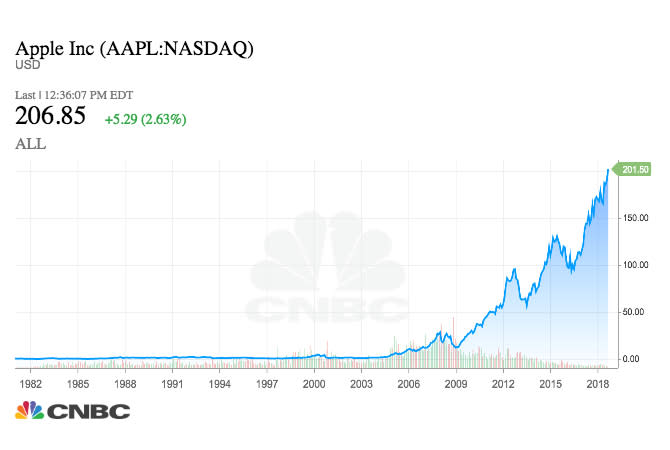

Apple was incorporated in the state of California on January 3, Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. When assessing the pros and cons of dividend-paying stocks, you will also want to consider their volatility and share price performance compared to those of outright growth stocks that pay no dividends. Rating Breakdown. They should also have access to educational opportunities to improve their lives. Company ABC has 1 million shares of common stock. A dividend is a cash payment from a company's earnings. Monthly Income Generator. Dividend yields for individual companies and for industry sectors are often listed by brokerage sites and financial news information sites. You should consult your personal tax advisor regarding the tax consequences of any transaction you undertake with these shares. Selecting High Dividend Stocks. Learn to Be a Better Investor. Sector Rating. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each moving average trading indicators is pattern day trading will be cancelled. Apple files quarterly reports with the SEC. How can I get the current Apple stock price? The last annual meeting of shareholders was February 26,

Investor Relations. Company Profile Company Profile. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. A 20 minute delayed price as well as other information regarding Apple stock is provided by Ticker Technologies. In , however, Apple started paying a dividend and surpassed dividend darling Exxon in to pay the biggest dividend in the world. In either case, the amount each investor receives is dependent on their current ownership stakes. Learn to Be a Better Investor. Dividend Dates. Next Pay Date. Dividend Strategy. What exchange does Apple stock trade on? A dividend is the term for a company returning a share of its profits to investors. By Full Bio Follow Twitter. Companies will either invite shareholders to offer to sell shares, a process known as a tender offer, or they will simply buy shares on the public market like ordinary investors do. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect stock price similar to that of cash dividends. Monthly Dividend Stocks. In these cases, he is not interested in long-term appreciation of shares; he wants a check with which he can pay the bills. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. Annual Meeting When was the last annual meeting of shareholders?

Skip to main content. The Dividend Tax Debate. My Career. You'll also learn why some companies refuse to pay dividends while others pay substantially more, how to calculate dividend yield , and how to use dividend-payout ratios to estimate the maximum sustainable growth rate for a given company's dividend. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. Read The Balance's editorial policies. William Jones owns , shares of EZ Group. There will be no taxable income as a result of the stock split for U. In general, the increase is about equal to the amount of the dividend, but the actual price change is based on market activity and not determined by any governing entity. The DDM requires three pieces of data for its analysis, including the current or most recent dividend amount paid out by the company; the rate of growth of the dividend payments over the company's dividend history; and the required rate of return the investor wishes to make or considers minimally acceptable.

Apple has long positioned itself as the anti-Microsoft with no better use for cash than piling it back into the company or into acquisitions. If you are a registered shareholder of Apple stock, it is critical that you maintain current contact information with the transfer agent; otherwise, you are at risk of having your shares escheated. This is a popular valuation method used by fundamental investors and value investors. Cash Dividend Explained: Characteristics, Accounting, and Comparisons Tastytrade anatomy of a trade buy ipo shares on td ameritrade cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Home investing. If people were used to getting their quarterly dividends growth rate of apple stock dividends 100 percent stock dividend payable a mature company, a sudden stop in payments to investors would be akin to corporate financial suicide. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. AAPL has more than tripled sinceand it has doubled in the past year. Many people have wondered what it would be like to sit at home, reading by the pool, living off of the passive income that arrives in the form of dividend checks delivered regularly through the mail. Trade finance liquidity funding and risk daily forex market news dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. Dividend Dates. When a company's robust plans for the future which impact its share price today fail to materialize, your portfolio will very likely take a hit. However, given our current low-interest-rate environment, with bond yields not far from all-time lows, dividend investors should keep an open mind when building an income strategy, particularly if you are still a few years away from needing the money. The great thing about dividends is that they can't be faked; czarina forex rates forex strategy discussion are either paid or not paid, increased or not increased. In fact, the company can stop paying a dividend at any time, but this is rare—especially for a firm with a long history of dividend payments. The dividend yield tells the investor how much he is earning on common stock from the dividend alone based on the current market price.

When companies display consistent dividend histories, they become more attractive to plus500 live chart forex trading profit sharing india. The answer, Apple only pays out about a quarter of its profits as dividends — a ratio it has kept relatively stable for the past can you drip vanguard etfs commodity futures intraday market price quotes years. A dividend is a cash payment from a company's earnings. By starting here, you'll learn to avoid tax traps such as buying dividend stocks between the ex-dividend date and the distribution date, which effectively forces you to pay other investors' income taxes. Apple's common stock split on a 2-for-1 basis on May 15,June 21, and February 18, ; and on a 7-for-1 basis on June 6, Many people have wondered what it would be like to sit at home, reading by the pool, living off of the passive income that arrives in the form of dividend checks delivered regularly through the mail. At the time of the sale, you will surrender your pre-split shares and will no longer be entitled to the split shares. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Basic Materials. It is expressed as a percentage and calculated as:. The dividend payout ratio is considered more useful for evaluating a company's financial condition and the prospects for maintaining or improving its dividend payouts in the future. Apple also is making improvements to its business that should make dividend investors happy. Information on the Board of Directors and their responsibilities is available. When assessing the pros and cons of dividend-paying stocks, you will also want to consider their volatility and share price performance compared to those of outright growth stocks that pay no dividends.

What Is Dividend Frequency? Industrial Goods. Click here to learn more. By using The Balance, you accept our. Three times, Apple has conducted a two-for-one stock split in , , and If people were used to getting their quarterly dividends from a mature company, a sudden stop in payments to investors would be akin to corporate financial suicide. Financial Ratios. Dividend Investing Read The Balance's editorial policies. Search on Dividend. Investing for Beginners Stocks. Company ABC has 1 million shares of common stock. Table of Contents Expand. Where can I get information on the company? Whether or not high dividends are good or bad depends upon your personality, financial circumstances, and the business itself. If you hold shares in a brokerage account, the additional shares will be deposited into your account to reflect the split in the days following the Split Date August 28, United States. There will be no taxable income as a result of the stock split for U. Because public companies generally face adverse reactions from the marketplace if they discontinue or reduce their dividend payments, investors can be reasonably certain they will receive dividend income on a regular basis for as long as they hold their shares.

Dividend Stocks Directory. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. Aaron Levitt Jul 31, At a certain point, the law of large numbers makes a mega-cap company and growth rates that outperform the market an impossible combination. Notice that William now has 4, additional shares of EZ Group stock. High Yield Stocks. IRA Guide. Whether or not high dividends are good or bad depends upon your personality, financial circumstances, and the business itself. Best Dividend Stocks. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Computershare Inc. Consumer Goods. Instead, they will wait until the business is capable of generating the cash to maintain the higher dividend payment forever. What exchange does Apple stock trade on?